Factsheet #12, February 2018 Indicates No Change from Factsheet #11 September 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Marine & Defence

MARINE & DEFENCE ©Luerssen An Australian company strengthening the nation’s sovereign shipbuilding industry. TABLE OF CONTENTS Who We Are 3 Our Vision & Values 4 Our People 5 Health, Safety & Environment 6 Quality 8 Our Defence History 10 Our Locations West Coast Facility 12 East Coast Facility 16 Defence Shipbuilding 18 Sustainment Works 20 Estate Works 22 CIVMEC CAPABILITY OVERVIEW CIVMEC CAPABILITY 1 Apprentices and Trainees CIVMEC CAPABILITY OVERVIEW CIVMEC CAPABILITY “ Our world-class facilities and extensive experience in heavy engineering and construction enable us to deliver projects of all sizes and complexities. 2 WHO WE ARE Civmec is an integrated, multi-disciplinary construction and engineering services provider to the Marine & Defence, Energy, Resources and Infrastructure sectors. Established in 2009, Civmec is one of Australia’s leading providers of turnkey solutions across a range of core capabilities. Our vast self-performance capability enables us to respond agilely to our clients’ needs while our commitment to innovation and technology ensures we work smarter, providing value-driven solutions. Focused on establishing long-term partnerships and working collaboratively with clients and delivery partners, we have played a significant role in the delivery of some of Australia’s most complex projects. We are strongly committed to supporting Australian industry. Civmec has been listed on the Singapore Exchange (SGX) since 2012, achieving dual listing on the SGX and the Australian Securities Exchange (ASX) in June 2018. CIVMEC CAPABILITY OVERVIEW CIVMEC CAPABILITY 3 OUR VISION & VALUES Our vision is to grow sustainably, delivering mutually beneficial outcomes for all stakeholders. Our culture, the way we think and operate, is COMMITMENT INNOVATION VALUE DRIVEN underpinned by our values. -

Infrastructure

INFRASTRUCTURE TABLE OF CONTENTS Who We Are 3 Our Vision & Values 4 Critical Safety Essentials 6 Health, Safety & Environment 7 Quality 8 Our People 10 Innovation & Technology 12 Infrastructure Services 13-14 Our Locations West Coast Facility 15-16 East Coast Facility 17-18 Construction 19 Project Experience 22-25 CIVMEC CAPABILITY OVERVIEW CIVMEC CAPABILITY 1 CIVMEC CAPABILITY OVERVIEW CIVMEC CAPABILITY 2 WHO WE ARE Civmec is an integrated, multi-disciplinary construction and engineering services LOGISTICS provider to the Oil & Gas, Metals & Minerals, Infrastructure, and Marine & Defence sectors. Established in 2009, Civmec is one of Australia’s leading providers of turnkey solutions across a range of core capabilities. Our vast self-performance capability enables us to respond agilely to our clients’ needs and our commitment to innovation and technology ensures SHIPBUILDING we work smarter, providing value-driven solutions. Focused on establishing long-term partnerships and working collaboratively with clients and delivery partners, we have played a significant role in the delivery of some of Australia’s most complex projects and are committed to supporting Australian industry. Civmec has been listed on the Singapore Exchange (SGX) since 2012, achieving dual listing on both the SGX and the Australian Securities Exchange (ASX) in June 2018. CIVMEC CAPABILITY OVERVIEW CIVMEC CAPABILITY 3 OUR VISION & VALUES Our vision is to grow sustainably, delivering mutually beneficial outcomes for all stakeholders. Our culture, the way we think and -

