Community Investment Fund: a Study in Andhra Pradesh

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SR NO First Name Middle Name Last Name Address Pincode Folio

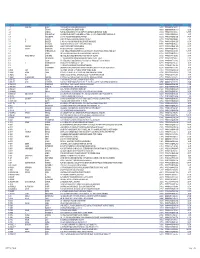

SR NO First Name Middle Name Last Name Address Pincode Folio Amount 1 A SPRAKASH REDDY 25 A D REGIMENT C/O 56 APO AMBALA CANTT 133001 0000IN30047642435822 22.50 2 A THYAGRAJ 19 JAYA CHEDANAGAR CHEMBUR MUMBAI 400089 0000000000VQA0017773 135.00 3 A SRINIVAS FLAT NO 305 BUILDING NO 30 VSNL STAFF QTRS OSHIWARA JOGESHWARI MUMBAI 400102 0000IN30047641828243 1,800.00 4 A PURUSHOTHAM C/O SREE KRISHNA MURTY & SON MEDICAL STORES 9 10 32 D S TEMPLE STREET WARANGAL AP 506002 0000IN30102220028476 90.00 5 A VASUNDHARA 29-19-70 II FLR DORNAKAL ROAD VIJAYAWADA 520002 0000000000VQA0034395 405.00 6 A H SRINIVAS H NO 2-220, NEAR S B H, MADHURANAGAR, KAKINADA, 533004 0000IN30226910944446 112.50 7 A R BASHEER D. NO. 10-24-1038 JUMMA MASJID ROAD, BUNDER MANGALORE 575001 0000000000VQA0032687 135.00 8 A NATARAJAN ANUGRAHA 9 SUBADRAL STREET TRIPLICANE CHENNAI 600005 0000000000VQA0042317 135.00 9 A GAYATHRI BHASKARAAN 48/B16 GIRIAPPA ROAD T NAGAR CHENNAI 600017 0000000000VQA0041978 135.00 10 A VATSALA BHASKARAN 48/B16 GIRIAPPA ROAD T NAGAR CHENNAI 600017 0000000000VQA0041977 135.00 11 A DHEENADAYALAN 14 AND 15 BALASUBRAMANI STREET GAJAVINAYAGA CITY, VENKATAPURAM CHENNAI, TAMILNADU 600053 0000IN30154914678295 1,350.00 12 A AYINAN NO 34 JEEVANANDAM STREET VINAYAKAPURAM AMBATTUR CHENNAI 600053 0000000000VQA0042517 135.00 13 A RAJASHANMUGA SUNDARAM NO 5 THELUNGU STREET ORATHANADU POST AND TK THANJAVUR 614625 0000IN30177414782892 180.00 14 A PALANICHAMY 1 / 28B ANNA COLONY KONAR CHATRAM MALLIYAMPATTU POST TRICHY 620102 0000IN30108022454737 112.50 15 A Vasanthi W/o G -

Fairs and Festivals, Part VII-B

PRG. 179.11' em 75-0--- . ANANTAPUR CENSUS OF INDIA 1961 VOLUME II ANDHRA PRADESH PART VII-B (10) FAIRS AND F ( 10. Anantapur District ) A. CHANDRA S:EKHAR OF THE INDIAN ADMINISTRATIVE SERVICE Sltl}erintendent of Cens'Us Ope'rations. Andhru Pradesh Price: Rs. 7.25 P. or 16 Sh. 11 d.. or $ 2.fil c, 1961 CENSUS PUBLICATIONS, ANDHRA PRADESH (All the Census Publications of this State will bear Vol. No. II) PART I-A General Report PART I-B Report on Vital Statistics PART I-C Subsidiary Tables PART II-A General Population Tables PARt II-B (i) Economic Tables [B-1 to B-1VJ PART II-B (ii) Economic Tables [B-V to B-IXJ PARt II-C Cultural and Migration Tables PART III Household Economic Tables PART IV-A Housing Report and Subsidiary Tables PART IV-B Housing and Establishment Tables PART V-A Special Tables for Scheduled Castes and Scheduled Tribes PART V-B Ethnographic Notes on Scheduled Castes and Scheduled Tribe5 PART VI Village Survey Monographs (46") PART VII-A (I)) Handicraft Survey Reports (Selected Crafts) PART VII-A (2) J PART VlI-B (1 to 20) Fairs and Festivals (Separate Book for each District) PART VIII-A Administration Report-Enumeration "'\ (Not for PART VIII-B Administration Report-Tabulation J Sale) PART IX State Atlas PART X Special Report on Hyderabad City District Census Handbooks (Separate Volume for each Dislricf) Plate I: . A ceiling painting of Veerabhadra in Lepakshi temple, Lepakshi, Hindupur Taluk FOREWORD Although since the beginning of history, foreign travellers and historians have recorded the principal marts and entrepots of commerce in India and have even mentioned impo~'tant festivals and fairs and articles of special excellence available in them, no systematic regional inventory was attempted until the time of Dr. -

