Appendix 11 Basingstoke and Deane Borough Council Parish

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

St Martin's Church East Woodhay Index, Catalogue and Condition Of

ST MARTIN’S CHURCH EAST WOODHAY INDEX, CATALOGUE AND CONDITION OF MEMORIAL AND OTHER INSCRIPTIONS 1546-2007 Prepared by Graham Heald East Woodhay Local History Society 2008 Developed from the 1987 Catalogue prepared by A C Colpus, P W Cooper and G G Cooper Hampshire Genealogical Society An electronic copy of this document is available on the Church website www.hantsweb.gov.uk/stmartinschurch First issue: June 2005 Updated and minor corrections: February 2008 St Martin’s Church, East Woodhay Index, Catalogue and Condition of Memorial Inscriptions, 1546 - 2007 CONTENTS Page Abbreviations 1 Plan of Memorial Locations 2 Index 3 Catalogue of Inscriptions and Condition Churchyard, Zone A 11 Churchyard, Zone B 12 Churchyard, Zone C 15 Churchyard, Zone D 28 Churchyard, Zone E 29 Churchyard, Zone F 39 Churchyard, Zone G 43 Church, East Window 45 Church, North Wall (NW) 45 Church, South Wall (SW) 48 Church, West Wall (WW) 50 Church, Central Aisle (CA) 50 Church, South Aisle (SA) 50 Pulpit, Organ and Porch 51 Memorials located out of position (M) 51 Memorials previously recorded but not located (X) 52 The Stained Glass Windows of St Martin’s Church 53 St Martin’s Church, East Woodhay Index, Catalogue and Condition of Memorial Inscriptions, 1546 - 2007 ABBREVIATIONS Form of Memorial CH Cross over Headstone CP Cross over Plinth DFS Double Footstone DHS Double Headstone FS Footstone HS Headstone K Kerb (no inscription) Kerb KR Kerb and Rail (no inscription) PC Prostrate Cross Plinth Slab Slab (typically 2000mm x 1000mm) SS Small Slab (typically 500mm -

North West Hampshire Benefice Ashmansworth + Crux Easton + East Woodhay + Highclere + Woolton Hill

1 North West Hampshire Benefice ASHMANSWORTH + CRUX EASTON + EAST WOODHAY + HIGHCLERE + WOOLTON HILL . making Christ known in our communities Profile for an Associate Priest North West Hampshire Benefice 1 ASHMANSWORTH + CRUX EASTON + EAST WOODHAY + HIGHCLERE + WOOLTON HILL . making Christ known in our communities Welcome! Welcome to this Benefice Profile and Role Description… and welcome to the Diocese of Winchester! At the heart of our life here is the desire to be always Living the Mission of Jesus. We are engaged in a strategic process to deliver a mission-shaped Diocese, in which parochial, pastoral The Diocese of and new forms of pioneering and radical ministry all flourish. Infused with God’s missionary Spirit we want three character traits to be clearly Winchester is an visible in how we live: exciting place to be . North West • Passionate personal spirituality Hampshire Benefice • Pioneering faith communities • Prophetic global citizens The Diocese of Winchester is an exciting place to be at the moment. We wait with eager anticipation to see how this process will unfold. We pray that, if God is calling you to join us in his mission in this part of the world, he will make his will abundantly “As the Father sent clear to you. me so I send you www.winchester.anglican.org/resources-archive/?s=&resourcecategory=mission- . Receive the action-planning Spirit” (John 20:21) Tim Dakin David Williams Bishop of Winchester Bishop of Basingstoke we are developing our Whitchurch Deanery is as beautiful as any other part of Hampshire, an area of rolling capacity to support each downland in the north together with the upper Test valley, bounded by the Berkshire border other and to engage and the A303. -

