First Capital Front.Indd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Target Finalizes Real Estate Transaction with Selection of 84 Additional Zellers Leases

FOR IMMEDIATE RELEASE Contacts: Amy Reilly, Target Communications, (612) 761-6782 Target Media Hotline, (612) 696-3400 John Hulbert, Investor Relations, (612) 761-6627 Target Finalizes Real Estate Transaction with Selection of 84 Additional Zellers Leases MINNEAPOLIS (Sept. 23, 2011) — Target Corporation (NYSE: TGT) is pleased to announce today that it has finalized its real estate transaction with Zellers Inc. with the selection of 84 additional Zellers leases, bringing the total number of leases selected, including an initial group of 105 leases selected in May, to 189. From this second group, Target has acquired the leasehold interests for 29 locations, the vast majority of which will open as Target stores beginning in 2013. The remaining leases have been or will be sold to other Canadian retailers or back to landlords. “Target is excited to take another meaningful step toward our expansion in Canada,” said Tony Fisher, president, Target Canada. “We look forward to delivering a superior shopping experience for our guests throughout Canada and building on our strong reputation as a good neighbor and partner in the communities in which we do business.” Target announced in January that it would purchase, for C$1.825 billion, the leasehold interests of up to 220 sites currently operated by Zellers Inc., a subsidiary of Hudson’s Bay Company. In May, Target selected an initial group of 105 leases, spanning all 10 provinces, in conjunction with its first payment to Zellers Inc. The vast majority of those sites will become Target stores beginning in 2013. The 84 leases announced today are part of Target’s second and final selection, and include the 39 leases for which Target transferred the rights to Walmart, as announced in June. -

Rethinking Toronto's Middle Landscape: Spaces of Planning, Contestation, and Negotiation Robert Scott Fiedler a Dissertation S

RETHINKING TORONTO’S MIDDLE LANDSCAPE: SPACES OF PLANNING, CONTESTATION, AND NEGOTIATION ROBERT SCOTT FIEDLER A DISSERTATION SUBMITTED TO THE FACULTY OF GRADUATE STUDIES IN PARTIAL FULFILMENT OF THE REQUIREMENTS FOR THE DEGREE OF DOCTOR OF PHILOSOPHY GRADUATE PROGRAM IN GEOGRAPHY YORK UNIVERSITY TORONTO, ONTARIO May 2017 © Robert Scott Fiedler, 2017 Abstract This dissertation weaves together an examination of the concept and meanings of suburb and suburban, historical geographies of suburbs and suburbanization, and a detailed focus on Scarborough as a suburban space within Toronto in order to better understand postwar suburbanization and suburban change as it played out in a specific metropolitan context and locale. With Canada and the United States now thought to be suburban nations, critical suburban histories and studies of suburban problems are an important contribution to urbanistic discourse and human geographical scholarship. Though suburbanization is a global phenomenon and suburbs have a much longer history, the vast scale and explosive pace of suburban development after the Second World War has a powerful influence on how “suburb” and “suburban” are represented and understood. One powerful socio-spatial imaginary is evident in discourses on planning and politics in Toronto: the city-suburb or urban-suburban divide. An important contribution of this dissertation is to trace out how the city-suburban divide and meanings attached to “city” and “suburb” have been integral to the planning and politics that have shaped and continue to shape Scarborough and Toronto. The research employs an investigative approach influenced by Michel Foucault’s critical and effective histories and Bent Flyvbjerg’s methodological guidelines for phronetic social science. -

Traffic Control Signals As of July 4, 2017 Traffic Control Signals TCS# Main Midblock Side 1 Route Side 2 Route Add

