EUROCAR GROUP Global Factors That Determine the Low Cost Production

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Business Herald International Law&Business Business New S in T E R

1 digest nationaL economic reLations Law&business business news internationaL ter n i s w e n s s e n i s u b s s e n i s u b & w a E L C STRY U ND I CHAMBER COMMER OF AND UKRAINIAN INTERNATIONAL BUSINESS HERALD business news ing for the new markets, the Klei UKRAINE AND SAUDI ARABIA struction cost is estimated at 700-800 Adhesive Machinery implements the WILL JOINTLY CONSTRUCT AIR- mln dollars. international quality standards, ISO PLANES The Ukrlandfarming structure 9001 including, and develops pro- includes 111 horizontal grain storage duction. «Taqnia Aeronotics», a daughter facilities, 6 seed plants, 6 enimal feed entity of the Saudi company for de- plants, 6 sugar plants and 2 leather The main field of the company activity – supply of hi-tech equipment velopment and investments and «An- producing plants as well as an egg to glue various materials. The com- tonov» State company have signed products plant «Imperovo Foods», 19 pany designers develop machines the agreement on development and poultry-breeding plants, 9 hen farms, according to the client requirements production of the light transport plane 3 poultry farms, 3 selection breeding and their high-class specialists ma- An- 132 in Saudi Arabia. The main farms, 3 long-term storage facilities terialize their ideas in metal. That’s goal of the agreement is to fulfill a and 19 meat-processing plants. number of tasks in aviation construc- why the company machines meet tion and technology transfer to Saudi the world requirements. But they are Arabia as well as to train Saudi per- much cheaper. -

European Business Club

ASSOCIATION АССОЦИАЦИЯ OF EUROPEAN BUSINESSES ЕВРОПЕЙСКОГО БИЗНЕСА РОССИЙСКАЯ ФЕДЕРАЦИЯ, RUSSIAN FEDERATION 127473 Москва ул. Краснопролетарская, д. 16 стр. 3 Ulitsa Krasnoproletarskaya 16, bld. 3, Moscow, 127473 Тел. +7 495 234 2764 Факс +7 495 234 2807 Tel +7 495 234 2764 Fax +7 495 234 2807 [email protected] http://www.aebrus.ru [email protected] http://www.aebrus.ru 12th May, 2012 Moscow PRESS RELEASE The Year Continues Strong for New Cars and Light Commercial Vehicles in Russia • Sales of new passenger cars and LCVs in Russia increased by 14% in April, 2012 • Among the top ten bestselling models so far, ten are locally produced According to the AEB Automobile Manufacturers Committee (AEB AMC), April, 2012 saw the sales of new cars and light commercial vehicles in Russia increase by 14% in comparison to the same period in 2011. This April, 266,267 units were sold; this is 33,189 units more than in April, 2011. From January to April, 2012 the percentage sales of new cars and light commercial vehicles in Russia increased by 18% in comparison to the same period in 2011 or by 135,066 more sold units. David Thomas, Chairman of the AEB Automobile Manufacturers Committee commented: "The solid growth of the Russian automotive market continues into the second quarter. Although the pace of the year on year growth is stabilising to less than 15% in recent months, we still feel that the AEB full year forecast for passenger cars and light commercial vehicles should be increased by 50,000 units to 2.85 mln." -------------------------------------------------------------- Attachments: 1. -

Automotive Market in Russia and the CIS Industry Overview February 2010 Contents

Automotive market in Russia and the CIS Industry overview February 2010 Contents Opening statement .............................................................................. 1 Russian economy ..................................................................................2 Russian automotive market in a global context ...................................... 4 Russian automotive industry ................................................................ 6 Light vehicle market ............................................................................. 7 Commercial vehicle (CV) market ......................................................... 10 Automotive components market ..........................................................11 Passenger car loan market .................................................................. 12 Dealership networks ........................................................................... 13 Automotive logistics ........................................................................... 14 CIS automotive markets ...................................................................... 15 Ukraine ......................................................................................... 15 Kazakhstan ................................................................................... 16 Belarus ......................................................................................... 17 Uzbekistan .................................................................................... 18 Ernst & Young’s involvement -