Oil Andspecial Gas REPORT FEATURE

Oil andSPECIAL Gas REPORT FEATURE KICK-OFF: Wood plc has been growing its Perth presence, Ralph Ellis says. Photos: Gabriel Oliveria Next boom nears as projects progress Decisions are expected on three major oil and gas projects worth $24 billion combined in 2020, with more to follow. Scarborough LNG project, and Worley’s oil and gas expo- support as it moves into the exe- Protracted discussions was last year selected for feed sure includes engineering, cute phase.” between the Browse partners studies on Shell’s Crux expansion. procurement and construction Mr Ellis said the Woodside and the owners of the North West Decisions on these projects, and management work at Woodside’s projects, in particular Browse Shelf Venture, where the gas will Santos’ Barossa, are due in 2020. Karratha gas plant, and brown- and Scarborough, would inten- be processed, are also delaying a Wood president operation ser- field engineering support for sify demand for skilled workers decision. vices for Asia Pacific, Ralph Ellis, Chevron across its WA assets. in WA. Mr Coleman said the negotia- told Business News the company Wood’s Mr Ellis said the tions were down to the last three had grown its team in Perth from outlook for the industry was Pipeline or four key value items. about 500 to more than 1,000 in good, with potentially two The two big Woodside projects Asked if the Browse delay Matt Mckenzie the past three years. big projects from Woodside are among 10 worth more than would lead to an ullage, or excess [email protected] @Matt_Mckenzie_ Part of that was organic, driven backed up by a pipeline of other $500 million each that are under- capacity, at North West Shelf’s by minerals and oil and gas, while developments. -

The Economic Impact of Floating LNG on Western Australia Volume 1

Economics and Industry Standing Committee The economic impact of floating LNG on Western Australia Volume 1 Report No. 2 Legislative Assembly May 2014 Parliament of Western Australia Committee Members Chairman Mr I.C. Blayney, MLA Member for Geraldton Deputy Chairman Hon F.M. Logan, MLA Member for Cockburn Members Mr P.C. Tinley, AM, MLA Member for Willagee Mr J. Norberger, MLA Member for Joondalup Mr R.S. Love, MLA Member for Moore (from 15 August 2013) Mr V.A. Catania, MLA Member for North West Central (from 9 May 2013 to 15 August 2013) Committee Staff Principal Research Officer Dr Loraine Abernethie, PhD (from 2 September 2013) Acting Principal Research Mr Michael Burton, BEc, BA (Hons) Officer (from 22 May 2013 to 30 August 2013) Research Officer Mr Michael Burton Legislative Assembly Tel: (08) 9222 7494 Parliament House Fax: (08) 9222 7804 Harvest Terrace Email: [email protected] PERTH WA 6000 Website: www.parliament.wa.gov.au/eisc Published by the Parliament of Western Australia, Perth. May 2014. ISBN: 978-1-925116-07-6 (Series: Western Australia. Parliament. Legislative Assembly. Committees. Economics and Industry Standing Committee. Report 2; Volume 1) 328.365 Economics and Industry Standing Committee The economic impact of floating LNG on Western Australia Volume 1 Report No. 2 Presented by Mr I.C. Blayney, MLA Laid on the Table of the Legislative Assembly on 15 May 2014 Chairman’s Foreword am pleased to present the first of the Economic and Industry Standing Committee’s (the Committee’s) reports from its Inquiry into the economic impact of floating Iliquefied natural gas (FLNG) on Western Australia. -

