Internet & Digital Media Insights

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

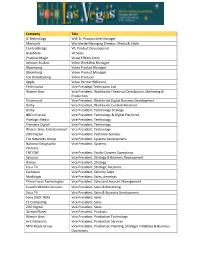

Company Title G-Technology WW Sr. Product Line Manager Microsoft

Company Title G-Technology WW Sr. Product Line Manager Microsoft Worldwide Managing Director, Media & Cable Contentbridge VP, Product Development GrayMeta VP Sales Practical Magic Visual Effects Artist Amazon Studios Video Workflow Manager Bloomberg Video Product Manager Bloomberg Video Product Manager Fox Broadcasting Video Producer Apple Video Partner Relations Technicolor Vice Presidept Technicolor Ltd Warner Bros. Vice President, Worldwide Theatrical Distribution, Marketing & Production Paramount Vice President, Worldwide Digital Business Development Dolby Vice President, Worldwide Content Relations Dolby Vice President, Technology Strategy NBCUniversal Vice President, Technology & Digital Platforms Pixelogic Media Vice President, Technology Premiere Digital Vice President, Technology Warner Bros. Entertainment Vice President, Technology ZOO Digital Vice President, Technical Services Fox Networks Group Vice President, Systems Development National Geographic Vice President, Systems Partners TNT/TBS Vice President, Studio Content Operations Synovos Vice President, Strategy & Business Development Disney Vice President, Strategy You.i TV Vice President, Strategic Accounts Cartesian Vice President, Security Sales MarkLogic Vice President, Sales, Americas Prime Focus Technologies Vice President, Sales and Account Management Crawford Media Services Vice President, Sales & Marketing You.i TV Vice President, Sales & Business Development Sony DADC NMS Vice President, Sales T2 Computing Vice President, Sales ZOO Digital Vice President, Sales -

A Discussion of Ecommerce: Innovation, Strategy & the Future of Digital Transactions

A Discussion of eCommerce: Innovation, Strategy & the Future of Digital Transactions 8 – 8:45 am: Registration, Coffee & Breakfast 8:45 – 9 am: D+P introduction to eCommerce M&A landscape Presented by: Reed Phillips, CEO & Managing Partner, DeSilva+Phillips 9 – 9:45 am: “Executing eCommerce” Panel and Q&A Andy Dunn, CEO, Bonobos Chris Fralic, Partner, First Round Capital Scott Kurnit, CEO, Keep Holdings, Founder, About, Inc. Shirley Romig, Head of Corporate Strategy, Hudson's Bay Co. Moderated by: Sheila Dharmarajan, Head of Business Development at Zelnick Media, Former on-air reporter at CNBC and Bloomberg TV 9:45 – 10:30 am: “Driving eCommerce” Panel and Q&A Russ D’Souza – Co-Founder, SeatGeek Daniel de Grandpre, CEO, DealNews Katy McCarthy, CEO, Geeknet & ThinkGeek Gautam Thakar, CEO, LivingSocial Moderated by: Jessica Naeve, Partner, DeSilva+Phillips Networking to Follow Andy Dunn Founder & CEO, Bonobos Andy Dunn is the founder and CEO of Bonobos Inc., the parent company of e- commerce-driven apparel brands Bonobos, AYR and Maide golf. Founded in 2007 with namesake menswear brand, Bonobos, Dunn has worked to define a new model for vertically integrated fashion retail in the e- commerce era, providing a bundle of high quality, great-fitting clothes and a hassle-free shopping experience across brands. He was named to Crain’s “40 under 40” list in 2013 and was listed as one of Fortune magazine’s “Rising Retail Stars” in 2012. Additionally, he founded Red Swan Ventures, an angel investment firm focused on building great consumer Internet companies, is on the board of personal dating website, Hinge, and is founding board chair emeritus of education social enterprise Blue Engine. -

Startup Culture Isn't Just a Fad, Signals CXO Money Snapdeal Raises AGE of INVES1MENI'5 $500 M More'in a Fresh Round

