EHR to EHR Conversions When, Why &

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Personal Health Records: the People’S Choice? Lisa Sprague, Senior Research Associate

Issue Brief – No. 820 November 30, 2006 Personal Health Records: The People’s Choice? Lisa Sprague, Senior Research Associate OVERVIEW — Information technology (IT), especially in the form of an electronic health record (EHR), is touted by many as a key component of meaningful improvement in health care delivery and outcomes. A personal health record (PHR) may be an element of an EHR or a stand-alone record. Proponents of PHRs see them as tools that will improve consumers’ ability to manage their care and will also enlist consumers as advocates for wide- spread health IT adoption. This issue brief explores what a PHR is, the extent of demand for it, issues that need to be resolved before such records can be expected to proliferate, and public-private efforts to promote them. NATIONAL HEALTH POLICY FORUM FACILITATING DIALOGUE. FOSTERING UNDERSTANDING. Issue Brief – No. 820 November 30, 2006 Personal Health Records: The People’s Choice? Take control, health care consumers are exhorted. Don’t risk having your health information swept away in a storm or unavailable when you are taken unconscious to the emergency room. Safeguard yourself and your family. Become empowered! The empowered consumer, a stock character in health-reform scenarios, is not so easily identified in real life. There is a range of reasons for this: A given consumer may be sick or injured or cognitively impaired, thus lack- ing the ability and/or will to exercise choice. He or she may have been conditioned to do what the doctor says without second-guessing. Most commonly, he or she may lack the information that is the coin of empow- erment. -

Implications of an Emerging EHR Monoculture for Hospitals And

Koppel R, Lehmann CU, J Am Med Inform Assoc 2015;22:465–471. doi:10.1136/amiajnl-2014-003023, Perspective Implications of an emerging EHR RECEIVED 29 May 2014 REVISED 29 July 2014 ACCEPTED 4 August 2014 monoculture for hospitals and healthcare PUBLISHED ONLINE FIRST 23 October 2014 systems Ross Koppel1, Christoph U Lehmann2 ABSTRACT .................................................................................................................................................... In many hospitals and health systems, a ‘new’ electronic health record means a shift to one vendor: Epic, a vendor that dominates in large and medium hospital markets and continues its success with smaller institutions and ambulatory practices. Our paper examines the implications of this emerging monoculture: its advantages and disadvantages for physicians and hospitals and its role in innovation, professional autonomy, implementation difficulties, workflow, flexibil- ity, cost, data standards, interoperability, and interactions with other information technology (IT) systems. .................................................................................................................................................... Key words: Epic; Implementation; Cost; Markets; Data Standards; Innovation Many healthcare systems and practices are shifting to Epic’s Several Chief Executive Officers (CEOs) describe Epic as the electronic health record (EHR).1 Based on software (MUMPS) default EHR choice—not because of its outstanding perform- developed at Massachusetts General -

Athenahealth, Inc. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K (Mark One) þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2017 or ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 001-33689 athenahealth, Inc. (Exact name of registrant as specified in its charter) Delaware 04-3387530 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 311 Arsenal Street, Watertown, Massachusetts 02472 (Address of principal executive offices) (Zip Code) 617-402-1000 Registrant’s telephone number, including area code Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, $0.01 par value The NASDAQ Stock Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Healthcare Industry Highlight: Revenue Cycle Management

Industry Highlight: Revenue Cycle Management Q1 2019 RCM Overview Intelligent, Automated Workflow Patient Access Claims Management RCM intelligently automates the complex tasks of the front and back office, optimizing: Case Management ✓ Patient encounters and consolidation of REVENUE records Charges & CYCLE ✓ Participation in value-based programs to Reimbursement generate maximum revenue ✓ Claims management, accounts receivable and claim resubmission Clinical ✓ Medical practice workflow, reducing Documentation redundant staff effort Medical Coding Increasing complexity in medical coding and rising healthcare costs make RCM an essential tool to maintain cash flow and stay solvent 1 RCM Market Size and Outlook The global RCM market is projected to grow to $65.2BN by 2025 from $23.6BN in 2016, a nine-year CAGR of 12.0% Value of Global RCM Market ($USD in BN) $80 Facing tight margins, time-consuming 60 regulation and enormous waste in the healthcare system, medical practices 40 are looking for adaptable solutions to streamline workflow, generating 20 significant drive in the RCM market 0 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 $23.6BN $16.5BN 40% Value of global RCM market in Estimated hospital spend on Percentage of RCM end-user market 2016 external RCM by 2020 constituted by physicians’ offices 12.0% $6.7BN 3-5% CAGR through 2025 Annual provider spend on Hospitals’ lost revenues due RCM to RCM errors 2 Source: CMS NHE Projections , Grandview Research, MicroMarketMonitor, HFMA Inefficiencies RCM Can Help Solve Key Industry Trends: -

Advancing Standards for Precision Medicine

Advancing Standards for Precision Medicine FINAL REPORT Prepared by: Audacious Inquiry on behalf of the Office of the National Coordinator for Health Information Technology under Contract No. HHSM-500-2017-000101 Task Order No. HHSP23320100013U January 2021 ONC Advancing Standards for Precision Medicine Table of Contents Executive Summary ...................................................................................................................................... 5 Standards Development and Demonstration Projects ............................................................................ 5 Mobile Health, Sensors, and Wearables ........................................................................................... 5 Social Determinants of Health (SDOH) ............................................................................................. 5 Findings and Lessons Learned .......................................................................................................... 6 Recommendations ........................................................................................................................................ 6 Introduction ................................................................................................................................................... 7 Background ................................................................................................................................................... 7 Project Purpose, Goals, and Objectives .................................................................................................. -

PROPERTY RIGHTS and ELECTRONIC HEALTH RECORDS by Jessica Carges

No. 17-37 Summer 2017 MERCATUS GRADUATE POLICY ESSAY PROPERTY RIGHTS AND ELECTRONIC HEALTH RECORDS by Jessica Carges The opinions expressed in this Graduate Policy Essay are the author’s and do not represent official positions of the Mercatus Center or George Mason University. Abstract This is an analysis of the current assignment of property rights of electronic health records and patient medical data. The paper focuses on the adverse incentives created by the current structure of property rights and hypothesizes that giving patients and provers co-ownership of medical data will best address concerns about interoperability and privacy, and also result in a number of additional positive benefits. Next the paper describes ways to make stronger patient ownership a reality despite the presence of special interest groups incentivized to block access. The paper concludes with state policy level analysis examining New Hampshire – the only state to currently grant patient ownership over medical data and electronic health record. this paper finds that state governments can follow New Hampshire’s lead and extend co-property rights to patients and providers to improve interoperability and privacy outcomes. Author Bio Jessica Carges is a research associate with the State Fiscal Health Team at The Pew Charitable Trusts. She received an MA in economics from George Mason University, and is an alumna of the Mercatus MA Fellowship program. Jessica holds a BS in economics, also from George Mason University. Committee Members Bobbi Herzberg, Distinguished Senior Fellow, F.A. Hayek Program for Advanced Study in Philosophy, Politics, and Economics. Nicole Fisher, President, HHR Strategies, Inc. -

