Korea Morning Focus

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Shinsegae Buy (004170 KS) (Maintain)

[Korea] Retail Shinsegae Buy (004170 KS) (Maintain) Additional negatives to be limited TP: W290,000 ▼ Upside: 31.5% Mirae Asset Daewoo Co., Ltd. Myoungjoo Kim [email protected] Minjeong Kyeong [email protected] 2Q20 review Operating loss due to COVID-19 For 2Q20, Shinsegae reported consolidated revenue of W1.01tr (-32.6% YoY) and an operating loss of W43.1bn (turning to loss YoY). For department stores (non-consolidated), operating profit plunged 56.3% YoY to W14.3bn. The duty-free division posted an operating loss of W37bn (turning to loss YoY). The results missed our estimates and the consensus, hurt by: 1) sluggish department store earnings due to sales mix deterioration; and 2) continued weakness at the duty-free division. In the department store division, the apparel/accessories segments have been slow to recover due to the rapid shift to online shopping amid the lingering impact of COVID-19. Additional negatives to be 2Q20 marked a bottom limited The pandemic weighed on all of Shinsegae’s businesses in 1H20, not just the department store and duty-free divisions. That said, we believe additional negatives are limited. Monthly same-store sales growth at department stores has recovered swiftly (to approximately 9% currently). Considering additional rent cuts for the Terminal 1 airport location (i.e., the temporary introduction of variable rent payments linked to sales), we expect the duty-free division to improve meaningfully in line with the recovery of revenue. Valuation and recommendation Lower TP to W290,000 (from W360,000) We revised down our 2021 EPS estimate by 5.1%, reflecting the decline in the value of Shinsegae’s stakes in subsidiaries (e.g., Shinsegae International [031430 KS/CP: W158,000]). -

FTSE Korea 30/18 Capped

2 FTSE Russell Publications 19 August 2021 FTSE Korea 30/18 Capped Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Alteogen 0.19 KOREA Hyundai Engineering & Construction 0.35 KOREA NH Investment & Securities 0.14 KOREA AmoreG 0.15 KOREA Hyundai Glovis 0.32 KOREA NHN 0.07 KOREA Amorepacific Corp 0.65 KOREA Hyundai Heavy Industries 0.29 KOREA Nong Shim 0.08 KOREA Amorepacific Pfd. 0.08 KOREA Hyundai Marine & Fire Insurance 0.13 KOREA OCI 0.17 KOREA BGF Retail 0.09 KOREA Hyundai Merchant Marine 1.02 KOREA Orion 0.21 KOREA BNK Financial Group 0.18 KOREA Hyundai Mipo Dockyard 0.15 KOREA Ottogi 0.06 KOREA Celltrion Healthcare 0.68 KOREA Hyundai Mobis 1.53 KOREA Paradise 0.07 KOREA Celltrion Inc 2.29 KOREA Hyundai Motor 2.74 KOREA Posco 1.85 KOREA Celltrion Pharm 0.24 KOREA Hyundai Motor 2nd Pfd. 0.33 KOREA Posco Chemical 0.32 KOREA Cheil Worldwide 0.14 KOREA Hyundai Motor Pfd. 0.21 KOREA Posco International 0.09 KOREA CJ Cheiljedang 0.3 KOREA Hyundai Steel 0.33 KOREA S1 Corporation 0.13 KOREA CJ CheilJedang Pfd. 0.02 KOREA Hyundai Wia 0.13 KOREA Samsung Biologics 0.92 KOREA CJ Corp 0.11 KOREA Industrial Bank of Korea 0.22 KOREA Samsung C&T 0.94 KOREA CJ ENM 0.15 KOREA Kakao 3.65 KOREA Samsung Card 0.08 KOREA CJ Logistics 0.12 KOREA Kangwon Land 0.23 KOREA Samsung Electro-Mechanics 0.81 KOREA Coway 0.36 KOREA KB Financial Group 1.78 KOREA Samsung Electronics 25.36 KOREA Daewoo Engineering & Construction 0.12 KOREA KCC Corp 0.12 KOREA Samsung Electronics Pfd. -

