Indian Entrepreneur Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Is the Vice Chairman and Managing

Mr Jayadev Galla Vice-Chairman Amara Raja Group Mr Jayadev Galla (Jay) is the Vice Chairman and Managing Director of Amara Raja Batteries Limited (ARBL), a leading manufacturer of Advanced Lead Acid batteries for Industrial and Automotive applications. ARBL is a joint venture between Amara Raja group and US based Johnson Controls Inc. (JCI). JCI is a USD 35 billion conglomerate and the global leader in building efficiency, automotive interior experience and automotive power solutions. The company owns the brand name “Amaron” which is the second largest selling automotive battery brand in India today. ARBL is a widely held public limited company listed on the National Stock Exchange of India Limited and the Bombay Stock Exchange Limited. The gross revenue for the year ending March 31, 2012 is more than USD 450 mn. Achievements Spearheading ARBL’s automotive batteries (Amaron) venture Striking a partnership with JCI, U.S.A. for the automotive battery business Winning the prestigious Ford World Excellence Award in 2004 achieved by meeting global delivery standards. ARBL is the 3rd supplier from India to be given this award. Posts and Responsibilities Confederation of Indian Industry Young Indians National Branding Chair Young Indian’s National Immediate Past Chairman Young Indians Immediate Past Chairman - District Chapter Initiatives Amara Raja Group of Companies Vice Chairman, Amara Raja Power Systems Limited Vice Chairman and Managing Director, Amara Raja Electronics Limited Vice Chairman, Mangal Industries Limited Director, Amara Raja Infra Private Limited Director, Amaron Batteries (P) Ltd. Director, Amara Raja Industrial Services (P) Ltd. Permanent Trustee of the Rajanna Trust The Trust was established in 1999 and is dedicated to rural development and to improve the economic conditions of the farmers in Chittoor District, Andhra Pradesh. -

Final Placement Brochure 2019-21

Hkkjrh; izca/k laLFkku jk;iqj Indian Institute of Management Raipur PLACEMENT BROCHURE 2 0 1 9 - 2 1 CONTENTS 02 03 04 Director’s Message Placement IIM Raipur – Mission, Chairman’s Message Vision 06 08 09 Naya Raipur - A New The EDGE A Degree of Age Town Difference 10 11 12 Post-Graduate Comprehensive Chart your Course Programme in Curriculum Management 13 14 16 Specializations International A Beacon of Light for Exchange Program Tomorrow’s Leaders 19 21 22 Clubs & Committees Final Placement at a Summer Placement Glance at a Glance 23 24 25 IIM Raipur Batch Class Representation Student Profile Summary 2018-20 of National Institutes 60 61 63 Access and Corporate Events Prominent Speakers Excellence 65 65 Recruitment All Ways Lead to Procedure Raipur DIRECTOR’S MESSAGE It is our constant endeavour to ensure that our alumni receive every kind of support both in terms of academics as well as research to encourage them in their overall career development. Dear Recruiter, Indian Institute of Management Raipur has For today's organizations, the need of the hour is successfully completed Ninth Batch of academic responsible managers who are capable of taking excellence. I would like to extend my sincere sensible decisions that result in positive long-term gratitude to all our corporate partners and implications for the firm, the industry and the stakeholders for providing their valuable support. society. Hence our approach has been designed in We look forward to strengthen this association and a way that emphasizes on enhancing the ethical engage with our corporate partners at multiple sense and value systems in our students along with levels. -

