2003 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

F472aab6-Ca7c-43D1-Bb92-38Be9e2b83da.Pdf

NR TITEL ARTIEST 1 Hotel California Eagles 2 Bohemian Rhapsody Queen 3 Dancing Queen Abba 4 Stayin' Alive Bee Gees 5 You're The First, The Last, My Everything Barry White 6 Child In Time Deep Purple 7 Paradise By The Dashboard Light Meat Loaf 8 Go Your Own Way Fleetwood Mac 9 Stairway To Heaven Led Zeppelin 10 Sultans Of Swing Dire Straits 11 Piano Man Billy Joel 12 Heroes David Bowie 13 Roxanne Police 14 Let It Be Beatles 15 Music John Miles 16 I Will Survive Gloria Gaynor 17 Born To Run Bruce Springsteen 18 Nutbush City Limits Ike & Tina Turner 19 No Woman No Cry Bob Marley & The Wailers 20 We Will Rock You Queen 21 Baker Street Gerry Rafferty 22 Angie Rolling Stones 23 Whole Lotta Rosie AC/DC 24 I Was Made For Loving You Kiss 25 Another Brick In The Wall Pink Floyd 26 Radar Love Golden Earring 27 You're The One That I Want John Travolta & Olivia Newton-John 28 Wuthering Heights Kate Bush 29 Born To Be Alive Patrick Hernandez 30 Imagine John Lennon 31 Your Song Elton John 32 Denis Blondie 33 Mr. Blue Sky Electric Light Orchestra 34 Lola Kinks 35 Don't Stop Me Now Queen 36 Dreadlock Holiday 10CC 37 Meisjes Raymond Van Het Groenewoud 38 That's The Way I Like It KC & The Sunshine Band 39 Love Hurts Nazareth 40 Black Betty Ram Jam 41 Down Down Status Quo 42 Riders On The Storm Doors 43 Paranoid Black Sabbath 44 Highway To Hell AC/DC 45 Y.M.C.A. -

100 Years: a Century of Song 1970S

100 Years: A Century of Song 1970s Page 130 | 100 Years: A Century of song 1970 25 Or 6 To 4 Everything Is Beautiful Lady D’Arbanville Chicago Ray Stevens Cat Stevens Abraham, Martin And John Farewell Is A Lonely Sound Leavin’ On A Jet Plane Marvin Gaye Jimmy Ruffin Peter Paul & Mary Ain’t No Mountain Gimme Dat Ding Let It Be High Enough The Pipkins The Beatles Diana Ross Give Me Just A Let’s Work Together All I Have To Do Is Dream Little More Time Canned Heat Bobbie Gentry Chairmen Of The Board Lola & Glen Campbell Goodbye Sam Hello The Kinks All Kinds Of Everything Samantha Love Grows (Where Dana Cliff Richard My Rosemary Grows) All Right Now Groovin’ With Mr Bloe Edison Lighthouse Free Mr Bloe Love Is Life Back Home Honey Come Back Hot Chocolate England World Cup Squad Glen Campbell Love Like A Man Ball Of Confusion House Of The Rising Sun Ten Years After (That’s What The Frijid Pink Love Of The World Is Today) I Don’t Believe In If Anymore Common People The Temptations Roger Whittaker Nicky Thomas Band Of Gold I Hear You Knocking Make It With You Freda Payne Dave Edmunds Bread Big Yellow Taxi I Want You Back Mama Told Me Joni Mitchell The Jackson Five (Not To Come) Black Night Three Dog Night I’ll Say Forever My Love Deep Purple Jimmy Ruffin Me And My Life Bridge Over Troubled Water The Tremeloes In The Summertime Simon & Garfunkel Mungo Jerry Melting Pot Can’t Help Falling In Love Blue Mink Indian Reservation Andy Williams Don Fardon Montego Bay Close To You Bobby Bloom Instant Karma The Carpenters John Lennon & Yoko Ono With My -

