Grouper-Tilefish Individual Fishing Quota Program 5-Year Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Honoring the Family Meal Helping Families Be Healthier and Happier with Quick, Easy Seafood Meals

Honoring the Family Meal Helping families be healthier and happier with quick, easy seafood meals OCTOBER IS NATIONAL SEAFOOD MONTH Seafood Nutrition Partnership is here to inspire Americans to enjoy seafood at least twice a week by showing how buying and Fun ways to preparing seafood is simple and delicious! USE THIS TOOLKIT For National Seafood Month in October, we are bringing the This toolkit is designed to inspire and focus back to family. demonstrate how you can implement National Seafood Month this October. Magic happens during family mealtime when children and parents Within the theme, several messaging tracks gather around the table and engage each other in conversation. Family meals eaten at home have been proven to benefit the will be promoted to speak to different health and wellness of children and adolescents, to fight obesity consumers. Please utilize the turnkey and substance abuse, and to make families stronger—creating a resources and messaging, or work with us to positive impact on our communities and our nation as a whole. customize it for your audiences. Join us as we work collaboratively with health partners, ▶ Quick, Easy Weeknight Meals seafood companies, retailers and dietitians from across the Many fish dishes cook in 15 minutes or less country to bring families back to the table. ▶ Fun Ways to Engage Seafood Nutrition Partnership is partnering with the Food Little Seafoodies Marketing Institute Foundation to emphasize the importance of Get kids cooking in the kitchen family meals, expanding National Family Meals Month throughout the year and into a true movement — the Family Meals Movement. -

Fish Spawning Aggregations

Fish Spawning Aggregations a focal point of fisheries management and marine conservation in Mexico Photo: Octavio Aburto Authorship Brad Erisman – Coastal Fisheries Research Program, University of Texas Marine Science Institute, 750 Channel View Drive, Port Aransas, TX 78373 William Heyman – LGL Ecological Research Associates, Inc., 4103 S. Texas Avenue, Bryan TX 77802 Stuart Fulton – Comunidad y Biodiversidad, Isla del Peruano 215, Lomas de Miramar, Guaymas, Sonora, Mexico Timothy Rowell – Gulf of California Marine Program, Scripps Institution of Oceanography, 9500 Gilman Drive, La Jolla, CA 92037 Illustrations – Larry Allen and Madeline Wukusick Graphic Design – Madeline Wukusick | www.communique.design Photography – Octavio Aburto, Richard Barnden, Douglas David Seifert, Walt Stearns, Cristina Limonta, Alfredo Barroso Citation – Erisman, B., W.D. Heyman, S. Fulton, and T.Rowell 2018. Fish spawning aggregations: a focal point of fisheries management and marine conservation in Mexico. Gulf of California Marine Program, La Jolla, CA. 24 p. Email Contact: Brad Erisman, [email protected] Fish Spawning Aggregations // 2 Contents > Introduction .................................................................................................................................................................. 4 > What are fish spawning aggregations (FSAs)? ............................................................................................................ 5 > What kinds of fishes form FSAs? ................................................................................................................................ -

RNA Detection Technology for Applications in Marine Science: Microbes to Fish Robert Michael Ulrich University of South Florida, [email protected]

University of South Florida Scholar Commons Graduate Theses and Dissertations Graduate School 6-25-2014 RNA Detection Technology for Applications in Marine Science: Microbes to Fish Robert Michael Ulrich University of South Florida, [email protected] Follow this and additional works at: https://scholarcommons.usf.edu/etd Part of the Biology Commons, and the Molecular Biology Commons Scholar Commons Citation Ulrich, Robert Michael, "RNA Detection Technology for Applications in Marine Science: Microbes to Fish" (2014). Graduate Theses and Dissertations. https://scholarcommons.usf.edu/etd/5321 This Dissertation is brought to you for free and open access by the Graduate School at Scholar Commons. It has been accepted for inclusion in Graduate Theses and Dissertations by an authorized administrator of Scholar Commons. For more information, please contact [email protected]. RNA Detection Technology for Applications in Marine Science: Microbes to Fish by Robert M. Ulrich A dissertation submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy College of Marine Science University of South Florida Major Professor: John H. Paul, Ph.D. Valerie J. Harwood, Ph.D. Mya Breitbart, Ph.D. Christopher D. Stallings, Ph.D. David E. John, Ph.D. Date of Approval June 25, 2014 Keywords: NASBA, grouper, Karenia mikimotoi, Enterococcus Copyright © 2014, Robert M. Ulrich DEDICATION This dissertation is dedicated to my fiancée, Dr. Shannon McQuaig for inspiring my return to graduate school and her continued support over the last four years. On no other porch in our little town have there been more impactful scientific discussions, nor more words of encouragement. ACKNOWLEDGMENTS I gratefully acknowledge the many people who have encouraged and advised me throughout my graduate studies. -