Asx Information Memorandum 3 Arbn 604 316 690 9 May 2018

1 Supporting Australian Industry 2 ASX INFORMATION MEMORANDUM 3 ARBN 604 316 690 9 MAY 2018 4 Henderson 5 Newcastle 6 COMPANY OVERVIEW FRONT COVER IMAGES 1. Henderson facility (showing current development in white outline) 2. Optus Stadium (Infrastructure Sector) 3. Luerssen Offshore Patrol Vessels (Marine and Defence Sector) 4. Yandicoogina Sustaining Project (Metals and Minerals Sector) 5. Coniston Manifold Project (Oil and Gas Sector) 6. Newcastle facility THE MARKETS WE OPERATE IN COMPANY OVERVIEW COMPETITIVE STRENGTHS COMPANY HIGHLIGHTS CURRENT MAJOR PROJECTS OUTLOOK FUTURE STRATEGY ASX INFORMATION MEMORANDUM TABLE OF CONTENTS BOARD OF DIRECTORS Photo (L to R): Chong Teck Sin (Lead Independent Director), Douglas Chester (Independent Director), James Fitzgerald (Executive Chairman), Patrick Tallon (Chief Executive Officer), Kevin Deery (Chief Operating Officer), Wong Fook Choy Sunny (Independent Director) EXECUTIVE TEAM Justine Campbell Charles Sweeney Rodney Bowes Adam Goldsmith Chief Financial Officer EGM - Construction EGM - Proposals EGM - Commercial and Risk THE MARKETS WE OPERATE IN OIL AND GAS METALS AND MINERALS INFRASTRUCTURE MARINE AND DEFENCE WATER AND ENERGY COMPANY OVERVIEW We are an Australian based multi-disciplinary construction and heavy engineering provider, with major facilities in Henderson, WA and Newcastle, NSW and satellite offices in Broome, Darwin, Gladstone and Sydney, offering an integrated turnkey solution to the oil and gas, metals and minerals, infrastructure, marine and defence, water and energy markets. Fundamental to our strategy is our diverse range of capabilities that enables us to provide complementary in-house core competencies and services. We are focused on enhancing our future growth by embracing sound work ethics, innovation and technology, whilst at the same time providing outstanding service to all our clients. -

Marine & Defence

MARINE & DEFENCE ©Luerssen An Australian company strengthening the nation’s sovereign shipbuilding industry. TABLE OF CONTENTS Who We Are 3 Our Vision & Values 4 Our People 5 Health, Safety & Environment 6 Quality 9 Our History 11 Our Locations West Coast 13 East Coast 17 Defence Shipbuilding 18 Sustainment 21 Estate Works 22 CIVMEC DEFENCE CAPABILITY 1 3,400 60+ people employed Apprentices on our projects and Trainees Our world-class facilities and extensive experience“ in heavy engineering and construction enable us to deliver projects of all sizes and complexities. DEFENCE CAPABILITY CIVMEC DEFENCE CAPABILITY 2 WHO WE ARE & DEFE RINE NCE Civmec is an integrated, multi-disciplinary MA construction and engineering services provider to the Marine & Defence, Oil & Gas, Metals & Minerals and Infrastructure sectors. S E Established in 2009, Civmec is one of Australia’s R A leading providers of turnkey solutions across a G U T range of core capabilities. & C L I U Our vast self-performance capability enables us O R to respond agilely to our clients’ needs and our T S commitment to innovation and technology ensures we A work smarter, providing value-driven solutions. R F N Focused on establishing long-term partnerships I and working collaboratively with clients and delivery partners, we have played a significant role in the delivery of some of Australia’s most complex projects CIVMEC and we are committed to supporting the Australian S defence industry. AL ME ER DEFENCE CAPABILITY TALS & MIN Civmec is dual listed on both the Singapore Exchange (SGX) and the Australian Securities Exchange (ASX). 3 OUR VISION & VALUES Our vision is to sustainably grow, delivering mutually beneficial outcomes for all stakeholders. -

Half-Year 2020 Report

INCORPORATING APPENDIX 4D 30 JUNE 2020 CONTENTS Overview 3 Financial summary 4 Base business 7 Developments 8 Sustainability 10 Governance 11 Half-Year Financial Statements 12 Shareholder information 21 Appendix 4D Results for announcement to the market More information on page 20 US$ million Revenue from ordinary activities Decreased 16%1 to 1,907 Net loss for the period attributable Decreased 1,071%1 to 4,067 to equity holders of the parent Underlying net profit after tax2 Decreased 28%1 to 303 Free cash flow2 Decreased 70%1 to 264 Interim dividend – fully franked 26 US cps H1 2020 About Woodside On the cover Inside cover Record date for determining entitlements to the dividend 25 August 2020 Woodside led the development of For more information about The Woodside operated Storage facilities 1. Comparisons are to the half-year ended 30 June 2019. the LNG industry in Australia and is Woodside’s assets and activities, North West Shelf Project’s at the Woodside 2. These are non-IFRS measures that are unaudited but derived from auditor reviewed Half-Year Financial applying this same pioneering spirit visit: www.woodside.com.au/about-us Karratha Gas Plant. operated Pluto LNG. Statements. These measures are presented to provide insight into Woodside’s performance. to solving future energy challenges. Refer to pages 4 and 5 for details. OVERVIEW The unprecedented disruption to the global economy has been a key feature of H1 2020. In addition to the Strong operational performance widespread impact of the COVID-19 pandemic on energy demand and the broader investment environment, Woodside delivered its highest first-half production result in H1 2020, achieving a record 50.1 MMboe. -

