Integrated Report 2020 Integrated Resilience

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Middle East Oil Pricing Systems in Flux Introduction

May 2021: ISSUE 128 MIDDLE EAST OIL PRICING SYSTEMS IN FLUX INTRODUCTION ........................................................................................................................................................................ 2 THE GULF/ASIA BENCHMARKS: SETTING THE SCENE...................................................................................................... 5 Adi Imsirovic THE SHIFT IN CRUDE AND PRODUCT FLOWS ..................................................................................................................... 8 Reid l'Anson and Kevin Wright THE DUBAI BENCHMARK: EVOLUTION AND RESILIENCE ............................................................................................... 12 Dave Ernsberger MIDDLE EAST AND ASIA OIL PRICING—BENCHMARKS AND TRADING OPPORTUNITIES......................................... 15 Paul Young THE PROSPECTS OF MURBAN AS A BENCHMARK .......................................................................................................... 18 Michael Wittner IFAD: A LURCHING START IN A SANDY ROAD .................................................................................................................. 22 Jorge Montepeque THE SECOND SPLIT: BASRAH MEDIUM AND THE CHALLENGE OF IRAQI CRUDE QUALITY...................................... 29 Ahmed Mehdi CHINA’S SHANGHAI INE CRUDE FUTURES: HAPPY ACCIDENT VERSUS OVERDESIGN ............................................. 33 Tom Reed FUJAIRAH’S RISE TO PROMINENCE .................................................................................................................................. -

Article the 90-Year Evolution of Japan's Academic Interest in Iran

Article 29 The 90-year Evolution of Japan’s Academic Interest in Iran Keiko Sakurai Professor, Faculty of International Research and Education, Waseda University Director, Organization for Islamic Area Studies, Waseda University I. Introduction War II broke out. Despite Iran’s declared neutrality, Britain and the Soviet Union jointly invaded Iran in 1929 1941 marked the beginning of official diplomatic , believing Rez‥ā Shāh to have closer ties to the relations between Japan and Iran. The countries signed Axis powers, particularly Germany. Iran remained a “Japan-Persia Temporary Trade Agreement” that under Anglo-Soviet control until 1946. year, and Japan opened a diplomatic office in Tehran Under the Anglo-Soviet Occupation, Iran broke that August. A Persian diplomatic office was later off relations with Japan in April 1942, and in 1945 opened in Tokyo in July 1930. Diplomatic contacts declared war against the Axis powers, including Japan. between two countries, however, actually started as After the San Francisco Peace Treaty came into effect early as 1878, when Japan’s special envoy to Russia in 1952, diplomatic ties between the countries were Takeaki Enomoto met with Persian monarch Nās4 er al- reestablished in November 1953 and have continued 2 Dīn Shāh in Saint Petersburg. Two years later, Japan uninterrupted since then. sent its first official delegation to Tehran, headed by Iran’s oil boom in 1973 accelerated economic 1 Masaharu Yoshida. Yoshida was granted an audience interactions with Japan. Nonetheless, personal contact with Nās4 er al-Dīn Shāh in 1880, and brought an between Japanese and Iranian citizens was mostly official communiqué back to Japan from the Persian limited to diplomacy and business interactions, with Empire. -

Energy Investments in a Zero-Carbon World

Investment Management ENERGY INVESTMENTS IN A ZERO-CARBON WORLD The energy sector is controversial. It faces a perfect (usually in the single to low double digits), whereas storm due to the short-term demand shock caused by the iron-ore and copper reserves are often measured in COVID-19 pandemic and the longer-term risk from the decades or even centuries. This means that at current reduction in society’s carbon footprint to combat climate production rates, under all scenarios for future oil change. Considering this uncertainty and the collapse demand, it is impossible for upstream reserves to in valuations in the sector, we are confronted with dual become obsolete due to inadequate demand for oil. scenarios: whether the sector presents an exceptional • With respect to new competitors, US shale has investment opportunity or is destined for obsolescence. We emerged as a powerful new supply source over believe the key questions are: the past few years. But we estimate that US shale 1. What is the risk that energy companies will be left with production requires an oil price of $60 per barrel or material stranded assets in a carbon-neutral world? more to be economical, underscoring the limits as to how much disruption shale can cause. 2. How will the coming energy transition impact the sustainability of energy companies? MULTI-DECADE DEMAND FOR OIL AND GAS This note focuses on the risks and opportunities presented It bears repeating that there is no scenario under by the upcoming transition for the energy sector. We which the demand for oil and gas will disappear in address company-specific issues as part of our research the next few decades. -

Green Hydrogen the Next Transformational Driver of the Utilities Industry

EQUITY RESEARCH | September 22, 2020 | 9:41PM BST The following is a redacted version of the original report. See inside for details. Green Hydrogen The next transformational driver of the Utilities industry In our Carbonomics report we analysed the major role of clean hydrogen in the transition towards Net Zero. Here we focus on Green hydrogen (“e-Hydrogen”), which is produced when renewable energy powers the electrolysis of water. Green hydrogen looks poised to become a once-in-a-generation opportunity: we estimate it could give rise to a €10 trn addressable market globally by 2050 for the Utilities industry alone. e-Hydrogen could become pivotal to the Utilities (and Energy) industry, with the potential by 2050 to: (i) turn into the largest electricity customer, and double power demand in Europe; (ii) double our already top-of-the-street 2050 renewables capex EU Green Deal Bull Case estimates (tripling annual wind/solar additions); (iii) imply a profound reconfiguration of the gas grid; (iv) solve the issue of seasonal power storage; and (v) provide a second life to conventional thermal power producers thanks to the conversion of gas plants into hydrogen turbines. Alberto Gandolfi Ajay Patel Michele Della Vigna, CFA Mafalda Pombeiro Mathieu Pidoux +44 20 7552-2539 +44 20 7552-1168 +44 20 7552-9383 +44 20 7552-9425 +44 20 7051-4752 alberto.gandolfi@gs.com [email protected] [email protected] [email protected] [email protected] Goldman Sachs International Goldman Sachs International Goldman Sachs International Goldman Sachs International Goldman Sachs International Goldman Sachs does and seeks to do business with companies covered in its research reports. -

Idemitsu Sustainability Report 2019 Independent Practitioner’S Sustainability Environment Social Governance ESG Data Comparative Table Assurance Report 3

Independent Practitioner’s Sustainability Environment Social Governance ESG Data Comparative Table Assurance Report 2 Management Vision CONTENTS We are an energy co-creation company that values diversity and inclusion, 2 Management Vision, Action Mindset, Contents GOVERNANCE creates new values with customers and stakeholders, and seeks harmony 3 Editorial Policy 49 Message from Outside Directors 4 Message from President 50 Directors, Audit & Supervisory Board Members with the environment and society. 7 Medium-term Management Plan and Executive Officers 10 Review of Operations 52 Corporate Governance 11 Idemitsu Group’s Sustainability 56 Compliance ■ We will deliver various forms of energy and materials in a sustainable manner. 57 Risk Management ENVIRONMENT 59 Intellectual Property ■ We will expand and share our problem-solving capabilities with the world. 15 Environmental Management / Environmental Policy 17 Overview of Environmental Impacts Through Our ESG Data ■ We will grow stronger by anticipating change and responding flexibly. Business Activities 61 Environment 18 Response to Climate Change 70 Social 23 Response to Circular Economy 75 Governance 24 Waste Reduction 76 Environmental Data of Refineries and Complexes Action Mindset 25 Water Management Independence and autonomy 26 Conservation of Biodiversity Comparative Table 27 Land Use Change 78 Comparative Table with GRI Standards We think and act initiatively 28 Management of Chemical Substances and 88 Comparative Table with ISO 26000 Reduction of Hazardous Substances Co-creation -

Notice Regarding Execution of Share Exchange Agreement for Idemitsu Kosan Co., Ltd

May 11, 2021 Press Release Company Name: Idemitsu Kosan Co.,Ltd. Representative Director & Chief Executive Officer: Shunichi Kito (Company Code: 5019, TSE, First Sect.) Contact person: Munehiro Sekine, General Manager, Investor Relations Office, Treasury Department (TEL: +81-3-3213-9307) Company Name: SDS Biotech K.K. President and Representative Director: Mitsuhiro Sagae (Company Code: 4952, TSE, Second Sect.) Contact person: Toshio Otsuka, Corporate Officer, General Manager, Corporate Service Division (TEL: +81-3-5825-5511) Notice Regarding Execution of Share Exchange Agreement for Idemitsu Kosan Co., Ltd. to Make SDS Biotech K.K. its Wholly-Owned Subsidiary (Simplified Share Exchange) Idemitsu Kosan Co., Ltd. (“Idemitsu Kosan”) and SDS Biotech K.K., a consolidated subsidiary of Idemitsu Kosan (“SDS Biotech”; together with Idemitsu Kosan, the “Companies”), hereby announce that the Companies adopted a resolution at their respective board of directors meetings held today to execute a share exchange for cash consideration through which Idemitsu Kosan will become the wholly-owning parent company in the share exchange and SDS Biotech will become a wholly-owned subsidiary in the share exchange (the “Share Exchange”) and that the Companies entered into a share exchange agreement (the “Share Exchange Agreement”) today, as stated below. The Share Exchange is planned to take effect on August 2, 2021; pursuant to the procedures for a simplified share exchange set forth in the main text of Article 796, paragraph (2) of the Companies Act (Act No. 86 of 2005, as amended; the same applies hereinafter), Idemitsu Kosan will not obtain approval via a resolution of its shareholders meeting, whereas SDS Biotech will obtain the approval of its annual shareholders meeting to be held on June 23, 2021. -

