A Study and Comparison of the Consumption Basis of Taxation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Historical Tax Law Changes Luxury Tax on Liquor

Historical Tax Law Changes Luxury Tax on Liquor Laws 1933, 1st Special Session, Chapter 18 levied the first Arizona state Luxury Tax on Liquor. The tax rates established by this law are shown below: 10¢ on each 16 ounces, or fractional part thereof, for malt extracts 10¢ on each container of spirituous liquor containing 16 ounces or less 10¢ on each 16 ounces of spirituous liquor in containers of more than 16 ounces 3¢ on each container of vinous liquor containing 16 ounces or less 3¢ on each 16 ounces of vinous liquor in containers of more than 16 ounces 5¢ on each gallon of malt liquor The tax was paid by the purchase of stamps affixed to each container of liquor and malt extract and canceled prior to sale. Taxes were payable to the State Tax Commission, prior to or at the time of the sale of the product. Of the total receipts collected, 96% was dedicated to the Board of Public Welfare and the remaining 4% was appropriated for the use of the State Tax Commission. The tax was a temporary tax and expired on March 1, 1935. (Effective June 28, 1933) Laws 1935, Chapter 14 extended the provisions of Laws 1933, 1st Special Session, Chapter 18 to May 1, 1935. (Effective February 20, 1935) Laws 1935, Chapter 78 permanently enacted the provisions of Laws 1933, 1st Special Session, Chapter 18, with respect to the Luxury tax on Liquor. The tax rates levied on containers of spirituous liquor and vinous liquor were replaced with the rates shown below: 5¢ on each container of spirituous liquor containing 8 ounces or less 5¢ on each 8 ounces of spirituous -

ACEA Tax Guide 2018.Pdf

2018 WWW.ACEA.BE Foreword The 2018 edition of the European Automobile Manufacturers’ Association’s annual Tax Guide provides an overview of specific taxes that are levied on motor vehicles in European countries, as well as in other key markets around the world. This comprehensive guide counts more than 300 pages, making it an indispensable tool for anyone interested in the European automotive industry and relevant policies. The 2018 Tax Guide contains all the latest information about taxes on vehicle acquisition (VAT, sales tax, registration tax), taxes on vehicle ownership (annual circulation tax, road tax) and taxes on motoring (fuel tax). Besides the 28 member states of the European Union, as well as the EFTA countries (Iceland, Norway and Switzerland), this Tax Guide also covers countries such as Brazil, China, India, Japan, Russia, South Korea, Turkey and the United States. The Tax Guide is compiled with the help of the national associations of motor vehicle manufacturers in all these countries. I would like to extend our sincere gratitude to all involved for making the latest information available for this publication. Erik Jonnaert ACEA Secretary General Copyright Reproduction of the content of this document is not permitted without the prior written consent of ACEA. Whenever reproduction is permitted, ACEA shall be referred to as source of the information. Summary EU member countries 5 EFTA 245 Other countries 254 EU member states EU summary tables 5 Austria 10 Belgium 19 Bulgaria 42 Croatia 48 Cyprus 52 Czech Republic 55 Denmark 65 Estonia 79 Finland 82 France 88 Germany 100 Greece 108 Hungary 119 Ireland 125 Italy 137 Latvia 148 Lithuania 154 Luxembourg 158 Malta 168 Netherlands 171 Poland 179 Portugal 184 Romania 194 Slovakia 198 Slovenia 211 Spain 215 Sweden 224 United Kingdom 234 01 EU summary tables Chapter prepared by Francesca Piazza [email protected] ACEA European Automobile Manufacturers’ Association Avenue des Nerviens 85 B — 1040 Brussels T. -