TCS - Listing of Traffic Control Signals as of July 4, 2017 Traffic Control Signals TCS# Main Midblock Side 1 Route Side 2 Route Add. Info. Private Access District Cabinet Controller Model System SCOOT No. MOC FDW APS WRM PE_TP PE_FH PE_RL MTO LED PCS 0002 JARVIS ST FRONT ST E LOWER TORONTO AND EAST YORK TS2 Type1 PEEK ATC - 1000 TransSuite FXT Yes No No No No No No Yes Yes 0003 KING ST E JARVIS ST TORONTO AND EAST YORK TS2 Type1 PEEK ATC - 1000 TransSuite FXT Yes No No Yes No No No Yes Yes 0004 JARVIS ST ADELAIDE ST E TORONTO AND EAST YORK TS2 Type1 ECONOLITE ASC/3 - 2100 TransSuite FXT Yes No No No No No No Yes Yes 0005 JARVIS ST RICHMOND ST E TORONTO AND EAST YORK TS2 Type1 ECONOLITE ASC/3 - 2100 TransSuite FXT Yes No No No No No No Yes Yes 0006 JARVIS ST QUEEN ST E TORONTO AND EAST YORK TS2 Type1 ECONOLITE ASC/3 - 2100 TransSuite FXT Yes No No No No No No Yes Yes 0007 JARVIS ST SHUTER ST TORONTO AND EAST YORK TS2 Type1 ECONOLITE ASC/3 - 2100 TransSuite FXT Yes No No No No No No Yes Yes 0008 JARVIS ST DUNDAS ST E TORONTO AND EAST YORK TS2 Type1 PEEK ATC - 1000 TransSuite FXT Yes Yes No No No No No Yes Yes 0009 JARVIS ST GERRARD ST E TORONTO AND EAST YORK TS2 Type1 ECONOLITE ASC/3 - 2100 TransSuite FXT Yes No No No No No No Yes Yes 0010 JARVIS ST CARLTON ST TORONTO AND EAST YORK TS2 Type1 ECONOLITE ASC/3 - 2100 TransSuite FXT Yes Yes No No No No No Yes Yes 0011 JARVIS ST WELLESLEY ST E TORONTO AND EAST YORK CA NOVAX 18 CCT SCOOT 23311 FXT Yes No No No No No No Yes Yes 0012 JARVIS ST ISABELLA ST TORONTO AND EAST YORK CA LS 180 SCOOT 23421 -

923466Magazine1final

www.globalvillagefestival.ca Global Village Festival 2015 Publisher: Silk Road Publishing Founder: Steve Moghadam General Manager: Elly Achack Production Manager: Bahareh Nouri Team: Mike Mahmoudian, Sheri Chahidi, Parviz Achak, Eva Okati, Alexander Fairlie Jennifer Berry, Tony Berry Phone: 416-500-0007 Email: offi[email protected] Web: www.GlobalVillageFestival.ca Front Cover Photo Credit: © Kone | Dreamstime.com - Toronto Skyline At Night Photo Contents 08 Greater Toronto Area 49 Recreation in Toronto 78 Toronto sports 11 History of Toronto 51 Transportation in Toronto 88 List of sports teams in Toronto 16 Municipal government of Toronto 56 Public transportation in Toronto 90 List of museums in Toronto 19 Geography of Toronto 58 Economy of Toronto 92 Hotels in Toronto 22 History of neighbourhoods in Toronto 61 Toronto Purchase 94 List of neighbourhoods in Toronto 26 Demographics of Toronto 62 Public services in Toronto 97 List of Toronto parks 31 Architecture of Toronto 63 Lake Ontario 99 List of shopping malls in Toronto 36 Culture in Toronto 67 York, Upper Canada 42 Tourism in Toronto 71 Sister cities of Toronto 45 Education in Toronto 73 Annual events in Toronto 48 Health in Toronto 74 Media in Toronto 3 www.globalvillagefestival.ca The Hon. Yonah Martin SENATE SÉNAT L’hon Yonah Martin CANADA August 2015 The Senate of Canada Le Sénat du Canada Ottawa, Ontario Ottawa, Ontario K1A 0A4 K1A 0A4 August 8, 2015 Greetings from the Honourable Yonah Martin Greetings from Senator Victor Oh On behalf of the Senate of Canada, sincere greetings to all of the organizers and participants of the I am pleased to extend my warmest greetings to everyone attending the 2015 North York 2015 North York Festival. -

CO. LIMITED, MINISO LIFESTYLE CANADA INC., MIHK MANAGEMENT INC., MINISO TRADING CANADA INC., MINISO CORPORATION and GUANGDONG SAIMAN INVESTMENT CO