Fishery Resources Reading: Chapter 3 Invertebrate and Vertebrate Fisheries Diversity and Life History Species Important Globally Species Important Locally

Exploited Fishery Resources Reading: Chapter 3 Invertebrate and vertebrate fisheries Diversity and life history species important globally species important locally Fisheries involving Invertebrate Phyla Mollusca • Bivalves, Gastropods and Cephalopods Echinodermata • sea cucumbers and urchins Arthropoda • Sub-phylum Crustacea: • shrimps and prawns • clawed lobsters, crayfish • clawless lobsters • crabs Phylum Mollusca: Bivalves Fisheries • Oysters, Scallops, Mussels, and Clams • World catch > 1 million MT • Ideal for aquaculture (mariculture) • Comm. and rec. in shallow water 1 Phylum Mollusca: Gastropods Fisheries • Snails, whelks, abalone • Largest number of species • Most harvested from coastal areas • Food & ornamental shell trade • Depletion of stocks (e.g. abalone) due to habitat destruction & overexploitation Phylum Mollusca: Cephalopods Fisheries • Squid, octopus, nautilus • 70% of world mollusc catch = squids • Inshore squid caught with baited jigs, purse seines, & trawls • Oceanic: gill nets & jigging Phylum Echinodermata Fisheries • Sea cucumbers and sea urchins Sea cucumber fisheries • Indian & Pacific oceans, cultured in Japan • slow growth rates, difficult to sustain Sea urchin fisheries • roe (gonads) a delicacy • seasonal based on roe availability Both Easily Overexploited 2 Sub-phylum Crustacea: Shrimps & Prawns Prawn fisheries • extensive farming (high growth rate & fecundity) • Penaeids with high commercial value • stocks in Australia have collapsed due to overfishing & destruction of inshore nursery areas Caridean -

Clean &Unclean Meats

Clean & Unclean Meats God expects all who desire to have a relationship with Him to live holy lives (Exodus 19:6; 1 Peter 1:15). The Bible says following God’s instructions regarding the meat we eat is one aspect of living a holy life (Leviticus 11:44-47). Modern research indicates that there are health benets to eating only the meat of animals approved by God and avoiding those He labels as unclean. Here is a summation of the clean (acceptable to eat) and unclean (not acceptable to eat) animals found in Leviticus 11 and Deuteronomy 14. For further explanation, see the LifeHopeandTruth.com article “Clean and Unclean Animals.” BIRDS CLEAN (Eggs of these birds are also clean) Chicken Prairie chicken Dove Ptarmigan Duck Quail Goose Sage grouse (sagehen) Grouse Sparrow (and all other Guinea fowl songbirds; but not those of Partridge the corvid family) Peafowl (peacock) Swan (the KJV translation of “swan” is a mistranslation) Pheasant Teal Pigeon Turkey BIRDS UNCLEAN Leviticus 11:13-19 (Eggs of these birds are also unclean) All birds of prey Cormorant (raptors) including: Crane Buzzard Crow (and all Condor other corvids) Eagle Cuckoo Ostrich Falcon Egret Parrot Kite Flamingo Pelican Hawk Glede Penguin Osprey Grosbeak Plover Owl Gull Raven Vulture Heron Roadrunner Lapwing Stork Other birds including: Loon Swallow Albatross Magpie Swi Bat Martin Water hen Bittern Ossifrage Woodpecker ANIMALS CLEAN Leviticus 11:3; Deuteronomy 14:4-6 (Milk from these animals is also clean) Addax Hart Antelope Hartebeest Beef (meat of domestic cattle) Hirola chews -

Valuable but Vulnerable: Over-Fishing and Under-Management Continue to Threaten Groupers So What Now?

See discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/339934856 Valuable but vulnerable: Over-fishing and under-management continue to threaten groupers so what now? Article in Marine Policy · June 2020 DOI: 10.1016/j.marpol.2020.103909 CITATIONS READS 15 845 17 authors, including: João Pedro Barreiros Alfonso Aguilar-Perera University of the Azores - Faculty of Agrarian and Environmental Sciences Universidad Autónoma de Yucatán -México 215 PUBLICATIONS 2,177 CITATIONS 94 PUBLICATIONS 1,085 CITATIONS SEE PROFILE SEE PROFILE Pedro Afonso Brad E. Erisman IMAR Institute of Marine Research / OKEANOS NOAA / NMFS Southwest Fisheries Science Center 152 PUBLICATIONS 2,700 CITATIONS 170 PUBLICATIONS 2,569 CITATIONS SEE PROFILE SEE PROFILE Some of the authors of this publication are also working on these related projects: Comparative assessments of vocalizations in Indo-Pacific groupers View project Study on the reef fishes of the south India View project All content following this page was uploaded by Matthew Thomas Craig on 25 March 2020. The user has requested enhancement of the downloaded file. Marine Policy 116 (2020) 103909 Contents lists available at ScienceDirect Marine Policy journal homepage: http://www.elsevier.com/locate/marpol Full length article Valuable but vulnerable: Over-fishing and under-management continue to threaten groupers so what now? Yvonne J. Sadovy de Mitcheson a,b, Christi Linardich c, Joao~ Pedro Barreiros d, Gina M. Ralph c, Alfonso Aguilar-Perera e, Pedro Afonso f,g,h, Brad E. Erisman i, David A. Pollard j, Sean T. Fennessy k, Athila A. Bertoncini l,m, Rekha J. -

(Slide 1) Lesson 3: Seafood-Borne Illnesses and Risks from Eating

Introductory Slide (slide 1) Lesson 3: Seafood-borne Illnesses and Risks from Eating Seafood (slide 2) Lesson 3 Goals (slide 3) The goal of lesson 3 is to gain a better understanding of the potential health risks of eating seafood. Lesson 3 covers a broad range of topics. Health risks associated specifically with seafood consumption include bacterial illness associated with eating raw seafood, particularly raw molluscan shellfish, natural marine toxins, and mercury contamination. Risks associated with seafood as well as other foods include microorganisms, allergens, and environmental contaminants (e.g., PCBs). A section on carotenoid pigments (“color added”) explains the use of these essential nutrients in fish feed for particular species. Dyes are not used by the seafood industry and color is not added to fish—a common misperception among the public. The lesson concludes with a discussion on seafood safety inspection, country of origin labeling (COOL) requirements, and a summary. • Lesson 3 Objectives (slide 4) The objectives of lesson 3 are to increase your knowledge of the potential health risks of seafood consumption, to provide context about the potential risks, and to inform you about seafood safety inspection programs and country of origin labeling for seafood required by U.S. law. Before we begin, I would like you to take a few minutes to complete the pretest. Instructor: Pass out lesson 3 pretest. Foodborne Illnesses (slide 5) Although many people are complacent about foodborne illnesses (old risk, known to science, natural, usually not fatal, and perceived as controllable), the risk is serious. The Centers for Disease Control and Prevention (CDC) estimates 48 million people suffer from foodborne illnesses annually, resulting in about 128,000 hospitalizations and 3,000 deaths. -

