Credit Suisse Celebrates

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

150 Years Anniversary Magazine

magazine. swiss life y anniversar The Life. Swiss of years 0 15 The anniversary magazine. Das Magazin zum Jubiläum. The first policy. Page 4 Insured with Swiss Life. Page 5 Time warp. From page 6 150 years. This is how long Swiss Life has been around. What happened during this time? Short stories are scattered throughout the magazine like a multicoloured mosaic – travel- ling back over the past 150 years. Life’s journeys. From page 7 Switzerland is a small but very diverse country, as confirmed by these 16 life stories. Some look back, some live com- pletely in the here and now, and some look to the future. Life stories from Switzerland. Working after retirement Securing people’s future for 150 years. Page 8 Bruno Gehrig is the Chairman of the Board of Directors of keeps you happy. Page 16. Swiss Life. He focuses on solving the medium- and long- term problems facing the Swiss pension system, but still finds time to criticise unfavourable developments in the system. Working after retirement keeps you happy. Page 16 Life expectancy is constantly on the rise. These days, many seniors stay fit and healthy until they are very old. Four examples of people who didn’t want to stop working at 65. And what scientists think of working after retirement age. Swiss Life’s commitment. Kids Festival for the The leader in Switzerland, strong in Europe. Page 28 football stars of tomorrow. Page 66. The insurance market has changed greatly during the past few years. Competition has become fiercer, both in Switzerland and abroad. -

Sales Prospectus with Integrated Fund Contract Clariden Leu (CH) Swiss Small Cap Equity Fund

Sales Prospectus with integrated Fund Contract Clariden Leu (CH) Swiss Small Cap Equity Fund September 2011 Contractual fund under Swiss law (type "Other funds for traditional investments") Clariden Leu (CH) Swiss Small Cap Equity Fund was established by Swiss Investment Company SIC Ltd., Zurich, as the Fund Management Company and Clariden Leu Ltd., Zurich, as the custodian bank. This is an English translation of the offical German prospectus. In case of discrepancies between the German and English text, the German text shall prevail. Part I Prospectus This Prospectus with integrated Fund Contract, the Simplified Prospectus and the most recent annual or semi-annual report (if published after the latest annual report) serve as the basis for all subscriptions of Shares in this Fund. Only the information contained in the Prospectus, the Simplified Prospectus or in the Fund Contract will be deemed to be valid. 1 General information Main parties Fund Management Company: Swiss Investment Company SIC Ltd. Claridenstrasse 19, CH-8002 Zurich Postal address: XS, CH-8070 Zurich Phone: +41 (0) 58 205 37 60 Fax: +41 (0) 58 205 37 67 Custodian Bank, Paying Agent and Distributor: Clariden Leu Ltd. Bahnhofstrasse 32, CH-8070 Zurich Phone: +41 (0) 844 844 001 Fax: +41 (0) 58 205 62 56 e-mail: [email protected] Website: http://www.claridenleu.com Investment Manager: Clariden Leu Ltd. Bahnhofstrasse 32, CH-8070 Zurich Phone: +41 (0) 844 844 001 Fax: +41 (0) 58 205 62 56 Auditors: KPMG Ltd Badenerstrasse 172, CH-8004 Zurich 2 Information on the Fund 2.1 General information on the Fund Clariden Leu (CH) Swiss Small Cap Equity Fund is an investment fund under Swiss law of the type “Other funds for traditional investments” pursuant to the Swiss Federal Act on Collective Investment Schemes of June 23, 2006. -

