WMN Annual Business Guide 2019 Download

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report & Accounts 2010

PENNON GROUP PLC | ANNUAL ANNUAL REPORT & ACCOUNTS 2010 REPORT & ACCOUNTS | 2010 This document is printed on 100% recycled paper When you have finished with this document please recycle it Pennon Group Plc Registered Office: Peninsula House, Rydon Lane, Exeter, Devon, England EX2 7HR pennon-group.co.uk Registered in England No. 2366640 CONTENTS Financial highlights and Group strategy ..............1 Directors’ Report continued Directors’ Report continued About our businesses: Pennon Group: Directors’ Report South West Water: Other financial information ......................... 28 Business Review: Regulatory and competitive environment ...16 Key relationships ............................................. 30 Chairman’s statement .......................................2 Customers, community and employees ......18 Principal risks and uncertainties ................ 30 Pennon Group: Key relationships ............................................. 20 Our corporate responsibility ...................... 32 Financial performance ......................................4 Principal risks and uncertainties ................ 21 Interpretation ................................................... 37 Funding position .................................................7 Viridor: Other statutory information ........................... 38 Chief Executives’ overviews: Regulatory and competitive environment .. 22 Board of Directors .................................................. 40 South West Water ............................................8 Customers, community -

ICAEW F&M Magazine

CHAIR’S LETTER | SERVICE PROVIDERS | PERSONAL VIEW | INDUSTRY NEWS INFORMED THE VOICE OF INVESTOR RELATIONS IN THE UK ISSUE 96 AUTUMN 2017 Navigating a new landscape for IR a special feature G Virtual AGMs E S D ebt IR PLUS MiFID II: THE COMPANY VIEW BEST PRACTICE AWARDS UPDATE NEW SOCIETY PR COURSE CORPORATE WEBSITE RESEARCH Join us for the premier event in the IR calendar Best Practice Awards 2017 RRecognisingecognising andand RewardingRewarding Excellence in Investor Relations 6:30pm, Tuesday 21 November THE PAVILION AT THE TOWER OF LONDON, LONDON, EC3N 4AB For more information and to book your tickets: WWW.IRSOCIETY.ORG.UK/EVENTS/DINNER +44 (0) 20 7379 1763 [email protected] INFORMED AUTUMN 2017 CONTENTS 4 CHAIR’S LETTER Meeting the challenges ahead 17– 34 Navigating a new David Lloyd-Seed, chair, IR Society landscape for IR 5 NEWS FROM THE SOCIETY G Virtual AGMs E S Revd. Richard Coles to host 2017 awards (p5) New IR Society members (p7) Latest CIR and ICIR passes (p9) D 6 A PERSONAL VIEW ebt IR London markets at the centre of innovation John Gollifer, general manager, IR Society 17 Implementing IR for all classes of capital 8 INDUSTRY NEWS Susan Davy and Sarah Heald, Pennon Group Seeking consensus in MiFID II 19 A changing investment landscape creates new challenges for IROs MiFID II – what about the companies? (p11) Rachel Carroll, Edison Investment Research David Walker, Hays 21 The rise of alternative funding and the How the corporate website has evolved into an implications for IR important engagement tool (p13) Michael -

Our Business Model and Investment Case

Our business model and investment case December 2018 Our business model and investment case As one of the largest FTSE 250 environmental infrastructure groups in the UK, Pennon has assets of around £6.2 billion and a workforce ofPENNON around BRAND IDENTITY GUIDELINES5,000 people. 3 Our group of companies As one of the largest environmental infrastructure groups in the UK, Pennon brings together Viridor, South West Water, Bournemouth Water Our vision and a number of business water brands. Our brands are one of our most valuable assets. We should never Bringing resources undervalueto life our design identity in terms of the huge contribution it can make to our organisation’s standing – it is often the first impression people get and can create a lasting image. Our values To ensure we consistently build and protect our brand profile, Trusted always followResponsible these brand identity design guidelines. Collaborative Progressive We do the right thing for our We keep our promises to our We forge strong relationships, We are always looking for customers and stakeholders customers, communities and working together to make a new ways to improve and each other positive impact make life better Our businesses Water & Wastewater B2B Water Retailer Waste Management Pennon business water brands. Separate identity guidelines for these brands are available from [email protected] Viridor Identity MASTER 06.07.16 BW Identity WIP 25.07.16 Based on Calibre Bold Pantone 347 (93C 100Y) Calibre Semi Bold and Regular Pantone 2145 (98C 62M 14K) Pantone: 347 Pantone: 2145 Water and wastewater services to a Delivering retail services to business and A leading UK recycling and residual waste population of c. -