Vision Paper Proceedings of the July 8, 2019 HIT Summit

Vision Paper Proceedings of the July 8, 2019 HIT Summit HIT Summit Planning Task Force Co-Chairs: Stephen Epstein, MD, MPP, FACEP (CEDR Committee Immediate Past Chair) Todd B. Taylor, MD, FACEP (Past Council Speaker, SEMI Founding Member) Members: JT Finnell, MD, FACEP, FACMI (ACEP Board Member) Jon Mark Hirshon, MD, PhD, MPH, FACEP (ACEP Board Member) Aisha Liferidge, MD, MPH, FACEP (ACEP Board Member) James Augustine, MD, FACEP (ACEP Board Member) Abhi Mehrotra, MD, MBA, FACEP (CEDR Committee Chair) Michelle Lin, MD, MPH, MS, FACEP (CEDR Committee Vice-Chair) Richard Griffey, MD, MPH, FACEP (Quality & Patient Safety Committee Chair) Nicholas Genes, MD, PhD, FACEP (SEMI Chair) Keith Kocher, MD, FACEP (Quality & Patient Safety Committee Vice-Chair) Benjamin Slovis, MD, MA, FACEP (SEMI Chair-Elect) Jay Schuur, MD, MHS, FACEP (E-QUAL Co-PI) Pawan Goyal, MD, MHA, CBA, PMP, FHIMSS, FAHIMA (ACEP Assc Executive Dir, Quality) Bill Malcom, MBA, PMP (ACEP CEDR Program Director) Nalani Tarrant, MPH, PMP (Dir, ACEP Quality Collaboratives, Data & Quality Measures) Dhruv Sharma, MS (Project Manager, ACEP Quality Collaboratives) Joseph Kennedy, MBA (ACEP Quality Administrator) SEMI = ACEP Section for Emergency Medicine Informatics WordCloud: Entire Document (visual representation of word frequency) ACEP Healthcare Information Technology Summit Evolving Emergency Care with Technology Vision Paper Proceedings of the July 8, 2019 Summit ACEP Headquarters, Irving, Texas INTRODUCTION ACEP convened an inaugural Healthcare Information Technology (HIT) Summit of ACEP members, industry luminaries, regulatory officials & ACEP staff (fig. 1) focusing on “Evolving Emergency Care with Technology”. This day-long event was structured using plenary keynotes, plenary group Figure 1 discussions and two breakout vision-sessions on HIT Policy, Artificial Attendee Demographics (Total 99) Intelligence, Distributed Healthcare, Data Integration\Management, Quality & 60 = ACEP Member Population Health (see appendix 1: Agenda). -

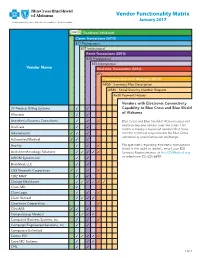

Vendor Functionality Matrix January 2017 an Independent Licensee of the Blue Cross and Blue Shield Association

Vendor Functionality Matrix January 2017 An Independent Licensee of the Blue Cross and Blue Shield Association Readiness Validated Claims Transactions (5010) 837 Professional 837 Institutional Remit Transactions (5010) 835 Professional 835 Institutional Vendor Name Real-time Transactions (5010) 27x Proprietary Real-time Messages (5010) AB50 - Summary Plan Description AB80 - Social Security Number Request Ax20 Payment History Vendors with Electronic Connectivity 2K Medical Billing Systems 3 3 Capability to Blue Cross and Blue Shield of Alabama Allscripts 3 3 Anesthesia Business Consultants 3 3 3 Blue Cross and Blue Shield of Alabama does not endorse any one vendor over the other. This AnviCare 3 3 matrix is merely a record of vendors that have Athenahealth 3 3 3 met the technical requirements for Blue Cross connectivity and information exchange. Automated Medical 3 3 3 Availity 3 3 3 For questions regarding electronic transactions listed in the table to the left, email your EDI Avid Anesthesiology Solutions 3 3 3 3 3 Services Representative at [email protected] AXIOM Systems Inc. 3 3 or telephone 205-220-6899. BrickMed, LLC 3 3 C&S Research Corporation 3 3 3 3 CBIZ MMP 3 3 Change Healthcare 3 3 3 3 3 3 Claim.MD 3 ClaimLogic 3 3 3 Claim Remedi 3 3 3 3 Clearwave Corporation 3 ClinixMIS 3 3 3 CompuGroup Medical 3 3 3 3 Compulink Business Systems, Inc. 3 3 3 Computer Engineered Solutions, Inc. 3 3 Computers Unlimited Cortex EDI 3 3 3 3 3 Cove MD Systems 3 3 3 CPU 3 3 1 of 4 Readiness Validated Claims Transactions (5010) 837 Professional 837 Institutional Remit Transactions (5010) 835 Professional 835 Institutional Vendor Name Real-time Transactions (5010) 27x Proprietary Real-time Messages (5010) AB50 - Summary Plan Description AB80 - Social Security Number Request Ax20 Payment History Creative Concepts in Communications 3 3 Custom Software Systems, Inc. -

