Your Council Tax Explained Updated March 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Meeting of the Council, Wednesday, 13 September 2017 Questions Under Standing Order A13 a Member May Only Submit Three Questions

Meeting of the Council, Wednesday, 13 September 2017 Questions Under Standing Order A13 A member may only submit three questions for consideration at each Council Meeting. Each member will present their first question in turn, when all the first questions have been dealt with the second and third questions may be asked in turn. The time for member’s questions will be limited to a total of 30 minutes. Question (1) by When did the council last conduct any monitoring and on the spot Councillor Carter checking of child work permits in Torbay? to the Executive Lead for Adults and Children’s Services (Councillor Parrott) Question (2) by Can you please advise me on a year by year basis over the past five Councillor Darling years, the number of apprenticeships offered to our community by (S) to the Mayor Torbay Council and how many of them were taken up by looked after and Executive children under the care of this or another authority? Lead for Finance, Regeneration and Corporate Services (Mayor Oliver) Question (3) by Campaign for Better Transport conducted some research into the levels Councillor Doggett of subsidy of bus services across the South West of England. The to the Executive results for 2016/2017 were as follows: Lead for Planning, Transport and BATH & NORTH EAST SOMERSET -- £1,539,674 Housing NORTH SOMERSET --- £300,590 (Councillor King) SOMERSET COUNTY COUNCIL--- £2,709,200 BOURNEMOUTH BOROUGH COUNCIL £ 322,900 POOLE BOROUGH COUNCIL-------- £ 668,810 DORSET COUNTY COUNCIL--------- £1,979,300 DEVON COUNTY COUNCIL---------- £ 4,780,129 TORBAY COUNCIL--------------------- £ 0 PLYMOUTH CITY COUNCIL-------------- £ 384,029 CORNWALL COUNTY COUNCIL---------£6,646,000 In light of the above do you think that Torbay has cut too deeply its supported bus routes and that it is time to reinstate some level of subsidy to ensure that routes such as the 65 can operate? Question (4) by Over a month ago a resident of Torquay town centre raised their Councillor Darling concerns with the Local Authority in respect of houses of multiple (M) to the occupation in Torquay. -

Financial Services STATEMENT of ACCOUNTS

Financial Services STATEMENT OF ACCOUNTS 2008/09 Torbay Council, Town Hall, Castle Circus, Torquay, Devon TQ1 3DS 1 TORBAY COUNCIL STATEMENT OF ACCOUNTS 2008/2009 Page Explanatory Foreword 3 Core Financial Statements: Income and Expenditure Account 21 Statement of Movement on the General Fund Balance 22 Statement of Recognised Gains and Losses 23 Balance Sheet24 Cash Flow Statement27 Notes to the Core Financial Statements: Index of Notes to the Core Financial Statements 29 Notes to the Core Financial Statements 31 Supplementary Financial Statement Collection Fund Summary Account107 Notes to Collection Fund Summary Statement109 Statement of Accounting Concepts and Accounting Policies 113 Financial Certificates Statement of Responsibilities for the Statement of Accounts 135 Independent Auditors’ Report to Members of Torbay Council 137 Annual Governance Statement 140 Glossary of Financial Terms 159 2 Explanatory Foreword 1Introduction The Statement of Accounts for 2008/09 has been prepared in accordance with “The Code of Practice on Local Authority Accounting in the United Kingdom 2008” published by the Chartered Institute of Public Finance and Accountancy (CIPFA). This sets out the principles and practices of accounting required to prepare a Statement of Accounts which 'presents fairly'the financial position and transactions of a local council. Any departures from this standard are disclosed in the notes to the accounts. 2Financial Overview The Council’s aims and objectives for the 2008/09 yeaR were set out in its Corporate Plan 2008+ and the Community Plan ‘Turning the Tide foR Torbay’. These are available on the Council’s website:- “Corporate Plan 2008+” -http://www.torbay.gov.uk/corporateplan “Turning the Tide foR Torbay”-http://www.torbay.gov.uk/communityplan The Council set a Revenue budget, includingthe local precept from Brixham Town Council, for 2008/09 of £110.9 million (an increase of 10% over 2007/08 excluding schools expenditure). -