Pennon Group

PROSPECTUS dated 20 September 2017 PENNON GROUP PLC (incorporated in England and Wales with limited liability under registration number 2366640) £300,000,000 Perpetual Capital Securities Issue price: 99.957 per cent. The £300,000,000 Perpetual Capital Securities (the “Capital Securities”) will be issued by Pennon Group plc (the “Issuer”) on 22 September 2017 (the “Issue Date”) subject to the terms and conditions set out herein under “Terms and Conditions of the Capital Securities” (the “Conditions”, and references herein to a numbered Condition shall be construed accordingly). The Capital Securities will constitute direct, unsecured and subordinated obligations of the Issuer, ranking pari passu and without any preference amongst themselves, and on a winding-up of the Issuer will rank in priority only to holders of Junior Share Capital (as defined in Condition 18), as further described in Condition 2. Periodic returns will accrue on the principal amount of the Capital Securities from (and including) the Issue Date to (but excluding) 22 May 2020 (the “First Call Date”) at a fixed rate of 2.875 per cent. per annum, payable (subject to deferral as described below) annually in arrear (with a short first returns accrual period) on 22 May in each year, commencing 22 May 2018. Thereafter, periodic returns will accrue on the principal amount of the Capital Securities at a floating rate of return equal to 3-month LIBOR plus 7.018 per cent. per annum (representing a 5.00 per cent. step-up), payable (subject to deferral as described below) quarterly in arrear on 22 February, 22 May, 22 August and 22 November in each year, commencing 22 August 2020. -

Written Evidence Submitted by Pennon/South West Water Pennon Group

Pennon /South West Water WQR0056 Written evidence submitted by Pennon/South West Water Pennon Group Pennon Group is a FTSE100 company and the owners of South West Water and Bournemouth Water. We provide water and wastewater services to a population of c.1.7 million in Cornwall, Devon and parts of Dorset and Somerset, and water-only services to c.0.5 million in parts of Dorset, Hampshire, and Wiltshire. South West Water sustains 6,000 jobs in the regional economy and, since 1989, has invested more than £7 billion to maintain and improve water and wastewater services. At the time of privatisation our coastal bathing waters were blighted by raw sewage outfalls but years of sustained investment by South West Water has transformed them into some of the best in Europe. Our pioneering Upstream Thinking catchment management scheme was one of the first to demonstrate nature-based improvements to water quality. We care deeply about the environment and are currently making our largest environmental investment for 15 years, with additional proposals submitted to Defra and our regulators to accelerate and expand investment to support a Green Recovery. In addition to the written views provided below, our CEO Susan Davy would be delighted to assist the Committee’s inquiry further by providing oral evidence. Summary of our view Our customers and communities are placing increasing importance on river water quality for amenity, in addition to ecology We care deeply about the environment and the priorities of our customers and communities - the environment is now our top priority, second only to safe clean drinking water Experience has taught us that working in partnership and understanding how most effectively to intervene will be essential if we are to play our part in delivering a step-change in river quality. -

Marlborough Extra Income Fund

Marlborough Extra Income Fund Interim Report For the six month period ended 20th October 2016 (Unaudited) MARLBOROUGH EXTRA INCOME FUND Authorised Fund Manager and Registrar Marlborough Fund Managers Ltd Marlborough House 59 Chorley New Road Bolton BL1 4QP Investor Support: (0808) 145 2500 (FREEPHONE) Authorised and regulated by the Financial Conduct Authority Trustee HSBC Bank plc 8 Canada Square London E14 5HQ Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority Investment Adviser Hargreave Hale Ltd 9-11 Neptune Court Hallam Way Whitehills Business Park Blackpool Lancashire FY4 5LZ Authorised and regulated by the Financial Conduct Authority Auditor Barlow Andrews LLP Carlyle House 78 Chorley New Road Bolton BL1 4BY Directors of Marlborough Fund Managers Ltd Andrew Staley Chairman Nicholas F J Cooling Deputy Chairman Allan Hamer Joint Managing Director Wayne D Green Joint Managing Director Dom M Clarke Finance Director Geoffrey Hitchin Investment Director Keith Ounsworth Director – Sales John R Heap Director – Strategic Development B John Leyland Director Helen Derbyshire Director – Compliance & Risk MARLBOROUGH EXTRA INCOME FUND CONTENTS PAGE AUTHORISED INVESTMENT ADVISER’S REPORT 1 AUTHORISED STATUS AND GENERAL INFORMATION 3 DIRECTORS’ STATEMENT 3 FUND INFORMATION Price and distribution record 4 Number of units in issue/Net asset value per unit 4 Ongoing charges 4 Synthetic risk and reward indicator 5 Portfolio statement 6 Portfolio split by investment -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

