Finance-Accounts-2017-18-Vol-II

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Understanding the Origin of the Terms 'WUNG', 'HAO' and 'TANGKHUL'

International Research Journal of Social Sciences_____________________________________ ISSN 2319–3565 Vol. 3(5), 36-40, May (2014) Int. Res. J. Social Sci. Understanding the Origin of the terms ‘WUNG’, ‘HAO’ and ‘TANGKHUL’ Mawon Somingam Department of Cultural and Creative Studies, North-Eastern Hill University (NEHU) Shillong, Meghalaya, 793022, INDIA Available online at: www.isca.in, www.isca.me Received 7th March 2014, revised 10 th April 2014, accepted 12 th May 2014 Abstract Understanding the origin and meaning of nomenclature of the ‘people’ or term referring to the ‘people’ is as important as identity of the people itself. At times, terms and nomenclatures of the ‘people’ are given by non locals. In the Naga context, the term ‘Naga’ itself is non-local, nomenclature of its federating tribes like Tangkhul is non-local, and names of many Tangkhul villages like Ukhrul, Tushen, Lambui, and Hundung etc. are given by non local administrators, missionaries, anthropologists and neighbouring communities among others. The core focus of the paper is to understand the origin of the terms WUNG, HAO and TANGKHUL. It also brings in the hypothesis of ‘Tangkhul-Meitei Origin’ while attempting to understand the people in brief. One of the main arguments of the paper is that the term HAO is the original or traditional nomenclature of the Tangkhul Nagas. Keywords : Wung, Hao, Tangkhul, Meitei, Christian and People. Introduction “Wung is no longer use today, neither by the people themselves, nor in official transaction” 5. However, it would be wrong to say Though there is no consensus among the local writers and that the term wung is no longer in use today. -

Mollen Kamsei Primary School Mull

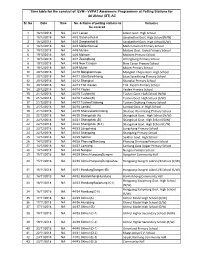

Time table for the conduct of EVM - VVPAT Awareness Programmes at Polling Stations for 44 Ukhrul (ST) AC Sl. No Date Time No. & Name of polling stations to Venue(s) be covered 1 18/12/2018 NA 44/1 Leisan Leisan Govt. High School 2 18/12/2018 NA 44/2 Sanakeithel-A Sanakeithel Govt. High School(N/W) 3 18/12/2018 NA 44/3 Sanakeithel-B Sanakeithel Govt. High School(S/W) 4 18/12/2018 NA 44/4 MollenKamsei Mollen Kamsei Primary School 5 19/12/2018 NA 44/5 Mullam Mullam Govt. Aided Primary School 6 19/12/2018 NA 44/6 Molnom Molnom Primary School 7 19/12/2018 NA 44/7 Zelengbung Zelengbung Primary School 8 19/12/2018 NA 44/8 New Canaan New Canan Primary School 9 19/12/2018 NA 44/9 Muirei Muirei Primary School 10 20/12/2018 NA 44/10 MongkotChepu Mongkot Chepu Govt. High School 11 20/12/2018 NA 44/11 LitanSareikhong Litan Sareikhong Primary School 12 20/12/2018 NA 44/12 Shangkai Shangkai Primary School 13 20/12/2018 NA 44/13 T.M. Kasom T.M. Kasom Primary School 14 20/12/2018 NA 44/14 Yaolen Yaolen Primary School 15 21/12/2018 NA 44/15 Tushen(A) Tushen Govt. High School (N/W) 16 21/12/2018 NA 44/16 Tushen(B) Tushen Govt. High School (S/W) 17 21/12/2018 NA 44/17 TushenChahong Tushen Chahong Primary School 18 21/12/2018 NA 44/18 Lambui Lambui Govt. Jr. -

CDL-1, UKL-1, SNP-1 Sl. No. Form No. Name Address District Catego Ry Status Recommendation of the Screening Commit