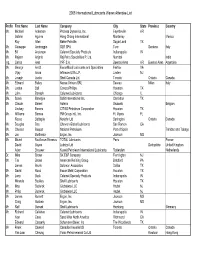

Final Attendee List

2008 International Lubricants Waxes Attendee List Prefix First Name Last Name Company City State Province Country Mr. Michael Ackerson Process Dynamics, Inc. Fayetteville AR Gabriel Aguirre Hong Chang International Monterrey Mexico Roy Allen Baker Petrolite Sugar Land TX Mr. Giuseppe Ambroggio SER SPA Turin Santena Italy Mr. Bill Anderson Calumet Specialty Products Indianapolis IN Mr. Rajesh Anjaria Raj Petro Specialities P. Ltd. Mumbai India Ing. Carlos Ares YPF S.A. Buenos Aires AR Buenos Aires Argentina Mr. George Arndt ExxonMobil Lubricants and Specialties Fairfax VA Vijay Arora Infineum USA L.P. Linden NJ Mr. Joseph Avolio Shell Canada Ltd. Toronto Ontario Canada Mr. Edward Bailey Nuova Univers SRL Seveso Milan Italy Mr. Justus Ball ConocoPhillips Houston TX Mr. John Banach Calumet Lubricants Chicago IL Ms. Soma Banerjee Sobit International Inc. Carrollton TX Mr Claude Bareel Asteria Brussels Belgium Lindsey Barnes CITGO Petroleum Corporation Houston TX Mr. Williams Barnes PM Group Intl., Inc. Ft. Myers FL Rocco Battagliag Norjohnj Ltd Burlinggton Ontario Canada Mr. Douglas Bea Chevron Global Lubricants San Ramon CA Mr. Chester Beeput National Petroleum Port of Spain Trinidad and Tobago Mr. Jim Borthwick Ergon, Inc Jackson MS Mr Michel Bouillerce-Mirassou TOTAL Lubricants Paris France David Boyes Lubrizol Ltd Derbyshire United Kingdom Arjan Brouwer Kuwait Petroleum International Lubricants Rotterdam Netherlands Dr. Mike Brown SK E&P Company Flemington NJ Mr. Tim Brown American Refining Group Bradford PA James Brunk Solomon Associates Dallas TX Mr. David Bucci Exxon Mobil Corporation Houston TX Mr. Larry Buck Calumet Specialty Products Indianapolis IN Miranda Buckley Shell Lubricants Houston TX Mr. Max Budwick Globalwax LLC Hazlet NJ Mr. -

List of CA100+ Non-Disclosers 142 of 167 CA100+ Target Companies (85%) Have Not Published a Review of Their Alignment with Industry Associations on Climate Change

