Annual Report and Financial Statements 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Alliance Trust Portfolio

Alliance Trust Portfolio University of St Andrews Month Ending 31/07/2013 No Of Equity Description Shares ALEXION PHARMACEUTICALS INC 10,900 AMAZON.COM 4,500 AMER INTERNATIONAL GROUP 21,514 AMGEN INC 9,600 ANGIE'S LIST 22,900 ANHEUSER-BUSCH INBEV 6,876 ARM HOLDINGS PLC 77,323 BANCA GENERALI SPA 35,206 BANGKOK BANK 122,600 BG GROUP 45,404 BORG WARNER INC 11,300 BROOKDALE SENIOR LIVING 24,370 CHECK POINT SOFTWARE TECHNOLOGIES LTD 17,200 CITIGROUP INC 20,650 CLEAN HARBORS INC 18,200 COMPUTERSHARE LTD 87,337 CONTINENTAL AG 4,935 CSL LTD 11,335 DENTSU INC 42,100 DNB ASA 50,402 ECOLAB INC 16,206 EMC CORP 49,000 ENN ENERGY HOLDINGS LTD 138,000 EQUINIX INC 5,300 ESSILOR INTERNATIONAL 7,186 FAST RETAILING CO LTD 2,100 GOOGLE INC CL'A' 1,600 KENMARE RESOURCES PLC 1,071,478 MACY'S 20,061 MILLICOM 8,604 MITSUI FUDOSAN CO LTD 26,979 NOVATEK 4,660 NOVO NORDISK A/S 6,724 OIL SEARCH LTD 175,993 OMNICOM GROUP INC 12,200 PNC FINANCIAL SERVICES INC 12,786 PRAXAIR INC 13,287 PRUDENTIAL PLC 41,841 RENEWABLES INFRASTRUCTURE GROUP LTD 357,100 ROCHE HOLDING AG 5,037 ROCKWELL AUTOMATION INC 10,100 ROPER TECHNOLOGIES INC 10,700 SPX CORPORATION 7,200 STARWOOD HOTELS & RESORTS WORLDWIDE 14,100 TERADATA 11,800 TRACTOR SUPPLY COMPANY 6,944 TRIMBLE NAVIGATION 21,000 UNILEVER PLC 25,446 VARIAN MEDICAL SYSTEMS 14,094 VISA INC 5,800 W. W. GRAINGER INC 4,643 WATERS CORP 11,300 Buckley Muething Portfolio University of St Andrews Month Ending 31/07/2013 No Of Fund Description Shares Value Bonds ALPHA NATURAL RESOURCES INC 100,000 ARCH COAL INC 100,000 BEAZER HOMES USA INC -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Capital Analytics UK Registrars Benchmarking Survey 2009

Capital Analytics UK Registrars Benchmarking Survey 2009 CAPITAL ANALYTICS UK REGISTRARS BENCHMARKING SURVEY 2009 September 2009 © Copyright, 2009 Capital Analytics Limited. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means without permission from Capital Analytics Limited. No advertising or other promotional use can be made of the information in this report without the express prior written consent of Capital Analytics Limited. Capital Analytics UK Registrars Benchmarking Survey 2009 CONTENTS SURVEY PURPOSE AND METHODOLOGY ................................................................................... 4 Purpose ................................................................................................................................................ 4 Methodology ........................................................................................................................................ 4 COMPANY SATISFACTION INDEX 2009 ........................................................................................ 6 INDUSTRY ANNUAL OVERALL COMPARISON 2005 - 2009 ...................................................... 7 OVERALL SATISFACTION WITH SERVICES .............................................................................. 8 Comments on Overall Satisfaction with Services ................................................................................ 8 Overall Satisfaction with Registrar .................................................................................................. -

