AAVAS FINANCIERS LIMITED Price Band Ad

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AAVAS Financiers

31 July 2021 1QFY22 Results Update | Sector: Financials AAVAS Financiers Estimate change CMP: INR2,530 TP: INR2,820 (+12%) Neutral TP change Ability to recover and bounce back will be put to test Rating change Increase in 1+dpd transitory in our view Motilal Oswal values your support in the Asiamoney Brokers Poll 2021 for PAT grew 20% YoY, but fell 32% QoQ, to INR599m (in line) in 1QFY22. NII India Research, Sales, Corporate rose 14% QoQ and 29% YoY, while operating profit fell 10% QoQ (7% beat). Access and Trading team. However, higher-than-expected credit cost of INR170m (est. INR110m) led We request your ballot. to the in line PAT. Sharp deterioration in 1+dpd to 12.7% (up 620bp QoQ), relative to some of its other peers who have reported their 1QFY22 numbers, could be indicative of the stress that was seen at the time of demonetization and Bloomberg AAVAS IN higher proportion of self-employed customers in the mix. Equity Shares (m) 78 M.Cap.(INRb)/(USDb) 198.1 / 2.7 Given the strength of this franchise, we remain convinced that it can script 52-Week Range (INR) 3068 / 1285 a gradual improvement in its 1+dpd and GS3 once collections further 1, 6, 12 Rel. Per (%) -6/26/54 improve, led by a recovery in economic activity. Our estimates are largely 12M Avg Val (INR M) 246 unchanged and we are building in ~50bp/35bp of credit costs in FY22E/FY23E. We maintain our Neutral rating with a TP of INR2,820/share, Financials & Valuations (INR b) given that the stock trades at rich valuations of 6.3x FY23E P/BV. -

Aavas Financiers Ltd

Name of the issue: Aavas Financiers Limited Updated: April 2021 1 Type of issue (IPO/ FPO) IPO 2 Issue size (Rs. in Cr) 1,640.32 3 Grade of issue alongwith name of the rating agency Not Applicable (excl. Anchor 4 Subscription Level (Number of times) 0.9112* Investor) Source: Minutes for basis of allotment dated Oct 3, 2018 * Figure is after technical rejections 5 QIB holding (as a %age of total outstanding capital) as disclosed to stock exchanges Particulars % (i) On Allotment 23.09% (ii) at the end of the 1st Quarter immediately aftof the issue (Dec 31, 2018) 31.24% (iii) at the end of 1st FY (March 31, 2019) 31.84% (iv) at the end of 2nd FY (March 31, 2020) 37.10% (v) at the end of 3rd FY (March 31, 2021) 40.35% Source: SE website 6 Financials of the issuer (Consolidated in Rs Cr) Particulars 31-Mar-19 31-Mar-20 31-Mar-21 Net Sales/ Income from operations 710.17 902.55 Not Available Net Profit after Minority Interest 176.03 249.04 Not Available Equity Capital 78.11 78.32 Not Available Reserves excluding revaluation reserves 1,758.91 2,019.59 Not Available Note: Financial for the year ended March 31, 2021 shall be updated in due course 7 Trading status in the scrip of the issuer Company's Equity Shares are listed on both the BSE Limited ("BSE") and the National Stock Exchange of India Limited ("NSE") Particulars Status (i) at the end of 1st FY (March 31, 2019) Frequently Traded (ii) at the end of 2nd FY (March 31, 2020) Frequently Traded (iii) at the end of 3rd FY (March 31, 2021) Frequently Traded Source: SE website 8 Change, if any, -