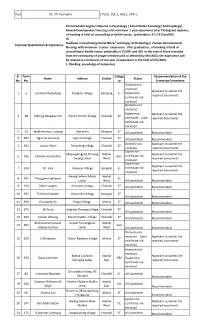

Post A1: STI Counselor 3 Posts: CDL-1, UKL-1, SNP-1 Post Graduate degree I diploma in Psychology / Social Work/ Sociology/ Anthropology/ Human Development/ Nursing; with minimum 1 year experience after PG degree/ diploma, of working in field of counselling in health sector; preferably in STI / RTI and HIV. Or Graduate in Psychology/Social Work/ Sociology/ Anthropology/ Human Development/ Essential Qualification & Experience: Nursing; with minimum 3 years .experience after graduation, of working in field of counselling in health sector; preferably in STI/RTI and HIV. In the case of those recruited from the community of people infected with or affected by HIV/AIDS, the experience will be relaxed to a minimum of one year of experience in the field of HIV/AIDS. 1. Working knowledge of computers Sl. Form Catego Recommendation of the Name Address District Status No. No. ry Screening Committee Domicile not enclosed, Applicant to submit the 1 2 Lanmila Khapudang Kongkan Village Kamjong ST Experience required documents certificate not enclosed Domicile not enclosed, Experience Applicant to submit the 2 38 Dilbung Rengwar Eric Purum Pantha Village Chandel ST certificate , Caste required documents certificate not enclosed 3 54 Makhreluibou Luikang Makhrelu Senapati ST All submitted Recommended 4 483 Ngorum Kennedy Japhou Village Chandel ST All submitted Recommended Domicile not Applicant to submit the 5 564 Jacinta Telen Penaching Village Chandel ST enclosed required documents Experience Mayanglangjing Tamang Imphal Applicant to submit the 6 756 -

APPEAL the Importance of Education in the Development of the Individual

APPEAL The importance of Education in the development of the individual in particular and society/economy in general, is an undeniable fact. With the change in the social set-up and emergence of Information Technology in the modern age, the need to review the system of Education has become necessary. Also, adequate environment for proper development of the students on one hand, and on the other to enable teachers to impart knowledge using modern methods/techniques in educational institution, is a requirement which has to be ensured by conducting studies on the existing institutions. This will provide an insight on the adequacy/shortfalls. As an endeavour towards this end, the Directorate of Economics & Statistics, Manipur as an authorized agency for statistical activities in the State of Manipur, is conducting the present survey on Private Schools as the first phase to build a database on the various aspects of Education in the Private sector in Manipur. The data collected will not be used, disclosed or retain to any third/other parties except for the purpose of generation of data base at the macro level. The Primary Investigators of this Directorate will be visiting all the Private Schools in Manipur for collection of the information through the schedule ‘Collection of information on Private Educational Institutions in Manipur, 2015’. Your valuable cooperation in providing the information as per the schedule will go a long way to enable the Directorate in generating data depicting the status of the Private Educational Institutions in -

200 DAYS FINAL Print

200 days of PMVDY – March 2020 1 1 200 days of PMVDY – March 2020 VanDhan is a movement spread across 27 States The Editorial Board EDITOR- IN- CHIEF - Shri. Pravir Krishna ,Managing Director, TRIFED 1. Sh. Amit Bhatnagar , DGM – MFP, TRIFED 2. Sh. Sandeep Pahalwan, SM – MFP, TRIFED 3. Sh. Roy Mathew, PMU Lead, TRIFED 4. Sh. Om Prakash - AM,MFP, TRIFED 5. Sh. Nikhil Rathi ,PMU,TRIFED 6. Sh. Javed Akhtar, Consultant Designer, TRIFED 7. Sh. Abhishek Toppo, Van Dhan Intern, TRIFED 8. Ms. Nutan Rani , Van Dhan Intern, TRIFED 9. Ms. Vanika Bajaj, Van Dhan Intern, TRIFED 10. Ms. Haleema Sadaf, Van Dhan Intern, TRIFED *The Van Dhan Natural producs on the cover page of this report have been produced at VDVK Senapati, Manipur. *The distillation unit shown on the cover page of this report has been installed at Dimapur. Nagaland 2 200 days of PMVDY – March 2020 Contents Content Page No. *States Page No. Messages 4 Andhra Pradesh 45 Van Dhan Timeline 7 Arunachal Pradesh 63 MSP for MFP Scheme 8 Assam 47 Implementation at a Glance 9 Bihar 60 About PMVDY 10 Van Dhan Products 13 Chhattisgarh 51 Good Manufacturing Goa 65 Practice & 14 Quality Certifications Gujarat 56 Van Dhan Equipments 15 Himachal Pradesh 62 Equipment & Toolkits 16 J&K, Ladakh 64 Premises for Processing & 17 Storage Jharkhand 41 PMVDY -Stages 19 Karnataka 37 State Advocacy Workshops 20 Kerala 55 District Advocacy 22 Workshops Madhya Pradesh 59 VDVK Trainings and 23 Advocacy Workshops Maharashtra 39 Convergences 24 Manipur 33 R&D support to VanDhan 25 Meghalaya 63 TRIFOOD 26 Mizoram 61 Tech For Tribals 27 Nagaland 35 CSR supported Van Dhan 29 Programs Odisha 49 Industry Partnerships 30 Rajasthan 43 Web application features 31 Sikkim 60 Model VDVKs 32 Tamil Nadu 58 States* 33-65 Telangana 61 Risk Assessment, Monitorng 65 & Evaluation Tripura 57 Corporate Affairs Division 66 Uttar Pradesh 53 Rs. -