Handbook of Statistics Ananthapuramu District 2016

HAND BOOK OF STATISTICS ANANTHAPURAMU DISTRICT 2016 Compiled and Published by CHIEF PLANNING OFFICER ANANTHAPURAMU DISTRICT OFFICERS AND STAFF ASSOCIATED WITH THE PUBLICATION Sri Ch. Vasudeva Rao : Chief Planning Officer Smt. P. SeshaSri : Dy.Director Sri J. Nagi Reddy : Asst. Director Sri S. Sreenivasulu : Statistical Officer Sri T.Ramadasulu : Dy.Statistical Officer, I/c C. Rama Shankaraiah : Data Entry Operator INDEX TABLE NO. CONTENTS PAGE NO. GENERAL A SALIENT FEATURES OF ANANTHAPURAMU DISTRICT B COMPARISON OF THE DISTRICT WITH THE STATE C ADMINISTRATIVE DIVISONS IN THE DISTRICT D PUBLIC REPRESENTATIVES/NON OFFICIALS E PROFILE OF ASSEMBLY / PARLIAMENTARY CONSTITUENCY 1 - POPULATION 1.1 VARIATION IN POPULATION OF - 1901 TO 2011 1.2 POPULATION STATISTICS SUMMERY-Census 2001- 2011 TOTAL NO.OF VILLAGES, HMLETS, HOUSEHOLDS, 1.3 AREA,POPULATION,DENSITY OF POPULATION AND SEX RATIO, MANDAL-WISE-Census 2011 RURAL AND URBAN POPULATION , MANDAL - WISE, 1.4 2011 CENSUS 1.5 POPULATION OF TOWNS AND CITIES - 2011 1.6 LITERACY, MANDAL - WISE, 2011 SCHEDULED CASTE POPULATION AND LITERACY RATE - CENSUS 1.7 2011 SCHEDULED TRIBES POPULATION AND LITERACY RATE - CENSUS 1.8 2011 DISTRIBUTION OF POPULATION BY WORKERS AND NON WORKERS - 1.9 MANDAL WISE 2011 CLASSIFICATION OF VILLAGES ACCORDING TO POPULATION SIZE, 1.10 MANDAL - WISE, 2011 HOUSELESS AND INSTITUTIONAL POPULATION, MANDAL-WISE- 1.11 CENSUS 2011 DISTRIBUTION OF PERSONS ACCORDING TO DIFFERENT AGE 1.12 GROUPS, 2011 CENSUS 1.13 RELEGION WISE MANDAL POPULATION - CENSUS 2011 2- MEDICAL AND PUBLIC HEALTH 2.1 GOVT.,MEDICAL FACILITIES FOR 2015-16 GOVERNMENT MEDICAL FACILITIES (ALLOPATHIC) MANDAL- 2.2 WISE(E.S.I.Particulars included), 2015-16 GOVT.,MEDICAL FACILITIES( INDIAN MEDICINE ), MANDAL-WISE - 2.3 2015-16 2.4 FAMILY WELFARE ACHIEVEMENTS DURING (2015-16) 3 - CLIMATE 3.1 MAXIMUM & MINIMUM TEMPERATURE (2015 & 2016) DISTRICT AVERAGE RAINFALL, SEASON-WISE AND MONTH WISE - 3.2 (2009-10 to 2015-16) 3.3 ANNUAL RAINFALL,STATION WISE, (2011-12 to 2015-16) TABLE NO. -

