Panorama Super

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

Covered Bond Prospectus December 2018

Bank of Queensland Limited (ABN 32 009 656 740) (incorporated with limited liability in the Commonwealth of Australia) AUD3,250,000,000 BOQ Covered Bond Programme unconditionally and irrevocably guaranteed as to payments of interest and principal by Perpetual Corporate Trust Limited (ABN 99 000 341 533) (incorporated with limited liability in the Commonwealth of Australia) as trustee of the BOQ Covered Bond Trust and Covered Bond Guarantor Under the AUD3,250,000,000 BOQ Covered Bond Programme (the Programme) established by Bank of Queensland Limited (BOQ and the Issuer) on the Programme Date, the Issuer may from time to time issue bonds (the Covered Bonds) denominated in any currency agreed between the Issuer and the relevant Dealer(s) (as defined below). The price and amount of the Covered Bonds to be issued under the Programme will be determined by the Issuer and the relevant Dealer at the time of issue in accordance with prevailing market conditions. Any Covered Bonds issued under the Programme on or after the date of this Prospectus are issued subject to the provisions described herein and in any supplement thereto. Perpetual Corporate Trust Limited in its capacity as trustee of the BOQ Covered Bond Trust (the Covered Bond Guarantor) has guaranteed payments of interest and principal under the Covered Bonds pursuant to a guarantee which is secured over the Mortgage Loan Rights (as defined in this Prospectus) and its other assets. Recourse against the Covered Bond Guarantor under its guarantee, except in limited circumstances, is limited to the extent of the Covered Bond Guarantor's right of indemnity from the Assets of the BOQ Covered Bond Trust (the Trust). -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

2020 Australia

Perpetual Limited ABN 86 000 431 827 Angel Place, Level 18, 123 Pitt Street Sydney NSW 2000 10 September 2020 Australia Phone +61 9229 9000 ASX Limited www.perpetual.com.au ASX Market Announcements Office Exchange Centre 20 Bridge Street Sydney NSW 2000 Perpetual Annual General Meeting 2020 The following announcements to the market are provided: AGM Notice of Meeting Letter to Shareholders Proxy Form Shareholder Question Form Online Guide from Link Market Services Perpetual Annual Report 2020 Sustainability Report Yours faithfully, Sylvie Dimarco Company Secretary (Authorising Officer) For personal use only Page 1 For personal use only ENDURING PROSPERITY Annual Report 2020 Perpetual Limited Annual Report 2020 ENDURING PROSPERITY Our purpose reflects our heritage and culture and underpins everything we do. As one of Australia’s oldest companies with a rich heritage dating back to 1886, we have supported our clients through periods of great change for more than 130 years. We are proud of our past and passionate about creating a sustainable future for our clients, our people and the communities in which we operate. Our purpose is to build enduring prosperity and across our three businesses – Perpetual Investments, Perpetual Private and Perpetual Corporate Trust – our clients remain our priority. Our goal is to provide exceptional products and services, while seeking to protect and grow our clients’ wealth, knowing that by doing so we can make a difference in their lives. Our people are integral to this goal – empowering our business to deliver to clients and being regarded as one of the most trusted brands in financial services. -

Private Wealth Superannuation and Pension Account Approved Product List

Private Wealth Superannuation and Pension Account Approved Product List 24 January 2020 The Private Wealth Superannuation and Pension Approved Products List (‘Investment List’) is issued by Diversa Trustees Limited (ABN 49 006 421 638, AFSL 235153) (‘Trustee’). The information in this document forms part of the following product disclosure statements: • Private Wealth Superannuation Account Product Disclosure Statement (PDS) dated 6 September 2017; • Private Wealth Reference Guide dated 6 September 2017 The information contained in this Investment List is general information only and does not take into account your personal objectives, financial situation and/or needs. Before you make an investment decision it is recommended you obtain professional financial advice from your Financial Adviser tailored to your personal circumstances. If you would like to request a printed copy of this Investment List, please contact your Financial Adviser or the Promoter; copies will be provided free of charge. Responsible Entity and Promoter Trustee and Issuer: Powerwrap Limited Diversa Trustees Limited ABN 67 129 756 850 ABN 49 006 421 638 AFSL 329829 AFSL 235153 PO Box 16071, Collins Street West RSE License No L0000635 VIC, 8007 GPO Box 3001, Melbourne Vic 3001 Phone: (03) 8681 4600 Phone: (03) 9665 0200 Fax: (03) 8681 4699 Fax: (03) 9620 5821 Managed Funds – Australian Fixed Interest Each of the funds listed below have their own Product Disclosure Statement. You must obtain and read a copy of the Product Disclosure Statements for all managed funds in -

