Executive Summary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HERBAL 6/28Ct FLAVOR ASSORTED TEA ASSORTED TEA Available Individually

6/28ct HERBAL 6/28ct FLAVOR ASSORTED TEA ASSORTED TEA Available Individually: Herbal: 6/28ct Mint Medley Orange & Spice – I Love Lemon Black Cranberry Apple Tea Cozy Chamomile 10/100ct Empty Tea Chest - Sweet Dreams holds 8 varieties of tea, or 64 tea Empty Tea Rack holds 6 varieties of tea bags Flavored/Green: 6/28ct English Tea Time Earl Grey Green Tea Black Lemon Lift Decaffeinated For more information contact: Green Tea With Pomegranate Tea Tommy Signorile Raspberry Royale 6/48ct (845) 628-0880 Constant Comment [email protected] At Bigelow, Tea is our Passion. Tea trends and your customers: • By offering a variety of teas you are able to appeal to more customers thus increasing sales. Tea is one of the fastest growing beverages and has a high profit vs. cost ratio. • Tea is no longer a Fall/Winter drink… just like coffee it has become a part of everyday life. How value added items can have a positive effect on their bottom line: • All Bigelow Tea is packaged in protective pouches to protect the tea from moisture, ambient smells and water. The pouch also helps to provide a 3 year shelf life. • We supply customers with complimentary tea racks and tea chests as long as they are purchasing our tea; we want to give you all the tools possible to help you grow sales. How our “green items” can help you meet your customer expectations: • Bigelow is an environmentally conscious company; we have added $1.5 million dollars worth of solar panels to our facility which supplies 20% of our energy. -

F All & Winter 2

Fall & winter 2009 MILOTM LOOSE TEA INFUSER DEAR VALUED CUSTOMER, Welcome to Fall/Holiday 2009! With consumer uncertainty settling, on shelf. I have also created the festive and functional Milo tea infuser, we are anticipating a strong and healthy second half of the year. Tea a truly innovative design. Say goodbye to the tea ball and chain!! Forté is uniquely poised— offering elegant and purposeful gift options at accessible price points. We truly are an affordable luxury that And finally, back by popular demand, the 2009 pre-assorted Holiday continues to sell well beyond expectations. Collection! We are appreciative of your enthusiastic feedback regarding the ease of last year’s program and its successful sell through. milo loose tea infuser NEW This season’s design has focused on enhanced merchandising. We And this year’s Collection is even better! Inspired by the simple beauty MEASURES : 6 X 2.75 X 2” have replaced many of our gift boxes with distinguished bands that of natural birch bark, we have developed a line of products that are An easy to use loose tea infuser that is showcase the unique, clean lines of our products. We have redesigned elegant in their simplicity and offer very accessible price points. In the perfect for brewing a cup, mug or small teapot. Just add loose tea to the stainless the interior of our best selling gift sets so that shoppers can easily spirit of the season, we are offering you a financial incentive to purchase steel base, twist on the colorful ceramic see the contents. These changes make dramatic, eye-=catching by the Assortment. -

Empire of Tea

Empire of Tea Empire of Tea The Asian Leaf that Conquered the Wor ld Markman Ellis, Richard Coulton, Matthew Mauger reaktion books For Ceri, Bey, Chelle Published by Reaktion Books Ltd 33 Great Sutton Street London ec1v 0dx, uk www.reaktionbooks.co.uk First published 2015 Copyright © Markman Ellis, Richard Coulton, Matthew Mauger 2015 All rights reserved No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publishers Printed and bound in China by 1010 Printing International Ltd A catalogue record for this book is available from the British Library isbn 978 1 78023 440 3 Contents Introduction 7 one: Early European Encounters with Tea 14 two: Establishing the Taste for Tea in Britain 31 three: The Tea Trade with China 53 four: The Elevation of Tea 73 five: The Natural Philosophy of Tea 93 six: The Market for Tea in Britain 115 seven: The British Way of Tea 139 eight: Smuggling and Taxation 161 nine: The Democratization of Tea Drinking 179 ten: Tea in the Politics of Empire 202 eleven: The National Drink of Victorian Britain 221 twelve: Twentieth-century Tea 247 Epilogue: Global Tea 267 References 277 Bibliography 307 Acknowledgements 315 Photo Acknowledgements 317 Index 319 ‘A Sort of Tea from China’, c. 1700, a material survival of Britain’s encounter with tea in the late seventeenth century. e specimen was acquired by James Cuninghame, a physician and ship’s surgeon who visited Amoy (Xiamen) in 1698–9 and Chusan (Zhoushan) in 1700–1703. -

