Barings Korea Trust

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Shinsegae Buy (004170 KS) (Maintain)

[Korea] Retail Shinsegae Buy (004170 KS) (Maintain) Additional negatives to be limited TP: W290,000 ▼ Upside: 31.5% Mirae Asset Daewoo Co., Ltd. Myoungjoo Kim [email protected] Minjeong Kyeong [email protected] 2Q20 review Operating loss due to COVID-19 For 2Q20, Shinsegae reported consolidated revenue of W1.01tr (-32.6% YoY) and an operating loss of W43.1bn (turning to loss YoY). For department stores (non-consolidated), operating profit plunged 56.3% YoY to W14.3bn. The duty-free division posted an operating loss of W37bn (turning to loss YoY). The results missed our estimates and the consensus, hurt by: 1) sluggish department store earnings due to sales mix deterioration; and 2) continued weakness at the duty-free division. In the department store division, the apparel/accessories segments have been slow to recover due to the rapid shift to online shopping amid the lingering impact of COVID-19. Additional negatives to be 2Q20 marked a bottom limited The pandemic weighed on all of Shinsegae’s businesses in 1H20, not just the department store and duty-free divisions. That said, we believe additional negatives are limited. Monthly same-store sales growth at department stores has recovered swiftly (to approximately 9% currently). Considering additional rent cuts for the Terminal 1 airport location (i.e., the temporary introduction of variable rent payments linked to sales), we expect the duty-free division to improve meaningfully in line with the recovery of revenue. Valuation and recommendation Lower TP to W290,000 (from W360,000) We revised down our 2021 EPS estimate by 5.1%, reflecting the decline in the value of Shinsegae’s stakes in subsidiaries (e.g., Shinsegae International [031430 KS/CP: W158,000]). -

FTSE Korea 30/18 Capped

2 FTSE Russell Publications 19 August 2021 FTSE Korea 30/18 Capped Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Alteogen 0.19 KOREA Hyundai Engineering & Construction 0.35 KOREA NH Investment & Securities 0.14 KOREA AmoreG 0.15 KOREA Hyundai Glovis 0.32 KOREA NHN 0.07 KOREA Amorepacific Corp 0.65 KOREA Hyundai Heavy Industries 0.29 KOREA Nong Shim 0.08 KOREA Amorepacific Pfd. 0.08 KOREA Hyundai Marine & Fire Insurance 0.13 KOREA OCI 0.17 KOREA BGF Retail 0.09 KOREA Hyundai Merchant Marine 1.02 KOREA Orion 0.21 KOREA BNK Financial Group 0.18 KOREA Hyundai Mipo Dockyard 0.15 KOREA Ottogi 0.06 KOREA Celltrion Healthcare 0.68 KOREA Hyundai Mobis 1.53 KOREA Paradise 0.07 KOREA Celltrion Inc 2.29 KOREA Hyundai Motor 2.74 KOREA Posco 1.85 KOREA Celltrion Pharm 0.24 KOREA Hyundai Motor 2nd Pfd. 0.33 KOREA Posco Chemical 0.32 KOREA Cheil Worldwide 0.14 KOREA Hyundai Motor Pfd. 0.21 KOREA Posco International 0.09 KOREA CJ Cheiljedang 0.3 KOREA Hyundai Steel 0.33 KOREA S1 Corporation 0.13 KOREA CJ CheilJedang Pfd. 0.02 KOREA Hyundai Wia 0.13 KOREA Samsung Biologics 0.92 KOREA CJ Corp 0.11 KOREA Industrial Bank of Korea 0.22 KOREA Samsung C&T 0.94 KOREA CJ ENM 0.15 KOREA Kakao 3.65 KOREA Samsung Card 0.08 KOREA CJ Logistics 0.12 KOREA Kangwon Land 0.23 KOREA Samsung Electro-Mechanics 0.81 KOREA Coway 0.36 KOREA KB Financial Group 1.78 KOREA Samsung Electronics 25.36 KOREA Daewoo Engineering & Construction 0.12 KOREA KCC Corp 0.12 KOREA Samsung Electronics Pfd. -

