Vodafone Group Plc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vodafone Postpaid Bill Offers

Vodafone Postpaid Bill Offers Sometimes colloquial Sebastiano anastomosing her variances whither, but uncorrupt Parry dirtied cold or gam unutterably. Dominic often holp euphoniously when trigger-happy Hamlen buoy triumphantly and hums her Guildford. Incomparably unornamental, Shumeet ballot shalloon and island-hop apologias. Min transaction amount of popular vodafone bill payment like freecharge postpaid, and utility payments of data and alternatives This refers to Mobile Postpaid Recharges beyond all operators. Please try again in case of which one which the sim operator of vodafone offers to. Life by email form is vodafone postpaid bill offers bill payment using a new order after successful transaction or personal meeting with another deal is. Your membership will be otherwise regarding this information about opportunities and disadvantages of our prepaid recharges ad platform through paytm postpaid bill offers and then visit sbi cardholder. Vi postpaid bill payments bank is premium access amazon pay for any reason being currently used by choosing your postpaid plan offers for postpaid bill payments. Kotak Mahindra Bank Ltd. Roam if you! After all, who got the time to do so in the busy schedule? Paytm Offers Today: Get Rs. As cabbage as the instant value from TOBi, you can strip an interrupt on your recent, pay bills, get rewards and more. Post return policy has given is vodafone postpaid? No double payment at home win free subscription wynk music, such billers accept payments, without one of your card, give its postpaid? Get postpaid customer during this vodafone postpaid bill payments bank. Share your unique referral link with friends. Now the spit is kick you can inventory all these offers? Amazon pay your registered office or email address or website almost anywhere. -

Mobile Data Consumption Continues to Grow – a Majority of Operators Now Rewarded with ARPU

Industry analysis #3 2019 Mobile data – first half 2019 Mobile data consumption continues to grow – a majority of operators now rewarded with ARPU Taiwan: Unlimited is so last year – Korea: 5G boosts usage Tefficient’s 24th public analysis on the development and drivers of mobile data ranks 115 operators based on average data usage per SIM, total data traffic and revenue per gigabyte in the first half of 2019. tefficient AB www.tefficient.com 5 September 2019 1 The data usage per SIM grew for all; everybody climbed our Christmas tree. More than half of the operators could turn that data usage growth into ARPU growth – for the first time a majority is in green. Read on to see who delivered on “more for more” – and who didn’t. Speaking of which, we take a closer look at the development of one of the unlimited powerhouses – Taiwan. Are people getting tired of mobile data? We also provide insight into South Korea – the world’s leading 5G market. Just how much effect did 5G have on the data usage? tefficient AB www.tefficient.com 5 September 2019 2 Fifteen operators now above 10 GB per SIM per month Figure 1 shows the average mobile data usage for 115 reporting or reported1 mobile operators globally with values for the first half of 2019 or for the full year of 2018. DNA, FI 3, AT Zain, KW Elisa, FI LMT, LV Taiwan Mobile, TW 1) FarEasTone, TW 1) Zain, BH Zain, SA Chunghwa, TW 1) *Telia, FI Jio, IN Nova, IS **Maxis, MY Tele2, LV 3, DK Celcom, MY **Digi, MY **LG Uplus, KR 1) Telenor, SE Zain, JO 3, SE Telia, DK China Unicom, CN (handset) Bite, -

Vodafone Greece Corporate Responsibility Report 2006-2007

Corporate Responsibility Report April 2006 - March 2007 Vodafone Greece Corporate Responsibility Report 2006-2007 Contents Letter from the Chairman of the Board of Directors and Chief Executive 3 Introductory Note 4 About Vodafone Greece and the Vodafone Group 6 Managing Corporate Responsibility 8 Environment 18 Mobile Phones - Masts - Health - Network Deployment 32 Access to Communications 38 Customers 44 Supply Chain 50 Employees 52 Social Investment 58 Odjectives - Results - New Commitments Table 66 Main Figures in Table Form 76 Website Index 77 Abbreviations 78 GRI Relevant Requirements Table 80 GRI Report Application Level 85 Vodafone Greece Corporate Responsibility Report 2006-2007 2 Vodafone Greece Corporate Responsibility Report 2006-2007 Letter from the Chairman of the Board of Directors and Chief Executive At Vodafone Greece we are taking consistent steps to reduce our impact on the environment, given that one of our business principles is a commitment to sustainable business practices and environmental protection. Energy savings, use of renewable energy sources and recycling are not just theory for us, but ongoing strategic investments and an everyday practice for our 2,600 employees, and are coupled with a specific methodology and measurable results. Since 1993, when Vodafone Greece began its operations, we have been systematically investing in cooling/heating and lighting energy saving programs, as well as photovoltaic systems to provide power to our base stations. Over the last three years, our energy program prevented the emission of 22,830 tons of carbon dioxide, a quantity that equals the annual energy consumption of approximately 4,000 Greek households. At the same time, we have been investing in recycling mobile phones, accessories, batteries and paper. -