Author Index

ABSTRACT AUTHOR INDEX The number following the name refers to the abstract number, not the page number. A number in bold indicates the author is the abstract presenter. Aaboe, Kasper 1915-P Adams, Rachel 2308-PUB, 2315-PUB Akhmetova, Saule B. 644-P, 649-P Aadahl, Mette 1997-P Adams, Sara R. 837-P, 1214-P Akhrass, Firas 1250-P Aamodt, Kristie I. 2056-P Adamson, Karen 1036-P, 1123-P, 1164-P, 1170-P Aki, Nanako 2412-PUB Abate, Nicola 33-OR Adeli, Khosrow 103-OR, 106-OR Akiyama, Noriko 1102-P Abbas, Malak 494-P, 2084-P Adhami, Anwar 539-P Akiyama, Yoshitaka 976-P Abbasi, Fahim 2140-PUB Adhikari, Pramisha 1726-P Akkari, Patrick Anthony 1613-P Abbass, Ibrahim 844-P, 2159-PUB Adhikary, Till 1850-P Akkireddy, Padmaja 2236-PUB Abbott, Akshar B. 608-P Adi, Saleh 873-P Akolkar, Beena 819-P Abbott, Alice M. 222-OR Adili, Fatemeh 2194-PUB Akoumianakis, Ioannis 215-OR Abbott, Scott 993-P, 1000-P, 1001-P, 1007-P Adkins, Laura 417-P Akturk, Halis K. 1586-P Abburi, Nandini 6-OR Advani, Andrew 485-P, 501-P, 552-P, 670-P Akueson, Cecelia E. 1347-P Abcouwer, Steven F. 601-P Aeby, Sébastien 766-P Al Jobori, Hussein 1097-P, 1875-P ABSTRACT AUTHOR INDEX Abdallah Hasan, Ahmed 505-P Aerni, Hans R. 1754-P Al Khaldi, Rasha 413-P, 2165-PUB Abdella, Nabilla 413-P, 2165-PUB Affi nati, Alison 2457-PUB Ala-Korpela, Mika 198-OR Abdesselam, Ines 2018-P Afrin, M.S.T. Rejina 2295-PUB Alarcón, Javier 1672-P Abdul-Ghani, Muhammad 188-OR, 1097-P, 1961-P Agarwal, Rishi 943-P Alarcon, Maria Lis 2338-PUB, 2362-PUB Abdulina, Galiya A. -

Top Midi Files & Styles with YAMAHA's Standards

YAMAHA Music Central Europe GmbH Siemensstr. 22 - 34 D-25462 Rellingen Tel.: +49(0)4101/303-0 http://www.yamaha.de YAMAHA Music Central Europe GmbH, Rellingen Branch Switzerland in Zurich Seefeldstrasse 94 CH-8008 Zürich YAMAHA Music Central Europe GmbH Branch Austria Schleiergasse 20 A-1100 Wien YAMAHA Music Central Europe Branch Benelux Clarissenhof 5 B NL-4133 AB Vianen YAMAHA Music Central Europe Sp. Z o.o. Oddzia w Polsce Ul. 17 Stycznia 56 02-146 WARSZAWA Polska BPL-EMI E 4/07 BPL-EMI CONTENTS Dear YAMAHA customer! 4 MUSIC SCHOOL 6 KEYBOARDS Entry-level Keyboards PSR-E213, PSR-E313 8/9 You are holding our current export product PSR-E403, PSR-450 10/11 line in your hands. This provides you with Overview - Entry-level Keyboards 12 information regarding the entire Yamaha Light Keyboard EZ-200 13 range in compact format. Illustrations and Digital Drums explanatory notes will guide you through it. DD-65 13 Portable Grand Pianos NP30, DGX-220 14/15 You will receive detailed information, DGX-520, DGX-620 16/17 brochures and expert advice from your Overview - Portable Grand Pianos 18 YAMAHA dealer. Of course, you can also Orient. Keyboards PSR-R200, PSR-A300, PSR-OR700 19 put the YAMAHA instruments through Home Keyboards PSR-S500, PSR-S700 20/21 their paces there. PSR-S900 / Overview - Home Keyboards 22/23 Entertainer Keyboard Tyros2 Super Edition 24/25 Our address is shown overleaf should you 26 ACCESSORIES wish to contact us directly. Microphones, Active-Boxes, Studio Monitors 26 Of course, you can also submit any queries, Stagepas Portable PA System 27 requests, suggestions or orders for cata- EMX Power Mixer, MG Mixer 28 logues on the Internet at www.yamaha.de. -

