Tata Large Cap Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Replacements in Indices

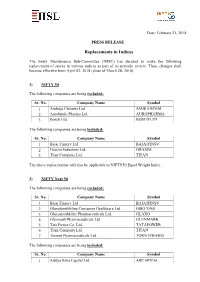

Date: February 21, 2018 PRESS RELEASE Replacements in Indices The Index Maintenance Sub-Committee (IMSC) has decided to make the following replacement of stocks in various indices as part of its periodic review. These changes shall become effective from April 02, 2018 (close of March 28, 2018). 1) NIFTY 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Ambuja Cements Ltd. AMBUJACEM 2 Aurobindo Pharma Ltd. AUROPHARMA 3 Bosch Ltd. BOSCHLTD The following companies are being included: Sr. No. Company Name Symbol 1 Bajaj Finserv Ltd. BAJAJFINSV 2 Grasim Industries Ltd. GRASIM 3 Titan Company Ltd. TITAN The above replacements will also be applicable to NIFTY50 Equal Weight Index. 2) NIFTY Next 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Bajaj Finserv Ltd. BAJAJFINSV 2 GlaxoSmithkline Consumer Healthcare Ltd. GSKCONS 3 Glaxosmithkline Pharmaceuticals Ltd. GLAXO 4 Glenmark Pharmaceuticals Ltd. GLENMARK 5 Tata Power Co. Ltd. TATAPOWER 6 Titan Company Ltd. TITAN 7 Torrent Pharmaceuticals Ltd. TORNTPHARM The following companies are being included: Sr. No. Company Name Symbol 1 Aditya Birla Capital Ltd. ABCAPITAL Sr. No. Company Name Symbol 2 Ambuja Cements Ltd. AMBUJACEM 3 Aurobindo Pharma Ltd. AUROPHARMA 4 Bosch Ltd. BOSCHLTD 5 General Insurance Corporation of India GICRE 6 L&T Finance Holdings Ltd. L&TFH 7 SBI Life Insurance Company Ltd. SBILIFE 3) NIFTY 500 The following companies are being excluded: Sr. No. Company Name Symbol 1 Adani Enterprises Ltd. ADANIENT 2 Ahluwalia Contracts (India) Ltd. AHLUCONT 3 Apar Industries Ltd. APARINDS 4 AstraZenca Pharma India Ltd. ASTRAZEN 5 Corporation Bank CORPBANK 6 Dalmia Bharat Ltd. -

50 KW Offer Solar Copy 2

21st Century Enviro Engineers Pvt.Ltd. Plot No. 120(10 Marla), COMPANY Industrial Area Phase II Chandigarh - 160002, India PROFILE www.21stcenturyenviro.com INTRODUCTION 21st CENTURY ENVIRO ENGINEERS PVT. LTD. is a Company dealing in the field of Environmental Engineering related activities. We are Registered Environmental Consultants of Pollution Control Board to Supply ETP’s, STP’s, APCD’s, Incinerators, Water Treatment Plants, Reverse Osmosis, Evaporators, Solid Waste Management and Rain Water Harvesting and to carry out EIA Studies . The Directors of the company are young Technocrats having versatile experience in this field. We have a back up of highly qualified and experienced technical team having versatile experience in Designing, Erection, Commissioning and Operation of different types of Effluent Treatment Plants. Our Managing Director himself is a Chemical Engineer with almost 25 Years Experience in this line and Technical Director is PhD. in Environmental Science with almost 30 Years working experience on various types of effluent treatment Technologies. Our team comprises of almost 150 people from different backgrounds e.g. Chemical, Environmental, Mechanical, Instrumentation, Civil, Accounts, Purchase, Marketing etc. We have our Marketing/ Design Office in Chandigarh and regional offices in Dhaka, Mumbai, New Delhi, Sikkim etc. and have our own testing Laboratory for Effluent/Water Testing and to study treatability of effluent on pilot scale. We have our own full-fledged manufacturing unit of Pollution Control Equipments in Village Kunjhal Baddi (HP). We also undertake annual operation and maintenance contracts and liasining services for the systems supplied by us. We are also Registered with CREST (Chandigarh Renewable Energy & Technology Promotion Society) and SECI (Solar Energy Corporation of India) for supplying Online/Offline Solar systems in Chandigarh, Himachal Pradesh, Uttarakhand, J&K, Punjab, Haryana, Delhi, Bihar etc. -