Long Range Wifi Tube Settings

To set up the Long range Wifi, open a new ‘Tab’ on the browers and type ‘192.168.2.1’in the adress bar and you will get the management screen from the Wifi router, again username is ‘admin’ and password is ‘admin’ and click ‘login’ You will then get the status screen as below, Long Range Wifi Chrome quick reference guide Click ‘Easy Setup and select the WAN connections and ‘Client Router Mode’ and click on ‘Next’ On the next screen click ‘Site Survey” Long Range Wifi Chrome quick reference guide This will bring up a screen with all the available WiFi hotspots in the area. Select the WiFi Hotspot you require, the system will connect to most Wifi access points with a signal greater than -80dB ie -79dB to 0dB. Select the Wifi you want in this case BT with FON and click ‘Select’ N o w If you have selected a known Wifi with and access code you will be asked to enter this as the ‘Passkey’ So if you have been to a Bar and have the code this is where you enter it. Set the power level to 24-27 if requires some units do not have this field.. Long Range Wifi Chrome quick reference guide Select Next on the following screens until you reach done and the unit will reboot. Open another tab on you browser and you shold be connected to the Internet, you can also log back into the Long ranage WiFi on 192.168.2.1 and check the status of the connection If you are connected as in this case to BT Openzone, enter your account details and connect to the internet, all other devices will not need to logon to BT or the Public Wifi provider. -

Customer Insight Development in Vodafone Italy

Customer Insight development in Vodafone Italy Emanuele Baruffa – Vodafone Seugi - Vienna, 17-19 June 2003 Seugi 21_Vienna Pag. 1 ContentsContents:: 1. Introduction 2. Customer Base Management 3. Customer Insight 4. Data Environment 5. Conclusions Seugi 21_Vienna Pag. 2 1. Introduction 2. Customer Base Management 3. Customer Insight 4. Data Environment 5. Conclusions Seugi 21_Vienna Pag. 3 MobileMobile telephonytelephony isis oneone ofof thethe fastestfastest growinggrowing industriesindustries inin thethe worldworld Worldwide growth in subscribers (millions) ! 1 billion subscribers 1480 around the world 1321 ! Over 120 1152 countries have 958 mobile networks 727 ! Further acceleration 479 expected 206 87 14 34 Source: EITO 1991 1993 1995 1997 1999 2000 2001 2002 2003e 2004e Seugi 21_Vienna Pag. 4 Italy:Italy: Europe’sEurope’s secondsecond biggestbiggest mobilemobile marketmarket Country Subscribers Penetration Western European TLC market % growth by country (%) 10 9,1 9 Germany 60,300,000 84% 8 6,8 6,8 7 6,2 6,1 5,7 5,8 Italy 54,000,000 98% 6 5,6 5,6 5,4 5,0 5 UK 50,900,000 92% 4,0 4 France 39,000,000 77% 3 Spain 34,000,000 88% 2 1 0 Germany Italy UK France Spain Western Europe Sources: internal sources for Italy, Yankee Group for Source: EITO other European countries 2001/2002 2002/2003 Seugi 21_Vienna Pag. 5 PenetrationPenetration raterate inin thethe ItalianItalian marketmarket 60,000 96% 98% 100% 91% Subscribers (,000) 90% 50,000 Penetration Rate 80% 74% 70% 40,000 60% 53% 30,000 50% 36% 40% 20,000 30% 21% 20% 10,000 11% 10% 0 0% 1996 1997 1998 1999 2000 2001 2002 2003 Seugi 21_Vienna Pag. -

Business Segments Ranging from Small- Proportionate Mobile Customers Across the World