WHO, WHAT, HOW and WHY Fact Sheet

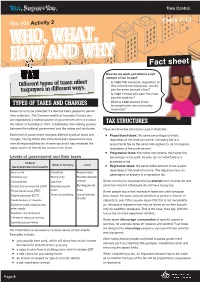

Ta x , Super+You. Take Control. Years 7-12 Tax 101 Activity 2 WHO, WHAT, HOW AND WHY Fact sheet How do we work out what is a fair amount of tax to pay? • Is it fair that everyone, regardless of Different types of taxes affect their income and expenses, should taxpayers in different ways. pay the same amount of tax? • Is it fair if those who earn the most pay the most tax? • What is a fair amount of tax TYPES OF TAXES AND CHARGES for people who use community resources? Taxes can only be collected if a law has been passed to permit their collection. The Commonwealth of Australia Constitution Act established a federal system of government when it created TAX STRUCTURES the nation of Australia in 1901. It distributes law-making powers between the national government and the states and territories. There are three tax structures used in Australia: Each level of government imposes different types of taxes and Proportional taxes: the same percentage is levied, charges. During World War II the Australian Government took regardless of the level of income. Company tax is a over all responsibilities for income tax and it has remained the proportional tax as the same rate applies for all companies, major source of federal tax revenue ever since. regardless of the profit earned. Progressive taxes: the higher the income, the higher the Levels of government and their taxes percentage of tax paid. Income tax for individuals is a Federal progressive tax. State or territory Local (Australian/Commonwealth) Regressive taxes: the same dollar amount of tax is paid, regardless of the level of income. -

Excise Duties in Finland in a Historical Perspective

Excise Duties in Finland in a Historical Perspective Leila Juanto 1 Excise Duties as Consumption Taxes In Finland, “excise duties” denote a certain, distinct group of consumption taxes. However, the term is not defined unambiguously in the literature, and problems abound when one begins looking for equivalents in the history of taxation in Finland or in the tax systems of other countries. As used today, the term nevertheless refers quite consistently to taxes that are levied on the basis of particular legislation and, in principle, explicitly called excise taxes in that legislation. In this perspective - the formal concept of excise duties - the excise duties in Finland comprise the excise duty on manufactured tobacco, the excise duty on alcohol and alcoholic beverages, the excise duty on electricity and certain energy sources, and the excise duty on soft drinks. One thing serving to clarify the concept of excise duty in the European Union, of which Finland is a member, is that excise duties fall into the category known as harmonized taxes. Clearly, EC Directives profoundly influence the content of the excise duties levied on certain products. As excise duties are part of the system of consumption taxation, it is appropriate to discuss their distinctive features and the ways in which they differ from the other taxes in that category. Here, the salient concept to consider is that of a material excise duty; in other words, taxes that share distinctive features can be classified as belonging to the same group. Consumption taxes are taxes levied on the consumption of goods and services; the taxes can be subdivided into general and selective consumption taxes according to how extensive the group of commodities is to which the tax applies.1 In terms of this classification, excise duties are selective taxes, the tax 1 Here, there is no reason to consider the occasional question whether the taxes on commodities used in entrepreneurial activity fall into the category of consumption taxes or whether such taxes are merely taxes on consumption by private households. -

Drawing the Line Between Takings and Taxation: the Continuous Burdens Principle, and Its Broader Application

Drawing the Line Between Takings and Taxation: The Continuous Burdens Principle, and Its Broader Application Eric Kades† Professor, William & Mary Law School (757) 221-3828 [email protected] CONTENTS I. Introduction ..................................................1 II. Existing Commentary on Distinguishing Taxes and Takings .........3 A. A Simple Solution: Taxation’s General Liabilities Versus Taking’s Specific Assets ............................................4 B. More Nuanced Classical Views ..............................9 C. The Policy Goals of Takings Favor the Classical View ..........17 III. The Primary Battle Ground to Date: Legality of Progressive Taxation ...........................................................19 A. History & Positive Legal Doctrine ...........................20 B. Normative Considerations of Progressive Income Taxation ........................................................25 IV. The Continuous Burdens Principle (CBP) ........................34 A. The Continuous Burdens Principle ..........................35 B. The Continuous Marginal Burdens Principle & Current Takings Doctrine ................................................56 C. Normative Foundations for the CBP .........................59 V. Fees, Special Assessments, & Specific Taxes ......................65 VI. Packaging & Logrolling .......................................69 VII. Conclusion .................................................74 †Thanks to Lynda Butler, Bob Ellickson, Jim Krier, Glynn Lunney, Tom Merrill, Ron Rosenberg, Cynthia Ward, and -

Luxury Tax: to Be Or Not to Be? to What Extent Will Nigeria Benefit from the Proposed Luxury Tax?

Luxury Tax: To be or not to be? To what extent will Nigeria benefit from the proposed luxury tax? Introducing luxury tax on certain items would increase the cost of those goods or services; therefore, more individuals may opt to make purchase at cheaper prices from the black market. An increased patronage of the black market is especially problematic because when taxable persons begin to operate in the informal market, the tax base is eroded. By: Bitrus Baba Introduction In recent times, the Nigerian Government has been showing interest in this form of taxation as Whether it seems timely or a little too late, a response to the declining revenues from oil Nigeria seems to be keen on measures to make and to deal with social imbalance. In November the “rich” pay more and therefore address 2014, the past administration announced plans redistribution of wealth through taxation of to introduce luxury taxes in the form of luxury items. surcharges on items such as private jets, luxury yachts, luxury cars, business class/first class tickets on airlines etc. The plan at the time Generally, luxury tax is a tax on luxury goods included the following: and services i.e. goods and services that are not essential and consumed by only a niche. It could be implemented through a sales tax system, 10% import surcharge on new private jets; value added tax system, or customs duty system 39% import surcharge on luxury yachts; of taxation. It typically affects the wealthy as 5% import surcharge on luxury cars; opposed to the vast majority of the populace undisclosed surcharge on business and first because the wealthy are the most likely to class plane tickets; purchase luxury items. -

Dr. Somnath, International Journal of Research In

Dr. Somnath, International Journal of Research in Management, Economics and Commerce, ISSN 2250-057X, Impact Factor: 6.384, Volume 07 Issue 10, October 2017, Page 85-94 Developments in Indirect Taxation in India: Road Ahead Dr. Somnath (Assistant Professor of Economics, Mukand Lal National College, Yamunanagar, Haryana, India) Abstract: India is the largest Federal democracy in the world. The Constitution of India provides that no tax shall be levied or collected by anyone except by the authority of law. Under the constitution, only the Parliament and State legislative assemblies have exclusive powers to make laws for levy of taxes. Prior to July,2017 multiple indirect taxes were levied by centre as well as states, by multiple agencies, due to which, not only avoidable leakages in tax collection taken place but also free flow of goods and services was affected. Doing business in such an environment became difficult and cumbersome affecting the national growth of the country negatively. In such a scenario Indian parliament has shown extraordinary foresight in conceiving a single indirect tax applicable throughout the country, which will make doing business easy, will help in increase business volumes leading to increased national growth, and will also help the government increase its welfare budget with higher collection of taxes ultimately resulting in overall prosperity of its citizens. With this aforementioned importance, On July 1, 2017, India unleashed its most revolutionary taxation reform in form of goods and services tax (GST) that promise to infuse a fresh energy into the economy by unifying the entire country into one Single Market. More than, twenty six years after liberalizing its economy to the outside world, India has now rolled out another significant financial reform that aims to carry forward and cement on the growth benefits of liberalization. -

Progressive Taxation As a Means for Improving Competitive Balance

Scottish Journal of Political Economy, Vol. 52, No. 1, February 2005 r Scottish Economic Society 2005, Published by Blackwell Publishing, 9600 Garsington Road, Oxford OX4 2DQ, UK and 350 Main Street, Malden, MA 02148, USA PROGRESSIVE TAXATION AS A MEANS FOR IMPROVING COMPETITIVE BALANCE Tsjalle van der Burgn and Aloys Prinznn Abstract The existing instruments for improving the competitive balance within a sports league, such as revenue sharing, restrictions on free agency and salary caps, all have their shortcomings. In this paper, we show that a progressive sports tax, the revenues of which are not redistributed to smaller teams in the league, could be a better instrument. From the broader perspective of the theory of optimum taxation, this instrument may have advantages as well. I Introduction In the field of professional team sports, there is a common perception that market forces can cause wealthy clubs to employ so much talent that the competitive balance within the league is jeopardised. Surprisingly, however, academics have not yet given a clear answer to the question what exactly is the optimal level of competitive balance, and it remains unclear if and to what extent the absence of restrictions on free-market forces yields non-optimal results (see also Szymanski, 2003). This is an interesting field of further research. In case it turns out that free-market forces do not yield optimal results, there are various instruments for improving competitive balance. Indeed, many instruments are used in practice already. In this paper, we assume that changes in the competiti- ve balance are desirable indeed, and we focus on the effectiveness of the instruments. -

