Q3 2019 Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Providing Internet for All in Myanmar—In Record Time

Providing internet for all in Myanmar—in record time Mobile connectivity and the many opportunities that come with it were unknown to larger population of Myanmar until 2014. In just 32 months, close to 90% of the South East Asian nation’s population and more than 94% of townships in whole or in part are covered by Telenor Myanmar’s network. Telenor Myanmar’s Chief Marketing Officer, Joslin Myrthong, explains how a non-discriminatory market approach and multi-stakeholder collaboration helped the company build the country’s largest and fastest growing network. “The journey to build a world-class mobile network in Myanmar started with 68 sites only, perhaps the smallest GSM launch in history, in Mandalay in September 2014. The reception from the people of Mandalay was fantastic and we quickly realized that expansion needed to happen even faster than we had planned for to satisfy the huge demand”, said Joslin. A month later, the network was expanded to the country’s business capital Yangon and from there steadily enlarged to other states and regions, including the rural areas. “We made all reasonable efforts to expand the coverage by engaging with all relevant stakeholders, including the ethnic groups, in order to deploy our network in a safe and secure manner. From day one, we have been focused on delivering internet for all, without any discrimination as to who you are or where you live”, explained Joslin. As part of this approach, Telenor Myanmar has ensured that anyone can register to use mobile services by submitting admissible IDs via multiple online and physical registration channels. -

TELENOR MICROFINANCE BANK LIMITED (TELENOR BANK) November 2017

The Pakistan Credit Rating Agency Limited TELENOR MICROFINANCE BANK LIMITED (TELENOR BANK) RATING REPORT UPDATE PREVIOUS REPORT CONTENTS [NOV-17] [APR-17] Entity Rating 1. RATING ANALYSES Long Term A+ A+ 2. FINANCIAL INFORMATION Short Term A1 A1 3. RATING SCALE 4. REGULATORY AND SUPPLEMENTARY Outlook Stable Stable DISCLOSURE NOV 2017 MICROFINANCE The Pakistan Credit Rating Agency Limited Profile & Ownership RATING RATIONALE . Commenced operations in September 2005; incorporated under the Microfinance Institution Ordinance 2001 The ratings of Telenor . In Mar16, Telenor Bank become 100% owned subsidiary of Telenor ASA through Microfinance Bank Limited reflect Telenor Pakistan (51%) and Telenor Pakistan B.V. (Amsterdam based [49%]) strong business profile emanating . The bank has been now fully acquired by Telenor Pakistan B.V. and is renamed as from growing customer base and Telenor Microfinance Bank, effective Jan17 diversified revenue stream of the . Operates through a nationwide network of 83 branches; head office in Karachi Bank. The deposit base witnessed . In collaboration with Telenor Pakistan, pioneered branchless banking in Pakistan; also escalated growth, mainly in the offers loans, savings and insurance products. Easypaisa, post-acquisition, is fully term deposits. The spreads acquired on the Bank’s balance sheet remained strong, though minor Governance declined YoY. Telenor Bank . Board comprises eight members including the CEO. Mr. Petter-Børre Furberg is the accounted for 20% of system share Chairperson. He has over 30 years of experience in the financial sector and has also in MFB industry deposits for served as the CEO of Telenor Myanmar Jun’17. The Bank is gradually . The board has four nominees of Telenor ASA, one of Telenor Pakistan, and two building its non-gold loan portfolio; independent directors reached ~31% by end- Jun17 in line . -

Annual Report 2016 CONTENT

Annual Report 2016 CONTENT Letter from the CEO 4 Group Executive Management 6 Summary of the Year 8 Financial Achievements 10 Our Strategy 12 Our Global Impact 13 Where We Operate 14 Stakeholder Engagement 16 Message from the Chair 18 The Board 20 Board of Directors’ Report 22 Sustainability Report 41 FINANCIAL STATEMENTS TELENOR GROUP Consolidated Income Statement 70 Consolidated Statement of Comprehensive Income 71 Consolidated Statement of Financial Position 72 Consolidated Statement of Cash Flows 73 Consolidated Statement of Changes in Equity 74 Notes to the Financial Statements 75 FINANCIAL STATEMENTS TELENOR ASA Income Statement 140 Statement of Comprehensive Income 141 Statement of Financial Position 142 Statement of Cash Flows 143 Statement of Changes in Equity 144 Notes to the Financial Statements 145 Responsibility Statement 158 Statement from the Corporate Assembly of Telenor ASA 159 Auditor’s Report 160 Definitions 165 ......---, 4 TELENOR ANNUAL REPORT 2016 LETTER FROM THE CEO LETTER FROM THE CEO VALUE CREATION IN Telenor has a proud history and comes from a strong position. We have a CHANGING TIMES diversified portfolio with solid market positions in Europe and Asia and we have strong operations based on quality We have a solid foundation Looking back at 2016, I am pleased to see networks and massmarket distribution with a good mix of assets, what we have accomplished at a time capabilities. In addition, Telenor’s solid market positions and scale we can leverage going when our industry is undergoing a funda majority ownerships enable strong forward, in a globalized and mental shift to adapt to a digital world. -

