Annual Report ‘06 Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Unipro Group Consolidated Financial Statements

UNIPRO GROUP CONSOLIDATED FINANCIAL STATEMENTS PREPARED IN ACCORDANCE WITH INTERNATIONAL FINANCIAL REPORTING STANDARDS AND INDEPENDENT AUDITOR’S REPORT 31 DECEMBER 2018 Contents INDEPENDENT AUDITOR’S REPORT CONSOLIDATED FINANCIAL STATEMENTS Consolidated Statement of Financial Position ......................................................................................... 1 Consolidated Statement of comprehensive Income ................................................................................ 2 Consolidated Statement of Changes in Equity ........................................................................................ 3 Consolidated Statement of Cash Flows .................................................................................................. 4 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Note 1. The Group and its operations ..................................................................................................... 5 Note 2. Principles of preparation and summary of significant accounting policies ................................. 7 Note 3. Critical accounting estimates and assumptions ........................................................................ 19 Note 4. Application of new and revised standards and clarifications .................................................... 20 Note 5. Related Parties ......................................................................................................................... 25 Note 6. Acquisitions and disposals ....................................................................................................... -

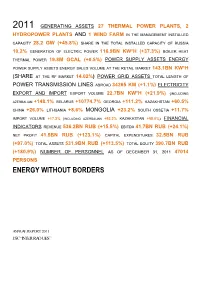

Energy Without Borders

2011 GENERATING ASSETS 27 THERMAL POWER PLANTS, 2 HYDROPOWER PLANTS AND 1 WIND FARM IN THE MANAGEMENT INSTALLED CAPACITY 28.2 GW (+45.8%) SHARE IN THE TOTAL INSTALLED CAPACITY OF RUSSIA 10.2% GENERATION OF ELECTRIC POWER 116.9BN KW*H (+37.3%) BOILER HEAT THERMAL POWER 19.8M GCAL (+0.5%) POWER SUPPLY ASSETS ENERGY POWER SUPPLY ASSETS ENERGY SALES VOLUME AT THE RETAIL MARKET 143.1BN KW*H (SHARE AT THE RF MARKET 14.02%) POWER GRID ASSETS TOTAL LENGTH OF POWER TRANSMISSION LINES ABROAD 34265 KM (+1.1%) ELECTRICITY EXPORT AND IMPORT EXPORT VOLUME 22.7BN KW*H (+21.9%) (INCLUDING AZERBAIJAN +148.1% BELARUS +10774.7% GEORGIA +111.2% KAZAKHSTAN +60.5% CHINA +26.0% LITHUANIA +8.6% MONGOLIA +23.2% SOUTH OSSETIA +11.7% IMPORT VOLUME +17.2% (INCLUDING AZERBAIJAN +93.2% KAZAKHSTAN +58.0%) FINANCIAL INDICATORS REVENUE 536.2BN RUB (+15.5%) EBITDA 41.7BN RUB (+24.1%) NET PROFIT 41.5BN RUB (+123.1%) CAPITAL EXPENDITURES 32.5BN RUB (+97.0%) TOTAL ASSETS 531.9BN RUB (+113.5%) TOTAL EQUITY 390.7BN RUB (+180.9%) NUMBER OF PERSONNEL AS OF DECEMBER 31, 2011 47014 PERSONS ENERGY WITHOUT BORDERS ANNUAL REPORT 2011 JSC “INTER RAO UES” Contents ENERGY WITHOUT BORDERS.........................................................................................................................................................1 ADDRESS BY THE CHAIRMAN OF THE BOARD OF DIRECTORS AND THE CHAIRMAN OF THE MANAGEMENT BOARD OF JSC “INTER RAO UES”..............................................................................................................8 1. General Information about the Company and its Place in the Industry...........................................................10 1.1. Brief History of the Company......................................................................................................................... 10 1.2. Business Model of the Group..........................................................................................................................12 1.4. -

Methodical Approach to Assessing the Effectiveness of the Management System of Thermal Power Plants in Russia

E3S Web of Conferences 124, 04003 (2019) https://doi.org/10.1051/e3sconf/201912404003 SES-2019 Methodical approach to assessing the effectiveness of the management system of thermal power plants in Russia P. I. Okley1, V. K. Lozenko1 and R. I. Inamov1,* 1 National Research University "Moscow Power Engineering Institute", Moscow, Russia Abstract. Physical deterioration of thermal power plants based on hydrocarbon fuels leads to technological violations (TV) in their work. Low rates of renewal of thermal generation predetermines the further exploitation of old capacities. In this regard, the activity of the management of energy holdings (EH) is more focused on maintaining the equipment in working condition. The methods, approaches and tools underlying decision-making by the management of energy holding companies are different, respectively, the results of the functioning of the organized management systems (MS) of each company are also different. To assess the effectiveness of the management system it is proposed to use such a generalized indicator as the number of technological violations per year per 1 GW of installed capacity. 1 Introduction capacity — for example, the balance of the largest holdings includes both traditional thermal power plants The electric power industry is one of the key areas of and nuclear and hydro generation. To understand the Russia's development, the country's economy and social scale of management activities it is interesting to find out position of all citizens depend on it. This industry is he general values of the installed capacity belonging to represented by 11 largest holding companies, which each holding in addition to data on production volumes produce about 85% of electricity (in 2018 - 921.8 billion and the technological structure of the generating kW*h) of the total annual production (1076.2 billion complex of the Russian Federation. -

2017 Annual Report of PJSC Inter RAO / Report on Sustainable Development and Environmental Responsibility

INFORMATION TRANSLATION Draft 2017 Annual Report of PJSC Inter RAO / Report on Sustainable Development and Environmental Responsibility Chairman of the Management Board Boris Kovalchuk Chief Accountant Alla Vainilavichute Contents 1. Strategic Report ...................................................................................................................................................................................... 8 1.1. At a Glance .................................................................................................................................................................................. 8 1.2. About the Report ........................................................................................................................................................................ 11 Differences from the Development Process of the 2016 Report ............................................................................................................ 11 Scope of Information ............................................................................................................................................................................. 11 Responsibility for the Report Preparation .............................................................................................................................................. 11 Statement on Liability Limitations ......................................................................................................................................................... -

Company News SECURITIES MARKET NEWS LETTER Weekly

SSEECCUURRIIITTIIIEESS MMAARRKKEETT NNEEWWSSLLEETTTTEERR weekly Presented by: VTB Bank, Custody March 5, 2020 Issue No. 2020/08 Company News Polyus to become Moscow Exchange’s blue chip instead of Severstal On February 28, 2020 it was reported that the Moscow Exchange planned to include the ordinary shares of Russian gold producer Polyus in its Blue Chip index instead of the shares of steelmaker Severstal on March 20. The depository receipts of multi-industry holding En+ Group will be replaced with its shares, and the shares together with the depository receipts of payment system operator Qiwi will be considered to be added to the MOEX Russia Index and the RTS Index. Other changes to the indices include addition of depository receipts of real estate developer Etalon Group and exclusion of Seligdar from the Broad Market Index, inclusion of ordinary shares of fertilizer producer Acron and Pharmacy Chain 36.6 in the SMID Index, and exclusion of ordinary shares of oil company RussNeft and oil and gas pipe producer TMK from the Oil and Gas Index. The committee also recommended that the Moscow Exchange launch a new sectorial index for the Russian real estate industry. Mail.ru’s board of directors approves listing on Moscow Exchange On March 2, 2020 the board of directors of Russian Internet company Mail.ru Group approved a listing of global depositary receipts (GDRs) on the Moscow Exchange. The plan is for Mail.ru Group’s GDRs to begin trading in Moscow by July. There will not be any secondary issuance accompanying the listing. Russian antitrust clears Fortum to buy stake in Uniper On March 2, 2020 it was announced that Russia’s Federal Antimonopoly Service cleared Finland’s Fortum to acquire a 20.5% stake in Germany’s Uniper. -

3. Inter RAO Group Today | 11

10 | PJSC Inter RAO | 2016 Annual Report 3. INTER RAO GROUP TODAY The Group operates in the following segments: A leading electricity export and import operator in Rus- — Electricity and heat generation sia. The Inter RAO Group’s supply geography comprises — Electricity supply and heat supply Finland, Belarus, Lithuania, Latvia, Estonia, Poland, Nor- — International electricity trading way, Ukraine, Georgia, Azerbaijan, South Ossetia, Ka- A diversified energy holding company — Engineering, power equipment export zakhstan, China and Mongolia. managing assets in Russia, as well as — Management of electricity distribution grids outside Russia Effectively manages power supply companies – guaran- in European and CIS countries. teed suppliers in 12 regions of Russia. Since 2010, PJSC Inter RAO has been rated in the List of Strategic Enterprises and Strategic Joint Stock Compa- Owns independent suppliers of electricity to large indus- nies of the Russian Federation1. trial consumers. GENERATING ASSETS SUPPLY ACTIVITIES ELECTRICITY EXPORT in 2016 THERMAL POWER PLANTS 41 17.0bn kWh ELECTRICITY IMPORT HYDROPOWER PLANTS 62 (including 5 low capacity HPPs) 10 in 2016 IN 62 REGIONS OF RUSSIA bn kWh WIND FARMS 3.1 1 According to the Decree of the President of Russia No. 1190 dated 30.09.2010 PJSC Inter RAO was included in the List of Strategic Enterprises and Strategic Joint-Stock Companies (Section 2 of the List of Open Joint Stock Companies with its assets held in federal ownership managed by the Russian Federation in order to ensure strategic 2 interests of State defence and security, moral values, healthcare, rights and legitimate interests protection of the citizens of the Russian Federation). -

An Overview of Boards of Directors at Russia's Largest

An Overview of Boards of Directors at Russia’s Largest Public Companies Andrei Rakitin Milena Barsukova Arina Mazunova Translated from Russian August 2020 Key Results According to information disclosed by 109 of Russia’s largest public companies: • “Classic” board compositions of 11, nine, and seven seats prevail • The total number of persons on Boards of the companies under study is not as low as it might seem: 89% of all Directors were elected to only one such Board • Female Directors account for 12% and are more often elected to the audit, nomination, and remuneration committees than to the strategy committee • Among Directors, there are more “humanitarians” than “techies”, while the share of “techies” among chairs is greater than across the whole sample • The average age for Directors is 53, 56 for Chairmen, and 58 for Independent Directors • Generation X is the most visible on Boards, and Generation Y Directors will likely quickly increase their presence if the development of digital technologies continues • The share of Independent Directors barely reaches 30%, and there is an obvious lack of independence on key committees such as audit • Senior Independent Directors were elected at 17% of the companies, while 89% of Chairs are not independent • The average total remuneration paid to the Board of Directors is RUR 69 million, with the difference between the maximum and minimum being 18 times • Twenty-four percent of companies disclosed information on individual payments made to their Directors. According to this, the average total remuneration is approximately RUR 9 million per annum for a Director, RUR 17 million for a Chair, and RUR 11 million for an Independent Director The comparison of 2020 findings with results of a similar study published in 2012 paints an interesting dynamic picture. -

MOSENERGO Group

PJSC MIPC Consolidated Financial Statements for the Year Ended 31 December 2016 Prepared in Accordance with International Financial Reporting Standards Moscow | 2017 FBK, LLC 44/1 Myasnitskaya st., Moscow, Russia 101990 T +7 (495) 737 5353 | F +7 (495) 737 5347 [email protected] | www.fbk.ru Independent Auditor’s Report To the Shareholders of PJSC MIPC Opinion We have audited the accompanying annual consolidated financial statements of PJSC MIPC and its subsidiaries (the Group), which comprise the consolidated statement of financial position as at December 31, 2016, and the consolidated statement of profit or loss and other comprehensive income, the consolidated statement of changes in equity and the consolidated statement of cash flow for the year ended December 31, 2016, and Notes to the annual consolidated financial statements comprising a summary of significant accounting policies and other explanatory information. In our opinion, the accompanying annual consolidated financial statements present fairly, in all material respects, the consolidated financial position of the Group as at December 31, 2016, and its consolidated financial performance and its consolidated cash flows for 2016 in accordance with International Financial Reporting Standards (IFRSs). Basis for Opinion We conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the annual consolidated financial statements section of our report. We are independent of the Group in accordance with Independence Rules for Auditors and Audit Firms and Code of Professional Ethics of Auditors, that correspond to the International Ethics Standards Board for Accountants’ Code of Ethics for Professional Accountants, and we have fulfilled our other ethical responsibilities in accordance with these requirements. -

Information on Candidates Nominated for Election to the Board of Directors of FGC UES, PJSC and Information on Availability Or

Information on candidates nominated for election to the Board of Directors of FGC UES, PJSC and information on availability or absence of their written consent to election to the Board of Directors of FGC UES, PJSC Status2 Aggregate Membership in the Boards of Directors of Relation to Shareholdi period of other companies ng in the Shareholder(s) Position (at the Candidate’s Candidate’s position and place of membership in Company No. who nominated Date of birth, education moment of I E N at the date of the report Nominated by the affiliates major Consent Full Name employment in the last 5 years1 the Company’s 1 the candidate nomination) candidate counter- Board of parties Directors 2013 – 2013 Director General, JSC Far East and Baikal Region Development Fund; Year of birth: 1973 2013 – 2014 Temporary Chief Pavel Executive Officer of Polyus Gold Higher Sergeyevich International Limited; Director General of Saint Petersburg State PJSC RusHydro Grachev PJSC 2014 – 2016 Chief Executive Officer PJSC Polyus 3 years 10 1 University, Diploma in Legal PJSC Polyus PJSC RusHydro no no no available (as an ROSSETI of Polyus Gold International Limited; Director General of months Studies, Lawyer; independent 2014 – 2016 President, JSC Polyus LLC “MC Polyus” SL Zoloto LLC director) Krasnoyarsk; University of Trieste, major in 2014 – present day Director General Law, J.D. of PJSC Polyus; 2016 – present day Director General of LLC “MC Polyus” 2008 – present day Member of the Year of birth: 1977 Management Board, Endowment Fund The Russian for Support and Development of the Prosperity Fund, Higher: Saint-Petersburg State University; PJSC "Aeroflot" The Prosperity M.V. -

Jsc Ogk-2 Annual Report 2017

JSC OGK-2 ANNUAL REPORT 2017 JSC OGK-2 ANNUAL REPORT 2017 This 2017 annual report (hereinafter referred to as the “Annual Report”) has been prepared using the information available to Joint-Stock Company “Second Wholesale Power Market Generating Company” (hereinafter, OGK-2, or the Company) at the time of its preparation. Some statements included in this Annual Report of the Company are forecasts for future events. Words such as “plans”, “will be”, “expected”, “will take place”, “estimates”, “will total”, “will occur”, and the like are forecasting by nature. Investors should not fully rely on the estimates and forecasts as they imply a risk of contradiction to reality. For this reason, the Company warns that the actual results or course of any events may significantly differ from forecast statements included in this annual report. Except as otherwise established by the applicable laws, the Company does not undertake to revise or confirm any expectations and estimates or publish updates and changes of forecast statements of the annual report as a result of any subsequent events or if new information becomes available. The information about the Company’s management staff is provided under the Federal Law No. 152-FZ “On Personal Data” dated July 27, 2006. 2 JSC OGK-2 ANNUAL REPORT 2017 Table of Contents 1. INFORMATION ABOUT THE COMPANY ............................................................................. 5 ADDRESS BY CHAIRMAN OF THE BOARD OF DIRECTORS OF JSC OGK-2, DIRECTOR GENERAL OF GAZPROM ENERGOHOLDING LLC D.V. FEDOROV ..... 10 ADDRESS BY DIRECTOR GENERAL OF JSC OGK-2 S.A. ANANYEV ........................ 11 1.1. Business Model ....................................................................................................................................... 12 1.2. -

INTER RAO Share Placement Price – 0.0535 RUB

Additional share issue Fundamentals Basic results of Private placement : INTER RAO share placement price – 0.0535 RUB Number of shares issued – 13,800,000,000,000 common shares Total number of shares placed with the participants of private placement – 6,822,972,629,771 shares. A total of 49.4% of newly issued shares were placed Number of shares placed with Inter RAO Capital – 2,917,890,939,501 (including shares for deal with Norilsk Nickel, stock option program and future deals) Final volume of Inter RAO’s authorized capital after private placement - 9,716,000,000,000 ordinary shares (increase by a factor of 3.36) Value of the share capital of the Company - 272.997 billion RUB* Total value of assets acquired by Inter RAO within the private placement: • Shares of utility companies - 283.2 bn RUB** • Cash – 81.8 bn RUB Share of government and state-owned companies in the authorized capital of Inter RAO amounts to 60%; Registration of additional share placement report by Federal Service for Financial Markets is planned for June 2011 Newly issued shares should start trading in June 2011 and merge into main symbol in October 2011 (MICEX) * Par value of 1 share - 0.02809767 RUB ** Value of assets based on independent appraisers. It does not include assets that might be received by INTER RAO’ s subsidiaries (closed subscription participants) after May, 17 2 Ownership structure Equity structure before Equity structure to May 17, 2011 Target equity structure after deals placement Minority finalization shareholders Federal Property Federal Property -

Jsc Atomenergoprom

Credit rating: BBB-/Stable/A-3 National scale rating: ruAAA/--/-- ATOMIC ENERGY POWER CORPORATION JSC ATOMENERGOPROM PRESENTATION www.atomenergoprom.ru 1 Presentation contents ATOMENERGOPROM in brief Nuclear energy industry development forecast Affiliates of ATOMENERGOPROM www.atomenergoprom.ru 2 Restructuring of the atomic industry State Atomic Energy Corporation ROSATOM Atomic Energy Power Corporation JSC “Atomenergoprom” Nuclear and Nuclear Nuclear fuel Engineering Machine Power radiation safety, defense complex cycle export Engineering generation decommissioning Sales of Non - nuclear Nuclear Science Nuclear Navy Technology R&D uranium and development activities services Goals of the establishment of JSC “Atomenergoprom”: To consolidate the civil part of nuclear industry, to increase its efficiency and to enhance its competitiveness To split commercial and defense sectors of nuclear industry To provide conditions to meet requirements of international integration processes To realize effectively a large-scale program of NPP construction in Russia www.atomenergoprom.ru 3 General Company Information JSC Atomenergoprom was established in 2007 according to Russian Federation Presidential Decree № 556 dated 27.04.2007. The State Atomic Energy Corporation Rosatom owns 100% shares of JSC Atomenergoprom (Federal law N 317-FL of 01.12.2007) According to Government Decree N 319 “On Measures for Creation of Joint Stock Company “Atomic Energy Power Corporation” dated May 26, 2007 shares of Russian nuclear industry enterprises were contributed into the equity of JSC Atomenergoprom. The staff total is approximately 177,000 employees. JSC Atomenergoprom imbibes a unique experience, which has been accumulated through all sectors of nuclear fuel cycle and NPP construction during last 60 years. In 2008 consolidated proceeds of JSC Atomenergoprom constituted 290 billion RUR.