Gotta Raise Taxes? Maybe It Wont Work! Brent J

Gotta Raise Taxes? Maybe It Wont Work! Brent J. Beverly, CFP® and Christian F. Li, CFP® You heard it here first: to pay for the extraordinary government programs in reference to COVID-19, the government is going to raise taxes. Some politicians have already been calling for increasing tax rates “on the rich” to levels not seen for decades. In January 2019, prominent politicians, such as Alexandria Ocasio-Cortez, proposed a 70 percent top Federal income tax rate, a rate not seen since 1981. The current top income tax bracket is 37% - not including state or local taxes. Several years ago, we published an article, Credit Hurricane Approaching! (read it here ) where we pointed out that the government debt has been climbing for many years and has to be addressed at some point. Things have gotten much worse since then. Even before COVID-19 hit the world, the U.S. deficit was running roughly $1 Trillion each year and U.S. government debt had grown to over $22 Trillion. In response to the economic problems triggered by COVID-19, the government has pumped an additional $3 Trillion into the economy. Since they were already negative, the only way to get additional money to spend is to borrow it, increasing the national debt even further. The basic equation is simple: revenue minus spending equals cash flow. If you cannot reduce spending, then you need to increase the revenue to ease the cash flow. You are sure to hear raising the tax rate being proposed. After all, if the top rate for Federal income taxes is 37%, by raising that to 70%, you should bring in almost double the tax revenue, right? The difficulty is, tax revenue does not work that way. -

GOODS and SERVICE TAX (GST) Seminar Compendium

GOODS AND SERVICE TAX (GST) Seminar Compendium Editor–in–Chief: Rev. Dr. Daniel Fernandes, SJ. ii GOODS AND SERVICE TAX (GST) Editor–in–Chief: Rev. Dr. Daniel Fernandes, SJ. Editors CMA. Ravidarshini Dr. Shubhra Rahul Dr. Mohan P.Philip Dr. Raja Jebasingh POST GRADUATE AND RESEARCH DEPARTMENT St. Joseph’s College of Commerce (Autonomous) 163, Brigade Road, Bangalore–560 025 iii Editorial Team Rev. Dr. Daniel Fernandes, SJ. Editor-In-Chief Editors: CMA. Ravidarshini Dr. Shubhra Rahul Dr. Mohan P. Philip Dr. Raja Jebasingh Edited & Published By: Post Graduate and Research Department, St. Joseph’s College of Commerce (Autonomous), 163, Brigade Road, Bangalore – 560 025, Karnataka Email: [email protected] Copyright@2015: Rev. Dr. Daniel Fernandes, SJ. St. Joseph’s College of Commerce (Autonomous), Bangalore – 560 025. Published: 2015 ISBN: 978-81-924180-4-9 Disclaimer: Responsibilities for the content of the full papers included in the publication remain with these respective authors. Typesetting and Printed at iv PREFACE I have great pleasure in publishing a compendium of proceedings of the national seminar organized by the post graduate department of Commerce on ‘Goods and Services Tax Bill’. The proposed Goods and Service Tax Bill or GST Bill, officially referred to as the Constitution (One Hundred and Twenty-second Amendment) Bill, 2014 is expected to reform the regulatory framework that governs the indirect tax regime within India. By the implementation of GST, the central government is hoping to create a common Indian market and thereby to reduce the cascading effect of tax on the cost of goods and services. GST bill is expected to impact the present tax structure, tax incidence, tax computation, credit utilization and reporting, which may lead to a complete overhaul of the current indirect tax system. -