Morningstar Equity Research Coverage

December 2019 Equity Research Coverage Morningstar covers more than 200 companies in We use the following guidelines to Contact Details Australia and New Zealand as part of our global determine our Australian equity coverage: Australia stock coverage of about 1,500 companies. We are × Nearly all companies in the S&P/ASX 100 Index. Helpdesk: +61 2 9276 4446 Email: [email protected] one of the largest research teams globally with × Companies in the S&P/ASX 200 Index which more than 100 analysts, associates, and have an economic moat and/or have cash flow New Zealand strategists, including 17 in Australia. Local analysts which is at least mildly predictable. Helpdesk: +64 9 915 6770 regularly glean insights from our global sector teams × In total, Morningstar will cover about 80% of Email: [email protected] in China, Europe, and the United States, enriching S&P/ASX 200 companies (which typically the process and enhancing outcomes for investors. equates to about 95% of S&P/ASX 200 by Our research philosophy focuses on bottom-up market capitalisation). Companies we choose analysis, developing differentiated and deep not to cover in this index are usually unattractive opinions on competitive forces, growth prospects, for most portfolios, in our opinion. and valuations for every company we cover. We × About 30 ex-S&P/ASX 200 stocks are selected publish on each company under coverage at least on Morningstar’s judgement of each security's quarterly, and as events demand, to ensure investment merit − which includes a very investment ideas are always relevant. strong lean towards high-quality companies We are an independent research house, and with sustainable competitive advantages, or therefore determine our coverage universe based economic moats. -

Download Annual Report 2015

Chairman’s Message The 2015 financial year saw BlueScope’s best profit performance since the impact of the global financial crisis on the steel sector in 2009. Dear Shareholder The 2015 financial year saw BlueScope’s best profit performance Strategy review since the impact of the global financial crisis on the steel sector BlueScope has a diverse portfolio of businesses. We are a global in 2009. leader in premium branded coated and painted steel products The Company’s return to earnings growth is pleasing. While and have regional strengths in engineered steel buildings. there is still a lot of work to do to achieve acceptable return on We have a strong competitive advantage in global markets – invested capital, I commend BlueScope employees across the highlighted by our outstanding brands, technology, channels globe for this year’s result. to market and manufacturing footprint. Underlying earnings grew across the Company in all but one We are the third largest manufacturer of painted and coated steel of our five operating segments. products globally, the number one in building and construction markets and the recognised quality leader in nine countries. Underlying performance In our North Star BlueScope Steel joint venture, we operate BlueScope’s net profit after tax (NPAT) of $136.3 million arguably the best performing steel plant in the US. was $218.7 million higher than FY2014. Underlying NPAT was $134.1 million, an increase of nine per cent over FY2014. The global steel industry has seen extensive changes in recent times. For example, from an annual average of 52 million tonnes Full year underlying EBIT was $301.8 million, 14 per cent higher in 2010–2013 China’s finished steel exports have doubled to over than the comparable period in FY2014 (prior to restatement of 100 million tonnes per annum, an increase equivalent to 20 times discontinued operations). -

Australia & New Zealand Report 2018

DISCLOSURE INSIGHT ACTION Australia & New Zealand Report 2018 On behalf of over 650 investors with US$87 trillion in assets. CDP Report 2018 | Published February 2019 Contents 3 CEO foreword 14 Appendix I List of disclosing companies in Australia & 4 Disclosure in 2018 New Zealand 5 Climate Change: Australia & New 18 Appendix II Zealand insights Responding companies in Australia & New Zealand – supply chain program 9 Water Security: Driving water stewardship 19 Appendix III Non-responding companies in Australia & 10 Forests: Building sustainable New Zealand supply chains 12 CDP Australia & New Zealand Awards 2018 13 Investor Signatories & Members in Australia & New Zealand Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP. This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. CDP has prepared the data and analysis in this report based on responses to the CDP 2018 information request. No representation or warranty (express or implied) is given by CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, CDP does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