Aavas Financiers BUY

Aavas Financiers BUY INITIATING COVERAGE AAVAS IN EQUITY March 24, 2021 Running its own race BFSI Longevity of profitable growth in the underpenetrated small-ticket Recommendation housing segment is a given for Aavas. Expect segment to post ~18% Mcap (bn): `189/US$2.6 CAGR through FY30, with Aavas best-suited to capitalize (~21%). Scalability hinges on niche positioning, technology-backed processes 3M ADV (mn): `246.3/US$3.4 and people. Asset quality is ensured from time-tested informal CMP: `2,405 assessment model, knowledge through local hires and in-house souring. TP (12 mths): `2,950 In periods of stress, prudent risk management DNA, diversified liquidity Upside (%): 23 profile and impressive collection infrastructure will make it stand out. Faster earnings compounding of ~21% vs <19% for peers (FY21-26E) Flags should help sustain premium valuations. Even if 1-year fwd P/B de-rates 30% (FY30), exit multiple of 4.9x implies ~15% IRR. Desired combination Accounting: GREEN of high-growth business with low construction risk makes 15%+ RoE Predictability: GREEN sustainable. Key risk: Absence of a long-term strategic shareholder. Earnings Momentum: GREEN Competitive position: STRONG Changes to this position: STABLE Catalysts Bang for the buck! AUM/disbursements posted 72%/48% CAGR between FY13-20; led by declining . >20% AUM and earnings growth in repayments (18% in FY20 vs 29% in FY14). Faster than system growth helped FY22 capture ~0.7% of HFC-HL share. Granular lending (nil developer), in-house . Normalization in 1+ DPD to <4% sourcing and LTVs of ~50% render underwriting credibility. Credit costs which spiked in FY21 to ~8.2% remained <60bps since inception. -

Ref. No. AAVAS/SEC/2021-22 7337 Date

AavasFINANCIERS LTD SAPNE A A P KE, S A AT H HAMAARA Ref. No. AAVAS/SEC/2021-22 7337 Date: July 19. 2021 To, To, The National Stock Exchange of India BSE Limited Limited Dept, of Corporate Services The Listing Department Phiroze Jeejeebhoy Towers, Exchange Plaza, Dalai Street, Fort, Bandra Kurla Complex, Mumbai - 400001 Mumbai - 400051 Scrip Symbol: AAVAS Scrip Code: 541988 Dear Sir /Madam, Sub: Annual Report for the Financial Year 2020-21 and Notice of the Annual General Meeting. We wish to inform you that Eleventh Annual General Meeting ("AGM") of the Members of Aavas Financiers Limited ("Company") will be held on Tuesday, August 10, 2021 at 3:30 P.M. through Video Conferencing ("VC") / Other Audio Visual Means ("OAVM") to transact the business as listed in the Notice of AGM. In this regard, please find attached herewith Annual Report of the Company for Financial Year 2020-21 along with the Notice of AGM. The Notice of AGM and Annual Report for FY 2020-21 are also made available on the website of the Company at the link: https://www.aavas.in/investor-relations/annual- reports. The Company shall commence the dispatch of the Notice of AGM and the Annual Report for FY 2020-21 to the Members by electronic means from today i.e. July 19, 2021, Monday. You are required to take the same on record. Enclosed a/a AAVAS FINANCIERS LIMITED (Formerly known as "Au HOUSING FINANCE LIMITED") An ISO 9001: 2015 Certified Company I CIN NO.: L65922R)2011PLC034297 Regd. & Corp. Office: 201-202, 2nd Floor, Southend Square, Mansarovar Industrial Area, laipur-302020 -

