Retail Sector Growth to Remain Steady

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Familymart Branches

Sheet1 Participating FamilyMart Branches BRANCH ADDRESS CONTACT NUMBER G/F 139 CORPORATE CENTER, VALERO ST. 0917-8129710 139 CORPORATE SALCEDO VILLAGE, MAKATI CITY 978-0109 G/F STALL 21 ELJ COMMUNICATIONS 964-8279 ABS - CBN CENTER, QUEZON CITY 0917-5225533 GF AEON PRIME BUILDING, ALABANG- AEON PRIME ZAPOTE ROAD COR. NORTHGATE 0917-8458988 BRIDGEWAY, MUNTINLUPA CITY G/F UNIT 1-4, AIC GRAND DE TOWER, 0917-846-0651 AIC GRANDE TOWER GARNET ROAD, ORTIGAS CENTER, PASIG 507-6348 CITY G/F ALCO BLDG. 391 SEN. GIL PUYAT ALCO BLDG 954-1585 MAKATI CITY G/F ALPHALAND SOUTHGATE MALL EDSA 0917-5827526 ALPHALAND COR. PASONG TAMO ST. MAKATI CITY 959-0832 LG/F UNIT 7 ANONAS LRT CITY CENTER 978-0131 ANONAS LRT AURORA BLVD. & ANONAS ST. PROJECT 3 0917-8057206 QUEZON CITY AVIDA TOWERS NEW MANILA (TOWER# 5), 0917-8466236 AVIDA NEW MANILA B. SERRANO AVE., BRGY. BAGONG LIPUNAN 964-1352 NG CRAME, QUEZON CITY G/F RETAIL SPACE 2-4, AVIDA TOWERS SAN 0917-8940484 AVIDA SAN LORENZO LORENZO, CHINO ROCES AVE., MAKATI CITY 964-1499 959-1275 AYALA MRT 2/F AYALA MRT STATION 3 MAKATI CITY 09178207217 G/F C1 AYALA TOWER ONE & EXCHANGE AYALA TOWER ONE PLAZA AYALA TRIANGLE AYALA AVE. MAKATI 625 - 0446 CITY AYALA TRIANGLE GARDENS AYALA AVE., AYALA TRIANGLE GARDENS 729-7962 MAKATI CITY 11th AVE COR 30th ST., BONIFACIO GLOBAL 0917-5818190 BGC CORP CITY 978-0138 G/F BLDG K, BLUE BAYWALK MACAPAGAL, 0917-8103789 BLUE BAYWALK EDSA EXT. COR. MACAPAGAL AVE. 218-9335 METROPARK, PASAY CITY G/F SPACE #3 BONIFACIO ONE TECHNOLOGY TOWER RIZAL DRIVE COR. -

Department of Labor and Employment List of Contractors/Subcontractors Registered Under D.O