Finn-Ancial Times Finncap Financials & Insurance Quarterly Sector Note

finn-ancial Times finnCap Financials & Insurance quarterly sector note Q3 2020 | Issue 9 Highlights this quarter: Elevated uncertainty and volatility have been hallmarks of the last 18 months, with Brexit, the UK General Election and more recently COVID-19 all contributing to the challenges that face investors wishing to carve out solid and stable returns amid these ‘unprecedented’ times. With this is mind, and simulating finnCap’s proven Slide Rule methodology, we found the highest quality and lowest value stocks across the financials space, assessing how the make-up of these lists changed over the period January 2019 to July 2020, tracking indexed share price performance over the period as well as movements in P/E and EV/EBIT valuations. The top quartile list of Quality companies outperformed both the Value list and the FTSE All Share by rising +2.5% over the period versus -5.4% for the All Share and -14.3% for Value stocks. Furthermore, the Quality list had protection on the downside in the market crash between February and March 2020, and accelerated faster amid the market rally between late March and July 2020. From high to low (January to March), Quality moved -36.3% against the Value list at -45.5%, while a move off the lows to July was +37.4% for Quality and +34.0% for Value. There was some crossover between the Quality and Value lists, with 7 companies of the top quartile (16 companies in total) appearing in both the Quality and Value lists. This meant that a) investors could capture what we call ‘Quality at Value’ (i.e. -

FTSE Factsheet

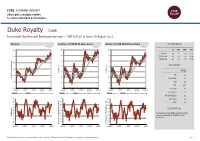

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Duke Royalty DUKE Investment Banking and Brokerage Services — GBP 0.4125 at close 10 August 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 10-Aug-2021 10-Aug-2021 10-Aug-2021 0.45 140 140 1D WTD MTD YTD Absolute -2.4 -1.2 -1.8 35.2 130 130 0.4 Rel.Sector -2.4 -0.5 -3.6 25.9 Rel.Market -2.8 -1.7 -3.7 20.9 120 120 0.35 VALUATION 110 110 0.3 Trailing 100 100 Relative Price Relative Price Relative 0.25 PE -ve Absolute Price (local (local currency) AbsolutePrice 90 90 EV/EBITDA -ve 0.2 80 80 PB 2.0 PCF 28.1 0.15 70 70 Div Yield 4.6 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Aug-2020 Nov-2020 Feb-2021 May-2021 Aug-2021 Price/Sales -ve Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.2 90 90 90 Div Payout -ve 80 80 80 ROE -ve 70 70 70 Share Index) Share Share Sector) Share - 60 - 60 60 DESCRIPTION 50 50 50 40 40 The Company is a globally focused investment 40 RSI RSI (Absolute) 30 30 company specialising in diversified royalty investment. -

Morningstar Report

Report as of 25 Sep 2021 Aberdeen Standard Equity Inc Trust plc , (GB0006039597) Morningstar Rating™ Peer Group Classification Last Close Last Actual NAV (23 Sep 2021) Discount Estimated Nav QQ Morningstar IT UK Equity 345.00 379.95 -9.20 379.95 Income Investment Objective Performance The fund aims to provide shareholders with an above 169 average income while also providing real growth in 146 capital and income. It will invest in a diversified 123 portfolio consisting mainly of quoted UK equities 100 which will normally comprise between 50 and 70 77 individual equity holdings. 54 2016 2017 2018 2019 2020 2021-08 -10.88 23.83 -12.55 9.46 -19.70 19.51 Fund 16.75 13.10 -9.47 19.17 -9.82 14.66 Benchmark 8.76 10.73 -10.56 18.95 -12.56 15.52 Category Management Fee Summary Management fee of 0.65% p.a. of NA on the first GBP 175m and 0.55% thereafter. No performance fee. Contract terminable on notice period of 6 months. Portfolio 31/08/2021 Asset Allocation % Long Short Net Equity Style Box™ Mkt Cap % Fund America Europe Asia Large Size Stocks 113.11 0.00 113.11 Giant 17.55 Bonds 0.00 0.00 0.00 Mid Large 18.27 Cash 0.00 13.11 -13.11 Medium 22.91 Other 0.00 0.00 0.00 Small Small 24.92 Value Blend Growth Micro 16.35 Style Average Mkt Fund Cap (Mil) Ave Mkt Cap GBP 4,115.7 <25 25-50 50-75 >75 7 Top Holdings Stock Sector Weightings % Fund World Regions % Fund Name Sector % hCyclical 66.41 Americas 2.36 BHP Group PLC r 4.54 rBasic Materials 13.25 United States 2.36 Rio Tinto PLC r 4.30 tConsumer Cyclical 14.81 Canada 0.00 CMC Markets PLC y 3.99 -