Opening Bell

Opening Bell July 1, 2020 Market Outlook Today’s Highlights Indian markets are likely to open with a flat to negative bias Events - India Nikkei Manufacturing Markit on the back of mixed global cues and indications of no near- PMI, EU Manufacturing PMI term respite from the pandemic as government extended the food aid till November. Global news flows and virus tackling measures in India would be key monitorables. Index Movement 10600 Markets Yesterday 35600 . Domestic markets ended marginally lower tracking mixed 34600 10200 though largely positive global cues 33600 9800 32600 9400 . US markets ended sharply higher following continued 31600 optimism about the economic outlook and release of better 30600 9000 than expected June consumer confidence data 29600 8600 Key Developments BSE (LHS) NSE (RHS) C lose Previous C hg (%) MTD(%) YTD(%) P/E (1yrfwd) . Output of eight core industries fell 23.4% in May 2020 S ensex 34,916 34,962 -0.1 7.7 -15.4 23.1 (37% decline in April 2020) on account of Covid-19 related Nifty 10,302 10,312 -0.1 7.5 -15.3 22.7 lockdown. Except for fertiliser production, which grew 7.5% YoY in May 2020, all other sectors - coal (14.0%), Institutional Activity crude oil (7.1%), natural gas (16.8%), refinery products C Y18 C Y19 YTD C Y20 Yesterday Last 5 Days (21.3%), steel (48.4%), cement (22.2%) and electricity F II (| cr) -68,503 40,893 -70,450 -2,000 -1,805 (15.6%) recorded a decline in production D II (| cr) 107,388 44,478 95,352 2,051 1,014 . -

PLACEMENT REPORT 2016-2017 Placement

PLACEMENT REPORT 2016-2017 Placement Sr No Name of Student Company Name 1 Surbhi Arya Chief Software Solutions 2 Vinny Toprani Test Yantra Software Solutions (India) Pvt. 3 Sidhdhi Raul Anand Infomedia Pvt Ltd, Goa 4 Karishma Shivlingkar PTC, India 5 Fatheh Ansari Forestowl Pvt Ltd 6 Vaishnavi Shelar Chief Software Solutions 7 Shridhar Jindal PTC, India 8 Muttak Vidyasagar Umashankar Transperfect Solutions India Pvt Ltd 9 Badh Parminder RavindarpalSingh AlarityIT Solution Pvt Ltd 10 parbate Deepika Baban PerceivTech India 11 Salunkhe Kiran Ashish Vyom Labs Pvt Ltd 12 Varsha Raghavan PTC, India 13 Sagar Somnath Kaldante Vyom Labs Pvt Ltd 14 Sopan Ambadas Kale Vyom Labs Pvt Ltd 15 Shubham Dilip Waghamare PerceivTech India 16 Shailesh Gopichand Rawte Vyom Labs Pvt Ltd 17 Mithun Sain PerceivTech India 18 Seema A Dahitule PerceivTech India Packages Offered MBA Amount Highest Package 4.8 L PA 2.6 L PA Average Package MCA Amount Highest Package 6.35 L PA Average Package 1.6 L PA Sr. No. Name of the Company Sr. No. Name of the Company 1 Amul India 23 Tech Mahindra 2 Bharti Airtel Services Ltd. 24 KPIT Cummins Infosystems Ltd. 3 HDFC Bank 25 Aftek Software 4 Axis Bank 26 Persistent System Ltd. 5 Racold 27 Siemens 6 IBN Research 28 Bitwise Solution 7 Greenland Education 29 Infosys 8 Thyssen Krupp Industries Ltd. 30 Accenture 9 Kirloskar Brothers 31 Capgemini 10 Sah Petroleum 32 Krawler Network 11 ICICI Securities 33 PTC Software Pvt Ltd. 12 Supreme Petrochem 34 C- DAC, Pune 13 Deutsche Bank 35 Vyom Labs 14 Motilal Oswal 36 MindStix Software Labs 15 Adani Group 37 Percive Tech Pvt Ltd. -

Amara Raja Batteries (AMARAJ)