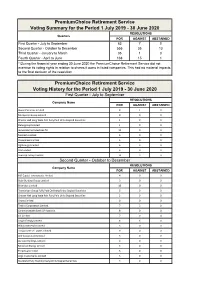

Voting Rights Exercised 2019-2020

PremiumChoice Retirement Service Voting Summary for the Period 1 July 2019 - 30 June 2020 RESOLUTIONS Quarters FOR AGAINST ABSTAINED First Quarter - July to September 63 7 0 Second Quarter - October to December 555 35 13 Third Quarter - January to March 35 1 0 Fourth Quarter - April to June 138 15 1 * During the financial year ending 30 June 2020 the PremiumChoice Retirement Service did not exercise its voting rights in relation to shares it owns in listed companies. This had no material impacts to the final decision of the resolution. PremiumChoice Retirement Service Voting History for the Period 1 July 2019 - 30 June 2020 First Quarter - July to September RESOLUTIONS Company Name FOR AGAINST ABSTAINED Ausnet Services Limited 9 1 0 Macquarie Group Limited 9 0 0 Charter Hall Long Wale Reit Fully Paid Units Stapled Securities 1 0 0 Duluxgroup Limited 1 0 0 James Hardie Industries Plc 13 0 0 Metcash Limited 5 0 0 Onemarket Limited 3 0 0 Agl Energy Limited. 6 3 0 Asx Limited 6 0 0 Suncorp Group Limited 10 3 0 Second Quarter - October to December RESOLUTIONS Company Name FOR AGAINST ABSTAINED Mff Capital Investments Limited 4 0 0 Baby Bunting Group Limited 3 0 0 Brambles Limited 10 0 0 Transurban Group Fully Paid Ordinary/Units Stapled Securities 6 0 0 Charter Hall Long Wale Reit Fully Paid Units Stapled Securities 2 0 0 Orora Limited 8 0 0 Telstra Corporation Limited. 7 2 0 Commonwealth Bank Of Australia. 8 0 0 Csl Limited 7 0 0 Origin Energy Limited 8 6 0 Pilbara Minerals Limited 5 0 0 Treasury Wine Estates Limited 9 0 0 Arb Corporation Limited. -

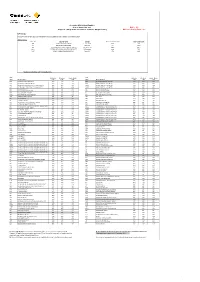

Commsec Margin Lending Approved Securities List

Accepted ASX Listed Equities as at 21 September 2021 Buffer - 5% Subject to change at the discretion of CommSec Margin Lending Maximum Gearing Ratio - 90% LVR Changes Changes since the last Approved Securities List was published are outlined in the below table: ASX Securities ASX Code Security Name Change Previous Portfolio LVR New Portfolio LVR AST AUSNET SERVICES LIMITED Capped LVR 75% 75% BGL BELLEVUE GOLD LIMITED New LVR 0% 40%* SXL SOUTHERN CROSS MEDIA GROUP LIMITED Uncapped LVR 40%* 40%* QLTY BETASHARES GLOBAL QUALITY LEADERS ETF LVR Increase 65% 70% CLNE VANECK GLOBAL CLEAN ENERGY ETF New LVR 0% 65% *Available via facilities with PLVR enabled only ASX Portfolio Standard Single Stock ASX Portfolio Standard Single Stock Code Security Name LVR LVR LVR Code Security Name LVR LVR LVR A200 BETASHARES AUSTRALIA 200 ETF 80% 75% 70% BNKS BETASHARES GLOBAL BANKS ETF 70% 65% 60% A2M THE A2 MILK COMPANY LIMITED 55% 50% 45% BOQ BANK OF QUEENSLAND LIMITED 70% 65% 60% AAA BETASHARES AUSTRALIAN HIGH INTEREST CASH ETF 90% 85% 80% BOQPE BANK OF QUEENSLAND LIMITED 70% 65% 60% AAC AUSTRALIAN AGRICULTURAL COMPANY LIMITED 50% 45% 40% BOQPF BANK OF QUEENSLAND LIMITED 70% 65% 60% ABA AUSWIDE BANK LTD 50% 45% 40% BPT BEACH ENERGY LIMITED 50% 45% 40% ABC ADELAIDE BRIGHTON LIMITED 60% 55% 50% BRG BREVILLE GROUP LIMITED 65% 60% 55% ABP ABACUS PROPERTY GROUP 65% 60% 55% BSL BLUESCOPE STEEL LIMITED 70% 65% 60% ACDC ETFS BATTERY TECH & LITHIUM ETF 60% 55% 50% BVS BRAVURA SOLUTIONS LIMITED 45% 40% 35% AD8 AUDINATE GROUP LIMITED 40% 0% 0% BWP BWP TRUST 70% 65% 60% ADH ADAIRS LIMITED 45% 40% 35% BWX BWX LIMITED 45% 40% 35% ADI APN INDUSTRIA REIT 60% 55% 50% BXB BRAMBLES LIMITED 80% 75% 70% AEF AUSTRALIAN ETHICAL INVESTMENT LIMITED 40% 35% 30% CAJ CAPITOL HEALTH LIMITED 40% 0% 0% AFG AUSTRALIAN FINANCE GROUP LTD 40% 35% 30% CAR CARSALES.COM LIMITED. -