The Living History Classroom (Fall 2015)

FALL 2015 Living History CLASSROOM Through the Wilderness Exploring North Carolina with Lawson, Tuscarora & the First Printing Press A Publication of Tryon Palace “The State of North Carolina from the best Authorities &c.” is a map drawn by Samuel Lewis in 1795. Does it look different from the North Carolina we see today? Mapping Our State Words to Know When traveling today, many of us chart our course by using , which GPS GPS: short for Global Positioning System, relies on information from satellites and maps to make sure we arrive at which uses satellites and maps to determine our intended destination. People living in the 17th and 18th centuries location could not use a computer system. To find their way, they relied on Cartography: the science of making maps for paper maps. defined transportation routes used to trade Cartography is a skill that combines mathematics, geography, and art goods on land and waterways to produce a physical map of the earth. Accurate maps define boundaries Cartographer: a person who combines and settle arguments over land. They also show dangerous waters and observation, math, and drawing to make maps coastlines to help save the lives of sailors. Land surveyor: a person whose job is to Cartographers in the 1600s and 1700s often used surveying skills. measure and examine an area of land Land surveyors used chains to measure the distance between two points. Theodolite: a surveying tool made from a Surveyor’s chains were 66 feet long with 100 links. Each link was about 8 telescope, it sits on a tripod and measures inches long. -

Boxes and Packaging Catalogue

Boxes and Packaging Catalogue Self Storage Product Catalogue Please call Egans to place an order (03) 9687 4488 Alternatively, visit our offices at 110 Maribyrnong St, Footscray 3011, VIC Book/Wine Box Crystal Box - Generic Flat Pack - Generic BW / BWLD. CRY FLAT Use with polystyrene insert for pre- Well cushioned double layer box Ideal for use as a lay flat ward- cious wine. Also available as a light provides protection for precious and robe or linen box. Double duty box with no print. fragile items. strength cardboard. 406 X 298 X 431mm 403 x 301 x 330mm 915 x 505 x 320mm Kitchen Box (dividers sold Egans Carry Box Wine/Audio Visual Box seperately) EGANS NSCWINE KITCHBOX KITCHEN DIVIDERS A Great sized strong 1 piece Pack wine in laydown position industrial grade packing box. using the moulded inserts (sold For bowls, cups or wine glasses. Comes with the Egans logo. seperately) or DVD/Stereo. 600 x 300 x 306mm 340 x 450 x 315mm 490 x 325 x 165mm Wine Insert - 6 Bottle Picture Box - Generic Port A Robe - Generic (Rail WINEIN6BG PIC sold seperately) Robe (PR) Rail (H) Moduled Fibre construction provides Durable single layer cardboard. Ideal a protective layer between bottle for small and medium sized pictures, transfer clothes direct from Cup- layers to suit Wine Carton. mirrors, paintings or table tops. board to box. Size fits NSCWINE 1040 x 775 x 75mm 594 x 476 x 1099mm www.egans.com.au Self Storage Product Catalogue Please call Egans to place an order (03) 9687 4488 Alternatively, visit our offices at 110 Maribyrnong St, Footscray 3011, VIC Priority Box Archive Box - Generic Tea Chest - Generic Print PRISAFESPOT SU TC/TCPLAIN The last box to be packed and the Strong all-purpose storage & ar- #1 Moving box. -