2021 Virtual Buyer Meetings: Korea

VIRTUAL TRADE EVENT 2021 VIRTUAL BUYER MEETINGS: KOREA Tuesday, Jun 8 - Wednesday, Jun 9, 2021 Registration: Thursday, Apr 8 - Friday, Apr 30, 2021 | 12:00 PM Virtual Meetings | Korea, Republic of | East Asia https://www.wusata.org/e/JW6OHLO EVENT DETAILS The Western United States Agricultural Trade Association (WUSATA®) and the PRODUCT DESCRIPTION 13 Western State Departments of Agriculture, announce participation and registration in the following activity, brought to you by the USDA's Foreign Agricultural Service: Frozen fruit, canned vegetables, beverage mixes, coffee, tea, wine, cereals, wheat & grain products, oatmeal, 2021 Virtual Buyer Meetings: Korea ~ June 8-9, 2021 confectioneries, bakery products, oils, condiments, Introduce your unique consumer-oriented products to buyers remotely! maple syrup, sauces, spices & seasonings, organic Seven companies from South Korea are seeking products to import for their foods, healthy & natural products, snacks, chocolates, customers. These companies have experience importing food and beverage protein snacks, ice cream, frozen meals, vegan meat, products into the Korean market. They distribute to retail, online and foodservice peanut butter, nuts (hazelnuts, almonds, walnuts, businesses across the country. This is a great opportunity for companies seeking a pistachios & pecans), pet food and animal feed. distribution partner in Korea. INDUSTRY FOCUS Please review the list of products each company is seeking to see if your Consumer Oriented products fit. If you are interested in meeting with buyers from any of these companies, please sign up quickly. Meeting times are limited. Here is more information about each of the Korean companies: 1. GED Corporation (www.gedfood.co.kr) - Importer and distributor based in Seoul, which sells into the retail, online and foodservice channels. -

Tested Websites

1 Appendix: Lists of tested websites monetary non-monetary Name URL Name URL KDB www.kdb.co.kr e-Post www.epostbank.go.kr IBK www.ibk.co.kr Saemaeul www.kfcc.co.kr KB www.kbstar.com Shinhyup openbank.cu.co.kr KEB www.keb.co.kr Aju aju.banking.fsb.or.kr Hana www.hanabank.com Dongyang dy.banking.fsb.or.kr Shinhan www.shinhan.com Yeju www.yejubank.co.kr Suhyup www.suhyup-bank.com HS www.hsb.co.kr NH banking.nonghyup.com HK www.hansolbank.co.kr Woori www.wooribank.com SC www.scstandardmutualsavingsbank.co.kr SC (bank) www.standardchartered.co.kr Yenarae http://www.yenaraebank.co.kr Citi www.citibank.co.kr Shinan http://www.shinanbank.co.kr Daegu www.dgb.co.kr Moa www.moa-bank.co.kr Busan www.busanbank.co.kr TS www.samsungbank.co.kr Gwangju www.kjbank.com Hyundai www.hyundaisb.com Jeju www.e-jejubank.com Shinhan www.shinhansavings.com Jeonbuk www.jbbank.co.kr Hanwha hanwhas.banking.fsb.or.kr Kyoungnam www.knbank.co.kr EG egbank.banking.fsb.or.kr HSBC www.hsbc.co.kr Hankuk kibank.banking.fsb.or.kr Table 1. List of financial institution websites in Korea 2 Rank Name URL Rank Name URL 1 Naver www.naver.com 51 Hangame www.hangame.com 2 Daum www.daum.net 52 Twitter www.twitter.com 3 Nate www.nate.com 53 Tcloud www.tcloud.co.kr 4 Cyworld www.nate.com/cymain 54 Digital times www.dt.co.kr 5 11st www.11st.co.kr 55 Wownet www.wownet.co.kr 6 Gmarket www.gmarket.com 56 Tmap www.tmap.co.kr 7 Google www.google.com 57 Nexon www.nexon.com 8 Facebook www.facebook.com 58 Lotte i mall www.lotteimall.com 9 Auction www.auction.co.kr 59 CJ mall www.cjmall.com 10 -

Global Marketing Firm Transitions to Cloud File Services to Reduce Costs, Improve Agility & Boost Collaboration

