Saudi Central Bank

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Table of Contents

KUWAIT COUNTRY READER TABLE OF CONTENTS Harrison M. Symmes 1953-1955 Principal Officer, Kuwait City William A. Stoltzfus, Jr. 1954-1956 Vice Consul, Kuwait City William D. Brewer 1955-1957 Principal Officer, Kuwait City Talcott W. Seelye 1956-1960 Consular-Economic Officer, Kuwait City Joan Seelye 1956-1960 Spouse of Consular-Economic Officer, Kuwait City James A. Placke 1959-1961 Economic Officer, Baghdad, Iraq Dayton S. Mak 1961-1963 Charge d’ Affaires, Kuwait City Nicholas Shapiro Lakas 1962-1964 Economic Officer, Kuwait City William A. Stoltzfus, Jr. 1963 Charge d’ Affaires, Kuwait City Charles O. Cecil 1966-1968 Rotation Officer, Kuwait City James A. Placke 1966-1969 Economic Officer, Kuwait City William D. Wolle 1968-1970 Deputy Chief of Mission, Kuwait City George Quincey Lumsden 1969-1972 Economic Officer, Kuwait City 1972-1974 Desk Officer, Kuwait, Bahrain, Qatar, UAE, Washington, DC Walter M. McClelland 1970-1974 Deputy Chief Of Mission, Kuwait City François M. Dickman 1972-1976 State Department, Arabian Peninsula Desk, Washington, DC Richard W. Bogosian 1972-1976 Economic Officer, Kuwait City William A. Stoltzfus, Jr. 1972-1976 Ambassador, Kuwait Richard E. Undeland 1974-1975 Public Affairs Officer, USIS, Kuwait City 1 Frank E. Maestrone 1976-1979 Ambassador, Kuwait Richard C. Howland 1978 Office of the Inspector General, Washington, DC François M. Dickman 1979-1983 Ambassador, Kuwait Brooks Wrampelmeier 1980-1982 Deputy Chief Of Mission, Kuwait City James Larocco 1981-1983 Economic Officer, Kuwait City Anthony Quainton 1984-1987 Ambassador, Kuwait Kenneth A. Stammerman 1987-1989 Economic Counselor, Kuwait City 1989-1992 Consul General, Dhahran, Saudi Arabia Douglas R. -

Saudi Arabia Banking Pulse for Q1 2021

Saudi Arabia Banking Pulse Quarter 1, 2021 FOREWORD Alvarez & Marsal Middle East Limited (A&M) is delighted to publish the Q1’21 edition of the Kingdom of Saudi Arabia (KSA) Banking Pulse (“The Pulse”). In this quarterly series, we share results from our research examining the top ten largest listed KSA banks by assets, and highlight key performance indicators of the KSA banking industry. The Pulse aims to help banking executives and board members stay current on industry trends. Following the completion of NCB’s and SAMBA’s merger we have changed our universe to include The Saudi National Bank (the merged entity, SNB) and Bank Aljazira (BJAZ) instead of NCB and SAMBA, as the Pulse tracks the performance of the top ten banks by asset size. Hence, for consistency of comparison, all historical data has been adjusted to include SNB and BJAZ instead of NCB and SAMBA. The Q1’21 results of the new entity apparently includes financials of NCB, as a standalone entity, as the merger came into effect in April’21. SAMBA’s and merged entity’s pro- forma financials are not available for Q1’21. Despite economic challenges, aggregate net income of top ten KSA banks increased substantially by 34.1% QoQ in Q1’21. The increase in profitability was largely on account of decrease in impairments (-49.7% QoQ). Lending growth more than doubled to 5.0% QoQ. NPL/net loan ratio remained stable at 2.0%. With a coverage ratio of ~150%, the Saudi banks are well covered for any potential asset quality risks. -

