Global Gaming Business Magazine and Managing Editor of Casino Connection Atlantic City

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

S Aloha Spirit Begins on Oahu Island Hawaii Honolulu and Island of Oahu – Images by Lee Foster by Lee Foster

Hawaii’s Aloha Spirit Begins on Oahu Island Hawaii Honolulu and Island of Oahu – Images by Lee Foster by Lee Foster When the plane touches down in Hawaii, the magic of the eight major Islands in the Hawaiian group begins to infuse the sensibility of a traveler. First of all, a traveler from North America has just made a long voyage, 2,000 miles and fully five hours from western U.S. cities, or longer from Chicago and New York. After traversing long stretches of ocean, the islands suddenly appear, as improbable as they must have seemed to the first Polynesians who sailed and paddled their canoes from the South Seas to this site about 750 A.D. or possibly earlier. From out of nowhere the modern visitor alights into a fully-realized dream, Hawaii. When you leave the airplane, a lei may be put around your neck, if you are on a tour. If not, you may want to buy a lei at the airport, just to get into the spirit. Leis are sometimes made of vanda orchids or of plumeria. The perfume of the lei and the warm tropical air of Hawaii immediately bathe a visitor. A range of bright flowers can be seen everywhere, starting with bougainvillea or hibiscus, the state flower, giving a technicolor aura to Hawaii. Brightly floral aloha shirts, which appear so ostentatious on the mainland, seem immediately appropriate here. Then you begin observing people in this airport. The most striking aspect of the people is that their racial origins are diverse and are primarily from the Orient. -

Experiential Learning Adventures Adding Substance to Incentives Page 24 by Christine Loomis

A COASTAL COMMUNICATIONS CORPORATION PUBLICATION MARCH/APRIL 2015 VOL. 22 NO. 2 $10.00 GEL: Group Experiential Learning programs help participants apply skills learned in sailboat racing directly to Experiential the corporate environment. Learning Adventures Adding Substance to Incentives Credit: Group Experiential Learning Page 18 Golf & Spa Resorts Page 24 Building Teams Page 32 Las Vegas & Reno Page 38 FOR US, BUSINESS WILL ALWAYS BE PERSONAL. 866.770.7268 wynnmeetings.com ISSN 1095-9726 .........................................USPS 012-991 A COASTAL COMMUNICATIONS CORPORATION PUBLICATION MARCH/APRIL 2015 Vol. 22 No. 2 FEATURES 18 Experiential Learning Adventures Adding Substance to Incentives Page 24 By Christine Loomis 24 Golf & Spa DEPARTMENTS Resorts 4 PUBLISHER’S MESSAGE The Right Combo for 6 INDUSTRY NEWS Incentive Travel Programs 9 SNAPSHOTS By John Buchanan 10 INCENTIVE PROGRAMS The Power of Choice — Designing Effective Individual Travel Rewards 32 Building Teams Page 18 By Mary MacGregor Find the Best Blueprint Lorski Photography Credit: An insurance group became farmers for a 12 SITE SELECTION to Engage, Energize and day at The Simple Farm where they harvested Inspiring Global Encourage Your Group vegetables, milked goats and made goat cheese. Destinations — From By Derek Reveron Emerging to Tried-and-True By Susan Adams, CPIM, CEP 16 RISK MANAGEMENT Business Travel DESTINATION Safety for Women By Yelena Kashina 50 CORPORATE LADDER 38 A Perfect Fit 50 READER SERVICES in Las Vegas How Mega-hotels Are Making Room for Smaller Meetings By Christine Loomis The Gallery at Mandarin Oriental, Las Vegas is ideal for 80-person seated dinners and receptions for 200. Page 38 Insurance & Financial Meetings Management is published bi-monthly by Coastal Communications Corporation, 2700 N. -