Aavas Financiers Limited

AAVAS FINANCIERS LIMITED CIN: L65922RJ2011PLC034297 Registered and Corporate Office: 201-202, 2nd Floor, South End Square, Mansarover Industrial Area, Jaipur 302 020, Rajasthan, India Tel: +91 14 1661 8800 Fax: +91 14 1661 8861 E-mail: [email protected]|Website: www.aavas.in Notice to Members NOTICE is hereby given that the Eleventh Annual General Financial Company – Housing Finance Company (Reserve Meeting of the Members of Aavas Financiers Limited will Bank) Directions, 2021 (“RBI Master Directions”) (including be held on Tuesday, August 10, 2021 at 3:30 P.M., Indian any statutory modification(s) or re-enactment thereof for Standard Time (“IST”) through Video Conferencing (“VC”) / the time being in force) and as per the provisions of Other Audio Visual Means (“OAVM”) Facility to transact the Articles of Association of the Company, Mrs. Kalpana Iyer following businesses: (DIN: 01874130) who was appointed as an Independent Director of the Company on June 23, 2016 and who ORDINARY BUSINESSES has submitted declaration that she meets the criteria for 1. To consider and adopt: independence as provided under Section 149(6) of the (a) the audited Standalone Financial Statements of the Act and Regulation 16(1) (b) & 25 (8) of the SEBI LODR Company for the Financial Year ended March 31, 2021 Regulations and is not debarred from holding the office together with the reports of the Board of Directors of Director by virtue of any SEBI order or any other such and Auditors thereon; and authority and who is eligible for re- appointment, be and (b) the audited Consolidated Financial Statements of the is hereby re-appointed as an Independent Director (Non- Company for the Financial Year ended March 31, Executive) not liable to retire by rotation, on the Board 2021 together with the report of the Auditors thereon. -

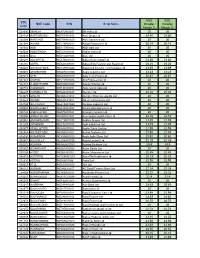

BSE Code NSE Code ISIN Scrip Name NSE Intraday Margin % BSE

NSE BSE BSE NSE Code ISIN Scrip Name Intraday Intraday Code Margin % Margin % 523395 3MINDIA INE470A01017 3M India Ltd 20 20 524348 AARTIDRUGS INE767A01016 Aarti Drugs Ltd 24.86 24.86 524208 AARTIIND INE769A01020 Aarti Industries Ltd 20 20 541988 AAVAS INE216P01012 Aavas Financiers Ltd 20.14 20.14 500002 ABB INE117A01022 ABB India Ltd 20 20 500488 ABBOTINDIA INE358A01014 Abbott India Ltd 20 20 500410 ACC INE012A01025 ACC Ltd 20 20 540691 ABCAPITAL INE674K01013 Aditya Birla Capital Ltd 23.86 23.86 535755 ABFRL INE647O01011 Aditya Birla Fashion and Retail Ltd 20.25 20.25 540025 ADVENZYMES INE837H01020 Advanced Enzyme Technologies Ltd 23.89 23.89 500003 AEGISCHEM INE208C01025 Aegis Logistics Ltd 23.23 23.23 500215 ATFL INE209A01019 Agro Tech Foods Ltd 20.87 20.87 532683 AIAENG INE212H01026 AIA Engineering Ltd 20 20 532331 AJANTPHARM INE031B01049 Ajanta Pharma Ltd 20 20 500710 AKZOINDIA INE133A01011 Akzo Nobel India Ltd 20 20 506235 ALEMBICLTD INE426A01027 Alembic Ltd 25.32 25.32 533573 APLLTD INE901L01018 Alembic Pharmaceuticals Ltd 20 20 539523 ALKEM INE540L01014 Alkem Laboratories Ltd 20 20 532749 ALLCARGO INE418H01029 Allcargo Logistics Ltd 20 20 500008 AMARAJABAT INE885A01032 Amara Raja Batteries Ltd 20 20 500425 AMBUJACEM INE079A01024 Ambuja Cements Ltd 20 20 590006 AMRUTANJAN INE098F01031 Amrutanjan Health Care Ltd 22.16 22.16 590062 ANDHRSUGAR INE715B01013 Andhra Sugars Ltd 24.09 24.09 532259 APARINDS INE372A01015 Apar Industries Ltd 21.08 21.08 500877 APOLLOTYRE INE438A01022 Apollo Tyres Limited 22.55 22.55 542484 ARVINDFASN INE955V01021 -