District Survey Report - 2018

District Survey Report - 2018 DEPARTMENT OF MINES AND GEOLOGY Government of Andhra Pradesh DISTRICT SURVEY REPORT - ANANTAPURAMU DISTRICT Prepared by ANDHRA PRADESH SPACE APPLICATIONS CENTRE (APSAC) ITE & C Department, Govt. of Andhra Pradesh 2018 DMG, GoAP 1 District Survey Report - 2018 ACKNOWLEDGEMENTS APSAC wishes to place on record its sincere thanks to Sri. B.Sreedhar IAS, Secretary to Government (Mines) and the Director, Department of Mines and Geology, Govt. of Andhra Pradesh for entrusting the work for preparation of District Survey Reports of Andhra Pradesh. The team gratefully acknowledge the help of the Commissioner, Horticulture Department, Govt. of Andhra Pradesh and the Director, Directorate of Economics and Statistics, Planning Department, Govt. of Andhra Pradesh for providing valuable statistical data and literature. The project team is also thankful to all the Joint Directors, Deputy Directors, Assistant Directors and the staff of Mines and Geology Department for their overall support and guidance during the execution of this work. Also sincere thanks are due to the scientific staff of APSAC who has generated all the thematic maps. VICE CHAIRMAN APSAC DMG, GoAP 2 District Survey Report - 2018 TABLE OF CONTENTS Contents Page Acknowledgements List of Figures List of Tables 1 Salient Features of the District 1 1.1 Historical Background 1 1.2 Topography 1 1.3 Places of Tourist Importance 2 1.4 Rainfall and Climate 6 1.5 Winds 12 1.6 Population 13 1.7 Transportation: 14 2 Land Utilization, Forest and Slope in the District -

Standard Template

STANDARD TEMPLATE STANDARD TEMPLATE FOR EVALUATION OF ALL PROJECTS/ ACTIVITIES Information to be furnished by the project S. No. Information required proponent Name of the project or activity Mining for M/s. K. Saddru Khan Granites 1. – Colour Granite Quarry 2. Name of the organization/owner Sri. K. Saddru Khan Address for communication Police Line Road, Near Govt. Urdu School, Millerpet, 3. Bellary - 583101, Karnataka 4. Telephone numbers 9686531599, 9980828562 5. Email id of the organization or contact person [email protected] Location of the proposed project or activity Sy. No. 266 Havaligi Village, 6. Vidapanakal Mandal, Anantapur District, Andhra Pradesh 7. Appraisal category (b2 or b1) Category ‘B’ (B2) Nearest habitation and distance from the project 8. Havaligi is the nearest village – 0.67 km (W) or activity 9. Installed capacity / production capacities 2112 Cu.m per Annum Specify the fuel (coal / CNG / biomass/others) Diesel based machinery will be used during quarry 10. and quantity required operations. 200 liters of diesel will be used per day Details of land use/land cover Present land use will be changed with commencement 11. of mining activities. Occupancy, ownership of the land in which the activity is proposed: 12. (government land / private land / forest land Government Land /revenue land /temple land /leased land/ land belongs to other department) If it is a forest land, the following details shall be furnished: (Whether it is a reserved forest / protected forest/demarcated forest/ national parks/ 13. sanctuaries/ any land in possession of forest Not applicable department.) (The village map with Sy. No. Indicating nearest forest boundary line from the site shall be enclosed) 14. -

Study and Collection of Hakku Patras and Other Documents Among Folk Communities in Andhra Pradesh

EAP201: Study and collection of Hakku Patras and other documents among folk communities in Andhra Pradesh Dr Thirmal Rao Repally, Potti Sreeramulu Telugu University 2008 award - Pilot project £10,261 for 12 months This survey gives an in-depth look at the function of Hakku Patras amongst the folk communities of Andhra Pradesh. It gives a brief account of the methodology of the survey and finally lists the artefacts that were discovered. Further Information You can contact the EAP team at [email protected] EAP-201 SURVEY REPORT On Hakku Patras among the Performing Communities of Andhra Pradesh The period of the Project 1 September 2008 to 31 August 2009 Submitted by Principal Investigator R. Thirmal Rao, Ph.D. Director, Andhra Pradesh Government Oriental Manuscripts Library and Research Institute, Behind O.U. Police Station, O.U. Campus, Hyderabad – 500 007. Andhra Pradesh. INDIA. Mobile : +91-9848794939 E-mail : [email protected] 1 C O N T E N T S Page No. 1. Introduction - 3 2. Location of Andhra Pradesh in India (Map) - 5 3. Andhra Pradesh (Map) - 6 4. Notes on Performing Communities - 7 1) General Folk Performances - 7 2) Particular Folk Performances - 8 3) Social Hierarchy of dependent or sub-caste - 9 5. What is Hakku Patras - 13 6. About the Project - 14 7. Details of Survey Methodology - 15 1) Field Work Plan - 17 2) Problems in Field Work - 17 3) Gathering information from other sources - 19 8. Condition of the Hakku Patras - 20 9. Photographing the Hakku Patras - 21 10. Copyright - 22 11. Number of families contacted - 24 12. -