Unclassified Fourteenth- Century Purbeck Marble Incised Slabs

Reports of the Research Committee of the Society of Antiquaries of London, No. 60 EARLY INCISED SLABS AND BRASSES FROM THE LONDON MARBLERS This book is published with the generous assistance of The Francis Coales Charitable Trust. EARLY INCISED SLABS AND BRASSES FROM THE LONDON MARBLERS Sally Badham and Malcolm Norris The Society of Antiquaries of London First published 1999 Dedication by In memory of Frank Allen Greenhill MA, FSA, The Society of Antiquaries of London FSA (Scot) (1896 to 1983) Burlington House Piccadilly In carrying out our study of the incised slabs and London WlV OHS related brasses from the thirteenth- and fourteenth- century London marblers' workshops, we have © The Society of Antiquaries of London 1999 drawn very heavily on Greenhill's records. His rubbings of incised slabs, mostly made in the 1920s All Rights Reserved. Except as permitted under current legislation, and 1930s, often show them better preserved than no part of this work may be photocopied, stored in a retrieval they are now and his unpublished notes provide system, published, performed in public, adapted, broadcast, much invaluable background information. Without transmitted, recorded or reproduced in any form or by any means, access to his material, our study would have been less without the prior permission of the copyright owner. complete. For this reason, we wish to dedicate this volume to Greenhill's memory. ISBN 0 854312722 ISSN 0953-7163 British Library Cataloguing in Publication Data A CIP catalogue record for this book is available from the -

358 940 .Co.Uk

The Villager November 2017 Sherbornes and Pamber 1 04412_Villager_July2012:19191_Villager_Oct07 2/7/12 17:08 Page 40 2 Communications to the Editor: the Villager CONTACTS Distribution of the Villager George Rust and his team do a truly marvellous job of delivering the Villager Editor: magazine to your door. Occasionally, due to a variety of reasons, members of his Julie Crawley team decide to give up this job. Would you be willing to deliver to a few houses 01256 851003 down your road? Maybe while walking your dog, or trying to achieve your 10,000 [email protected] steps each day! George, or I, would love to hear from you. Remember: No distributor = no magazine ! Advertisements: Emma Foreman Welcome to our new local police officer 01256 889215/07747 015494 My name is PCSO Matthew Woods 15973 and I will now be replacing PCSO John [email protected] Dullingham as the local officer for Baughurst, Sherborne St John, Ramsdell, North Tadley, Monk Sherborne, Charter Alley, Wolverton, Inhurst and other local areas. I will be making contact with you to introduce myself properly in the next few weeks Distribution: so I look forward to meeting you all. George Rust If anybody wishes to contact me, my email address is below. 01256 850413 [email protected] Many thanks PCSO 15973 Matthew Woods Work mobile: 07392 314033 [email protected] Message from the Flood and Water Management Team: Future Events: Lindsay Berry Unfortunately it is fast becoming the time of year when we need to think about the state of Hampshire’s land drainage network. -

67263 Imposed

Of the many walks in the parish just a few have been chosen, WALK 4 (& 5) The Rights of Way Network intended to show the varied countryside including open downland, steep slopes, small fields and woodland. The rights This walk starts in the village alongside The Old House in Rights of way are paths and tracks which you, the public, can of way shown on this map are recorded on the definitive map Newbury Road at Frog’s Hole. (Parking is available in the use. These routes generally cross over private land, and we ask 2005. March Printed 2005. Council Parish Kingsclere © going walking and when you expect to be back. be to expect you when and walking going and as such the public have the right to use them. centre of the village). It is an easy walk across fields and you to bear this in mind and be responsible when exercising are you where and when someone Tell roads. crossing when care take and footwear and clothing suitable through some of our many copses, about 3-miles. your rights to use such routes. Wear print. of time at correct was leaflet the within contained Information herewith. contain information Publishers are unable to accept any responsibility for accident or loss resulting from following the following from resulting loss or accident for responsibility any accept to unable are Publishers WALK 1 From Frog’s Hole follow the path to the left of the cottages, the leaflet, this of preparation the in taken been has care every Whilst Council. Parish Kingclere by forward s Hampshire Paths Partnership. -

Goddards Lane, Sherfield-On-Loddon Statement of Community Involvement

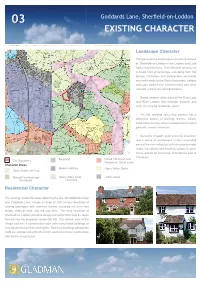

03 *RGGDUGV/DQH6KHUÀHOGRQ/RGGRQ EXISTING CHARACTER Landscape Character The site lies immediately adjacent to the settlement RI6KHU¿HOGRQ/RGGRQLQWKH/RGGRQDQG/\GH Valley character area. This character area covers a broad tract of landscape extending from Old Basing, Chineham and Basingstoke eastwards and northwards to the District boundary. Loddon and Lyde Valley’s key characteristics and other relevant extracts are provided below: %URDGVKDOORZYDOOH\VLGHVRIWKH5LYHU/\GH and River Loddon that meander through, and unify, the varying landscape types; 7KHÀDWORZO\LQJYDOOH\ÀRRUSDVWXUHKDVD GLVWLQFWLYH SDWWHUQ RI GUDLQDJH GLWFKHV ZLOORZ lined watercourses, water meadows and an often pastoral, remote character; *HQHUDOO\XQVSRLOWTXLHWDQGUXUDOFKDUDFWHU and a sense of remoteness in less accessible parts of the river valley, but with intrusion by major roads, the railway and electricity pylons in some areas, and by an incinerator immediately east of Chineham Mixed Farmland and Site Boundary Parkland Woodland: Small scale Character Areas Modern Military Open Valley Sides Open Arable on Clay Mixed Farmland and Open Valley Floor Urban areas Woodland Farmland Residential Character The existing residential areas adjoining the site off Goddards Close and Goddards Lane include a range of 20th century dwellings of varying typologies with common themes including red brick and render; roofs of slate; and red clay tiles. The local character of 6KHU¿HOGRQ/RGGRQSURYLGHVGHVLJQHOHPHQWVWKDWFRXOGEHWDNHQ forward into the proposed residential site. The historic core -

HERITAGE ASSESSMENT Baughurst House, Wolverton Townsend, Baughurst Hants, RG26 5SS

HERITAGE ASSESSMENT Baughurst House, Wolverton Townsend, Baughurst Hants, RG26 5SS Proposed Re-alignment of Entrance Drive November 2016 PREPARED BY: PRO VISION PLANNING & DESIGN FOR AND ON BEHALF OF: Mr & Mrs S Hall HERITAGE ASSESSMENT BAUGHURST HOUSE, WOLVERTON TOWNSEND, BAUGHURST, HANTS RG26 5SS PROJECT NO. 2179/DRIVE PREPARED BY: ANDREW PATRICK DiplArch(Portsmouth) DipTP RegdArcht CONSULTANT CHECKED BY: JAMES CLEARY DIRECTOR DATE: NOVEMBER 2016 PRO VISION PLANNING AND DESIGN GROSVENOR COURT WINCHESTER ROAD AMPFIELD WINCHESTER HAMPSHIRE SO51 9BD COPYRIGHT: The contents of this document must not be copied or reproduced in whole or in part without the prior written consent of PV Projects. CONTENTS Page 1.0 Introduction & Summary 1 2.0 Overview 2 3.0 Driveways: Existing, Proposed and Heritage Impact Assessment 7 Appendices Appendix A: Site Plan As Existing Appendix B: Site Plan as Proposed Appendix C: Photographs 1 1.0 Introduction & Summary 1.1 Pro Vision Planning & Design are instructed by Mr & Mrs S Hall to assess the potential heritage impact of the proposed re-alignment of the main entrance drive to Baughurst House, Wolverton Townsend, Baughurst, Hants. Wolverton Townsend is the name of the lane from Pound Green to Townsend and Wolverton. 1.2 This Heritage Statement therefore:- a) Outlines relevant information on the overall complex of buildings and grounds at Baughurst House, as the context for the assessment; b) Describes the existing driveways; c) Describes the proposed re-alignment; and d) Assesses the proposed change in light of the listed status of the house and the relationship of the existing and proposed drives to its special architectural and historic interest and its setting. -