Department of Labor and Employment List of Contractors/Subcontractors registered under D.O. 174 (as of April 2018) Date of Region Name of Establishments Address Registration Number Nature of Business Registration PROFESSIONAL, SCIENTIFIC AND NCR 1957 SECURITY & INVESTIGATION AGENCY CORPORATION 502 5TH FLR. A&T BLDG., ESCOLTA ST., BINONDO, MANILA 30-Jun-17 NCR-MFO-80100-063017-042-N TECHNICAL ACTIVITIES UNIT 31 LLANAR BLDG., BONNY SERRANO COR. 10TH AVE., BRGY. SOCORRO, NCR 1ST CONCEPTS & SOLUTIONS LABOR SERVICE COOP. 03-Jul-17 NCR-QCFO-4534-0114-004 MANPOWER SERVICES CUBAO, Q.C. UNIT 2403 24F ANTEL GLOBAL BUILDING, #3 JULIA VARGAS AVE., BRGY. SAN NCR 24/7 INTERNATIONAL CORPORATION 01-Feb-18 NCR-PFO-62010-020118-030-N OTHER SERVICE ACTIVITIES ANTONIO, PASIG CITY NCR 3RD LANTING SECURITY & WATCHMAN AGENCY 5263 DIESEL ST., PALANAN, MAKATI CITY 05-Jun-17 NCR-MPFO-8100-060517-047-N SECURITY AGENCY NCR 4CS MANPOWER SERVICES 256 SAMSON ROAD, BRGY. 075, CALOOCAN CITY 05-Mar-18 NCR-CFO-78101-030118-016-N MANPOWER SERVICES NCR 4TH DIMENSION MULTI-PURPOSE COOPERATIVE 27-B C. BENITEZ ST., HORSESHOE VILLAGE, QUEZON CITY 11-Dec-17 NCR-QCFO-7493-032817-017 MANPOWER SERVICES NCR 5TH P ADVERTISING SERVICES 55-D MATAHIMIK ST., TEACHERS VILL. WEST DILIMAN, Q.C. 27-Jul-17 NCR-QCFO-73109-072717-051 MANPOWER SERVICES ADMINISTRATIVE AND SUPPORT NCR 7107 CONSTRUCTION AND CONSULTANCY, INC. UNIT 504 NEW GOLD BLDG., F. BENITEZ ST., ERMITA, MANILA 22-Dec-17 NCR-MFO-78101-122217-001-N SERVICE ACTIVITIES NCR 888 GALLANT SECURITY SERVICES CORPORATION 558 QUIRINO AVENUE, BRGY TAMBO, PARAÑAQUE CITY 30-Jun-17 NCR-MUNTA-749201010-111 LR OTHER SERVICE ACTIVITIES NCR A & P SERVICES, INC. -

Sec 17-A Fy 2018

12. Check whether the issuer: (a) has filed all reports required to be filed by Section 17 of the SRC and SRC Rule 17 thereunder or Section 11 of the RSA and RSA Rule 11(a)-1 thereunder, and Sections 26 and 141 of The Corporation Code of the Philippines during the preceding twelve (12) months (or for such shorter period that the registrant was required to file such reports); Yes [ X ] No [ ] (b) has been subject to such filing requirements for the past ninety (90) days. Yes [ X ] No [ ] 13. State the aggregate market value of the voting stock held by non-affiliates of the registrant. P1,931,103,029 as of December 31, 2018 APPLICABLE ONLY TO ISSUERS INVOLVED IN INSOLVENCY/SUSPENSION OF PAYMENTS PROCEEDINGS DURING THE PRECEDING FIVE YEARS: 14. Check whether the issuer has filed all documents and reports required to be filed by Section 17 of the Code subsequent to the distribution of securities under a plan confirmed by a court or the Commission. Yes [ ] No [X] DOCUMENTS INCORPORATED BY REFERENCE 15. If any of the following documents are incorporated by reference, briefly describe them and identify the part of SEC Form 17-A into which the document is incorporated: Consolidated Financial Statements as of and for year ended December 31, 2018 (Incorporated as reference for Item 7 to 12 of SEC Form 17-A) ________________________________________________________________________ CENTURY PROPERTIES GROUP INC. Page 2 of 84 SEC Form 17-A TABLE OF CONTENTS PART I. BUSINESS AND GENERAL INFORMATION 4 Item 1 Business……………………………………………………………………………………………... 4 Item 1.1 Overview…………………………………………………………………………. -

Ccn Tin Importer Im0006021794 430968150000 Daesang Ricor Corporation Im0002959372 003873536000 Westpoint Industrial Sales Co