A Tea for Every

our tea offering CATALOGUE FOR CORPORATE SALES a tea for WHITE TEA GREEN TEA ROOIBOS ROOIBOS ORGANIC ORGANIC ORGANIC buddha's blend silk dragon jasmine cinnamon rooibos chai super ginger every mug A zen melange of jasmine Spring-plucked green tea, This combo of cinnamon and This super-spicy rooibos pearls, hibiscus blossoms scented with night-blooming rooibos has a clean taste your is packed with ginger, and white and green tea. jasmine flowers. breath will thank you for. peppercorns and pepper. GREEN TEA OOLONG FRUIT INFUSION FRUIT INFUSION ORGANIC green passionfruit the skinny forever nuts strawberry rhubarb parfait A super refreshing blend of With pu'erh, ginger, eleuthero This nutty jumble of almonds, This rich, tangy blend green tea, pineapple and and oolong, it's the ultimate apples and cinnamon steeps combines rhubarb, strawberry passion fruit. digestive aid. bright pink. It's nuts! and yogurt pieces. BLACK TEA BLACK TEA HERBAL HERBAL ORGANIC ORGANIC ORGANIC ORGANIC cream of earl grey david's breakfast blend mother's little helper peppermint amour A creamy twist on the classic A sweet, full-bodied black Drift away with this relaxing This refreshingly minty Earl Grey, with a rich hint of tea you’ll somehow love even blend of peppermint, herb is super soothing and vanilla bean. more with a splash of milk. lemongrass and valerian root. revitalizing. BLACK TEA MATÉ HERBAL FRUIT INFUSION ORGANIC ORGANIC saigon chai the buzz cold 911 just peachy Black tea with Saigon This stimulating blend of ginger, At the first sign of a cold, This fruity iced tea is packed cinnamon, ginger, cardamom matcha, maté, guarana and citrus reach for this super-soothing with the juicy flavour of ripe and peppercorns. -

![(1990): Plywood Tea-Chests: Part-1 General [CED 9: Timber and Timber Stores]](https://docslib.b-cdn.net/cover/0160/1990-plywood-tea-chests-part-1-general-ced-9-timber-and-timber-stores-830160.webp)

(1990): Plywood Tea-Chests: Part-1 General [CED 9: Timber and Timber Stores]

इंटरनेट मानक Disclosure to Promote the Right To Information Whereas the Parliament of India has set out to provide a practical regime of right to information for citizens to secure access to information under the control of public authorities, in order to promote transparency and accountability in the working of every public authority, and whereas the attached publication of the Bureau of Indian Standards is of particular interest to the public, particularly disadvantaged communities and those engaged in the pursuit of education and knowledge, the attached public safety standard is made available to promote the timely dissemination of this information in an accurate manner to the public. “जान का अधकार, जी का अधकार” “परा को छोड न 5 तरफ” Mazdoor Kisan Shakti Sangathan Jawaharlal Nehru “The Right to Information, The Right to Live” “Step Out From the Old to the New” IS 10-1 (1990): Plywood Tea-Chests: Part-1 General [CED 9: Timber and Timber Stores] “ान $ एक न भारत का नमण” Satyanarayan Gangaram Pitroda “Invent a New India Using Knowledge” “ान एक ऐसा खजाना > जो कभी चराया नह जा सकताह ै”ै Bhartṛhari—Nītiśatakam “Knowledge is such a treasure which cannot be stolen” ( : .- .-- 1 IS10 (Part1 ):1990 PLYWOOD TEA-CHESTS - SPECIFICATION ’ PART 1 GENERAL ( Fifth Revision) ’ UDC 621’788’1i3 [ 674 - 419’32 : 663’95 3 :. i, I> 1 ‘9 ,I.’ Q BIS 1991 // ,;. : I BUREAU OF INDIAN STANDARDS MANAK BHAVAN, 9 BAHADUR SHAH ZAFAR MARG . NEW DELHI llG002 Price Group 3 __dWmmy 199 1 Timber Stores Sectional Committee, CED 33 FOREWORD This Indian Standard ( Part 1 ) ( Fifth Revision ) was adopred by the Bureau of Indian Standards on 23 March 1990, after the draft finalized by the Timber Stores Sectional Committee had been approved by the Civil Engineering Division Council. -

Manufacturer Product Old Stock Price New Stock Price Big Train Blended Iced Coffees (Includes 20 Below),Blended Crèmes, Blended Green Tea, 3.5 Lb

