Cerner, Athenahealth and Veeva Chase Cloudbased

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Healthcare Industry Highlight: Revenue Cycle Management

Industry Highlight: Revenue Cycle Management Q1 2019 RCM Overview Intelligent, Automated Workflow Patient Access Claims Management RCM intelligently automates the complex tasks of the front and back office, optimizing: Case Management ✓ Patient encounters and consolidation of REVENUE records Charges & CYCLE ✓ Participation in value-based programs to Reimbursement generate maximum revenue ✓ Claims management, accounts receivable and claim resubmission Clinical ✓ Medical practice workflow, reducing Documentation redundant staff effort Medical Coding Increasing complexity in medical coding and rising healthcare costs make RCM an essential tool to maintain cash flow and stay solvent 1 RCM Market Size and Outlook The global RCM market is projected to grow to $65.2BN by 2025 from $23.6BN in 2016, a nine-year CAGR of 12.0% Value of Global RCM Market ($USD in BN) $80 Facing tight margins, time-consuming 60 regulation and enormous waste in the healthcare system, medical practices 40 are looking for adaptable solutions to streamline workflow, generating 20 significant drive in the RCM market 0 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 $23.6BN $16.5BN 40% Value of global RCM market in Estimated hospital spend on Percentage of RCM end-user market 2016 external RCM by 2020 constituted by physicians’ offices 12.0% $6.7BN 3-5% CAGR through 2025 Annual provider spend on Hospitals’ lost revenues due RCM to RCM errors 2 Source: CMS NHE Projections , Grandview Research, MicroMarketMonitor, HFMA Inefficiencies RCM Can Help Solve Key Industry Trends: -

Advancing Standards for Precision Medicine

Advancing Standards for Precision Medicine FINAL REPORT Prepared by: Audacious Inquiry on behalf of the Office of the National Coordinator for Health Information Technology under Contract No. HHSM-500-2017-000101 Task Order No. HHSP23320100013U January 2021 ONC Advancing Standards for Precision Medicine Table of Contents Executive Summary ...................................................................................................................................... 5 Standards Development and Demonstration Projects ............................................................................ 5 Mobile Health, Sensors, and Wearables ........................................................................................... 5 Social Determinants of Health (SDOH) ............................................................................................. 5 Findings and Lessons Learned .......................................................................................................... 6 Recommendations ........................................................................................................................................ 6 Introduction ................................................................................................................................................... 7 Background ................................................................................................................................................... 7 Project Purpose, Goals, and Objectives .................................................................................................. -

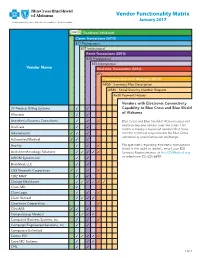

Vendor Functionality Matrix January 2017 an Independent Licensee of the Blue Cross and Blue Shield Association

Vendor Functionality Matrix January 2017 An Independent Licensee of the Blue Cross and Blue Shield Association Readiness Validated Claims Transactions (5010) 837 Professional 837 Institutional Remit Transactions (5010) 835 Professional 835 Institutional Vendor Name Real-time Transactions (5010) 27x Proprietary Real-time Messages (5010) AB50 - Summary Plan Description AB80 - Social Security Number Request Ax20 Payment History Vendors with Electronic Connectivity 2K Medical Billing Systems 3 3 Capability to Blue Cross and Blue Shield of Alabama Allscripts 3 3 Anesthesia Business Consultants 3 3 3 Blue Cross and Blue Shield of Alabama does not endorse any one vendor over the other. This AnviCare 3 3 matrix is merely a record of vendors that have Athenahealth 3 3 3 met the technical requirements for Blue Cross connectivity and information exchange. Automated Medical 3 3 3 Availity 3 3 3 For questions regarding electronic transactions listed in the table to the left, email your EDI Avid Anesthesiology Solutions 3 3 3 3 3 Services Representative at [email protected] AXIOM Systems Inc. 3 3 or telephone 205-220-6899. BrickMed, LLC 3 3 C&S Research Corporation 3 3 3 3 CBIZ MMP 3 3 Change Healthcare 3 3 3 3 3 3 Claim.MD 3 ClaimLogic 3 3 3 Claim Remedi 3 3 3 3 Clearwave Corporation 3 ClinixMIS 3 3 3 CompuGroup Medical 3 3 3 3 Compulink Business Systems, Inc. 3 3 3 Computer Engineered Solutions, Inc. 3 3 Computers Unlimited Cortex EDI 3 3 3 3 3 Cove MD Systems 3 3 3 CPU 3 3 1 of 4 Readiness Validated Claims Transactions (5010) 837 Professional 837 Institutional Remit Transactions (5010) 835 Professional 835 Institutional Vendor Name Real-time Transactions (5010) 27x Proprietary Real-time Messages (5010) AB50 - Summary Plan Description AB80 - Social Security Number Request Ax20 Payment History Creative Concepts in Communications 3 3 Custom Software Systems, Inc. -

Top 20 Ehr Software

TOP 20 EHR SOFTWARE C M CONVERTED MEDIA TOP 20 EHR SOFTWARE 1 AdvancedMD AdvancedEHR 11 Allscripts Allscripts Professional EHR 2 Cerner Cerner Ambulatory EHR 12 CareCloud CareCloud Charts 3 athenahealth athenahealth EHR 13 CureMD All in One EHR 4 Epic Epic EHR 14 Practice Velocity VelociDoc EHR Azalea Health 5 Practice Fusion Practice Fusion EHR 15 Azalea EHR Innovations 6 Kareo Kareo Clinical 16 ReLi Med Solutions ReLiMed EMR 7 Henry Schein MicroMD EMR 17 MedEZ MedEZ 8 drchrono drchrono EHR 18 iSALUS Healthcare OfficeEMR 9 NextGen Healthcare NextGen Healthcare EHR 19 ChartLogic ChartLogic EMR Modernizing 10 EMA 20 ICANotes ICANotes EHR Medicine C M CONVERTED MEDIA EHR IN PRACTICE HOW THESE RANKINGS WERE GENERATED This ranking was determined using a number of factors including industry standing, public opinion of software, social media presence, and available software features relevant to the needs of a small business. This ranking should serve as a rough estimate of software suitability, and more in-depth analysis can be taken below or by using our EHR software comparison. C M CONVERTED MEDIA SHORTLISTING EHR VENDORS CHECKLIST Research EHR employed by similar sized practices in 1 6 Produce an RFI document and send to vendor shortlist the same specialty Identify market leading solutions which offer some 2 7 Narrow shortlist based on RFI responses support in your specialty Leverage professional network for recommendations Compile requirements and business processes in an 3 8 based on their experience RFP document Narrow shortlist based -

CONFERENCE PROGRAM November 15–17, 2016, Boston, MA

CONFERENCE PROGRAM November 15–17, 2016, Boston, MA CONFERENCE PROGRAM | MESSAGE President and Chair’s Message Dear Colleague: “What we need is a national conversation of experts,” Mark Levin, Partner, Third Rock Ventures, once told the audience at the Annual Personalized Medicine Conference. “Across the industry, across government, the best people in this country to come together to tell us how to maximize value for patients. That is the big challenge in our future.” The 12th Annual Personalized Medicine Conference responds to Levin’s call to action with a concentrated focus on generating solutions to the field’s challenges. It will showcase what is new, offer insights into the issues, and provide partnership and networking opportunities for attendees. But most importantly, it will examine the unique contributions that researchers, investors, industry representatives, policy experts, payers, health care providers and patients can make at each stage in the development of personalized medicine products and services to forge a path through the field’s barriers. The conference program, which is organized around those stages, will go beyond defining personalized medicine’s challenges by, for example: ¢ Exploring the latest trends in research and development ¢ Analyzing the issues facing the diagnostic industry ¢ Finding commonalities in multiple definitions of “value” in health care ¢ Providing examples of the kinds of evidence appropriate for coverage and payment ¢ Examining the best practices for integrating personalized medicine into clinical settings ¢ Debating the circumstances that warrant the sharing of data for research We are pleased to present the entire conference program here, which covers these and many other topics. Sincerely yours, Edward Abrahams, Ph.D. -

Small Practice Ambulatory Emr/Pm (10 Or Fewer Physicians) 2019

SMALL PRACTICE AMBULATORY EMR/PM (10 OR FEWER PHYSICIANS) 2019 BUILDING STRONG FOUNDATIONS FOR CUSTOMER SUCCESS ® %/ Performance Report | January 2019 DRILL DEEPER TABLE OF CONTENTS 2 Executive Insights 6 Expanded Insights 29 Vendor Insights 31 AdvancedMD 45 eClinicalWorks 33 Allscripts 47 eMDs 35 Aprima 49 Greenway Health 37 athenahealth 51 Kareo 39 CareCloud 53 NextGen Healthcare 41 Cerner 55 Virence Health (GE Healthcare) 43 CureMD 57 Data Index 68 Vendor Executive Interview Details 1 EXECUTIVE INSIGHTS SMALL PRACTICE AMBULATORY EMR/PM (10 OR FEWER PHYSICIANS) 2019 BUILDING STRONG FOUNDATIONS FOR CUSTOMER SUCCESS As healthcare has moved beyond meaningful use, small practices have begun to expect more from their vendors and to look for EMRs that do more than meet basic regulatory requirements. As a result, EMR/PM satisfaction among small practices (10 or fewer physicians) has varied greatly over the past year—scores for a number of vendors have swung more than 10 percentage points (some positively, some negatively). To explore what the future holds for this market, KLAS spoke to hundreds of small practice customers about their EMR/PM experiences and needs and also interviewed executives and representatives from AdvancedMD, Allscripts, Aprima, athenahealth, Azalea Health, CareCloud, Cerner, CureMD, eMDs, Greenway Health, Kareo, NextGen, Quest Diagnostics, and Virence Health (GE Healthcare) to find out how these vendors plan to increase customer satisfaction going forward. What Are the Most Important Vendor/ NextGen Healthcare, CureMD, and Aprima Product Attributes for Small Practices? Most Aligned to Deliver Customer Success (n=57) The green bars represent the total tallies after New 7 Technology each need was weighted When asked to name the top things EMR/PM vendors should focus based on whether the respondent ranked it first, on, small practices overwhelmingly say that before addressing more Advanced Needs second, or third. -

Top Integrated Electronic Health Records Physician Practice Management & Billing Vendors

BLACK BOOK RANKINGS 2014 USER SURVEY Top Integrated Electronic Health Records Physician Practice Management & Billing Vendors Publication Date: May 2014 Electronic Health Records Ambulatory Practice Management Software Solutions Outsourced Revenue Cycle Management Services BLACK BOOK™ TOP INTEGRATED PRACTICE MANAGEMENT & REVENUE CYCLE MANAGEMENT EHR SOFTWARE VENDORS May 2014 ©2014 Black Book Rankings LLC. This report is a licensed product. Do not duplicate or distribute without permission. Page 1 2014 Black Book Integrated Practice Management – Revenue Cycle Management EHR Software Top Vendors Report Black Book™ annually evaluates leading health care/medical software and service providers across 18 operational excellence key performance indicators completely from the perspective of the client experience. Independent and unbiased from vendor influence, more than 380,000 healthcare IT users are invited to contribute to various annual customer satisfaction polls. Suppliers also encourage their clients to participate to produce current and objective customer service data for buyers, analysts, investors, consultants, competitive suppliers and the media. For more information or to order customized research results, please contact the Client Resource Center at +1 727.953.3355 or [email protected] © 2014, 2013 Black Book Rankings LLC All Rights Reserved. Reproduction of this publication in any form without prior written permission is forbidden. The information contained herein has been obtained from sources believed to be reliable. Brown-Wilson Group, Inc. the parent corporation of Black Book™, Black Book Rankings LLC, Black Book Market Research LLC, and The Black Book of Outsourcing®, disclaims all warranties as to the accuracy, completeness or adequacy of such information. Brown-Wilson Group shall have no liability for errors, omissions or inadequacies in the information contained herein or for interpretations thereof. -

