Dipascali, Frank Plea

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Exhibit a Pg 1 of 40

09-01161-smb Doc 246-1 Filed 03/04/16 Entered 03/04/16 10:33:08 Exhibit A Pg 1 of 40 EXHIBIT A 09-01161-smb Doc 246-1 Filed 03/04/16 Entered 03/04/16 10:33:08 Exhibit A Pg 2 of 40 Baker & Hostetler LLP 45 Rockefeller Plaza New York, NY 10111 Telephone: (212) 589-4200 Facsimile: (212) 589-4201 Attorneys for Irving H. Picard, Trustee for the substantively consolidated SIPA Liquidation of Bernard L. Madoff Investment Securities LLC and the Estate of Bernard L. Madoff UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK SECURITIES INVESTOR PROTECTION CORPORATION, No. 08-01789 (SMB) Plaintiff-Applicant, SIPA LIQUIDATION v. (Substantively Consolidated) BERNARD L. MADOFF INVESTMENT SECURITIES LLC, Defendant. In re: BERNARD L. MADOFF, Debtor. IRVING H. PICARD, Trustee for the Liquidation of Bernard L. Madoff Investment Securities LLC, Plaintiff, Adv. Pro. No. 09-1161 (SMB) v. FEDERICO CERETTI, et al., Defendants. 09-01161-smb Doc 246-1 Filed 03/04/16 Entered 03/04/16 10:33:08 Exhibit A Pg 3 of 40 TRUSTEE’S FIRST SET OF REQUESTS FOR PRODUCTION OF DOCUMENTS AND THINGS TO DEFENDANT KINGATE GLOBAL FUND, LTD. PLEASE TAKE NOTICE that in accordance with Rules 26 and 34 of the Federal Rules of Civil Procedure (the “Federal Rules”), made applicable to this adversary proceeding under the Federal Rules of Bankruptcy Procedure (the “Bankruptcy Rules”) and the applicable local rules of the United States District Court for the Southern District of New York and this Court (the “Local Rules”), Irving H. -

Yom Kippur Morning 5770 Lehman Brothers, Failed

YOM KIPPUR MORNING 5770 LEHMAN BROTHERS, FAILED BANKS, UNEMPLOYMENT, CITIBANK, ALLEN STANFORD, AIG, MARC DREIER, THE SEC, BEAR STEARNS, BAIL OUTS, BANKRUPTCIES, UNEMPLOYMENT, JAMES NICHOLSON, DELAYED RETIREMENTS, BANK OF AMERICA, UBS. BERNIE MADOFF, GREED IS GOOD, FINANCIAL MELTDOWN, MERRILL LYNCH, SUB-PRIME MORTGAGE LOANS, CALIFORNIA GOING BROKE. NON-PROFITS GOING BROKE, 401K’s DISAPPEARING, WALL STREET, TARP AND GREED, INVESTMENT BANKING IS ALL WE NEED. ECONOMY IN A FREEFALL, ECONOMY IN NEAR COLLAPSE, SUICIDE AND HEDGE FUNDS, PLUNGING HOME VALUES. THE IRS BANK FAILURES, DELAYED RETIREMENT, GM STOCK SELLING FOR A DOLLAR, STIMULUS PACKAGE, JOBS DISAPPEARING, COLLEGE ENDOWMENT FUNDS ARE SLASHED FRANK DIPASCALI, PONZI SCHEMES, CHURCH PONZI SCHEMES, AFRICAN PONZI SCHEMES, JEWISH PONZI SCHEMES, PONZI, PONZI, PONZI, BERNIE MADOFF My son David will tell you that the wildest roller coaster rides in the country are at Cedar Point Amusement Park in Sandusky, Ohio. However, looking at the American economy these past two years, we know that there have been some pretty wild rides here as well and, unlike the amusement park, these rides don’t end after two minutes. The last year and a half of the Bush Administration was a terrifying freefall. Not necessarily because of the wrong decisions being made; it just seemed that no one was in charge. No one spoke up. No one acted. No one took responsibility and the economy seemed to careen closer to the edge of the cliff with every passing day. The only real option for whoever won the Presidential election was to actually do something. Our congregants and our community, like most other congregations and communities, have been deeply affected by the events of the past two years. -