Liste a – Datterselskaber Under Telenor

Liste A – Datterselskaber under Telenor ASA Business Registration Owner Company name Country Number share Cinclus Technology AS 963 246 862 100,00% Norway Ci ncl us Technology AS 100,00% Sweden (Branch) Telenor Maritime AS (ex Maritime 985 173 710 98,93% Norway Communications Partner AS) Telenor Maritime Inc. (ex Maritime 260122158 100,00% USA Communications Partner Inc.) Telenor Broadcast 983 935 125 100,00% Norway Holding AS Canal Digital AS 977 273 633 100,00% Norway Canal Digital Danmark 13879842 100,00% Denmark A/S Canal Digital Finland OY 0900990-9 100,00% Finland Canal Digital Norge AS 936 653 820 69,70% Norway Canal Digital Sverige AB 556039-8306 100,00% Sweden Zona vi AS 982 739 845 100,00% Norway Canal Digital Norge AS 936 653 820 30,30% Norway Norkring AS 976 548 973 100,00% Norway Norkring België N.V. 0808.922.491 75,00% Belgium Premium Sports AS 989 656 430 100,00% Norway Telenor Satellite AS (ex Telenor Satellite 974 529 068 100,00% Norway Broadcasting AS) Telenor UK Ltd 03188910 100,00% England Telenor Business 984 400 993 100,00% Norway Partner Invest AS Telenor 983 793 754 100,00% Norway Communication II AS 701Search Pte Ltd 200613507R 33,33% Singapore 702 Search (Thailand) 62160303 33,33% Netherlands B.V. 703 Search (Indonesia) 62160400 31,50% Netherlands B.V. 1 Liste A – Datterselskaber under Telenor ASA Argos Takes Care of It 99,94% Marocco SA Doorstep AS 982 265 460 50,00% Norway Leiv Eiriksson 984 829 906 1,50% Norway Nys kapning AS Telenor Maritime AS (ex Maritime 985 173 710 1,07% Norway Communications Partner AS) Norvestor IV L.P 14,70% Guernsey Oter Invest AS 993 377 953 91,40% Norway Otrum AS 837 088 852 100,00% Norway Otrum Content 100,00% Germany Services GmbH Otrum Finland Oy 358201900600 100,00% Finland Otrum Svenska SE5566032127301 100,00% Sweden AB Otrum, filial af 33156804 100,00% Denmark Otrum Svenska AB Simula School of Res earch and 991 435 646 7,14% Norway Innovation AS Telenor Cloud Services AS (ex Telenor Business 998 027 292 100,00% Norway Internet Services AS) Tel enor Common 13-10-041370 100,00% Hungary Operation Zrt. -

Telenor's Global Impact

Telenor’s Global Impact A Quantification of Telenor’s Impact on the Economy and Society Final KPMG Report 7 November 2016 Document Classification - KPMG Confidential Important notice This document has been prepared by KPMG United Kingdom Plc (“KPMG”) solely for Telenor ASA (“Telenor” or “Addressee”) in accordance with terms of engagement agreed between Telenor and KPMG. KPMG’s work for the Addressee was performed to meet specific terms of reference agreed between the Addressee and KPMG and that there were particular features determined for the purposes of the engagement. The document should not be regarded as suitable to be used or relied on by any other person or any other purpose. The document is issued to all parties on the basis that it is for information only. This document is not suitable to be relied on by any party wishing to acquire rights against KPMG (other than Telenor) for any purpose or in any context. Any party other than Telenor that obtains access to this document or a copy and chooses to rely on this document (or any part of it) does so at its own risk. To the fullest extent permitted by law, KPMG does not accept or assume any responsibility to any readers other than Telenor in respect of its work for Telenor, this document, or any judgements, conclusions, opinions, findings or recommendations that KPMG may have formed or made. KPMG does not assume any responsibility and will not accept any liability in respect of this document to any party other than Telenor. KPMG does not provide any assurance on the appropriateness or accuracy of sources of information relied upon and KPMG does not accept any responsibility for the underlying data used in this document. -

International Telecommunication Union

ฬ 36-C PP-02) 2002֨711) ύ 2002֨9Z23[ –10Z18[\Ꮀ^6Ǯ ȏၖ ݗ ǎ1999-2002֨ฬ˫ ffffffffffffffffffffffffffffffffffffff ffffffffffffffffffffffffff̕ڣ֨ జ fffffffffffffffffffffffff̕ڣ#Ϥ ! జ &fffffffffffffffffffffff ֨ జ fffffffffffffffffffffҔ- ֨()*+ జ ./01 2349fffffffffffffffffffffff ffffffffffffffffffffff+78*()֨ <fffffffffffffffffffffffffַ>;:>()! AB()<:;<ַ ……………………………………………..22@? ……………….…30 ݗ̕ڣజ5--23ฬ C̓EF̓ၖ<HၖIJ జ6—Kҵ23ฬ ̓EF̓ၖ<HၖMN J …………………….…52 OPQ23ฬ2F!RSTΡȉWXY ………………………..60 ********** Y:\APP\PDF_SERVER\CHINESE\IN\PP02\036C.DOC 21.08.02 21.08.02 -2/60- PP-02/36-C 1 abc234ฬdˤfg(జ82ࡀ) *E, djklmYnoǞWq ܺ}~r Hၖ”z{ݗ <vȑx ݗ ǎฬrs<klmYntu˫ ڣ0 ) (PP-98)tu4֨ƑฬRS sklmYn (1998֨,Һ ̕F FIJPP-98 <()()*+MN J RN z ˫ǎ Ƒ ֨ݗ klmYn#K@ABoǞ 2 ¡Qhttp://www.itu.int/council/z ݗ 4٫z4٫RS҅ ฬ ******* ̕ڣజ1¢1999-2002֨ 2∗z1998֨12Z31[,ฬ188£ 3 2zW£2¤γ §¨˩<2ͪˣ¬k2002֨6Z30[\ฬ189£ 4 ˷]234ฬdcඪµ¶g<cˤfg®1992֨ lmYn®1994֨Ǡ°±²࡙ 2z¹ǎ1999֨9Z17[ฬ\±¸ Q½8̕ڣฬ aJº»+ 5 A–෪ं (34 ) -ቅ <ᇰ J#˩<% ˩< KLG'#˩<% !Ꮀ#ฬ$% MƼͪ &' O.3 Ƿ)* ҺͪG +),-#˩<% 0Ꮀ#˩<% .#ฬ$˩<% G#˩<% ͪ01 Pᒇ 2) RΨ.- 345-#˩<% RTUV<BCඟW' 3'ᇰ6ͪ XYZ#˩<% 7 V[Һᇰ<&3 &ಯҺͪ˩< ƤG#]^˩<% &ಯҺͪ#ฬ$% _˷aG (+),-˩<) :;<&#˩<% B – (33 ) ξ&; (ฬ˩<) ෪)?@A ሓ (ˤ) BCඟᇰ ' αᎰG#˩<% ____________________ ݗ Ρȉ ฬ∗ Y:\APP\PDF_SERVER\CHINESE\IN\PP02\036C.DOC 21.08.02 21.08.02 -3/93- PP-02/36-C Һ< ቅ ;A˩<B; (˩<) Ƒ˩<; (˩<) ?;A˨ฬ˩<B; ;A˩<B; ! o;A˩<B; #Һ (˩<) f;A˩<B; ༨˨ aK;A[.ǷaK˩<B; & ξ5; '( a ɖ;Aฬ{|˩<B; )! (˩<) ͪ˩<; ˨ Y;A˩<B; ̐+ ͪඟ; ,- ˷;A˩<B; . (˩<) ˷ ;A˩<B; 01234 (ˤ) ჲሓ˷;A˩<B; 567 (˩<) Һ;A˩<B; Ψ9:; ྑ;AFB; Ꮀท>; ;A˩<B; ?ඟ;AˤB; ;A[.Ƿ z{ |¡{¢B; CD; Ꮀᇰͪͪ;A˩<B; E˨;AFB; Ꮀ.; GH!; Ꮀ;A˩<B; -I0JKL ˨ฬMF; ?QAFB; NᎰOP;A˩<B; ¤ࢨ;A˩<B; QRҺ;A˩<B; ¤Һ;A˨˩<B; ST; ¦§;A˩<B; S3;AฬB; ඟಯ;A˩<B; UทV; Һ© ;A˩<B; WXYZ; Һ© ;Aฬ˩<B; ł< Ƥ.;A˩<B; [ \Һ;A˩<B; {|˩<; ෪Һ;A˩<B; Ψ«ᇰ˩<; [ ^_˩<; Nn෪<¬;A{|˩<B; `ɖ;A˩<B; ˷ͪ ;A˩<B; bͪ ;A˩<B; ® ;A˩<B; dᒇf; . -

Telenor Microfinance Bank Limited (TMB)

VIS Credit Rating Company Limited www.vis.com.pk RATING REPORT Telenor Microfinance Bank Limited (TMB) REPORT DATE: RATING DETAILS April 30, 2021 Indicative Rating Previous Rating RATING ANALYSTS: Rating Category Long-term Short-term Long-term Short-term Arsal Ayub, CFA Entity Rating A A-1 A+ A-1 [email protected] Rating Date April 30,’21 April 30,’20 Rating Outlook Negative Rating Watch – Negative COMPANY INFORMATION External auditors: M.s. EY Ford Rhodes Chartered Incorporated in 2005 Accountants Public Limited Company Chairman: Mr. Irfan Wahab Khan Key Shareholder(s): Chief Executive Officer: Mohammad Mudassar Aqil Telenor Pakistan B.V – 55.0% Alipay (Hong Kong) Holding Limited – 45.0% APPLICABLE METHODOLOGY(IES) Applicable Rating Criteria: Microfinance Banks (June 2019) https://www.vis.com.pk/kc-meth.aspx 1 VIS Credit Rating Company Limited www.vis.com.pk Telenor Microfinance Bank Limited (TMB) OVERVIEW OF THE RATING RATIONALE INSTITUTION Telenor Microfinance Telenor Microfinance Bank Limited (‘TMB’ or ‘the Bank’) is a subsidiary of Telenor Pakistan B.V (TP), (a Bank Limited (TMB) was Netherland based company owned by Telenor ASA) having major shareholding in the Bank. As on December incorporated in 2005 as a 31, 2020, TMB’s operations were spread across 89 branches (2018: 120 branches) nationwide. limited company under the Companies Ordinance, 1984. Commencing operations in 2005, the Bank grew quickly to become one of the largest microcredit provider in the country and the market leader in the Branchless Banking segment, though its flagship product “Easy Paisa”. Profile of Chairman However, given operational challenges faced by the bank in its lending operations, the Bank had embarked on Mr. -

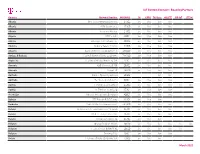

Iot Custom Connect - Roaming Partners

IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Albania One Telecommunications sh.a 27601 live live live live Albania ALBtelecom sh.a. 27603 live live live live Albania Vodafone Albania 27602 live live live live Algeria ATM Mobilis 60301 live live live live Algeria Wataniya Telecom Algerie 60303 live live live live Andorra Andorra Telecom S.A.U. 21303 live live live live Anguilla Cable and Wireless (Anguilla) Ltd 365840 live live live live Antigua & Barbuda Cable & Wireless (Antigua) Limited 344920 live live live live Argentina Telefónica Móviles Argentina S.A. 72207 live live live live Armenia VEON Armenia CJSC 28301 live live live live Armenia Ucom LLC 28310 live live live live Australia SingTel Optus Pty Limited 50502 live live Australia Telstra Corporation Ltd 50501 live live live live Austria T-Mobile Austria GmbH 23203 live live live live live live Austria A1 Telekom Austria AG 23201 live live live live Azerbaijan Bakcell Limited Liable Company 40002 live live live live Bahrain STC Bahrain B.S.C Closed 42604 live live live Barbados Cable & Wireless Barbados Ltd. 342600 live live live live Belarus Belarusian Telecommunications Network 25704 live live live live Belarus Mobile TeleSystems JLLC 25702 live live live live Belarus Unitary Enterprise A1 25701 live live live Belgium Orange Belgium NV/SA 20610 live live live live live live Belgium Telenet Group BVBA/SPRL 20620 live live live live live Belgium Proximus PLC 20601 live live live live Bolivia Telefonica Celular De Bolivia S.A. 73603 live live live March 2021 IoT Custom Connect - Roaming Partners Country Column1 Network Provider Column2MCCMNCColumn10 Column32G Column4GPRS Column53G Data Column64G/LTE Column7NB-IoT LTE-M Bosnia and Herzegovina PUBLIC ENTERPRISE CROATIAN TELECOM Ltd. -