EHR to EHR Conversions When, Why &

EHR to EHR Conversions When, Why & How Navigating EHR Mergers, Acquisitions and Dissatisfactions Presented by: Jeffery Daigrepont, Senior Vice President | Coker Group [email protected] | 770-597-0590 Agenda . Current State of the Market . Navigating EHR Mergers & Acquisitions – Merging practices/hospitals of different EHRs . Navigating EHR Dissatisfaction . Future Proofing HCIT Investments . Summary 2 Current State of the Market 3 EMR Market for Hospitals- Top Companies . Athena Health (Aquired RazorInsights and Harvards WebOMR) . Allscripts (Eclipsys, end of life) . Cerner . CPSI . Epic Systems . eClinicalWorks (Ambulatory Only, but popular bolt-on) . GE Healthcare . HCS EMR . Healthcare Management Systems . Healthland (Now CPIS) . McKesson . Meditech . NextGen (Discontinued inpatient) . Quadramed . Prognosis . RazorInsights (Now Athena) . Siemens Medical (Now Cerner) Source: http://www.healthcareitnews.com/news/black-book-names-best-best-ehrs 4 The Market Size (Buyers) Hospitals 11% CAHs 49% Community IDNs 41% Approximately 5000 hospitals 5 CDC EHR Adoption Stats… . In 2015, 78% of office-based physicians used any type of electronic health record (EHR) system, up from 18% in 2001. In 2015, 48% of office-based physicians reported having a system that met the criteria for a basic system, up from 11% in 2006. In 2015, 69% of office-based physicians reported that they intended to participate (i.e., they planned to apply or already had applied) in "meaningful use" incentives. From 2010 (the earliest year that trend data are available) -

Epic Interoperability

INTEROPERABILITY WHITE PAPER Epic Interoperability Interoperability—the ability of different information technology systems and software applications to communicate, exchange data, and use the information that has been exchanged1—helps to provide comprehensive patient information in an electronic health record. Epic enables the secure flow of patient data between Epic sites and between Epic and other vendors’ systems. We accomplish this in three ways: 1) Care Everywhere, Epic’s patient record exchange platform 2) interfaces, and 3) application programming interfaces (APIs). Source: “EMR Interoperability 2014”, KLAS Enterprises, September 2014 Patient record exchange between healthcare organizations Care Everywhere is Epic’s standards-based patient record exchange platform and uses the Consolidated Clinical Document Architecture (C-CDA) as required for Meaningful Use Stage 2 certification.2 Epic installed Care Everywhere in all versions of its EpicCare EHR software in use so that 100% of customers who are live with EpicCare also have the ability to exchange patient records. Care Everywhere is available to 436,726 providers at over 1,183 hospitals and 33,989 clinics. These organizations cover a patient population of approximately 183 million—over 56.5% of the U.S. population. 1 HIMSS Dictionary of Healthcare Information Technology Terms, Acronyms and Organizations, 2nd Edition, 2010 2 Full Meaningful Use Stage 2 certification details are available at http://www.epic.com/software-certification.php © Epic. All Rights Reserved. October 2016 INTEROPERABILITY WHITE PAPER Organizations using Care Everywhere make up the largest EHR-based exchange group in the United States3, exchanging 1.25 million patient records a day with each other and with over 10,000 other organizations.4 This includes healthcare providers using other EHR systems, Health Information Service Providers, Health Information Exchanges, and entities connected to the eHealth Exchange like the VA, the Social Security Administration and the DoD. -