Case Study Case Study: Cheil Worldwide Global Marketing Firm Transitions to Cloud File Services to Reduce Costs, Improve Agility & Boost Collaboration Cheil extends the scale and durability of AWS cloud storage to multiple offices worldwide Cheil Worldwide, a marketing company under the Samsung Group, has 53 offices on five continents. Offering a range of advertising, public relations, digital marketing, and other services, Cheil has compiled a long list of brand-name clients, including Absolut, Adidas, Coca-Cola, and Microsoft. The award-winning agency centers its multi-platform campaigns around ideas that move, and as the digital files representing its creative Executive Summary campaigns have grown in size and complexity, Cheil has been forced to rethink how it stores, protects, and shares unstructured data. Industry: Marketing Global File System: Nasuni The firm’s search for a new platform began with a single location, explains Cheil EHQ Object Storage: Amazon Web (European Headquarters) IT Operations Manager Michael Goral. The London office had Services been relying on traditional NAS storage hardware. But after only six years, the Use Cases: NAS Consolidation; maintenance fees on the hardware had climbed so high that it would have been less Cloud First; File Archive; Cloud expensive to buy an entirely new box. Backup; Cloud Disaster Recovery; Multi-Site File As Cheil and other global marketing agencies work with more 4K and 8K videos, Adobe Collaboration; Digital Creative files, and documents, the volume of files stored is growing rapidly. This growth Transformation; ROBO isn’t predictable at Cheil, either: An office’s file storage needs will expand and contract with its work and the nature of its engagements with clients. -

In the United States District Court for the District of Delaware

Case 1:19-cv-00776-UNA Document 1 Filed 04/29/19 Page 1 of 65 PageID #: 1 IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF DELAWARE LG CHEM, LTD. and ) LG CHEM MICHIGAN INC., ) ) Plaintiffs, ) ) v. ) C.A. No. _________________ ) SK INNOVATION CO., LTD. and ) JURY TRIAL DEMANDED SK BATTERY AMERICA, INC., ) ) Defendants. ) COMPLAINT Plaintiffs LG Chem, Ltd. (“LG Chem”) and LG Chem Michigan, Inc. (“LGCMI”) (collectively “LGC” or “Plaintiffs”), by and through their undersigned counsel, hereby file the following Complaint for trade secret misappropriation under the Defend Trade Secrets Act under 18 U.S.C. § 1836, et seq. (“DTSA”) and the Delaware Uniform Trade Secrets Act (“DUTSA”), tortious interference with a prospective business opportunity, unfair competition in violation of Delaware’s Deceptive Trade Practices Act, 6 Del. C. §§ 2532 et seq., conversion, and unjust enrichment against Defendants SK Innovation Co., Ltd. (“SKI”), and SK Battery America, Inc. (“SKBA”) (collectively “Defendants”), and allege as follows: INTRODUCTION 1. Defendants have systematically stolen LGC’s intellectual property and technology concerning LGC’s lithium-ion batteries, battery cells, battery modules, and battery packs, including components thereof and related production and testing systems and processes therefor. These products, systems, and processes are used in the rapidly-growing and highly-competitive Electric Vehicle (“EV”) industry. Through diligent work and heavy investment over the course of many years, LGC became a leading developer of EV batteries and related technologies. Defendants, Case 1:19-cv-00776-UNA Document 1 Filed 04/29/19 Page 2 of 65 PageID #: 2 on the other hand, have avoided the arduous, time-consuming, and expensive process of developing their own EV battery technologies. -

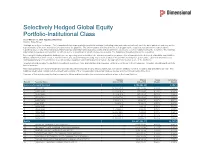

Selectively Hedged Global Equity Portfolio-Institutional Class As of March 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

Selectively Hedged Global Equity Portfolio-Institutional Class As of March 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. This fund operates as a fund-of-funds and generally allocates its assets among other mutual funds, but has the ability to invest in securities and derivatives directly. The holdings listed below contain both the investment holdings of the corresponding underlying funds as well as any direct investments of the fund. -