Fintech Monthly Market Update | July 2021

Fintech Monthly Market Update JULY 2021 EDITION Leading Independent Advisory Firm Houlihan Lokey is the trusted advisor to more top decision-makers than any other independent global investment bank. Corporate Finance Financial Restructuring Financial and Valuation Advisory 2020 M&A Advisory Rankings 2020 Global Distressed Debt & Bankruptcy 2001 to 2020 Global M&A Fairness All U.S. Transactions Restructuring Rankings Advisory Rankings Advisor Deals Advisor Deals Advisor Deals 1,500+ 1 Houlihan Lokey 210 1 Houlihan Lokey 106 1 Houlihan Lokey 956 2 JP Morgan 876 Employees 2 Goldman Sachs & Co 172 2 PJT Partners Inc 63 3 JP Morgan 132 3 Lazard 50 3 Duff & Phelps 802 4 Evercore Partners 126 4 Rothschild & Co 46 4 Morgan Stanley 599 23 5 Morgan Stanley 123 5 Moelis & Co 39 5 BofA Securities Inc 542 Refinitiv (formerly known as Thomson Reuters). Announced Locations Source: Refinitiv (formerly known as Thomson Reuters) Source: Refinitiv (formerly known as Thomson Reuters) or completed transactions. No. 1 U.S. M&A Advisor No. 1 Global Restructuring Advisor No. 1 Global M&A Fairness Opinion Advisor Over the Past 20 Years ~25% Top 5 Global M&A Advisor 1,400+ Transactions Completed Valued Employee-Owned at More Than $3.0 Trillion Collectively 1,000+ Annual Valuation Engagements Leading Capital Markets Advisor >$6 Billion Market Cap North America Europe and Middle East Asia-Pacific Atlanta Miami Amsterdam Madrid Beijing Sydney >$1 Billion Boston Minneapolis Dubai Milan Hong Kong Tokyo Annual Revenue Chicago New York Frankfurt Paris Singapore Dallas -

Weekend News Summary

Weekend News Summary THE SUNDAY TIMES INDICES THIS MORNING Current (%) 1W% Change Sirius seeks light at end of the tunnel: Work continued at Sirius Value Change* Minerals’ Woodsmith mine in North Yorkshire, even as shares in the FTSE 100 7,415.0 -0.2% 1.1% company fell to new lows amid fears over its future. The company so DAX 30 12,383.8 0.02% -0.7% far has completed just over a mile of a planned 23-mile tunnel to take CAC 40 5,647.2 0.1% -0.9% polyhalite deposits from its site near Whitby to Teesside for export as DJIA** 26,820.3 - -0.4% fertiliser. S&P 500** 2,961.8 - -1.0% Clipper Logistics delivers warning with higher profit: A logistics NASDAQ Comp.** 7,939.6 - -2.2% company that processes online orders for retailers including John Nikkei 225 21,755.8 -0.6% -0.9% Lewis and Boohoo.com has posted a strong increase in annual Hang Seng 40 26,092.3 0.5% -1.8% earnings but warned of potential trading turbulence in the year Shanghai Comp 2,905.2 -0.9% -2.5% ahead. Kospi 2,063.1 0.6% -2.0% Fosun ‘discussing bid’ for Thomas Cook brand name: The Chinese BSE Sensex 38,642.5 -0.5% 2.1% company that was working on a rescue deal for Thomas Cook before S&P/ASX 200 6,688.3 -0.4% -0.2% it collapsed is interested in buying the brand name of the 178-year- Current Values as at 10:15 BST, *%Chg from Friday Close, ** As on Friday Close old tour operator. -

Annual Report 2020 Annual Report for the Year Ended 31 December 2020 Annual Report and Financial Accounts 2020