London Investor Roadshow February 2017

London Investor Roadshow February 2017 © Pennon Group plc 2017 Disclaimer For the purposes of the following disclaimers, references to this technology systems management and protection including higher risks, “document” shall mean this presentation pack and shall be deemed to maintaining finance and funding to meet ongoing commitments, include references to the related speeches made by or to be made by the uncertainty arising from open tax computations where liabilities remain to presenters, any questions and answers in relation thereto and any other be agreed and difficulty in recruitment, retention and development of related verbal or written communications. appropriate skills which are required to deliver the Group’s strategy. This document contains certain “forward-looking statements” with respect Forward looking statements should therefore be construed in light of such to Pennon Group’s financial condition, results of operations and business risks, uncertainties and other factors and undue reliance should not be and certain of Pennon Group's plans and objectives with respect to these placed on them. Nothing in this document should be construed as a profit matters which may constitute “forward-looking statements” within the forecast. meaning of the U.S. Private Securities Litigation Reform Act of 1995 (the “PSLRA”). All written or verbal forward-looking statements, made in this document or made subsequently, which are attributable to Pennon Group or any other Forward-looking statements are sometimes, but not always, identified by member of the Pennon Group or persons acting on their behalf are their use of a date in the future or such words as “anticipate”, “aim”, expressly qualified in their entirety by the factors referred to above. -

SAVANNAH Q3 2020 BOARD REVIEW an Analysis of the FTSE 100 & FTSE 250 Executive and Non-Executive Board Appointments in Q3 2020 INTRODUCTION

www.savannah-group.com SAVANNAH Q3 2020 BOARD REVIEW An analysis of the FTSE 100 & FTSE 250 Executive and Non-Executive Board appointments in Q3 2020 INTRODUCTION I am pleased to present our analysis of the executive director appointments already in the first 9 appointments to the FTSE 100 and FTSE 250 boards months. in the third quarter of 2020. As usual, we report the appointments of executive and non-executive Clearly, there has been a catch up and a quick directors to the boards of these companies, identify extrapolation of these numbers shows that we will the trends and we name individuals concerned. see around 100 executive director appointments to the FTSE 350 companies this year. This is still Just as this report was being finalised, we hosted well short of the 2018 numbers, and we have not a webinar to discuss “Boardroom Gender Diversity yet seen the impact of the Covid-19 lockdown. – Unfinished Business”. Moderated by the author, Given the lead time for very senior appointments, our panellists were Denise Wilson OBE, CEO of and being aware first hand that many search the Hampton Alexander Committee, Sir Andrew assignments were immediately put “on hold” when Mackenzie, recently retired CEO of BHP Plc and now the first lockdown was introduced, we expect to see Non-Executive Director at Royal Dutch Shell, and the impact materialise in Q4 and Q1 2021, perhaps Ruth Cairnie, Chair of Babcock International and later. On a positive note, we are seeing a trend of SID at Associated British Foods. We were joined by increasing numbers of women appointed to the 100 FTSE chairs, CEOs and senior directors from the executive director roles. -

20080319 Trading Notice Functional 0049

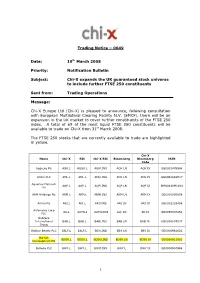

Trading Notice – 0049 Date: 19 th March 2008 Priority: Notification Bulletin Subject: Chi-X expands the UK guaranteed stock universe to include further FTSE 250 constituents Sent from: Trading Operations Message: Chi-X Europe Ltd (Chi-X) is pleased to announce, following consultation with European Multilateral Clearing Facility N.V. (EMCF), there will be an expansion in the UK market to cover further constituents of the FTSE 250 index. A total of 69 of the most liquid FTSE 250 constituents will be available to trade on Chi-X from 31 st March 2008. The FTSE 250 stocks that are currently available to trade are highlighted in yellow. Chi-X Name Chi-X RIC Chi-X RIC Bloomberg Bloomberg ISIN Code Aggreko Plc AGK.L AGGK.L AGKl.INS AGK LN AGK IX GB0001478998 Amlin PLC AML.L AML.L AMLl.INS AML LN AML IX GB00B2988H17 Aquarius Platinum AQP.L AQP.L AQPl.INS AQP LN AQP IX BMG0440M1284 Ltd ARM Holdings Plc ARM.L ARM.L ARMl.INS ARM LN ARM IX GB0000595859 Arriva Plc ARI.L ARI.L ARIl.INS ARI LN ARI IX GB0002303468 Autonomy Corp AU.L AUTN.L AUTNl.INS AU/ LN AU IX GB0055007982 PLC Babcock International BAB.L BAB.L BABl.INS BAB LN BAB IX GB0009697037 Group Balfour Beatty PLC BALF.L BALF.L BBYl.INS BBY LN BBY IX GB0000961622 Barratt BDEV.L BDEV.L BDEVl.INS BDEV LN BDEV IX GB0000811801 Development Plc Bellway PLC BWY.L BWY.L BWYl.INS BWY.L BWY IX GB0000904986 1 Biffa PLC BIFF.L BIFF.L BIFFl.INS BIFF LN BIFF IX GB00B129PL77 Bradford & Bingley BB.L BB.L BBl.INS BB/ LN BB IX GB0002228152 PLC Bunzl PLC BNZL.L BNZL.L BNZLl.INS BNZL LN BNZL IX GB00B0744B38 Burberry -