2014 ESG Integrated Ratings of Public Companies in Korea

2014 ESG Integrated Ratings of public companies in Korea Korea Corporate Governance Service(KCGS) annouced 2014 ESG ratings for public companies in Korea on Aug 13. With the ESG ratings, investors may figure out the level of ESG risks that companies face and use them in making investment decision. KCGS provides four ratings for each company which consist of Environmental, Social, Governance and Integrated rating. ESG ratings by KCGS are graded into seven levels: S, A+, A, B+, B, C, D. 'S' rating means that a company has all the system and practices that the code of best practices requires and there hardly exists a possibility of damaging shareholder value due to ESG risks. 'D' rating means that there is a high possibility of damaging shareholder value due to ESG risks. Company ESG Integrated Company Name Code Rating 010950 S-Oil Corporation A+ 009150 Samsung Electro-Mechanics Co., Ltd. A+ 000150 DOOSAN CORPORATION A 000210 Daelim Industrial Co., Ltd. A 000810 Samsung Fire & Marine Insurance Co., Ltd. A 001300 Cheil Industries Inc. A 001450 Hyundai Marine&Fire Insurance Co., Ltd. A 005490 POSCO. A 006360 GS Engineering & Construction Corp. A 006400 SAMSUNG SDI Co., Ltd. A 010620 Hyundai Mipo Dockyard Co., Ltd. A 011070 LG Innotek Co., Ltd. A 011170 LOTTE CHEMICAL CORPORATION A 011790 SKC Co., Ltd. A 012330 HYUNDAI MOBIS A 012450 Samsung Techwin Co., Ltd. A 023530 Lotte Shopping Co., Ltd. A 028050 Samsung Engineering Co., Ltd. (SECL) A 033780 KT&G Corporation A 034020 Doosan Heavy Industries & Construction Co., Ltd. A 034220 LG Display Co., Ltd. -

Posco International Corporation

POSCO INTERNATIONAL CORPORATION Sustainability Report 2019 About This Report The 2019 POSCO INTERNATIONAL Sustainability Report, the forth annual publication, illustrate the Company’s performance fulfill- ing its economic, social, and environmental responsibility. POSCO INTERNATIONAL aims to transparently disclose its sustainability management activities for the year 2019 and communicate with wide-ranging stakeholders. Reporting Guidelines Global Reporting Initiative(GRI) Standards: Core Option Reporting Period January 1, 2019 ~ December 31, 2019 * 2017 ~ H1 of 2020 for a portion of the performance data Reporting Scope Economy: On a consolidated basis in accordance with the K-IFRS 〮 Society & Environment: POSCO INTERNATIONAL Headquarters, 〮 POSCO SPS1), and overseas worksites (Myanmar, Indonesia, and Uzbekistan) Areas where major operations are based: Republic of Korea 〮 1) This refers to the STS Division, the TMC Division and the Plate Fabrication Division that were split off as subsidiaries in April 2020. Reporting Cycle Annually(publication of the most recent report: 2019) Assurance Financial data: Earnst & Young Han Young 〮 Non-financial data: DNV GL 〮 Contact Details Address: 165 Convensia-daero(POSCO Tower-Songdo), Yeonsu-gu, Incheon, Republic of Korea Tel: +82-2-759-2861 Department in charge: Sustainability Management Section E-mail: [email protected] POSCO INTERNATIONAL CORPORATION Sustainability Report 2019 03 Global CSR Activities 01 We Make Sustainability 02 Sustainability Management Strategy 102 Global CSR Overview -

Holdings-Report.Pdf

The Fund is a closed-end exchange traded management Investment company. This material is presented only to provide information and is not intended for trading purposes. Closed-end funds, unlike open-end funds are not continuously offered. After the initial public offering, shares are sold on the open market through a stock exchange. Changes to investment policies, current management fees, and other matters of interest to investors may be found in each closed-end fund's most recent report to shareholders. Holdings are subject to change daily. PORTFOLIO HOLDINGS FOR THE KOREA FUND as of July 31, 2021 *Note: Cash (including for these purposes cash equivalents) is not included. Security Description Shares/Par Value Base Market Value (USD) Percent of Base Market Value SAMSUNG ELECTRONICS CO 793,950 54,183,938.27 20.99 SK HYNIX INC COMMON 197,500 19,316,452.95 7.48 NAVER CORP COMMON STOCK 37,800 14,245,859.60 5.52 LG CHEM LTD COMMON STOCK 15,450 11,309,628.34 4.38 HANA FINANCIAL GROUP INC 225,900 8,533,236.25 3.31 SK INNOVATION CO LTD 38,200 8,402,173.44 3.26 KIA CORP COMMON STOCK 107,000 7,776,744.19 3.01 HYUNDAI MOBIS CO LTD 26,450 6,128,167.79 2.37 HYUNDAI MOTOR CO 66,700 6,030,688.98 2.34 NCSOFT CORP COMMON STOCK 8,100 5,802,564.66 2.25 SAMSUNG BIOLOGICS CO LTD 7,230 5,594,175.18 2.17 KB FINANCIAL GROUP INC 123,000 5,485,677.03 2.13 KAKAO CORP COMMON STOCK 42,700 5,456,987.61 2.11 HUGEL INC COMMON STOCK 24,900 5,169,415.34 2.00 SAMSUNG 29,900 4,990,915.02 1.93 SK TELECOM CO LTD COMMON 17,500 4,579,439.25 1.77 KOREA INVESTMENT 53,100 4,427,115.84 -