Pop / Rock / Commercial Like the Way I Do Melissa Etheridge Jessie Joshua Kadison Downtown Petula Clark Sorry Seems to Be the Ha

Repertoireliste Pop / Rock / commercial Like the way I do Melissa Etheridge Jessie Joshua Kadison Downtown Petula Clark Sorry seems to be the hardest word, Can you feel the love tonight Elton John Imagine, Let it be,Yesterday, Sgt.Peppers, Here comes the sun John Lennon/The Beatles Ain´t no sunshine Bill Withers I will survive Gloria Gaynor Don´t let the sun go down George Michael/Elton John Isn´t she lovely Stevie Wonder She´s out of my life, Man in the mirror, Human Nature Michael Jackson Mandy Barry Manilow Diamonds are a girls best friend, I want to be loved by you Marilyn Monroe Against all odds You can´t hurry love Phil Collins Purple Rain Prince The winner takes it all,Chiquitita,Waterloo,Dancing Queen, SOS, Thank you for the music Abba Torn Natalie Imbruglia Yes Sir,I can Boogie Baccara Celine Dion The power of love, Alone, I drove all night, The prayer, I surrender, My heart will go on, That´s the way it is, Because you loved me, Think twice, It´s all coming back, All by myself, Love doesn´t ask why, Falling into you, River deep Mountain high, Nature Boy, Natural Woman Who wants to live forever, Show must go on Queen Freedom Wham! Valerie, Back to black, Rehab, Will you still love me Amy Winehouse I will always love you, The greatest love of all, Whitney Houston Rise like a phoenix Conchita Wurst These boots are made for walking Nancy Sinatra Black Velvet Alannah Myles Christina Aguilera Hurt Destiny´s Child Emotion Fly me to the moon Frank Sinatra Son of a preacher man Dusty Springfield Gene Pittey Somethings got a hold of my -

Desiring Myth: History, Mythos and Art in the Work of Flaubert and Proust

Desiring Myth: History, Mythos and Art in the Work of Flaubert and Proust By Rachel Anne Luckman A thesis submitted for the degree of DOCTOR OF PHILOSOPHY Department of French Studies College of Arts and Law The University of Birmingham August 2009 University of Birmingham Research Archive e-theses repository This unpublished thesis/dissertation is copyright of the author and/or third parties. The intellectual property rights of the author or third parties in respect of this work are as defined by The Copyright Designs and Patents Act 1988 or as modified by any successor legislation. Any use made of information contained in this thesis/dissertation must be in accordance with that legislation and must be properly acknowledged. Further distribution or reproduction in any format is prohibited without the permission of the copyright holder. Abstract Previous comparative and parallel ‘genetic criticisms’ of Flaubert and Proust have ignored the different historical underpinnings that circumscribe the act of writing. This work examines the logos of Flaubert and Proust’s work. I examine the historical specificity of A la recherche du temps perdu, in respect of the gender inflections and class-struggles of the Third French Republic. I also put forward a poetics of Flaubertian history relative to L’Education sentimentale. His historical sense and changes in historiographic methodologies all obliged Flaubert to think history differently. Flaubert problematises both history and psychology, as his characterisations repeatedly show an interrupted duality. This characterization is explicated using René Girard’s theories of psychology, action theory and mediation. Metonymic substitution perpetually prevents the satisfaction of desire and turns life into a series of failures. -

Karaoke Mietsystem Songlist

Karaoke Mietsystem Songlist Ein Karaokesystem der Firma Showtronic Solutions AG in Zusammenarbeit mit Karafun. Karaoke-Katalog Update vom: 13/10/2020 Singen Sie online auf www.karafun.de Gesamter Katalog TOP 50 Shallow - A Star is Born Take Me Home, Country Roads - John Denver Skandal im Sperrbezirk - Spider Murphy Gang Griechischer Wein - Udo Jürgens Verdammt, Ich Lieb' Dich - Matthias Reim Dancing Queen - ABBA Dance Monkey - Tones and I Breaking Free - High School Musical In The Ghetto - Elvis Presley Angels - Robbie Williams Hulapalu - Andreas Gabalier Someone Like You - Adele 99 Luftballons - Nena Tage wie diese - Die Toten Hosen Ring of Fire - Johnny Cash Lemon Tree - Fool's Garden Ohne Dich (schlaf' ich heut' nacht nicht ein) - You Are the Reason - Calum Scott Perfect - Ed Sheeran Münchener Freiheit Stand by Me - Ben E. King Im Wagen Vor Mir - Henry Valentino And Uschi Let It Go - Idina Menzel Can You Feel The Love Tonight - The Lion King Atemlos durch die Nacht - Helene Fischer Roller - Apache 207 Someone You Loved - Lewis Capaldi I Want It That Way - Backstreet Boys Über Sieben Brücken Musst Du Gehn - Peter Maffay Summer Of '69 - Bryan Adams Cordula grün - Die Draufgänger Tequila - The Champs ...Baby One More Time - Britney Spears All of Me - John Legend Barbie Girl - Aqua Chasing Cars - Snow Patrol My Way - Frank Sinatra Hallelujah - Alexandra Burke Aber Bitte Mit Sahne - Udo Jürgens Bohemian Rhapsody - Queen Wannabe - Spice Girls Schrei nach Liebe - Die Ärzte Can't Help Falling In Love - Elvis Presley Country Roads - Hermes House Band Westerland - Die Ärzte Warum hast du nicht nein gesagt - Roland Kaiser Ich war noch niemals in New York - Ich War Noch Marmor, Stein Und Eisen Bricht - Drafi Deutscher Zombie - The Cranberries Niemals In New York Ich wollte nie erwachsen sein (Nessajas Lied) - Don't Stop Believing - Journey EXPLICIT Kann Texte enthalten, die nicht für Kinder und Jugendliche geeignet sind. -

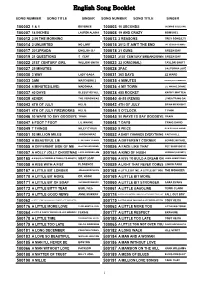

English Song Booklet

English Song Booklet SONG NUMBER SONG TITLE SINGER SONG NUMBER SONG TITLE SINGER 100002 1 & 1 BEYONCE 100003 10 SECONDS JAZMINE SULLIVAN 100007 18 INCHES LAUREN ALAINA 100008 19 AND CRAZY BOMSHEL 100012 2 IN THE MORNING 100013 2 REASONS TREY SONGZ,TI 100014 2 UNLIMITED NO LIMIT 100015 2012 IT AIN'T THE END JAY SEAN,NICKI MINAJ 100017 2012PRADA ENGLISH DJ 100018 21 GUNS GREEN DAY 100019 21 QUESTIONS 5 CENT 100021 21ST CENTURY BREAKDOWN GREEN DAY 100022 21ST CENTURY GIRL WILLOW SMITH 100023 22 (ORIGINAL) TAYLOR SWIFT 100027 25 MINUTES 100028 2PAC CALIFORNIA LOVE 100030 3 WAY LADY GAGA 100031 365 DAYS ZZ WARD 100033 3AM MATCHBOX 2 100035 4 MINUTES MADONNA,JUSTIN TIMBERLAKE 100034 4 MINUTES(LIVE) MADONNA 100036 4 MY TOWN LIL WAYNE,DRAKE 100037 40 DAYS BLESSTHEFALL 100038 455 ROCKET KATHY MATTEA 100039 4EVER THE VERONICAS 100040 4H55 (REMIX) LYNDA TRANG DAI 100043 4TH OF JULY KELIS 100042 4TH OF JULY BRIAN MCKNIGHT 100041 4TH OF JULY FIREWORKS KELIS 100044 5 O'CLOCK T PAIN 100046 50 WAYS TO SAY GOODBYE TRAIN 100045 50 WAYS TO SAY GOODBYE TRAIN 100047 6 FOOT 7 FOOT LIL WAYNE 100048 7 DAYS CRAIG DAVID 100049 7 THINGS MILEY CYRUS 100050 9 PIECE RICK ROSS,LIL WAYNE 100051 93 MILLION MILES JASON MRAZ 100052 A BABY CHANGES EVERYTHING FAITH HILL 100053 A BEAUTIFUL LIE 3 SECONDS TO MARS 100054 A DIFFERENT CORNER GEORGE MICHAEL 100055 A DIFFERENT SIDE OF ME ALLSTAR WEEKEND 100056 A FACE LIKE THAT PET SHOP BOYS 100057 A HOLLY JOLLY CHRISTMAS LADY ANTEBELLUM 500164 A KIND OF HUSH HERMAN'S HERMITS 500165 A KISS IS A TERRIBLE THING (TO WASTE) MEAT LOAF 500166 A KISS TO BUILD A DREAM ON LOUIS ARMSTRONG 100058 A KISS WITH A FIST FLORENCE 100059 A LIGHT THAT NEVER COMES LINKIN PARK 500167 A LITTLE BIT LONGER JONAS BROTHERS 500168 A LITTLE BIT ME, A LITTLE BIT YOU THE MONKEES 500170 A LITTLE BIT MORE DR. -