Index Stock Update >> Marico Stock Update >> Gabriel India Stock Update >> PTC India Stock

Visit us at www.sharekhan.com November 04, 2015 Index Stock Update >> Marico Stock Update >> Gabriel India Stock Update >> PTC India Stock Update >> Ipca Laboratories Stock Update >> Skipper Viewpoint >> Lloyd Electric & Engineering For Private Circulation only REGISTRATION DETAILS Regd Add: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos. BSE - INB/INF011073351 ; BSE- CD ; NSE - INB/ INF231073330 ; CD-INE231073330 ; MSEI - INB/INF261073333 ; CD-INE261073330 ; DP - NSDL-IN-DP-NSDL-233-2003 ; CDSL-IN-DP-CDSL-271-2004 ; PMS- INP000000662 ; Mutual Fund-ARN 20669 ; Commodity trading through Sharekhan Commodities Pvt. Ltd.: MCX-10080 ; (MCX/TCM/CORP/0425) ; NCDEX- 00132 ; (NCDEX/TCM/CORP/0142) ; NCDEX SPOT-NCDEXSPOT/116/CO/11/20626 ; For any complaints email at [email protected] ; Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and Do’s & Don’ts by MCX & NCDEX and the T & C on www.sharekhan.com before investing. investor’s eye stock update Marico Reco: Buy Stock Update Enhanced focus to improve volume growth; maintain Buy CMP: Rs399 Company details Key points Price target: Rs460 Mixed operating performance: During Q2FY2016, Marico’s revenue grew by 4% to Rs1,485.4 crore, entirely driven by a 4% volume growth (domestic business’ volume Market cap: Rs25,735 cr growth stood at 5.5%). The gross profit margin (GPM) improved by almost 500BPS to 52 week high/low: Rs466/299 49.3% on the back of ~30% decline in the copra prices and 33% decline in the prices of liquid paraffin. -

Inner 25 India Pharma & Healthcare Fund

Modera erate tely Mod High to e H w at ig o er h L d o M V e r y w H Tata India Pharma & Healthcare Fund o i L g (An open ended equity scheme investing in Pharma and Healthcare Services Sector) h Riskometer Investors understand that their principal As on 30th June 2021 PORTFOLIO will be at Very High Risk INVESTMENT STYLE Company name No. of Market Value % of Company name No. of Market Value % of Primarily focuses on investment in at least 80% of its net Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets assets in equity/equity related instruments of the companies in the Pharma & Healthcare sectors in India. Equity & Equity Related Total 55184.24 97.88 Glenmark Pharmaceuticals Ltd. 167000 1089.76 1.93 INVESTMENT OBJECTIVE Healthcare Services Sanofi India Ltd. 13000 997.39 1.77 The investment objective of the scheme is to seek long Apollo Hospitals Enterprise Ltd. 70500 2551.99 4.53 Gland Pharma Ltd. 19662 673.29 1.19 term capital appreciation by investing atleast 80% of its Fortis Healthcare Ltd. 795000 1935.03 3.43 Laurus Labs Ltd. 90000 619.79 1.10 net assets in equity/equity related instruments of the companies in the pharma & healthcare sectors in Syngene International Ltd. 265000 1545.75 2.74 India.However, there is no assurance or guarantee that the investment objective of the Scheme will be Narayana Hrudayalaya Ltd. 301420 1483.74 2.63 Other Equities^ 1186.14 2.10 achieved.The Scheme does not assure or guarantee any Metropolis Healthcare Ltd. -

Ipca Laboratories (IPCLAB)