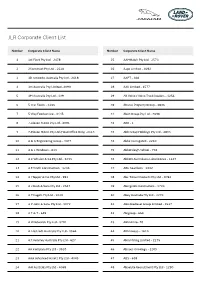

JLR Corporate Client List

JLR Corporate Client List Number Corporate Client Name Number Corporate Client Name 1 1st Fleet Pty Ltd - 2478 25 AAMHatch Pty Ltd - 2573 2 2Construct Pty Ltd - 2620 26 Aapc Limited - 4092 3 3D networks Australia Pty Ltd - 2618 27 AAPT - 468 4 3m Australia Pty Limited -4090 28 AAV Limited - 1577 5 3M Australia Pty Ltd - 139 29 AB Volvo / Volvo Truck Dealers - 1256 6 5 Star Foods - 3166 30 Abacus Property Group - 3036 7 5 Way Foodservice - 3145 31 Abah Group Pty Ltd - 2698 8 7-eleven Stores Pty Ltd - 4091 32 ABB - 1 9 7-Eleven Stores Pty Ltd (Head Office Only) -2113 33 Abb Group Holdings Pty Ltd - 4093 10 A & G Engineering Group - 3473 34 Abbe Corrugated - 2210 11 A & L Windows - 613 35 Abbotsleigh School - 702 12 A C Whalan & Co Pty Ltd - 3233 36 Abbott Australasia Laboratories - 1247 13 A E Smith Construction - 1236 37 ABC Seamless - 1002 14 A I Topper & Co. Pty Ltd - 991 38 Abc Tissue Products Pty Ltd - 4094 15 A J Bush & Sons Pty Ltd - 2647 39 Abergeldie Contractors - 1724 16 A P Eagers Pty Ltd - 3020 40 Abey Australia Pty Ltd - 3270 17 A P John & Sons Pty Ltd - 1072 41 ABG Biodiesel Group Limited - 1537 18 A T & T - 649 42 Abigroup - 650 19 A W Edwards Pty Ltd - 3701 43 ABN Amro -70 20 A. Hartrodt Australia Pty Ltd - 3564 44 ABN Group - 1610 21 A.T. Kearney Australia Pty Ltd - 627 45 Abra Mining Limited - 2275 22 AA Company Pty Ltd - 3510 46 Abraxis Oncology - 2209 23 AAA Advanced Assets Pty Ltd - 4045 47 ABS - 638 24 AAI Australia Pty Ltd - 4068 48 Absolute Recruitment Pty Ltd - 1290 JLR Corporate Client List Number Corporate Client -

Accredited Sponsors at 3 June 2020 and ANZSCO Unit Group 2613 Primary Visa Grants