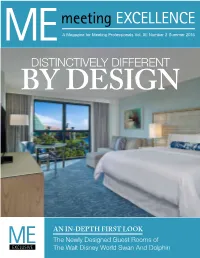

Distinctively Different by Design

A Magazine for Meeting Professionals Vol. XII Number 2 Summer 2015 DISTINCTIVELY DIFFERENT BY DESIGN AN IN-DEPTH FIRST LOOK The Newly Designed Guest Rooms of EXCLUSIVE The Walt Disney World Swan And Dolphin PUERTO RICO Governors Suite Parlor FAST FACTS • 240 guest rooms featuring Sheraton’s Sweet Sleeper® Beds • Located in the heart of Old San Juan, close to popular shops, restaurants, art galleries, museums, and nightlife • Short 20 minute ride from airport • Over 9,000 sq. ft. of flexible meeting space Rest assured, we’ll help you put your • Beautiful ballroom, offering spacious pre-function area meeting planning needs to bed! • Nine meeting and breakout rooms • Link@Sheraton Internet lounge Book your next meeting with us by August 31, 2015 and consume by • Palio Restaurant with bayfront terrace March 31, 2016 and receive any combination of the following based • Chicago Burger Company with bayfront views upon the size of your program: • Thrilling on-site casino • Sheraton Sweet Sleeper Pillows • Rooftop pool and fitness center • Sheraton Sweet Sleeper Sheet Sets • Sheraton Sweet Sleeper Bed • Up to 100,000 Starpoints® Signing Bonus No U.S. Passport Required! 800.746.1561 * For new business only. Must consume by March 31, 2016. Based upon availability and may not be combined with any other offer. Restrictions apply. www.SheratonOldSanJuan.com The five meeting hotels and resorts featured throughout this issue of Meeting Excellence have joined together to give VIP Values – unique booking bonuses when you reserve your meeting or event during specified value dates. The VIP Values are good for special discounts on amenities and services specific to each destination. -

Ipw Travel Writer Awards History

IPW TRAVEL WRITER AWARDS HISTORY U.S. Travel Association and Brand USA’s IPW Travel Writer Awards were established to honor outstanding work in print journalism for United States travel destination stories. Entrants for the IPW Travel Writer Awards must be domestic or international media attending IPW or media who attended IPW the previous year. Learn more. 2019 – IPW Anaheim BEST IPW HOST CITY ARTICLE (DENVER, CO) Winner: “Things To Do in Denver When You’re…” - Stephanie Holmes, New Zealand Travel Herald, New Zealand Finalist: “100% Local em Denver” - Artur Luiz Andrade and Renato Machado (Brazil), PANROTAS BEST U.S. TRAVEL DESTINATION Winners: “Viagem de Moto Pelo Alabama nos EUA” - Luciano Palumbo (Brazil), TurismoEtc, “It’s a Piece of Good Life” - KiSun Lee (Korea), Lonely Planet Magazine Korea “Charming Charleston: The Hot New City Break” - Jonathan Thompson (United Kingdom), The Times Finalists: “California on Two Wheels: My Bike Trip through Napa Valley and Sonoma County” - Nicola Brady (freelance writer, Ireland), Irish Independent “Ein Roadtrip durch den Rust Belt der USA” - Verena Wolff (freelance writer, Germany), dpa- Deutsche Presseagentur, “Meow and Mahalo” - Jay Jones (freelance writer, USA), Los Angeles Times BEST TRADE PUBLICATION ARTICLE Winner: “Le Nouveau Monde En Version « RÉTRO »” - Thierry Beaurepere (France), Voyages & Stratégie Finalists: “On the Road” - Peter Ellegard (United Kingdom), Revista Vivir De Viaje “Philly on Foot” - Pamela Brossman (USA), Destinations Magazine 2018 – IPW Denver BEST IPW HOST CITY ARTICLE (WASHINGTON, DC) Winner: “Kult i Georgetown” - Terje Myklebost (Snarøya, Norway), GREAT Hotels & Food Finalist: “Washington, D.C.'s Eclectic Music Scene is Remarkably Cool” - Michael Fisher (freelance writer, Canada), Toronto Star BEST U.S. -