Amara Raja Batteries (AMARAJ) CMP: | 630 Target: | 590 ( -6%) Target Period: 12 months REDUCE May 16, 2019 Subdued performance; growth a concern… Amara Raja Batteries (ARBL) reported a muted set of Q4FY19 numbers. Revenues were at | 1,567 crore (down 0.9% YoY). EBITDA rose 14.9% YoY to | 242 crore with attendant EBITDA margins at 15.5%, up 54 bps Particulars sequentially. ARBL enjoyed significant gross margin expansion on both YoY (353 bps) and QoQ basis (203 bps), mitigated by an increase in employee Particular Amount costs & other expenses. Consequent reported PAT rose 8.7% YoY to | 119 Market Capitalization | 10761 Crore Total Debt (FY19P) (| crore) 46.8 crore. ARBL declared a final dividend of | 5.08/share for FY19. Cash & Investments (FY19P) (| crore) 72.0 EV (FY19P) | 10735.8 Crore Result Update Result Replacement demand, benign lead prices to support! 52 week H/L (|) 908 / 610 Equity capital (| crore) 17.1 ARBL’s segment mix was at ~75% automotive and ~25% industrial. Face value (|) | 1 Replacement demand forms a lion’s share of automotive demand at ~70% while OEM demand makes up the rest. The auto OEM space has been Key Highlights witnessing muted demand since Diwali, thereby having a knock-on impact on ancillary players including battery makers. OEM demand is expected to Revenue growth for Q4FY19 below expectations. FY19 revenue (up remain subdued in the next few quarters amid vast regulatory changes 12.1% YoY) impacted positively by (ABS, BS-VI) and general slowdown in consumer discretionary expenditure. by 2-W & 4-W replacement demand However, for battery manufacturers, the replacement market would and inverter segment while OEM continue to provide steady state demand, especially in view of robust OEM segment was a laggard sales seen during the past few years, thus driving revenue growth. -

Indian Entrepreneur Fund (R) Fund Factsheet I June 2014

INDIAN ENTREPRENEUR FUND (R) FUND FACTSHEET I JUNE 2014 Indian Entrepreneur Fund (IEF): Objective: Launched in March 2010, Indian Entrepreneur Fund aims to invest in “Entrepreneur run and/or family owned businesses”; listed on the Indian stock markets, for compounding gains over the medium to long term. Indian Entrepreneur Fund aims to invest in high growth (listed) businesses owned and managed by Indian entrepreneurs/families for superior long term wealth creation. IEF will be a portfolio of around 20 high growth, high quality businesses led by entrepreneurs with vision and integrity, execution, capital allocation and distribution skills. The fund seeks value creating traits in the investments, including, Size of Opportunity, Management Quality, Earnings Growth, Quality of Business and Value. Research methodology and brief rationale: Our study covered the universe of Top 500 listed companies by market cap and we segregated them into four categories based on their ownership structures - Entrepreneur run/ Family Owned Entrepreneur/Family Owned Firms comprise ~50% of India’s market cap (in 2003 it was ~38% ) . Fastest growing businesses . Superior operating margins . Over 20% OPMs consistently over the last 10 years. Biggest wealth creators Portfolio Manager’s Commentary: Markets continued their good run. The benchmark BSE 500 increased by 6.4% during the month. Key outperforming stocks during the month were Ajanta Pharma, Havells, Astral Polytechnik, Asian Paints etc, while Bajaj Finance and Shree Cement underperformed during the month. However, we remain positive on the strength of these businesses. During the month we trimmed holding in Havells and Shree Cement, while increasing stake in Astral Polytechnik. Thermax has been the new inclusion in the fund. -