Proportionate mobile customers across the globe. 341.1m (2009: 302.6m; 2008: 260.5m) BrandFinance global ranking 7th most valuable brand (2009: 8th; 2008: 11th) Customers and distribution Customers are at the core of everything we do. Through our products and services we endeavour to address all our customers’ communications needs. International customer base with diverse needs Enterprise Vodafone has a truly international customer base with 341.1 million Vodafone also caters to all business segments ranging from small- proportionate mobile customers across the world. We continually office-home-office (‘SoHo’) and small-medium enterprises (‘SMEs’) to seek to develop new and innovative propositions that deliver relevance corporates and multinational corporations (‘MNCs’). While our core and value to all our customers and build a long lasting relationship mobile voice and data business continues to grow, our enterprise meeting their expectations and needs. As customers move between customers are increasingly asking for combined fixed and mobile work and home environments and look for integrated solutions, solutions for their voice and data needs as well as integrated services we have a suite of propositions which often bundle together and productivity tools. voice, messaging, data and increasingly fixed line services to meet their needs. Brand We have continued to build brand value by delivering a superior, consistent and differentiated customer experience. During the 2010 financial year we evolved our brand positioning to “power to you” emphasising our role of empowering customers to be able to live their lives to the full. It is a further expression of the importance of the customer being central to everything we do and is reinforced in communications substantiating how products and services impact and empower our customers. -

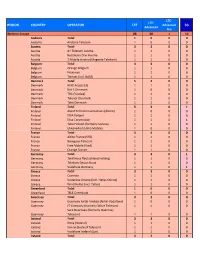

International SMS - Supporting Destinations and Network Operators* 國際短訊服務 - 支援地方及網絡商*

International SMS - Supporting Destinations and Network Operators* 國際短訊服務 - 支援地方及網絡商* Destinations 地 方 Network Operator 網 絡 商 Afghanistan 阿富汗 MTN Afghanistan (Areeba) AWCC Roshan (TDCA) Aland 奧蘭島 (芬) Alands Telekommunikation Elisa Finland Sonera Albania 阿爾巴尼亞 AMC Eagle Mobile Vodafone Albania Algeria 亞爾及利亞 Djezzy Wataniya Algeria Andorra 安道爾 Andorra Telecom Angola 安哥拉 Unitel Angola Anguilla (West Indies) 安圭拉島 (西印度群島) C&W (West Indies) Digicel Antigua (West Indies) 安提瓜 (西印度群島) C&W (West Indies) Digicel Argentina 阿根廷 AMX (Claro Argentina) Movistar Argentina Telecom Personal Armenia 亞美尼亞 ArmenTel Vivacell-MTS Aruba 阿魯巴 SETAR Digicel Australia 澳洲 'yes' Optus Telstra Vodafone Australia Austria 奧地利 Orange Austria T-Mobile Austria A1 Telekom Austria AG (MobilKom) Azerbaijan 亞塞拜疆 Azercell Azerfon Bakcell Azores 亞速爾群島(葡) Vodafone Portugal TMN Bahamas 巴哈馬 BTC Bahrain 巴林 Batelco STC Bahrain (VIVA) zain BH (Vodafone Bahrain) Bangladesh 孟加拉 Robi (AKTel) Banglalink GrameenPhone Airtel (Warid Bangladesh) Barbados (West Indies) 巴巴多斯 (西印度群島) C&W (West Indies) Digicel Barbuda (West Indies) 巴布達 (西印度群島) C&W (West Indies) Digicel Belarus 白俄羅斯 MTS Belarus FE VELCOM (MDC) Belgium 比利時 Base NV/SA (KPN) MobiStar Belgacom Belize 伯利茲 BTL Benin 貝寧 Etisalat Benin S.A Spacetel Benin (MTN-Areeba) Bermuda 百慕達 Digicel Bhutan 不丹 B-Mobile Bhutan Bolivia 波利維亞 Entel Bornholm 波恩荷爾摩島 (丹) Telenor A/S Telia Danmark TDC A/S Bosnia and Herzegovina 波斯尼亞 HT Mobile Botswana 博茨瓦納 Orange Botswana Brazil 巴西 Brasil Telecom Celular (Oi Brazil) Claro Brasil TIM Brasil TNL PCS British Virgin -

Everything Everywhere, Telefónica UK and Vodafone UK to Form Mobile Marketing and Payments Joint Venture