Ehr Software Vendor Directory

EHR SOFTWARE VENDOR DIRECTORY 2017 Edition C M CONVERTED MEDIA OVERVIEW CONTACT ADP acquired AdvancedMD, an established provider of EHR solutions for private practice healthcare environments in 2011. ADP AdvancedMD With ADP, the AdvancedMD product offerings have expanded to include an enhanced in-house billing suite, medical coding 10876 S River Front Pkwy capabilities and integration with outsourced medical billing providers. Suite 400 South Jordan ADP AdvancedMD EHR provides functionality for medical practices as well as components designed for administrative and UT billing use. 84095 United States For medical practices, ADP AdvancedMD EHR provides a patient portal for admissions and check-ins alongside document 800-825-0224 management, e-prescriptions and more. All of this is available as a mobile platform on iOS devices. [email protected] Role-based access to the EHR for nurses and physicians improves workflow by limiting system complexity for each role. During the medical coding and billing phase, there are options to present the information for in-house coders or to integrate it with the API from an outsourced medical billing company. The ADP AdvancedMD EHR and revenue cycle management solutions are available to clients via a tiered subscription access program. There is an initial installation and training fee, and then clients may select “a-la-carte” options for their subscription package that are best suited to their practice. COMPARE ADP ADVANCEDMD EHR & MANY MORE ADP AdvancedMD EHR provides a complete healthcare solution for practices of any size. Their products are cloud based, Compare software features, mobile accessible but can also be installed as desktop only. -

Electronic Health Record (EHR) Compatible Systems

Electronic Health Record (EHR) Compatible Systems FIGMD is the technical partner of the American College of Rheumatology’s RISE Registry whose platform integrates with and extracts data from the provider’s electronic health record systems (EHR). After integration of your EHR system is complete, the registry will extract your practice's data, simplifying your efforts for reporting and benchmarking your Merit- Based Incentive Payment System (MIPS) for CMS submissions. The below list is comprised of nearly 200 EHR systems used by rheumatology practices that have successfully integrated with the RISE registry. Find your registry and contact us today at [email protected]. System System Name Type EMR Advanced Data System - Docassistant Pull EMR Allmeds Pull EMR Allscripts Pull EMR Allscripts Push - Client Submitted EMR Allscripts Professional Pull EMR Allscripts Professional Push - Client Submitted EMR Allscripts TouchWorks Pull EMR Allscripts TouchWorks Push - Client Submitted EMR AltaPoint Pull EMR Amazing Charts Pull EMR American Medical Software Pull EMR Aprima Pull EMR Aprima Push - Client Submitted EMR Athena Push - Vendor Submitted EMR CareCloud Push - Vendor Submitted EMR Centricity or Centricity Practice Solution Pull 1 | P a g e Electronic Health Record (EHR) Compatible Systems EMR Cerner Pull System System Name Type EMR Cerner Push - Vendor Submitted EMR Cerner - Power Chart Push - Vendor Submitted EMR Chart Maker Clinical Pull EMR Chart Perfect Pull EMR ChartLogic Pull EMR ChartLogic Push - Vendor Submitted EMR Chartmaker Medical -

2019 Annual Report

2019 ANNUAL REPORT 2019 ANNUAL REPORT or more than 40 years, Cerner has played a leadership role in digitizing health, an F important step toward improving the standard of living of the world’s population. As we enter the cognitive era of health care, Cerner is leading, alongside our clients, health care’s ever-quickening transformation. The opportunities in front of Cerner are massive, as we expect the foundational work from digitization to begin harvesting its true potential – to encourage health and wellness, to shift to preventative care and to reduce costs that have yet to be contained. It’s why we believe that, in a seamless and connected world, everyone thrives. Table of Contents: Annual Report 2019 Board of Directors ................................................................................................................................................................................ 2 Leadership ................................................................................................................................................................................................3 Cerner’s long-term performance ..................................................................................................................................................4 A letter to our shareholders, clients and associates ...........................................................................................................5 Appendix: Reconciliation of GAAP results to Non-GAAP results ..............................................................................13