Ipca Laboratories (IPCLAB) CMP: | 2040 Target: | 2290 (12%) Target Period: 12 months HOLD May 31, 2021 Upbeat guidance, execution remains key Q4 revenues remained subdued growing just 3.8% YoY to | 1115 crore. Strong YoY growth of 19.7% in export formulations to | 338 crore was partly Particulars offset by API sales decline of 5.5% YoY to | 260 crore. Domestic Particular Amount formulations remained flat at | 434 crore vs. | 431 crore in Q4FY20. EBITDA Market Capitalisation | 25873 crore margins improved 484 bps YoY to 20.5% due to better gross margins and Debt (FY21) | 267 crore lower other expenditure. EBITDA grew 35.8% YoY to | 229 crore. PAT grew Cash (FY21) | 365 crore 87.5% YoY to | 161 crore (I-direct estimate: | 204 crore). Delta vis-à-vis EV | 25775 crore EBITDA was due to higher other income, lower depreciation and tax rate. 52 week H/L (|) 2456/1467 Equity capital | 25.4 crore Update Result Export formulations main catalyst for growth Face value | 2 Price performance Growth in export formulations (29% of FY21 revenues) was on the back of growth in both international generics and international branded 2500 14000 formulations. The international anti-malarial institutional business has also 12000 2000 contributed substantially to overall exports growth. US traction will take 10000 longer than earlier estimated due to USFDA import alerts for the Ratlam 1500 8000 facility that is the only API source for Silvassa and Pithampur formulations 1000 6000 plants along with Silvassa and Pithampur (Indore) plants that are specifically 4000 500 earmarked for the US business, besides third party sales. -

Pharma Sector Report -Sept’20

Mutual Fund: Pharma Sector Report -Sept’20 Private & confidential. Only for limited circulation. Contact us: [email protected] Executive Summary: Since the outbreak of the Coronavirus crisis, the pharma sector stepped into the spotlight. Long overdue investments have been flowing towards the sector and even pharma funds in the mutual fund industry have begun to outperform. Nevertheless, there is still a clear need for government spending in this sector. Compared to the US, which has the highest per capita spending on healthcare at $5000, India spends merely ~ $50 per capita. The current situation presents the Indian government with a perfect opportunity to increase its expenditure in this sector, to facilitate its growth and fast-track its progress. Few points about the Pharma Funds: The market capitalization of the entire pharma & healthcare industry is ~ Rs. 10 lac crs, whereas the total size of pharma funds in the mutual fund is ~Rs. 10k crs, translating to ~ 1% of the entire sector in value terms. (This excludes the pharma holdings in other categories). There are 43 pharma & healthcare companies that form part of the Top 500 companies. Out of these, pharma funds have an exposure to 36 companies. There are 11 companies in the Top 100; 11 in the Midcap space (101-250) and 14 Smallcaps (251-500). The 7 companies that do not form part of the pharma funds’ portfolios are Caplin Point Lab, Glenmark Pharma, Granules India, Piramal Enterprises, Poly Medicure, Suven Pharma and Wockhardt Ltd. Cipla Ltd., Divis Laboratories Ltd. and Dr. Reddy’s Laboratories Ltd. are the only stocks that form part of every pharma fund. -

List of 3Rd Party Manufacturer of Pre-Qualified/Registered Firms with PPT Hospital