Manufacturer Product Old Stock Price New Stock Price Big Train Blended Iced Coffees (includes 20 Below),Blended Crèmes, Blended Green Tea, 3.5 lb. Bags$ 19.00 $ 19.60 Blended Iced Coffees (includes 20 Below),Blended Crèmes, Blended Green Tea, Single Serve Packets$ 1.00 $ 1.03 Chai Tea, 3.5 lb. Bags $ 20.25 $ 21.00 Chai Tea, 12 oz. Bags $ 5.25 $ 5.50 Chai Tea, Single Serve Packets $ 0.81 $ 0.84 Fruit Tea Blast $ 9.17 $ 9.67 Low Carb Blended Iced Coffees, 2 lb. Cans $ 27.50 $ 29.00 Low Carb Blended Iced Coffees, Single Serve Packets $ 1.00 $ 1.06 Low Carb Chai, 2 lb. Cans $ 21.50 $ 23.00 Low Carb Chai, Single Serve Packets $ 0.78 $ 0.84 Low Carb Hot Cocoa, 2 lb. Cans $ 22.50 $ 24.00 Low Carb Hot Cocoa, Single Serve Packets $ 0.50 $ 0.60 Hot Chocolate, 3.5 lb. Bags $ 12.00 $ 13.25 Hot Chocolate, Single Serve Packets $ 0.50 $ 0.60 Shaken Iced Tea, 2 lb. Bags $ 9.00 $ 9.60 Add-A-Boosts $ 0.26 $ 0.27 Important Note: Big Train has discontinued their support of the Buy 5, Get 1 Free program for distributors and direct wholesale customers, although we don't know what the effective date will be yet for orders placed with BPS. For now, please assume that 2/18/08 will be the last date you can take advantage of the Buy 5, get 1 Free program. We will continue to ship all Big Train orders over $50 at no charge. -

Decision No 2/2013 of the EU-EFTA Joint Committee on Common

L 315/106 EN Official Journal of the European Union 26.11.2013 ACTS ADOPTED BY BODIES CREATED BY INTERNATIONAL AGREEMENTS DECISION No 2/2013 OF THE EU-EFTA JOINT COMMITTEE ON COMMON TRANSIT of 7 November 2013 amending the Convention of 20 May 1987 on a common transit procedure (2013/675/EU) THE EU-EFTA JOINT COMMITTEE, (5) The proposed amendments lead to an alignment of provisions on common transit with the EU provisions Having regard to the Convention of 20 May 1987 on a on transit. common transit procedure ( 1), and in particular Article 15(3)(a) thereof, (6) Therefore the Convention should be amended accord ingly, Whereas: (1) The Recommendation of 26 June 2009 of the Customs HAS ADOPTED THIS DECISION: Cooperation Council amended the Harmonised System nomenclature. As a consequence, on 1 January 2012, Article 1 Commission Implementing Regulation (EU) No 1006/2011 ( 2 ) entered into force and replaced HS code The Convention of 20 May 1987 on a common transit 1701 11 by two new HS codes, namely 1701 13 and procedure shall be amended as set out in the Appendix to 1701 14, and HS code 2403 10 by two new HS codes, this Decision. namely 2403 11 and 2403 19. Article 2 (2) Consequently, the corresponding HS codes specified in the list of goods involving higher risk of fraud of The amendments set out in point 1 of the Appendix to this Annex I to Appendix I to the Convention of 20 May Decision shall apply from 1 January 2012. 1987 on a common transit procedure (the ‘Convention’) should be amended accordingly. -