2 General Description of the Russian-Made Vehicle Fleet

;-.. ; : s -- 0--21297 .4 { Public Disclosure Authorized VehicleFle'et Public Disclosure Authorized Characterizationin CentralAsia and, the Caucasus Public Disclosure Authorized Reportfor the RegionalStudy on: CleanerTransportation FuelIs for UrbanAir QualityImprovement Public Disclosure Authorized inCentralAsia -and the Caucasus Vehicle Fleet Characterization in Central Asia and the Caucasus Report for the Regional Study on: Cleaner Transportation Fuels for Urban Air Quality Improvement in Central Asia and the Caucasus Canadian International Development Agency Joint UNDPlWorld Bank Energy Sector ManagementAssistance Programme (ESMAP) Contents Acknowledgments ............................................... vii Abbreviations and Acronyms ............................................... ix Executive Summary ............................................... xi Vehicle Technology in Central Asia and the Caucasus........................................ xii Fleet Octane Requirements ........................................ xiii Inspection and Maintenance Programs ........................................ xiv Uzbekistan's Natural Gas Conversion Program ........................................ xvi Conclusions and Recommendations ....................................... xvii 1 Introduction ................................................ 1 1.1 Objectives .1 1.2 Background .2 Impact of Fuel on Vehicle Emissions .2 Long Range Effects of Emissions .2 Climate Change and Greenhouse Gases .2 Impact of Fuel on Vehicle Technology. 3 1.3 Study Methodology.3 -

Project Document

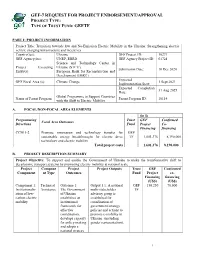

GEF-7 REQUEST FOR PROJECT ENDORSEMENT/APPROVAL PROJECT TYPE: TYPE OF TRUST FUND: GEFTF PART I: PROJECT INFORMATION Project Title: Transition towards low and No-Emission Electric Mobility in the Ukraine: Strengthening electric vehicle charging infrastructure and incentives Country(ies): Ukraine GEF Project ID: 10271 GEF Agency(ies): UNEP, EBRD GEF Agency Project ID: 01724 Science and Technology Center in Project Executing Ukraine (STCU), Submission Date: 10 Dec 2020 Entity(s): European Bank for Reconstruction and Development (EBRD) Expected GEF Focal Area (s): Climate Change 1 Sept 2021 Implementation Start: Expected Completion 31 Aug 2025 Date: Global Programme to Support Countries Name of Parent Program Parent Program ID: 10114 with the Shift to Electric Mobility A. FOCAL/NON-FOCAL AREA ELEMENTS (in $) Programming Trust GEF Confirmed Focal Area Outcomes Directions Fund Project Co- Financing financing CCM 1-2 Promote innovation and technology transfer for GEF sustainable energy breakthroughs for electric drive TF 1,601,376 8,190,000 technology and electric mobility Total project costs 1,601,376 8,190,000 B. PROJECT DESCRIPTION SUMMARY Project Objective: To support and enable the Government of Ukraine to make the transformative shift to decarbonize transport systems by promoting electric mobility at national scale Project Compone Project Project Outputs Trust GEF Confirmed Component nt Type Outcomes Fund Project co- Financing financing (US$) (US$) Component 1: Technical Outcome 1: Output 1.1: A national GEF 150,250 70,000 Institutionaliz Assistance The Government multi-stakeholder TF ation of low- of Ukraine advisory group is carbon electric establishes an established for mobility institutional coordination of framework for government strategy, effective policies and actions to coordination, promote e-mobility in develops capacity Ukraine. -

December 2013 Publication of LUKOIL Lubricants Company

Publication of LUKOIL Lubricants Company December 2013 (LLK-International) New Year is a holiday longed for by perhaps all people on Earth. Let the New Year give you belief that it will be a year of new achievements, successes and fulfilments! Be healthy and happy. I wish you a festive spirit! LUKOIL President V. Yu. Alekperov LUKOIL Chairman G. M. Kiradiev CONTENTS 2 HAPPY NEW YEAR! 6 3 FORUM Moscow International Lubricants Week 2013 6 CORPORATE AFFAIRS LUKOIL brand is synonymous with carefully calibrated and effective movement forward 8 PARTNERSHIP Breakthrough in Ukraine 12 10 Northern supply lines 12 LUKOIL lubricants in Georgia 14 LUKOIL lubes for key clients in Romania and Macedonia 16 LUKOIL starts producing lubes in Austria 16 18 Road to China 20 NEWS 20 «МАСЛА@ЛУКОЙЛ» #4 December 2013 "Масла@ЛУКОЙЛ" is a publication of LLK-International Publisher: RPI Address: LLK-International, 6 Malaya Yakimanka, Moscow 119180 Phone: +7 (495) 980 39 12 e-mail: [email protected] Press run: 2,000 The magazine is registered by the Federal Service for Media Law Compliance and Cultural Heritage. Registration certificate ПИ №ФС77-28009 1 Dear Colleagues, Dear friends! t’s a tradition that before New In 2013, we continued supplies IYear we summarize the outgo- to AVTOTOR Company as LUKOIL ing year, thoroughly weigh past de- GENESIS engine oils became the velopments and ask ourselves what first fill lubricants for Opel and has been done. Was it done well? Chevrolet, while LUKOIL gear oils Effectively? How can we improve our became the first fill oils for engines performance? of Hyundai trucks and KIA cars. -

Guide to Assembly Plants in Europe

Guide to assembly plants in Europe station wagon, S-class sedan and B Lieu Saint-Amand, France (Sevel 3 Ruesselsheim, Germany – hybrid, CL, CLS, SLS AMG; Nord: Fiat 50%, PSA 50%) – Opel/Vauxhall Insignia, KEY Maybach (ends 2013) Citroen C8, Jumpy/Dispatch; Fiat Opel/Vauxhall Astra 5 Ludwigsfelde, Germany – Mercedes Scudo, Scudo Panorama; Peugeot 4 Luton, UK – Opel/Vauxhall Vivaro; BMW GROUP Sprinter 807, Expert Renault Trafic II; Nissan Primastar (See also 2 , 20 ) 6 Hambach, France – Smart ForTwo; 5 Ellesmere Port, UK – Opel/Vauxhall 1 Dingolfing, Germany – BMW ForTwo Electric FORD Astra, AstraVan 5-series sedan, station wagon, M5 7 Vitoria, Spain – Mercedes Viano, (See also 7 ) 6 Zaragoza, Spain – Opel/Vauxhall station wagon, 5-series Gran Vito 1 Southampton, UK – Ford Transit Corsa, CorsaVan, Meriva, Combo Turismo, 6-series coupe, 8 Kecskemet, Hungary – Next 2 Cologne, Germany – Ford Fiesta, 7 Gliwice, Poland – Opel/Vauxhall convertible, M6 coupe, convertible, Mercedes A and B class Fusion Astra Classic and Notchback, Zafira 7-series sedan 3 Saarlouis, Germany – Ford Focus, 8 St. Petersburg, Russia – Chevrolet 2 Leipzig, Germany – BMW 1-series FIAT GROUP Focus ST, Focus Electric (2012) Captiva, Cruze; Opel Antara, Astra (3 door), coupe, convertible, i3 AUTOMOBILES first-generation Kuga A Togliatti, Russia (GM and AvtoVAZ (2013), i8 (2014), X1 (See also 33 , 34 , 35 , 45 ) 4 Genk, Belgium – Ford Mondeo, joint venture) – Chevrolet Niva, Viva 3 Munich, Germany – BMW 3-series 1 Cassino, Italy – Alfa Romeo Galaxy, S-Max sedan, station wagon -

Marca Modelo Año De Producción Lado Conductor Lado Copiloto

530 U 3397004584 Jul. 2020 Para aplicaciones individuales: Marca Modelo Año de Lado Lado copiloto Observaciones producción conductor ACURA MDX 09.06-> 650 U ✓ ALFA ROMEO 155 [167] 02.92-04.96 ✓ 480 U Bosch, sólo como producto de substitución para el equipo Bosch ALFA ROMEO 164 [164] 06.87-12.98 530 US ✓ ALFA ROMEO 164 [164] 06.87-12.98 ✓ ✓ ALFA ROMEO 166 [936] 07.98-10.07 ✓ 480 U Bosch, sólo como producto de substitución para el equipo Bosch ASTON MARTIN Cygnet 04.11-10.13 ✓ 450 U AUDI 80 [8C2;B4] 09.91-05.95 530 US ✓ AUDI 80 [8C2;B4] 09.91-05.95 ✓ ✓ AUDI 80 Avant [8C5;B4] 03.92-07.95 530 US ✓ AUDI 80 Avant [8C5;B4] 03.92-07.95 ✓ ✓ AUDI A3 [8L1] 09.96-06.03 ✓ 450 U Recto AUDI A4 [8D2;B5] 11.94-09.01 ✓ 500 U AUDI A4 [8E2;B6] 10.00-03.01 530 US ✓ AUDI A4 [8E2;B6] 10.00-03.01 ✓ ✓ AUDI A4 Avant [8D5;B5] 11.94-09.01 ✓ 500 U AUDI A6 Avant Allroad 05.00-12.00 550 US ✓ [4BH;C5] AUDI A6 Avant Allroad 05.00-12.00 550 U ✓ [4BH;C5] AUDI RS4 Avant [8D5;B5] 05.00-09.01 ✓ ✓ AUDI RS4 Avant [8D5;B5] 05.00-09.01 530 US ✓ AUDI RS6 [4B4] 07.02-04.04 550 US ✓ AUDI RS6 [4B4] 07.02-04.04 550 U ✓ AUDI RS6 Avant [4B6] 05.02-09.04 550 US ✓ AUDI RS6 Avant [4B6] 05.02-09.04 550 U ✓ AUDI S3 [8L1] 08.98-06.03 ✓ 480 U Recto AUDI S4 [8D2;B5] 10.97-09.01 530 US ✓ AUDI S4 [8D2;B5] 10.97-09.01 ✓ ✓ Robert Bosch GmbH Automotive Aftermarket Auf der Breit 4 76227 Karlsruhe Germany 2 | 13 AUDI S4 Avant [8D5;B5] 10.97-09.01 ✓ ✓ AUDI S4 Avant [8D5;B5] 10.97-09.01 530 US ✓ AUDI S6 [4B;C5] 09.99-05.04 550 U ✓ AUDI S6 [4B;C5] 09.99-05.04 550 US ✓ AUDI S6 Avant [4B;C5] 09.99-01.05 -

LUKOIL Intends to Expand Extensively Its Presence in the Synthetic Oil Market

JANUARY 2016 PUBLICATION OF LUKOIL LUBRICANTS COMPANY (LLK-INTERNATIONAL) LLK-INTERNATIONAL GENERAL DIRECTOR MAXIM DONDE: PAGE 2 „LUKOIL intends to expand extensively its presence in the synthetic oil market. This segment is the future of our business.“ CONTENTS 2 INTERVIEW Аlways Moving Forward LLK-International General Director Maxim Donde sums up the Company's performance in 2015 2 6 CORPORATE AFFAIRS Energetic Expansion in All Directions The heads of LLK-International's foreign subsidiaries speak about their companies' achievements and plans for 2016 13 CORPORATE AFFAIRS LUKOIL Recognized as Innovation Company of the Year in Maritime Shipping Our colleagues win a prestigious award for developing 6 high technology marine lubricants 14 PARTNERSHIP Setting Up Industry Standards LUKOIL becomes the first company in the world to receive the approval of Mercedes-Benz for 0W-30 engine oil for trucks 15 MARKETS LLK-International Prepares Ground for Breakthrough in China 13 The Company starts building its own dealer network in the world's most populated country 18 PARTNERSHIP Renault Russia Picks LUKOIL GENESIS for Its Motrio Brand LLK-International enters another cooperation deal with a leading global car manufacturer 19 FORUM 15 The Year of Opportunities Our coverage of the 11th Moscow International Lubricants Week 23 PRODUCT LUKOIL Motor Oil, Gasoline Stations Recognized as № 1 National Brands in Russia Participants in a nationwide poll recognize LUKOIL's excellence "МАСЛА@ЛУКОЙЛ" in lubricants production and marketing January 2016 "МАСЛА@ЛУКОЙЛ" is a publication of LLK-International 24 CORPORATE AFFAIRS Publisher: RPI Appointments Address: LLK-International, 6 Malaya Yakimanka, Moscow 119180 The latest key staff moves in Turkey and Ukraine Phone: +7 (495) 980 39 12 e-mail: [email protected] Press run: 2,000 The magazine is registered by the Federal Service for Media Law Compliance and Cultural Heritage. -

New Number Announcement December 2019

New Number Announcement December 2019 Field Product Number Part Number Article Group PC/HD Make Bulletin 4275-21991 02-1991 Molded Heater Hose PC BMW 12/2019 4275-21992 02-1992 Molded Heater Hose PC JAGUAR 12/2019 4275-21993 02-1993 Molded Heater Hose PC LAND ROVER 12/2019 4275-21994 02-1994 Molded Heater Hose PC LAND ROVER 12/2019 4275-21995 02-1995 Molded Heater Hose PC LAND ROVER 12/2019 4275-21996 02-1996 Molded Heater Hose PC LAND ROVER 12/2019 4275-21997 02-1997 Molded Heater Hose PC LAND ROVER 12/2019 4275-21998 02-1998 Molded Heater Hose PC LAND ROVER 12/2019 4275-21999 02-1999 Molded Heater Hose PC LAND ROVER 12/2019 4275-22000 02-2000 Molded Heater Hose PC LAND ROVER 12/2019 4275-22001 02-2001 Molded Heater Hose PC LAND ROVER 12/2019 4275-22002 02-2002 Molded Heater Hose PC LAND ROVER 12/2019 4275-22007 02-2007 Molded Heater Hose PC OPEL, VAUXHALL 12/2019 4275-22011 02-2011 Molded Heater Hose PC VOLVO 12/2019 4275-22062 02-2062 Molded Heater Hose PC BMW 12/2019 4275-22141 02-2141 Molded Heater Hose PC LAND ROVER 12/2019 4275-22147 02-2147 Molded Heater Hose PC LAND ROVER 12/2019 4275-22401 02-2401 Molded Heater Hose PC FIAT 12/2019 4275-22402 02-2402 Molded Heater Hose PC FIAT 12/2019 4275-22403 02-2403 Molded Heater Hose PC FIAT 12/2019 4275-22404 02-2404 Molded Heater Hose PC FIAT 12/2019 4275-22405 02-2405 Molded Heater Hose PC RENAULT 12/2019 4275-22406 02-2406 Molded Heater Hose PC RENAULT 12/2019 4275-22407 02-2407 Molded Heater Hose PC RENAULT 12/2019 4275-22408 02-2408 Molded Heater Hose PC RENAULT 12/2019 4275-22409 -

Guide to Assembly Plants in Europe

AN_071112_16_17.qxd 3/13/08 4:11 PM Page 16 PAGE 16 · www.autonew seurope.com November 12, 2007 Guide to assembly plants in Europe BMW GROUP A San Benedetto Val di Sangro, Italy (Sevel Sud: Fiat 50%, (2008). Note: GM has temporary plant on site until 4 Flins, France – Renault Clio III, Clio II (See also 3 , 25 ) PSA 50%) – Citroen Jumper/Relay; Fiat Ducato; permanent plant opens in 2008. 5 Maubeuge, France – Passenger cars: Kangoo, new 1 Dingolfing, Germany – BMW 5-series sedan, station Peugeot Boxer 11 Asaka, Uzbekistan (UzDaewoo: joint venture of GM, Kangoo; LCV: new Kangoo Express, new Kangoo Express wagon, 6-series coupe, convertible, 7-series sedan, B Lieu Saint-Amand, France (Sevel Nord: Fiat 50%, PSA GM Daewoo and Uzautosanoat) – Daewoo Tico, Matiz, Compact; Nissan Kubistar M5 sedan, station wagon, M6 coupe, convertible 50%) – Citroen Atlante/C8, Dispatch/Jumpy; Fiat Scudo, Damas, Nexia, Lacetti; (from kits** starting in 2008) 6 Sandouville, France – Renault Laguna III Sport Tourer and 2 Leipzig, Germany – BMW 1-series 3 door, coupe, Scudo Panorama, Ulysse; Lancia Phedra; Peugeot 807, Chevrolet Epica, Tacuma, Captiva hatchback, Espace IV, Vel Satis convertible, 3-series sedan Expert, TePee A Togliatti, Russia (joint venture of GM and AvtoVAZ) – 7 Palencia, Spain – Renault Megane II hatchback, sport 3 Munich, Germany – BMW 3-series sedan, station wagon Chevrolet Niva, Viva; Opel car (2008) hatch, sport station wagon 4 Regensburg, Germany – BMW 1-series 5 door, 3-series FORD B Warsaw, Poland (FSO: UkrAvto 60%, GM Daewoo 40%) – 8 Valladolid, -