CCN TIN IMPORTER IM0006021794 430968150000 DAESANG RICOR CORPORATION IM0002959372 003873536000 WESTPOINT INDUSTRIAL SALES CO. INC. IM0002992817 000695510000 ASIAN CARMAKERS CORPORATION IM0002963779 232347770000 STRONG LINK DEVELOPMENT CORPORATION IM0003299511 002624091000 TABAQUERIA DE FILIPINAS INC. IM0003063011 217711150000 ASIAWIDE REFRESHMENTS CORPORATION IM0002963639 001007787000 GX INTERNATIONAL INC. IM0006830714 456650820000 MOBIATRIX INC IM0003014592 002765139000 INNOVISTA TECHNOLOGIES INC. IM0003214699 005393872000 MONTEORO CHEMICAL CORPORATION IM0004340299 000126640000 LINKWORTH INTERNATIONAL INC. IM0006804179 417272052000 EATON INDUSTRIES PHILIPPINES LLC PH IM0002957590 000419293000 ALLEGRO MICROSYSTEMS PHILS. INC. IM0004143132 001030408000 PUENTESPINA ORCHIDS AND TROPICAL IM0003131297 004558769000 ARCHITECKS METAL SYSTEMS INC. IM0003025799 103873913000 MCMASTER INTERNATIONAL SALES IM0002973979 000296020000 CARE PRODUCTS INC IM0003014231 001026198000 INFRATEX PHILIPPINES INC. IM0002962691 000288655000 EURO-MED LABORATORIES PHILS. INC. IM0003031438 006818264000 NORTHFIELDS ENTERPRISES INT'L. INC. IM0003170217 002925850000 KENRICH INT'L . DISTRIBUTOR INC. IM0003259994 000365522000 KAMPILAN MANUFACTURING CORPORATION IM0003132498 103901522000 PEONY MERCHANDISING IM0002959496 204366533000 GLOBEWIDE TRADING IM0002966514 000070213000 NORKIS TRADING CO INC. IM0003232492 000117630000 ENERGIZER PHILIPPINES INC. IM0003131513 000319974000 HI-Q COMMERCIAL.INC IM0003035816 000237662000 PHILIPPINE INTERNATIONAL DEV'T INC. IM0003090795 113041122000 -

Date of Correspondence

Ayala Corporation Makati Central PO Box 1444 Makati City 1254 Philippines Tel (632) 848 5643 Fax (632) 848 5768 16 January 2017 www.ayala.com.ph Philippine Stock Exchange 3/F, The Philippine Stock Exchange, Inc. Tower One and Exchange Plaza, Ayala Ave., Makati City Attention: Mr. Jose Valeriano B. Zuño III OIC-Head, Disclosure Department Philippine Dealing & Exchange Corporation 6766 Ayala Avenue corner Paseo de Roxas Makati City Attention: Ms. Vina Vanessa S. Salonga Head, Issuer Compliance and Disclosure Department Subject: Report on the Top 100 Shareholders Gentlemen: This is in connection with the Exchange’s Revised Disclosure Rules requiring Ayala Corporation to submit a report on the top 100 shareholders of the Company. In compliance therewith, we are submitting herewith the list of top 100 shareholders of the Company’s common share for the quarter-ending 31 December 2016. Thank you. Very truly yours, SOLOMON M. HERMOSURA Corporate Secretary and General Counsel BPI STOCK TRANSFER OFFICE AYALA CORPORATION TOP 100 STOCKHOLDERS AS OF DECEMBER 31, 2016 RANK STOCKHOLDER NUMBER STOCKHOLDER NAME NATIONALITY CERTIFICATE CLASS OUTSTANDING SHARES PERCENTAGE TOTAL 1 13000734 MERMAC INC FIL A 303,689,196 48.9643% 303,689,196 3RD FLOOR, MAKATI STOCK EXCHANGE BUILDING, AYALA TRIANGLE, AYALA AVENUE, MAKATI CITY 1226 2 16000305 PCD NOMINEE CORPORATION (NON-FILIPINO) NOF A 151,493,460 24.4255% 151,493,460 37F TOWER 1, THE ENTERPRISE CENTER, AYALA AVE COR PASEO DE ROXAS, 1226 MAKATI CITY 3 16000304 PCD NOMINEE CORPORATION (FILIPINO) FIL A 79,698,716 12.8499% 79,698,716 37F TOWER 1, THE ENTERPRISE CENTER, AYALA AVE COR PASEO DE ROXAS, 1226 MAKATI CITY 4 13000804 MITSUBISHI CORPORATION JAP A 63,077,540 10.1701% 63,077,540 14/F L.V. -