CORPORATISING TOURISM in MANIPUR a Dossier Indigenous Perspectives & EQUATIONS

CORPORATISING TOURISM IN MANIPUR TOURISM CORPORATISING a Dossier Indigenous Perspectives & EQUATIONS Indigenous Perspectives Corporatising TOURISMin MANIPUR Indigenous Perspectives EQUATIONS Corporatising Tourism in Manipur 2017 Editorial Team: Ram Wangkheirakpam Swathi Seshadri With inputs from Nandini Thockchom, Ratika Yumnam & Chingya Luithui Articles contributed by: Kalpana Thaoroijam Soraisam Devajani Jinine Laishramcha Sothing Shimray Design & Layout: Laishram Chinglen Cover Photo by Salam Rajesh Printer: National Printing Press, Bengaluru This publication may be reproduced in whole or in part for educational, advocacy or not-for-profit purposes. We would appreciate acknowledging Indigenous Perspectives and EQUATIONS as the source and letting us know of the use. Copies available online. For print copies contact: Indigenous Perspectives Chingmeirong Maning Leikai Khongnang Ani Karak, Assembly Road, Imphal East - 795001 Manipur, India Tel/fax : +91 (385) 2422269 EMAIL : [email protected] | URL : www.inperspectives.org EQUATIONS, Flat no - A2, 1st oor, No 21/7, 2nd Cross 1st A Main Road, Atmananda Colony, Sultan Palya, R T Nagar Post Bengaluru - 560032, Karnataka, India Tel : +91 (80) 23659711 / 23659722 EMAIL : [email protected] | URL : www.equitabletourism.org Corporatising Tourism in Manipur Preface Tourism is not as innocent and benign as is largely perceived. Like any other developmental issue there are serious ramifications and implications for local economies, social and cultural fabric of the places promoted as tourism destinations, on the environment and biodiversity and on power rela- tions. The Government of Manipur in its endeavour to provide job opportunities and overall progress in the State, has been pushing tourism industry as the key source of economic growth. In the process, infrastructure development has been given prime attention. -

Executive Summary

Consultancy Services for Preparation of Detailed Project Report DETAILED PROJECT REPORT for 2 Laning of Hungpung-Longpi Kajui Road on NH 202 EXECUTIVE SUMMARY EXECUTIVE SUMMARY 0.1 GENERAL National Highways and Infrastructure Development Corporation Limited (NHIDCL) has decided to take up the development of various National Highways Corridors in the North-eastern state where the intensity of traffic has increased significantly in plain areas and where there is requirement of safe and efficient movement of traffic mainly in hilly terrains. This project is a part of the above mentioned programme and the project awarded to Consultant is Consultancy Services for carrying out Feasibility Study, Preparation of Detailed Project Report and providing pre-construction services in respect of 2 laning of Yaingangpokpi-Nagaland Border in the state of Manipur. Project Stretch: Hungpung-Longpi Kajui (36.423Km). The NHIDCL has been entrusted with implementation of the development of this corridor from Ministry’s Plan Funds. In order to fulfil the above task, NHIDCL has entrusted the work of preparation of the feasibility study and Detailed Project Report for the above project to M/s S. M. Consultants., vide contract agreement dated 19th January 2017. The Letter of Acceptance was communicated vide letter No NHIDCL/DPR/IM&UJ/Manipur/2016/293. 0.2 OBJECTIVE The main objectives of the consultancy service will focus on establishing technical, financial viability of the project and prepare detailed project reports for rehabilitation/ upgradation/ construction of the existing road to two lane NH with paved shoulder configuration with the following points to be ensured. Ensure Enhanced safety of the traffic, the road users and people living close to the Highway . -