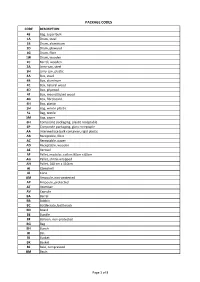

Package Codes

PACKAGE CODES CODE DESCRIPTION 43 Bag, super bulk 1A Drum, steel 1B Drum, aluminium 1D Drum, plywood 1G Drum, fibre 1W Drum, wooden 2C Barrel, wooden 3A Jerry-can, steel 3H Jerry-can, plastic 4A Box, steel 4B Box, aluminum 4C Box, natural wood 4D Box, plywood 4F Box, reconstituted wood 4G Box, fibreboard 4H Box, plastic 5H Bag, woven plastic 5L Bag, textile 5M Bag, paper 6H ComposIte packaging, plastic receptable 6P Composite packaging, glass receptaple AA Intermediate bulk container, rigid plastic AB Receptable, fibre AC Receptable, paper AD Receptable, wooden AE Aerosol AF Pallet, modular, collars 80cm x 60cm AG Pallet, shrink-wrapped AH Pallet, 100 cm x 110cm AI Clamshell AJ Cone AM Ampoule, non-protected AP Ampoule, protected AT Atomiser AV Capsule BA Barrel BB Bobbin BC Bottlecrate, bottlerack BD Board BE Bundle BF Balloon, non-protected BG Bag BH Bunch BI Bin BJ Bucket BK Basket BL Bale, compressed BM Basin Page 1 of 8 PACKAGE CODES CODE DESCRIPTION BN Bale, non-compressed BO Bottle, non-protected, cylindrical BP Balloon, protected BQ Bottle, protected cylindrical BR Bar BS Bottle, non-protected, bulbous BT Bolt BU Butt BV Bottle, protected bulbous BW Box, for liquids BX Box BY Board, in bundle/bunch/truss, BZ Bars, in bundle/bunch/truss CA Can, rectangular CB Beer crate CC Churn CD Can, with handle and spout CE Creel CF Coffer CG Cage CH Chest CI Canister CJ Coffin CK Cask CL Coil CM Collis CN Container not otherwise specified as transport equipment CO Carboy, non-protected CP Carboy, protected CQ Cartdidge CR Crate CS Case CT -

An Examination of Tea Smuggling in England During the Long Eighteenth Century

The Thirst for Tea: An Examination of Tea Smuggling in England During the Long Eighteenth Century Abstract: This paper seeks to examine several facets of the phenomenon of tea smuggling during the “long” eighteenth century. In order to understand why tea smuggling occurred at this time, one must consider the laws which necessitated smuggling, as well as the economic environment of Britain throughout the century. In addressing the extensive popularity of ritualized tea drinking, one can comprehend why tea, specifically–admittedly among a myriad of other valuable commodities–was selected to be smuggled. The material nature of the tea ritual, in addition to the smuggling process, is crucial to understanding the significance of tea itself and associated illicit activities. By investigating these elements concurrently, one may begin to understand why tea was smuggled during the eighteenth century, and how the British government consequently worked to end smuggling altogether. 2 The thirst for tea transcended all social classes across the English empire throughout the “long” eighteenth century.1 At the beginning of its rise to economic dominance, tea was considered a luxury commodity, enjoyed only by the upper echelons of society, who acclimatized themselves to its new, bitter taste. However, shortly after its introduction to the noble class and, by extension, court culture, the practice of tea consumption trickled down into the middle class, rapidly leaking into the poorest sectors of English society.2 From its elite beginnings, tea developed into an inherently British commodity, an essential to daily life for all social classes. It rose to popularity in Britain and the Dutch Republic initially, long before individuals of any class on the European continent picked up a tea cup.3 Tea trading occurred during the seventeenth century, but the beverage gained substantial adoration during the eighteenth. -

For All Occasions RE:FRESH

RE:FRESH TEA for all occasions IN AGED CARE For more information, visit ufs.com ENJOY A GOOD CUPPA ANYTIME Residents always look forward to tea time. We offer you solutions for a great tea experience in any place of your facility. • In-Room/Extra Services • Lounge & Guest Area • Dining • Functions & Activities 2 in-room Whether it’s envelopes or string & tag tea bags they can prepare at their own leisure, residents can enjoy a good cup of tea without having to leave the comfort of their own room. In-Room/Extra services: Sir Thomas Lipton bulk specialty teas in a choice of black tea, green tea and herbal infusions. Available in cartons of 500s for easier refill. Lipton tea available in black and green variants with foiled envelopes to ensure a fresh cup of tea every time. Lipton Yellow Label Lipton Green Gold Envelope Envelope Tea Tea Cup Bag 500s 300s 3 Lounge & guest area Tea and a chat? Whether it may be with other residents or visiting guests, residents always look forward to tea time as a way to socialize and catch-up with each other. Premium blends for different moods and tastes Sir Thomas Lipton has an extensive range for both residents and guests to enjoy at whatever time of day and according to their preference. Sir Thomas Lipton range in 8 variants 4 dining The same way that food plays an important role in their day, tea also brings them together during meal times. Tea comes in different formats of string & tag, envelopes and pot bags, so they can have great tea moments with their meals.