Eurovision Song Contest Is Not Just a Pop Song Competition: Often, It Is a Musical Manifestation of Political and Social Issues of Great Significance

60TH ANNIVERSARY CONFERENCE 24 APRIL 2015 #Eurovision60 The Eurovision Song Contest is not just a pop song competition: often, it is a musical manifestation of political and social issues of great significance. Melissa Scott ,, “New Europe, Center Stage - Orientalism and Nationalism in the Eurovision Song Contest”, Midway Review 2011 2 INTRODUCTION In 1956 the European Broadcasting Union (EBU) created the Eurovision Song Contest to foster closer ties between nations and to advance television technology. In 2015 the 60th Eurovision Song Contest will be held in Vienna. Over the past six decades the Eurovision Song Contest has created a European identity far beyond the confines of political unions and continental boundaries. The EBU is marking the event's 60th anniversary by celebrating not just the Contest’s musical achievements but also its impact on the European public sphere in areas such as forming national and European identities, embracing diversity and building cultural insight and understanding. ABOUT THE EBU The European Broadcasting Union (EBU) was established in 1950 and is now the world’s foremost alliance of public service media (PSM) with 73 Members in 56 countries in Europe and beyond. Between them, they operate over 1,700 television channels and radio stations reaching one billion people in around 100 languages. The EBU's mission is to safeguard the role of PSM and promote its indispensable contribution to society. It is the point of reference for industry expertise and a core for European media knowledge and innovation. The EBU operates EUROVISION and EURORADIO. EUROVISION is the media industry’s premier distributor and producer of top-quality live news, sport, entertainment, cultural and music content. -

DR HANRIO PHILIPPE 7 AVENUE NELLY DEGANNE RÉSIDENCE BACCARA 33120 ARCACHON Bordeaux, Le Mercredi 12 Décembre 2018 Mon Cher Co

DR HANRIO PHILIPPE 7 AVENUE NELLY DEGANNE RÉSIDENCE BACCARA 33120 ARCACHON Bordeaux, le mercredi 12 décembre 2018 Mon Cher Confrère, J’ai vu en consultation le 12/12/2018 votre patient, Monsieur Daniel VIDECOQ, né le 04/01/1946. Monsieur VIDECOQ est venu la dernière fois en 2010, depuis il voit le Docteur MOULINE à la Teste de Buch. Il vient avec sa femme, ils signalent que la maladie a lentement évolué pendant ces 8 ans, mais qu’il y a 6 mois il rentré en OFF très souvent, avec des blocages et un « freezing » très gênant. Il y a deux mois, la pompe apomorphine a été mise en place, sans une réduction de ses prises de STALEVO, seulement le SIFROL a été arrêté. La pompe ne fonctionne que pendant la journée, donc ses nuits sont mauvaises, il ne peut pas bouger, il se réveille vers minuit et après a du mal à se rendormir, son sommeil est fractionné. Le matin, il a du mal à démarrer jusqu'à la mise en fonction de la pompe. Pour améliorer son sommeil, une prise de SATELVO a été ajoutée à 23h, pour laquelle il doit se réveiller vu qu’il se couche à 21h-21h30, ayant pris de la MIRTAZAPINE à 20h. Ses plaintes sont qu’il doit se coucher tôt car il ne peut pas attendre, devoir se réveiller à 23h pour sa prise car après il a du mal à se rendormir, devoir se réveiller à 6h pour une autre prise. Son traitement actuel est : MODOPAR dispersible à 6h STALEVO 200mg 1 à 8h, et 150 mg à 11h, 14h, 17h, 20h et 23h VESICARE MOVICOL DOMPERIDONE MIRTAZAPINE à 20h RIVOTRIL gouttes à 23h POMPE de 8h à 20h, débit 1.6ml/h Je suis étonné que la pompe ait été mise de façon ambulatoire, qu’il n’ait pas de débit la nuit et que le traitement dopaminergique n’ait pas été changé. -