Country List for Cellular Plans

Campbell Scientific, Inc. Cellular Data Service World-Wide Coverage Plans Campbell Scientific Cellular Data Service is offered in the countries listed below. The list identifies the data plan code, associated cellular network carrier, and available countries. Orders for cellular data service need to indicate the desired plan. Service in other countries may be available. Contact Campbell Scientific if service is needed in a country not shown on the list. The customer is responsible to verify the modem is supported by the carrier. Cellular data service is subject to the Campbell Scientific, Inc., Cellular Data Service Plan Terms and Conditions and Customer Agreement found at www.campbellsci.com/cell-terms. Plan Country Operator IT1A Albania Eagle Mobile IT1A Albania Vodafone - Albania IT1B Anguilla Cable and Wireless (Anguilla) Ltd IT1B Antigua and Barbuda Cable & Wireless Antigua & Barbuda Ltd IT1B Argentina Telefónica Móviles Argentina S.A. IT1A Armenia Armenia Telephone Company (Armentel) Joint Venture IT1B Armenia UCOM LLC IT1B Aruba New Millennium Telecom Services NV IT1A Australia SingTel Optus Pty Limited IT1B Australia Telstra Corporation Limited IT1A Australia Vodafone Hutchison Australia Pty Limited IT1A Austria A1 Telekom Austria AG IT1A Austria T-Mobile Austria GmbH IT1A Azerbaijan Azercell Telecom LLC IT1A Bangladesh Banglalink Digital Communications Ltd. IT1B Bangladesh Grameenphone Ltd IT1B Barbados Cable & Wireless (Barbados) Ltd IT1A Belarus JLLC Mobile TeleSystems IT1A Belarus Unitary enterprise velcom IT1A Belgium ORANGE Belgium nv/SA IT1A Belgium Proximus PLC IT1A Belgium Telenet Group BVBA/SPRL IT1B Belize Belize Telemedia Limited IT1B Benin Etisalat Benin SA IT1A Bolivia (Plurinational State of) TIGO - Telefonica Celular de Bolivia S.A. -

Otello-Corporation-ASA Annual-Report-2019

TURNAROUND & GROWTH ANNUAL REPORT 2019 Otello Corporation ASA M $ 240.7 Q4 M Table of contents $ 70 Otello Corporation ASA Annual Report 2019 Key figures 06 Group Overview 10 CEO Letter 12 AdColony Back to the future 14 Bemobi Subscribe to premium apps in a world of opportunities 26 Skyfire 40 Vewd 44 Q3 $ 63 M Shareholder information 48 Representation of Board of Directors 54 $ 171 M Report from the Board of Directors 56 Otello Group financial statements 78 Parent company financial statements 132 Auditor’s Report 158 Declaration of executive compensation policies 162 Principles of corporate governance 166 Q2 $ 56 M $ 108 M Strong growth throughout the year Q1 $ 52 M Revenue of 2019 2 OTELLO CORPORATION ASA - ANNUAL REPORT 2019 OTELLO CORPORATION ASA - ANNUAL REPORT 2019 3 The story continues Acquisition of Novitech During 2019, Otello’s Bemobi business ac Bemobi regards this is an important strategic quired certain assets from a Brazilian com acquisition in many aspects. It enhances our pany, Novitech. The trans action included the channel offer and our current distribution plat following assets: hardware and software, in form, bringing a more diverse set of channels tellectual property, commercial agreements to our portfolio beyond the NDNC portals by with major Brazilian and Central American adding a Voice based No Credit Portal. Further, telecommunication carriers, as well as a few it considerably raises our service distribution selected employees. scale for our own services. 2016 1997 2005 2010 OPERA 2018 2019 FIRST WEB OPERA MINI ACQUIRED 2013 2015 BROWSER CHANGED ACQUIRED BROWSER RELEASED ADMARVEL ACQUIRED ACQUIRED NAME TO NOVITECH RELEASED BUSINESS OTELLO SKYFIRE CORPORATION BEMOBI SOLD 1995 2004 2016 2017 2014 MAJORITY OPERA OPERA LISTED 2015 SURFEASY ACQUIRED ACQUIRED STAKE IN SOFTWARE ON OSLO STOCK VEWD SOLD TO FOUNDED ADCOLONY SURFEASY SOLD EXCHANGE SYMANTEC OTELLO CORPORATION Key numbers of 2019 Employees Revenue Revenue Source Adj. -

