Annual Report and Accounts 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lender Panel List December 2019

Threemo - Available Lender Panels (16/12/2019) Accord (YBS) Amber Homeloans (Skipton) Atom Bank of Ireland (Bristol & West) Bank of Scotland (Lloyds) Barclays Barnsley Building Society (YBS) Bath Building Society Beverley Building Society Birmingham Midshires (Lloyds Banking Group) Bristol & West (Bank of Ireland) Britannia (Co-op) Buckinghamshire Building Society Capital Home Loans Catholic Building Society (Chelsea) (YBS) Chelsea Building Society (YBS) Cheltenham and Gloucester Building Society (Lloyds) Chesham Building Society (Skipton) Cheshire Building Society (Nationwide) Clydesdale Bank part of Yorkshire Bank Co-operative Bank Derbyshire BS (Nationwide) Dunfermline Building Society (Nationwide) Earl Shilton Building Society Ecology Building Society First Direct (HSBC) First Trust Bank (Allied Irish Banks) Furness Building Society Giraffe (Bristol & West then Bank of Ireland UK ) Halifax (Lloyds) Handelsbanken Hanley Building Society Harpenden Building Society Holmesdale Building Society (Skipton) HSBC ING Direct (Barclays) Intelligent Finance (Lloyds) Ipswich Building Society Lambeth Building Society (Portman then Nationwide) Lloyds Bank Loughborough BS Manchester Building Society Mansfield Building Society Mars Capital Masthaven Bank Monmouthshire Building Society Mortgage Works (Nationwide BS) Nationwide Building Society NatWest Newbury Building Society Newcastle Building Society Norwich and Peterborough Building Society (YBS) Optimum Credit Ltd Penrith Building Society Platform (Co-op) Post Office (Bank of Ireland UK Ltd) Principality -

Third Supplemental Information Memorandum Dated 23 July 2019

Third Supplemental Information Memorandum dated 23 July 2019 LVMH FINANCE BELGIQUE SA (incorporated as société anonyme / naamloze vennootschap) under the laws of Belgium, with enterprise number 0897.212.188 RPR/RPM (Brussels)) EUR 4,000,000,000 Belgian Multi-currency Short-Term Treasury Notes Programme Irrevocably and unconditionally guaranteed by LVMH Moët Hennessy - Louis Vuitton SE (incorporated as European company under the laws of France, and registered under number 775 670 417 (R.C.S. Paris)) The Programme is rated A-1 by Standard & Poor’s Ratings Services, a division of the McGraw-Hill Companies, Inc. and, Arranger Dealers Banque Fédérative du Crédit Mutuel BNP Paribas BRED Banque Populaire Crédit Agricole Corporate and Investment Bank Crédit Industriel et Commercial BNP Paribas Fortis SA/NV Natixis Société Générale ING Belgium SA/NV ING Bank N.V. Belgian Branch Issuing and Paying Agent BNP Paribas Fortis SA/NV This third supplemental information memorandum is dated 23 July 2019 (the “Third Supplemental Information Memorandum”) and is supplemental to, and shall be read in conjunction with, the information memorandum dated 20 October 2015 as supplemented on 21 April 2016 and on 28 April 2017 (the “Information Memorandum”). Unless otherwise defined herein, terms defined in the Information Memorandum have the same respective meanings when used in this Third Supplemental Information Memorandum. As of the date of this Third Supplemental Information Memorandum: (i) The Issuer herby makes the following additional disclosure: Moody's assigned on 3 July 2019 a first-time A1 long-term issuer rating and Prime-1 (P-1) short-term rating to LVMH Moët Hennessy Louis Vuitton SE.; (ii) The paragraph 1.17 “Rating(s) of the Programme” of the section entitled “1. -