A Global Compendium and Meta-Analysis of Property Tax Systems

A Global Compendium and Meta-Analysis of Property Tax Systems Richard Almy © 2013 Lincoln Institute of Land Policy Lincoln Institute of Land Policy Working Paper The findings and conclusions of this Working Paper reflect the views of the author(s) and have not been subject to a detailed review by the staff of the Lincoln Institute of Land Policy. Contact the Lincoln Institute with questions or requests for permission to reprint this paper. [email protected] Lincoln Institute Product Code: WP14RA1 Abstract This report is a global compendium of significant features of systems for recurrently taxing land and buildings. It is based on works in English, many of which were published by the Lincoln Institute of Land Policy. Its aim is to provide researchers and practitioners with useful infor- mation about these sources and with facts and patterns of system features, revenue statistics, and other data. It reports on systems in 187 countries (twenty-nine countries do not have such taxes; the situation in four countries is unclear). Accompanying the report are an Excel workbook and copies of the works cited when available in digital form. Keywords: Tax on property, recurrent tax on immovable property, property tax, real estate tax, real property tax, land tax, building tax, rates. About the Author Richard Almy is a partner in Almy, Gloudemans, Jacobs & Denne, a US-based consulting firm that works exclusively in property tax administration, chiefly for governments and related insti- tutions. Mr. Almy began his career as an appraiser with the Detroit, Michigan, Board of Asses- sors. Later he served as research director and executive director of the International Association of Assessing Officers (IAAO). -

A Closer Look

GLOBAL TAX WEEKLY ISSUE 125 | APRIL 2, 2015 a closer look SUBJECTS TRANSFER PRICING INTELLECTUAL PROPERTY VAT, GST AND SALES TAX CORPORATE TAXATION INDIVIDUAL TAXATION REAL ESTATE AND PROPERTY TAXES INTERNATIONAL FISCAL GOVERNANCE BUDGETS COMPLIANCE OFFSHORE SECTORS MANUFACTURING RETAIL/WHOLESALE INSURANCE BANKS/FINANCIAL INSTITUTIONS RESTAURANTS/FOOD SERVICE CONSTRUCTION AEROSPACE ENERGY AUTOMOTIVE MINING AND MINERALS ENTERTAINMENT AND MEDIA OIL AND GAS COUNTRIES AND REGIONS EUROPE AUSTRIA BELGIUM BULGARIA CYPRUS CZECH REPUBLIC DENMARK ESTONIA FINLAND FRANCE GERMANY GREECE HUNGARY IRELAND ITALY LATVIA LITHUANIA LUXEMBOURG MALTA NETHERLANDS POLAND PORTUGAL ROMANIA SLOVAKIA SLOVENIA SPAIN SWEDEN SWITZERLAND UNITED KINGDOM EMERGING MARKETS ARGENTINA BRAZIL CHILE CHINA INDIA ISRAEL MEXICO RUSSIA SOUTH AFRICA SOUTH KOREA TAIWAN VIETNAM CENTRAL AND EASTERN EUROPE ARMENIA AZERBAIJAN BOSNIA CROATIA FAROE ISLANDS GEORGIA KAZAKHSTAN MONTENEGRO NORWAY SERBIA TURKEY UKRAINE UZBEKISTAN ASIA-PAC AUSTRALIA BANGLADESH BRUNEI HONG KONG INDONESIA JAPAN MALAYSIA NEW ZEALAND PAKISTAN PHILIPPINES SINGAPORE THAILAND AMERICAS BOLIVIA CANADA COLOMBIA COSTA RICA ECUADOR EL SALVADOR GUATEMALA PANAMA PERU PUERTO RICO URUGUAY UNITED STATES VENEZUELA MIDDLE EAST ALGERIA BAHRAIN BOTSWANA DUBAI EGYPT ETHIOPIA EQUATORIAL GUINEA IRAQ KUWAIT MOROCCO NIGERIA OMAN QATAR SAUDI ARABIA TUNISIA LOW-TAX JURISDICTIONS ANDORRA ARUBA BAHAMAS BARBADOS BELIZE BERMUDA BRITISH VIRGIN ISLANDS CAYMAN ISLANDS COOK ISLANDS CURACAO GIBRALTAR GUERNSEY ISLE OF MAN JERSEY LABUAN LIECHTENSTEIN MAURITIUS MONACO TURKS AND CAICOS ISLANDS VANUATU GLOBAL TAX WEEKLY a closer look Global Tax Weekly – A Closer Look Combining expert industry thought leadership and team of editors outputting 100 tax news stories a the unrivalled worldwide multi-lingual research week. GTW highlights 20 of these stories each week capabilities of leading law and tax publisher Wolters under a series of useful headings, including industry Kluwer, CCH publishes Global Tax Weekly –– A Closer sectors (e.g.