Fishes of Hawaii: Life in the Sand Fishinar 11/14/16 Dr

Fishes of Hawaii: Life in the Sand Fishinar 11/14/16 Dr. Christy Pattengill-Semmens, Ph.D.– Instructor Questions? Feel free to contact me at Director of Science- REEF [email protected] Hawaiian Garden Eel (Gorgasia hawaiiensis) – Conger Eel Light grayish green, covered in small brownish spots. Found in colonies, feeding on plankton. Only garden eel in Hawaii. Up to 24” ENDEMIC Photo by: John Hoover Two-Spot Sandgoby (Fusigobius duospilus) – Goby Small translucent fish with many orangish-brown markings on body. Black dash markings on first dorsal (looks like vertical dark line). Small blotch at base of tail (smaller than pupil). Pointed nose. The only sandgoby in Hawaii. Photo by: John Hoover Eyebar Goby (Gnatholepis anjerensis) - Goby Thin lines through eye that do not meet at the top of the head. Row of smudgy spots down side of body. Small white spots along base of dorsal fin. Can have faint orange shoulder spot. Typically shallow, above 40 ft. Up to 3” Photo by: Christa Rohrbach Shoulder-spot Goby (Gnatholepis cauerensis) - Goby aka Shoulderbar Goby in CIP and SOP Line through eye is typically thicker, and it goes all the way across its head. Body has numerous thin lines made up of small spots. Small orange shoulder spot usually visible and is vertically elongated. Typically deeper, below 40 ft. Up to 3” Photo by: Florent Charpin Hawaiian Shrimpgoby (Psilogobius mainlandi) - Goby Found in silty sand, lives commensally with a blind shrimp. Pale body color with several vertical pale thin lines, can have brownish orange spots. Eyes can be very dark. -

Rubble Mounds of Sand Tilefish Mala Canthus Plumieri (Bloch, 1787) and Associated Fishes in Colombia

BULLETIN OF MARINE SCIENCE, 58(1): 248-260, 1996 CORAL REEF PAPER RUBBLE MOUNDS OF SAND TILEFISH MALA CANTHUS PLUMIERI (BLOCH, 1787) AND ASSOCIATED FISHES IN COLOMBIA Heike Buttner ABSTRACT A 6-month study consisting of collections and observations revealed that a diverse fauna of reef-fishes inhabit the rubble mounds constructed by the sand tilefish Malacanthus plumieri (Perciformes: Malacanthidae), In the Santa Marta region, on the Caribbean coast of Colombia, M, plumieri occurs on sandy areas just beyond the coral zone. The population density is correlated with the geomorphology of the bays; the composition of the material utilized depends on its availability. Experiments showed that debris was distributed over a distance of 35 m. Hard substrate must be excavated to reach their caves. In the area around Santa Marta the sponge Xestospongia muta was often used by the fish as a visual signal for suitable substratum. The rubble mounds represent a secondary structure within the "coral reef" eco- system. These substrate accumulations create structured habitats in the fore reef, which arc distributed like islands in the monotonous sandy environment and where numerous benthic organisms are concentrated. The tilefish nests attract other organisms because they provide shelter and a feeding site in an area where they would not normally be found. At least 32 species of fishes were found to be associated with the mounds. Some species lived there exclusively during their juvenile stage, indicating that the Malacanthus nests serve as a nursery-habitat. M. plumieri plays an important role in the diversification of the reef envi- ronment. For several years artificial reefs and isolated structures, for example patch reefs and coral blocks, have been the subject of investigations of development and dynamics of benthic communities (Randall, 1963; Fager, 1971; Russell, 1975; Russell et aI., 1974; Sale and Dybdahl, 1975). -

Travel to Peru with Chef Mawa Mcqueen&Apos;S

COOKING WITH THE QUEEN “A COMMUNITY THAT COOKS TOGETHER, STAYS TOGETHER” TRAVELING TO PERU WITH THE QUEEN CHEF MAWA MENU PERUVIAN STYLE FISH OR SHRIMP CEVICHE LOMO SALTADO TRADITIONAL PERUVIAN COCKTAIL “PISCO SOUR” ZOOM IN HERE WWW.MAWASKITCHEN.COM FRIDAY, JUNE 19TH – 5:30 PM MDT CHEF MAWA MCQUEEN Sponsored by ONE SNOWMASS PENTHOUSE – INSPIRATO SILVERPEAK HOLDINGS LARSEN LIMITED WWW.MAWASKITCHEN.COM | WWW.ALLINSNOWMASS.COM 1 INSTAGRAM @MAWASKITCHEN | #ZOOMCOOKINGWITHMAWA PERUVIAN STYLE FISH OR SHRIMP CEVICHE A Latin American favorite! A slight variation on the more commonly known ceviche normally prepared with a white fish such as tilapia. This recipe is prepared with shrimp and served with corn and sweet potatoes. The flavor will amaze you; the "cooking" time will more than impress you. This is the best Ceviche de Camaran recipes I've tried and it is very healthy. Course Appetizer Cuisine Latin America Prep Time 30 minutes Cook Time Total Time 30 minutes Servings: 6 Ingredients • 1.5 lbs shrimp or white fresh fish • 1 spring celery • Teaspoon garlic past • Teaspoon ginger past • 3 Tbsp cilantro chopped • 8 limes fresh squeezed juice or enough to cover the seafood • 1 tsp Kosher salt • 1 jalapeno or habanero seeded, cored and diced small • 1 medium red onion finely chopped (fine julienne) • 1 corn Boiled optional • Cooked (boiled) sweet potatoes optional We will make lèche tigre or tiger milk! Instructions 1. Peel and devein shrimp or fish and cut into small pieces (about 1/2" 2. Place in a shallow glass or ceramic container add salt stir 3. put all ingredients on top. -