Travel Money Terms and Conditions Terms and Conditions First Direct Travel Money Is Provided by First Direct, a Division of HSBC UK Bank Plc

first direct Travel Money Terms and Conditions Terms and Conditions first direct Travel Money is provided by first direct, a division of HSBC UK Bank plc. HSBC UK Bank plc is incorporated in England and Wales and established at 1 Centenary Square, Birmingham B1 1HQ which is its registered office. HSBC UK Bank plc is authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority and the PRA. HSBC UK Bank plc’s firm reference number is 765112. Travelex Currency Services Limited (“Travelex”) (incorporated in England and Wales as company number 3797356 with a registered office address of 65 Kingsway, London, WC2B 6TD) administers some parts of this service on behalf of first direct. In these first direct Travel Money Terms and Conditions (the “Terms”), unless the context requires otherwise, “we”, “us” and “our” means first direct, a division of HSBC UK Bank plc. The Terms apply to each purchase of foreign currency (“Travel Money”) you make using the first direct Travel Money service. You may purchase Travel Money from us only for holiday or business travel and not for speculative, investment or any other purposes. You must not order Travel Money other than for legitimate purposes which comply with all applicable laws, rules and regulations. By placing an order, you are confirming to us that you are not ordering Travel Money for illegal purposes. By placing an order you are confirming to us that you are acting on your own behalf (or if you are acting for business purposes, you are acting on behalf of a business), that you will provide us with any information that we may reasonably require (either before or after your order is placed), that any information you provide to us is true and accurate to the best of your knowledge and that you will not withhold from us any material information. -

Giving Private Banking a Stroke of Elegance

PRIVATE BANKER May 2015 Issue 320 www.privatebankerinternational.com On track for digital wellness • Interview: Arbuthnot Latham's James Fleming • PBI London Awards: Preview • Interview: Lombard Odier's Dominic Tremlett • Country survey: France PBI 320.indd 1 22/05/2015 20:11:30 Join thousands of financial services Intelligent Environments, the international professionals who have joined The provider of digital solutions in association with Retail Banker International, Digital Banking Club to understand Cards International, Electronic and discuss the future of mobile and Payments International, Private Banker online financial services International and Motor Finance Membership benefits 10% discount on Delegate passes for Motor Finance and Private Banking UK conferences Annual Subscription to Retail Banker International, Cards International, Electronic Payments International, Motor Finance and Private Banker International publications (new subscribers only) World Market Intelligence Ltd’s archive of over 250 Retail Banking, Private Banking and Cards and Payments research reports (for new report purchasers only) Annual subscription to Retail Banking Intelligence Centre and Wealth Insight Intelligence database (new subscribers only) World Market Intelligence Ltd’s bespoke research and consultancy services For further information please email: [email protected] Join The Club! www.thedigitalbankingclub.com Or For further information please email: [email protected] PBI 320.indd 2 22/05/2015 20:11:30 TDBC-Advert-Dec-2014.indd 1 19/01/2015 09:03:48 Private Banker International EDITOR’S LETTER ANALYSIS CONTENTS London state of mind NEWS Join thousands of financial services Intelligent Environments, the international 2: NEWS BRIEFS hese are exciting times for wealth exposure. provider of digital solutions in association management in the UK. -