Top 20 Ehr Software

TOP 20 EHR SOFTWARE C M CONVERTED MEDIA TOP 20 EHR SOFTWARE 1 AdvancedMD AdvancedEHR 11 Allscripts Allscripts Professional EHR 2 Cerner Cerner Ambulatory EHR 12 CareCloud CareCloud Charts 3 athenahealth athenahealth EHR 13 CureMD All in One EHR 4 Epic Epic EHR 14 Practice Velocity VelociDoc EHR Azalea Health 5 Practice Fusion Practice Fusion EHR 15 Azalea EHR Innovations 6 Kareo Kareo Clinical 16 ReLi Med Solutions ReLiMed EMR 7 Henry Schein MicroMD EMR 17 MedEZ MedEZ 8 drchrono drchrono EHR 18 iSALUS Healthcare OfficeEMR 9 NextGen Healthcare NextGen Healthcare EHR 19 ChartLogic ChartLogic EMR Modernizing 10 EMA 20 ICANotes ICANotes EHR Medicine C M CONVERTED MEDIA EHR IN PRACTICE HOW THESE RANKINGS WERE GENERATED This ranking was determined using a number of factors including industry standing, public opinion of software, social media presence, and available software features relevant to the needs of a small business. This ranking should serve as a rough estimate of software suitability, and more in-depth analysis can be taken below or by using our EHR software comparison. C M CONVERTED MEDIA SHORTLISTING EHR VENDORS CHECKLIST Research EHR employed by similar sized practices in 1 6 Produce an RFI document and send to vendor shortlist the same specialty Identify market leading solutions which offer some 2 7 Narrow shortlist based on RFI responses support in your specialty Leverage professional network for recommendations Compile requirements and business processes in an 3 8 based on their experience RFP document Narrow shortlist based -

CONFERENCE PROGRAM November 15–17, 2016, Boston, MA

CONFERENCE PROGRAM November 15–17, 2016, Boston, MA CONFERENCE PROGRAM | MESSAGE President and Chair’s Message Dear Colleague: “What we need is a national conversation of experts,” Mark Levin, Partner, Third Rock Ventures, once told the audience at the Annual Personalized Medicine Conference. “Across the industry, across government, the best people in this country to come together to tell us how to maximize value for patients. That is the big challenge in our future.” The 12th Annual Personalized Medicine Conference responds to Levin’s call to action with a concentrated focus on generating solutions to the field’s challenges. It will showcase what is new, offer insights into the issues, and provide partnership and networking opportunities for attendees. But most importantly, it will examine the unique contributions that researchers, investors, industry representatives, policy experts, payers, health care providers and patients can make at each stage in the development of personalized medicine products and services to forge a path through the field’s barriers. The conference program, which is organized around those stages, will go beyond defining personalized medicine’s challenges by, for example: ¢ Exploring the latest trends in research and development ¢ Analyzing the issues facing the diagnostic industry ¢ Finding commonalities in multiple definitions of “value” in health care ¢ Providing examples of the kinds of evidence appropriate for coverage and payment ¢ Examining the best practices for integrating personalized medicine into clinical settings ¢ Debating the circumstances that warrant the sharing of data for research We are pleased to present the entire conference program here, which covers these and many other topics. Sincerely yours, Edward Abrahams, Ph.D. -