No. S197744 Vancouver Registry IN THE SUPREME COURT OF BRITISH COLUMBIA IN THE MATTER OF THE COMPANIES' CREDITORS ARRANGEMENT ACT, R.S.C. 1985, c. C-36, AS AMENDED BETWEEN: MINISO INTERNATIONAL HONG KONG LIMITED, MINISO INTERNATIONAL (GUANGZHOU) CO. LIMITED, MINISO LIFESTYLE CANADA INC., MIHK MANAGEMENT INC., MINISO TRADING CANADA INC., MINISO CORPORATION and GUANGDONG SAIMAN INVESTMENT CO. LIMITED PETITIONERS AND: MIGU INVESTMENTS INC., MINISO CANADA INVESTMENTS INC., MINISO (CANADA) STORE INC., MINISO (CANADA) STORE ONE INC., MINISO (CANADA) STORE TWO INC., MINISO (CANADA) STORE THREE INC., MINISO (CANADA) STORE FOUR INC., MINISO (CANADA) STORE FIVE INC., MINISO (CANADA) STORE SIX INC., MINISO (CANADA) STORE SEVEN INC., MINISO (CANADA) STORE EIGHT INC., MINISO (CANADA) STORE NINE INC., MINISO (CANADA) STORE TEN INC., MINISO (CANADA) STORE ELEVEN INC., MINISO (CANADA) STORE TWELVE INC., MINISO (CANADA) STORE THIRTEEN INC., MINISO (CANADA) STORE FOURTEEN INC., MINISO (CANADA) STORE FIFTEEN INC., MINISO (CANADA) STORE SIXTEEN INC., MINISO (CANADA) STORE SEVENTEEN INC., MINISO (CANADA) STORE EIGHTEEN INC., MINISO (CANADA) STORE NINETEEN INC., MINISO (CANADA) STORE TWENTY INC., MINISO (CANADA) STORE TWENTY-ONE INC., MINISO (CANADA) STORE TWENTY-TWO INC. and 1120701 B.C. LTD. RESPONDENTS THIRD REPORT OF THE MONITOR ALVAREZ & MARSAL CANADA INC. SEPTEMBER 11, 2019 TABLE OF CONTENTS 1.0 INTRODUCTION ....................................................................................................................... 3 2.0 PURPOSE OF REPORT -

Ads Canadian Bank 343 Amex Bank of Canada 303 Bank Of

SECTION I NUMERIC LIST / LISTE NUMÉRIQUE 1 ADS CANADIAN BANK 343 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 034300012 00012-343 20 Queen Street West - Suite 2600, Toronto, ON M5H 3R3 034300092 00092-343 20 Queen Street West - Suite 2600, Toronto, ON M5H 3R3 AMEX BANK OF CANADA 303 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 030300012 00012-303 101 McNabb Street, Markham, ON L3R 4H8 030300022 00022-303 101 McNabb Street, Markham, ON L3R 4H8 030300032 00032-303 101 McNabb Street, 101 McNabb Street, Markham, ON L3R 4H8 BANK OF AMERICA NATIONAL ASSOCIATION 241 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 024101312 01312-241 Main Branch, 200 Front St. W., Suite 2700, Toronto, ON M5V 3L2 024156792 56792-241 Main Branch, 200 Front St. W., Suite 2700, Toronto, ON M5V 3L2 BANK OF CANADA 177 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 017700000 00000-177 Banking Services, 245 Sparks Street, Ottawa, ON K1A 0G9 017700006 00006-177 Banking Services, 245 Sparks Street, Ottawa, ON K1A 0G9 BANK OF CHINA (CANADA) 308 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 030800012 00012-308 50 Minthorn BLVD-Suite 600, Markham, ON L3T 7X8 030800022 00022-308 Toronto Downtown -

Your Guide to Moving In

Your Guide to Moving In At Tridel, we understand that you’re moving more than just your “stuff”. You’re moving you. And that involves a great deal. We’ve helped thousands of people move into their new homes with ease. While it’s exciting, we also appreciate that it’s a lot of work. So remember, we’re here to help and we hope this is a good start. Once again, congratulations and welcome to your new home. Welcome to Tridel. Helpful Documents and Other Links Below are links to documents that outline important information as well as things you need to take care of at least two weeks before your moving date. Your Homeowner Orientation - What to Expect Del Condominium Rental - Help Manage or Rent Your Home bazinga! - The Private Social Network & Essential Utility Top 10 Items to Take Care of Before your Move Your Checklist for Moving Survival Kit for your Moving Day Change your Address with Service Canada Change your Address with Canada Post Tridel ‘Always On’ Cable and Telephone information What to Expect Once You Close How your Utility Metering and Billing Works Your Neighbourhood Designation of Agent Information Questions or Need Help? Home Orientation Allow me to introduce myself. Your new home. At Tridel, we have the privilege of witnessing the burst of “new home pride” every day, and it’s something that we never take for granted. We want the first time you see your home to be the best experience possible. We’ve created your Homeowner Orientation to be just that. We’ll be contacting you soon to schedule yours. -