Saudi Arabia Economic Report

SAUDI ARABIA ECONOMIC REPORT JUNE 2021 TABLE OF CONTENTS A SHARP V-SHAPED MACRO RECOVERY OUTLOOK FOR THE KINGDOM Executive Summary 1 2020 very challenging year for the Kingdom The year 2020 has been a noticeably challenging year for Saudi Arabia amid Pandemic spillovers and low oil prices for most of the year. Real GDP growth is assumed to have reported its first contraction Introduction 2 in almost three years, registering -4.1% in 2020. It is yet worth mentioning that real non-oil GDP growth rebounded in the second half of 2020 and high-frequency indicators suggest the recovery Economic Conditions 4 has continued in 2021. The unemployment rate for Saudi nationals increased to 15.4% in the second quarter of 2020 before declining to 12.6% in the fourth quarter of the year. Real Sector 4 Noticeable current account deficit in 2020 likely to shift to a surplus in next two years Following the twin shocks of coronavirus pandemic and the lower oil prices amid the global downward demand since end of January 2020 urging the cut in oil production implied by the OPEC agreement, Saudi External Sector 6 Arabia witnessed in 2020 net deterioration in its external position. In fact, the current account balance of 2020 witnessed a deficit for US$ 19.6 billion, against a surplus of US$ 38.2 billion in 2019. It is worth noting that the Public Sector 7 current account is forecasted to shift back from a deficit of 2.8% of GDP in 2020 to a surplus of 3-4% of GDP in the next two years as per the IMF, as oil and non-oil merchandise exports are expected to pick-up globally, accompanied by gradual resumption of religious tourism receipts and higher domestic capital spending. -

Un-Vaccinated 91.1% of COVID Dead

olympics Pages 15 & 16 THE FIRST ENGLISH LANGUAGE DAILY IN FREE KUWAIT markets Established in 1977 / www.arabtimesonline.com Page 9 FRIDAY-SATURDAY, AUGUST 6-7, 2021 / ZUL-HIJJAH 27-28, 1442 AH emergency number 112 NO. 17756 16 PAGES 150 FILS CDC PUTS KUWAIT IN HIGH-RISK CATEGORY FOR COVID Un-vaccinated 91.1% of COVID dead New cases 718 Opinion Kuwait likely to implement VAT KUWAIT CITY, Aug 5, (Agencies): Some KUWAIT CITY, Aug 5, (Agencies): Kuwait will most likely imple- According to the report, the oil exports and local gas consumption 91.1 per cent of the Any chance to get ment the Value Added Tax (VAT) this year or next year, says the will continue to be the driving forces behind the economic growth of latest World Bank report on the economies of the member-nations of Kuwait as the country still relies on oil as its main source of income. people who died from the Gulf Cooperation Council (GCC). As part of measures taken in view of the corona pandemic, the GCC COVID-19 in July out of the dilemma? The World Bank also predicted that the economy of Kuwait will countries provided unemployment insurance; while fi ve of them includ- were not vaccinated, increase by 2.4 percent within 2021; followed by a projected 3.2 per- ed health insurance in their support measures, that is, except Kuwait. Kuwait Health Minis- cent growth in the next two years — 2022 and 2023. These measures somehow mitigated the dire consequences of shortened It presented projections for Kuwait on the following economic in- work hours and closures in a bid to curb the spread of corona. -

Kuwait at a Glance: 2001-02

COUNTRY REPORT Kuwait Kuwait at a glance: 2001-02 OVERVIEW The political scene will continue to be marked by persistent wrangling among the different elements of the country’s political structures, despite the recent cabinet changes. Differences between the leading branches of the ruling family over issues of power sharing and the succession are likely to persist. The lack of consensus and deep divisions within the National Assembly will continue to delay the passage of legislation needed to implement political and economic reforms, although limited fiscal reform is in prospect. Comfortable trade surpluses and investment income will ensure current-account surpluses of US$8.9bn in both 2001 and 2002. This will be despite an anticipated drop in oil prices, since oil production will rise slightly in 2002. Growth will slow to 2.1% in 2001 from its 2000 level of 4%, but will pick up to 2.5% in 2002. Key changes from last month Political outlook • Relations between the executive and legislature will remain fraught, although a few reform initiatives will be carried through. Kuwaiti concessions to Iraq will be linked to the issue of prisoners of war. Economic policy outlook • Ministerial members have been appointed to a committee to oversee economic reform, but the process will continue to be slow and constrained by political wrangling. Job creation will remain a primary objective of policy, slowing privatisation efforts and driving attempts to attract foreign investment. A new law allowing foreigners to invest in Kuwait without a local sponsor or partner has been passed. Economic forecast • As oil prices are forecast to gradually decline in 2001 and 2002, growth will slow from 4% in 2000 to 2.1% in 2001, but will pick up to 2.5% in 2002 as government spending and oil production rise in that year. -

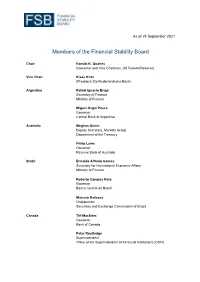

Members List FSB Plenary

As of 24 September 2021 Members of the Financial Stability Board Chair Randal K. Quarles (Governor and Vice Chairman, US Federal Reserve) Vice Chair Klaas Knot (President, De Nederlandsche Bank) Argentina Rafael Ignacio Brigo Secretary of Finance Ministry of Finance Miguel Ángel Pesce Governor Central Bank of Argentina Australia Meghan Quinn Deputy Secretary, Markets Group Department of the Treasury Philip Lowe Governor Reserve Bank of Australia Brazil Erivaldo Alfredo Gomes Secretary for International Economic Affairs Ministry of Finance Roberto Campos Neto Governor Banco Central do Brasil Marcelo Barbosa Chairperson Securities and Exchange Commission of Brazil Canada Tiff Macklem Governor Bank of Canada Peter Routledge Superintendent Office of the Superintendent of Financial Institutions (OSFI) Canada Nick Leswick Associate Deputy Minister Department of Finance China Zou Jiayi Vice Minister Ministry of Finance Yi Gang Governor People’s Bank of China Guo Shuqing Chairman China Banking and Insurance Regulatory Commission France François Villeroy de Galhau Governor Banque de France Emmanuel Moulin Director General, Treasury and Economic Policy Directorate Ministry of Economy and Finance Robert Ophèle Chairman Autorité des Marchés Financiers (AMF) Germany Jörg Kukies State Secretary Federal Ministry of Finance Jens Weidmann President Deutsche Bundesbank Mark Branson President Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) Hong Kong Eddie Yue Chief Executive Hong Kong Monetary Authority India Ajay Seth Secretary, Economic Affairs -

Annual Board of Directors Report for the Year Ended 31/12/2020

Board of Director’s Report For the year ending December 31, 2020 1 Internal Content list Main group activities ................................................................................................ 04 Strategy and Objectives .......................................................................................... 05 Business Summary of the Bank's Business Groups and Sectors ................................ 07 Retail Banking .......................................................................................................... 07 Digital Transformation ............................................................................................. 11 Islamic Banking ........................................................................................................ 13 Corporate Banking ................................................................................................... 15 Offshore branches and representative offices ......................................................... 17 Treasury and Investment Sector .............................................................................. 18 Business Technology ............................................................................................... 19 Business Technology Governance and Information Security .................................... 20 Compliance Department .......................................................................................... 20 Social Responsibility ............................................................................................... -

SAUDI ARABIA Building New Benchmarks

SAUDI ARABIA Building new benchmarks The kingdom’s groundbreaking hosting of this month’s G20 Leaders’ Summit puts its stunning transformation in the global spotlight. Discover how Saudi Arabia is realizing opportunities for all. In collaboration with CONTENT FROM COUNTRY REPORTS SAUDI ARABIA Saudi Arabia: Building new benchmarks The kingdom’s socioeconomic transformation is extremely impressive The new King Abdullah Financial District (KAFD) in Riyadh, Saudi Arabia SHUTTERSTOCK: KHALEDSAAD001 The red carpets in Riyadh may have been rolled away due to the COVID-19 achievable blueprint for an ambitious nation that is incredibly proud of its pandemic forcing this year’s G20 Leaders’ Summit in Saudi Arabia to be- past, but is firmly focused on the future. “It expresses our long-term goals and come a high-profile virtual event rather than a glittering gathering in its expectations and it is built upon our country’s unique strengths and capabilities. modern and prosperous capital, but the kingdom will certainly look back on It guides our aspirations toward a new phase of development—to create a vi- its presidency of the premier forum for international economic cooperation brant society in which all citizens can fulfill their dreams, hopes and ambitions with great pride and a sense of real achievement. to succeed in a thriving economy,” states Crown Prince and Chairman of the Through a series of focused discussions, conferences, forums, working Council of Economic and Development Affairs Mohammed bin Salman bin groups and ministerial meetings, Saudi Arabia has developed a rewarding port- Abdulaziz Al Saud. folio of projects and initiatives under the theme of “Realizing Opportunities of the 21st Century for All”. -

MENA MARKETS December 10 — 14, 2017

WEEKLY RESEARCH MENA MARKETS December 10 — 14, 2017 TOP NEWS details in Saudi king approving $19 billion of economic stimulus steps PAGE 1 Qatar 2018 budget sees modest rise in spending, marginally UAE non-oil growth to edge up to 3% this year, central bank Saudi Arabia to raise energy prices, pay cash to poorer citizens UAE central bank raises key rate 25 bps Saudi central bank raises reverse repo rate 25 bps Kuwait standing alone as it keeps interest rate on hold despite Fed Saudi Aramco signing $10.4 billion worth of MOUs with companies Saudi Aramco lifting spending plans to $414bln over next decade Saudi sovereign fund planning cinema venture with AMC Entertainment French utility firm EDF wants to take part in Saudi nuclear plans: CEO Saudi to establish $8 billion export bank for industry, mining Abu Dhabi-based fund to invest $2 billion in India technology Bank of China in financing agreement with UAE industrial zone Abraaj Group says acquires minority stake in Turkish online travel agent Morocco announcing auto industry deals worth $1.45 billion Algeria's Sonatrach planning joint energy projects with Total Siemens returning to Libya with $826mln power deals MARKETS EQUITIES Price % 1 W Saudi Arabia 7075.72 -0.14% The Dubai index turned negative in the last two sessions ending the week in the Abu Dhabi 4339.22 1.46% red area. The main drag came from Emmar Properties shares that slumped 10% to its lowest level since June, on news of a smaller-than-expected special Dubai 3355.40 -1.12% dividend for shareholders. -

Saudi German Health Investor Presentation – 1Q 2021 SGH at a Glance *Aggregate Figures from 2015 Till Q Till 1 2021 Avg

Saudi German Health Investor Presentation – 1Q 2021 6 ~1k bed ~90% Operational Population Hospitals Capacity Access 5.7k 992 1.4k Total Total Total Staff Doctors Nurses 3.7 60% 52% Avg. Length of Utilization Utilization Rates Stay Rates (Beds) (Clinics) 332k* 7.3mn* 170k* Inpatient Outpatient Performed Censes Censes Surgeries SGH at a Glance 2 *Aggregate figures from 2015 till Q1 2021 Mission Vision Group To Provide Evidence-Based, Safe Medical To be the Leader in Improving People’s Lives. Services Delivered with Effective Management, Engagement with Our Community and The Fulfillment of Our Stakeholder’s Needs. 3 TABLE OF CONTENT 01 02 03 04 05 Overview Market Landscape Financial & Updates & Q1 2021 Results Operational Strategic Focus Highlights 4 01 Overview 5 Our People Eng. Sobhi Batterjee Makarem Batterjee Dr Ahmed Shebl Madani Hozaien Chairman President and Vice Chairman Group Chief Executive Officer Group Chief Financial Officer 6 About Saudi German Health Saudi German Health at a Glance Middle East Healthcare Company (MEAHCO), publicly known as Saudi German Health (SGH), is a leading healthcare provider in Saudi Arabia. Building on a long family legacy as medical pioneers in the Kingdom, Saudi German Health was founded by the Batterjee family 33 years ago to relieve people’s suffering and have a positive impact on their health. In 1988, Eng. Sobhi Batterjee, Chairman of Saudi German Health, and Dr. Khalid Batterjee, Vice President of Saudi German Health, established the first hospital in Jeddah and collaborated with German University Hospitals to bring advanced German healthcare standards and expertise to the local community for the first time in the Kingdom of Saudi Arabia. -

