Understanding Mandis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Disposition of All-India Service and O.A.S.-Group 'A' (S.B.) & Above Rank Officers in Odisha

FOR OFFICIAL USE GOVERNMENT OF ODISHA DISPOSITION OF ALL-INDIA SERVICE AND O.A.S.-GROUP 'A' (S.B.) & ABOVE RANK OFFICERS IN ODISHA (48th EDITION) AS ON 01-06-2018 ISSUED BY GENERAL ADMINISTRATION & P.G. DEPARTMENT Available in http://www.odisha.gov.in/c a dre /Cadreli stleft.htm GOVERNMENT OF ODISHA GENERAL ADMINISTRATION & P.G. DEPARTMENT DISPOSITION OF ALL-INDIA SERVICE AND O.A.S.-GROUP 'A' (S.B.) & ABOVE RANK OFFICERS IN ODISHA CONTENTS PAGE I.A.S. Officers Cadre Schedule i-ii I.A.S. Officers 1–24 I.P.S. Officers Cadre Schedule 25–26 I.P.S. Officers 27–38 I.F.S. Officers Cadre Schedule 39–40 I.F.S. Officers 41–50 O.A.S. Officers Cadre Schedule 51–54 O.A.S. (Special Secretary) 55–56 O.A.S. (Superior Administrative Grade) Officers 57–64 O.A.S. (Super Timescale) Officers 65–78 O.A.S.-Group-'A' (S.B.) Officers 79–92 The contents of this edition should not be deemed to convey sanction or authority in the matter of any seniority, pay allowances, date of birth and the like. Any error or omission may kindly be brought to the notice of Principal Secretary to Government, General Administration & P.G. Department, Bhubaneswar with a view to its being corrected in the next edition. I.A.S. Officers I. A. S. OFFICERS CADRE SCHEDULE 1. Senior Duty Post under the State Government . 129 Chief Secretary to the Government and . 1 Chief Development Commissioner. Member, Board of Revenue . 1 Chief Administrator, KBK . -

University of Hyderabad PROSPECTUS

University of Hyderabad PROSPECTUS 2019-20 Online Registration Fee General Category : Rs. 550=00 EWS Category : Rs. 500=00 OBC Category : Rs. 350=00 SC/ST/PWD Category : Rs. 250=00 UNIVERSITY OF HYDERABAD (A Central University established by an Act of Parliament) Visitor The President of India Chief Rector The Governor of Telangana Chancellor Justice L. Narasimha Reddy Vice-Chancellor Prof. Appa Rao Podile University’s Official Address: The University of Hyderabad Prof. C. R. Rao Road, P.O. Central University, Gachibowli, Hyderabad 500 046, Telangana, (India) University’s EPABX: 040-2313 0000 University’s Website: http://www.uohyd.ac.in University of Hyderabad PROSPECTUS 2019-20 P.O. Central University Hyderabad – 500 046 Telangana India Admission Enquiries: Deputy Registrar (Acad. & Exams.) Tel. 040-2313 2102 Section Officer (Academic) Tel. 040-2313 2103 Email: [email protected] Fax: 040 2301 0292 Online Registration Fee General Category : Rs. 550=00 EWS Category : Rs. 500=00 OBC Category : Rs. 350=00 SC/ST/PWD Category : Rs. 250=00 Excellence in University System To introduce the element of excellence in the University system, the University Grants Commission had identified a few Universities and granted them the status of ‘Universities with Potential for Excellence’. Based on the evaluation and recommendations of a committee, the University Grants Commission declared the University of Hyderabad a ‘University with Potential for Excellence’. The University was sanctioned a grant of Rs.30 crore under UPE Phase – 1 under this scheme for Interfacial Studies & Research and Holistic Development for a period of 5 years (2002-2007) and Rs.50 crore under the Phase - 2 (2012-2016). -

