Value Partners Classic Equity Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

China's Logistics Capabilities for Expeditionary Operations

China’s Logistics Capabilities for Expeditionary Operations The modular transfer system between a Type 054A frigate and a COSCO container ship during China’s first military-civil UNREP. Source: “重大突破!民船为海军水面舰艇实施干货补给 [Breakthrough! Civil Ships Implement Dry Cargo Supply for Naval Surface Ships],” Guancha, November 15, 2019 Primary author: Chad Peltier Supporting analysts: Tate Nurkin and Sean O’Connor Disclaimer: This research report was prepared at the request of the U.S.-China Economic and Security Review Commission to support its deliberations. Posting of the report to the Commission's website is intended to promote greater public understanding of the issues addressed by the Commission in its ongoing assessment of U.S.-China economic relations and their implications for U.S. security, as mandated by Public Law 106-398 and Public Law 113-291. However, it does not necessarily imply an endorsement by the Commission or any individual Commissioner of the views or conclusions expressed in this commissioned research report. 1 Contents Abbreviations .......................................................................................................................................................... 3 Executive Summary ............................................................................................................................................... 4 Methodology, Scope, and Study Limitations ........................................................................................................ 6 1. China’s Expeditionary Operations -

2020 Interim Results Presentation

China Vanke Co., Ltd. 2020 Interim Results Presentation August 2020 Interim Results Summary Financial Overview Business Overview Key Priorities in 2020 H2 Interim Results Summary 2020 Interim Results Presentation 03/33 Results Summary ⚫ Net profit attributable to equity ⚫ Cash and cash ⚫ Contract sales amount ⚫ Revenue ⚫ Net gearing ratio shareholder of the Company equivalents RMB320.48 RMB146.35 RMB12.51 RMB194.29 27.0% billion billion billion billion +16.9% from the Remained at 5.1% 5.6% beginning of the year industry low level ⚫ Cash to interest-bearing ⚫ Contract amount of project ⚫ Property services ⚫ Occupancy rate of rental liabilities due within one year ⚫ Fortune Global 500 ratio sold but not yet booked revenue housing RMB695.33 RMB6.7 93.7% of mature 2.0 208th billion billion projects +3.7 percentage points from Enhanced coverage +14.2% from the beginning of the year 26.8% the beginning of the year 46 Interim Results Summary 2020 Interim Results Presentation 04/33 Business gradually recovers under the pandemic ⚫ Property development : Improved capacity for individual projects, 5 projects were shortlisted for China’s Top 50 Bestsellers; ⚫ Property services: Vanke Service incorporated the development of “urban management services” into its development strategy on the basis of “simultaneous development of the residential and commercial services”; the urban management services coverage has expanded to 7 cities; ⚫ Long-term rental housing : Occupancy rate gradually returned to the level before the pandemic; occupancy rate of mature projects increased by 3.7 percentage points ; ⚫ Retail property development and operation : The customer flow and revenue gradually recovered; area in operation up by 11% during the first half of the year; ⚫ Logistics and warehousing : Occupancy rate of stabilized high-standard warehouse projects rose back to 89%. -

Corporate Social Responsibility White Paper

2020 CEIBS CORPORATE SOCIAL RESPONSIBILITY WHITE PAPER FOREWORD The Covid-19 pandemic has brought mounting research teams, as well as alumni associations and com- uncertainties and complexities to the world economy. Our panies. The professors obtained the research presented globalized society faces the challenge of bringing the in the paper through the employment of detailed CSR virus under control while minimizing its impact on the parameters focused on business leaders, employee economy. Economic difficulties substantially heighten the behavior and their relationship to the external environ- urgency for a more equitable and sustainable society. ment. This granular and nuanced form of research is a powerful tool for guiding the healthy development of CSR. At the same time, there is an ever-pressing need to enrich and expand the CSR framework in the context of The five CEIBS alumni companies featured in the social and economic development. CEIBS has incorporat- white paper offer exceptional examples of aligning busi- ed CSR programs into teaching, research, and student/ ness practices with social needs. Their learning-based alumni activities since its inception. The international busi- future-proof business innovations are a powerful demon- ness school jointly founded by the Chinese government stration of how best to bring CSR to the forefront of busi- and the European Union has accelerated knowledge ness activities. These five firms all received the CSR creation and dissemination during the pandemic to sup- Award in April 2019 at the second CEIBS Alumni Corpo- port economic stability and business development. The rate Social Responsibility Award, organized by the CEIBS institution has also served as a key communication chan- Alumni Association. -

China Oil & Gas Sector

12 January 2017 Asia Pacific/Hong Kong Equity Research Energy China Oil & Gas Sector Research Analysts SECTOR FORECAST Horace Tse 852 2101 7379 [email protected] 2017: A year of second-phase recovery Jessie Xu 852 2101 7650 [email protected] Figure 1: Chinese Oils typically see expansion of multiples during upcycle (Rebased to 100) EV/EBITDA (x) 300 6.5 6.0 250 Oil price trend - 2016-17 vs 2009-11 5.5 +1STD: 5.3x 5.0 200 4.5 Avg: 4.2x 4.0 150 3.5 3.0 -1STD: 3.2x 100 2.5 CNOOC 2.0 50 1.5 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-16 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jul-16 Jan-17 Jul-17 Source: the BLOOMBERG PROFESSIONAL™ service, company data, Credit Suisse estimates ■ Accelerated oil market rebalancing post OPEC deal. We believe the OPEC cut effective from January, coupled with robust 1.5mb/d global oil demand growth, should induce 400mbs of inventory drawdown in 2017 and accelerate the global oil market rebalance. CS forecasts US$56/bbl Brent in 2017, with upside risk if OPEC adheres to the 32.5mb/d low-end output cut. Since the announcement of the OPEC deal, oil prices were up 22% and global peers have rallied 12%, but Chinese Oils, particularly CNOOC, have lagged. We expect a reversal of the underperformance trend. ■ Multiple catalysts ahead. (1) We think the market is too bearish on CNOOC’s production/reserves and its upcoming 2017 Strategy Preview could surprise on the upside. -

Summary of 2019 Interim Report of Ping an Bank Co., Ltd

Security Code: 000001 Security name: Ping An Bank Notice No.: 2019-037 Code of preference shares: 140002 Short name of preference shares: PYY01 Code of convertible bonds: 127010 Short name of convertible bonds: PYZZ Summary of 2019 Interim Report of Ping An Bank Co., Ltd. I. Important notes 1. This summary of interim report is extracted from the full text of the interim report. Investors are advised to carefully read the complete interim report at the news media designated by the CSRC to have a comprehensive understanding of the business performance, financial position and future development plan of Ping An Bank Co., Ltd. (Hereinafter “Ping An Bank” or “the Bank”). 2. The board of directors (hereinafter referred to as the “Board”), the supervisory committee, the directors, the supervisors and senior management of the Bank guarantee the authenticity, accuracy and completeness of the contents of the Interim Report, in which there are no false representations, misleading statements or material omissions, and are severally and jointly liable for its contents. 3. The 26th meeting of the 10th session of the Board of the Bank deliberated the 2019 Interim Report together with its summary. The meeting required 13 directors to attend, and 13 directors attended the meeting. This Interim Report was approved unanimously at the meeting. 4. The 2019 Interim Financial Report prepared by the Bank was unaudited, but it has been reviewed by PricewaterhouseCoopers Zhong Tian LLP. Notification of non-standard audit opinions □Applicable √ Not applicable 5. Xie Yonglin (the Bank’s Chairman), Hu Yuefei (the President), Xiang Youzhi (the CFO)and Zhu Peiqing (the head of the Accounting Department) guarantee the authenticity, accuracy and completeness of the financial report contained in the 2019 Interim Report. -

China 500 2019 the Annual Report on the Most Valuable and Strongest Chinese Brands March 2019 Contents

China 500 2019 The annual report on the most valuable and strongest Chinese brands March 2019 Contents. Bridging the Gap 4 About Brand Finance 6 Get in Touch 6 Request Your Brand Value Report 7 Foreword 8 Executive Summary 10 Regional Analysis 16 Sector Reputation Analysis 18 Brand Finance China 500 (USD m) 20 Definitions 30 Brand Valuation Methodology 32 Market Research Methodology 33 Stakeholder Equity Measures 33 Consulting Services 34 Brand Evaluation Services 35 Communications Services 36 Brand Finance Network 38 Brand Finance China 500 March 2019 3 Bridging the Gap. were able to apply Flame & Dragon for supporters. These The combined imagery are only granted to of flames and dragons is companies deemed traditional and represents highly reputable by the the omnipotence of College of Arms. We the dragon. This style have found that the of dragon is used by usage of the Coat of the richest Dynasty in Arms is helpful in our Chinese history, the Song core Brand Finance Dynasty. business, particularly in the international market Circles where the implied status The earliest coins used is recognised, but also in China can be traced with regards to the back to the First Emperor Brand Finance Institute, Qinshihuangdi in the Brand Finance Forums, Qin Dynasty. The logo and Brand Exchange. of the World Heritage Committee is a Chinese All aspects of the full Qin coin. Brand Finance Coat of Arms have been Clouds specially created and Auspicious cloud patterns have meaning related have been circulated for to our ethos and more than 5,000 years philosophy. and are one of the most representative cultural Original version Bridge symbols of China. -

Harding, Loevner Funds, Inc. Annual Report 2020

Fundamental. Thinking. Worldwide. Annual Commentary October 31, 2020 Harding, Loevner Funds, Inc. Global Equity Portfolio ▪ International Equity Portfolio ▪ International Small Companies Portfolio ▪ Institutional Emerging Markets Portfolio ▪ Emerging Markets Portfolio ▪ Frontier Emerging Markets Portfolio ▪ Global Equity Research Portfolio ▪ International Equity Research Portfolio ▪ Emerging Markets Research Portfolio ▪ Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary. You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling (877) 435-8105 or by sending an email request to [email protected]. If your account is held through a financial intermediary, you can contact your financial intermediary to make your election. Your election to receive reports in paper will apply to all Funds held with the Fund complex/your financial intermediary. -

2019 Semi-Annual Report August 2019

1 S.F. Holding Co., Ltd. 2019 Semi-Annual Report S.F. Holding Co., Ltd. 2019 Semi-Annual Report August 2019 2 S.F. Holding Co., Ltd. 2019 Semi-Annual Report Notice The Company prepared its 2019 Semi-Annual Report in accordance with relevant regulations and guidelines set forth by the China Securities Regulatory Commission and the Shenzhen Stock Exchange, including the “Publicly Listed Company Information Disclosure Content and Format Guideline No. 3 Semi-Annual Report Content and Format,” the “Shenzhen Stock Exchange Listing Rules,” the “Shenzhen Stock Exchange Standard Operating Guidelines for Small and Medium Enterprises,” and the “Small and Medium Enterprise Information Disclosure Memorandum No. 2 – Matters Related to Periodic Disclosures.” The Company's 2019 Semi-Annual Report was prepared and published in Chinese and the English version is for reference only. Should there be inconsistency between the Chinese version and the English version, the Chinese version shall prevail. Investors can access the Company's 2019 Semi-Annual Report on Cninfo (www.cninfo.com.cn), which is designated by the China Securities Regulatory Commission for Publishing the Semi-Annual Report. 3 S.F. Holding Co., Ltd. 2019 Semi-Annual Report Chapter 1 Important Information, Table of Contents, and Definitions The Company's Board of Directors, Supervisory Committee, directors, supervisors, and senior management hereby guarantee that the contents of the Semi-Annual Report are true, accurate, and complete, and that there are no misrepresentations, misleading statements, or material omissions, and shall assume individual and joint legal liabilities. Wang Wei, the Company's responsible person, NG Wai Ting, the person in charge of accounting work, and Wang Lixiu, the person in charge of the accounting department (accounting officer), hereby declare and warrant that the financial report within the Semi-Annual Report is true, accurate, and complete. -

ZTO Express (ZTO, BUY, TP: $21.00)

November 21, 2016 Initiation of Coverage ZTO Express (ZTO, BUY, TP: $21.00) BUY HOLD SELL ZTO: Logistics Leader Stands Out from the Crowd; Initiate Buy with $21 Target Target Price: $21.00 Current Price: $16.30 52-Week High (MM) $18.45 We are initiating coverage of ZTO Express with a Buy rating and $21 price target, 52-Week Low (MM) $14.15 representing 30% upside. We are attracted to ZTO as one of the best managed express EV (MM) $10,342 delivery companies, whose sound growth strategy for sustainable share gain should Market Cap (MM) $12,098 Shares Outstanding (MM) 742 propel it to the forefront of a growing industry. The company owns and manages a high Average Daily Trading Volume (M) 7.3 % of core assets which has helped it earn the highest net profit per parcel among its Source: Factset Tongda peers. We think that these factors together with RMB 11bn net cash balance should help the company compete successfully in the ever-growing express delivery industry. Meanwhile, we think its investment in automated sorting lines and trucks Price Performance should help drive continuous cost structure improvement. Our $21 target is based on 18 32x our 2017 non-GAAP EPS estimate of $0.64, or 0.7x PEG. 17 Ready for Express 2.0. We think China's express delivery industry has entered 16 ▪ 2.0 after the initial explosive growth stage. The market likely remains highly 14 competitive, however, strategy, operations, execution, and precise management 13 of network partners should play a more essential role. -

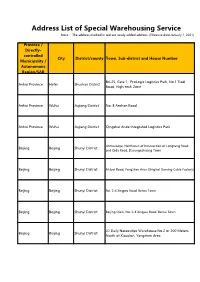

Address List of Special Warehousing Service Note: the Address Marked in Red Are Newly Added Address

Address List of Special Warehousing Service Note: The address marked in red are newly added address. (Effective date:January 1, 2021) Province / Directly- controlled City District/county Town, Sub-district and House Number Municipality / Autonomous Region/SAR B4-25, Gate 1, ProLogis Logistics Park, No.1 Tiedi Anhui Province Hefei Shushan District Road, High-tech Zone Anhui Province Wuhu Jiujiang District No. 8 Anshan Road Anhui Province Wuhu Jiujiang District Qingshui Ande Integrated Logistics Park Jinmucaoye, Northwest of Intersection of Longtang Road Beijing Beijing Shunyi District and Qida Road, Dasungezhuang Town Beijing Beijing Shunyi District Mubei Road, Yangzhen Area (Original Daming Cable Factory) Beijing Beijing Shunyi District No. 2-4 Xingwu Road, Beiwu Town Beijing Beijing Shunyi District Beijing Qixin, No. 2-4 Xingwu Road, Beiwu Town JD Daily Necessities Warehouse No.2 or 200 Meters Beijing Beijing Shunyi District North of Xiaodian, Yangzhen Area Daming Cable Factory or JD Warehouse No.3 , Beijing Beijing Shunyi District Xiaodian, Yangzhen Area 50 Meters North of Beijing Warehouse, Shaziying Village Bus Sichuan Province Beijing Shunyi District Stop, Yangzhen Beijing Beijing Shunyi District 200 Meters North of Xiaodian Middle School, Yangzhen Beijing Beijing Shunyi District No. 33 Zhangliang Road Beijing Beijing Shunyi District Andahui Warehouse, No. 33 Zhangliang Road No.1 Warehouse, Building Material Warehouse A, Beijing Beijing Beijing Shunyi District Department Store, No. 33 Zhangliang Road SF Cold Chain, Rongshang 3rd Road, Xingmao 2nd Beijing Beijing Tongzhou District Street, Majuqiao Sichuan Province Beijing Chaoyang District No.1-1, Kanghua Road, Laojuntang Village 5/F, Tiejian Warehouse #4, CR Logistics Base, No. 11 Beijing Beijing Tongzhou District Xingmao 1st Street Beijing Zhonghan United Lifting Machinery Co.,Ltd., Beijing Beijing Shunyi District No. -

EMERGING MARKETS EQUITY 2019 Year End Report

EMERGING MARKETS EQUITY 2019 Year End Report COMPOSITE PERFORMANCE (% TOTAL RETURN) FOR PERIODS ENDED DECEMBER 31, 20191 SINCE 3 MONTHS 1 YEAR 3 YEARS2 5 YEARS2 10 YEARS2 INCEPTION2,3 HL EMERGING MARKETS (GROSS OF FEES) 12.73 26.90 12.82 7.52 6.95 12.70 HL EMERGING MARKETS (NET OF FEES) 12.47 25.78 11.83 6.59 6.00 11.79 MSCI EMERGING MARKETS INDEX (GROSS)4,5 11.93 18.88 11.99 6.00 4.04 9.18 1The Composite performance returns shown are preliminary; 2Annualized Returns; 3Inception Date: November 30, 1998; 4The Benchmark Index; 5Gross of withholding taxes. Please read the above performance in conjunction with the footnotes on the last page of this report. Past performance does not guarantee future results. All performance and data shown are in US dollar terms, unless otherwise noted. SECTOR EXPOSURE (%) WHAT'S INSIDE HL EM MSCI EM (UNDER) / OVER THE BENCHMARK Market Review › CASH 3.3 — EMs rose sharply in the quarter, INFO TECHNOLOGY 18.9 15.7 supported by easing US-China trade tensions and fading fears CONS STAPLES 8.9 6.3 of an imminent global recession. INDUSTRIALS 7.9 5.3 Performance and Attribution › FINANCIALS 26.5 24.2 Sources of relative return by CONS DISCRETIONARY 15.0 14.2 region and sector. ENERGY 7.5 7.4 UTILITIES 2.1 2.6 Perspective and Outlook › HEALTH CARE 1.2 2.9 The strong EM returns in 2019 reflected a jump in the earnings COMM SERVICES 8.1 11.0 multiple that investors were REAL ESTATE 0.0 3.0 willing to pay for companies’ future cash flows, particularly MATERIALS 0.6 7.4 for semiconductor manufacturers (8.0) (4.0) 0.0 4.0 8.0 and online retailers. -

China Quarterly Report & Look Ahead

Q2 2020 CHINA A QUARTERLY REPORT & LOOK AHEAD Disclaimer Certain information in this presentation constitutes forward-looking statements. Due to various risks, uncertainties, and assumptions made in our analysis, actual events or results or actual performance of the markets covered by this presentation may differ materially from those described. The information herein reflects our current views only, is subject to change, and is not intended to be promissory or relied upon by the reader. There can be no certainty that events will turn out as presented. Data are from sources deemed to be reliable. No representation or warranties either expressed or implied are made as to the accuracy of the information presented. Past performance is not a guarantee of future results. China Separate Account (SMA) Since Q1 2020 YTD 2020 Inception1 China A SMA -14.7% -14.7% -7.9% MSCI Emerging Markets -23.6% -23.6% -16.1% S&P 500 -19.6% -19.6% -11.3% 1 Inception date for the Phillips & Co. China A SMA is August 1, 2019. The information provided herein is obtained from sources believed to be reliable, but no reservation or warranty is made as to its accuracy or completeness. These investments are not insured or otherwise protected by the U.S. Government, the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other government agency and involve risk, including the possible loss of investment principal. Funds within your account(s) have a variety of different investment risks, objectives. Past performance is no guarantee of future results. Data Sources: Bloomberg, Phillips & Co.