Daxer & Marschall 2015 XXII

Daxer & Marschall 2015 & Daxer Barer Strasse 44 - D-80799 Munich - Germany Tel. +49 89 28 06 40 - Fax +49 89 28 17 57 - Mobile +49 172 890 86 40 [email protected] - www.daxermarschall.com XXII _Daxer_2015_softcover.indd 1-5 11/02/15 09:08 Paintings and Oil Sketches _Daxer_2015_bw.indd 1 10/02/15 14:04 2 _Daxer_2015_bw.indd 2 10/02/15 14:04 Paintings and Oil Sketches, 1600 - 1920 Recent Acquisitions Catalogue XXII, 2015 Barer Strasse 44 I 80799 Munich I Germany Tel. +49 89 28 06 40 I Fax +49 89 28 17 57 I Mob. +49 172 890 86 40 [email protected] I www.daxermarschall.com _Daxer_2015_bw.indd 3 10/02/15 14:04 _Daxer_2015_bw.indd 4 10/02/15 14:04 This catalogue, Paintings and Oil Sketches, Unser diesjähriger Katalog Paintings and Oil Sketches erreicht Sie appears in good time for TEFAF, ‘The pünktlich zur TEFAF, The European Fine Art Fair in Maastricht, European Fine Art Fair’ in Maastricht. TEFAF 12. - 22. März 2015, dem Kunstmarktereignis des Jahres. is the international art-market high point of the year. It runs from 12-22 March 2015. Das diesjährige Angebot ist breit gefächert, mit Werken aus dem 17. bis in das frühe 20. Jahrhundert. Der Katalog führt Ihnen The selection of artworks described in this einen Teil unserer Aktivitäten, quasi in einem repräsentativen catalogue is wide-ranging. It showcases many Querschnitt, vor Augen. Wir freuen uns deshalb auf alle Kunst- different schools and periods, and spans a freunde, die neugierig auf mehr sind, und uns im Internet oder lengthy period from the seventeenth century noch besser in der Galerie besuchen – bequem gelegen zwischen to the early years of the twentieth century. -

Abacha Funds at Swiss Banks”

Embargo: 4 September 2000 10 a.m. “Abacha funds at Swiss banks” Report of the Swiss Federal Banking Commission Berne, 30 August 2000 1. Object of the investigation and regulatory framework 1.1. Object and scope of the investigation In November 1999 the Swiss Federal Banking Commission (SFBC) began investiga- tions to ascertain whether a total of 19 banks in Switzerland had fully adhered to due diligence requirements (see 1.2 below) as set out in banking law and other applicable legislation in accepting and handling funds from the entourage of the former President of Nigeria, Sani Abacha. The SFBC did not institute any criminal proceedings in respect of money laundering or any other offence. Criminal proceedings in connection with Abacha-related funds are pending in Geneva. The request for judicial assistance from Nigeria does not fall within the SFBC’s remit; this is being handled by the Federal Office of Justice and by the in- vestigating authorities in Geneva. The administrative procedure undertaken by the SFBC involved an extraordinary amount of work. A very large quantity of documentary material needed to be evaluated. Discussions took place with the management of many of the banks concerned. At one bank all persons actually or potentially involved were formally questioned. The re- sources deployed by the SFBC were correspondingly large: 12 people, i.e. 14 % of the SFBC’s total staff, were at one time or another involved with the processing of the mat- ter and related investigatory tasks. 1.2. Due diligence obligations When accepting and depositing funds from customers, banks have a number of obliga- tions with regard to due diligence, with a view to upholding public trust in a properly op- erating banking system (‘maintenance of trust or reputation’). -

The Zurich Banking Centre

The Zurich banking centre Facts and figures 2015/2016 edition Foreword Zurich’s banking centre is of key importance to the region and a significant contributor to its economic value creation. It also plays a pivotal role as an employer, educator, lender, customer, taxpayer, and promoter of cultural institutions. The banking centre is currently in a phase of historic change. With business models being realigned and new regulations implemented, it is essential to establish the right operating environment for the financial sector and safeguard Zurich’s locational advantages for the future. The common goal for all those involved must be to position the financial centre as stable and forward-looking, thus enabling it to maintain its appeal both internationally and locally and continue to play an impor- tant economic role in the Zurich region. The Canton of Zurich and the Zurich Banking Association work to create the conditions in which the banking centre can flourish. They also endeavour to promote a reasoned debate on its future with publications such as this, which we hope you enjoy reading. Zurich, January 2015 Thomas Ulrich Markus Assfalg President of the Zurich Head of the Business and Banking Association Economic Development Division of the Office for Economy and Labour of the Canton of Zurich A key player in Zurich’s economy Nominal gross value creation in Nominal gross value creation the banking sector in Switzerland: in the Zurich financial centre: CHF 28.9 bn (2013) CHF 28.0 bn ( 2013 ) 12% 44% 43% 56% 45% Zurich region Banks Insurance companies Rest of Switzerland Other financial service providers Source: BAKBASEL The Zurich financial centre, which covers the cantons of Zurich, Schwyz and Zug, is an economic mainstay of the region, with around one in every five Swiss francs of economic value created here linked directly to its activities. -