(Cpd) Council for Physicians List of Accredited Providers As of September 26, 2018

CONTINUING PROFESSIONAL DEVELOPMENT (CPD) COUNCIL FOR PHYSICIANS LIST OF ACCREDITED PROVIDERS AS OF SEPTEMBER 26, 2018 ACCREDITATION E-MAIL ADDRESS TELEPHONE NO. NO. NAME OF PROVIDER ADDRESS FAX NO. DATE OF EXPIRATION Philippine Medical Association PMA Bldg., North Avenue, Quezon [email protected] / 929-6366 1 2012-001 (PMA) City www.philippinemedicalassociation.org Fax: 929-6951 13-Feb-21 College of Medicine, University of 547 Pedro Gil St., Ermita, Manila, 2 2012-002 the Philippines Philippines, 1000 [email protected] 0918-905-0862 18-Apr-20 Rm. 2007 Medical Arts Bldg., UST 749-9707 Fax No. 740- 3 2012-003 Dementia Society of the Philippines Hospital, España, Manila www.dementia.org.ph 9725 14-Feb-15 [email protected] / Unit 25 Facilities Centre, #548 [email protected]/ (632) 531-1278/ 534- 4 2012-004 Diabetes Philippines Shaw Blvd., Mandaluyong City www.diabetesphil.org 9559 12-Jul-20 Unit 205 The Garden Heights [email protected] / Condominium 268 E. Rodriguez Sr. [email protected] / 584-2700 5 2012-005 Pain Society of the Philippines, Inc. Avenue, Quezon city www.painsociety.ph Cel: 0917-6213705 13-Mar-20 Unit 4 Metro Square Townehomes, 374-1855 Pediatric Infectious Disease No. 35 Scout Tuazon cor. Scout de [email protected]/ Fax No. 412-6998 6 2012-006 Society of the Philippines (PIDSP) Guia, Quezon City www.pidsphil.org Cel: 0917-834-9837 13-Feb-21 Room 403 PPS Building, #52 Perinatal Association of the Kalayaan Avenue, Brgy. Malaya, [email protected]/ 925-3538 7 2012-007 Philippines, Inc. Quezon City www.perinatphil.org.ph Cel: 0920-945-3513 13-Feb-21 516-2900 / 405-0140 Philippine Academy of Family [email protected] / Fax: 254-5646 8 2012-008 Physicians, Inc. -

Meralco Ave Pasig City Zip Codel

1 / 3 Meralco Ave Pasig City Zip Codel UNIONBANK OF THE PHILS 42F EXEC OFC UNIONBANK PLAZA BUILDING MERALCO AVE COR ONYX ST ORTIGAS CENTER PASIG CITY METRO MANILA .... Find 100 properties for your search pasig city zip code from Philippines's ... Pasig Condo for Sale in Urbano Velasco Ave., Pinagbuhatan, Pasig City.. Pinagbuhatan, City of Pasig, Metro Manila (Floor Area: 30.60 sqm) – For ... The Exchange Regency Condominium, Exchange Road corner Meralco Ave., Brgy.. Post Office Meralco Pasig City Metro Manila Philippines. ... Address: Meralco, Lopez Bldg., Ortigas Avenue, Pasig City Metro Manila ... Postal / Zip Code: 1600. Makati City, Pasig City. Malabon City, Pateros City. Mandaluyong City ... Location, Zip Code. 1st Avenue to 7th Avenue [West], 1405. Amparo Subdivision, 1425.. IDD : area code, +63 (0)02. Climate type · tropical monsoon climate · Native languages, Tagalog. Website, www.pasigcity.gov.ph. Pasig, officially the City of Pasig (Tagalog: Lungsod ng Pasig), is a 1st class highly urbanized ... Located in Meralco Avenue, it is where the offices of the Philippine Sports Commission, Philippine .... The postal code for Pasig City, specifically its capitol district, is 1603. A component of Metro Manila, Pasig City has several other districts with their. estancia mall. ground floor meralco ave pasig, zip code 1605. Phone: +63 2 656 6990. Monday Tuesday Wednesday Thursday Friday Saturday Sunday: 11:00 .... PASIG. BRANCH CODE, BRANCH NAME, ADDRESS. 020, Pasig Ortigas, G/F Benpress Bldg. Meralco Ave. cor., Exchange Road, Ortigas Center, ... 240, Pasig Mercedes, 463 B&D Bldg., Mercedes Avenue, Brgy San Miguel, Pasig City 1600.. ... Manila is centrally located in Ortigas Commercial Business District between Quezon City, Mandaluyong and Pasig City. -