Document 1 Freedom of Information Request FA 20/06/00144 Accredited Sponsors at: 3 June 2020 Sponsor Name 1300SMILES Ltd 2XU PTY LTD 3D Systems Asia-Pacific Pty Ltd 3M australia 3P Learning Limited 4mation Technologies Pty Ltd A & G ENGINEERING PTY LTD A ABRAHAMS & OTHERS A CROOK & Others A HARTRODT AUSTRALIA PTY LTD A Trahair & Others A.N. COOKE MANUFACTURING COMPANY PROPRIETARY LIMITED A.P. Eagers Limited AAA NEXTT GROUP PTY LTD AAM PTY LTD AAPC LIMITED AAW Global Logistics Pty Ltd ABARIS PRINTING AND PUBLISHING CO PTY LTD ABB Australia Pty Ltd ABB POWER GRIDS AUSTRALIA PTY LIMITED Abbott Australasia PTY LTD Abbott Risk Consulting Ltd Abbvie Pty Ltd ABERDEEN STANDARD INVESTMENTS AUSTRALIA LIMITED ABERGELDIE PERSONNEL PTY LTD ABM Systems Australia Pty Ltd ABN AMRO CLEARING SYDNEY PTY LTD ABT ASSOCIATES PTY LTD Acadian Asset Management (Australia) Ltd ACCENT GROUP LIMITED Accenture Australia Holdings Pty Ltd ACCESS TESTING PTY LTD ACCIDENT & HEALTH INTERNATIONAL UNDERWRITING PTY LTD ACCIONA ENERGY AUSTRALIA GLOBAL PTY LTD ACCIONA INFRASTRUCTURE AUSTRALIA PTY LTD ACCOLADE WINES AUSTRALIA LIMITED Accordant Pty Ltd Achmea Schadeverzekeringen N.V. ACI Operations Pty Ltd ACI WORLDWIDE (PACIFIC) PTY LTD ACN 150 898 605 PTY LTD ACON Health Limited ACT Corrective Services ACT Education and Training Directorate ACT EMERGENCY SERVICES AGENCY ACTIVE CONTRACTING PTY LTD Activision Blizzard Pty Limited Page 1 Document 1 Adapt-A-Lift Group Pty Ltd Adecco Australia Pty Ltd Adelaide Animal Hospitals Pty Ltd Adelaide Community Healthcare Alliance Incorporated Adelaide Festival Centre Trust ADELAIDE UNICARE PTY LTD ADG ENGINEERS (AUST) PTY LTD ADIDAS AUSTRALIA PTY LIMITED ADOBE SYSTEMS PTY LTD Adrenalin Media Pty Ltd Adult Multicultural Education Services Advance Delivery Consulting Pty Ltd ADVANCE VISION TECHNOLOGY (AUST.) PTY. -

2020 1 for Personal Use Only 01 OUR BUSINESS

For personal use only For personal use only 01. OUR BUSINESS WHAT WE DO 4 OUR VALUES 5 CONTENTS LOCATION OF FACILITIES 6 & PROJECTS YEAR IN REVIEW 8 FINANCIAL HIGHLIGHTS 10 EXECUTIVE CHAIRMAN’S STATEMENT 12 CHIEF EXECUTIVE OFFICER’S REPORT 14 02. OUR OPERATING SECTORS OIL & GAS 20 METALS & MINERALS 24 DEFENCE & INFRASTRUCTURE 28 03. OUR SUSTAINABILITY HEALTH, SAFETY, ENVIRONMENT & QUALITY 34 OUR PEOPLE 37 COMMUNITY ENGAGEMENT 40 SUSTAINABILITY 41 BOARD OF DIRECTORS 42 EXECUTIVE TEAM 43 04. FINANCIAL REPORT DIRECTORS’ STATEMENT 46 REPORT ON CORPORATE GOVERNANCE 53 CORPORATE REGISTRY 79 INDEPENDENT AUDITOR’S REPORT 80 CONSOLIDATED INCOME STATEMENT 89 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME 90 STATEMENTS OF FINANCIAL POSITION 91 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY 93 CONSOLIDATED STATEMENT OF CASH FLOWS 95 NOTES TO THE FINANCIAL STATEMENTS 97 STATISTICS OF For personal use only SHAREHOLDERS 166 NOTICE OF ANNUAL GENERAL MEETING 168 DISCLOSURE OF INFORMATION ON DIRECTORS SEEKING RE-ELECTION 189 PROXY FORM 193 CIVMEC ANNUAL REPORT 2020 1 For personal use only 01 OUR BUSINESS WHAT WE DO OUR VALUES LOCATION OF FACILITIES & PROJECTS YEAR IN REVIEW FINANCIAL HIGHLIGHTS EXECUTIVE CHAIRMAN’S STATEMENT CHIEF EXECUTIVE OFFICER’S REPORT For personal use only CIVMEC ANNUAL REPORT 2020 3 Civmec is an integrated, multi-disciplinary construction and engineering services provider to the Oil & Gas, Metals & Minerals and Defence & Infrastructure sectors. Established in 2009, we are one of Australia’s leading providers of turnkey solutions across a range of core capabilities. Our vast self-performance capability enables us to respond agilely to our clients’ needs and our commitment to innovation and technology enables us to work smarter, providing value- driven solutions. -