The Economic Times August 3, 2015 Page No. 1 & 13 GUNGHOA poll of 100 C-sutte occupiers across companies has revealed that as ma~60% CXO-Ievel execs in India invested a portion of their wealth in startups Startup Culture isn't Just a Fad, Signals CXO Money Snapdeal Raises AGE OF INVES1MENI'5 $500 m more'in a Fresh Round 2VEARS Alibaba, Foxconn and 3YEARS_ SoftBank pick up stakes 4 YEARS. DealDIIest IN JA/IIUMv, AU- A MIX OFVALUA- 5-10YEARS baba started talks tIon mIsmaId1IS with SnapdeaI to and demand for !!10VEARS_ ,,-pick-,---,UP-,--stake~_-----lper10nnaIlCIHed 11 MAY,FOIIaNI metrIcs dI!Iayed NORESPONSE. too evinced interest dosure.of deal planned to open their wallets to this as- [email protected] set class in the coming months. As many as 79 CXOs said they would New Delhi: Jasper Infotech, which TEAM ET recommend investing in startups to oth- owns and operates online marketplace ers' although with an important caveat Snapdeal.com, has raised fresh capi- that these investments were risky and As many as six in 10 CXO-levelexecu- tal, estimated at about $500 million, in tives in India have invested a portion of investors needed to make them with a new round led by Chinese e-com- their wealth in startups, an ET poll of their eyes fully open. merce giant Alibaba Group and Tai- 100 randomly selected C-Suite occu- wanese electronics manufacturer piers across compa- Investlnlln Friends' Ventures •• 13 Foxconn, tech news startup Re/Code NBFCSQUEUE nies in a range of in- claimed late on Sunday. -

Attendance Audit Summary

ATTENDANCE AUDIT SUMMARY CES® 2020 January 7-10, 2020 Las Vegas, Nevada CES.tech Letter from Consumer Technology Association (CTA)® For more than 50 years, CES® has served as a global platform for companies to share innovative technology with the world. In these challenging times, CES showcases the spirit of innovation and brings together energy and creativity that will enable technology to make the world healthier, safer, more resilient and connected. CES 2020 featured transformative technologies such as artificial intelligence, the 5G ecosystem and mobile connectivity. CES 2020 inspired and connected major industries across the globe and highlighted trends that are now more important than ever, including non-traditional tech and tech for good. We are certain that technology, including the innovations at CES, will help energize the global economy and pull the world through the current crisis to emerge safer and stronger than before. CES 2020 hosted 4419 exhibiting companies across more than 2.9 million net square feet and attracted a total attendance of 171,268, including 6517 members of media. This result aligns with our strategy of managing attendee numbers and attracting the most highly qualified attendees. CES is one of a select group of trade shows that follow the strict auditing requirements set by UFI, the Global Association of the Exhibition Industry. CES adheres to these requirements to ensure that you have the most detailed and accurate information on CES’s trade event attendance. To help you succeed and grow your business, we are proud to provide you with this independently audited attendance data in our CES 2020 Attendance Audit Summary. -

In the Court of Chancery of the State of Delaware

IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE STEPHEN G. PERLMAN, REARDEN LLC, a California limited liability company, and ARTEMIS NETWORKS LLC, a Delaware limited liability company, Plaintiffs, Civil Action No. 10046-VCP v. VOX MEDIA, INC., a Delaware corporation, Defendant. MEMORANDUM OPINION Date Submitted: June 10, 2015 Date Decided: September 30, 2015 Matthew E. Fischer, Esq., Jacob R. Kirkham, Esq., Jacqueline A. Rogers, Esq., POTTER ANDERSON & CORROON LLP, Wilmington, Delaware; Neville L. Johnson, Esq., Douglas L. Johnson, Esq., James T. Ryan, Esq., JOHNSON & JOHNSON, LLP, Beverly Hills, California; Attorneys for Plaintiffs, Stephen G. Perlman, Rearden LLC, and Artemis Networks LLC. Peter L. Frattarelli, Esq., ARCHER & GREINER, P.C., Wilmington, Delaware; Attorneys for Defendant, Vox Media, Inc. PARSONS, Vice Chancellor. This is an action by a Delaware limited liability company (“LLC”), a California LLC, and an entrepreneur seeking equitable relief and money damages against a Delaware corporation for defamation. The corporation owns and operates a website that, in 2012, published an allegedly defamatory article about a non-party Delaware corporation that is affiliated closely with the Delaware LLC and the entrepreneur. After the website rewrote substantially the article that same day and admitted publicly that it was not vetted properly, the website published another article several days later that the plaintiffs allege is false and defamatory. Then, in 2014, the website published an article about the Delaware LLC that, in its first sentence, referenced and hyperlinked the 2012 articles, allegedly repeated and enhanced the original statements, and imputed those allegedly false and defamatory statements to the Delaware LLC. -

2015 Valuation Handbook – Guide to Cost of Capital and Data Published Therein in Connection with Their Internal Business Operations