2021 Virtual Buyer Meetings: Korea

VIRTUAL TRADE EVENT 2021 VIRTUAL BUYER MEETINGS: KOREA Tuesday, Jun 8 - Wednesday, Jun 9, 2021 Registration: Thursday, Apr 8 - Friday, Apr 30, 2021 | 12:00 PM Virtual Meetings | Korea, Republic of | East Asia https://www.wusata.org/e/JW6OHLO EVENT DETAILS The Western United States Agricultural Trade Association (WUSATA®) and the PRODUCT DESCRIPTION 13 Western State Departments of Agriculture, announce participation and registration in the following activity, brought to you by the USDA's Foreign Agricultural Service: Frozen fruit, canned vegetables, beverage mixes, coffee, tea, wine, cereals, wheat & grain products, oatmeal, 2021 Virtual Buyer Meetings: Korea ~ June 8-9, 2021 confectioneries, bakery products, oils, condiments, Introduce your unique consumer-oriented products to buyers remotely! maple syrup, sauces, spices & seasonings, organic Seven companies from South Korea are seeking products to import for their foods, healthy & natural products, snacks, chocolates, customers. These companies have experience importing food and beverage protein snacks, ice cream, frozen meals, vegan meat, products into the Korean market. They distribute to retail, online and foodservice peanut butter, nuts (hazelnuts, almonds, walnuts, businesses across the country. This is a great opportunity for companies seeking a pistachios & pecans), pet food and animal feed. distribution partner in Korea. INDUSTRY FOCUS Please review the list of products each company is seeking to see if your Consumer Oriented products fit. If you are interested in meeting with buyers from any of these companies, please sign up quickly. Meeting times are limited. Here is more information about each of the Korean companies: 1. GED Corporation (www.gedfood.co.kr) - Importer and distributor based in Seoul, which sells into the retail, online and foodservice channels. -

Tested Websites

1 Appendix: Lists of tested websites monetary non-monetary Name URL Name URL KDB www.kdb.co.kr e-Post www.epostbank.go.kr IBK www.ibk.co.kr Saemaeul www.kfcc.co.kr KB www.kbstar.com Shinhyup openbank.cu.co.kr KEB www.keb.co.kr Aju aju.banking.fsb.or.kr Hana www.hanabank.com Dongyang dy.banking.fsb.or.kr Shinhan www.shinhan.com Yeju www.yejubank.co.kr Suhyup www.suhyup-bank.com HS www.hsb.co.kr NH banking.nonghyup.com HK www.hansolbank.co.kr Woori www.wooribank.com SC www.scstandardmutualsavingsbank.co.kr SC (bank) www.standardchartered.co.kr Yenarae http://www.yenaraebank.co.kr Citi www.citibank.co.kr Shinan http://www.shinanbank.co.kr Daegu www.dgb.co.kr Moa www.moa-bank.co.kr Busan www.busanbank.co.kr TS www.samsungbank.co.kr Gwangju www.kjbank.com Hyundai www.hyundaisb.com Jeju www.e-jejubank.com Shinhan www.shinhansavings.com Jeonbuk www.jbbank.co.kr Hanwha hanwhas.banking.fsb.or.kr Kyoungnam www.knbank.co.kr EG egbank.banking.fsb.or.kr HSBC www.hsbc.co.kr Hankuk kibank.banking.fsb.or.kr Table 1. List of financial institution websites in Korea 2 Rank Name URL Rank Name URL 1 Naver www.naver.com 51 Hangame www.hangame.com 2 Daum www.daum.net 52 Twitter www.twitter.com 3 Nate www.nate.com 53 Tcloud www.tcloud.co.kr 4 Cyworld www.nate.com/cymain 54 Digital times www.dt.co.kr 5 11st www.11st.co.kr 55 Wownet www.wownet.co.kr 6 Gmarket www.gmarket.com 56 Tmap www.tmap.co.kr 7 Google www.google.com 57 Nexon www.nexon.com 8 Facebook www.facebook.com 58 Lotte i mall www.lotteimall.com 9 Auction www.auction.co.kr 59 CJ mall www.cjmall.com 10 -