Our Legacy What Defines Us, What We Leave Behind 075360E WE BUY HEIRLOOMS and FAMILY TREASURES

Since 1895. The world’s oldest banking magazine. With the Issue 4 / 2019 Credit Suisse Worry Barometer 2019 Our legacy What defines us, what we leave behind 075360E WE BUY HEIRLOOMS AND FAMILY TREASURES. As a subsidiary of Gübelin, we would be happy to assist you with the sale of antique jewellery or gemstones. We can help you to best assess their value and market potential. For a consultation, please contact us at: +41 41 429 18 18 www.edigem.com Anzeige_Edigem_CS_Bulletin_220x297.indd 1 12.11.19 12:45 Editorial What we want to leave behind Johann Wolfgang von Goethe once observed, “What you have inherited from your forefathers, earn over again for yourselves or it will not be yours.” In our report on the Young Investors Organization (page 16), a young heiress explains that she has given serious 1 2 3 4 thought to how she wants to use her wealth: “No one needs to remember my name,” she says, “but I want to leave something 1 Viola Steinhoff Werner The Head behind to benefit those who come after me.” of Global Next Generation and This issue is devoted to the multifaceted topic of legacies. Families at Credit Suisse interviewed two fifth-generation descendants We look at the pleasures, as well as the difficulties, of giving and of John D. Rockefeller who want to receiving and ask this question: “What do we want to leave behind?” use the family’s wealth to promote Roger Federer, probably Switzerland’s best-known son, wants to the common good, with the help of free-market tools. -

Switzerland in the 19Th Century

Switzerland in the 19th century The founding of the Swiss federal state ushered in a period of greater stability as regards both domestic and foreign affairs. The revised Constitution of 1874 extended the powers of the federal government and introduced the optional legislative referendum. Switzerland developed its system of direct democracy further and in 1891 granted the people the right of initiative on the partial revision of the Federal Constitution. That same year the Catholic conservatives – the losers of the Sonderbund war – celebrated, for the first time, the election of one of its representatives to the federal government. The federal state used its new powers to create favourable conditions for the development of a number of industries and service sectors (railways, machine construction and metalworking, chemicals, food industry and banking). These would become the mainstays of the Swiss economy. Not everyone in Switzerland reaped the benefits of the economic upturn. In the 19th century poverty, hunger and a lack of job prospects drove many Swiss people to seek their fortunes elsewhere, particularly in North and South America. At home, industrial towns and cities saw an influx of rural and, increasingly, foreign migrants. Living conditions for many members of this new urban working class were often precarious. Foreign policy During the wave of revolution that engulfed Europe in the early 1850s, relations between Switzerland and Austria, which also ruled northern Italy, were extremely tense. Many Italians, who wanted to see a united and independent Italy (Risorgimento), sought refuge in liberal- run Ticino. The local community sympathised with their cause, some even fighting alongside their Italian comrades or smuggling weapons for them. -

Credit Suisse Group Announces Changes to the Corporate Governance Structure of Winterthur Group

Media Relations CREDIT SUISSE GROUP P.O. Box 1 CH-8070 Zurich www.credit-suisse.com Telephone +41 44 333 88 44 Telefax +41 44 333 88 77 [email protected] Credit Suisse Group Announces Changes to the Corporate Governance Structure of Winterthur Group Election of New Boards of Directors at Winterthur Zurich, May 3, 2005 – Credit Suisse Group today announced changes to the corporate governance structure of Winterthur Group, in line with the repositioning of the insurance business within the company. The Boards of Directors of "Winterthur" Swiss Insurance Company and Winterthur Life have been newly elected and will be chaired by Oswald J. Grübel, CEO of Credit Suisse Group, effective immediately. Following the announcement by Credit Suisse Group that it would reposition Winterthur as a financial investment and prepare it for a capital market flotation, the Group has now decided to adapt the corporate governance structure of Winterthur to reflect this change of parameters. The composition of the Boards of Directors of the two Winterthur entities was previously the same as that of the Board of Directors of Credit Suisse Group. The decision to establish separate Boards of Directors will enhance supervision at Winterthur Group and will enable specific insurance issues to be monitored more closely. The management structure of Winterthur Group will remain unchanged. The Boards of Directors, which comprise eight members, will be chaired by Oswald J. Grübel, CEO of Credit Suisse Group. Anton van Rossum has been appointed Vice-Chairman. A list of the members of the Boards of Directors and their Committees is attached. -

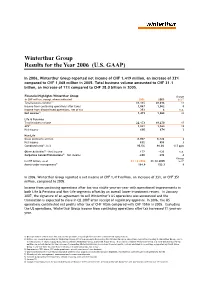

Winterthur Group Results for the Year 2006 (U.S

Winterthur Group Results for the Year 2006 (U.S. GAAP) In 2006, Winterthur Group reported net income of CHF 1,419 million, an increase of 33% compared to CHF 1,068 million in 2005. Total business volume amounted to CHF 31.1 billion, an increase of 11% compared to CHF 28.0 billion in 2005. Financial Highlights Winterthur Group Change in CHF million, except where indicated 2006 2005 in % 7) Total business volume1) 31,115 28,016 11 Income from continuing operations after taxes 1,067 1,062 0 Income from discontinued operations, net of tax 352 6 n.a. Net income2) 1,419 1,068 33 Life & Pensions Total business volume 22,173 19,270 15 APE3) 1,841 1,563 18 Net income 690 674 2 Non-Life Gross premiums written 8.907 8,726 2 Net income 832 809 3 Combined ratio4), in % 95.5% 96.0% -0.5 ppts Other Activities5) – Net income 177 -123 n.a. Corporate Center/Eliminations6) – Net income -280 -292 -4 Change in CHF billion, as of 31.12.2006 31.12.2005 in %7) Assets under management8) 164.8 153.3 8 In 2006, Winterthur Group reported a net income of CHF 1,419 million, an increase of 33%, or CHF 351 million, compared to 2005. Income from continuing operations after tax was stable year-on-year with operational improvements in both Life & Pensions and Non-Life segments offset by an overall lower investment return. In January 2007, the signature of an agreement to sell Winterthur’s US operations was announced and the transaction is expected to close in Q2 2007 after receipt of regulatory approval. -

Credit Suisse Group Finance (Guernsey)

BASE PROSPECTUS Credit Suisse AG (incorporated with limited liability in Switzerland) and Credit Suisse Group Finance (Guernsey) Limited (incorporated with limited liability in Guernsey, Channel Islands) and Credit Suisse Group AG (incorporated with limited liability in Switzerland) Euro Medium Term Note Programme Notes issued by Credit Suisse Group Finance (Guernsey) Limited will be unconditionally and irrevocably guaranteed by Credit Suisse Group AG (incorporated with limited liability in Switzerland) ________________________________ Under this Euro Medium Term Note Programme (the Programme), each of Credit Suisse AG, acting through its Zurich head office or a designated branch (CS), Credit Suisse Group Finance (Guernsey) Limited (CSG Finance Guernsey) and Credit Suisse Group AG (CSG), in its capacity as an issuer and together with CSG Finance Guernsey and CS, each an Issuer and together the Issuers) may from time to time issue notes (the Notes) denominated in any currency agreed between the Issuer of such Notes (the relevant Issuer) and the relevant Dealer (as defined below). The payments of all amounts due in respect of the Notes issued by CSG Finance Guernsey (Guaranteed Notes) will be unconditionally and irrevocably guaranteed by Credit Suisse Group AG (in such capacity, the Guarantor). Notes may be issued in bearer, registered or uncertificated form (respectively Bearer Notes, Registered Notes and Uncertificated Notes). The Notes may be issued on a continuing basis to one or more of the Dealers specified under ‘‘Description of the Programme’’ and any additional Dealer appointed under the Programme from time to time by CSG or CS (each a Dealer and together the Dealers), which appointment may be for a specific issue or on an ongoing basis. -

Daxer & M Arschall 20 16

XXIII Daxer & Marschall 2016 Recent Acquisitions, Catalogue XXIII, 2016 Barer Strasse 44 | 80799 Munich | Germany Tel. +49 89 28 06 40 | Fax +49 89 28 17 57 | Mob. +49 172 890 86 40 [email protected] | www.daxermarschall.com 2 Paintings, Oil Sketches and Sculptures, 1630-1928 My special thanks go to Simone Brenner and Diek Groenewald for their research and their work on the text. I am also grateful to them for so expertly supervising the production of the catalogue. We are much indebted to all those whose scholarship and expertise have helped in the preparation of this catalogue. In particular, our thanks go to: Martina Baumgärtel, John Bergen, Brigitte Brandstetter, Regine Buxtorf, Thomas le Claire, Sue Cubitt, Francesca Dini, Marina Ducrey, Isabel Feder, Sabine Grabner Sibylle Gross, Mechthild Haas, Frode Haverkamp, Kilian Heck, Ursula Härting, Jean-François Heim, Gerhard Kehlenbeck, Michael Koch, Rudolf Koella. Miriam Krohne, Bjørn Li, Philip Mansmann, Marianne von Manstein, Dan Malan, Verena Marschall, Giuliano Matteucci, Hans Mühle, Werner Murrer, Anette Niethammer, Astrid Nielsen, Claudia Nordhoff. Otto Naumann, Susanne Neubauer, Marcel Perse, Max Pinnau, Mara Pricoco, Katrin Rieder, Herbert Rott, Hermann A. Schlögl, Arnika Schmidt, Annegret Schmidt-Philipps, Ines Schwarzer, Atelier Streck, Caspar Svenningsen, Jörg Trempler, Gert-Dieter Ulferts, Gregor J. M. Weber, Gregor Wedekind, Eric Zafran, Wolf Zech, Christiane Zeiller. Our latest catalogue Paintings, Oil Sketches and Unser diesjähriger Katalog Paintings, Oil Sketches and Sculptures erreicht Sculptures appears in good time for TEFAF, The sie pünktlich zur TEFAF, The European Fine Art Fair in Maastricht. European Fine Art Fair in Maastricht. Viele Werke kommen direkt aus privaten Sammlungen und waren seit Jahren, Many of the works being sold come directly from manchmal Jahrzehnten nicht mehr auf dem Markt. -

LETTER to SHAREHOLDERS 1998 INTERIM RESULTS Share Performance

21558_Halbjahres98_E 07.09.1998 14:24 Uhr Seite 1 LETTER TO SHAREHOLDERS 1998 INTERIM RESULTS Share performance CHF Credit Suisse Group Swiss Market Index (adjusted) 350 300 250 200 150 100 J FMAMJ J ASONDJ FMAMJ J ASONDJ FMAMJ J A 1996 1997 1998 Change Share data 30 June 1998 31 Dec. 1997 in % Number of shares issued 267,142,861 266,128,097 0.4 Shares ranking for dividend 267,064,503 265,750,460 0.5 Market capitalisation (CHF m) 90,134 60,060 50 Share price (CHF) 337.50 226 49 high January–June 1998 341 low January–June 1998 216 Change 1st half 1998 1st half 1997 in % Earnings per share (CHF) 9.02 6.79 33 Average shares ranking for dividend 266,340,880 n.a. Financial Calendar Media conference for 1998 results Tuesday, 16 March 1999 1999 Annual General Meeting Friday, 28 May 1999 Contents Commentary on the consolidated half-year results 3 Consolidated income statement 6 Consolidated balance sheet 7 Consolidated off-balance sheet business, selected notes to the consolidated financial statements 8 Credit Suisse 10 Credit Suisse Private Banking 12 Credit Suisse First Boston 13 Credit Suisse Asset Management 16 Winterthur 17 Closing 20 21558_Halbjahres98_E 07.09.1998 14:24 Uhr Seite 3 DEAR SHAREHOLDERS Credit Suisse Group posted net profit of CHF 2.4 bn in the first half of 1998, exceeding the previous year’s corresponding figure by 36%. Return on equity amounted to 18.4%. All business units – Credit Suisse, Credit Suisse Private Banking, Credit Suisse First Boston, Credit Suisse Asset Management and Winterthur – improved substantially on their previous year’s results.