Market Results Through #DBDLADQ 2014 201 Valuation Handbook Guide to Cost of Capital Industry Risk Premia Company List Cover image: Duff & Phelps Cover design: Tim Harms Copyright © 2015 by John Wiley & Sons, Inc. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748- 6008, or online at http://www.wiley.com/go/permissions. The forgoing does not preclude End-users from using the 2015 Valuation Handbook – Guide to Cost of Capital and data published therein in connection with their internal business operations. Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. -

Tech That Reality Check Making Money from News

NEWS REALITY IN THE November 2018 CHECK Using technology to combat DIGITAL misinformation AGE CONTINENTAL SHIFT NBC News International’s Deborah Turness on covering a divided Europe MAKING MONEY FROM NEWS Industry leaders across TECH THAT Europe share their views Check out the smart tools reshaping reporting Paid Post by Google This content was produced by the advertising department of the Financial Times, in collaboration with Google. Paid Post by Google This content was produced by the advertising department of the Financial Times, in collaboration with Google. Digital News Innovation Fund 30 European countries 559 Projects €115M In funding g.co/newsinitiative 2 | GoogleNewsInitiative.ft.com Foreword THE FUTURE OF NEWS In 2015, Google launched the Digital News Innovation Fund (DNI Fund) to stimulate innovation across the European news industry. The DNI Fund supports ambitious projects in digital journalism across a range of areas – from creating open-source technology that improves revenue streams to investing in quality, data-driven investigative journalism. Ludovic Blecher Head of the Digital News Google asked a dozen leaders from the industry to allocate a total of Innovation Fund €150m to projects submitted by media companies and start-ups – no strings attached: all intellectual property remains with the companies themselves. To date, we’ve selected 559 projects across 30 countries, supporting them with more than €115m. But it’s not just about the money. The DNI Fund provides space and opportunity to take risks and experiment. In the media industry, many players don’t compete with each other across borders. We are Veit Dengler also proud to have fostered publishers working together to tackle Executive board member, their common challenges, through technological collaboration. -

Services & Offerings

STAG DINING 2020 SERVICES & OFFERINGS Meal Kits - Pantry Provisions - Natural Wine - Gifting - Cocktail Kits & Classes - Event Space - Crenn Farm 1 LETTER FROM STAG 4 STAG DINING GROUP STAG OVERVIEW MEAL KITS & OFFERINGS 8 NATURAL WINES 10 COCKTAIL KITS & CLASSES 12 WINEMAKING PARTNERS 16 CRENN & STAG 18 OUR VENUE 22 CLIENTS 27 TEAM 28 CONTACT 32 STAG DINING GROUP 925 O'Farrell St San Francisco, CA 94109 (415) 944-2065 [email protected] www.stagdining.com DERBY COCKTAIL CO www.derbycocktail.co CERF CLUB www.cerfclub.com © 2020 Stag Dining Group Select Photography by David Dines, dines.co 2 3 WITH A DECADE OF EXPERIENCE IN HOSPITALITY, WE HAVE NEVER SEEN A CHALLENGE THAT FACES US QUITE LIKE THE ONE POSED BY COVID-19. With virtually every restaurant worker out of a job, and traditional supply chains for food, wine and spirits broken, we have been UPDATED OFFERINGS seeking opportunities to mend those bonds in pragmatic ways while continuing to serve our customers. Our revised offerings are an attempt to help our clients engage their stakeholders, employees MEAL KITS and clients in ways that are fitting for this time and address the social, racial, environmental and biological crises that we are PANTRY PROVISIONS facing collectively as a society. NATURAL WINE At Stag Dining Group we believe every plate and every glass GIFTING tells a unique story, and we make every effort to connect guests COCKTAIL KITS & CLASSES to each other, to the environment and to the thought leaders of CRENN FARM this industry in authentic ways. Since our inception, we have witnessed the power that transformative culinary experiences have CERF CLUB EVENT VENUE on our guests and the conversations that can be sparked at the table. -

20Annual Report UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

20 20Annual Report UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2020. OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period from to . Commission file number 001-37713 eBay Inc. (Exact name of registrant as specified in its charter) Delaware 77-0430924 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 2025 Hamilton Avenue San Jose, California 95125 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (408) 376-7008 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading symbol Name of exchange on which registered Common stock EBAY The Nasdaq Global Select Market 6.00% Notes due 2056 EBAYL The Nasdaq Global Select Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes È No ‘ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ‘ No È Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