List of CA100+ Non-Disclosers 142 of 167 CA100+ target companies (85%) have not published a review of their alignment with industry associations on climate change. A full list is below: • A.P. Moller - Maersk • CEZ, A.S. • Adbri Ltd • China National Offshore Oil Corporation (CNOOC) Limited • AES Corporation • China Petroleum & Chemical • Air France KLM S.A. Corporation (Sinopec) • Air Liquide • China Shenhua Energy • Airbus Group • China Steel Corporation • American Airlines Group Inc. • Coal India • American Electric Power Company, Inc. • Coca-Cola Company • Anhui Conch Cement • Colgate-Palmolive Company • ANTAM (Aneka Tambang) • CRH • Bayer AG • Cummins Inc. • Berkshire Hathaway • Daikin Industries, Ltd. • Bluescope Steel Limited • Daimler AG • BMW • Dangote Cement Plc • Boeing Company • Danone S.A. • Boral Limited • Delta Air Lines, Inc. • Bumi Resources • Devon Energy Corporation • Bunge Limited • Dominion Energy, Inc • Canadian Natural Resources Limited • Dow Inc • Caterpillar Inc. • E.ON SE • CEMEX S.A.B. De C.V. • Ecopetrol Sa • Centrica • EDF List of CA100+ Non-Disclosers 1 • Enbridge Inc. • LafargeHolcim Ltd • ENEL SpA • Lockheed Martin Corporation • ENEOS Holdings • Lukoil OAO • ENGIE • LyondellBasell Industries Cl A • Eni SpA • Marathon Petroleum • Eskom Holdings Soc Limited • Martin Marietta Materials, Inc. • Exelon Corporation • National Grid Plc • Fiat Chrysler Automobiles NV • Naturgy • FirstEnergy Corp. • Nestlé • Formosa Petrochemical • NextEra Energy, Inc. • Fortum Oyj • Nippon Steel Corporation • Gazprom • Nissan Motor Co., Ltd. • General Electric Company • Nornickel (MMC Norilsk Nickel OSJC) • General Motors Company • NRG Energy, Inc. • Grupo Argos • NTPC Ltd • Grupo Mexico • Occidental Petroleum Corporation • Hitachi, Ltd. • Oil & Natural Gas Corporation • Hon Hai Precision Industry • Oil Search • Honda Motor Company • Orica • Iberdrola, S.A. -

The Cosmo Energy Group Is Making a New and Vigorous Step Forward

COSMO REPORT 2019 About the Cosmo Energy Group Long-Term Vision The Cosmo Energy Group is making a new and vigorous step forward. Enhancing the earnings strength of the petroleum related businesses and growing the renewable energy business into a new main business segment. What have not changed What to be changed Stable supply of energy Growing the renewable “Customer First” mindset energy business into a new Energy-related business domains main business segment Composition of ordinary income (excluding the impact of inventory valuation) Renewable energy Petroleum Others Petroleum Renewable energy and others Petroleum and others (Mainly wind power generation) (Mainly wind power generation) Petrochemical Petrochemical Future FY2018 FY2022 business Consolidated Medium- portfolio Term Management Oil E&P* Plan Image Oil E&P* Oil E&P* Petrochemical * Oil exploration & production 1997 Petroleum 1989 Launched IPP (Independent Power 1986 Asian Oil was merged Producer) operations. into Cosmo Oil. Oil E&P Cosmo Oil was established through Qatar Petroleum tripartite merger of Daikyo Oil, Maruzen Oil, Development and the former Cosmo Oil (Cosmo Refining). was established. 1933 : Maruzen Oil was established. 1939 : Daikyo Oil was established. 1952 : Asian Oil was established. 1968 : Abu Dhabi Oil was established2. 1970 : United Petroleum Development was established. FY 1986 '87 '88 '89 '90 '91 '92 '93 '94 '95 '96 '97 '98 '99 1. See pages 41 and 42 on the impact of inventory valuation. 2. Daikyo Oil and Maruzen Oil (Cosmo Energy Group, currently) and Nippon Mining (JXTG Group, currently) made joint investments to establish Abu Dhabi Oil. 3. GC: Global Compact 4. International Petroleum Investment Company (IPIC) merged with Mubadala Development Company (MDC), an energy-related investment management company fully owned by the Emirate of Abu Dhabi, to become Mubadala Investment Company (MIC) at present. -

Energizing the Future

Corporate Report 2016 [Year ended December 31, 2015] ENERGIZING THE FUTURE Showa Shell Sekiyu K.K. Business Model Business Model Procurement Refi ning Oil Business Gasoline, kerosene, In the oil business, we refi ne imported diesel oil, heavy fuel oil, petrochemicals,emicals, crude oil at our Group refi neries and sell and LPG oil products. Our highly competitive Group refi neries, local contract dealers, and business partners including transportation companies are all playing critical roles to Synergies provide the oil products that customers between assets Management need in a safe and stable manner. Strategies Byproduct fuel Former business facility sites Corporate Procurement Governance Energy Solutions Business Solar Business In the solar business, we produce and sell our proprietary CIS thin-fi lm solar modules. At the same time, we also construct and sell The wholly owned subsidiary Solar Frontier K.K. operates solar power plants that use these modules. the solar business. In the electric power business, we leverage synergies with our other businesses Electric Power Business to construct and operate power stations as well as sell electricity. Allocation of Resources Management Resources and Stakeholders Technologies and expertise Networks of the Shell Manufacturing facilities Business partners Group and Saudi Aramco CONTENTS 2 Our History 20 Business Activities 4 Group CEO Interview 20 Special Feature: 12 Corporate Governance TO THE NEXT GROWTH STAGE 22 Oil Business 28 Energy Solutions Business Customers Export Storagee Sales Oil product -