Capability Overview

CAPABILITY OVERVIEW CAPABILITY © Luerssen CAPABILITY OVERVIEW TABLE OF CONTENTS Who We Are 01 OUR MARKETS 18 Our Journey 02 Oil & Gas 21 Our Vision and Values 04 Metals & Minerals 23 OUR LOCATIONS 05 Infrastructure 25 West Coast Facility 06 Marine & Defence 27 East Coast Facility 09 OUR SERVICES 28 Critical Safety Essentials 10 Heavy Engineering 31 Health, Safety and Environment 11 Shipbuilding 33 Quality 12 Modularisation 35 Our People 14 Earthworks & Civil Works 37 Registered Training Organisation 15 Precast and Prestressed Concrete 39 Diversity and Inclusion 16 Structural, Mechanical and Piping 41 Community Engagement 17 Electrical, Instrumentation and Control 43 Maintenance & Turnarounds 45 Refractory 47 Industrial Insulation 49 Surface Treatment 51 Access Solutions 53 WHO WE ARE Civmec is an integrated, multi-disciplinary construction and engineering services LOGISTICS provider to the Oil & Gas, Metals & Minerals, Infrastructure, and Marine & Defence sectors. Established in 2009, Civmec is one of Australia’s leading providers of turnkey solutions across a range of core capabilities. SHIPBUILDING Our vast self-performance capability enables us to respond agilely to our clients’ needs and our commitment to innovation and technology ensures we work smarter, providing value-driven solutions. Focused on establishing long-term partnerships and working collaboratively with clients and delivery partners, we have played a significant role in the delivery of some of Australia’s most complex projects and are committed to supporting Australian -

Metals & Minerals

METALS & MINERALS TABLE OF CONTENTS Who We Are 3 Our Vision & Values 4 Critical Safety Essentials 6 Health, Safety & Environment 7 Quality 8 Our People 10 Innovation & Technology 12 Metals & Minerals Services 13-14 Our Locations West Coast Facility 15-16 East Coast Facility 17-18 Construction 19 Maintenance 22 Project Experience 24-27 OVERVIEW CIVMEC CAPABILITY 1 CIVMEC CAPABILITY OVERVIEW CIVMEC CAPABILITY 2 WHO WE ARE Civmec is an integrated, multi-disciplinary construction and engineering services LOGISTICS provider to the Oil & Gas, Metals & Minerals, Infrastructure, and Marine & Defence sectors. Established in 2009, Civmec is one of Australia’s leading providers of turnkey solutions across a range of core capabilities. Our vast self-performance capability enables us to respond agilely to our clients’ needs and our commitment to innovation and technology ensures SHIPBUILDING we work smarter, providing value-driven solutions. Focused on establishing long-term partnerships and working collaboratively with clients and delivery partners, we have played a significant role in the delivery of some of Australia’s most complex projects and are committed to supporting Australian industry. Civmec has been listed on the Singapore Exchange (SGX) since 2012, achieving dual listing on both the SGX and the Australian Securities Exchange (ASX) in June 2018. CIVMEC CAPABILITY OVERVIEW CIVMEC CAPABILITY 3 OUR VISION & VALUES Our vision is to grow sustainably, delivering mutually beneficial outcomes for all stakeholders. Our culture, the way we think