URC Top 100 Stockholders and PDTC

BPI STOCK TRANSFER OFFICE UNIVERSAL ROBINA CORPORATION TOP 100 STOCKHOLDERS AS OF JUNE 30, 2012 RANK STOCKHOLDER NUMBER STOCKHOLDER NAME NATIONALITY CERTIFICATE CLASS OUTSTANDING SHARES PERCENTAGE TOTAL 1 10002999 JG SUMMIT HOLDINGS INC. FIL U 1,320,223,061 60.5189% 1,320,223,061 43/F ROBINSONS EQUITABLE TOWER ADB AVE.,COR.POVEDA ST. ORTIGAS CENTER, PASIG CITY 2 16011312 PCD NOMINEE CORPORATION (NON-FILIPINO) NOF U 498,136,847 22.8345% 498,136,847 G/F MAKATI STOCK EXCHANGE BLDG 6767 AYALA AVE., MAKATI CITY 3 16011313 PCD NOMINEE CORPORATION (FILIPINO) FIL U 350,133,639 16.0501% 350,133,639 G/F MSE BLDG. 6767 AYALA AVE., MAKATI CITY 4 07015995 ELIZABETH Y. GOKONGWEI AND/OR JOHN GOKONGWEI JR. FIL U 2,479,400 0.1136% 2,479,400 43/F ROBINSONS EQUITABLE TOWER ADB AVE. COR POVEDA ROAD PASIG CITY 5 12009862 LITTON MILLS, INC. FIL U 2,237,434 0.1025% 2,237,434 URC CORPORATE TOWER I ROBINSON GALLERIA ORTIGAS AVENUE, PASIG METRO MANILA 6 07015993 LISA YU GOKONGWEI AND/OR ELIZABETH GOKONGWEI FIL U 575,000 0.0263% 575,000 43/F ROBINSONS-EQUITABLE TOWER ADB AVE. COR POVEDA ST. ORTIGAS CENTER, PASIG CITY 6 16029927 ROBINA GOKONGWEI PE AND/OR ELIZABETH GOKONGWEI FIL U 575,000 0.0263% 575,000 43/F ROBINSONS-EQUITABLE TOWER ADB AVE. COR POVEDA ST. ORTIGAS CENTER, PASIG CITY 6 15006669 FAITH GOKONGWEI ONG AND/OR ELIZABETH GOKONGWEI FIL U 575,000 0.0263% 575,000 43/F ROBINSONS-EQUITABLE TOWER ADB AVE. COR POVEDA ST. ORTIGAS CENTER, PASIG CITY 6 19026738 MARCIA GOKONGWEI SY AND/OR ELIZABETH GOKONGWEI FIL U 575,000 0.0263% 575,000 43/F ROBINSONS-EQUITABLE TOWER ADB AVE., COR POVEDA ST. -

Doing Business in the PH Easier the Philippines Has Made It Easier for Foreign and Local Investors to Start a Business in the Country