List of 3rd party Manufacturer of Pre-qualified/Registered Firms with PPT Hospital SL. Name of the Parent Firm Name of the 3rd party manufacturer NO A B C 1 M/s AKUMENTIS HEALTHCARE LTD. (i) M/S Unimark Healthcare Ltd (ii) M/S Applied Communication & Controls (iii) Maxcure Nutravedics Ltd (iv) Akums Drugs & Pharmaceuticals Ltd 2 M/s ALCON LABORATORIES(INDIA)PVT.LTD (i) M/S Wintac Limited 3 M/s ABBOTT HEALTHCARE PVT. LTD. (i) Akums Drugs & Pharmaceuticals Ltd (ii) Medibios Laboratories Pvt. Ltd. (iii) Tristar Formulations Pvt. Ltd. (iv) Hetero Labs Ltd (v) M/S Aqua Vitoe Laboratories 4 M/s ABBOTT INDIA LIMITED. (i) Acme Formulation Pvt Ltd (ii) Revenbhel Healthcare Pvt. Ltd. 5 M/s CENTAUR PHARMACEUTICALS PVT. LTD. (i) M/S Pure & Cure Healthcare Pvt. Ltd. (ii) M/S The Madras Pharmaceuticals (iii) M/S Akums Drugs & Pharmaceuticals Limited 6 M/S CIPLA LIMITED (i) Akums Drugs & Pharmaceuticals Ltd (ii) BDR Pharmaceuticals International Pvt. Ltd. (iii) M/S Medispray Laboratories Pvt. Ltd. (iv) M/S Golden Cross Pharma Pvt. Ltd. (v) M/S Tirupati Medicare Limited (vi) M/S Mepromax Lifesciences PVT Ltd. (vii) M/S Virchow Biotech Private Limited (viii) Hetero Labs Ltd (ix) Pegasus Farmaco Iindia Pvt. Ltd. (x) Meditab Specialities Pvt. Ltd. 7 M/s DR. REDDYS LABORATORIES LTD (i) Bdr Pharmaceuticals Ltd (ii) Naprod Lifesciences Pvt. Ltd (iii) Hetero Labs Ltd (iv) Natco Pharma Ltd (v) Amgen Manufacturing Limited 8 M/s FOURRTS (INDIA) LABORATORIES PVT. (i) M/S Swiss Garnier Biotech (ii) M/S Sun Glow Pharmaceuticals Private Limited 9 M/s GLOBUS REMEDIES (i) Park Pharmaceuticals (ii) Baxil Pharma Pvt. -

Weights for New Portfolio of India Small Cap Index (ISCIN) - As on March 12, 2013 S No Ticker Name ISIN SEDOL Weights 1 FB in Equity Federal Bank Ltd

Weights for New Portfolio of India Small Cap Index (ISCIN) - As on March 12, 2013 S No Ticker Name ISIN SEDOL Weights 1 FB IN Equity Federal Bank Ltd. INE171A01011 6139845 4.00% 2 APHS IN Equity Apollo Hospitals Enterprise Ltd. INE437A01024 6273583 3.52% 3 ABNL IN Equity Aditya Birla Nuvo Ltd. INE069A01017 6100421 3.43% 4 TTCH IN Equity Tata Chemicals Ltd. INE092A01019 6101167 3.26% 5 MMFS IN Equity Mahindra & Mahindra Financial Services Ltd. INE774D01024 B8F8822 3.25% 6 TGBL IN Equity Tata Global Beverages Ltd. INE192A01025 6121488 3.09% 7 HPCL IN Equity Hindustan Petroleum Corp. Ltd. INE094A01015 6100476 2.95% 8 EXID IN Equity Exide Industries Ltd. INE302A01020 B1D3ZC9 2.86% 9 RCAPT IN Equity Reliance Capital Ltd. INE013A01015 6101082 2.44% 10 UNTP IN Equity United Phosphorus Ltd. INE628A01036 B0L0W35 2.32% 11 PLNG IN Equity Petronet LNG Ltd. INE347G01014 B00KT68 2.24% 12 AL IN Equity Ashok Leyland Ltd. INE208A01029 B01NFT1 2.20% 13 UT IN Equity Unitech Ltd. INE694A01020 B17MRV5 2.14% 14 CRG IN Equity Crompton Greaves Ltd. INE067A01029 B1B90H9 2.08% 15 OBC IN Equity Oriental Bank of Commerce INE141A01014 6121507 2.01% 16 IPCA IN Equity IPCA Laboratories Ltd. INE571A01020 6433473 1.96% 17 JUBI IN Equity Jubilant FoodWorks Ltd. INE797F01012 B3PRM66 1.94% 18 MRF IN Equity MRF Ltd. INE883A01011 6214128 1.88% 19 ALBK IN Equity Allahabad Bank INE428A01015 6708289 1.85% 20 STR IN Equity Strides Arcolab Ltd. INE939A01011 6690535 1.84% 21 DITV IN Equity Dish TV India Ltd. INE836F01026 B1RMW32 1.78% 22 JKBK IN Equity Jammu & Kashmir Bank Ltd. -