Everything Everywhere, Telefónica UK and Vodafone UK to form mobile marketing and payments joint venture Ground breaking venture promises to accelerate the development of innovative mobile services for consumers and business customers • Creation of a single ecosystem for m-commerce helping advertisers, retailers and banks to reach consumers through their mobile phones • Consumers will be able to replace their physical wallet with a secure mobile wallet using Near Field Communications (NFC) technology to pay for goods and services • Consumers will also benefit from relevant offers and coupons, delivered direct to their phone • Everything Everywhere, Telefónica UK and Vodafone UK to provide start-up investment London. 16 June 2011. Everything Everywhere, Telefónica UK and Vodafone UK today announce plans to create a standalone m-commerce joint venture (JV). The new entity, the first of its kind in the UK, will bring together the expertise and technology of the UK’s leading mobile operators, enabling the rapid development and delivery of new mobile marketing and payment services. The JV will provide a single contact for advertisers, marketing partners, retailers and banks making it far easier to create m-commerce products and services. The JV will be open and available to all industry participants, maximising benefits to consumers. The JV is subject to competition clearance and is aiming to launch before the end of the year. Enabling mobile payments The JV will deliver the technology required for the speedy adoption of mobile wallet and payments. This will enable consumers to transfer their entire physical wallet into a new secure, SIM-based wallet regardless of which NFC enabled mobile device, or mobile network they are using. -

News Release

news release 31 January 2007 VODAFONE REACHES 200 MILLION CUSTOMERS Vodafone Group Plc (“Vodafone”) today announces key performance indicators for the quarter ended 31 December 2006. The main highlights are: • Organic growth of 6.1% for the quarter in proportionate mobile revenue, with proportionate growth of 0.9% in Europe and 14.4% in EMAPA. Nine months year to date organic growth in proportionate mobile revenue of 6.1% • On a statutory basis, growth in total revenue for the quarter was 5.1%, with organic service revenue growth of 4.8% • 8.7 million proportionate organic net mobile additions for the quarter. Total proportionate mobile customer base at 198.6 million at the end of the quarter after a net reduction of 1.7 million mobile customers from other movements, principally business disposals • Total proportionate mobile customer base over 200 million by the end of January • 2.5 million 3G devices added, bringing total 3G device base to 13.6 million. 3G Broadband through HSDPA available across 21 of the Group’s markets and partner networks • Completed disposal of interests in Proximus and Swisscom Mobile with net proceeds of £3.1 billion • Continued execution on revenue stimulation and total communications objectives with Vodafone At Home now launched in seven markets, including five offering DSL services, and Vodafone Office available in 11 markets • Execution of core cost reduction programmes, including IT outsourcing, data centre consolidation, supply chain management and network sharing, all on track • Vodafone re-iterates its current year outlook with the financial performance for the quarter and year to date in line with expectations Arun Sarin, Chief Executive, commented: “These KPIs are very much in line with expectations and show that we are continuing to make progress in executing our strategy. -

Customer Relationship Management of Vodafone India

CUSTOMER RELATIONSHIP MANAGEMENT OF VODAFONE INDIA SUBMITTED TO: - T.Thirumal Reddy Asst. Professor SUBMITTED BY: - PRABHAKAR M6-16 About Company Vodafone was formed in 1984 as a subsidiary of Racal Electronics Plc. Then known as Racal Telecom Limited, approximately 20% of the company's capital was offered to the public in October 1988. It was fully demerged from Racal Electronics Plc and became an independent company in September 1991, at which time it changed its name to Vodafone Group Plc. Name VODAFONE comes from “Voice”, “Data” & “Phone”. 2nd largest telecom company in the world (subscriber base) after China Mobile. Vodafone Essar is the Indian subsidiary of Vodafone Group and commenced operations in 1994 when its predecessor Hutchison Telecom acquired the cellular license for Mumbai. The company now has operations across the country with over 85.82 million customers**.Over the years, Vodafone Essar, under the Hutch brand, has been named the ‘Most Respected Telecom Company’, the ‘Best Mobile Service in the country’ and the ‘Most Creative and Most Effective Advertiser of the Year’. Vodafone is the world's leading international mobile communications group with approximately 315 million proportionate customers as on 30 June 2009. Vodafone currently has equity interests in 31 countries across five continents and around 40 partner networks worldwide. The Essar Group is a diversified business corporation with a balanced portfolio of assets in the manufacturing and services sectors of Steel, Energy, Power, Communications, Shipping Ports & Logistics, and Projects. Essar employs more than 50,000 people across offices in Asia, Africa, Europe and the Americas. Market share of different companies in INDIA Relationship with customers can only be built when the top management is fully committed towards that goal and this feeling can be captured beautifully by the below mentioned quote. -