Spandana Sphoorty Financial Limited a Strong Business Franchise Viewpoint

Spandana Sphoorty Financial Limited A strong business franchise Viewpoint Spandana Sphoorty Financials Limited (SSFL) is our preferred pick and Sector: Banks & Finance has emerged as a strong NBFC-MFI (well capitalised and improving Company Update ROEs) bolstered by strong business quality (strong risk management and diversified book). Over the years, SSFL had built its business by Change expanding access to funds/capital, while maintaining an improving rating profile and a conservative asset-quality book. SSFL’s strong risk View: Positive management and business strength are seen in its strong portfolio CMP: Rs. 1,170 quality (robust repayment rates, low GNPAs/NNPAs). In this note, we have introduced FY2022E earnings estimates and are accordingly Upside potential: 22-25% á rolling over our price target (PT) on FY2022E book value estimates. We retain our Positive view on the stock and see 22-25% upsides from á Upgrade No change â Downgrade current levels. Strong operating metrics, with levers available to further improve: SSFL Company details has high pre-tax ROA with an improving trend (at 14.6% for Q2FY2020 from 12.6% FY2019) as well. Moreover, its attractive margins (NIM at Market cap: Rs. 7,508 cr 18.6% in Q2FY2020 from 16.8% in FY2019) indicate its business model strength. Over the years, SSFL had built its business by expanding 52-week high/low: Rs. 1400/690 access to funds/capital, while maintaining an improving rating profile and a conservative asset-quality book. We believe there are significant NSE volume: (No of 1.3 lakh positive levers available to the MFI at present, with its leverage ratio shares) (large headroom to increase leverage from current 1.3x), increased BSE code: 542759 securitisation potential (PSL qualification helps) and improving trend of rating profile (cheaper cost of funds). -

![Instrument Ratings an Associates Bank Facilities [ICRA]](https://docslib.b-cdn.net/cover/1701/instrument-ratings-an-associates-bank-facilities-icra-2741701.webp)

Instrument Ratings an Associates Bank Facilities [ICRA]

Rating Updates For December 2017 Company Name (New Ratings) Instrument Ratings A N Associates Bank Facilities [ICRA]BB(Stable)/[ICRA]A4 AASAN Corporate Solutions Private Limited Non-Convertible Debentures Provisional [ICRA]A+(SO)(Stable) Aavas Financiers Limited Commercial Paper [ICRA]A1+ Aditya Birla Retail Limited Bank Facilities [ICRA]A-(Stable)/[ICRA]A2+ Alstom Systems India Private Limited Bank Facilities [ICRA]A+(SO)(Stable)/[ICRA]A1+(SO) Alstom Transport India Limited Bank Facilities [ICRA]A+(SO)(Stable)/[ICRA]A1+(SO) Anamudi Real Estates LLP Bank Facilities [ICRA]A+(Stable) Anglo French Drug & Industries Limited Bank Facilities [ICRA]BBB-(Stable) Annapurna Microfinance Private Limited Vivriti Valor 012 2017 PTC Series A1 Provisional [ICRA]A-(SO) Aptus Value Housing Finance India Limited Non-Convertible Debenture [ICRA]A(stable) ASA International India Microfinance Limited Non-Convertible Debenture [ICRA]BBB-(Stable) Bandipur Sopan Welfare Society MFI Grading M5 Barbeque Nation Hospitality Limited Commercial Paper [ICRA]A1+ Barbrik Project Limited Bank Facilities [ICRA]A-(Stable) Bazaar Konnections Bank Facilities [ICRA]B(Stable) Bharat Financial Inclusion Limited IMLRT November 2017 PTC Series A Provisional [ICRA]AA(SO) Bharti Telecom Limited Commercial Paper [ICRA]A1+ Bhartiya International Limited Bank Facilities [ICRA]A(Stable)/[ICRA]A1 BIBA Apparels Private Limited Bank Facilities [ICRA]A+(Stable)/[ICRA]A1+ BIBA Apparels Private Limited Commercial Paper [ICRA]A1+ Brindavan Beverages Pvt. Ltd. Bank Facilities [ICRA]BBB+(Stable)/[ICRA]A2 -

![Aavas Financiers Limited: Long-Term Rating Upgraded to [ICRA]AA-(Stable); Short-Term Rating Reaffirmed](https://docslib.b-cdn.net/cover/8308/aavas-financiers-limited-long-term-rating-upgraded-to-icra-aa-stable-short-term-rating-reaffirmed-2898308.webp)