View Annual Report

CONTENTS CHAIRMAN’S LETTER DEAR SHAREHOLDERS FY2012 has been a good year for your Company. The key financial results were: ¥ Consolidated revenues increased by 30% to Rs. 96.7 billion in FY2012. ¥ Earnings before interest, taxes, depreciation and amortization (EBITDA)1 rose by 55% to Rs. 25.4 billion. ¥ Profit after Tax (PAT)2 grew by 45% to Rs. 15.3 billion. ¥ Diluted Earnings per Share (EPS) increased from Rs. 64.9 in FY2011 to Rs. 83.8 in FY2012. I am particularly delighted by four developments. First, your Company succeeded in yet another blockbuster generic launch in the USA under 180- days marketing exclusivity. Dr. Reddy’s launched olanzapine 20 mg tablets, the generic version of the brand Zyprexa®. Olanzapine is used to treat schizophrenia and bipolar disorder. This product has added around USD 100 million to your Company’s revenues for FY2012. Second, the biosimilars business continues along its impressive growth path. In my letter to you last year, I had discussed the critical importance of developing biosimilars in the years to come. I am happy to note that your Company’s global biosimilars business grew by 45% over last year and recorded sales of USD 26 million. Today, the biosimilars portfolio of Dr. Reddy’s constitutes (i) filgrastim, (ii) peg-filgrastim, (iii) rituximab and (iv) darbepoetin alfa, which have commercial presence in 13 countries among emerging markets. These are helping to treat patients suffering from cancer — and at prices that are significantly more affordable than the corresponding innovator drugs. Soon, I expect to see Dr. Reddy’s biosimilars entering developed markets. -

Name: 2Nd APPCON India - ASIAN Pharma Packaging Conference Location: Mumbai-India Dates: 2Nd & 3Rdnovember 2017

Name: 2nd APPCON India - ASIAN Pharma Packaging Conference Location: Mumbai-India Dates: 2nd & 3rdNovember 2017 For Agenda/Event Brochure, Information & Registration, Contact: Priyesh Waghmare E: [email protected] | T: +91 (0)20.6527.2803 Quote discount code: PPCi1MP20 to claim for 20% discount expiring 7th September 2017 & PPCi1MP15 to claim for 15% discount expiring 19th October 2017 The objective of the conference is to secure and optimize packaging by navigating regulatory requirements with innovative materials and technologies. http://www.acius.net/?cID=299 Key Highlights: 20+ speakers 100+ senior packaging heads from pharma companies 10 exhibitors 2-days of branding opportunities through innovative formats such as technology shootout, site visit and speaking Early Confirmed Speakers: Chief Advisor: Santanu Chowdhury, Senior General Manager, Packaging Development, Sun Pharma Barun Kumar Dey, Director & Head Packaging Development, Dr Reddy’s Laboratories Lokesh Sharma, Director-Supply Chain, Eisai Pharmaceuticals Prasad Satam, GM Packaging Research Development, Aurobindo Pharma Alpesh Shah, General Manager-Packaging, Intas Pharmaceuticals Kaushik Roy, GM – Packaging Research Development, Mylan Laboratories Pradeep Dhargalkar, Head Packaging Development, Unichem Laboratories Atul Mulay, Deputy General Manager – Packaging Development, Cadila Pharmaceuticals Ajay Bapat, Head Packaging Development, Emcure Pharmaceuticals Munindra Roy, Senior Manager Packaging Development, Gland Pharma K Ram Mohan, Senior Packaging, NATCO -