Sherfield on Loddon Neighbourhood Development Plan Examiner's Report

Sherfield on Loddon Neighbourhood Development Plan 2011 to 2029 Report by Independent Examiner to Basingstoke and Deane Borough Council Janet L Cheesley BA (Hons) DipTP MRTPI CHEC Planning Ltd 14 November 2017 Contents Page Summary and Conclusion 4 Introduction 4 Legislative Background 5 EU Obligations 5 Policy Background 6 The Neighbourhood Development Plan Preparation 7 The Sherfield on Loddon Neighbourhood Development Plan 8 Policy H1 New Housing 9 Policy H2 New Housing To Meet The Requirement Of Local Plan Policy SS5 9 Policy H3 Provision Of Housing To Meet Local Needs 14 Policy D1 Preserving And Enhancing The Historic Character And Rural Setting Of Sherfield On Loddon 15 Policy D2 Design Of New Development 17 Policy G1 Protection And Enhancement Of The Natural Environment 20 Policy G2 Protection And Enhancement Of Local Green Spaces 21 Policy G3 Reducing Flood Risk 23 Policy T1 Improving And Enhancing The Footpath Network 24 Policy T2 Creating A Cycle Network 24 Policy T3: Improving Road Safety In Sherfield On Loddon 25 Sherfield on Loddon Neighbourhood Development Plan Examiner’s Report CHEC Planning Ltd 2 Policy CF1 Local Community-Valued Assets And Facilities 26 Policy CF2 Provision Of New Community Facilities 26 Policy E1 New Employment Development 27 Policy C1 Enabling Fibre Optic And Telecommunications Connections 28 Referendum & the Sherfield on Loddon Neighbourhood Development Plan Area 29 Minor Modifications 30 Appendix 1 Background Documents 32 Sherfield on Loddon Neighbourhood Development Plan Examiner’s Report CHEC Planning Ltd 3 Summary and Conclusion 1. The Sherfield on Loddon Neighbourhood Development Plan has a clear vision and sets out strategic aims. -

29.08.2021 Weekly Intercessions

THE PARISH OF THE HOLY TRINITY CHRISTCHURCH WEEKLY INTERCESSIONS Week beginning Sunday 29th August 2021 THE THIRTEENTH SUNDAY AFTER TRINITY PLEASE REMEMBER IN YOUR PRAYERS: PARISH INTERCESSIONS: The sick or those in distress: Phil Aspinall, Brian Barley, Chris Calladine, Isla Drayton, John Franklin, Iain, Marion Keynes, Gill de Maine, Geoffrey Owen, Eileen Parkinson, Richard Passmore, Lynn Pearson, Roméo Ronchesse, Paul Rowsell, Sandra, Sia, Betty Sullivan, The long term sick: Brian Keemer, Denise Wall The housebound and infirm: Those recently departed: Karen Baden, Elizabeth Barr, Brenda Woodward Those whose anniversary of death falls at this time: Christine Sadler (30th), Susan Roberts (1st September), Eileen Wall (1st), Patricia Devall (1st), Joy Saberton (2nd), Daniel Whitcher (4th) ~~~~~~~~~~~~~~~~~~~ ANGLICAN COMMUNION & WINCHESTER DIOCESE AND DEANERY INTERCESSIONS: Sunday 29th August The Thirteenth Sunday after Trinity Anglican Cycle: South Sudan: Justin Badi Arama (Archbishop, and Bishop of Juba) Diocesan Life: Chaplaincy: lay and ordained, in prisons, schools, universities, police, hospitals and in our communities; and Anna Chaplains working with older people and chaplains working with those with disability, the deaf & hard of hearing. Deanery: The Area Dean, Canon Gary Philbrick. The Assistant Area Dean , Matthew Trick, The Lay Chair of Synod, Susan Lyonette. Members of the Standing Committee. The Deanery Synod and our representatives on the Diocesan Synod. Kinkiizi Prayers : Kanyantorogo Archdeaconry. Monday 30th August John Bunyan, Spiritual Writer, 1688 Anglican Cycle: Ekiti Kwara (Nigeria): Andrew Ajayi (Bishop) Diocese: Benefice of Burghclere with Newtown and Ecchinswell with Sydmonton: Burghclere: The Ascension; Ecchinswell w Sydmonton: St Lawrence; Newtown: St Mary the Virgin & St John the Baptist. Clergy & LLMs: Priest in Charge: Anthony Smith. -

St. James' Church, Ashmansworth

ST. JAMES’ CHURCH, ASHMANSWORTH This little church on the Hampshire Downs at the north end of the Winchester Diocese has an intriguing history reaching back into the 10th century. It also has a singular charm as its small white, weatherboard bell tower is sighted above the high banks and hedges of the lane that winds down towards the Bourne Valley. Sadly, the old bells no longer ring out over the scattered village - because they must be re-hung before they can even be chimed. (It has, up to now, seemed unlikely that adequate funds will ever be available for full circle ringing). Indeed, this situation is a part of the dilemma facing this small parish, a dilemma created, strangely enough, by a generous bequest from one of its parishioners, Miss Annie Taylor. This bequest led the Parochial Church Council to call in experts to advise on what might be done to restore and make safe the bell tower, to preserve and improve the remains of the wall paintings as well as to repair the effects of sheer age on the church as a whole; which has inevitably taken place despite the devoted attention of church wardens and parishioners over the years. It needs little imagination to recognise that this survey revealed a call for restoration work with costs far exceeding the value of this bequest. The earliest extant reference to Ashmansworth is found in the Charter of King Athelstan the Victorious (925-940) and it is certain that a Saxon church stood on this site of the present building which itself belongs mainly to the 12th century and at that time was mentioned in the general confirmation of his manors by Edward I. -