Irrigation Profile of Kurnool District

10/31/2018 District Irrigation Profiles IRRIGATION PROFILE OF KURNOOL DISTRICT *Click here for Ayacut Map INTRODUCTION Kurnool district with a Population of 40.47 Lakhs lies between latitude 14°-54' North to 16°-11' and longitude 76°-56' East to 78°-25' East. 58.60% of Kurnool District lies in Krishna basin and 41.40% in Pennar Basin. This district is bounded by Tungabhadra and Krishna Rivers and Mahaboob Nagar District in North, Kadapa and Ananthapur Districts on South, Karnataka State on West and Prakasham District in the East. The main rivers flowing in the district are (1) Tungabhadra River which is a tributary to Krishna River (2) Hundri, a tributary to Tungabhadra (3) Kundu River is a major tributary to River Penna. Kurnool is city and the headquarters of Kurnool district in the Indian state of Andhra Pradesh. It is also known as the Gateway to Rayalaseema. Kurnool served as the state capital of Andhra (not Andhra Pradesh) from 1 October 1953 to 31 October 1956. As of 2011 census, it is the fifth most populous city, with a population of 424,920. Etymology: The name Kurnool is derived from "Kandanavolu", "the city known as Kandenapalli" or "the city of Kandena". Kandena is a Telugu word; it means grease. The city was also called the city of Skanda or Kumaraswamy (the chief God of Wars) History: Little was known about Kurnool Town before the 11th century. The earliest knowledge of this settlement dates from the 11th century. It has developed as transit place on the southern banks of the river Tungabhadra and was commonly known as 'Kandenavolu'. -

District Survey Report - 2018

District Survey Report - 2018 DEPARTMENT OF MINES AND GEOLOGY Government of Andhra Pradesh DISTRICT SURVEY REPORT - ANANTAPURAMU DISTRICT Prepared by ANDHRA PRADESH SPACE APPLICATIONS CENTRE (APSAC) ITE & C Department, Govt. of Andhra Pradesh 2018 DMG, GoAP 1 District Survey Report - 2018 ACKNOWLEDGEMENTS APSAC wishes to place on record its sincere thanks to Sri. B.Sreedhar IAS, Secretary to Government (Mines) and the Director, Department of Mines and Geology, Govt. of Andhra Pradesh for entrusting the work for preparation of District Survey Reports of Andhra Pradesh. The team gratefully acknowledge the help of the Commissioner, Horticulture Department, Govt. of Andhra Pradesh and the Director, Directorate of Economics and Statistics, Planning Department, Govt. of Andhra Pradesh for providing valuable statistical data and literature. The project team is also thankful to all the Joint Directors, Deputy Directors, Assistant Directors and the staff of Mines and Geology Department for their overall support and guidance during the execution of this work. Also sincere thanks are due to the scientific staff of APSAC who has generated all the thematic maps. VICE CHAIRMAN APSAC DMG, GoAP 2 District Survey Report - 2018 TABLE OF CONTENTS Contents Page Acknowledgements List of Figures List of Tables 1 Salient Features of the District 1 Historical Background 1 1.1 Topography 1 1.2 Places of Tourist Importance 2 1.3 Rainfall and Climate 6 1.4 Winds 12 1.5 Population 13 1.6 Transportation: 14 1.7 2 Land Utilization, Forest and Slope in the District -