With Alan Fuerstman, South Founder and Ceo of Montage Resorts

PROFILE ONE ON ONE >> >> >> >> >> >> SENSATIONAL WITH ALAN FUERSTMAN, SOUTH FOUNDER AND CEO OF MONTAGE RESORTS hen Alan Fuerstman opened the first Montage How has the concept of luxury continued to evolve in your industry Hotel & Resort in Laguna Beach in 2002, it was and beyond? apparent that a new notion of luxury had arrived. Luxury has continued to evolve to where there is an expectation that WYes, the hotel had an incomparable setting, beautiful accommodations, great hotels embody their destinations and capture a true sense of place. restaurants helmed by acclaimed chefs, and stellar service. What it The aesthetic and vibe should be an authentic reflection of the locale and AFRICA didn’t have, however, was pretense - and that made it instantly unique culture, and the experiences should be inspired by the unique attributes in its category. In this way, Fuerstman and his team rewrote the book of the location. on luxury hotels, capturing the zeitgeist of the affluent traveler, who was just as comfortable in jeans as in a suit - and needed a casually Two of your children currently work with Montage Resorts. What elegant destination to match. is it like to work with family? What business philosophies have you handed down to your children? SECRETS OF THE CAPE It’s an approach that continues to ring true today, as evidenced by the All four of my children have worked with me at some point. I take company’s continued success and expansion into a world-renowned incredible pride in how they have conducted themselves and have $ * USD collection of properties spanning Beverly Hills; Park City, Utah; contributed to our success. -

Laura Woodward

120 TEQUESTA Laura Woodward. Trail at Palm Beach. Watercolor. Private collection. 121 Laura Woodward: The Artist Who Changed South Florida’s History Deborah Pollack Laura Woodward, who (1834-1926) was born in Mount Hope, Orange County, New York, in 1834, by 1872 was a professionally trained Hudson River School artist. The Hudson River School credo espoused uplifting artists’ spirituality by painting amid nature. Members of this school sketched outside in the summer and early autumn, and, in the winter, created faithfully rendered paintings from those sketches. By using this method, Woodward’s watercolors and oils became much like color photographs of the areas she portrayed. Woodward began spending winters in St. Augustine in the 1880s in search of tropical scenes to depict with her graceful brush on paper and canvas. She could not have imagined how her life would markedly change from this practice and how her paintings of that beautiful state were to precipitate a huge alteration of fate, both for her and the way we perceive Florida today. While wintering in St. Augustine, Laura was quite “engrossed with her work”1 Her friend, artist Martin Johnson Heade, had a home in St. Augustine, and by the end of 1889 to the beginning of 1890, Laura had joined the St. Augustine society of artists at their studios located at the Ponce de Leon Hotel (now Flagler College), a huge, twin-towered Moorish-Revival building completed by Henry M. Flagler, the great developer of Florida’s east coast, in 1888.2 When the Ponce de Leon Hotel opened, it was hailed as an architectural masterpiece of Spanish Renaissance and aesthetic “Oriental” or Moorish design.^ In keeping with the Renaissance theme, Flagler established artist’s studios in the back of the palatial hotel—thereby fulfilling Woodward’s desire of hav ing a studio at an important resort. -

The Legend Inspires. the Promise Continues

THE KAHALA 2013-2014 VOL. 8, NO. 2 the legend inspires. the promise continues. December 2013-june 2014, VOL.8, NO.2 OAHKA_131200_AdsPlaced.indd 1 10/22/13 4:44:46 PM OAHKA_131200_AdsPlaced.indd 2 10/22/13 4:45:08 PM OAHKA_131200_AdsPlaced.indd 3 10/22/13 4:45:19 PM CONTENTS Volume 8, Number 2 Features 13 The Kahala Experience A memory lasts a lifetime. Guests and staff reminisce about their favorite moments, from celebrity encounters to family vacations, and what makes The Kahala special. 18 Five Decades of Aloha With its opening on January 22, 1964, The Kahala established itself as the epitome of style and comfort, from its mid-century modernist design to its celebrity-studded ON THE COVER guest list to its gracious hospitality—a reputation that has The Kahala celebrates its Golden Jubilee endured for 50 years. with effervescence. Story by Thelma Chang 30 A Majestic Soundscape The gentle strum of a slack-key guitar, a beautiful falsetto, a lilting ‘ukelele jam session—Hawaiian music in all its variety has taken center stage at The Kahala for 50 years. Story by Eliza Escaño-Vasquez ©SHUTTERSTOCK 4 OAHKA_131200_AdsPlaced.indd 5 10/22/13 4:45:34 PM CONTENTS Volume 8, Number 2 Features 36 Evolution of Hawaiian Cuisine From traditional filet Wellington to quick-fried ahi musubi to the hotel’s own Kahalasadas, The Kahala’s cuisine has not only kept pace with the Islands’ changing dining scene, but for much of the time has led it. Story by Mari Taketa Photography by Carin Krasner 42 The Architecture of Optimism The visionaries who designed the hotel created a building that epitomized the modernist aesthetic and the reach-for-the-sky optimism of mid-20th-century America. -

