Regulatory Story Go to Market News Section

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stoxx® Europe Ipo (60 Months) Index

STOXX® EUROPE IPO (60 MONTHS) INDEX Components1 Company Supersector Country Weight (%) CELLNEX TELECOM Telecommunications ES 6.13 DELIVERY HERO Retail DE 5.29 JUST EAT TAKEAWAY.COM NV Retail NL 5.21 SCOUT24 Technology DE 3.41 COVESTRO Chemicals DE 2.72 AUTO TRADER GROUP Media GB 2.50 HELLOFRESH AG Retail DE 2.18 AMUNDI Financial Services FR 2.08 KOJAMO OYJ Real Estate FI 2.00 GALENICA SANTE AG Retail CH 1.92 VAT GROUP AG Industrial Goods & Services CH 1.91 ASR NEDERLAND NV Insurance NL 1.79 SIG COMBIBLOC GROUP AG Industrial Goods & Services CH 1.72 CONVATEC PLC Health Care GB 1.70 SIGNIFY Industrial Goods & Services NL 1.54 NEXI SPA Industrial Goods & Services IT 1.50 TEAMVIEWER AG Technology DE 1.49 INWIT Telecommunications IT 1.43 AVAST PLC Technology GB 1.41 LA FRANCAISE DES JEUX Travel & Leisure FR 1.28 STADLER RAIL AG Industrial Goods & Services CH 1.19 BAWAG GROUP AG Banks AT 1.05 NETCOMPANY GROUP AS Technology DK 1.03 SOFTCAT Technology GB 0.89 PIRELLI & C. S.P.A. Automobiles & Parts IT 0.89 COUNTRYSIDE PROPERTIES PLC Personal & Household Goods GB 0.88 LANDIS GYR GROUP AG Industrial Goods & Services CH 0.86 INTEGRAFIN HOLDINGS PLC Financial Services GB 0.81 DOMETIC GROUP AB Personal & Household Goods SE 0.77 BRAVIDA HOLDING AB Industrial Goods & Services SE 0.72 SILTRONIC Technology DE 0.69 TRAINLINE PLC Travel & Leisure GB 0.68 SPIE Industrial Goods & Services FR 0.68 INTERTRUST NV Financial Services NL 0.68 ZUR ROSE GROUP Retail CH 0.66 ASCENTIAL PLC Media GB 0.64 SINCH Technology SE 0.64 Virgin Money UK Banks GB 0.62 HASTINGS -

Sanne Group Plc Annual Report and Accounts 2020 1 Sanne at a Glance

Annual Report and Accounts 2020 Sanne is a leading global provider of alternative asset and corporate services. Contents 01 03 04 Introduction Governance Financial Statements 01 Financial and operational highlights of 56 Chairman’s Introduction 110 Independent Auditors' Report YMJ^JFW 58 Corporate Governance Report 118 Consolidated Income Statement 02 Sanne at a glance 60 Board of Directors 119 Consolidated Statement of Comprehensive Income 62 Sanne’s Executive Committee 120 Consolidated Balance Sheet 02 63 Leadership 121 Consolidated Statement of Changes in Equity 64 Board Effectiveness Strategic Report 122 Consolidated Cash Flow Statement 70 Directors’ Report 123 Notes to the Consolidated 06 Chairman’s Statement 74 Nomination and Governance Financial Statements Committee Report 08 Chief Executive Officer’s Statement 171 Glossary of Terms 77 Audit Committee Report 12 Value Chain 173 Shareholder and Corporate Information 82 Risk Committee Report 14 Business Model 85 Directors’ Remuneration at-a-glance 16 Our Stakeholders 86 Remuneration Committee Report 20 Strategy Review 97 Annual Report on Remuneration 24 Key Performance Indicators 107 Directors’ Responsibilities Statement 28 Segmental Review 30 Chief Financial Officer’s Review 34 Alternative Performance Measure definitions 36 ESG and Sustainability 46 Risk Management 52 Viability Statement www.sannegroup.com/annualreport Introduction Strategic Report Governance Financial Statements Financial and operational highlights of the year Robust financial performance, 2 1 with strong profit -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 30 January 2020 AA AA. Support Services — GBP 0.4766 at close 30 January 2020 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 30-Jan-2020 30-Jan-2020 30-Jan-2020 1 120 120 1D WTD MTD YTD Absolute -4.2 -9.3 -18.0 -18.0 110 110 0.9 Rel.Sector -3.4 -7.9 -18.2 -18.2 Rel.Market -3.0 -6.9 -16.2 -16.2 100 100 0.8 90 90 VALUATION 0.7 80 80 Trailing RelativePrice RelativePrice 70 70 0.6 PE 8.5 Absolute Price (local (local Absolute currency)Price 60 60 EV/EBITDA 9.2 0.5 PB -ve 50 50 PCF 2.7 0.4 40 40 Div Yield 3.4 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Jan-2019 Apr-2019 Jul-2019 Oct-2019 Price/Sales 0.4 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity - 100 90 90 Div Payout 28.6 90 80 80 ROE - 80 70 70 70 Index) Share Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 40 The principal activity of the Company is providing 40 RSI RSI (Absolute) service of consumer roadside assistance. 30 30 30 20 20 20 10 10 10 RSI (Relative to FTSE UKFTSE All to RSI (Relative RSI (Relative to FTSE UKFTSE All to RSI (Relative 0 0 0 Jan-2019 Mar-2019 May-2019 Jul-2019 Sep-2019 Nov-2019 Jan-2019 Mar-2019 May-2019 Jul-2019 Sep-2019 Nov-2019 Jan-2019 Mar-2019 May-2019 Jul-2019 Sep-2019 Nov-2019 See final page and http://www.londonstockexchange.com/prices-and-markets/stocks/services-stock/ftse-note.htm for further details. -

Case 20-32299-KLP Doc 208 Filed 06/01/20 Entered 06/01/20 16

Case 20-32299-KLP Doc 208 Filed 06/01/20 Entered 06/01/20 16:57:32 Desc Main Document Page 1 of 137 Case 20-32299-KLP Doc 208 Filed 06/01/20 Entered 06/01/20 16:57:32 Desc Main Document Page 2 of 137 Exhibit A Case 20-32299-KLP Doc 208 Filed 06/01/20 Entered 06/01/20 16:57:32 Desc Main Document Page 3 of 137 Exhibit A1 Served via Overnight Mail Name Attention Address 1 Address 2 City State Zip Country Aastha Broadcasting Network Limited Attn: Legal Unit213 MezzanineFl Morya LandMark1 Off Link Road, Andheri (West) Mumbai 400053 IN Abs Global LTD Attn: Legal O'Hara House 3 Bermudiana Road Hamilton HM08 BM Abs-Cbn Global Limited Attn: Legal Mother Ignacia Quezon City Manila PH Aditya Jain S/O Sudhir Kumar Jain Attn: Legal 12, Printing Press Area behind Punjab Kesari Wazirpur Delhi 110035 IN AdminNacinl TelecomunicacionUruguay Complejo Torre De Telecomuniciones Guatemala 1075. Nivel 22 HojaDeEntrada 1000007292 5000009660 Montevideo CP 11800 UY Advert Bereau Company Limited Attn: Legal East Legon Ars Obojo Road Asafoatse Accra GH Africa Digital Network Limited c/o Nation Media Group Nation Centre 7th Floor Kimathi St PO Box 28753-00100 Nairobi KE Africa Media Group Limited Attn: Legal Jamhuri/Zaramo Streets Dar Es Salaam TZ Africa Mobile Network Communication Attn: Legal 2 Jide Close, Idimu Council Alimosho Lagos NG Africa Mobile Networks Cameroon Attn: Legal 131Rue1221 Entree Des Hydrocarbures Derriere Star Land Hotel Bonapriso-Douala Douala CM Africa Mobile Networks Cameroon Attn: Legal BP12153 Bonapriso Douala CM Africa Mobile Networks Gb, -

Annual Report and Accounts for the Year Ended 31 December 2018 Sannegroup.Com Stock Code: SNN Code: Stock

a Sanne Group plc Group Sanne Annual Report for the year ended 31 December 2018 Annual Report and Accounts for the year ended 31 December 2018 sannegroup.com Stock code: SNN Sanne Group Plc AR2018 - Front.indd 3 08/04/2019 11:49:23 26236 8 April 2019 11:48 am Proof 13 Welcome to Sanne Group plc’s 2018 Annual Report and Accounts SANNE is a leading global provider of outsourced alternative asset and corporate services. We provide high quality administration, reporting and fiduciary services to the leading alternative asset managers, financial institutions, family offices and corporates. We service clients from 18 locations spread across the Americas, Europe, Africa and Asia- Pacific. Our dedicated asset class and market experts are supported by the latest industry technology, systems and accredited business processes. Sanne Group Plc AR2018 - Front.indd 4 08/04/2019 11:49:24 26236 8 April 2019 11:48 am Proof 13 Annual Report and Accounts for the year ended 2018 Stock code: SNN sannegroup.com notes-heading-level- one What you’ll find inside this report notes-heading-level-two notes-heading-level-three notes-heading-level-four SANNE operates across global markets and in a highly Introduction notes-strapline specialised industry, serving a wide range of alternative Investment Proposition 4 notes-text-body asset managers, financial institutions, family offices Operational Highlights 6 > notes-list-bullet and corporates. Chairman’s Statement 8 > notes-list-bespoke Chief Executive Officer’s Statement 10 − notes-list-dash Strategic Report d. notes-list-alpha Strategy 16 5. notes-list-number Investment Strategic KPIs 18 vi. -

FTSE Factsheet

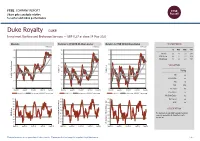

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Duke Royalty DUKE Investment Banking and Brokerage Services — GBP 0.37 at close 14 May 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-May-2021 14-May-2021 14-May-2021 0.4 180 180 1D WTD MTD YTD Absolute 2.8 1.4 2.8 21.3 170 170 Rel.Sector 0.4 1.7 3.1 18.2 0.35 160 Rel.Market 1.6 2.7 2.1 11.1 160 150 150 0.3 VALUATION 140 140 130 Trailing Relative Price Relative 0.25 Price Relative 130 120 PE -ve Absolute Price (local (local currency) AbsolutePrice 120 EV/EBITDA -ve 110 0.2 PB 1.3 100 110 PCF 17.3 0.15 90 100 Div Yield 7.5 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 May-2020 Aug-2020 Nov-2020 Feb-2021 May-2021 Price/Sales -ve Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.2 100 90 90 Div Payout -ve 90 80 80 ROE -ve 80 70 70 70 Index) Share Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 The Company is a globally focused investment 40 40 RSI RSI (Absolute) 30 company specialising in diversified royalty 30 investment. -

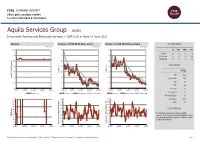

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Aquila Services Group AQSG Investment Banking and Brokerage Services — GBP 0.26 at close 18 June 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 18-Jun-2021 18-Jun-2021 18-Jun-2021 0.35 115 115 1D WTD MTD YTD Absolute 0.0 0.0 0.0 0.0 0.3 110 110 Rel.Sector 1.9 2.8 1.0 -2.0 Rel.Market 1.7 1.7 0.4 -8.2 0.25 105 105 VALUATION 0.2 100 100 Trailing 0.15 95 95 Relative Price Relative Price Relative PE 82.2 Absolute Price (local (local currency) AbsolutePrice 0.1 90 90 EV/EBITDA 38.4 0.05 85 85 PB 2.0 PCF +ve 0 80 80 Div Yield 1.1 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Price/Sales 1.3 Absolute Price Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.1 100 90 90 Div Payout 90.5 90 80 80 ROE 2.6 80 70 70 70 Index) Share Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 The Company operates as a venture capital 40 40 RSI RSI (Absolute) 30 company. The Company provides financing for one or 30 30 more growing unquoted companies looking for capital 20 20 to expand the business. -

Creating the World's Largest Interdealer Broker

TP ICAP Annual Report and Accounts 2016 Creating the world’s largest interdealer broker Annual Report and Accounts 2016 Introduction TP ICAP is a global brokerage and information firm that plays Strategic report a central role at the heart of the world’s wholesale financial, Highlights 1 Who we are 2 energy and commodities markets. Our transformation and the > Our brokers match buyers and sellers of financial, energy and benefits it creates 4 commodities products and facilitate price discovery Our business model 6 Our strategy 8 > We provide independent data to participants in the financial, Key performance indicators 10 energy and commodities markets, including live and historical Chairman’s statement 12 pricing content, and advanced valuation and risk analytics Chief Executive’s review 14 Business and operating review 18 > We are a trusted partner to our clients, enabling them to transact Financial review 26 with confidence Risk management 32 > We facilitate the flow of capital and commodities around the world, Our principal risks and uncertainties 34 enhancing investment and contributing to economic growth Resources, relationships and responsibilities 38 Governance report Chairman’s Governance review 42 Board of Directors 44 This Annual Report has been prepared for, and only for, the members of the Company as a body, and no other persons. The Company, Corporate governance report 46 its Directors, employees, agents or advisers do not accept or assume responsibility to any other person to whom this document is shown or into whose hands it may come and such responsibility is expressly disclaimed. By their nature, the statements concerning the risks Report of the Nominations Committee 50 and uncertainties facing the Group in this Annual Report involve uncertainty since future events and circumstances can cause results Report of the Audit Committee 51 and developments to differ materially from those anticipated. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 25 November 2015 BCA Marketplace BCA Support Services — GBP 1.695 at close 25 November 2015 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 25-Nov-2015 25-Nov-2015 25-Nov-2015 1.8 140 150 1D WTD MTD YTD Absolute -0.3 -0.3 -4.1 34.0 1.7 130 140 Rel.Sector -1.6 -0.6 -7.1 27.0 Rel.Market -1.2 -0.2 -3.8 36.3 1.6 120 130 VALUATION (local currency) (local 1.5 110 120 Trailing Relative Price Relative Price 1.4 100 110 PE - Absolute Price Price Absolute EV/EBITDA - 1.3 90 100 PCF - PB - 1.2 80 90 Price/Sales - Nov-2014 Feb-2015 May-2015 Aug-2015 Nov-2015 Nov-2014 Feb-2015 May-2015 Aug-2015 Nov-2015 Nov-2014 Feb-2015 May-2015 Aug-2015 Nov-2015 Div Yield - Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout - 100 100 90 ROE - 90 90 80 Net Debt/Equity - 80 80 70 70 70 60 60 DESCRIPTION 60 50 50 50 The Company owns and operates Europe's largest 40 40 RSI (Absolute) RSI 40 used vehicle marketplace (which it operates through 30 30 its Vehicle Remarketing Division), both in terms of the 20 30 number of vehicles sold and revenue, as well as the 10 20 20 UK's market-leading provider of vehicle buying RSI (Relative to FTSE UK All-Share Index) UK All-Share to FTSE (Relative RSI RSI (Relative to FTSE UK All-Share Sector) UK All-Share to FTSE (Relative RSI 0 10 10 services, We Buy Any Car Limited ("˜"˜WBAC'') Nov-2014 Feb-2015 May-2015 Aug-2015 Nov-2015 Nov-2014 Feb-2015 May-2015 Aug-2015 Nov-2015 Nov-2014 Feb-2015 May-2015 Aug-2015 Nov-2015 See final page and http://www.londonstockexchange.com/prices-and-markets/stocks/services-stock/ftse-note.htm for further details. -

The UK Private Equity IPO Report

THE UK PRIVATE EQUITY IPO REPORT Private equity-backed IPOs: 1 January 2009 – 31 December 2017 IN ASSOCIATION WITH 2 | THE UK PRIVATE EQUITY IPO REPORT CONTENTS FOREWORD 03 HISTORIC ANALYSIS OF PRIVATE EQUITY-BACKED IPOS IN THE UK 04 BETWEEN 1 JANUARY 2009 AND 31 DECEMBER 2017 VOLUME AND VALUE OF PRIVATE EQUITY-BACKED IPOS LISTING IN THE UK 05 TOP 10 PRIVATE EQUITY-BACKED IPOS 06 INDUSTRIES 07 FREE FLOAT 12 USE OF PROCEEDS 13 PRICING 14 PERFORMANCE 15 ANALYSIS OF ACTIVE PRIVATE EQUITY HOUSES BY SIZE 17 LOCK-UP PERIODS 18 HOLDING PERIODS 20 PRIVATE EQUITY-BACKED IPO ACTIVITY IN 2017 21 APPENDIX 23 PRIVATE EQUITY-BACKED IPOS 1 JANUARY 2009 - 31 DECEMBER 2017 23 METHODOLOGY 31 CONTACTS 32 3 | THE UK PRIVATE EQUITY IPO REPORT FOREWORD Public markets have long been an important exit route for private equity houses selling their stakes into the companies they have backed, yet little research has been conducted into how these businesses perform after they have floated. This report, published by the BVCA and PwC, provides an historic analysis of private equity-backed IPOs in the UK between 1 January 2009 and 31 December 2017. It looks at a number of metrics including the use of proceeds, pricing and performance to build a picture of the IPO market and the key trends with the market. The performance numbers are particularly revealing as they show that private equity-backed IPOs are trading on average 43.9% higher than their offer price for the period from IPO to 31 December 2017 compared to the non-private equity-backed IPOs of the same period which are trading at an average of 26.6% higher. -

Market Notice N12 2020

Instruments for which suspension from execution under RPW is to be revoked effective 13 August Symbol ISIN Name LREl BMG5361W1047 Lancashire Holdings Ltd LO24d DE000LTT0243 Lotto24 CHRc DK0060227585 Chr Hansen Holding A/S EDPRu ES0127797019 EDP Renovaveis SA UPONOh FI0009002158 Uponor Oyj SPIEp FR0012757854 SPIE SA DVOl GB0002670437 Devro PLC FSJl GB0003395000 James Fisher & Sons PLC HTGl GB0004478896 Hunting PLC MTOl GB0004657408 Mitie Group PLC LOOKl GB00B17MMZ46 Lookers PLC DNLMl GB00B1CKQ739 DUNELM GROUP PLC LAMl GB00B1CL5249 Lamprell PLC International Personal Finance IPFl GB00B1YKG049 PLC FOXTl GB00BCKFY513 Foxtons Group PLC RSAl GB00BKKMKR23 RSA Insurance Group PLC CARDl GB00BLY2F708 Card Factory PLC SPIl GB00BNLPYF73 Spire Healthcare Group PLC DTYl GB00BRB37M78 Dignity PLC DOMl GB00BYN59130 Domino's Pizza Group PLC TBCGl GB00BYT18307 TBC Bank Group PLC EQNl GB00BYWWHR75 Equiniti Group PLC GOCOl GB00BZ02Q916 GoCo Group PLC KRXi IE0004927939 Kingspan Group PLC PGSo NO0010199151 PGS ASA GRNGs SE0006288015 Granges AB Instruments to be suspended or re-suspended from execution under RPW effective 12 August Symbol ISIN Name Scope Action BVIp FR0006174348 Bureau Veritas SA EU Level Suspended MGGTl GB0005758098 Meggitt PLC EU Level Suspended FOURl GB0006640972 4imprint Group PLC EU Level Suspended RTNl GB00B0YG1K06 Restaurant Group PLC/The EU Level Suspended OCDOl GB00B3MBS747 Ocado Group PLC EU Level Suspended RMVl GB00BGDT3G23 Rightmove PLC EU Level Suspended AAFl GB00BKDRYJ47 Airtel Africa PLC EU Level Suspended TRNl GB00BKDTK925 Trainline