Certain Cold-Rolled Steel Flat Products from the Republic of Korea: Final Results of Antidumping Duty Administrative Review; 2018-2019

This document is scheduled to be published in the Federal Register on 07/29/2021 and available online at federalregister.gov/d/2021-16172, and onBILLINGgovinfo.gov CODE: 3510-DS-P DEPARTMENT OF COMMERCE International Trade Administration [A-580-881] Certain Cold-Rolled Steel Flat Products from the Republic of Korea: Final Results of Antidumping Duty Administrative Review; 2018-2019 AGENCY: Enforcement and Compliance, International Trade Administration, Department of Commerce. SUMMARY: The Department of Commerce (Commerce) determines that certain cold-rolled steel flat products (cold-rolled steel) from the Republic of Korea were not sold in the United States at prices below normal value during the period of review (POR), September 1, 2018, through August 31, 2019. DATES: Applicable [INSERT DATE OF PUBLICATION IN THE FEDERAL REGISTER]. FOR FURTHER INFORMATION CONTACT: Michael J. Heaney, George McMahon, or Marc Castillo, AD/CVD Operations, Office VI, Enforcement and Compliance, International Trade Administration, U.S. Department of Commerce, 1401 Constitution Avenue, NW, Washington, DC 20230; telephone: (202) 482-4475, (202) 482-1167, or (202) 482-5019, respectively. SUPPLEMENTARY INFORMATION: Background On January 25, 2021, Commerce published the Preliminary Results of this administrative review.1 We invited interested parties to comment on the Preliminary Results. Between February 24, and March 5, 2021, Commerce received timely filed case briefs and rebuttal briefs from United States Steel Corporation (U.S. Steel), additional domestic parties,2 Hyundai Steel 1 See Certain Cold Rolled Steel Flat Products from the Republic of Korea: Preliminary Results of Antidumping Duty Administrative Review; 2018-2019, 86 FR 6871 (January 25, 2021) (Preliminary Results), and accompanying Preliminary Decision Memorandum (PDM). -

Korean Multinationals Show Solid Recovery After Global Crisis

Korean multinationals show solid recovery after global crisis Report dated November 16, 2010 EMBARGO: The contents of this report must not be quoted or summarized in the print, broadcast or electronic media before November 16, 2010, 10:00 a.m. Seoul; 1 a.m. GMT, and 9:00 p.m. November 15, 2010, New York. Seoul and New York, November 16, 2010 The Institute of International Affairs of the Graduate School of International Studies (GSIS) at Seoul National University in Seoul, and the Vale Columbia Center on Sustainable International Investment (VCC) at Columbia University in New York, are releasing the first annual report on leading Korean multinationals. The research for this report was conducted in 2010 and covers the period 2007 to 2009. 1 Highlights The Republic of Korea (henceforth ‘Korea’), the 11 th largest economy in the world, has now become one of the leading investors abroad. The number and the size of the corporate giants that dominate the economy have increased over the years, boosting and diversifying their investments around the world. Korea’s multinational enterprises ranked by their foreign assets (see table 1 below) show about USD 93 billion in assets held abroad. 2 Samsung Electronics Co., Ltd. (SEC), a member of a leading Korean conglomerate, ranked 1 st with slightly over USD 18 billion, followed by another top conglomerate member, LG Electronics, with over USD 10 billion dollars. Hyundai Heavy Industries Co., Ltd, and DSME Co., Ltd, had foreign assets of over USD 8 billion each and LG Display had over USD 6 billion. The top five firms together accounted for just over half of the total foreign assets of the top 20 companies.