Thrum's Hawaiian Almanac: All About Hawaii

l,3fai.r'� AT WAIKIKI Manuladurer, Wholesaler and Retailer of carved woods, hors d'oeuvre trays, salad bowls, lamps, custom-built furniture and tables. MAIN OFFICE AND FACTORY 404 Ward Avenue • Phone 564-907 RETAIL LOCATIONS lllolr'a M The Outrigger Hotel - 2335 Kalakaua Avenue - Phone 939-994 IJl•lr'a nt The Hilton Hawaiian Village - 2005 Kalia Rd. - Phone 913-6955 ll•t•II .io,·01 carry Hawaiian, Oriental and Polynesian Carved Woods and •ho♦ luwnlry. Catalogue available on req\Jest. T!,i� is the only surviving image in Hawaii from a temple of human WHEN ONE COMPARES - THEY BUY AT BLAIR'S ,.1rrilicc. lt was carved from the trunk of an ohia lehua tree. -Bishop Museum Photo, The Recognized Book of Authentic Inforrnation on Hawaii Combined with THRUM·s HAWAIIAN ALMANAC AND STANDARD GUIDE Compiled and Edited by Chades E. Frankel 90th EDITION -� 1968 -a..... Published by STAR-BULLETIN PRINTING CO. 420 Ward Street Honolulu, Hawaii, U.S.A. 96814 Contents Page FOREWORD ........................................................ 7 SIGHTS ANO SOUNDS ............................................... 9 Ha,Yaiian Music .................................................... 9 Hawaii Calls ..............................•....................... 13 Ha\vaiian C'ultt1re, ................................................. l4 Sul'tlng- ....................................•..............•........ 19 Golf ..................................•.........•.....•..•......... 22 Coc-kllghting ...............................•...........•. ·, · ·, · .... 25 'l'ht• fJishop hifuseun1.......................•......... -

To Download a PDF of This Article

A Culture of Gracious Service An Interview with Alan J. Fuerstman, Founder and Chief Executive Offi cer, Montage Hotels & Resorts EDITORS’ NOTE Prior to launch- together to celebrate and enjoy one background in having operated spas for so ing Montage Hotels & Resorts, Alan another. many years within the properties I managed. Fuerstman was the Vice President Is there a consistent feel it’s an area where we can distinguish ourselves of Hotel Operations at Bellagio in throughout Montage properties, or as leaders in the industry. Spa Montage Laguna Las Vegas, Nevada. Previously, he is it about what works in a specifi c beach was actually the very fi rst mobil fi ve-star served as President and Managing locale? rated spa, and we continue to design and create Director of The Phoenician resort in Destination and location are es- exceptional spas and spa programming in every Scottsdale, Arizona, where he was sential. There will be a residential destination we’re developing. also responsible for ITT Sheraton’s aesthetic at each property refl ecting With the focus now on offerings like Luxury Collection properties, St. the lifestyle of each location as inter- express check-in/check-out and various in- Regis Aspen and St. Regis Houston, preted by Montage. We focus on great room gadgets, for Montage, is it challenging and all ITT Sheraton properties in attention to detail without the preten- to put all the technology in that’s needed Arizona. Before this, Fuerstman Alan J. Fuerstman tiousness or stuffi ness that used to be and not lose that personal service side? served as General Manager of the associated with old-style luxury. -