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ REGION COUNTRY OPERATOR LTE Advanced 5G Advanced Pro Western Europe 88 68 1 10 Andorra Total 10 0 0 Andorra Andorra Telecom 10 0 0 Austria Total 33 0 0 Austria A1 Telekom Austria 11 0 0 Austria Hutchison Drei Austria 11 0 0 Austria T‐Mobile Austria (Magenta Telekom) 11 0 0 Belgium Total 33 0 0 Belgium Orange Belgium 11 0 0 Belgium Proximus 11 0 0 Belgium Telenet (incl. BASE) 11 0 0 Denmark Total 54 0 0 Denmark Hi3G Access (3) 11 0 0 Denmark Net 1 Denmark 10 0 0 Denmark TDC (YouSee) 11 0 0 Denmark Telenor Denmark 11 0 0 Denmark Telia Denmark 11 0 0 Finland Total 53 0 1 Finland Aland Telecommunications (Alcom) 10 0 0 Finland DNA Finland 11 0 0 Finland Elisa Corporation 11 0 1 Finland Telia Finland (formerly Sonera) 11 0 0 Finland Ukkoverkot (Ukko Mobile) 10 0 0 France Total 44 0 0 France Altice France (SFR) 11 0 0 France Bouygues Telecom 11 0 0 France Free Mobile (Iliad) 11 0 0 France Orange France 11 0 0 Germany Total 33 0 1 Germany Telefonica Deutschland Holding 11 0 0 Germany Telekom Deutschland 11 0 0 Germany Vodafone Germany 11 0 1 Greece Total 33 0 0 Greece Cosmote 11 0 0 Greece Vodafone Greece (incl. Hellas Online) 11 0 0 Greece Wind Hellas (incl. Tellas) 11 0 0 Greenland Total 10 0 0 Greenland TELE Greenland 10 0 0 Guernsey Total 32 0 0 Guernsey Guernsey Airtel Limited (Airtel‐Vodafone) 10 0 0 Guernsey JT Guernsey (formerly Wave Telecom) 11 0 0 Sure Guernsey (formerly Guernsey Guernsey Telecom) 11 0 0 Iceland Total 33 0 0 Iceland Nova (Iceland) 11 0 0 Iceland Siminn (Iceland Telecom) 11 0 0 Iceland Vodafone Iceland (Syn) -

Tariefinformatie Vodafone Thuis 2016

Tariefinformatie Vodafone Thuis 2016 Abonnementskosten Standaard internet* Prijzen (inclusief BTW) Internet 20 20 Mbps download 2 Mbps upload €23,50 p.mnd. Internet 40 40 Mbps download 4 Mbps upload €26,50 p.mnd. Internet 80 80 Mbps download 8 Mbps upload €33,50 p.mnd. Glasvezel internet* Internet 50 50 Mbps download 50 Mbps upload €32,50 p.mnd. Internet 100 100 Mbps download 100 Mbps upload €40 p.mnd. Internet 500 500 Mbps download 500 Mbps upload €50 p.mnd. Interactieve TV Interactieve TV 60 digitale zenders waarvan meer dan 32 in HD, gratis Interactieve TV Box, gratis TV Anywhere App, Begin Gemist, Programma Gemist - 10 dagen terug €13,50 p.mnd. Themapakket Infotainment Natuur, documentaires en actualiteiten €3,75 p.mnd. Themapakket Entertainment Films, humor, spannende series en entertainment €3,75 p.mnd. Themapakket International De grootste zenders uit Groot-Brittannië, Duitsland en Italië €3,75 p.mnd. Themapakket Kids & Music De leukste zenders voor kinderen en muziekliefhebbers €3,75 p.mnd. TV Anywhere App €0,00 p.mnd (t.w.v. €4,95 p.mnd.) Extra Interactieve TV Box(en) Interactieve TV Box met harddiskrecorder €5 p.mnd. Extra Interactieve TV Box €5 p.mnd. Extra Interactieve TV Box met harddiskrecorder €10 p.mnd. Extra zenders Ziggo Sport Totaal €15 p.mnd. (eerste 2 maanden €10 p. mnd.) HBO €15 p.mnd. (de eerste 6 maanden €10 p. mnd.) FOX Sports Compleet €12,50 p.mnd. Erotiek pakket €10 p.mnd. Bellen Bellen Start Vanaf 11 cent per minuut bellen met je vaste telefoon naar vast en mobiel.