Covid-19: Response of India

RESPONSE TO C VID -19 S E R I E S 2 V O L U M E 1 RESPONSE OF India Inc. A STUDY OF 50 CORPORATIONS (AS ON 5 APRIL 2020) SAMPRITI MUKHERJEE | SOUMA SEKHAR GANGOPADHYAY FACULTY MENTOR: ASEEM PRAKASH SCHOOL OF PUBLIC POLICY AND GOVERNANCE TATA INSTITUTE OF SOCIAL SCIENCES HYDERABAD 1 About the Series: The School of Public Policy & Governance, TISS Hyderabad, is collaborating and supporting the initiative undertaken by its alumnus to document the response of Indian firms and philanthropic collaboratives in the times of COVID-19. This report analyses the responses of business corporations towards their employees, corporations, and allied key stakeholders in the aftermath of the COVID-19 shock. In the first part of the series, an attempt has been made to document all initiatives and announcements made by 50 major Indian firms and philanthropic collaboratives till 5 April 2020. The policy response has been classified under - a) Employee sensitivity measures, b) Community Outreach, c) Business Re-orientation, d) and Financial Support. Note: As we understand, this documentation is a dynamic exercise and will require constant upgradation. We will attempt to add the new initiatives regularly and disseminate it widely. Sources: The authors have taken due diligence to ensure the accuracy of the information presented in this document. Any inadvertent omissions/lapses are deeply regretted. Please inform of any such omissions at [email protected]. Immediate measures will be taken to correct the information. About the Authors: Sampriti Mukherjee, alumnus of the batch 2017-19, is currently a full-time Researcher at the Institute for Competitiveness, India. -

AP Govt to Take Over Private Hospitals If Needed

VIJAYAWADA l TUESDAY l MARCH 31, 2020 l `7.00 l PAGES 12 l LATE CITY EDITION SAME TIME NEXT YEAR: NEW NO CHANGE IN DURATION OF GAMES ICONIC STADIUM TO BE QUARANTINE FACILITY The Games will be held over 16 days, as had been originally planned and The Jawaharlal Nehru Sports Complex in New Delhi will be used as a TOKYO OLYMPICS DATES OUT will now end on August 8. They were due to open on July 24 this year but quarantine facility. As reported by this newspaper, Sports Authority 10 the COVID-19 pandemic forced the first peace-time postponement of the of India had already offered it last week if the need arises. A letter The Tokyo Olympics will begin on July 23 next year, officials Games. In a statement, the IOC said the new dates would give officials the district magistrate sent to the SAI secretary on Monday said it SAI HAS TEN REGIONAL said, just a week after they decided to defer it by a year time to deal with the disruption caused by the pandemic would acquire the complex with immediate effect CENTRES ACROSS INDIA CHENNAI ■ MADURAI ■ VIJAYAWADA ■ BENGALURU ■ KOCHI ■ HYDERABAD ■ VISAKHAPATNAM ■ COIMBATORE ■ KOZHIKODE ■ THIRUVANANTHAPURAM ■ BELAGAVI ■ BHUBANESWAR ■ SHIVAMOGGA ■ MANGALURU ■ TIRUPATI ■ TIRUCHY ■ TIRUNELVELI ■ SAMBALPUR ■ HUBBALLI ■ DHARMAPURI ■ KOTTAYAM ■ KANNUR ■ VILLUPURAM ■ KOLLAM ■ WARANGAL ■ TADEPALLIGUDEM ■ NAGAPATTINAM ■ THRISSUR ■ KALABURAGI AP govt to take over private hospitals if needed Medical institutes told to provide resources to fight COVID-19; State may use hotels, wedding halls, colleges and hostels too -

Sl.NO Reg No Student Name 1 130021601004 ABDUL MALIK ARSHATH. B 2 130021601005 ABDUL RAHMAN. a 3 130021601007 ABDUR RAHMAN. K 4 130021601008 ABDUS SALAM

B. S. Abdur Rahman Crescent Institute of Science & Technology Placed students details in the year 2017 Sl.NO Reg No Student Name 1 130021601004 ABDUL MALIK ARSHATH. B 2 130021601005 ABDUL RAHMAN. A 3 130021601007 ABDUR RAHMAN. K 4 130021601008 ABDUS SALAM. A.M 5 130011601064 MOHAMED IMRAN FARIDH. J 6 130021601009 ABHISHEK. V 7 130021601010 ABOO MOHAMED SALIH. R 8 130021601012 AFRAN SHARIFF. A 9 130021601013 AFZAL. N 10 130021601016 AJAY. G 11 130021601017 AJITH KUMAR. K 12 130021601018 AJMALDEEN. S 13 130021601019 AJMAL KHAN. S 14 130021601020 AJMAL. M 15 130021601022 AKHIL AJITH 16 130021601023 AMJATH ALI. A 17 130021601024 ANANTHA NARAYANAN. V 18 130021601025 ANEESH. A 19 130021601026 ANOOP. N 20 130021601027 ANWAR BASHA. M 21 130021601028 ARAVIND. Y.L 22 130021601029 ARAVIND RAJ. K 23 130021601002 ABDUL AKRAM. M 24 130021601031 ASHIK UL KADHIR. S 25 130021601034 BALA SUBRAMANIAN. G 26 130021601035 BALAJI SINGARAM. K.R 27 130011601090 RAHAMATHULLA. A 28 130011601127 YUNUS MOHAMED. S 29 130011601081 MOHAMMED YOUSUF. T 30 130011601063 MOHAMED HASSAAN. S 31 130021601037 BILAL ABDUL SATHAR 32 130021601038 CHANDRA MURUGAN. K 33 130021601039 CHANDRAMOHAN. B 34 130021601040 DEEPAK KUMAR. K 35 130021601042 ELUMALAI. V 36 130021601043 FAHAD AHMED MAHAROOF ALI 37 130021601045 FARID AHAMED. J 38 130021601046 FAYAS AHAMED. M 39 130021601049 GOKUL. S 40 130021601051 GUGANESSHWAR. S 41 130021601052 GURUCHARAN. G 42 130021601053 HAFIZUR RAHMAN. M 43 130021601054 MANIKANDAN. A 44 130021601055 HAMEED IMTIAZ 45 130021601056 HARI. S 46 130021601057 HARI KRISHNAN. B 47 140111601001 ABDUL BASITH. A 48 130021601058 HARIHARAN. V 49 140111601002 ABDUL KADHAR. A 50 130021601059 HARISH ALI. -

Best Practices-1 Iipc Guest Lectures

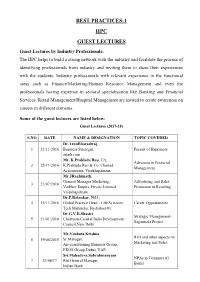

BEST PRACTICES-1 IIPC GUEST LECTURES Guest Lectures by Industry Professionals: The IIPC helps to build a strong network with the industry and facilitate the process of identifying professionals from industry and inviting them to share their experiences with the students. Industry professionals with relevant experience in the functional areas such as Finance/Marketing/Human Resource Management and even the professionals having expertise in sectoral specialization like Banking and Financial Services /Retail Management/Hospital Management are invited to create awareness on careers in different domains. Some of the guest lectures are listed below: Guest Lectures (2017-18) S.NO DATE NAME & DESIGNATION TOPIC COVERED Dr.ArunBharadwaj, 1 23/11/2016 Business Strategist, Pursuit of Happiness arunb.com Mr. K.Prahlada Rao, CA, Advances in Financial 2 25/11/2016 K.Prahlada Rao & Co. Charted Management Accountants, Visakhapatnam. Mr.JRaghunath, General Manager Marketing, Advertising and Sales 3 21/07/2016 Vaibhav Empire Private Limited, Promotion in Retailing Visakhapatnam. Dr.P.Ratnakar, PhD., 4 15/11/2016 Global Practice Head - Life Sciences, Career Opportunities Tech Mahindra, Hydrabad-81. Dr.G.V.R.Shastri Strategic Management- 5 31/01/2018 Chairman-Coastal India Development Sagarmala Project Council,New Delhi Mr.Venkata Krishna ROI and other aspects on 6 19/08/2015 Sr.Manager, Air-conditioning Business Group, Marketing and Sales. EROS Group,Dubai, UAE. Sri.Mahadeva Subrahmanyam NPAs in Commercial 7 23/08/17 Rtd.General Manager, Banks Indian Bank Dr.RaviSundar M, Global Market Scenario 8 23/01/2018 Head, Institutional Equity Research, and Investment Elara Capital, Mumbai. Strategies Mr.Dinaka Kadam, Career Planning and Director, Heading People Sigma 9 21/11/2017 potential to know Academy, Hyderabad (Consultancy yourself to reach success. -

Annual Report 2019-20

PROGRESS... ON! AMARA RAJA BATTERIES LIMITED ANNUAL REPORT 2019-20 Every road forks into two ways: down one way, there’s a continuity of life as it comes, down the other, there’s a zeal to bring in disruptive CORPORATE OVERVIEW changes to make path- Vision, Core Purpose and Values 2 breaking transformations. Financial progress 4 We chose the second From the Management’s Desk 6 lane. It called for a lot of Awards & Recognition 10 blood, sweat and hard toil, STATUTORY DOCUMENTS yet we stuck on. And, we Management Discussion & Analysis 12 triumphed. We progressed Corporate Social Responsibility 70 at every step and emerged 10-Year Financials 75 better every day. Corporate Information 76 Directors’ Report 77 Along the way, we reinvented ourselves, FINANCIAL STATEMENTS to remain relevant and Standalone Financial Statements 159 resolute in sync with the Consolidated Financial Statements 220 evolving paradigm of NOTICE 279 business and advancing technology. We resolved every issue differently, devised every system inimitably, and confronted every challenge distinctively. Because, we always believed there’s Gotta be a Better Way. Amara Raja Batteries Limited 1 Vision, Core purpose and Values Core Purpose To transform our increasing spheres of influence and to improve the quality of life by building institutions that provide better access to better opportunities to more people… all the time. Core Values Innovation Innovation to us is proactively rebelling for Vision better ways of doing things leading to newer possibilities. Through the Amara Raja way® Excellence and through enduring progressive partnerships Excellence to us is continually enhancing our performance to consistently produce we will be a Global Leader outstanding results with lasting impact. -

Industry-Sector-Testimonials-For-Bajaj

industry Lucas TVS, Chennai Lucas TVS was established in 1962 as Joint Venture between Lucas Plc. UK and TVS Group, India. Providing complete system solutions in Auto Electricals, specialized motors for Air Compressors, Stop - Start Systems, Engine Cooling Modules, Ignition Products and Diesel Fuel Injection Systems. Lucas TVS is currently supplying to over 90% of automotive manufacturers in India and also exporting to North America and Europe. Lucas TVS products are also integrated into some of the top global brands like Audi, Mercedes-Benz, BMW, Porsche, Rolls Royce. Bajaj LED lightings is used in their production area. 53 Suzuki Motorcycle India Pvt. Ltd., Gurgaon Suzuki Motorcycle India Private Limited is a subsidiary of Suzuki Motor Corporation, Japan which has the manufacturing philosophy of value packed products right from the inception. SMIPL will be manufacturing two wheelers best suited for the valuable Indian customers covering all segments. Bajaj Luminaires have supplied our LED Floodlight and Streetlight in their plant. 54 Bajaj Auto Limited, Pune Bajaj Auto is the world's sixth-largest manufacturer of motorcycles and the fourth-largest in India. It is also the world’s largest three-wheeler manufacturer having plants at Walunj, Chakan and PantNagar. They are constantly upgrdaing the illumination of their plants and offices, by using .nxt range of Bajaj LED Luminaires. 55 Volvo, Bengaluru Volvo Trucks is the second-largest heavy-duty truck brand in the world, with manufacturing plant at Hoskote Bengaluru. They have moved towards usage of LED lighting in their plant, by using Bajaj Luminaires .nxt LED products. 56 SMS India Pvt.