Acquisition of the Bristol Water Group and Proposed Special Dividend and Share Consolidation

Pennon Group plc 3 June 2021 THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION Pennon Group plc Acquisition of the Bristol Water Group and proposed Special Dividend and Share Consolidation Pennon Group plc (Pennon or the Group) is pleased to announce that it has acquired 100% of the issued share capital of Bristol Water Holdings UK Limited and its subsidiaries, including Bristol Water plc (Bristol Water), (together, the Bristol Water Group), from its indirect shareholders: infrastructure funds advised by iCON Infrastructure LLP (80% of the shares); and ITOCHU Corporation (20%) for an equity value of £425 million, and an enterprise value of £8141 million including assumed debt (the Acquisition). Pennon is also announcing a return of capital to shareholders, consisting of a Special Dividend of c.£1.5 billion, and a share buy-back programme of up to £0.4 billion. Highlights • Acquisition of the Bristol Water Group for £425 million cash consideration, adding a high- quality business with approximately 1.2 million customers • Acquisition is expected to be earnings accretive and will result in an increase of c.16% in the Group regulatory capital value (RCV) as at 31 March 2021 • The acquisition price equates to a premium to RCV of 44%2 • Proposed c.£1.5 billion special dividend and share consolidation, and a proposed share buyback programme of up to £0.4 billion • Following the Acquisition and the return of capital to shareholders, the Group is targeting net debt to RCV gearing of below 65% by the end of K73 • The Board has decided to increase the Group’s dividend level by c.9% (equivalent to an increase of 2 pence per share on a pre-consolidation basis) from 2021/22 onwards, and to continue its sector-leading dividend policy of CPIH + 2% growth. -

Our Big Chance for Business to Build Back Responsibly

TIME TO FIX UP Our big chance for business to build back responsibly Build Back and supported by Responsibly Insights in association with CONTENTS FOREWORD 3 1. THE CONTEXT 4 2. THE BUSINESS RESPONSE – WHAT WE HEARD: INSIGHTS AND OPPORTUNITIES 6 RESET THE MEASURES OF SUCCESS 7 CHANGE THE CULTURE OF BUSINESS 8 PRIORITISE HEALTH AND WELLBEING 8 RETHINK OFFICES, LOCATIONS AND JOBS 10 TURN UP THE VOLUME ON EQUALITY AND SOCIAL INCLUSION 11 CONNECT TO COMMUNITIES 13 BUILD RESILIENCE TO FUTURE SHOCKS AND ACCELERATE ACTION ON CLIMATE CHANGE 14 TACKLE WASTE AND MOVE TO A CIRCULAR ECONOMY 15 3. TURNING OPPORTUNITIES INTO ACTION 17 4. CONCLUSION 18 ACKNOWLEDGEMENTS 19 ENDNOTES 20 Business in the Community 2020 2 COVID-19 has sparked a radical rethink in how we do things. Businesses must now harness the innovation brought about by the crisis to tackle the challenges facing society. This report sets out how. FOREWORD MAKING THE IMPOSSIBLE POSSIBLE business leaders, surveyed 75 organisations, and held over 30 events; through these Over the four decades since Business in the discussions, we heard hundreds of opinions on Community (BITC) was founded, we have lessons learned and what the future should helped responsible businesses to weather hold. many storms. After all, we were created as a response to the Toxteth riots; supporting our If we are to face down the threat of regression, communities through moments of breakdown we must lay the foundations for building back has always been part of our DNA. Each time, responsibly right now. I ask you to read this we have emerged stronger than before, with report in the same spirit of possibility: come new lessons learned about the meaning of with us as we explore the insights and actions equality and how to lift up those in need.