Independent Expert's Report for Xplore Wealth Limited

XPLORE WEALTH LIMITED TAKEOVER OFFER FROM HUB24 LIMITED BY SCHEME OF ARRANGEMENT INDEPENDENT EXPERT 'S REPORT AND FINANCIAL SERVICES GUIDE 14 DECEMBER 2020 14 December 2020 The Board of Directors Xplore Wealth Limited Suite 1, Level 5, 28 Margaret Street Sydney NSW 2000 Dear Directors, Independent Expert’s Report for Xplore Wealth Limited 1. Introduction Xplore Wealth Limited (“ Xplore Wealth ”) is an Australian Securities Exchange (“ ASX ”) listed specialist wealth management platform service provider that aims to provide a broad range of platform solutions to financial advisers. On 27 October 2020, Xplore has a market capitalisation of $19.6 million. HUB24 Limited ( “HUB24” ) is also an ASX listed specialist platform service provider engaging in the provision of investment and superannuation portfolio administration services, licensee services to financial advisers and IT consulting services. On 27 October 2020, HUB24 has a market capitalisation of $1.3 billion. On 28 October 2020 Xplore Wealth and HUB24 entered into a Scheme Implementation Agreement for HUB24 to acquire 100% of the shares and options in Xplore Wealth through two schemes of arrangement (“ Proposed Transaction”). The consideration for the shares is a combination of cash and scrip, and for the options is cash. Further details of the Proposed Transaction are set out in Section 1 of our detailed report. 2. Purpose of the report In order to assist shareholders and optionholders evaluate the Proposed Transaction, the directors of Xplore Wealth have engaged Leadenhall Corporate Advisory Pty Ltd (“ Leadenhall ”) to prepare an independent expert’s report assessing whether the Proposed Transaction is in the best interests of Xplore Wealth’s shareholders not associated with HUB24 (“ Shareholders ”) and separately whether it is in the best interests the holders of options to acquire Xplore Wealth shares ( “Optionholders”). -

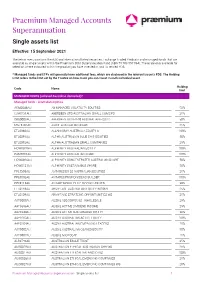

Praemium Super Single Assets List.Pdf

Praemium Managed Accounts Superannuation Single assets list Effective: 15 September 2021 The below menu contains the ASX and international listed securities, Exchange Traded Products and managed funds that are available as single assets within the Praemium SMA Superannuation Fund (ABN 75 703 857 864). These are only available for selection where indicated within the product you have invested in, and its related PDS. * Managed funds and ETPs will generally have additional fees, which are disclosed in the relevant issuer’s PDS. The Holding Limit refers to the limit set by the Trustee on how much you can invest in each individual asset. Holding Code Name limit MANAGED FUNDS (unlisted Australian domiciled)* Managed funds - Australian equities ACM0006AU AB MANAGED VOLATILITY EQUITIES 50% CSA0131AU ABERDEEN STD AUSTRALIAN SMALL COMS FD 25% CRS0003AU ABERDEEN STD EX-20 AUSTRALIAN EQS FD 50% MGE9705AU AIRLIE AUSTRALIAN SHARE 25% ETL0060AU ALLAN GRAY AUSTRALIA EQUITY A 100% ETL0091AU ALPHA AUSTRALIAN BLUE CHIP EQUITIES 50% ETL0092AU ALPHA AUSTRALIAN SMALL COMPANIES 25% HOW0019AU ALPHINITY AUSTRALIAN EQUITY 100% PAM0001AU ALPHINITY AUSTRALIAN SHARE 100% HOW0026AU ALPHINITY CONCENTRATED AUSTRALIAN SHARE 50% HOW0121AU ALPHINITY SUSTAINABLE SHARE 50% PPL5308AU ANTARES EX-20 AUSTRALIAN EQUITIES 25% PPL0002AU ANTARES PROF DIVIDEND BUILDER 100% PPL0115AU ANTARES PROF ELITE OPPORTUNITIES 50% ETL0148AU ARMYTAGE AUSTRALIAN EQUITY INCOME 25% ETL0139AU ARMYTAGE STRATEGIC OPPORTUNITIES WS 25% AAP0008AU AUSBIL 130/30 FOCUS - WHOLESALE 25% AAP3656AU AUSBIL ACTIVE