Market Masala… the Flavors That Influenced the Market This Week

Go India Advisors Weekly Newsletter Market Masala… The flavors that influenced the market this week Week 24/CY20: 6th – 12th June 2020 1 Headlines this week Go India Advisors Another Day, another Deal; Powell GDP statement; Court – interest(ed) or not Weekly Newsletter Supreme Court clarified on the case of interest charged during moratorium. The issue now is limited to interest on interest deferred during moratorium. This is significant less Jio announced 7th and 8th sale of it's equity, this time 1.16% for threatening than question of interest waiver all together. Rs5683cr to Abu Dhabi Investment Authority (ADIA) and Banking sector took a sigh of relief and so did Indian additional 0.93% to Silver Lake Partners for Rs4546cr. Totalling upto 21.06% stake for Rs97885cr. More deals in offing are market. TPG(US$1.5bn), Saudi Arabia's Public Investment Fund (PIF) (US$1.5bn). And some rumours about either Google or Microsoft coming in. US Fed in it MPC on Thursday was dovish as expected. However more than expected downbeat assessment of the economy proved little bit too much for the stock markets to handle. This triggered the worst falls in stock market since 16th March. 13-06-2020 2 Global Markets – risk off Go India Advisors US Fed downbeat assessment of the economy, too hot for market to handle Weekly Newsletter Returns % Data for year 2020; except as specified 13-06-2020 3 Indian market – rally takes a breather Go India Advisors Volatility is the name of the game Weekly Newsletter Indian Markets for Week Ending 12th June 2020 For more information: Click on the image. -

WHO GMP Certified Manufacturing Units for Certificate of Pharmaceutical Products (COPP)

WHO GMP Certified Manufacturing Units for Certificate of Pharmaceutical Products (COPP) in various States of India* Sr. State Total no. of WHO GMP No. Certified Manufacturers 1. Andhra Pradesh 35 2. Assam 01 3. Delhi (NCT) 09 4. Goa 38 5. Gujarat 423 6. Haryana 40 7. Himachal Pradesh 115 8. Jammu and Kashmir 15 9. Karnataka 82 10. Kerala 10 11. Madhya Pradesh 37 12. Maharashtra 209 13. Odisha(Orissa) 01 14. Puducherry 16 15. Punjab 11 16. Rajasthan 19 17. Sikkim 13 18. Tamil Nadu 74 19. Telangana 52 20. Uttar Pradesh 18 21. Uttarakhand 104 22. West Bengal 07 Total 1329 * List as received from the States / UTs through Zonal / Sub-Zonal Offices of CDSCO as on February 2015. Sr. No Sub-Sr. no. Name and address of WHO GMP Certified Manufacturers State-wise ANDHRA PRADESH 1. 1) EISAI PHARMATECHNOLOGY AND MANUFACTURING PVT. LTD, Ramky Pharma City (SEZ), Parawada,Visakhapatnam-Dist. 2. 2) DR.REDDY'S LABS LTD.,UNIT-7, Pydibhimavaram, Srikakulam District. 3. 3) DIVI'S LABORATORIES LIMITED UNIT-II, UNIT-II, Chippada Village, Visakhapatnam Dist. 4. 4) WANBURY LIMITED, Doctors Organic Chemicals Division, Iragavaram, K.IIIindalaparru, West Godavari Dist. 5. 5) Mylan LABORATORIES LTD, Plot No.5, Road No.12,Tadi (V), Visakhapatnam-Dist. 6. 6) S.M.S.PHARMACEUTICALS LIMITED, Plot No.28,Parawada, Visakhapatnam District. 7. 7) SMILAX LABORATORIES LTD, Plot No.70 & 71,Parwada, Visakhapatnam District. 8. 8) RA CHEM PHARMA LTD, R.S.No.50/1, Mukteshwarapuram, Krishna - District. 9. 9) LEE PHARMA LIMITED, Plot No.V, Phase-II, VSEZ, Duvvada, Sabbavaram (M), Visakhapatnam-Dist.