Socio Economic Impact Due to Climate Variability on Selected

Meetei S, et al., J Environ Sci Curr Res 2021, 4: 027 DOI: 10.24966/ESCR-5020/100027 HSOA Journal of Environmental Science: Current Research Research Article incidence and dependency on government funds. In such cases, rural communities tend to be more vulnerable in comparison to urban Socio Economic Impact Due to counterparts. Therefore, the need of time is to delineate climate Climate Variability on Selected change impacts across rural and urban communities, and to develop appropriate policies to mitigate or adapt the impacts. Public awareness Villages of Ukhrul and Thoubal and capacity building will enhance more on understanding the present scenario of climate change. Moreover, facilitate assessment of climate Districts, Manipur change vulnerabilities and risk on bio-physical and socio-economy in terms of water, agriculture, forest and health sectors geared towards Sanamacha Meetei*, Mohd Habibullah Khan, Ashem Rahul reducing climatic vulnerability is warranted. According to Hewitt Singh, SW Yuingamla, Zahir Shah and Onil Laishram [2], social vulnerability is the susceptibility of a given population to Directorate of Environment and Climate Change, Porompat, Imphal East, be harmed from exposure to a hazard, directly affecting its ability Manipur, India to prepare for, respond to, and recover. Furthermore, Houghton [1], calculated the temperature increase in the last hundred years and the last three decades have been successively warmer at the Earth’s surface than any preceding decade since 1850 IPCC [3], Moreover, Abstract climate change impacts on human health could occur through both As global climate change continues, many of the villages are direct (e.g., thermal stress) and indirect (e.g., disease vectors and likely to become vulnerable at present. -

Details of 701 Functional One Stop Centres(Oscs)

FUNCTIONAL ONE STOP CENTRES Summary Sheet Sr. No. Name of State / UT Number of OSCs Functional 1. Andaman and Nicobar (UT) 03 2. Andhra Pradesh 13 3. Arunachal Pradesh 24 4. Assam 33 5. Bihar 38 6. Chandigarh (UT) 01 7. Chhattisgarh 27 8. Dadra and Nagar Haveli and 02 Daman & Diu (UT) 9. Delhi (UT) 11 10. Goa 02 11. Gujrat 33 12. Haryana 22 13. Himachal Pradesh 12 14. Jammu & Kashmir (UT) 18 15. Jharkhand 24 16. Karnataka 30 17. Kerala 14 18. Lakshadweep (UT) 01 19. Ladakh (UT) 01 20. Maharashtra 37 21. Madhya Pradesh 52 22. Manipur 16 23. Meghalaya 11 24. Mizoram 08 25. Nagaland 11 26. Odisha 31 27. Punjab 22 28. Puducherry (UT) 04 29. Rajasthan 33 30. Sikkim 04 31. Tamil Nadu 34 32. Telangana 33 33. Tripura 08 34. Uttar Pradesh 75 35. Uttarakhand 13 36. West Bengal 00 Total 701 One Stop Centre Details SI. NO District OSC Address Concerned CA OSC Phone Mail ID Number Andaman and Nicobar (UT) 1. South Andaman SAKHI One Stop Centre Ms. Reeta Devi 8900909396 [email protected] Near AYUSH Hospital, Type V, Quarter No:JG-6, Junglighat Port Blair, A&N Islands Pin Code 744103 2. North & Middle SAKHI One Stop Centre Mrs.Shvatha Priya 9940169132 [email protected] Andaman Old Zonal Library Maybunder North & Middle Andaman 3. Car Nicobar SAKHI One Stop Centre Mrs.Zareena Bibi 9434269836 [email protected] Perka Head Quarter Nicobar Car Nicobar Andhra Pradesh 4. East Godavari Disha (Sakhi) One Stop Sailaja Ranganadham . 9493270181/ [email protected]. -

Annual Report

NORTH EASTERN REGION COMMUNITY RESOURCE MANAGEMENT PROJECT - UKHRUL (NERCORMP-UKHRUL) ANNUAL REPORT (1st April 2017 to 31st March 2018) A Joint Project of North Eastern Council, Ministry of DoNER, Government of India & International Fund for Agricultural Development Introduction Ukhrul district is a hill district covering an area of 4544 sq km in the eastern part of Manipur state bordering Myanmar. The district is dominantly inhabited by the Tangkhuls followed by the Kukis. Agriculture is the primary source of livelihood of the people in the district. Ukhrul, the district headquarter is 84 km from Imphal, the state capital of Manipur. The district is famous for its richness in wildlife resources; Shirui lily (Lilium Macklineae), the flower of the State, Uningthou, the wood of the state, nongyeen, the bird of the state are all found in Ukhrul District. Ango range where most of the endangered species of animals and plants of the state are found is along the border of Ukhrul district. Ukhrul district is a major supplier of potato, beans, cabbage, parkia, peas, beans and other agri-produces to Imphal market and other places like Dimapur. Besides agriculture produces, of late banana, orange and lemon have started penetrating Imphal market. Ukhrul is connected to Imphal in the south east and Nagaland in the north by National Highway 202. Road connectivity between the District Headquarters and villages still remain very poor although it is gradually improving. The district remains economically backward on account of many factors. Use of traditional methods in agricultural practices leading to low productivity, lack of power supply, absence of industries and lack of good governance are some of the reasons upholding the cycle of poverty. -