Sparsholt College Campus Bus Timetable 2021/22

Sparsholt College campus bus timetable 2021/22 Aldershot – Aldermaston - 0118 971 3257 Pick up Drop off Time Price Time (Departs SCH 4.40 pm) Band Aldershot – Train station Road opp Station Cafe 7.55 am 6.25 pm D Heath End - layby, by Camdenwell's Fish Bar 8.00 am 6.25 pm D Farnham -South Street bus stop by Sainsbury's AM/ junction of West Street & Castle Street PM 8.05 am 6.15 pm D Bordon – bus stop on the A325 Farnham Road (East Bound) near Station Rd 8.25 am 5.55 pm D Alton – Sainsbury’s, Draymans Way 8.45 am 5.35 pm C Four Marks - Lymington Bottom Bus Stop 8.55 am 5.25 pm B New Alresford – The Co-op bus stop 9.05 am 5.15 pm B Amesbury - Amport and District – 01264 772307 Pick up Drop off Time Price Time (Departs SCH 4.40 pm) Band Amesbury – Central Car Park 8.30 am 5.50 pm C Bulford Camp - Near Junction of Marlborough Rd/ Horne Rd 8.40 am 5.40 pm C Tidworth – Hampshire Cross bus stop 8.50 am 5.30 pm C Ludgershall - Outside Tesco 8.55 am 5.25 pm B Weyhill Road – Appleshaw (AM) / White House (PM) crossroad 9.00 am 5.15 pm B Weyhill Road – Layby past Short Lane 9.05 am 5.20 pm B Middle Wallop – Junction of The Avenue/Danebury Rd 9.15 am 5.05 pm B Stockbridge – St Peters Church 9.20 am 4.50 pm A Bitterne - Wheelers - 02380 471800 Pick up Drop off Time Price Time (Departs SCH 4.50 pm) Band Bitterne – West End Rd, opposite Sainsbury’s 7.45 am 6.15 pm B Portswood – bus stop outside Bus Depot, now Sainsbury’s 8.00 am 6.00 pm B Chilworth -Roundabout at Bassett Avenue (AM); 1st bus stop The Avenue after pedestrian lights (PM) 8.15 am 5.45 pm -

Basingstoke Rural West Covering the Wards Of: Baughurst and Tadley North; Kingsclere; Sherborne St John; Burghclere, Highclere and St Mary Bourne; East Woodhay

Basingstoke Rural West Covering the wards of: Baughurst and Tadley North; Kingsclere; Sherborne St John; Burghclere, Highclere and St Mary Bourne; East Woodhay www.hampshire.police.uk Welcome to the Basingstoke Rural West Newsletter, November 2019 Your neighbourhood policing team includes: PC Simon Denton PC Jon Hayes You can contact the team at [email protected] — though this address is not monitored every day. For reporting crime, call 101 or go to the Hampshire police website www.hampshire.police.uk. Community Priorities The current neighbourhood priority is Burglary. A residential property in Cannon Heath, Overton, was broken into during daylight hours and jewellery was stolen. An electric bike was stolen from a garage in Ecchinswell. Some facts about burglaries (sources in brackets). Most burglaries take place between 10am and 3pm. (Safestyle UK) The average burglary lasts for eight minutes. (Dr Claire Nee, Unviersity of Portsmouth) Many burglaries are ‘spur of the moment’ decisions by a burglar who notices an open door, open window, valuables on display or some other weakness. (Thames Valley Police) The vast majority of burglars will want to avoid meeting the home’s occupants at any cost. (The Independent) A burglar may typically examine many houses before finding one that looks like an easy one to steal from. Homes with no security measures in place are five times more likely to be burgled than those with simple security measures. Good window locks and strong deadlocks can make a big difference. In most burglaries, the criminals broke into the house or flat through the door, either by forcing the lock or kicking it in.