Consultation Statement Brixham Peninsula Neighbourhood Plan

Consultation Statement (second version) An integral part of the Brixham Peninsula Neighbourhood Plan Consultation Statement (second version) Contents 1 Introduction ................................................................................................. 4 2 The Neighbourhood Forum ........................................................................... 5 2.1 Early formation ............................................................................................ 5 2.2 Development of the Neighbourhood Plan ....................................................... 6 3 The Town of Brixham ................................................................................... 7 3.1 The Brixham Town Council ............................................................................ 7 3.2 The Signal ................................................................................................... 7 3.3 July 2008 survey .......................................................................................... 8 3.4 July 2010 community engagement event ....................................................... 8 3.5 January 2013 community engagement event .................................................. 8 3.6 September 2014 and September 2016 “Celebrating Brixham” events ............... 9 4 Churston, Galmpton and Broadsands ........................................................... 10 4.1 The Churston, Galmpton and Broadsands Community Partnership ................. 10 4.2 April 2010 survey ...................................................................................... -

Road Safety Strategy 2017 – 2020 Brixham * Paignton * Torquay Contents

Road Safety Strategy 2017 – 2020 Brixham * Paignton * Torquay Contents Foreword ................................................................................................................................................. 4 Executive Summary.................................................................................................................................. 5 Setting the Scene ..................................................................................................................................... 6 Background ............................................................................................................................................... 6 What is a Road Safety Strategy ................................................................................................................ 6 Torbay Council’s Roles and Responsibilities? ............................................................................................ 6 Where we are Now? ................................................................................................................................ 7 Casualty and Collision Data ...................................................................................................................... 7 Our Challenges ....................................................................................................................................... 12 Who is Getting Killed or Seriously Injured? ............................................................................................ -

Which Areas Accept Co-Op Compostable Carrier Bags?

Which areas accept Co-op compostable carrier bags? The following councils accept our compostable carrier bags in their food waste collection service: Aberdeen City Council Aberdeenshire Council Angus Council Ashford Borough Council Aylesbury Vale District Council Basildon District Council Bath & North East Somerset Council Bolton Metropolitan Borough Council Borough of Broxbourne Braintree District Council Brentwood Borough Council Bristol City Council Bury Metropolitan Borough Council Canterbury City Council Castle Point Borough Council Chelmsford City Council Cheltenham Borough Council Cherwell District Council Cheshire West And Chester Council Chiltern District Council Christchurch Borough Council City of London Corporation Clackmannanshire Council Colchester Borough Council Corby Borough Council Cotswold District Council Dacorum Council Daventry District Council Derby City Council Dover District Council Dundee City Council East Ayrshire Council East Devon District Council East Dorset District Council East Dunbartonshire Council East Hertfordshire District Council East Northamptonshire Council East Renfrewshire Council East Riding of Yorkshire Council Eastleigh Borough Council Edinburgh City Council Elmbridge Borough Council Epping Forest District Council Epsom & Ewell Borough Council Falkirk Council Forest of Dean Council Glasgow City Council Gloucester City Council Gravesham Borough Council Guildford Borough Council Harlow Council High Peak Borough Council Inverclyde Council Isle Of Wight Council King's Lynn & West Norfolk Borough -