Anantapur District Grade IV Panchayat Secretary Exam Result

Andhra Pradesh Public Service Commission - Vijayawada Group -III Notification No :29/2016 - Anantapur GENERAL STUDIES PH Age Ex- AND Paper II Commu Creamy Layer Date of Acquiring SNO HT No Reference Id OTPR ID Candidate Name Total Marks GRL Date Of Birth Gender Categor Relaxatio Serviceme Local District Qualification Mobile No Email Id Address For Communication MENTAL Marks nity Status Qualification y n Under n ABILITY PAPER 1 M AGRAHARAM VIL AND Degree from any [email protected] 1 291228995 5184093660 AP1000209162 B RAVI 104.0816 71.0714 175.1530 1 6111990 Male BC-A NonCreamyLayer - No ANANTHAPUR 14-Jul-11 9494007371 POST,TADIMARRI,ANANTAPUR,Tadimarri,ANANTHAPUR, University om 515631 Degree from any [email protected] 18/121,OLD GUNTAKAL,GUNTAKAL,Guntakal 2 291211920 5184133916 AP1000553363 GUNDALA VENKATESH 104.0816 69.6429 173.7245 2 15051989 Male BC-A NonCreamyLayer - No ANANTHAPUR 10-Aug-10 8143283913 University m (Urban),ANANTHAPUR,515803 Degree from any peeranna32@gmail 10-20A,BANDAMEEDAPALLI 3 291224076 5184030920 AP1000008782 P E ERANNA 95.2381 78.2143 173.4524 3 10011991 Male BC-B NonCreamyLayer - No ANANTHAPUR 23-Apr-11 9493761591 University .com VILLAGE,,Kundurpi,ANANTHAPUR,515766 bhargavikadiri@gm 6-2-442-2A,KOVUR 4 291225766 5184057049 AP1000184100 KORRAPATI BHARGAVI 92.1768 79.6428 171.8196 4 14051986 Female OC NOT APPLICABLE - No ANANTHAPUR BSCED 04-Jun-07 8197646789 ail.com NAGAR,,Anantapur,ANANTHAPUR,515001 KADIRI CHENNAMMAGARI Degree from any kcvikram66@gmail. DOOR NO 17 175 OLD CHURCH STREET ,KUTAGULLA 5 291222212 -

Wind Speed Model for Anantapur District, Western Andhra Pradesh, India

International Journal of Innovative Research in Advanced Engineering (IJIRAE) ISSN: 2349-2163 Volume 1 Issue 8 (September 2014) www.ijirae.com Wind Speed Model for Anantapur District, Western Andhra Pradesh, India Sandeep Chinta* Arun Agarwal C. Raghavendra Rao Centre for Earth and Space Sciences School of Computer and School of Computer and University of Hyderabad Information Sciences Information Sciences Hyderabad, India University of Hyderabad University of Hyderabad Abstract— The main objective of the present study is to analyse statistically the wind data obtained in western part of Andhra Pradesh State, India. The wind speed at heights of 10 m and 25 m above ground level were measured. In this study, exponential regression surface model were performed for estimation of wind speed and power over Anantapur District, Western Andhra Pradesh, India in spatially at different extrapolated elevations and to identify potential wind locations. This attempt was made by the Geostatistical method using in-situ data by the conventional methods for 30 stations. Spatial estimation of wind speed and power has been carried using Kriging method of exponential variogram at different extrapolated elevations up to 55m. It was observed that wind speed and power were increased with increase of altitude for all the stations exponentially. Using this Kriging analysis we identified new wind potential locations for different elevations for generating wind energy. Keywords— Spatial Interpolation; Wind Speed; Power; Western Andhra Pradesh I. INTRODUCTION Among various non-conventional energy sources wind energy offers the greatest realizable potential. Assessment of any site from the point of view of wind energy potential is an essential and primary exercise in any wind power generation program. -

District Census Handbook, Anantapur, Part XII-A & B, Series-2

CENSUS OF INDIA 1991 SERIES 2 ANDHRA PRADESH DISTRICT CENSUS HANDBOOK ANANTAPUR PART XII - A It B VILLAGE & TOWN DIRECTORY VILLAGE It TOWNWISE PRIMARY CENSUS ABSTRACT DIRECTORATE OF CENSUS OPERATIONS ANDHRA PRADESH PUBLISHED BY THE GOVERNMENT OF ANDHRA PRADESH 1998 FOREWORD Publication of the District Census Handbooks (DCHs) was initiated after the 1951 Census and is continuing since then with some innovations/modifications after each decennial Census. This is the most valuable district level publication brought out by the Census Organisation on behalf of each State Govt'; Union Territory administration. It Inter alia Provides data/information on some of the basic demographic and socio-economic characteristics and on the availability of certain important civic amenities/facilities in each village and town of the respective districts. This publication has thus proved to be of immense utility to the planners., administrators, academicians and researchers. The scope of the DCH was initially confined to certain important census tables on population, economic and socio-cultural aspects as also the Primary Census Abstract (PCA) of each village and town (ward wise) of the district. The DCHs published after the 1961 Census contained a descriptive account of the district, administrative statistics, census tables and Village and Town Directories including PCA. After the 1971 Census, two parts of the District Census Handbooks (Part-A comprising Village and Town Directories and Part-B comprising Village and Town PCA) were released in all the States and Union Territories. The third Part (C) of the District Census Handbooks comprising administrative statistics and district census tables, which was also to be brought out, could not be published in many States/UTs due to considerable delay in compilation of relevant material.