In Asia-Pacific

Internet of Things Case Studies LEADING THE WORLD OF INNOVATION I PN Asia- ACIFIC FEBRUARY 2020 TABLE OF CONTENTS 1 Foreword 1 2 Introduction 2 3 Case Studies Manufacturing & Utilities 4 3.1 Capturing Real-Time Operational Data – Dialog Axiata 5 3.2 Reducing Electricity Theft and System Losses – CISNR, Jazz & PESCO 7 3.3 Boosting the Productivity of Plastics Production – Daviteq & Viettel 8 Smart Agriculture 10 3.4 Supporting Precision Agriculture– Momoku & Maxis 11 3.5 Helping Livestock Farmers Become More Productive – DycodeX & XL Axiata 13 3.6 Supporting Better Poultry Farming – Sierad Produce & XL Axiata 15 Smart Buildings 17 3.7 Enabling Smart Buildings at Scale – Softhard.IO 18 3.8 Enabling Smarter Manage of Staff Attendance - Grameenphone 20 3.9 Enabling Householders to Easily Control Security and Energy Usage – ACIS & Viettel 22 Smart Cities 24 3.10 Improving Waste Management in Urban Areas – Qlue & Telkomsel 25 3.11 Tracking Assets to Save Costs and Improve Customer Experience – Telstra 27 3.12 Connecting People with Available Parking Spaces – TM ONE 29 3.13 Enabling Smart Traffic Management in Cities – TM ONE 31 Transportation: Automotive & Aviation 33 3.14 Bringing Tailored Car Insurance to Developing Markets – AIS & Thaivivat 34 3.15 Managing Urban Airspace for Unmanned Aircraft – Garuda Robotics & Singtel 36 3.16 Delivering Cost-Effective Vehicle Tracking and Fleet Management – Telenor Pakistan 38 3.17 Enabling Cost-Effective Deliveries by Drones – Fling & True 40 4 Conclusions 43 INTERNET OF THINGS CASE STUDIES LEADING THE WORLD OF INNOVATION IN ASIA-PACIFIC INTERNET OF THINGS CASE STUDIES 1 Foreword In the technology and telecommunications sectors, 5G is the new golden child. -

Q2 2020 Report

Q2 – 2020 Interim report January – June 2020 Contents Highlights and Group performance 1 Outlook for 2020 2 Interim report 6 Telenor’s operations 6 Group performance 13 Interim condensed financial information 15 Notes to the interim consolidated financial statements 20 Definitions 27 1 TELENOR SECOND QUARTER 2020 Delivering critical services in demanding times This quarter has brought unprecedented challenges for our customers and employees, as societies in the regions Telenor operates in have endured the COVID-19 pandemic and the impact of measures taken to stop it. In such a situation, providing our customers with critical services and ensuring our employees’ health and safety has been our first priority. Despite the challenges, I am proud to say that during the past months, Telenor has taken a leap within digitalisation. We are now further increasing our focus on touch free operations, digital customer interactions and new ways of working. Our operating model has given us flexibility to manage operations, cost and investments, contributing to an EBITDA growth of 1% and free cash flow of NOK 4 billion in the quarter. As expected, lockdowns have affected prepaid markets in Asia and global roaming revenues negatively. Combined with a reduction in new sales, this led to a decline in organic subscription and traffic revenues of 4%, which was offset by an opex reduction of 12%. The financial results this quarter are positively impacted by the strong performance of our operations in Norway and Finland, while Bangladesh and Pakistan, as expected, remain the most challenged prepaid markets. Our strategy of growth, modernisation and responsible business has provided us with the ability to deliver critical services and manoeuvre in these demanding times.