Community Plan Working for a Healthy, Prosperous and Happy Bay

2011+ Torbay’s Community Plan Working for a healthy, prosperous and happy Bay 2 South Devon’s beautiful Bay Torbay: an excellent place to live, work, visit and invest in. www.torbaydevelopmentagency.co.ukTorbay’s Community Plan Working for a healthy, prosperousFollow us onand happy @TorbayTDA Bay 3 Contents Contents . 3 Foreword by Chair of Torbay Strategic Partnership . .4-5 Moving forward from the last Community Plan . 6 Early Intervention . 7 Our Ambition for the Bay . 8 Delivering our ambition . 9 Transport Economy and Environment . 10 Health and Well Being . 14 Communities . 16 Population and Migration . 18 4 5 Foreword by Chair of Torbay Strategic Partnership Welcome to Torbay’s Community Plan We are proud of the way partners have worked together to deliver on the Community Plan Priorities and the Local Area Agreement (LAA) . We have seen many successes over the last 3 years . This refreshed plan has been developed and prepared by the Torbay Strategic Partnership on behalf of all the residents of Torbay, building on the previous Community Plan ‘Turning the Tide for Torbay’ . It outlines the Partnership’s ambition for Torbay over the next 20 years bringing together the views of residents as well as representatives from the business, community and voluntary sectors . Four key challenges have emerged from the refreshment: Developing our economy, improving job prospects and responding to the recession Opportunities for older people and the challenges of providing services for an ageing population Climate Change – reducing our carbon footprint and the increased risk of flooding Improving quality of life for the least well off in our society The plan aims to unlock Torbay’s potential and drive forward its economic prosperity to deliver our vision of healthy, prosperous and happy communities with a higher quality of life and improved access to jobs . -

Local Authority / Combined Authority / STB Members (July 2021)

Local Authority / Combined Authority / STB members (July 2021) 1. Barnet (London Borough) 24. Durham County Council 50. E Northants Council 73. Sunderland City Council 2. Bath & NE Somerset Council 25. East Riding of Yorkshire 51. N. Northants Council 74. Surrey County Council 3. Bedford Borough Council Council 52. Northumberland County 75. Swindon Borough Council 4. Birmingham City Council 26. East Sussex County Council Council 76. Telford & Wrekin Council 5. Bolton Council 27. Essex County Council 53. Nottinghamshire County 77. Torbay Council 6. Bournemouth Christchurch & 28. Gloucestershire County Council 78. Wakefield Metropolitan Poole Council Council 54. Oxfordshire County Council District Council 7. Bracknell Forest Council 29. Hampshire County Council 55. Peterborough City Council 79. Walsall Council 8. Brighton & Hove City Council 30. Herefordshire Council 56. Plymouth City Council 80. Warrington Borough Council 9. Buckinghamshire Council 31. Hertfordshire County Council 57. Portsmouth City Council 81. Warwickshire County Council 10. Cambridgeshire County 32. Hull City Council 58. Reading Borough Council 82. West Berkshire Council Council 33. Isle of Man 59. Rochdale Borough Council 83. West Sussex County Council 11. Central Bedfordshire Council 34. Kent County Council 60. Rutland County Council 84. Wigan Council 12. Cheshire East Council 35. Kirklees Council 61. Salford City Council 85. Wiltshire Council 13. Cheshire West & Chester 36. Lancashire County Council 62. Sandwell Borough Council 86. Wokingham Borough Council Council 37. Leeds City Council 63. Sheffield City Council 14. City of Wolverhampton 38. Leicestershire County Council 64. Shropshire Council Combined Authorities Council 39. Lincolnshire County Council 65. Slough Borough Council • West of England Combined 15. City of York Council 40. -

CONNECTING DEVON and SOMERSET: Get up to Speed

CONNECTING DEVON AND SOMERSET: Get up to Speed! with superfast broadband CDS announces the supplier for the business and community support programme Bridging the Digital Divide: Connecting Devon and Somerset announces comprehensive support programme to help businesses and communities Get up to Speed! on superfast broadband Connecting Devon and Somerset has announced the successful supplier for its £1 million business and community support programme, Get up to Speed! This programme has been designed to help bridge the digital divide between our rural and urban businesses and communities, as well as encourage take up of the new service as it rolls out across the counties. The Cosmic Peninsula Consortium, comprising Peninsular Enterprise and Cosmic successfully tendered for the contract to bring training, support and advice to communities and businesses throughout the programme area. Businesses can get advice on everything from improving efficiency and getting better use out of improved speeds to online marketing, new technologies, apps and software that will help them grow, develop and reach new markets. It’s not just about businesses however, communities can also benefit through gaining a better understanding of social media, accessing online public services as well as making the most of services such as iPlayer, live streaming, gaming and homeworking. The Cosmic Peninsular Consortium will now undertake a series of workshops and events that will follow the infrastructure roll out as it moves across Devon and Somerset, helping businesses and individuals access information and develop the skills to get the most from faster broadband speed. Councillor Andrew Leadbetter, Cabinet Member for Economy and Growth for Devon County Council, said: “The Get up to Speed! programme is an important element of Connecting Devon and Somerset. -