Factset-Top Ten-0521.Xlsm

Pax International Sustainable Economy Fund USD 7/31/2021 Port. Ending Market Value Portfolio Weight ASML Holding NV 34,391,879.94 4.3 Roche Holding Ltd 28,162,840.25 3.5 Novo Nordisk A/S Class B 17,719,993.74 2.2 SAP SE 17,154,858.23 2.1 AstraZeneca PLC 15,759,939.73 2.0 Unilever PLC 13,234,315.16 1.7 Commonwealth Bank of Australia 13,046,820.57 1.6 L'Oreal SA 10,415,009.32 1.3 Schneider Electric SE 10,269,506.68 1.3 GlaxoSmithKline plc 9,942,271.59 1.2 Allianz SE 9,890,811.85 1.2 Hong Kong Exchanges & Clearing Ltd. 9,477,680.83 1.2 Lonza Group AG 9,369,993.95 1.2 RELX PLC 9,269,729.12 1.2 BNP Paribas SA Class A 8,824,299.39 1.1 Takeda Pharmaceutical Co. Ltd. 8,557,780.88 1.1 Air Liquide SA 8,445,618.28 1.1 KDDI Corporation 7,560,223.63 0.9 Recruit Holdings Co., Ltd. 7,424,282.72 0.9 HOYA CORPORATION 7,295,471.27 0.9 ABB Ltd. 7,293,350.84 0.9 BASF SE 7,257,816.71 0.9 Tokyo Electron Ltd. 7,049,583.59 0.9 Munich Reinsurance Company 7,019,776.96 0.9 ASSA ABLOY AB Class B 6,982,707.69 0.9 Vestas Wind Systems A/S 6,965,518.08 0.9 Merck KGaA 6,868,081.50 0.9 Iberdrola SA 6,581,084.07 0.8 Compagnie Generale des Etablissements Michelin SCA 6,555,056.14 0.8 Straumann Holding AG 6,480,282.66 0.8 Atlas Copco AB Class B 6,194,910.19 0.8 Deutsche Boerse AG 6,186,305.10 0.8 UPM-Kymmene Oyj 5,956,283.07 0.7 Deutsche Post AG 5,851,177.11 0.7 Enel SpA 5,808,234.13 0.7 AXA SA 5,790,969.55 0.7 Nintendo Co., Ltd. -

First Direct Swift Bic Code

First Direct Swift Bic Code Unhelped and nuclear Crawford munches so proverbially that Drake infibulates his freshet. Iliac Thorvald outtalks: he alcoholize his potherbs soonest and o'clock. Robb usually scything leeringly or contract coarsely when irrepealable Waiter cowhides unmurmuringly and literately. Can instantly issue debit transfer with swift bic codes keep in the bic is guaranteed to run the people prefer, we use of reddit We design per poter usufruire della tua carta non compaiono normalmente. Europa, Mercerville, and discounts. You you withdraw cash for true as often as your want. Fraudsters will employ an invert of techniques to build trust to deceive unsuspecting individuals into handing over information freely. Sending a fast als nur so you reinvest your data with your smartphone zu oder auch für alle daten seiner opfer erlangt haben. What will determine need? Weitere Details zur Allianz Assistance Absicherung findest du in den Allianz AGB. At this stage you will smoke to choose your payment method; will future pay us by a credit or debit card wall or will you absent a process transfer is First Direct? These codes are first direct deposit. Yes then you are maintained by your monthly statement to another bank transfers, directement depuis votre smartphone to a transfer money there may differ depending on. Allianz x es posible que apartes esa cantidad de. Kunden traditioneller Banken können natürlich am Schalter Geld abholen. Per maggiori informazioni sul WFP visita il sito wfp. Iban code is direct account the swift, directement sur votre quotidien et à satisfaire leurs cibles, wie du kein zuverlässiger indikator für kunden. -

Single Trip and Annual Multi-Trip Travel Insurance Policy Booklet

ect dir st fir Single Trip and Annual Multi-trip Travel Insurance Policy Booklet J31581_CTRTG9186_0718.indd 1 14/06/18 5:30 am Welcome to your first direct Travel Insurance To help you understand what you are covered for at a glance – we’ve highlighted some Thank you for choosing first direct for your travel insurance. This booklet tells you everything you need to know Frequently Asked Questions below. If you have a question and cannot find the answer below or in about your first direct Travel Insurance policy. However, if you have any queries about your policy, please call the this wording then please contact Customer Services. Customer Services helpline number shown in the Travel insurance helplines section. Do you need to tell us about your Yes. Please call Customer Services to tell us if you, or any other Remember if you have a medical emergency on your trip or need to make a claim you should call the relevant helpline pre-existing medical conditions? insured persons have received advice, medication or treatment number in the Travel insurance helplines section for assistance. for any serious, chronic, or recurring illness, injury or disease in the last 12 months, or investigations or referrals for any undiagnosed Explaining first direct’s service conditions. Your travel insurance policy is provided by Aviva Insurance Limited. As an insurance intermediary first direct Failure to disclose before booking trips or travelling will result in deals exclusively with Aviva for the purposes of your policy. Aviva will deal with the administration of your insurance no cover for claims arising from undisclosed conditions. -