61 BUSINESS Doing business in the PH easier The Philippines has made it easier for foreign and local investors to start a business in the country. This is according to the latest report of World Bank-International Finance Corporation (WB-IFC) entitled “Doing Business 2017: Equal Opportunity for All.” ased on the 2017 Doing Business report, the Philippines climbed 4 notches from 103rd in 2016 to 99th in 2017 with a 60.40 score among 190 countries worldwide. The increase was driven by changes such as the implementation Bof an online tax payment system. Since 2011, the Philippines has gained 49 spots in the Doing Business report. The WB-IFC report measures and tracks business regulations of 190 countries across 10 indicators namely: h Starting a Business; h Dealing with Construction Permits; h Getting Electricity; h Registering Property; h Getting Credit; h Protecting Minority Investors; h Paying Taxes; h Trading Across Borders; h Enforcing Contracts; and h Resolving Insolvency. Among the 10 indicators, the country performed well on of corporate transparency index, increasing the transparency of 4 indicators including Protecting Minority Investors, Dealing building regulations, and the introduction of an online system for with Construction Permits, Paying Taxes, and Enforcing filing and paying health contributions.“This is important for the Contracts. Minor drops were recorded in Getting Credit, down economy to ensure small and medium enterprises can flourish 9 (from 109 to 118), Starting a Business – down 6 (from 165 and create jobs for millions of Filipinos,” the World Bank added. to 171), Getting Electricity – down 3 (from 19 to 22), and But the Philippines still trails its other ASEAN neighbors, Resolving Insolvency – down 3 (from 53 to 56). -

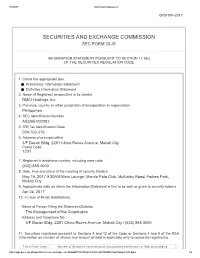

Securities and Exchange Commission Sec Form 20-Is

4/8/2017 Information Statement CR01997-2017 SECURITIES AND EXCHANGE COMMISSION SEC FORM 20-IS INFORMATION STATEMENT PURSUANT TO SECTION 17.1(b) OF THE SECURITIES REGULATION CODE 1. Check the appropriate box: Preliminary Information Statement Definitive Information Statement 2. Name of Registrant as specified in its charter DMCI Holdings, Inc. 3. Province, country or other jurisdiction of incorporation or organization Philippines 4. SEC Identification Number ASO95-002283 5. BIR Tax Identification Code 004-703-376 6. Address of principal office 3/F Dacon Bldg. 2281 Chino Roces Avenue, Makati City Postal Code 1231 7. Registrant's telephone number, including area code (632) 888 3000 8. Date, time and place of the meeting of security holders May 16, 2017 9:30AM Main Lounge, Manila Polo Club, McKinley Road, Forbes Park, Makati City 9. Approximate date on which the Information Statement is first to be sent or given to security holders Apr 24, 2017 10. In case of Proxy Solicitations: Name of Person Filing the Statement/Solicitor The Management of the Corporation Address and Telephone No. 3/F Dacon Bldg. 2281 Chino Roces Avenue, Makati City / (632) 888 3000 11. Securities registered pursuant to Sections 8 and 12 of the Code or Sections 4 and 8 of the RSA (information on number of shares and amount of debt is applicable only to corporate registrants): Title of Each Class Number of Shares of Common Stock Outstanding and Amount of Debt Outstanding http://edge.pse.com.ph/openDiscViewer.do?edge_no=3b56dbf7815c723a3318251c9257320d#sthash.NKqoh1JN.dpbs 1/2 4/8/2017 Information Statement Common 13,277,470,000 Preferred 3,780 13. -

October 5, 2012 the PHILIPPINE STOCK

October 5, 2012 THE PHILIPPINE STOCK EXCHANGE, INC. Philippine Stock Exchange Plaza Ayala Triangle, Ayala Avenue Makati City Attention: Ms. Janet A. Encarnacion Head – Disclosure Department Dear Ms. Encarnacion: In connection with PSE Disclosure Rules, please find attached list of Top 100 Stockholders of East West Banking Corporation (EW) as of September 30, 2012. Thank you. Very truly yours, Stock Transfer Service Inc. Page No. 1 EAST WEST BANKING CORPORATION List of Top 100 Stockholders As of 09/30/2012 Rank Sth. No. Name Citizenship Holdings Rank ------------------------------------------------------------------------------------------------------------------------ 1 0000000001 FILINVEST DEVELOPMENT CORPORATION Filipino 451,354,890 40.00% 2 0000000002 FILINVEST DEVELOPMENT CORPORATION FOREX Filipino 394,941,030 35.00% 3 0000000015 PCD NOMINEE CORPORATION (NON-FILIPINO) Foreign 211,125,300 18.71% 4 0000000014 PCD NOMINEE CORPORATION (FILIPINO Filipino 70,233,780 06.22% 5 0000000022 ALBERTO TIO ONG Filipino 405,000 00.04% 6 0000000030 ALFONSO S. TEH Filipino 250,000 00.02% 7 0000000034 DENNIS GRANADA BAGUYO Filipino 26,200 00.00% 8 0000000033 GERARDO S. LIMLINGAN,JR. Filipino 20,000 00.00% 9 0000000032 PONCIANO V. CRUZ, JR. Filipino 20,000 00.00% 10 0000000025 CHRISTIAN ESCUTERIO MENDEZ Filipino 11,400 00.00% 11 0000000023 PAUL A. AQUINO Filipino 10,000 00.00% 12 0000000019 ALFREDO O. BUNYE Filipino 5,500 00.00% 13 0000000031 CESAR E. CRUZ Filipino 2,300 00.00% 14 0000000027 JOSELITO L. BARRERA,JR. Filipino 1,300 00.00% 15 0000000035 RYAN S. CAZENAS Filipino 1,200 00.00% 16 0000000037 EDGARDO A. BAYANI &/OR WINKEL DEE B. BERNARDINO Filipino 500 00.00% 17 0000000026 STEPHEN G. -

(Cpd) Council for Physicians List of Accredited Providers As of January 31, 2018

CONTINUING PROFESSIONAL DEVELOPMENT (CPD) COUNCIL FOR PHYSICIANS LIST OF ACCREDITED PROVIDERS AS OF JANUARY 31, 2018 TELEPHONE NO. ACCRE. NO. NAME OF PROVIDER ADDRESS E-MAIL ADDRESS FAX NO. Philippine Medical PMA Bldg., North Avenue, 929-6366 1 2012-001 [email protected] / www.philippinemedicalassociation.org Association (PMA) Quezon City Fax: 929-6951 College of Medicine, 547 Pedro Gil St., Ermita, pgim- 2 2012-002 0918-905-0862 University of the Manila, Philippines, 1000 [email protected] Rm. 2007 Medical Arts Dementia Society of the 749-9707 Fax No. 3 2012-003 Bldg., UST Hospital, www.dementia.org.ph Philippines 740-9725 España, Manila diabetesphilippines@pldtdsl Unit 25 Facilities Centre, .net / (632) 531-1278/ 534- 4 2012-004 Diabetes Philippines #548 Shaw Blvd., [email protected]/ 9559 Mandaluyong City www.diabetesphil.org Unit 205 The Garden [email protected] / Pain Society of the Heights Condominium 268 584-2700 5 2012-005 [email protected] / Philippines, Inc. E. Rodriguez Sr. Avenue, Cel: 0917-6213705 www.painsociety.ph Quezon city Unit 4 Metro Square Pediatric Infectious 374-1855 Townehomes, No. 35 Scout 6 2012-006 Disease Society of the [email protected]/ www.pidsphil.orgFax No. 412-6998 Tuazon cor. Scout de Guia, Philippines (PIDSP) Cel: 0917-834-9837 Quezon City Room 403 PPS Building, Perinatal Association of the [email protected]/ 925-3538 7 2012-007 #52 Kalayaan Avenue, Brgy. Philippines, Inc. www.perinatphil.org.ph Cel: 0920-945-3513 Malaya, Quezon City 516-2900 / 405- Philippine Academy of 2244 Taft Avenue, Malate, [email protected] / 0140 8 2012-008 Family Physicians, Inc.