Successful Local Sustainable Transport Fund 15/16 Revenue Bids

SUCCESSFUL LOCAL SUSTAINABLE TRANSPORT FUND 15/16 REVENUE BIDS DfT Total Lead Local Region Project Name Funding Programme Authority/Organisation Contribution Awarded Cost East Derby City Council Connected Keeping Derby Moving £961,000 £8,007,000 £8,968,000 Midlands East Leicester City Council Leicester 'Fit for Business' £775,000 £5,790,000 £6,565,000 Midlands East Leicestershire County Smarter Travel for Business £978,500 £23,320,000 £24,298,500 Midlands Council East Nottingham sustainable access to Nottingham City Council £1,180,000 £19,340,000 £20,520,000 Midlands employment, skills and training programme Getting Cambridgeshire to Work – East of Cambridgeshire County securing smarter travel as part of £1,000,000 £20,421,000 £21,421,000 England Council Cambridgeshire’s economic success story 1 East of Peterborough City Council Travelchoice Focus £900,000 £10,300,000 £11,200,000 England East of Southend on Sea Borough Ideas in Motion Southend £750,000 £4,780,000 £5,530,000 England Council North East Durham County Council Walk To project £3,980,000 £29,809,000 £33,789,000 North East Durham County Council Durham Local Motion to Work £840,000 £2,264,000 £3,104,000 Newcastle City Council North East (Tyne & Wear Integrated Go Smarter £3,850,000 £2,605,470 £6,455,470 Transport Authority) Northumberland County North East Go Smarter Northumberland £710,000 £130,000 £840,000 Council Stockton-on-Tees Borough North East Connect Tees Valley £1,267,000 £1,706,000 £2,973,000 Council 2 Cheshire West & Chester North West Connecting the Atlantic Gateway -

Q2 1617 LA Referrals

Referrals to Local Authority Adoption Agencies from First4Adoption by region Q2 July-September 2016 Yorkshire & The Humber LA Adoption Agencies North East LA Adoption Agencies Durham County Council 13 North Yorkshire County Council* 30 1 Northumberland County Council 8 Barnsley Adoption Fostering Unit 11 South Tyneside Council 8 Rotherham Metropolitan Borough Council 11 2 North Tyneside Council 5 Bradford Metropolitan Borough Council 10 Redcar Cleveland Borough Council 5 Hull City Council 10 1 Web Referrals Phone Referrals Middlesbrough Council 3 East Riding Of Yorkshire Council 9 City Of Sunderland 2 Cumbria County Council 7 Gateshead Council 2 Calderdale Metropolitan Borough Council 6 1 Newcastle Upon Tyne City Council 2 0 3.5 7 10.5 14 Leeds City Council 6 1 Web Referrals Phone Referrals Doncaster Metropolitan Borough Council 5 Hartlepool Borough Council 4 North Lincolnshire Adoption Service 4 1 City Of York Council 3 North East Lincolnshire Adoption Service 3 1 Darlington Borough Council 2 Kirklees Metropolitan Council 2 1 Sheffield Metropolitan City Council 2 Wakefield Metropolitan District Council 2 * Denotes agencies with more than one office entry on the agency finder 0 10 20 30 40 North West LA Adoption Agencies Liverpool City Council 30 Cheshire West And Chester County Council 16 Bolton Metropolitan Borough Council 11 1 Manchester City Council 9 WWISH 9 Lancashire County Council 8 Oldham Council 8 1 Sefton Metropolitan Borough Council 8 2 Web Referrals Phone Referrals Wirral Adoption Team 8 Salford City Council 7 3 Bury Metropolitan -