271 Chapter 3 Ukraine

KYIV CHERNIGIV AVTOLOGISTIKA LTD. ETALON NIKO GROUP/UKRAINIAN TERMINAL LUTSK Sumy BOGDAN Rivné BORYSPIL UKRAINE KALYNIVKA ETALON Kharkiv BLG VIDI LOGISTICS Poltava CHERKASY CHERKASSY BUS KREMENCHUG AUTOKRAZ Luhansk KYIV CHERNIGIV SOLOMONOVO AVTOLOGISTIKA LTD. ETALON CHASIV YAR ŠKODA NIKO GROUP/UKRAINIAN TERMINAL LUTSK Sumy CHASIV YAR BUSES Donetsk BOGDAN Rivné BORYSPIL Kryvyï Rih KALYNIVKA ETALON ZAPORIZHIA Kharkiv BLG VIDI LOGISTICS UKRAVTO Poltava CHERKASY Mylolaiv CHERKASSY BUS KREMENCHUG CHORNOMORSK Odessa AUTOKRAZ Luhansk SOLOMONOVO AVTOLOGISTIKA LTD. CHASIV YAR ŠKODA PORT CHORNOMORSK CHASIV YAR BUSES Donetsk Kryvyï Rih ZAPORIZHIA ' Simferopol UKRAVTO Mylolaiv Sevastopol PORT Compounds CHORNOMORSK Odessa INLAND Compounds AVTOLOGISTIKA LTD. CAR Production Sites PORT CHORNOMORSK TRUCK Production Sites H&H Production Sites Simferopol' Sevastopol PORT Compounds INLAND Compounds CHAPTER 3 CARPORT Production COMPOUNDS Sites (A) OperatorTRUCK Production SitesCity Rail connection Storage capacity (sqm) Workshop (sqm) Services provided AVTOLOGISTIKA LTD CHORNOMORSK YES 10,000 1,600 1, 2, 3, 4, 5 H&H Production Sites PORT CHORNOMORSK CHORNOMORSK YES n/a n/a (A) 1 = Storage 2 = Pre-Delivery-Inspection (PDI) 3 = Mechanical/Technical Services 4 = Refurbishment 5 = Paintye INLAND COMPOUNDS Operator City Rail connection Storage capacity (sqm) Workshop (sqm) Services provided (A) AVTOLOGISTIKA LTD PYLYPOVYCHI (KYIV) NO 300,000 4,500 1, 2, 3, 4, 5 BLG VIDI LOGISTICS KALYNIVKA NO 66,000 500 1, 2 NIKO GROUP/ VISHNIEIVY (KYIV) Not an ECG member at the time of going to press UKRAINIAN TERMINAL (A) 1 = Storage 2 = Pre-Delivery-Inspection (PDI) 3 = Mechanical/Technical Services 4 = Refurbishment 5 = Paint CAR PRODUCTION SITES Group Site Brand Model UKRAVTO ZAPOROZHIA ZAZ ZAZ Lanos, ZAZ Sens, ZAZ Forza, ZAZ VIDA, ZAZ Lanos pick up SKODA SOLOMONOVO ŠKODA Skoda Fabia, Octavia, Rapid, Superb, Yeti, Spaceback TRUCK PRODUCTION SITES Group Site Brand Model AUTOKRAZ KREMENCHUG Kraz n/a 271.