The Global Economy, Economic Crisis, and White-Collar Crime

Contents Volume 9 • Issue 3 • August 2010 SPECIAL ISSUE The Global Economy, Economic Crisis, and White-Collar Crime EDITORIAL INTRODUCTION White-collar crime and the Great Recession .......................................................................429 Neal Shover, Peter Grabosky WALLS OF SECRECY AND SILENCE RESEARCH ARTICLE. Walls of secrecy and silence: The Madoff case ..........................................435 and cartels in the construction industry Henk van de Bunt POLICY ESSAY. Secrecy, silence, and corporate crime reforms ..................................................455 William S. Laufer POLICY ESSAY. Silent or invisible? Governments and corporate financial crimes .....................467 John Minkes POLICY ESSAY. How to effectively get crooks like Bernie Madoff in Dutch .............................475 Henry N. Pontell, Gilbert Geis POLICY ESSAY. Getting our attention .......................................................................................483 Nancy Reichman SERIOUS TAX FRAUD AND NONCOMPLIANCE RESEARCH ARTICLE. Serious tax fraud and noncompliance: A review of evidence ....................493 on the differential impact of criminal and noncriminal proceedings Michael Levi POLICY ESSAY. Criminal prosecution within responsive regulatory practice ............................515 Valerie Braithwaite POLICY ESSAY. Fairness matters—more than deterrence: .........................................................525 Class bias and the limits of deterrence Paul Leighton POLICY ESSAY. Serious tax noncompliance: Motivation -

S Finance Chief to Plead Guilty

MADOFF’S FINANCE CHIEF TO PLEAD GUILTY For those of you complaining that I’m not reporting on 3-year old Sibel Edmonds revelations, here’s some news that may offer fresh new insight into the sordid world of international crime and power. Frank DiPascali, the finance chief at Bernard Madoff’s investment advisory business who agreed to plead guilty, could help prosecutors build criminal cases against other players in his boss’s $65 billion Ponzi scheme. DiPascali, 52, is scheduled to enter his plea tomorrow in federal court in Manhattan, U.S. Attorney Lev Dassin told a judge in an Aug. 8 letter that didn’t specify the charges. DiPascali would waive indictment and plead guilty, which signals to lawyers that he is cooperating to lessen his prison term. "I believe he’s cooperating," said John J. Fahy, a former federal prosecutor not involved in the case. "He would be very valuable to the government because he has been close to Madoff for so many years and had to have seen some of the fraudulent transactions that went on. From what we know of Madoff, he trusted very few people." Madoff, of course, has gone off to prison without really telling anyone where the bodies are buried, where the money went, or even who on Wall Street knew and facilitated his scheme. We won’t know for some time how cooperative DiPascali will be, but if he is cooperative, and if he does know where even a few of the bodies are buried, his cooperation might free up information that is otherwise, thus far, successfully buried. -

Ex-Boyfriend Charged in EP Murder 83 Low: Ment Monday in Providence Stanfield Outside Her Home in a Perpetrated Every Day in Rhode 54 Mother of Three District Court

www.pawtuckettimes.com The Blackstone Valley’s Neighborhood Newspaper since 1885 Newsstand: 50 Cents NFL throws the book at Brady, Patriots SPORTS, Page B1 Tuesday, May 12, 2015 WEATHER TODAY High: Ex-boyfriend charged in EP murder 83 Low: ment Monday in Providence Stanfield outside her home in a perpetrated every day in Rhode 54 Mother of three District Court. Riverside apartment complex just Island by abusers seeking to exert Yuland Stanfield, 43, with a last before 11 a.m. Sunday. power and control over their part- stabbed outside known address of Santurri's death was the city's ners. Althea Street, first homicide of the year. “Stanfield has a lengthy history WHAT A apartment building Providence, was During the arraignment proceed- of domestic violence assaults dat- arraigned on one ings Monday morning, Stanfield, ing back to 1992. It is important to W RLD By JOSEPH FITZGERALD count of first- who was ordered held without bail, realize that this crime was not an [email protected] degree murder and began crying and wailing and fell isolated incident, but the final abu- Local and wire reports two counts of vio- to his knees before he was escorted sive act in a pattern of violent EAST PROVIDENCE – A 43- lating a restraining out of the courtroom by five court behaviors, all of which need to be PARTY TIME’S year-old man charged with the fatal order in connection officers. taken seriously by law enforcement stabbing of his ex-girlfriend out- with the murder of Stanfield Meanwhile, advocates against and our communities,” Kristin side her apartment complex on 42-year-old Christine domestic violence were quick to Lyons, executive director of the OVER FOR Mother’s Day broke down and Santurri, a mother of three, who speak out Monday, saying Women’s Center of Rhode Island, cried and had to be escorted out of died at Rhode Island Hospital after Santurri’s murder is a tragic SEXY SENIOR the courtroom during his arraign- being stabbed multiple times by reminder that domestic violence is See MURDER, page A2 NORRISTOWN, Pa. -