HUNTING PIXIE DUST Tips & Tricks

HUNTING PIXIE DUST Tips & Tricks HUNTING PIXIE DUST Tips & Tricks Guide BY M. SCHMIDT 2 Welcome to the Hunting Pixie Dust Disneyland Tips and Tricks Guide. We are Mark and Heidi and our goal is to help people create Pixie Dust on their next Disney vacation! In this guide you will find 79 tips and tricks to visit the Disneyland Resort like a Pro! We have compiled these tips and tricks from our years of visiting the parks and research we have conducted. We know you will get a lot Pixie Dust out of this guide. This guide is sectioned into groups to help you find the tip you want fast. Not all of the tips will be useful to all people. For example, you may be driving to the Disneyland Resort, so you will not need the tips on flying. While some tips may only apply to certain groups, there are more than enough practical tips to help you save money and get the most out of your Disneyland vacation. If you are planning your first trip to the Disneyland Resort, check out our over- view articles to learn more about the parks. Overview of the Disneyland Resort Overview of Disneyland 3 Table of Contents Pre-Arrival Tips .................................. 5 Travel Tips ........................................ 12 Money Saving Tips ........................... 18 Packing Tips...................................... 26 Hotel Tips.......................................... 27 General Disneyland Tips ................... 34 Cheap/Free Souvenirs ....................... 44 Security Line Tips ............................. 47 Parking Tips ...................................... 49 Conclusion ........................................ 51 Join Us on Social Media ................... 51 4 1. Pre Arrival Tips The following tips will help you plan for your trip. -

To Download a PDF of an Interview with Robert

Growing the Conrad Brand An Interview with Robert Rechtermann, General Manager, Conrad New York The entrance to Conrad New York EDITORS’ NOTE Robert Rechtermann hotel brand, we feel that this important Running a hotel restaurant in any city is al- arrived at Conrad New York follow- new property will help reestablish the ways a challenge because you’re competing with ing a four-year run as General Conrad brand in the U.S. New York is a great local restaurants. But we wanted to create Manager of Five Star Five Diamond huge gateway city, so this particular des- something that was approachable for both the Peninsula New York. Previously, tination and market is key for the brand community and the traveler; we had one great Rechtermann held a range of man- as it continues to evolve and expand. space to work with on the second fl oor off of our agement-level positions including But part of our role in opening atrium lobby – there is a lot of traffi c there. You can Resident Manager of The Peninsula this hotel in lower Manhattan was to also have drinks in the lobby. We created a concept Chicago; Director of Operations at introduce this part of the world to the called Atrio, named after the atrium, and we have a The Ritz-Carlton, Boston Common Conrad brand. great chef from the Four Seasons New York hotel. in 2006; EAM F&B at The Ritz-Carlton, How are you building the brand It’s a breakfast/lunch/dinner restaurant but there is Boston Common from 2003 to 2006; in North America and will there be a separate barista for coffee in the morning; the EAM F&B at the Five Diamond Robert Rechtermann a consistent feel to the properties? actual bar is in the restaurant as well – it’s an open Hilton Short Hills from 1998 to 2003; There is some consistency, but kitchen so you see a lot of activity. -

Flagler's Florida

(%+#%")'* (%&)$,+ George G. Matthews Alexander W. Dreyfoos President Trustee G.F. Robert Hanke Kelly M. Hopkins Vice President Trustee William M. Matthews Jesse D. Newman Treasurer Trustee Thomas S. Kenan, III John B. Rogers Secretary Trustee John M. Blades Executive Director Dear Educators and Students: The Whitehall Society of theFlagler Museum, in collaborationwith the Palm Beach Post andthe School District of Palm Beach County, is very pleased to bring you Flagler’s Florida . This Newspapers-in-Education tabloid tellS the story of Henry Flagler’S phenomenal impact on Florida, within thecontext of America’sGilded Age(1865 to 1929), themost amazing period in America’s history. Henry Flagler’S life andwork reflected the time in which he lived. The Gilded Age waS in many ways the most exciting period in our country’s history. In a recent interview, historical novelist Eric Larson described the Gilded Age as a time in American history when “people really thought they could do the impossible. There waS a charming sense of overreaching, andin the course of overreaching, achieving amazing things.” Henry Flagler dreamed of doing things others thought were impoSSible, andhe succeeded in accomplishinghis dreams. After playing a key role in the development of the modern American corporation as the architect of Standard Oil’S corporate structure, Henry Flagler used hiS fortune to invent modern Florida by: building a railway system that connected Florida’sentire east coast from Jacksonville to Key West, buildingaseries of luxury hotels that established