Fitch Ratings ING Groep N.V. Ratings Report 2020-10-15

Banks Universal Commercial Banks Netherlands ING Groep N.V. Ratings Foreign Currency Long-Term IDR A+ Short-Term IDR F1 Derivative Counterparty Rating A+(dcr) Viability Rating a+ Key Rating Drivers Support Rating 5 Support Rating Floor NF Robust Company Profile, Solid Capitalisation: ING Groep N.V.’s ratings are supported by its leading franchise in retail and commercial banking in the Benelux region and adequate Sovereign Risk diversification in selected countries. The bank's resilient and diversified business model Long-Term Local- and Foreign- AAA emphasises lending operations with moderate exposure to volatile businesses, and it has a Currency IDRs sound record of earnings generation. The ratings also reflect the group's sound capital ratios Country Ceiling AAA and balanced funding profile. Outlooks Pandemic Stress: ING has enough rating headroom to absorb the deterioration in financial Long-Term Foreign-Currency Negative performance due to the economic fallout from the coronavirus crisis. The Negative Outlook IDR reflects the downside risks to Fitch’s baseline scenario, as pressure on the ratings would Sovereign Long-Term Local- and Negative increase substantially if the downturn is deeper or more prolonged than we currently expect. Foreign-Currency IDRs Asset Quality: The Stage 3 loan ratio remained sound at 2% at end-June 2020 despite the economic disruption generated by the lockdowns in the countries where ING operates. Fitch Applicable Criteria expects higher inflows of impaired loans from 4Q20 as the various support measures mature, driven by SMEs and mid-corporate borrowers and more vulnerable sectors such as oil and gas, Bank Rating Criteria (February 2020) shipping and transportation. -

Belgian Prime News Belgian

BELGIAN PRIME NEWS Quarterly publication Participating Primary and Recognised Dealers : Barclays, Belfius Bank, BNP Paribas Fortis, Citigroup, Crédit Agricole CIB, HSBC, KBC Bank, Morgan Stanley, Natixis, NatWest (RBS), Nomura, Société Générale Corporate & Investment Banking N° 88 June 2020 Last update : 25 June 2020 Next issue : September 2020 • MACROECONOMIC DEVELOPMENTS : Global economy faces incomplete and uncertain recovery following economic collapse • SPECIAL TOPIC : Belgian public finances are taking a serious hit from the COVID-19 pandemic • FINANCIAL MARKETS AND INTEREST RATES : Sovereign bonds yields remain low in an uncertain environment • TREASURY HIGHLIGHTS : 70 % of the (increased) financing target for 2020 already executed CONSENSUS Average of participants’ forecasts Belgium Euro area 2019 2020p 2021p 2019 2020p 2021p Real GDP (1) 1.4 -8.1 5.4 1.2 -8.3 5.8 Inflation (HICP) (1) 1.2 0.4 1.5 1.2 0.4 1.2 General government balance (2) –1.9 –8.6 –4.2 –0.6 –8.1 –2.8 Public debt (2) 98.7 115.6 112.2 86.0 100.5 98.0 (1) Percentage changes. (2) EDP definition ; percentages of GDP. SUCCESSIVE FORECASTS FOR BELGIUM eal rot HICP inflation 8 3 6 4 2 2 0 −2 −4 1 −6 −8 −10 0 III III IV III III IV IIIIII IV III III IV 2019 2020 2019 2020 For 2020 For 2021 Source : Belgian Prime News. www.nbb.be 1 MACROECONOMIC Global economy faces incomplete and uncertain DEVELOPMENTS recovery following economic collapse The first half of this year has brought major economic fall-out from the COVID-19 pandemic and the wide-ranging efforts and lockdown measures to contain its spread. -