Arteriosclerosis, Thrombosis and Vascular Biology I Peripheral Vascular Disease

Cardiovascular diseases afflict people of all races, ethnicities, genders, religions, ages, sexual orientations, national origins and disabilities. The American Heart Association Arteriosclerosis, Thrombosis is committed to ensuring that our workforce and volunteers reflect the world’s diverse and Vascular Biology I population. We know that such diversity will enrich us with the talent, energy, perspective Peripheral Vascular Disease and inspiration we need to achieve our mission: building healthier lives, free of Scientific Sessions 2017 cardiovascular diseases and stroke. For information on upcoming Final Program American Heart Association May 4-6, 2017 | Hyatt Regency Minneapolis | Minneapolis, Minnesota Scientific Conferences, visit professional.heart.org Abstracts are available on http://professional.heart.org/atvbpvd sessions National Center This is an annual scientific meeting of the American Heart Association, sponsored by the Council on 7272 Greenville Avenue Arteriosclerosis, Thrombosis and Vascular Biology and Council on Peripheral Vascular Disease, in Dallas, Texas 75231-4596 collaboration with the Council on Functional Genomics and Translational Biology and the Society of Vascular Surgery’s Vascular Research Initiatives Conference. ©2017, American Heart Association, Inc. All rights reserved. Unauthorized use prohibited. 3/17JN0649 professional.heart.org Program at a Glance Wednesday Thursday Friday Saturday May 3, 2017 May 4, 2017 May 5, 2017 May 6, 2017 7:00 AM Registration, Early Career Registration, Early Career Separate -

Karaoke Catalog Updated On: 09/04/2018 Sing Online on Entire Catalog

Karaoke catalog Updated on: 09/04/2018 Sing online on www.karafun.com Entire catalog TOP 50 Tennessee Whiskey - Chris Stapleton My Way - Frank Sinatra Wannabe - Spice Girls Perfect - Ed Sheeran Take Me Home, Country Roads - John Denver Broken Halos - Chris Stapleton Sweet Caroline - Neil Diamond All Of Me - John Legend Sweet Child O'Mine - Guns N' Roses Don't Stop Believing - Journey Jackson - Johnny Cash Thinking Out Loud - Ed Sheeran Uptown Funk - Bruno Mars Wagon Wheel - Darius Rucker Neon Moon - Brooks & Dunn Friends In Low Places - Garth Brooks Fly Me To The Moon - Frank Sinatra Always On My Mind - Willie Nelson Girl Crush - Little Big Town Zombie - The Cranberries Ice Ice Baby - Vanilla Ice Folsom Prison Blues - Johnny Cash Piano Man - Billy Joel (Sittin' On) The Dock Of The Bay - Otis Redding Bohemian Rhapsody - Queen Turn The Page - Bob Seger Total Eclipse Of The Heart - Bonnie Tyler Ring Of Fire - Johnny Cash Me And Bobby McGee - Janis Joplin Man! I Feel Like A Woman! - Shania Twain Summer Nights - Grease House Of The Rising Sun - The Animals Strawberry Wine - Deana Carter Can't Help Falling In Love - Elvis Presley At Last - Etta James I Will Survive - Gloria Gaynor My Girl - The Temptations Killing Me Softly - The Fugees Jolene - Dolly Parton Before He Cheats - Carrie Underwood Amarillo By Morning - George Strait Love Shack - The B-52's Crazy - Patsy Cline I Want It That Way - Backstreet Boys In Case You Didn't Know - Brett Young Let It Go - Idina Menzel These Boots Are Made For Walkin' - Nancy Sinatra Livin' On A Prayer - Bon