Aavas Financiers Limited: Long-Term Rating Upgraded to [ICRA]AA-(Stable); Short-Term Rating Reaffirmed

August 19, 2020 Aavas Financiers Limited: Long-term rating upgraded to [ICRA]AA-(Stable); short-term rating reaffirmed Summary of rating action Previous Rated Amount Current Rated Amount Instrument* Rating Action (Rs. crore) (Rs. crore) [ICRA]AA- (Stable); upgraded from NCD Programme 350 350 [ICRA]A+ (Positive) Commercial Paper 50 50 [ICRA]A1+; reaffirmed [ICRA]AA- (Stable); upgraded from Long-term Bank Lines 1,240 1,240 [ICRA]A+ (Positive) Total 1,640 1,640 *Instrument details are provided in Annexure-1 Rationale The revision in the long-term rating takes into account Aavas’ sustained and resilient performance during the past few years despite the challenging operating environment. The company has continued to grow at a healthy calibrated pace while maintaining its key metrics. As the scale has doubled during the past two years, the company has demonstrated a significant improvement in its cost structure. Also, Aavas continued to report a better-than-industry average asset quality (gross stage 3 of 0.46% as on June 30, 2020), capitalisation (gearing of 2.6x and capital adequacy of 56% as on June 30, 2020) and solvency metrics with an improving profitability trajectory. While the ongoing challenging operating environment amid the Covid-19 pandemic is likely to lead to some weakening in the asset quality and profitability, ICRA notes that Aavas has sufficient capital buffer to absorb asset-side shocks without significantly impairing its financial profile from the current strong level. Also, ICRA draws comfort from Aavas’ demonstrated ability to bring down the portfolio under moratorium to one of the lowest levels (17.8% in June 2020) in the housing finance industry. -

Detailed Table of Contents

Detailed Table of Contents 1. Infrastructure finance Opinion Outstanding portfolio growth and market dynamics ● Review of growth in overall infrastructure financing market − Growth in infrastructure projects sanctioned by financial institutions − Capex of all institutionally assisted projects − Segment wise share of investments ● Growth outlook and market share outlook for NBFCs ● Key growth drivers ● New funding avenues for infrastructure sector ● NBFCs’ product mix and borrowing profile Asset quality ● Past trend in Gross NPAs and restructured assets ● Outlook on GNPAs Profitability ● Profitability - for overall NBFCs and for NBFCs excluding PFC and REC Industry Information ● Underlying asset dynamics ● Regulatory framework ● Key growth drivers and risks in the finance market 2. Housing finance Opinion Outstanding portfolio growth and market dynamics ● Review of housing finance market growth ● Growth outlook for HFCs ● Analysis of large HFCs vis-à-vis small and medium sized HFCs ● Market share of HFCs vs. Banks including outlook ● Player wise market share of HFCs ● Breakup of HFC portfolio (Retail housing loans, Non-Retail) Key growth drivers Profitability ● Borrowing profile of HFCs ● Profitability of HFCs – separate trend for large HFCs vis-à-vis small and medium sized HFCs ● Profitability- Retail housing loans and non-retail segment Asset quality ● Past trend in Gross NPAs ● Outlook on GNPAs Key risks Annexure Industry Information ● Underlying asset dynamics and demand drivers ● Regulatory framework ● Key growth drivers and risks -