In Eastern Partner Countries

EU4Digital: supporting digital economy and society in the Eastern Partnership Market Assessment for Digital Innovation and Scale-up Initiative in Eastern partner countries Final report June 2020 1 About this study In early 2020, EU4Digital Facility launched activity ‘Market Assessment for Digital Innovation and Scale-up Initiative (DISC) in Eastern Partner Countries’ (hereinafter – study / research) The goal is to analyse the investment landscape for digital high tech companies in these countries: Armenia, Azerbaijan, Belarus, Georgia, the Republic of Moldova and Ukraine. The activity was inspired by Digital Innovation and Scale-up initiative (DISC) in Central, Eastern and South Eastern Europe region (European Commission Factsheet). Based on the findings of this study, the European Commission will be able to adjust its plans to better serve the needs of the local markets, developing adapted financial support instruments. This research aims to: 1. Understand digital innovation and high-tech start-ups investment landscape and identify existing gaps on investment in Eastern partner countries. 2. Map the main private & corporate equity investors that provide financing to digital start-ups and fast growth companies in Eastern partner countries. 3. Map the main public sector investment programs in start-up / tech-oriented companies at the country-level. 4. Analyse micro-level data on private investments in start-up / tech-oriented companies in the region. 5. Provide recommendations to develop and use financial instruments for digital innovation and the scale-up of high-tech start-ups. The research focuses on start-ups at the creation and scale-up phases, rather than traditional SMEs on their path to digitalisation. -

Download Report

www.peakstone.com E-Commerce M&A Update September 2015 E-Commerce Industry Update | September 2015 E-Commerce M&A Update . E-Commerce M&A continues to see strong activity. Year-to-date 2015 transaction volume of 216 deals is on pace with record 2014 levels. During 2014, there were 375 transactions, an increase of over 12% from the prior year . For the year-to-date 2015 period, strategic buyers accounted for 80% of the e-commerce M&A transactions with financial buyers making up the difference. During 2014, strategic buyers accounted for just over 85% of the transactions . For announced transactions (albeit a limited sample size), e-commerce multiples saw a modest increase from 10.5x EBITDA and 0.7x revenue in 2014 to 10.6x EBITDA and 1.1x revenue year-to-date 2015 . Peakstone equally weighted e-commerce index continues to outperform the S&P 500 . Notable publicly announced 2015 transactions: o QVC, Inc. entered into a definitive agreement to acquire zulily, Inc. for approximately $2.4 billion. The transaction is anticipated to close during the fourth quarter of 2015 o Gamestop entered into a definitive agreement to acquire Geeknet for approximately $130 million o Expedia entered into a definitive agreement to acquire Orbitz for $1.4 billion 1 E-Commerce Industry Update | September 2015 E-Commerce - M&A Market Overview E-Commerce transaction activity has been strong with favorable valuation trends U.S. Internet Retail Transactions by Buyer Type U.S. Internet Retail Transaction Multiples 400 14.0x 12.3x 11.7x 350 55 12.0x 11.3x 10.5x 10.1x -

Ten Strategies of a World-Class Cybersecurity Operations Center Conveys MITRE’S Expertise on Accumulated Expertise on Enterprise-Grade Computer Network Defense

Bleed rule--remove from file Bleed rule--remove from file MITRE’s accumulated Ten Strategies of a World-Class Cybersecurity Operations Center conveys MITRE’s expertise on accumulated expertise on enterprise-grade computer network defense. It covers ten key qualities enterprise- grade of leading Cybersecurity Operations Centers (CSOCs), ranging from their structure and organization, computer MITRE network to processes that best enable effective and efficient operations, to approaches that extract maximum defense Ten Strategies of a World-Class value from CSOC technology investments. This book offers perspective and context for key decision Cybersecurity Operations Center points in structuring a CSOC and shows how to: • Find the right size and structure for the CSOC team Cybersecurity Operations Center a World-Class of Strategies Ten The MITRE Corporation is • Achieve effective placement within a larger organization that a not-for-profit organization enables CSOC operations that operates federally funded • Attract, retain, and grow the right staff and skills research and development • Prepare the CSOC team, technologies, and processes for agile, centers (FFRDCs). FFRDCs threat-based response are unique organizations that • Architect for large-scale data collection and analysis with a assist the U.S. government with limited budget scientific research and analysis, • Prioritize sensor placement and data feed choices across development and acquisition, enteprise systems, enclaves, networks, and perimeters and systems engineering and integration. We’re proud to have If you manage, work in, or are standing up a CSOC, this book is for you. served the public interest for It is also available on MITRE’s website, www.mitre.org. more than 50 years.