Ads Canadian Bank 343 Amex Bank of Canada 303 Bank Of

SECTION I NUMERIC LIST / LISTE NUMÉRIQUE 1 ADS CANADIAN BANK 343 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 034300012 00012-343 20 Queen Street West - Suite 2600, Toronto, ON M5H 3R3 034300092 00092-343 20 Queen Street West - Suite 2600, Toronto, ON M5H 3R3 AMEX BANK OF CANADA 303 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 030300012 00012-303 101 McNabb Street, Markham, ON L3R 4H8 030300022 00022-303 101 McNabb Street, Markham, ON L3R 4H8 030300032 00032-303 101 McNabb Street, 101 McNabb Street, Markham, ON L3R 4H8 BANK OF AMERICA NATIONAL ASSOCIATION 241 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 024101312 01312-241 Main Branch, 200 Front St. W., Suite 2700, Toronto, ON M5V 3L2 024156792 56792-241 Main Branch, 200 Front St. W., Suite 2700, Toronto, ON M5V 3L2 BANK OF CANADA 177 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 017700000 00000-177 Banking Services, 245 Sparks Street, Ottawa, ON K1A 0G9 017700006 00006-177 Banking Services, 245 Sparks Street, Ottawa, ON K1A 0G9 BANK OF CHINA (CANADA) 308 Routing Numbers / Numéros d'acheminement Electronic Paper(MICR) Électronique Papier(MICR) Postal Address - Addresse postale 030800012 00012-308 50 Minthorn BLVD-Suite 600, Markham, ON L3T 7X8 030800022 00022-308 Toronto Downtown -

Complete Studentcare Network Listing

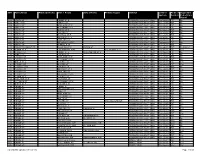

COMPLETE STUDENTCARE NETWORK LISTING Discover the Networks’ Advantages* *Please note that you are not limited to Network members. You are covered for the insured portion of your Plan regardless of the practitioner you choose. By visiting a Network member, you will get additional coverage. Dental Professionals To view the details of the Network deal, visit studentcare.ca. AJAX AJAX Dr. Zina R. Shoaib Dr. Aryan Rezaeifar Ajax Dental Centre Ajax NS Dental 5B - 161 Harwood Avenue North 18 - 1801 Harwood Avenue North Ajax, ON L1Z 0A1 Ajax, ON L1T 0K8 (905) 426-8304 (905) 426-2222 www.ajaxsmiles.com www.ajaxnsdental.com AJAX ANCASTER Dr. Nalini Sutharsan Dr. Anca Bordeianu Ajax NS Dental Norton Dental Centre 18 - 1801 Harwood Ave North 99 Fiddlers Green Road Ajax, ON L1T 0K8 Ancaster, ON L9G 1W4 (905) 426-2222 (905) 648-6116 www.ajaxnsdental.com ANCASTER ANCASTER Dr. Manjula Duhan Dr. Ammar Taimish Golf Links Dental Norton Dental Centre 1015 Golf Links Road, Suite 401B 99 Fiddlers Green Road Ancaster, ON L9K 1L6 Ancaster, ON L9G 1W4 (905) 648-9616 (905) 648-6116 AURORA AURORA Dr. Tina Ghaboulian Dr. Benjamin Ghotbi Yonge Wellington Dental Aurora Gateway Dental 15242 Yonge Street 3 - 676 Wellington Street East Aurora, ON L4G 1L9 Aurora, ON L4G 0K3 (905) 841-2993 (905) 503-2273 www.ywdental.com AURORA AURORA Dr. Beatrice Marr Dr. Jo-Anne Meyer Dawson Dental Centre - Aurora Dawson Dental Centre - Aurora 133 Pedersen Drive 133 Pedersen Drive, Unit A3 Aurora, ON L4G 0E3 Aurora, ON L4G 0E3 (905) 713-2600 (905) 713-2600 BARRIE BARRIE Altima Barrie Dental Centre Dr. -