Gk-Update-12Th-Sept-2019

GK Update 12 Sept, 2019 NATIONAL UPDATES: 1. Skill India gets its first Batch of IES officers to the ISDS cadre: The fresh batch of the newest central government services, the Indian Skill Development Services (ISDS) commenced their training program at the Administrative Training Institute (ATI) in Mysuru, Karnataka. These are the first batch which is joining the ISDS cadre from the Indian Engineering Service Examination conducted by UPSC. The aim for this is to attract young and talented administrators towards institutionalizing the Skill Development environment in the country. The induction of young talent as ISDS officers is one of the special initiatives taken by the Ministry of Skill Development and Entrepreneurship (MSDE) and the government as a whole, to significantly strengthen the skill development eco-system in the country. This is the first batch of young minds from Indian Engineering Services to be included in the MSDE. Note: Minister of State in the Ministry of Skill Development and Entrepreneurship: Raj Kumar Singh. 2. Haryana launches two insurance schemes for traders: The State government of Haryana has launched two insurance schemes for registered small and medium traders. The schemes includes “Mukhyamantri Vyapari Samuhik Niji Durghatna Beema Yojana” and “Mukhyamantri Vyapari Kshatipurti Beema Yojana“. An insurance cover of Rs 5 lakh would be provided under the Mukhyamantri Vyapari Samuhik Niji Durghatna Beema Yojana. An insurance cover ranging from Rs 5 lakh to Rs 25 lakh would be provided under the Mukhyamantri Vyapari Kshatipurti Beema Yojana. Traders registered under the Haryana Goods and Service Tax (HGST) Act, 2017 would be covered under these schemes. -

Wn 086 India Today Power List 2020 3 DU Alumni in Top 5 Pramod Kuma Mishra

www.alumni.du.ac.in / The University of Delhi Alumni eZine Edition Ten 2020 wn 086 India Today Power List 2020 : 3 DU alumni in Top 5 Number 1 Pramod Kumar Mishra IAS MA Eco DSchool Principal Secretary to the Prime Minister of India Prime Mover Because he is responsible for the appointment of bureaucrats, experts and politicians to positions in the administration. Because no Principal Secretary to the Prime Minister in recent years has handled roles as diverse as appointments to constituting alpix 0845A empowered groups like the 11 groups for managing Covid-19, and framing legislation like the recent agriculture laws. Because as a result of his diligence and understanding of bureaucracy and policy, he serves as the Prime Minister’s eyes and ears. He has been the PM’s principal helper in removing middlemen from all spheres of governance to ensure the fruits of development directly reach the poor. Disaster Expert : He is a leading disaster management expert. In May 2019, he was one of three winners of the United Nations’ Sasakawa Award, for improving the resilience of communities most exposed to floods and droughts. Shaktikanta Das IAS BA Hons MA His St Stephen’s Governor, Reserve Bank of India Firefighter Because he has been at the forefront of the effort to get India’s economy back on track, with the RBI announcing Rs 8 lakh crore worth of measures since March 2020. Because he chairs the RBI’s Monetary Policy Committee, which has cut the repo rate (the rate at which commercial banks borrow from the RBI) by a total of 115 basis points during the lockdown to increase Number 3 alpix 0841A liquidity in the economy. -

The India Cements Limited

THE INDIA CEMENTS LIMITED UNCLAIMED DIVIDEND FOR THE YEAR 2010-11 TO BE TRANSFERRED TO INVESTOR EDUCATION AND PROTECTION FUND AS REQUIRED UNDER SECTION 124 OF THE COMPANIES ACT 2013 READ WITH THE INVESTOR EDUCATION AND PROTECTION FUND AUTHORITY (ACCOUNTING, AUDIT, TRANSFER AND REFUND) RULES, 2016, AS AMENDED FOLIO / DPID_CLID NAME CITY PINCODE 1201040000010433 KUMAR KRISHNA LADE BHILAI 490006 1201060000057278 Bhausaheb Trimbak Pagar Nasik 422005 1201060000138625 Rakesh Dutt Panvel 410206 1201060000175241 JAI KISHAN MOHATA RAIPUR 492001 1201060000288167 G. VINOD KUMAR JAIN MANDYA 571401 1201060000297034 MALLAPPA LAGAMANNA METRI BELGAUM 591317 1201060000309971 VIDYACHAND RAMNARAYAN GILDA LATUR 413512 1201060000326174 LEELA K S UDUPI 576103 1201060000368107 RANA RIZVI MUZAFFARPUR 842001 1201060000372052 S KAILASH JAIN BELLARY 583102 1201060000405315 LAKHAN HIRALAL AGRAWAL JALNA 431203 1201060000437643 SHAKTI SHARAN SHUKLA BHADOHI 221401 1201060000449205 HARENDRASINH LALUBHA RANA LATHI 365430 1201060000460605 PARASHURAMAPPA A SHIMOGA 577201 1201060000466932 SHASHI KAPOOR BHAGALPUR 812001 1201060000472832 SHARAD GANESH KENI RATNAGIRI 415612 1201060000507881 NAYNA KESHAVLAL DAVE NALLASOPARA (E) 401209 1201060000549512 SANDEEP OMPRAKASH NEVATIA MAHAD 402301 1201060000555617 SYED QUAMBER HUSSAIN MUZAFFARPUR 842001 Page 1 of 301 FOLIO / DPID_CLID NAME CITY PINCODE 1201060000567221 PRASHANT RAMRAO KONDEBETTU BELGAUM 591201 1201060000599735 VANDANA MISHRA ALLAHABAD 211016 1201060000630654 SANGITA AGARWAL CUTTACK 753004 1201060000646546 SUBODH T -

09.09.2019 to 14.09.2019

www.mahendraguru.com 09.09.2019 to 14.09.2019 Write us @ [email protected] www.mahendraguru.com Qno.1 Who is appointed as the new Qno.10 In which city, the Union Managing Director of Microsoft Environment Minister addressed India? the 5th Convocation of the Forest Research Institute? Ans Rajiv Kumar Ans Dehradun Qno.2 Which of the following city ranks 5th in the 2019 Knight Frank Co- Qno.11 Which of the following bank Living Index? provide $200 million to upgrade rural roads in 34 districts of Ans Mumbai Maharashtra? Qno.3 Who has launched Kisan Man Ans Asian Development Bank Dhan Yojana in Ranchi, Jharkhand? Qno.12 What is the theme of International Literacy Day in Ans Shri Narendra Modi 2019? Qno.4 Who represented India in the 7th Ans Literacy and Multilingualism Regional Comprehensive Economic Partnership (RCEP) Qno.13 In which of the following cities, ministerial meeting? Swachh Mahotsav event 2019 was held? Ans Piyush Goyal Ans New Delhi Qno.5 In which country, the 7th Regional Comprehensive Qno.14 What amount will be infused by Economic Partnership (RCEP) Centre in state general insurance ministerial meeting held? firms? Ans Thailand Ans 12,000 crores Qno.6 How many billions, China Qno.15 Which of the following company invested in Pakistan development sells Global Village Tech Park for projects? 2,800 crore to Blackstone? Ans 1 billion Ans Coffee Day Qno.7 Recently, How many crore rupees Qno.16 Which of the following small approved for implementing the finance bank, declined the listing infrastructure projects identified deadline -

The Hindu Editorial Analysis 27 March 2019

THE HINDU EDITORIAL ANALYSIS 27 MARCH 2019 18 May 2019 Editorial by Vishal Sir Editorial by Vishal Sir THE HINDU EDITORIAL ANALYSIS The future belongs to those who believe in the beauty of their dreams THE HINDU EDITORIAL ANALYSIS Editorial by Vishal Sir THE HINDU EDITORIAL ANALYSIS Woes (noun) = Great sorrow or distress, troubles (संकट) Strip away (ph vb) = To gradually reduce something important or something that has existed for a long time Overseas (adj) = From, to, or relating to a foreign country, especially one across the sea (विदेशी) Contract (verb) = Decrease in size, number, or range (संकुवित) Slump (noun) = A sudden severe or prolonged fall in the price, value, or amount of something (मंदी) Insatiable (adj) = Impossible to satisfy, uncontrollable (लालिी) Becalmed (adj) = Unable to move through lack of wind Burgeon (verb) = Begin to grow or increase rapidly; flourish Editorial by Vishal Sir THE HINDU EDITORIAL ANALYSIS Coherence (noun) = The quality of being logical and consistent (अनुकूल होना) Traction (noun) = The action of drawing or pulling something over a surface Convene (verb) = Come or bring together for a meeting or activity; assemble (आयोजन) Imbibe (verb) = Absorb or assimilate (ideas or knowledge) (सोखना) Coherence (noun) = The quality of being logical and consistent (अनुकूल होना) Lurking (adj) = Remaining hidden so as to wait in ambush (विपा) Manifest (verb) = Be evidence of; prove (प्रकट करना) Editorial by Vishal Sir THE HINDU EDITORIAL ANALYSIS Title: External woes (Given the widening trade deficit, urgent measures are needed to boost exports) Context: The estimates for foreign trade showing a sharp slowdown in merchandise export growth in April, to 0.64% from a year earlier, ought to add to concerns about the economy. -

Prospectus 2017-18

University of Hyderabad PROSPECTUS 2017-18 Online Registration Fee General Category : Rs. 350=00 OBC Category : Rs. 250=00 SC/ST/PWD Category: Rs. 150=00 UNIVERSITY OF HYDERABAD (A Central University established by an Act of Parliament) Visitor The President of India Chief Rector The Governor of Telangana Chancellor Dr. C. Rangarajan Vice-Chancellor Prof. Appa Rao Podile University’s Official Address: The University of Hyderabad Prof. C. R. Rao Road, P.O. Central University, Gachibowli, Hyderabad 500 046, Telangana, (India) University’s Website: http://uohyd.ac.in University’s EPABX: 040-2313 0000 University’s Website: http://www.uohyd.ac.in/ University of Hyderabad Prospectus 2017-18 P.O. Central University Hyderabad – 500 046 Telangana, India Admission Enquiries: Joint Registrar (Acad. & Exams.) Tel. 040-2313 2102 Asst. Registrar (Academic) Tel. 040-2313 2103 Email: [email protected] Fax: 040 2301 0292 Online Registration Fee General Category : Rs. 350=00 OBC Category : Rs. 250=00 SC/ST/PWD Category: Rs. 150=00 Excellence in University System To introduce the element of excellence in the University system, the University Grants Commission had identified a few Universities and granted them the status of ‘Universities with Potential for Excellence’. Based on the evaluation and recommendations of a committee, the University Grants Commission declared the University of Hyderabad a ‘University with Potential for Excellence’. The University was sanctioned a grant of Rs.30 crore under UPE Phase – 1 under this scheme for Interfacial Studies & Research and Holistic Development for a period of 5 years (2002-2007) and Rs.50 crore under the Phase - 2 (2012-2016). -

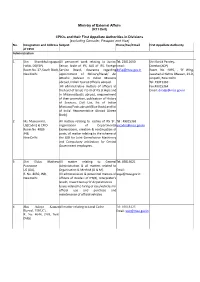

(RTI Cell) Cpios and Their First Appellate Authorities in Divisions

Ministry of External Affairs (RTI Cell) CPIOs and their First Appellate Authorities in Divisions [excluding Consular, Passport and Visa] No. Designation and Address Subject Phone/Fax/Email First Appellate Authority of CPIO Administration 1. Shri Shambhulingappa All personnel work relating to Junior, Tel: 23011650 Shri Kartik Pandey, Hakki, DS(FSP) Senior, Scale of IFS, JAG of IFS, Foreign Email: Director(ADP) Room No. 37, South Block, Service Board, clearance regarding [email protected] Room. No. 4095, , ‘B’ Wing, New Delhi appointment of Military/Naval/ Air Jawaharlal Nehru Bhawan, 23-D, Attache /Adviser in Indian Missions Janpath, New Delhi abroad, Indian Tourist Officers abroad. Tel: 49015363 All administrative matters of officers at Fax:49015364 the level of Grade I to IV of IFS at Hqrs and Email: [email protected] in Missions/posts abroad, empanelment of their promotion, publication of History of Services, Civil List, list of Indian Missions/Posts abroad (Blue Book) and list of India’ Representative Abroad (Green Book). 2 Ms. Manusmriti, All matters relating to cadres of IFS 'B' , Tel : 49015368 US(Cadre) & CPIO organisation of Departmental [email protected] Room No. 4086 Examinations, creation & continuation of JNB, posts, all matter relating to the scheme of New Delhi the GOI for Joint Consultative Machinery and Compulsory arbitration for Central Government employees. 3 Shri Eldos Mathew All matter relating to General Tel: 49016621 Punnoose Administration & all matters related to US (GA), Organisation & Method (O & M). Email:- R. No. 4050, JNB, All administrative & personnel matters of [email protected] New Delhi officers of Grade-I of IFS(B), Interpreter’s Grade, Inward Group ‘A’ deputationists. -

Orissa High Court Filing Report As on :06/01/2021

ORISSA HIGH COURT FILING REPORT AS ON :06/01/2021 SL FILING NO NAME OF PETNR./APPEL COUNSEL FOR PETNR./APPEL PS CASE/LOWER COURT CASE/DISTRICT 1 BLAPL/0000091/2021 LOKANATH SINGH S.K.MOHANTY SURADA /81 /2020 VS VS () STATE OF ODISHA // 2 BLAPL/0000092/2021 RAKESH DAS AMULYA RATNA PANDA BALASORE SADAR /271 /2020 VS VS () STATE OF ODISHA // 3 BLAPL/0000093/2021 AKSHAYA NAIK PARTHA SARATHI NAYAK BIKRAMPUR FCI /103 /2020 VS VS () STATE OF ODISHA // 4 BLAPL/0000094/2021 AJAY HARIJAN ANIRUDHA DAS DABUGAM /119 /2020 VS VS () STATE OF ODISHA // 5 BLAPL/0000095/2021 DEBASISH PRADHAN @ DEBASIS @ KANHA S.MOHAPATRA RUPSA /57 /2020 VS VS () STATE OF ODISHA // 6 BLAPL/0000096/2021 RADHA MOHAN MAHANA B.R.TRIPATHY RAYAGADA TOWN /390 /2020 VS VS () STATE OF ODISHA // 7 BLAPL/0000097/2021 SANJAYA KUMAR NAIK MOHENDRA KUMAR MOHAPATRO KORAPUT VIGILANCE /30 /2020 VS VS () STATE OF ODISHA(VIG.) // 8 BLAPL/0000098/2021 RANJAN KUMAR DAS PRAFULLA KUMAR RATH BALASORE VIGILANCE /1 /2021 VS VS () STATE OF ODISHA // 9 BLAPL/0000099/2021 QADIR KHAN @ FAIZ AHAMED @ ASHOK BIHARISUSHANTA @ RAJU KUMAR SAMANTARAY PARADEEP /180 /2016 VS VS () STATE OF ODISHA // 10 BLAPL/0000100/2021 NIBASH BEHERA @ MANTUA KASHINATH PATTNAIK MADHUPATNA /230 /2020 VS VS () STATE OF ODISHA // 11 BLAPL/0000101/2021 BAPI @ ARUN KUMAR PRADHAN DEBA KUMAR RATH NUAGAON /86 /2020 VS VS () STATE OF ODISHA // Page 1/28 ORISSA HIGH COURT FILING REPORT AS ON :06/01/2021 SL FILING NO NAME OF PETNR./APPEL COUNSEL FOR PETNR./APPEL PS CASE/LOWER COURT CASE/DISTRICT 12 BLAPL/0000102/2021 PRAMOD KUMAR RATH H.S.MISHRA SAMBALPUR VIGILANCE /38 /2020 VS VS () STATE OF ODISHA(VIG.) // 13 BLAPL/0000103/2021 CHAKRADHAR MALICK DR. -

List of Awardees of Police Medals for Meritorious Service

POLICE MEDAL FOR MERITORIOUS SERVICE INDEPENDENCE DAY-2016 ANDHRA PRADESH 1. SHRI KARIYAPPA JAGANNADHA REDDY,ADDITIONAL SUPERINTENDENT OF POLICE , HYDERABAD,ANDHRA PRADESH 2. SHRI DUDEKULA CHINNA HUSSAIN,ADDITIONAL SUPERINTENDENT OF POLICE,GUNTUR, ANDHRA PRADESH 3. SHRI BADIPALLI SREENIVASULU,SUB DIVISIONAL POLICE OFFICER,GUDUR,ANDHRA PRADESH 4. SHRI K. PRAKASH RAO,DEPUTY SUPERINTENDENT OF POLICE,NELLORE,ANDHRA PRADESH 5. SHRI G. RAJEEV KUMAR,ASSISTANT COMMISSIONER OF POLICE AIR PORT,VIJAYAWADA, ANDHRA PRADESH 6. SHRI V. GANESH BABU,ADDITIONAL COMMANDANT,HYDERABAD,ANDHRA PRADESH 7. SHRI T. POUL RAJ,RESERVE SUB INSPECTOR,VENKATAGIRI,ANDHRA PRADESH 8. SHRI KARANAM CHANDRASEKHAR PILLAI,SUB INSPECTOR ,TIRUPATHI,ANDHRA PRADESH 9. SHRI M. GIRINIVASA RAO,ARMED RESERVE SUB INSPECTOR,VIZIANAGARAM,ANDHRA PRADESH 10. SMT. M. SAROJA,WOMAN ASSISTANT SUB INSPECTOR,VIJAYAWADA,ANDHRA PRADESH 11. SHRI JABAPOLU RAMACHANDRAIAH,ARMED RESERVE SUB INSPECTOR,HYDERABAD, ANDHRA PRADESH 12. SHRI MERUGUMUVVALA DHANA-RAJU,ASSISTANT SUB INSPECTOR,GHAGALLU,ANDHRA PRADESH 13. SHRI CH. PAPA RAO,HEAD CONSTABLE,VIZIANAGARAM,ANDHRA PRADESH 14. SHRI RAMA KOTI NAIK,HEAD CONSTABLE,HYDERABAD,ANDHRA PRADESH ARUNACHAL PRADESH 15. SHRI APUR BITIN,DIGP,NAMSAI,ARUNACHAL PRADESH 16. SHRI TAB TECHI,DY. SP,ZIRO,ARUNACHAL PRADESH ASSAM 17. SHRI DURGA MOHAN BAISHYA ,SUPDT OF POLICE ,COMMUNICATION APRO, HQ, ASSAM, ULUBARI GUWAHATI-781007,ASSAM 18. SHRI ASWINI NARZARI,SUPDT OF POLICE,APRO ASSAM GUWAHATI,ASSAM 19. SHRI ANIL CHANDRA SARMAH,SUB INSPECTOR OF POLICE(UB),DHEMAJI ,ASSAM 20. SHRI TAHER UDDIN AHMED,SUB INSPECTOR (RM),APRO HEADQUARTERS GUWAHATI, ASSAM 21. SHRI KISHORE SINGH RAI,SUBINSPECTOR OF POLICE AB,1ST A.P BN, LIGIRIPUKHURI, NAZIRA-785685,ASSAM 1 22. SHRI PRAFULLA BORUAH ,ASSTT SUB INSPECTOR (OPR),SANKAR, TILLA BOP, DIPHU KARBI-ANGLONG, ASSAM,ASSAM 23. -

Weekly Updated Current Affairs for Week 37/(9-15-September) (2019)

WEEKLY UPDATED CURRENT AFFAIRS FOR WEEK 37/(9-15-SEPTEMBER) (2019) WEEKLY OBJECTIVE MULTIPLE CHOICE QUESTIONS ON CURRENT AFFAIRS: FOR WEEK 37/52 –9-15-September (2019) 1. Which among the following Union Territories will have a common high court? a) Ladakh and Chandigarh b) Jammu & Kashmir and Daman and Diu c) Jammu & Kashmir and Ladakh d) Jammu & Kashmir and Himachal Pradesh 2. India has announced one million dollar humanitarian aid to which nation? a) Bahamas b) Maldives c) Havana d) Cayman Islands 3. Which nation’s president announced recently that he has cancelled his secret meeting with the Taliban leaders and Afghanistan President? a) Russia b) United States c) Pakistan d) France 4. Ram Jethmalani, one of India’s most renowned and respected criminal lawyers, passed away at the age of 95 on September 8, 2019. Jethmalani had not fought in which among the following cases? a) Ajmal Kasab death penalty case b) Indira Gandhi Assassination case c) Rajiv Gandhi assassination case d) Jessica Lall case 5. The Asian Development Bank (ADB) and Indian Government signed USD 200 million loan agreement to upgrade rural roads in which State? a) Rajasthan b) Maharashtra c) Gujarat d) Bihar 6. Which city hosted the ‘ANGAN’, an international Conference on Energy Efficiency in Building Sector? a) Mumbai b) New Delhi c) Gurugram d) Chandigarh 7. Which of the following personalities has been bestowed with the 2019 Ramon Magsaysay Award? a) Ravish Kumar b) Kiran Bedi c) Arvind Kejriwal d) Arnab Goswami 8. What is the name of the book based on the speeches of President Ramnath Kovind, whose second edition was recently released by the Vice President? a) SanskritiKeSath b) LoktantraKeSwar c) Desh Ki Pehchan d) SamajAurSanskar 9.