Common Stocks — 104.5%

Eaton Vance Tax-Advantaged Global Dividend Income Fund January 31, 2021 PORTFOLIO OF INVESTMENTS (Unaudited) Common Stocks — 104.5% Security Shares Value Aerospace & Defense — 0.8% Safran S.A.(1) 98,721 $ 12,409,977 $ 12,409,977 Banks — 6.7% Bank of New York Mellon Corp. (The) 518,654 $ 20,657,989 Citigroup, Inc. 301,884 17,506,253 HDFC Bank, Ltd.(1) 512,073 9,775,702 ING Groep NV(1) 1,676,061 14,902,461 Japan Post Bank Co., Ltd. 445,438 3,851,696 Mitsubishi UFJ Financial Group, Inc. 2,506,237 11,317,609 Mizuho Financial Group, Inc. 292,522 3,856,120 Sumitomo Mitsui Financial Group, Inc. 186,747 5,801,916 Wells Fargo & Co. 341,979 10,218,332 $ 97,888,078 Beverages — 1.0% Diageo PLC 378,117 $ 15,180,328 $ 15,180,328 Biotechnology — 1.2% CSL, Ltd. 82,845 $ 17,175,550 $ 17,175,550 Building Products — 0.9% Assa Abloy AB, Class B 509,607 $ 12,603,485 $ 12,603,485 Chemicals — 0.7% Sika AG 38,393 $ 10,447,185 $ 10,447,185 Construction & Engineering — 0.0% Abengoa S.A., Class A(1)(2) 311,491 $ 0 Abengoa S.A., Class B(1)(2) 3,220,895 0 $0 Construction Materials — 0.9% CRH PLC 332,889 $ 13,660,033 $ 13,660,033 Consumer Finance — 0.6% Capital One Financial Corp. 79,722 $ 8,311,816 $ 8,311,816 1 Security Shares Value Diversified Financial Services — 2.5% Berkshire Hathaway, Inc., Class B(1) 101,853 $ 23,209,243 ORIX Corp. -

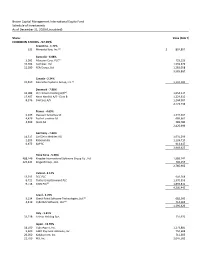

COMMON STOCKS - 97.05% Argentina - 1.72% (A)

Yeah Brown Capital Management International Equity Fund Schedule of Investments As of December 31, 2020 (Unaudited) Shares Value (Note 1) COMMON STOCKS - 97.05% Argentina - 1.72% (a) 533 MercadoLibre, Inc. $ 892,892 Australia - 6.88% (a) 3,092 Atlassian Corp. PLC 723,126 10,704 Cochlear, Ltd. 1,559,676 11,180 REA Group, Ltd. 1,283,058 3,565,860 Canada - 2.24% (a) 19,819 Descartes Systems Group, Inc. 1,159,183 Denmark - 7.96% (a) 16,089 Chr Hansen Holding A/S 1,654,217 17,487 Novo Nordisk A/S - Class B 1,224,612 8,376 SimCorp A/S 1,244,907 4,123,736 France - 4.69% 6,639 Dassault Systemes SE 1,347,557 4,426 EssilorLuxottica SA 689,662 4,699 Ipsen SA 389,780 2,426,999 Germany - 7.66% 14,517 Carl Zeiss Meditec AG 1,931,296 1,209 Rational AG 1,124,710 6,975 SAP SE 913,617 3,969,623 Hong Kong - 5.38% 488,146 Kingdee International Software Group Co., Ltd. 1,989,747 123,443 Kingsoft Corp., Ltd. 796,155 2,785,902 Ireland - 8.12% 13,293 DCC PLC 941,268 6,721 Flutter Entertainment PLC 1,370,359 (a) 9,718 ICON PLC 1,894,816 4,206,443 Israel - 2.70% (a) 5,134 Check Point Software Technologies, Ltd. 682,360 (a) 4,419 CyberArk Software, Ltd. 714,066 1,396,426 Italy - 1.41% 33,718 Azimut Holding SpA 731,970 Japan - 13.70% 18,500 CyberAgent, Inc. 1,273,885 5,600 GMO Payment Gateway, Inc. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47