Climate and Energy Benchmark in Oil and Gas

Climate and Energy Benchmark in Oil and Gas Total score ACT rating Ranking out of 100 performance, narrative and trend 1 Neste 57.4 / 100 8.1 / 20 B 2 Engie 56.9 / 100 7.9 / 20 B 3 Naturgy Energy 44.8 / 100 6.8 / 20 C 4 Eni 43.6 / 100 7.3 / 20 C 5 bp 42.9 / 100 6.0 / 20 C 6 Total 40.7 / 100 6.1 / 20 C 7 Repsol 38.1 / 100 5.0 / 20 C 8 Equinor 37.9 / 100 4.9 / 20 C 9 Galp Energia 36.4 / 100 4.3 / 20 C 10 Royal Dutch Shell 34.3 / 100 3.4 / 20 C 11 ENEOS Holdings 32.4 / 100 2.6 / 20 C 12 Origin Energy 29.3 / 100 7.3 / 20 D 13 Marathon Petroleum Corporation 24.8 / 100 4.4 / 20 D 14 BHP Group 22.1 / 100 4.3 / 20 D 15 Hellenic Petroleum 20.7 / 100 3.7 / 20 D 15 OMV 20.7 / 100 3.7 / 20 D Total score ACT rating Ranking out of 100 performance, narrative and trend 17 MOL Magyar Olajes Gazipari Nyrt 20.2 / 100 2.5 / 20 D 18 Ampol Limited 18.8 / 100 0.9 / 20 D 19 SK Innovation 18.6 / 100 2.8 / 20 D 19 YPF 18.6 / 100 2.8 / 20 D 21 Compania Espanola de Petroleos SAU (CEPSA) 17.9 / 100 2.5 / 20 D 22 CPC Corporation, Taiwan 17.6 / 100 2.4 / 20 D 23 Ecopetrol 17.4 / 100 2.3 / 20 D 24 Formosa Petrochemical Corp 17.1 / 100 2.2 / 20 D 24 Cosmo Energy Holdings 17.1 / 100 2.2 / 20 D 26 California Resources Corporation 16.9 / 100 2.1 / 20 D 26 Polski Koncern Naftowy Orlen (PKN Orlen) 16.9 / 100 2.1 / 20 D 28 Reliance Industries 16.7 / 100 1.0 / 20 D 29 Bharat Petroleum Corporation 16.0 / 100 1.7 / 20 D 30 Santos 15.7 / 100 1.6 / 20 D 30 Inpex 15.7 / 100 1.6 / 20 D 32 Saras 15.2 / 100 1.4 / 20 D 33 Qatar Petroleum 14.5 / 100 1.1 / 20 D 34 Varo Energy 12.4 / 100 -

Cosmo Report 2020 04

Cosmo Energy Group’s Value Creation Strategy and Achievements Message Financial Analysis Business activity Sustainability Data History of Value Creation Thirty-four years have passed since the establishment of Cosmo Oil and the start of the Cosmo Energy Group. Amid a variety of environmental changes, the Cosmo Energy Group’s mission of a safe and stable energy supply remains unchanged and the Group aims to contribute to society. Related to all businesses Related to the Petroleum Business Related to the Renewable Energy and Other Businesses Related to the Oil E&P Business Related to the Petrochemical Business 1933 1985 1986 2006 2007 2012 2013 2020 Birth of a new Cosmo Oil toward a Prospects for a New journey as the Prologue to Cosmo Oil new development stage new growth path Cosmo Energy Group Became unwaveringly competitive despite rough waves of Damage and reconstruction from the March 2011 Striving to grow based on the Group’s established business Daikyo Oil and Maruzen Oil started operation. liberalization. Earthquake. base and contributing to a sustainable society. Corporate Origin Corporate 1933 Maruzen Oil established. 1984 “Cosmo Oil” (Refining) 1986 Cosmo Oil established. 2015 Cosmo Energy Holdings established. established. 1939 Daikyo Oil established. 1989 Asian Oil merged into Cosmo Oil to form an organization of four refineries. 1933 Maruzen Oil established. 1986 Cosmo Oil established through tripartite merger 2007 Business alliance formed with IPIC (currently MIC). 2013 Sakaide Refinery closed, becoming an organization of of Daikyo Oil, Maruzen Oil and former Cosmo Oil three refineries. 1939 Daikyo Oil established. 2007 Japanese education program launched in the UAE.