Pivot Table-Sample V1.Xlsx

Pivot Table for October 04, 2021 Security Name S1 S2 Pivot R1 R2 S&P BSE 100 Index 17675.0960 17740.0920 17786.1060 17851.1020 17897.1150 S&P BSE 200 Index 7532.0470 7561.2840 7581.1870 7610.4240 7630.3270 S&P BSE 500 Index 23683.6480 23778.4570 23841.3280 23936.1370 23999.0080 S&P BSE Auto Index Index 23384.1860 23599.4630 23729.9770 23945.2540 24075.7680 S&P BSE Bankex Index 41985.6600 42246.5740 42431.4020 42692.3160 42877.1450 S&P BSE Consumer Durables Index 40726.3050 41209.5980 41482.6840 41965.9770 42239.0630 S&P BSE Capital Goods Index 25678.6430 25795.6170 25925.0840 26042.0590 26171.5250 S&P BSE CPSE 1585.5500 1599.7300 1613.8000 1627.9800 1642.0500 S&P BSE Dollex 100 Index 2458.4670 2471.6440 2480.1170 2493.2940 2501.7670 S&P BSE Dollex 200 Index 1686.0600 1695.4400 1701.3200 1710.7000 1716.5800 S&P BSE Dollex 30 Index 6451.5530 6480.0660 6499.4530 6527.9660 6547.3530 S&P BSE Metal Index Index 19597.5040 19951.9690 20202.9040 20557.3690 20808.3050 S&P BSE Oil & Gas Index Index 18098.9650 18233.8380 18394.5040 18529.3770 18690.0430 S&P BSE Power Index 3133.8300 3169.0200 3202.2200 3237.4100 3270.6100 S&P BSE Public Sector Index 8356.6500 8420.9700 8476.4700 8540.7890 8596.2890 S&P BSE Realty Index 3959.5200 3999.5800 4060.4000 4100.4600 4161.2800 S&P BSE Sme Ipo Index 7207.3130 7382.6960 7476.8030 7652.1870 7746.2940 S&P BSE Sensex Index 58396.6600 58581.1170 58735.5980 58920.0550 59074.5350 S&P BSE Sensex Total Return Index 88090.4140 88090.4060 88090.4140 88090.4060 88090.4140 S&P BSE Teck Index Index 15110.9770 15166.4040 -

S No Housing Finance Companies Website PLI Code

List of Primary Lending Institutions that have signed MoU with NHB (National Housing Bank) under Rural Housing Interest Subsidy Scheme (RHISS) status as on 31/12/2019. S No Housing Finance Companies Website PLI Code 1 Aadhar housing Finance Ltd www.aadharhousing.com RAADR1101 2 Aavas Financiers LTD www.auhfin.in/index RAUHF1101 3 Aditya Birla Housing Finance LTD adityabirlahomeloans.com RBRLA1101 4 Altum Credo Home Finance Private LTD www.altumcredo.com RALTM1101 5 Anand Housing Finance Ltd RANAD1101 6 Aptus Value Housing Finance India LTD www.aptusindia.com RAPTS1101 7 ART Affordable Housing Finance India LTD arthfc.com RRAAS1101 8 Aspire Home Finance LTD www.ahfcl.com RASPR1101 9 Bee Secure Home Finance PVT LTD www.incred.com RBSEC1101 10 Can Fin Home Finance LTD www.canfinhomes.com RCANF1101 11 Capri Global Housing Finance LTD cgclhomeloans.com RCPRI1101 12 Cent Bank Home Finance LTD www.cbhfl.com RCENT1101 13 DMI Housing Finance Pvt Ltd www.dmihousingfinance.in RDMIH1101 14 Edelweiss Housing Finance LTD www.edelweissfin.com REDEL1101 15 Fasttrack Housing Finance Ltd www.fasttrackhfc.com RFAST1101 16 Fullerton India Home Finance LTD www.fullertonindia.com RFULL1101 17 Gruh Finance Ltd (Merged into Bandhan Bank) www.gruh.com RGRUH1101 18 Hinduja Housing Finance Ltd http://www.hindujahousingfinance.com/ RHIND1101 19 Homeshree Housing Finance LTD homeshree.com RHOME1101 20 IKF Housing Finance Pvt LTD www.ikffinance.com RIKFL1101 21 India Bulls Housing Finance LTD www.indiabullshomeloans.com RINDB1101 22 India Home Loan LTD www.indiahomeloan.co.in RINDH1101 23 India Infoline Housing Finance LTD www.iifl.com/home-loans RIIHF1101 24 India Shelter Finance Corporation LTD www.indiashelter.in RISFC1101 25 IndoStar Home Finance Private LTD www.indostarcapital.com RINDO1101 26 LIC Housing Finance Ltd.