Foraminiferal Assemblages of Upper Cretaceous from the Manipur

INTERNATIONAL JOURNAL OF SCIENTIFIC & TECHNOLOGY RESEARCH VOLUME 9, ISSUE 02, FEBRUARY 2020 ISSN 2277-8616 Foraminiferal assemblages of upper cretaceous from the Manipur Ophiolite belt at Naothalung and Mova blocks in Hungpung, Ukhrul district, Manipur state, Northeast India Pemmaya Kasomva, Venkatachalapathy.R Abstract: Fifty nine (59) geological samples were systematically collected from the exotic limestone blocks of the Manipur ophiolite belt at Hungpung village, Ukhrul district, Manipur. The study area lies within 94º20′17″ & 94º20′43″ East longitudes and 25º02′43″ & 25º02′71″ North latitude. These limestone block is mainly composed of micritic limestone, chert, sandstone, marl and a matrix of flyschoid rocks and usually hard, calcitic crystalline. 10 genera and 25 species planktic foraminifera are identified and recognised six (6) biozone from the blocks of Naothalung and Mova. Viz., Globotruncana ventricosa. Globotruncanita calcarata, Globotruncanella havanensis, Globotruncana aegyptiaca, Gansserina gansseri, Abathomphalus mayaroensis. Keywords: Upper cretaceous, Exotic Limestone, Manipur Ophiolite Belt, NE India ———————————————————— 1. INTRODUCTION The pelagic limestones and chert of these region of the Manipur is a small state having an area of about 22,327 exotic blocks in the Melange zone of Ukhrul area km2. The state is located in the eastern corner of India provided data on deep oceanic sediments in Late which is a part of Northeast India, bordering with the Cretaceous and their subsequent abduction along the Myanmar (Burma) in the eastern and southern part, eastern margin of the Indian plate [12].Chungkham and Nagaland on the north, Assam on the west and Mizoram Caron [13] correlate the foraminifers assemblages of on the south – western part. -

The Campanian-Maastrichtian Foraminifers from the Exotic Limestone of Naothalung Block in Hungpung Village Ukhrul District, Manipur State, Northeast India

PemmayaKasomva et al., IJSRR 2019, 8(1), 1674-1686 Research article Available online www.ijsrr.org ISSN: 2279–0543 International Journal of Scientific Research and Reviews The Campanian-Maastrichtian Foraminifers from the Exotic Limestone of Naothalung Block in Hungpung Village Ukhrul District, Manipur State, Northeast India Pemmaya Kasomva1* and Venkatachalapathy.R2 1 Department of Geology, Periyar University, Salem-636 011, Tamil Nadu. India, E- mail:[email protected], mob no.: 8438279725 ABSTRACT Planktic and benthic foraminifers of the Upper Cretaceous (Early Maastrichtian – Late Campanian) from the exotic limestone block of the Naothalung area, Ukhrul region, Manipur Ophiolite Belt, have been studied the foraminiferal assemblages and age determined. The presence of the exotic limestone blocks varies in size a few centimetres to tens of meters compiled of micritic limestone, sandstone, marl, basic rocks and conglomerate embedded in matrix of flyschoid rocks were recognised in the mélange zone and usually the limestones from these blocks are mostly calcitic, hard, crystalline and creamy white, greyish in colour. Planktonic foraminiferal zonation from bottom to top of the succession consist of the zones defined by Gansserina gansseri, Globotruncana aegyptiaca, Globotruncana aegyptiaca, Globotruncana aegyptiaca, Globotruncana aegyptiaca, Globotruncana aegyptiaca. KEYWORDS: Campanian, Maastrichtian, Exotic Limestone, ManipurOphiolite Belt, NE India *Corresponding author Pemmaya Kasomva Department of Geology Periyar University, Salem-636 011, Tamil Nadu. E- mail: [email protected], mob no.: 8438279725 IJSRR, 8(1) Jan. – March., 2019 Page 1674 PemmayaKasomva et al., IJSRR 2019, 8(1), 1674-1686 INTRODUCTION The occurrences of cretaceous flysch associated limestone in Manipur, Northeast India was first reported and one of the early workers of a broad geological account of Manipur.