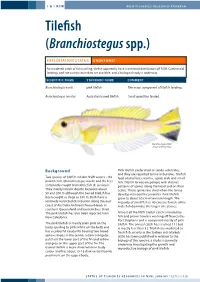

Tilefish (Branchiostegus Spp.)

I & I NSW WILD FISHERIES RESEARCH PROGRAM Tilefish (Branchiostegus spp.) EXPLOITATION STATUS UNDEFINED An incidental catch of fish trawling, tilefish apparently have a restricted distribution off NSW. Commercial landings and size composition data are available, and a biological study is underway. SCIENTIFIC NAME STANDARD NAME COMMENT Branchiostegus wardi pink tilefish The major component of tilefish landings. Branchiostegus serratus Australian barred tilefish Small quantities landed. Branchiostegus wardi Image © Bernard Yau Background Pink tilefish prefer mud or sandy substrates, and they are reported to live in burrows. Tilefish Two species of tilefish inhabit NSW waters - the feed on molluscs, worms, squid, crab and small pink tilefish, (Branchiostegus wardi) and the less fish. Tilefish larvae are pelagic with distinct commonly caught barred tilefish (B. serratus). patterns of spines along the head and on their They mainly inhabit depths between about scales. These spines are shed when the larvae 50 and 200 m although the barred tilefish has develop into benthic juveniles. Pink tilefish been caught as deep as 350 m. Both have a grow to about 50 cm maximum length. The relatively restricted distribution along the east majority of small fish (< 40 cm) are female while coast of Australia, between Noosa Heads in male fish dominate the larger size classes. southern Queensland and eastern Bass Strait. The pink tilefish has also been reported from Almost all the NSW tilefish catch is landed by New Caledonia. fish and prawn trawlers working off Newcastle- Port Stephens and is comprised mostly of pink The pink tilefish is mainly plain pink on the tilefish. The annual catch has reached 11 t but body, grading to pink/white on the belly and is mostly less than 5 t. -

Spiny Lobster Amendment 4

AMENDMENT 4 TO THE FISHERY MANAGEMENT PLAN FOR SPINY LOBSTER IN THE GULF OF MEXICO AND SOUTH ATLANTIC INCLUDING THE REGULATORY IMPACT REVIEW AND ENVIRONMENTAL ASSESSMENT prepared by the South Atlantic and Gulf of Mexico Fishery Management Councils SEPTEMBER 1994 Financial assistance for producing this Amendment was provided by grant funds from the National Marine Fisheries Service, National Oceanic and Atmospheric Administration, under Public Law 94-265, the Magnuson Fishery Conservation and Management Act. TABLE OF CONTENTS PAGE LIST OF ACTIONS IN SPINY LOBSTER AMENDMENT 4 ........................................... i REGULATORY IMPACT REVIEW FOR SPINY LOBSTER AMENDMENT 4 ..................... ii 1.0 PURPOSE AND NEED.................................................................................. 1 2.0 ALTERNATIVESINCLUDINGTHEPROPOSEDACTION .....................................5 3.0 AFFECTED ENVIRONMENT.......................................................................... 7 A. Optimum Yield.....................................................................................7 B. Definition of Overfishing......................................................................... 7 C. Commercial Fishery...........................................:.................,................. 8 D. Recreational Fishery .............................................................................. 9 E. Status of the Stocks ............................................................................... 16 ~~-· 4.0 ENVIRONMENTAL CONSEQUENCES ...............................:;:-.: