Report Authors

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Services & Offerings

STAG DINING 2020 SERVICES & OFFERINGS Meal Kits - Pantry Provisions - Natural Wine - Gifting - Cocktail Kits & Classes - Event Space - Crenn Farm 1 LETTER FROM STAG 4 STAG DINING GROUP STAG OVERVIEW MEAL KITS & OFFERINGS 8 NATURAL WINES 10 COCKTAIL KITS & CLASSES 12 WINEMAKING PARTNERS 16 CRENN & STAG 18 OUR VENUE 22 CLIENTS 27 TEAM 28 CONTACT 32 STAG DINING GROUP 925 O'Farrell St San Francisco, CA 94109 (415) 944-2065 [email protected] www.stagdining.com DERBY COCKTAIL CO www.derbycocktail.co CERF CLUB www.cerfclub.com © 2020 Stag Dining Group Select Photography by David Dines, dines.co 2 3 WITH A DECADE OF EXPERIENCE IN HOSPITALITY, WE HAVE NEVER SEEN A CHALLENGE THAT FACES US QUITE LIKE THE ONE POSED BY COVID-19. With virtually every restaurant worker out of a job, and traditional supply chains for food, wine and spirits broken, we have been UPDATED OFFERINGS seeking opportunities to mend those bonds in pragmatic ways while continuing to serve our customers. Our revised offerings are an attempt to help our clients engage their stakeholders, employees MEAL KITS and clients in ways that are fitting for this time and address the social, racial, environmental and biological crises that we are PANTRY PROVISIONS facing collectively as a society. NATURAL WINE At Stag Dining Group we believe every plate and every glass GIFTING tells a unique story, and we make every effort to connect guests COCKTAIL KITS & CLASSES to each other, to the environment and to the thought leaders of CRENN FARM this industry in authentic ways. Since our inception, we have witnessed the power that transformative culinary experiences have CERF CLUB EVENT VENUE on our guests and the conversations that can be sparked at the table. -

In Eastern Partner Countries

EU4Digital: supporting digital economy and society in the Eastern Partnership Market Assessment for Digital Innovation and Scale-up Initiative in Eastern partner countries Final report June 2020 1 About this study In early 2020, EU4Digital Facility launched activity ‘Market Assessment for Digital Innovation and Scale-up Initiative (DISC) in Eastern Partner Countries’ (hereinafter – study / research) The goal is to analyse the investment landscape for digital high tech companies in these countries: Armenia, Azerbaijan, Belarus, Georgia, the Republic of Moldova and Ukraine. The activity was inspired by Digital Innovation and Scale-up initiative (DISC) in Central, Eastern and South Eastern Europe region (European Commission Factsheet). Based on the findings of this study, the European Commission will be able to adjust its plans to better serve the needs of the local markets, developing adapted financial support instruments. This research aims to: 1. Understand digital innovation and high-tech start-ups investment landscape and identify existing gaps on investment in Eastern partner countries. 2. Map the main private & corporate equity investors that provide financing to digital start-ups and fast growth companies in Eastern partner countries. 3. Map the main public sector investment programs in start-up / tech-oriented companies at the country-level. 4. Analyse micro-level data on private investments in start-up / tech-oriented companies in the region. 5. Provide recommendations to develop and use financial instruments for digital innovation and the scale-up of high-tech start-ups. The research focuses on start-ups at the creation and scale-up phases, rather than traditional SMEs on their path to digitalisation. -

How to Catch a Unicorn

How to Catch a Unicorn An exploration of the universe of tech companies with high market capitalisation Author: Jean Paul Simon Editor: Marc Bogdanowicz 2016 EUR 27822 EN How to Catch a Unicorn An exploration of the universe of tech companies with high market capitalisation This publication is a Technical report by the Joint Research Centre, the European Commission’s in-house science service. It aims to provide evidence-based scientific support to the European policy-making process. The scientific output expressed does not imply a policy position of the European Commission. Neither the European Commission nor any person acting on behalf of the Commission is responsible for the use which might be made of this publication. JRC Science Hub https://ec.europa.eu/jrc JRC100719 EUR 27822 EN ISBN 978-92-79-57601-0 (PDF) ISSN 1831-9424 (online) doi:10.2791/893975 (online) © European Union, 2016 Reproduction is authorised provided the source is acknowledged. All images © European Union 2016 How to cite: Jean Paul Simon (2016) ‘How to catch a unicorn. An exploration of the universe of tech companies with high market capitalisation’. Institute for Prospective Technological Studies. JRC Technical Report. EUR 27822 EN. doi:10.2791/893975 Table of Contents Preface .............................................................................................................. 2 Abstract ............................................................................................................. 3 Executive Summary .......................................................................................... -

Download the Full Report

SovereignWealthFunds15:Maquetación 1 20/10/15 17:57 Página 1 SovereignWealthFunds15:Maquetación 1 20/10/15 17:57 Página 2 Editor: Javier Santiso, PhD Associate Professor, ESADE Business School Vice President, ESADEgeo - Center for Global Economy and Geopolitics SovereignWealthFunds15:Maquetación 1 20/10/15 17:57 Página 3 Index Foreword 5 Executive Summary 7 Direct investing by sovereign wealth funds in 2014: The worst of times, the best of times 11 I Geographic Analysis 21 Sovereign wealth funds in Spain and Latin America: Spain's consolidation as an investment destination 23 Sovereign wealth funds from Muslim countries: Driving the Halal industry and Islamic finance 37 Different twins and a distant cousin: Sovereign wealth funds in Hong Kong, Singapore and South Korea 51 II Sector Analysis 65 Sovereign wealth funds and the geopolitics of agriculture 67 Sovereign Venture Funds 79 The kings of the king of sports: Sovereign wealth funds and football 95 Financing of the digital ecosystem: The “disruptive” role of SWFs…Reconsidered 109 Sovereign wealth funds and heritage assets: An investor’s perspective 121 ANNEX. ESADEgeo Sovereign Wealth Funds Ranking 2015 133 Sovereign wealth funds 2015 Index 3 SovereignWealthFunds15:Maquetación 1 20/10/15 17:57 Página 4 SovereignWealthFunds15:Maquetación 1 20/10/15 17:57 Página 5 Preface SovereignWealthFunds15:Maquetación 1 20/10/15 17:57 Página 6 1. Preface The pattern of world economic growth during 2015 has undergone In both 2014 and 2015 developed and emerging countries' a significant change relative to previous years. While the developed sovereign wealth funds have continued to feature prominently in economies succeeded in shaking off their lethargy and improving significant strategic transactions worldwide. -

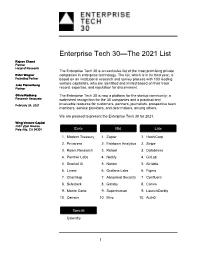

Enterprise Tech 30—The 2021 List

Enterprise Tech 30—The 2021 List Rajeev Chand Partner Head of Research The Enterprise Tech 30 is an exclusive list of the most promising private Peter Wagner companies in enterprise technology. The list, which is in its third year, is Founding Partner based on an institutional research and survey process with 103 leading venture capitalists, who are identified and invited based on their track Jake Flomenberg Partner record, expertise, and reputation for discernment. Olivia Rodberg The Enterprise Tech 30 is now a platform for the startup community: a Research Associate watershed recognition for the 30 companies and a practical and February 24, 2021 invaluable resource for customers, partners, journalists, prospective team members, service providers, and deal makers, among others. We are pleased to present the Enterprise Tech 30 for 2021. Wing Venture Capital 480 Lytton Avenue Palo Alto, CA 94301 Early Mid Late 1. Modern Treasury 1. Zapier 1. HashiCorp 2. Privacera 2. Fishtown Analytics 2. Stripe 3. Roam Research 3. Retool 3. Databricks 4. Panther Labs 4. Netlify 4. GitLab 5. Snorkel AI 5. Notion 5. Airtable 6. Linear 6. Grafana Labs 6. Figma 7. ChartHop 7. Abnormal Security 7. Confluent 8. Substack 8. Gatsby 8. Canva 9. Monte Carlo 9. Superhuman 9. LaunchDarkly 10. Census 10. Miro 10. Auth0 Special Calendly 1 2021 The Curious Case of Calendly This year’s Enterprise Tech 30 has 31 companies rather than 30 due to the “curious case” of Calendly. Calendly, a meeting scheduling company, was categorized as Early-Stage when the ET30 voting process started on January 11 as the company had raised $550,000. -

Portfolio Management Revolution Technology Trending Paper Silicon Valley, CA Q4 2014

The Portfolio Management Revolution Technology Trending Paper Silicon Valley, CA Q4 2014 The Portfolio Management Revolution Over the past few years, a new crop of online wealth man- agement startups has come on the scene, threatening to disrupt a profitable business line once the sole province of banks and private advisors. Betterment, for example, in four years has On the back end, technology startups such grown to over 50,000 customers and man- as Addepar, MyVest, and Kensho are serving ages more than $1B in assets. Such consum- wealth managers and private bankers by pro- er-facing services, known as robo-advisors, viding platforms that increase efficiency, feed also include Wealthfront, SigFig, Personal intelligence on market moving global trends, Capital, FutureAdvisor, and several others. and otherwise bring portfolio management into the 21st century. The emerging class of portfolio analytics Venture capital (VC) has pumped $800M into startups represent the new face of wealth man- the space over the last two years, recognizing agement, and their popularity attests to this. the runaway popularity of the new services and Many of the consumer-facing startups are aimed the vast potential for profitability. Investment is at the younger picking up speed. In generations, which the second quarter have high expecta- As wealth is transferred of 2014 alone, tions and, in many from the boomer investment in per- cases, are ignored sonal finance ser- by traditional pri- generation to generations vices was $261M, vate wealth man- according to CB agers and banks X and Y, it will represent Insights. who doubt the a $41T opportunity. -

Financial Services Deals for July 2018

Financial Services Deals for July 2018 Company Name Description Deal Synopsis Ajax Health Provider of operational and financial support to the The company received $124.97 million of development capital emerging medical device companies. The company from Kohlberg Kravis Roberts, Aisling Capital, Iconiq Capital, operates healthcare companies that address significant HealthQuest Capital, Polaris Partners, WTI and other unmet needs by developing emerging medical device undisclosed investors on July 19, 2018. technologies and focuses on improving lives and bringing speed, simplicity and cost efficiency to healthcare. Applied Data Finance Developer of consumer financial platform intended for The company raised $145 million of development capital from lending money. The company's platform provides MAI Capital Management, Park Cities Asset Management, underestimated under-banked consumer loans and credit Victory Park Capital (Illinois), and other undisclosed investors on facilities to non-prime borrowers through assessment of July 25, 2018. This new capital will accelerate the company's credit risk using technology and advanced data science continued growth to reach individuals in need of and machine learning enabling consumers credit and loan straightforward, affordable loans. facilities as per their requirement and capability to payback. FinTech Acquisition II Operator of a blank check company. The company's The company (NASDAQ: FNTE) was acquired by International formation was facilitated for the purpose of effecting a Money Express, via its financial sponsor Stella Point Capital, merger, capital stock exchange, asset acquisition, stock through a reverse merger, resulting in the combined entity purchase, reorganization or the similar business trading on the NASDAQ Stock Exchange on July 26, 2018. combination. -

Q2 2018 Venture Capital Deals and Exits 3 July 2018

DOWNLOAD THE DATA PACK Q2 2018 VENTURE CAPITAL DEALS AND EXITS 3 JULY 2018 Fig. 1: Global Quarterly Venture Capital Deals*, Fig. 3: Number of Venture Capital Deals in Q2 2018 by Q1 2013 - Q2 2018 Fig. 2: Venture Capital Deals* in Q2 2018 by Region Investment Stage 4,500 80 100% Angel/Seed 7% 5% 1% 3% 4,000 2% 70 Aggregate Deal Value ($bn) 90% 1% 6% 3% Series A/Round 1 Other 1% 3% 3,500 60 80% 4% Series B/Round 2 3,000 50 70% 31% Israel 6% 2,500 54% 36% Series C/Round 3 60% 40 India 2,000 Series D/Round 4 and 50% No. of Deals 30 1,500 17% Later Greater China Growth 40% 16% 1,000 20 8% Capital/Expansion Proportion of Total Europe PIPE 500 10 30% 0 0 20% 37% North America Grant 31% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 10% Venture Debt 30% 2013 2014 2015 2016 2017 2018 0% Add-on & Other No. of Deals Aggregate Deal Value ($bn) No. of Deals Aggregate Deal Value Source: Preqin Source: Preqin Source: Preqin Fig. 5: Average Value of Venture Capital Deals by Investment Fig. 4: Venture Capital Deals* in Q2 2018 by Industry Stage, 2016 - H1 2018 Fig. 6: Number of US Venture Capital Deals* in Q2 2018 by State 40% 37% 140 35% 120 115 117 104 30% 2016 100 California 25% 24% 23% 80 80 2017 20% 34% New York 36% 14% 15% 60 49 15% 13% 13% 41 Q1-Q2 12% Massachusetts 40 32 29 32 29 2018 Proportion Proportion of Total 9% 26 2828 28 10% 8% 16 22 5% 5% Average Deal Size ($mn) 20 1211 5% 4% 4% 4% Washington 2% 1% 3%2% 2% 2 2 2 0% 0 Illinois 4% Other Round 3 Round 1 Round 2 Series C/ Series Series A/ Series B/ Series 4% Internet Other IT Other Other Services Business Food & Related Telecoms 13% Angel/Seed Industrials Healthcare Agriculture Software & 9% Consumer Expansion Venture Debt Venture 4 and Later Discretionary Series D/Round Series Growth Capital/ No. -

The State of Growth Equity for Minority Business: a River of Capital Flowing Past Our Communities

The State of Growth Equity for Minority Business | 1 The State of Growth Equity for Minority Business: A river of capital flowing past our communities Marlene Orozco and Eutiquio “Tiq” Chapa The State of Growth Equity for Minority Business | 2 The NAIC (www.naicpe.com) was formed in 1971 as About this White Paper the American Association of MESBICs (AAMESBIC), Inc., under President Richard M. Nixon’s Black Capital- ism program, which sought to ease access to capital The National Association of Investment for diverse business. During the 1980s, AAMESBIC Companies, Inc. (NAIC) commissioned this report lobbied successfully for legislation that would allow alongside the report by Lawrence C. Manson, Jr., diverse firms to repurchase the preferred stock from “Access to Capital: Accelerating Growth of Diverse- the U.S. Small Business Administration (SBA) while and Women-Owned Businesses,” as part of a grant raising funds that were not SBA regulated. AAMESBIC from the Minority Business Development Agency firms began approaching pension funds and other (MBDA), an agency within the United States Depart- institutional investors to raise larger pools of capital. ment of Commerce. The grant seeks to facilitate the aggregation and deployment of $1 billion in growth In the next decade, the organization changed its name equity capital to ethnically Diverse- and Women- to the National Association of Investment Companies, Owned Business Enterprises (DWBEs). Inc. as most members had turned from reliance on the SBA to become independent, institutional private equi- ty firms. Today, the NAIC has a membership of more In this report, Marlene Orozco, Chief Executive Officer than 80 diverse private equity and hedge fund firms of Stratified Insights, LLC, a premier research managing more than $165 billion in assets. -

Largest Venture Capital Deals and Exits; Deals by Value and Stage

The Preqin Quarterly: Private Equity, Q3 2012 This report is an excerpt from: Preqin Quarterly: Private Equity, Q3 2012. To download the full report please visit: https://www.preqin.com/docs/quarterly/PE/Private_Equity_Quarterly_Q3_2012.pdf Largest Venture Capital Deals and Exits; Deals by Value and Stage Fig. 42: Average Value of Venture Capital Deals by Stage, Fig. 43: Proportion of Number and Aggregate Value of Venture 2010 - 2012 YTD Capital Deals by Industry, Q3 2012 45 30% 28% 40 25% 35 21% 22% 30 20% 18% 25 17% 16% 15% 20 12% 15 10% 8% 8% 7% 6% 10 5% Average Deal Size ($mn) Average 5% 4% 4% 5% 4% 3% 5 2% 3% 3% 2% 2% 0 0% Other Seed Debt Angel/ Angel/ Disc. Venture Other IT Internet Business Series B/ Series Round 2 Services Round 1 Round 3 Series A/ Series Series C/ Series Growth Round 4 Round Series D/ Series Capital/ Related Telecoms and Later Industrials Semic. & & Semic. Expansion Consumer Electronics Cleantech Software & Healthcare Unspecified 2009 2010 2011 2012 YTD No. of Deals Aggregate Value of Deals Source: Preqin Venture Deals Analyst Source: Preqin Venture Deals Analyst Fig. 44: 10 Largest Venture Capital Deals, Q3 2012 Deal Size Name Date Stage Investors Primary Industry Location (mn) Square Sep-12 Series D/Round 4 200 USD Citi Ventures, Rizvi Traverse Management, Starbucks Mobile Payments US Flipkart Aug-12 Series D/Round 4 150 USD Accel Partners, Iconiq Capital, Naspers, Tiger Global Management Internet India Bessemer Venture Partners, Draper Fisher Jurvetson, General Growth Capital/ Box.net, Inc. Jul-12 125 USD Atlantic, New Enterprise Associates, SAP Ventures, Scale Venture Cloud Computing US Expansion Partners, The Social+Capital Partnership Andreessen Horowitz, Atomico, Baroda Ventures, DOCOMO Fab.com Jul-12 Series C/Round 3 105 USD Capital, First Round Capital, Mayfi eld Fund, Menlo Ventures, Internet US Pinnacle Ventures, ru-Net Ltd. -

Equity Financing Decreased to 50.8% for Large Corporate in 2021-Q2

AMERICAN INVESTMENT COUNCIL 2021-Q2 Private Equity Trends Table of Contents Page Deal Activity 3 Deal Financing and Pricing 6 Fundraising 11 Exits 13 PAGE 2 2021-Q2 Investment volume and number of deals increased by 60% and 61% respectively from 2020-Q2 Deal Value (Bil.) No. of Deals $800 6,000 $700 $753 $745 $684 5,000 $600 $648 $596 $500 4,000 $533 $505 $400 $441 3,000 $300 $380 $345 2,000 $200 $283 1,000 $175 $100 $173 $0 - 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Q1 Q2 2021 2021 PAGE 3 Source: PitchBook The 10 largest U.S. private equity deals in 2021-Q2 accounted for 29% of total deal value Investment Value Rank Company Description Date Financial Sponsor (Bil.) Business/Productivity RealPage 4/22/2021 $10.20 Thoma Bravo 1 Software IT Consulting and Perspecta 5/06/2021 $7.10 Peraton, Veritas Capital 2 Outsourcing Apollo Global Management, Certares, Hertz Road 5/12/2021 $6.50 3 Knighthead Capital Management Insight Partners, Norwest Venture Partners, CoreLogic Other Commercial Services 6/04/2021 $6.00 4 Stone Point Capital BayPine, StepStone Group, TSG Mavis Tire Supply Automotive 5/04/2021 $6.00 5 Consumer 6 Michaels Stores Specialty Retail 4/15/2021 $5.00 Apollo Global Management 7 Pluralsight Educational Software 4/06/2021 $3.50 Vista Equity Partners Elliott Management, Evergreen Coast Cubic Aerospace and Defense 5/25/2021 $3.10 8 Capital, Veritas Capital 9 A Cloud Guru Educational Software 6/02/2021 $2.00 Pluralsight, Vista Equity Partners Network Management ThycoticCentrify 4/13/2021 $1.40 Centrify, TPG 10 Software Note: The list above only reflects completed private equity transactions with disclosed investment values PAGE 4 Source: PitchBook, Web search transactions decreased to decreased transactions The average proportion of equity financing for LBO Sources of Financing of Sources 100% 20% 40% 60% 80% 0% 2003 34.8% 4.7% 54.5% includes bank debt, secured debt, senior unsecured debt, public/high yield debt, bridge loan and mezzanine debt. -

Venture Capital Report

Venture Capital Report U.S. | 4Q | 2018 VENTURE CAPITAL REPORT VENTURE CAPITAL REPORT The following report presents Dow Jones VentureSource’s quarterly findings for U.S. venture capital investment, fundraising, and liquidity. The included charts and graphs offer a comprehensive view of the trends currently affecting the venture capital market. Highlights for 4Q 2018 include: • A long-building tsunami of VC cash crested in 4Q, obliterating all quarterly and annual records for equity investment. • VC fundraising surged again with the fourth-largest quarter on record, helping to end 2018 with the biggest annual haul in 18 years. • The M&A market had its second-best quarter on record, catapulting 2018 as the top year ever for both the number of M&A transactions and the amounts paid. • VC-backed companies going public had a more mixed quarter, but ended 2018 as the best year for IPOs since 2014. • The San Francisco Bay area took 61% of all capital invested into U.S. companies in 4Q, by far the most extreme regional concentration ever seen. (The Bay Area average dating back to 1992 is 33%.) VENTURE CAPITAL REPORT 2 UNPRECEDENTED QUARTER AND YEAR BREAKS RECORDS FOR U.S. EQUITY INVESTMENT FINANCING Equity Financings in U.S.-Based, In a year when every single quarter set a new all-time VC-Backed Companies (2015–2018) record for equity investment, the final quarter managed to $45.00 1600 leap 33% above 3Q’s already staggering figure for capital raised. Altria Group’s $12.8 billion financing for Juul Labs $40.00 1400 $35.00 Inc.