KOREA Morning Focus

March 15, 2018 KOREA Morning Focus Company News & Analysis Major Indices Close Chg Chg (%) SM Entertainment (041510/Buy/TP: W50,000) KOSPI 2,486.08 -8.41 -0.34 Positive on KeyEast/FNC Add Culture acquisition KOSPI 200 321.99 -0.99 -0.31 KOSDAQ 886.92 0.67 0.08 Sector News & Analysis Turnover ('000 shares, Wbn) Volume Value Internet/Game (Overweight) KOSPI 357,035 6,259 Japan visit note: Expanding lifestyle presence KOSPI 200 74,841 4,749 KOSDAQ 920,060 5,181 Market Cap (Wbn) Value KOSPI 1,652,629 KOSDAQ 285,293 KOSPI Turnover (Wbn) Buy Sell Net Foreign 1,580 1,709 -130 Institutional 1,232 1,375 -142 Retail 3,437 3,154 283 KOSDAQ Turnover (Wbn) Buy Sell Net Foreign 366 440 -74 Institutional 184 235 -51 Retail 4,617 4,481 136 Program Buy / Sell (Wbn) Buy Sell Net KOSPI 1,309 1,502 -192 KOSDAQ 187 197 -10 Advances & Declines Advances Declines Unchanged KOSPI 324 502 61 KOSDAQ 525 638 92 KOSPI Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Samsung Electronics 2,588,000 5,000 645 Celltrion 306,500 -4,500 582 Hynix 90,700 700 512 Pharmicell 8,710 2,010 230 KODEX LEVERAGE 17,215 -40 212 KOSDAQ Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value SillaJen 119,900 2,600 250 NATURECELL 54,600 2,000 171 CIS 2,495 265 138 Diostech 38,550 250 108 Celltrion Healthcare 104,900 0 92 Note: As of March 14, 2018 Mirae Asset Daewoo Research SM Entertainment (041510 KQ) Positive on KeyEast/FNC Add Culture acquisition Entertainment Acquisition of rivals to strengthen content production business; Maintain positive view Company Update We reaffirm our Buy call and target price of W50,000 on SM Entertainment. -

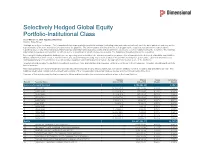

Selectively Hedged Global Equity Portfolio-Institutional Class As of March 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

Selectively Hedged Global Equity Portfolio-Institutional Class As of March 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. This fund operates as a fund-of-funds and generally allocates its assets among other mutual funds, but has the ability to invest in securities and derivatives directly. The holdings listed below contain both the investment holdings of the corresponding underlying funds as well as any direct investments of the fund. -

Holdings-Report.Pdf

The Fund is a closed-end exchange traded management Investment company. This material is presented only to provide information and is not intended for trading purposes. Closed-end funds, unlike open-end funds are not continuously offered. After the initial public offering, shares are sold on the open market through a stock exchange. Changes to investment policies, current management fees, and other matters of interest to investors may be found in each closed-end fund's most recent report to shareholders. Holdings are subject to change daily. PORTFOLIO HOLDINGS FOR THE KOREA FUND as of July 31, 2021 *Note: Cash (including for these purposes cash equivalents) is not included. Security Description Shares/Par Value Base Market Value (USD) Percent of Base Market Value SAMSUNG ELECTRONICS CO 793,950 54,183,938.27 20.99 SK HYNIX INC COMMON 197,500 19,316,452.95 7.48 NAVER CORP COMMON STOCK 37,800 14,245,859.60 5.52 LG CHEM LTD COMMON STOCK 15,450 11,309,628.34 4.38 HANA FINANCIAL GROUP INC 225,900 8,533,236.25 3.31 SK INNOVATION CO LTD 38,200 8,402,173.44 3.26 KIA CORP COMMON STOCK 107,000 7,776,744.19 3.01 HYUNDAI MOBIS CO LTD 26,450 6,128,167.79 2.37 HYUNDAI MOTOR CO 66,700 6,030,688.98 2.34 NCSOFT CORP COMMON STOCK 8,100 5,802,564.66 2.25 SAMSUNG BIOLOGICS CO LTD 7,230 5,594,175.18 2.17 KB FINANCIAL GROUP INC 123,000 5,485,677.03 2.13 KAKAO CORP COMMON STOCK 42,700 5,456,987.61 2.11 HUGEL INC COMMON STOCK 24,900 5,169,415.34 2.00 SAMSUNG 29,900 4,990,915.02 1.93 SK TELECOM CO LTD COMMON 17,500 4,579,439.25 1.77 KOREA INVESTMENT 53,100 4,427,115.84 -

Cultural Production in Transnational Culture: an Analysis of Cultural Creators in the Korean Wave

International Journal of Communication 15(2021), 1810–1835 1932–8036/20210005 Cultural Production in Transnational Culture: An Analysis of Cultural Creators in the Korean Wave DAL YONG JIN1 Simon Fraser University, Canada By employing cultural production approaches in conjunction with the global cultural economy, this article attempts to determine the primary characteristics of the rapid growth of local cultural industries and the global penetration of Korean cultural content. It documents major creators and their products that are received in many countries to identify who they are and what the major cultural products are. It also investigates power relations between cultural creators and the surrounding sociocultural and political milieu, discussing how cultural creators develop local popular culture toward the global cultural markets. I found that cultural creators emphasize the importance of cultural identity to appeal to global audiences as well as local audiences instead of emphasizing solely hybridization. Keywords: cultural production, Hallyu, cultural creators, transnational culture Since the early 2010s, the Korean Wave (Hallyu in Korean) has become globally popular, and media scholars (Han, 2017; T. J. Yoon & Kang, 2017) have paid attention to the recent growth of Hallyu in many parts of the world. Although the influence of Western culture has continued in the Korean cultural market as well as elsewhere, local cultural industries have expanded the exportation of their popular culture to several regions in both the Global South and the Global North. Social media have especially played a major role in disseminating Korean culture (Huang, 2017; Jin & Yoon, 2016), and Korean popular culture is arguably reaching almost every corner of the world. -

STOXX EAST ASIA 1800 Selection List

STOXX EAST ASIA 1800 Last Updated: 20210401 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 424.9 1 1 KR7005930003 6771720 005930.KS KR002D Samsung Electronics Co Ltd KR KRW Y 314.8 2 2 JP3633400001 6900643 7203.T 690064 Toyota Motor Corp. JP JPY Y 169.7 3 3 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 124.8 4 4 JP3435000009 6821506 6758.T 682150 Sony Corp. JP JPY Y 112.6 5 5 JP3436100006 6770620 9984.T 677062 Softbank Group Corp. JP JPY Y 94.6 6 6 JP3236200006 6490995 6861.T 649099 Keyence Corp. JP JPY Y 74.1 7 7 JP3970300004 BQRRZ00 6098.T JP503G RECRUIT HOLDINGS JP JPY Y 70.5 8 8 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORPCN H HKD Y 70 9 9 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 61.1 10 11 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 59.7 11 12 JP3371200001 6804585 4063.T 680458 Shin-Etsu Chemical Co. Ltd. JP JPY Y 59.7 12 15 JP3902900004 6335171 8306.T 659668 Mitsubishi UFJ Financial Group JP JPY Y 58.5 13 17 JP3756600007 6639550 7974.T 663955 Nintendo Co. Ltd. JP JPY Y 56.7 14 13 JP3571400005 6895675 8035.T 689567 Tokyo Electron Ltd. JP JPY Y 56.6 15 18 JP3734800000 6640682 6594.T 664068 Nidec Corp. -

Media/Entertainment Rise of Webtoons Presents Opportunities in Content Providers

Media/Entertainment Rise of webtoons presents opportunities in content providers The rise of webtoons Overweight (Maintain) Webtoons are emerging as a profitable new content format, just as video and music streaming services have in the past. In 2015, webtoons were successfull y monetized in Korea and Japan by NAVER (035420 KS/Buy/TP: W241,000/CP: W166,500) and Kakao Industry Report (035720 KS/Buy/TP: W243,000/CP: W158,000). In late 2018, webtoon user number s April 9, 2020 began to grow in the US and Southeast Asia, following global monetization. This year, NAVER Webtoon’s entry into Europe, combined with growing content consumption due to COVID-19 and the success of several webtoon-based dramas, has led to increasing opportunities for Korean webtoon companies. Based on Google Trends Mirae Asset Daewoo Co., Ltd. data, interest in webtoons is hitting all-time highs across major regions. [Media ] Korea is the global leader in webtoons; Market outlook appears bullish Jeong -yeob Park Korea is the birthplace of webtoons. Over the past two decades, Korea’s webtoon +822 -3774 -1652 industry has created sophisticated platforms and content, making it well-positioned for [email protected] growth in both price and volume. 1) Notably, the domestic webtoon industry adopted a partial monetization model, which is better suited to webtoons than monthly subscriptions and ads and has more upside potent ial in transaction volume. 2) The industry also has a well-established content ecosystem that centers on platforms. We believe average revenue per paying user (ARPPU), which is currently around W3,000, can rise to over W10,000 (similar to that of music and video streaming services) upon full monetization. -

Morning Focus

August 22, 2018 Korea Morning Focus Company News & Analysis Major Indices Close Chg Chg (%) Shinsegae International (031430/Buy/TP: W260,000) KOSPI 2,270.06 22.18 0.99 Power of platform KOSPI 200 291.93 3.32 1.15 KOSDAQ 787.15 17.37 2.26 Turnover ('000 shares, Wbn) Volume Value KOSPI 290,503 5,093 KOSPI 200 78,660 3,894 KOSDAQ 504,193 3,420 Market Cap (Wbn) Value KOSPI 1,518,199 KOSDAQ 262,063 KOSPI Turnover (Wbn) Buy Sell Net Foreign 1,506 1,400 106 Institutional 1,232 1,249 -17 Retail 2,282 2,433 -151 KOSDAQ Turnover (Wbn) Buy Sell Net Foreign 404 292 111 Institutional 304 167 137 Retail 2,718 2,953 -235 Program Buy / Sell (Wbn) Buy Sell Net KOSPI 1,280 1,225 54 KOSDAQ 250 121 129 Advances & Declines Advances Declines Unchanged KOSPI 523 293 82 KOSDAQ 891 249 102 KOSPI Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Hynix 78,400 3,700 429 Samsung Electronics 44,800 950 422 KODEX KOSDAQ150 15,620 990 247 LEVERAGE SEMCO 143,500 10,000 176 Celltrion 268,500 7,500 167 KOSDAQ Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value SillaJen 62,900 2,400 105 ECOMAISTER 13,600 1,450 94 Keayeast 3,335 -40 92 ViroMed 217,200 16,200 83 Daea TI 9,170 50 81 Note: As of August 21, 2018 Mirae Asset Daewoo Research This document is a summary of a report prepared by Mirae Asset Daewoo Co., Ltd. -

Studio Dragon(253450.KQ)

Studio Dragon (253450.KQ) Re-rating is on the way Although Covid-19 effects have reduced Studio Dragon’s room for top-line Company Comment │Oct 12, 2020 growth via diversification of its programming platforms, we draw attention to stronger margins amid intensified competition among global OTTs. The stiffer ※ Refer to page 2 for competition is to boost production studios’ bargaining power and spur expansion ESG index/event tables of the global content market. We maintain Studio Dragon as our sector top pick. Buy (maintain) TP (12-mth) W110,000 (maintain) Pay attention to strengthening bargaining power and widening margins CP (20/10/08) W85,000 Sector Media/entertainment We maintain a Buy rating on Studio Dragon, continuing to suggest it as our Kospi/Kosdaq 2,391.96 / 871.62 sector top pick in respect of: 1) its increased bargaining power; and 2) intact Market cap (common) US$2,074.5mn expectations towards re-rating in response to global content market expansion. Outstanding shares (common) 28.1mn We view the firm’s recent sale of global broadcasting rights for Jirisan to iQIYI 52W high (’20/07/08) W92,500 as evidencing the emergence of OTT operators in possession of both abundant low (’19/10/10) W65,000 funding power to counter Netflix and a willingness to secure content in Asia. Average trading value (60D) US$18.3mn Accordingly, content producers are set to enjoy increased bargaining power. Dividend yield (2020E) 0.00% Meanwhile, with the company currently in talks with both Apple and HBO Max Foreign ownership 9.2% regarding global market original productions, we see opportunities for further Major Shareholders expansion into the global content market.