Cerner, Athenahealth and Veeva Chase Cloudbased

9/18/2015 Cerner, Athenahealth And Veeva Chase Cloud-Based EHR - NASDAQ.com Cerner, Athenahealth And Veeva Chase CloudBased EHR By Investor's Business Daily, January 23, 2015, 04:55:00 PM EDT A new wrinkle in federal rules this year aims to urge more hospitals and other medical providers into the 21st century. Those expectations have helped lift a handful of companies in IBD's Computer SoftwareMedical group, a group at the intersection of health care and Internet technology and key suppliers to the health industry's conversion from paper to digital electronic records.Cerner ( CERN ),Athenahealth ( ATHN ) andVeeva Systems ( VEEV ) are at the head of that list. All three have seen benefits from the American Recovery and Reinvestment Act of 2009, also known as the stimulus bill. All have also seen their share of recent ups and downs. The initial bill set aside $19 billion to help health care providers convert their patient records systems from paper to digital, or electronic health records. As of Dec. 1, the Centers for Medicare and Medicaid Services Pinterest reported the program had paid more than $25.7 billion to participants, including hospitals, doctors and insurance companies, meeting "meaningful use" requirements. Tumblr Email Print Beginning this year, the government will ratchet up the pressure by trimming reimbursements to medical Gmail providers not yet converted to EHR systems, or converts that are falling short of the meaningfuluse Favorites benchmarks set out by the stimulus bill. More... (293) Nearly 80% of physicians and hospitals are already using EHRs or plan to start soon, according to data from AddThis the federal government and industry research groups. -

Small Practice Ambulatory Emr/Pm (10 Or Fewer Physicians) 2019

SMALL PRACTICE AMBULATORY EMR/PM (10 OR FEWER PHYSICIANS) 2019 BUILDING STRONG FOUNDATIONS FOR CUSTOMER SUCCESS ® %/ Performance Report | January 2019 DRILL DEEPER TABLE OF CONTENTS 2 Executive Insights 6 Expanded Insights 29 Vendor Insights 31 AdvancedMD 45 eClinicalWorks 33 Allscripts 47 eMDs 35 Aprima 49 Greenway Health 37 athenahealth 51 Kareo 39 CareCloud 53 NextGen Healthcare 41 Cerner 55 Virence Health (GE Healthcare) 43 CureMD 57 Data Index 68 Vendor Executive Interview Details 1 EXECUTIVE INSIGHTS SMALL PRACTICE AMBULATORY EMR/PM (10 OR FEWER PHYSICIANS) 2019 BUILDING STRONG FOUNDATIONS FOR CUSTOMER SUCCESS As healthcare has moved beyond meaningful use, small practices have begun to expect more from their vendors and to look for EMRs that do more than meet basic regulatory requirements. As a result, EMR/PM satisfaction among small practices (10 or fewer physicians) has varied greatly over the past year—scores for a number of vendors have swung more than 10 percentage points (some positively, some negatively). To explore what the future holds for this market, KLAS spoke to hundreds of small practice customers about their EMR/PM experiences and needs and also interviewed executives and representatives from AdvancedMD, Allscripts, Aprima, athenahealth, Azalea Health, CareCloud, Cerner, CureMD, eMDs, Greenway Health, Kareo, NextGen, Quest Diagnostics, and Virence Health (GE Healthcare) to find out how these vendors plan to increase customer satisfaction going forward. What Are the Most Important Vendor/ NextGen Healthcare, CureMD, and Aprima Product Attributes for Small Practices? Most Aligned to Deliver Customer Success (n=57) The green bars represent the total tallies after New 7 Technology each need was weighted When asked to name the top things EMR/PM vendors should focus based on whether the respondent ranked it first, on, small practices overwhelmingly say that before addressing more Advanced Needs second, or third.