Directors Report 2020

The DIRECTORS REPORT 2020 www.saudire.net 2 Board of directors Mr. Hesham Al-Shaikh Mr. Mishari Al-Mishari Chairman of the Board, the Executive Committee and Vice Chairman of the Board and Member of the Investment the Investment Committee Committee and the Nomination and Remuneration Committee Mr. Hesham Al-Shaikh is a Non-Executive director Mr. Mishari Al-Mishari is a Non-Executive director who joined Saudi Re in 2011 and currently serves who joined Saudi Re in 2009. He serves as the as the Chairman of the board, in addition to his Vice Chairman of the board, and a member of the role as the Chairman of the Executive Committee Nomination and Remuneration Committee and the and the Chairman of the Investment Committee. Investment Committee. Currently, he is a member of Mr. Al-Shaikh sits on the board of a number of the board in Hana Food Industries Company and a companies including Probitas Holding Company member of the boards in a number of companies in (Bermuda) and Watan First Financial Institute. He also previously held board membership in Ashmore education. Mr. Al-Mishari also previously served as a Saudi Arabia Investments, the Saudi Civil Aviation board member in the Saudi Investment Bank and the Holding Company and Al-Jazira Bank. Saudi Development Fund. Mr. Al-Shaikh has more than 35 years of experience Mr. Al-Mishari has more than 35 years of experience in the banking and investments sectors during which he assumed various leading positions last of assumed various leading positions concluding with the which was Deputy Managing Director of the Arab role of the managing director of Al-Jazira Bank in Saudi National Bank in Saudi Arabia. -

A Targeted Industry Approach for Raising Quality Private-Sector Employment in Saudi Arabia for More Information on This Publication, Visit

C O R P O R A T I O N SHANTHI NATARAJ, HOWARD J. SHATZ, LOUAY CONSTANT, MATTHEW SARGENT, SEAN MCKENNA, YOUSUF ABDELFATAH, FLORENTINE ELOUNDOU NEKOUL, NATHAN VEST, THE DECISION SUPPORT CENTER A Targeted Industry Approach for Raising Quality Private-Sector Employment in Saudi Arabia For more information on this publication, visit www.rand.org/t/RRA536-1. About RAND The RAND Corporation is a research organization that develops solutions to public policy challenges to help make communities throughout the world safer and more secure, healthier and more prosperous. RAND is nonprofit, nonpartisan, and committed to the public interest. To learn more about RAND, visit www.rand.org. Research Integrity Our mission to help improve policy and decisionmaking through research and analysis is enabled through our core values of quality and objectivity and our unwavering commitment to the highest level of integrity and ethical behavior. To help ensure our research and analysis are rigorous, objective, and nonpartisan, we subject our research publications to a robust and exacting quality-assurance process; avoid both the appearance and reality of financial and other conflicts of interest through staff training, project screening, and a policy of mandatory disclosure; and pursue transparency in our research engagements through our commitment to the open publication of our research findings and recommendations, disclosure of the source of funding of published research, and policies to ensure intellectual independence. For more information, visit www.rand.org/about/principles. RAND’s publications do not necessarily reflect the opinions of its research clients and sponsors. Published by the RAND Corporation, Santa Monica, Calif.