Centrefund Realty Corporation Is a Growth

2000 annual report CENTREFUND centrefund realty corporation is a growth- oriented, publicly traded real estate investment company that concentrates on the ownership of neighbourhood and community food-anchored shopping centres in high-growth areas. The Company’s primary investment objective is the creation of value through long-term maximization of cash flow and capital appreciation from its growing shopping centre portfolio. This objective is achieved by proactively managing Centrefund’s existing shopping centre portfolio, by seeking appropriate, opportunistic acquisitions and by undertaking selective develop- ment activities. Centrefund is managed by experienced real estate professionals who have a significant interest in creating long- term value for all shareholders. The Company’s common shares and convertible debentures trade on The Toronto Stock Exchange. financial highlights 1 | report to shareholders 2 | operational review 5 shopping centre portfolio 10 | management’s discussion and analysis 12 management’s responsibility 22 | auditors’ report 23 consolidated financial statements 24 corporate information 43 | shareholder information 44 financial highlights (in thousands of dollars, except per share amounts) 2000 1999 1998 1997 1996 income statement Gross rental income $ 147,893 $ 136,827 $ 112,599 $ 71,798 $ 47,477 Earnings (loss) $ (15,171) $ 11,233 $ 16,662 $ 10,020 $ 8,045 Per common share $ (1.93) $ (0.17) $ 0.45 $ 0.47 $ 0.63 Funds from operations before provision for previous management’s incentive and other fees and termination -

LEGEND Fratelli Village Pizzeria

CONGRATULATIONS TO ALL THE READERS’ CHOICE 2018 WINNERS! F AMILy RestURANt LOCAL pIzzA GOLF COURse CHINA/GIFt sHOp Boston Pizza.............................................................D Pizza Nova................................................................D Scarboro Golf and Country Club ................................D LEGEND Fratelli Village Pizzeria ..............................................P Fratelli Village Pizzeria ..............................................P Sweet Pea Soap Company ........................................D Dentonia Park Golf Course ........................................P D: DIAMOND P: PLATINUM Walmart....................................................................P Victorian Monkey ......................................................P Dominos...................................................................G Markham Green Golf Club.........................................G Vi Pei Bistro-Bluffs....................................................G Pizza Pizza................................................................S Tom Frost Florists .....................................................G G: GOLD S: SILVER MUsICAL INstRUMeNts The Black Dog Pub ...................................................S GyMNAstIC sCHOOL LOCAL pUB CLeARANCe/OUtLet CeNtRe Long & McQuade ......................................................D Scarborough Gym Elites............................................D MUsICAL INstRUCtION FIsH & CHIps The Olde Stone Cottage ............................................D -

List of Traffic Signals (2018-07-03) Page 1 of 46

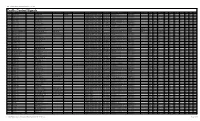

ID# Main Street Midblock Route Side 1 Route Side 2 Route Private Access District Control Mode of Accessible System Control Pedestrian Signal 0002 JARVIS ST FRONT ST E TORONTO AND EAST YORK TransSuite FXT No 0003 KING ST E JARVIS ST TORONTO AND EAST YORK TransSuite FXT No 0004 JARVIS ST ADELAIDE ST E TORONTO AND EAST YORK TransSuite FXT No 0005 JARVIS ST RICHMOND ST E TORONTO AND EAST YORK TransSuite FXT No 0006 JARVIS ST QUEEN ST E TORONTO AND EAST YORK TransSuite FXT No 0007 JARVIS ST SHUTER ST TORONTO AND EAST YORK TransSuite FXT No 0008 JARVIS ST DUNDAS ST E TORONTO AND EAST YORK TransSuite FXT Yes 0009 JARVIS ST GERRARD ST E TORONTO AND EAST YORK TransSuite FXT No 0010 JARVIS ST CARLTON ST TORONTO AND EAST YORK TransSuite FXT Yes 0011 JARVIS ST WELLESLEY ST E TORONTO AND EAST YORK TransSuite FXT No 0012 JARVIS ST ISABELLA ST TORONTO AND EAST YORK TransSuite FXT No 0013 MOUNT PLEASANT RD CHARLES ST E JARVIS ST TORONTO AND EAST YORK TransSuite FXT Restricted 0014 BLOOR ST E TED ROGERS WAY 250 BLOOR ST E TORONTO AND EAST YORK TransSuite FXT Yes 0015 CHURCH ST FRONT ST E WELLINGTON ST E TORONTO AND EAST YORK TransSuite FXT No 0016 KING ST E CHURCH ST TORONTO AND EAST YORK TransSuite FXT No 0017 CHURCH ST ADELAIDE ST E TORONTO AND EAST YORK TransSuite FXT No 0018 CHURCH ST RICHMOND ST E TORONTO AND EAST YORK TransSuite FXT No 0019 QUEEN ST E CHURCH ST TORONTO AND EAST YORK TransSuite FXT Yes 0020 CHURCH ST SHUTER ST TORONTO AND EAST YORK TransSuite FXT Yes 0021 DUNDAS ST E CHURCH ST TORONTO AND EAST YORK TransSuite FXT No 0022 CHURCH ST