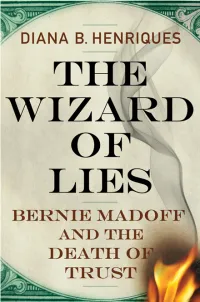

Read Chapter 1 As a PDF

1 An Earthquake on Wall Street Monday, December 8, 2008 He is ready to stop now, ready to just let his vast fraud tumble down around him. Despite his confident posturing and his apparent imperviousness to the increasing market turmoil, his investors are deserting him. The Spanish banking executives who visited him on Thanksgiving Day still want to withdraw their money. So do the Italians running the Kingate funds in London, and the managers of the fund in Gibraltar and the Dutch-run fund in the Caymans, and even Sonja Kohn in Vienna, one of his biggest boosters. That’s more than $1.5 billion right there, from just a handful of feeder funds. Then there’s the continued hemorrhaging at Fairfield Greenwich Group—$980 million through November and now another $580 million for December. If he writes a check for the December redemptions, it will bounce. There’s no way he can borrow enough money to cover those with- drawals. Banks aren’t lending to anyone now, certainly not to a midlevel wholesale outfit like his. His brokerage firm may still seem impressive to his trusting investors, but to nervous bankers and harried regulators today, Bernard L. Madoff Investment Securities is definitely not “too big to fail.” Last week he called a defense lawyer, Ike Sorkin. There’s probably not much that even a formidable attorney like Sorkin can do for him at this point, but he’s going to need a lawyer. He made an appointment for 2 | The Wizard of Lies 11:30 am on Friday, December 12. -

SEC Complaint

GEORGE S. CANELLOS REGIONAL DIRECTOR Andrew M. Calamari Robert J. Burson (Not admitted in New York) Alexander M. Vasilescu Aaron P. Arnzen (Not admitted in New York) Kristine M. Zaleskas Attorneys for Plaintiff SECURITIES AND EXCHANGE COMMISSION New York Regional Office 3 World Financial Center New York, NY 10281 (212) 336-1100 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK ---------------------------------------------------------------------------------x SECURITIES AND EXCHANGE COMMISSION, Plaintiff, Civ. - against- ENRICA COTELLESSA-PITZ, Defendant. ---------------------------------------------------------------------------------x COMPLAINT Plaintiff Securities and Exchange Commission ("Commission"), for its Complaint against defendant Enrica Cotellessa-Pitz ("Cotellessa-Pitz," or the "Defendant"), alleges: SUMMARY 1. Cotellessa-Pitz was the Controller for Bernard L. Madoff Investment Securities LLC ("BMIS"), and worked with other BMIS employees in falsifying documents that Bernard L. Madoff ("Madoff') used to hide his massive Ponzi scheme. While Cotellessa-Pitz may not have been aware of the Ponzi scheme, she nevertheless assisted in falsifying, among other things, BMIS' s internal accounting j oumals and ledgers in order to misclassify, and obfuscate, hundreds ofmillions ofdollars of income purportedly generated by BMIS's investment advisory operations (the "IA Operations"). Cotellessa-Pitz also falsified financial statements filed with the Commission and other regulators, as well as materials that were prepared to mislead Commission staff examiners and other external reviewers, including federal and state tax auditors. VIOLATIONS 2. By virtue ofthe conduct alleged herein, Defendant directly or indirectly, singly or in concert, has engaged in acts, practices, schemes and courses ofbusiness that aided and abetted violations ofSection 17(a) ofthe Securities Exchange Act of 1934 (the "Exchange Act") [15 U.S.C. -

In Re: Santander-Optimal Securities Litigation 09-CV-20215

Case 1:09-cv-20215-PCH Document 156 Entered on FLSD Docket 10/21/2009 Page 1 of 229 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF FLORIDA CASE NO. 09-20215-CIV-HUCK/O’SULLIVAN IN RE SANTANDER-OPTIMAL SECURITIES CONSOLIDATED AMENDED CLASS LITIGATION ACTION COMPLAINT JURY TRIAL DEMANDED / ACKERMAN, LINK & SATORY, P.A. 2525 Ponce de León Boulevard, Suite 700 Coral Gables, Florida 33134 Tel: (305) 529-9100 Fax: (305) 529-1612 LABATON SUCHAROW LLP 140 Broadway New York, New York 10005 Tel: (212) 907-0700 Fax: (212) 818-0477 COUGHLIN STOIA GELLER RUDMAN & ROBBINS LLP 120 E. Palmetto Park Road, Suite 500 Boca Raton, Florida 33432-4809 Tel: (561) 750-3000 Fax: (561) 750-3364 Case 1:09-cv-20215-PCH Document 156 Entered on FLSD Docket 10/21/2009 Page 2 of 229 TABLE OF CONTENTS Page I. NATURE OF THE ACTION 1 II. THE PARTIES 12 A. PLAINTIFFS 12 B. DEFENDANTS 15 III. RELEVANT NON-PARTIES 20 IV. BACKGROUND FACTS 21 A. MADOFF’S PONZI SCHEME 21 B. MADOFF’S ARREST AND GUILTY PLEA 22 V. SUBSTANTIVE ALLEGATIONS CONCERNING THE SANTANDER DEFENDANTS 23 A. IN 2002, SANTANDER AND OIS IDENTIFIED MADOFF’S SUBSTANTIAL COUNTERPARTY AND CUSTODIAL RISK 23 1. The First Courvoisier Memorandum 23 2. The Second Courvoisier Memorandum 26 B. OIS VIOLATED ITS OWN INTERNAL DUE DILIGENCE PROCEDURES, AMONG OTHER THINGS, BY FAILING TO CONTACT MADOFF’S COUNTERPARTIES 32 1. The OIS 2005 Due Diligence Questionnaire 32 2. The OIS 2008 Due Diligence Questionnaire 34 3. OIS’s Quantitative Analytics Tools Raised Red Flags 40 4. -

SEC Complaint

ANDREW M. CALAMARI ACTING REGIONAL DIRECTOR Robert J. Burson (Not admitted in New York) Alexander M. Vasilescu Aaron P. Arnzen .Kristine M. Zaleskas Attorneys for Plaintiff SECURITIES AND EXCHANGE COMMISSION New York Regional Office 3 World Financial Center New York, NY 10281 (212) 336-1100 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK -------------------------------------------------------------------------x SECURITIES AND EXCHANGE COMMISSION, Plaintiff, Civ. - against- JURy TRIAL DEMANDED PETER B. MADOFF, Defendant. -----------------------------------'--------------------------------------x COMPLAINT Plaintiff Securities and Exchange Commission ("Commission"), for its Complaint against defendant Peter B. Madoff ("Peter, or "Defendant"), alleges: SUMMARY 1. Peter Madoff, Bernard Madoffs ("Madoff') younger brother, was Bernard L. MadoffInvestment Securities LLC's ("BMIS") Senior Managing Director and Chief Compliance Officer ("CCO") from 1969 through December 11, 2008. Peter was responsible for catastrophic compliance failures in these roles even while he created the illusory (albeit convincing) fayade of a functioning compliance program that allowed Madoff and BMIS to carry out a decades-long Ponzi scheme. 2. Peter was responsible for supervising BMIS's market-making and proprietary trading operations (the "MM & PT Operations"), which are not the subjects of this action. Madoff also enlisted Peter's help in several illicit projects concerning BMIS's investment advisory operations (the "IA Operations"), through which Madoff -

2009 Year in Review: SEC and SRO Selected Enforcement Cases and Developments Regarding Broker-Dealers

review 2009 Year in Review: SEC and SRO Selected Enforcement Cases and Developments Regarding Broker-Dealers www.morganlewis.com TABLE OF CONTENTS Page Executive Summary ....................................................................................................... 1 The SEC ................................................................................................... 2 Developments Relating to Bernard Madoff’s Ponzi Scheme..................... 4 Auction Rate Securities............................................................................. 4 FINRA....................................................................................................... 4 NYSE Regulation...................................................................................... 5 U.S. Securities and Exchange Commission ................................................................... 7 Enforcement Developments at the SEC in 2009 ................................................. 7 Changes in Personnel and Division of Enforcement Structure ................. 7 Enforcement Statistics .............................................................................. 9 Policy Developments .............................................................................. 11 Financial Fraud Enforcement Task Force............................................... 13 Financial Crisis Inquiry Commission ....................................................... 13 Legislative Developments....................................................................... 14 Current -

United States V. Frank Dipascali, Jr., 09 Cr. ___ (RJS) Count Charge

United States v. Frank DiPascali, Jr., 09 Cr. ___ (RJS) Count Charge Maximum Penalties 5 yrs. imprisonment; 3 yrs. sup. release; fine of the ONE Conspiracy greatest of $250,000 or twice the gross gain or loss; mandatory $100 special assessment; restitution. 20 yrs. imprisonment; 3 yrs. sup. release; fine of the TWO Securities Fraud greatest of $5,000,000 or twice the gross gain or loss; mandatory $100 special assessment; restitution. 5 yrs. imprisonment; 3 yrs. sup. release; fine of the THREE Investment Adviser Fraud greatest of $10,000 or twice the gross gain or loss; mandatory $100 special assessment; restitution. 20 yrs. imprisonment; 3 yrs. sup. release; fine of the FOUR Falsifying Books and Records of greatest of $5,000,000 or twice the gross gain or a Broker Dealer loss; mandatory $100 special assessment; restitution. 5 yrs. imprisonment; 3 yrs. sup. release; fine of the FIVE Falsifying Books and Records of greatest of $10,000 or twice the gross gain or loss; an Investment Adviser mandatory $100 special assessment; restitution. 20 yrs. imprisonment; 3 yrs. sup. release; fine of the SIX Mail Fraud greatest of $250,000 or twice the gross gain or loss; mandatory $100 special assessment; restitution. 20 yrs. imprisonment; 3 yrs. sup. release; fine of the SEVEN Wire Fraud greatest of $250,000 or twice the gross gain or loss; mandatory $100 special assessment; restitution. 20 yrs. imprisonment; 3 yrs. sup. release; fine of the EIGHT International Money Laundering greatest of $500,000, or twice the value of the To Promote Specified Unlawful monetary instruments or funds involved, or twice the Activity gross gain or loss; mandatory $100 special assessment; restitution. -

08-01789-Smb Securities Investor Protection Corporation V. Bernard L

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK SECURITIES INVESTOR PROTECTION CORPORATION, Adv. Pro. No. 08-01789 (SMB) Plaintiff-Applicant, SIPA LIQUIDATION v. BERNARD L. MADOFF INVESTMENT (Substantively Consolidated) SECURITIES LLC, Defendant. In re: BERNARD L. MADOFF, Debtor. IRVING H. PICARD, Trustee for the Substantively Consolidated SIPA Liquidation of Bernard L. Madoff Investment Securities LLC and for the Estate of Bernard L. Madoff, Plaintiff, Adv. Pro. No. 10-04658 (SMB) v. CAROL NELSON, Defendant. IRVING H. PICARD, Trustee for the Substantively Consolidated SIPA Liquidation of Bernard L. Madoff Investment Securities LLC and for the Estate of Bernard L. Madoff, Plaintiff, v. Adv. Pro. No. 10-04377 (SMB) CAROL NELSON, Individually and as Joint Tenant; and STANLEY NELSON, Individually and as Joint Tenant, Defendants. POST-TRIAL FINDINGS OF FACT AND CONCLUSIONS OF LAW A P P E A R A N C E S: BAKER & HOSTETLER LLP 45 Rockefeller Plaza New York, New York 10111 David J. Sheehan, Esq. Dean D. Hunt, Esq. Nicholas J. Cremona, Esq. Lan Hoang, Esq. Seanna R. Brown, Esq. Of Counsel Attorneys for Irving H. Picard, Trustee for SIPA Liquidation of Bernard L. Madoff Investment Securities LLC CHAITMAN LLP 465 Park Avenue New York, New York 10022 Helen Davis Chaitman, Esq. Gregory M. Dexter, Esq. Of Counsel Attorneys for Defendants Carol Nelson and Stanley Nelson STUART M. BERNSTEIN United States Bankruptcy Judge: Plaintiff, Irving H. Picard, as trustee (the “Trustee”) for the liquidation of Bernard L. Madoff Investment Securities LLC (“BLMIS”) under the Securities Investor Protection Act, 15 U.S.C. §§ 78aaa, et seq. (“SIPA”) brought these adversary proceedings to recover intentional fraudulent transfers (the “Two-Year Transfers,” defined below) made by BLMIS to Carol Nelson and Stanley Nelson (collectively, the “Defendants”) in the aggregate amount of $3,065,077.00 The Court consolidated the cases for trial and 2 conducted a two-day trial on May 8 and 9, 2019.