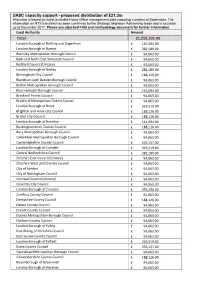

UASC Capacity Support - Proposed Distribution of £21.3M Allocation Is Based on Latest Available Home Office Management Data Capturing Numbers at September

UASC capacity support - proposed distribution of £21.3m Allocation is based on latest available Home Office management data capturing numbers at September. The information on NTS transfers has been confirmed by the Strategic Migration Partnership leads and is accurate up to December 2017. Please see attached FAQ and methodology document for further information. Local Authority Amount Total 21,258,203.00 London Borough of Barking and Dagenham £ 141,094.00 London Borough of Barnet £ 282,189.00 Barnsley Metropolitan Borough Council £ 94,063.00 Bath and North East Somerset Council £ 94,063.00 Bedford Council (Unitary) £ 94,063.00 London Borough of Bexley £ 282,189.00 Birmingham City Council £ 188,126.00 Blackburn with Darwen Borough Council £ 94,063.00 Bolton Metropolitan Borough Council £ 94,063.00 Bournemouth Borough Council £ 141,094.00 Bracknell Forest Council £ 94,063.00 Bradford Metropolitan District Council £ 94,063.00 London Borough of Brent £ 329,219.00 Brighton and Hove City Council £ 188,126.00 Bristol City Council £ 188,126.00 London Borough of Bromley £ 141,094.00 Buckinghamshire County Council £ 188,126.00 Bury Metropolitan Borough Council £ 94,063.00 Calderdale Metropolitan Borough Council £ 94,063.00 Cambridgeshire County Council £ 235,157.00 London Borough of Camden £ 329,219.00 Central Bedfordshire Council £ 282,189.00 Cheshire East Council (Unitary) £ 94,063.00 Cheshire West and Chester Council £ 94,063.00 City of London £ 94,063.00 City of Nottingham Council £ 94,063.00 Cornwall Council (Unitary) £ 94,063.00 Coventry City -

Emerging Decision – Briefing for SLT, Cabinet Members and Climate Change Review Panel Subject

Emerging Decision – Briefing for SLT, Cabinet Members and Climate Change Review Panel Subject: Working Towards a Carbon Neutral Community and Council – A proposed approach for 2021-22 Contact details: Name: Jacqui Warren (Climate Emergency Officer) Email: [email protected] What is the proposal and it benefits? Background Since 2008 Torbay Council has been taking action to tackle climate change, including a range of actions as outlined in two previous climate change strategies the Local Plan (2012-2030) and Local Transport Plan (2011-2026), as well as many other associated actions in other policy documents. Highlights include: Developing 2 large solar farms All Council reports include a Climate Change section All officers encouraged to actively seek environmentally friendly ways of working / supply of goods and services Tor Bay Harbour Authority has installed solar PV panels, procured an electric forklift truck and installed LED lighting Energy efficiency advice available to homes through Cosy Devon Partnership and Exeter Community Energy Delivery of active travel (walking and cycling) infrastructure in particular through the Local Sustainable Transport Fund However, in light of Torbay Council declaring a Climate Emergency in June 2019, there is now an immediate need to accelerate action and make significant progress over the next ten years to achieve carbon neutrality across the Council and Community. This paper outlines an initial approach to be delivered across 2021 - April 2022. It proposes to deliver immediate actions to tackle the Climate Emergency whilst also allowing some time to refresh the Torbay Climate Change Strategy (2014-2019) and co-design and develop with partners, new longer term action plans to work towards a Carbon Neutral (CN) council and CN Torbay (community).