Annual Report 2020 Annual Report for the year ended 31 December 2020 Annual Report and Financial Accounts 2020 Investing for Generations Catering for every generation, Alliance Trust aims to grow your capital over time and provide rising income by investing in global equities. ALLIANCE TRUST. EXPERT MANAGER SELECTION ADAPTING TO CHANGE. Shareholders benefit from having Willis Towers Watson Alliance Trust has both a modern vision and a rich heritage. (WTW) as our Investment Manager.4 WTW is a leading Established in 1888, we have successfully navigated many global investment group, directly managing $153 billion5 for market crises and adapted our strategy over time. Today, institutional investors and advising them on $3.4 trillion.6 we offer a responsibly managed portfolio, which provides Its scale helps us to keep costs down for investors, while the individual UK investors with exclusive access to the top global breadth and depth of WTW’s resources has enabled stock selections of some of the world’s best1 investment it to build and manage a diverse team of best-in-class1 managers; at a competitive cost. Stock Pickers with complementary investment approaches for Alliance Trust (see pages 20 and 21). Risk-controlled Our multi-manager approach reduces risk and volatility, Focused Stock Picking smoothing out the peaks and troughs of performance WTW tasks each Stock Picker with investing in no more than normally associated with a single manager. 20 stocks in which they have the highest level of conviction.7 The resulting portfolio is diversified across countries and Designed to perform industries but its individual holdings are very different from High conviction stock picking gives the portfolio potential any index-tracking fund. -

ASLIT Investor Update Presentation

Aberforth Partners LLP Presentation to ASLIT Investors May 2021 14 Melville Street ‐ Edinburgh EH3 7NS Tel 0131 220 0733 ‐ Fax 0131 220 0735 [email protected] ‐ www.aberforth.co.uk Aberforth Partners LLP is authorised and regulated by the Financial Conduct Authority Aberforth Unit Trust Managers Limited is authorised and regulated by the Financial Conduct Authority Aberforth Partners update . Over 30 years of value investing ─ We remain committed to the self‐imposed ceiling on the business ─ AUM capped at c.1.5% of the NSCI (XIC)’s market cap ─ Unchanged ownership structure, collegiate approach, investment focus . A consistent process as the partnership continues its natural evolution ─ Sonya Kim joined as an investment manager on 1 March 2021 ─ The investment managers’ biographies are included in the appendix . Alignment of interests through the managers’ significant holdings . UK Stewardship Code 2020 – updated report available on our website Aberforth Partners LLP 1 Performance – periods to 30 April CAGR 16 months to Total Return %YTD1 YearApril 2021 *Launch **Inception FTSE All‐Share 9.7 25.9 ‐1.1 3.6 3.6 FTSE 250 (XIC) 12.2 41.2 2.7 5.8 5.8 FTSE SmallCap (XIC) 23.4 69.5 25.5 8.2 8.2 NSCI (XIC) 16.9 55.9 11.9 6.9 6.9 ASLIT Total Assets 22.8 55.1 ‐1.9 3.2 2.4 ASLIT ORD NAV 31.5 83.3 ‐2.8 3.4 2.5 ASLIT ORD share price 22.0 85.8 ‐5.4 ‐0.5 ‐ ASLIT ZDP share price 3.2 5.2 2.8 2.9 ‐ *Excludes the effects of launch costs **Inception date for ASLIT was 30/06/2017 . -

Fully Focussed Global Equity Investment Trust

Alliance Trust PLC Results for six months ended 30 June 2019 Fully focussed global equity investment trust Financial highlights As at / 6 months As at / 12 months As at / 6 months to to 30 June 2019 to 31 Dec 2018 30 June 2018 Share price 796.0p 688.0p 748.0p NAV per share 836.8p 723.6p 793.2p Total shareholder return 16.8% -6.1% 1.1% Total dividend 6.980p 13.55p 6.778p Encouraging performance in H1 2019 • Total Shareholder Return (TSR) of 16.8%, Net Asset Value (NAV) Total Return of 16.7% and Equity Portfolio Total Return of 16.3%* compared with the MSCI ACWI Total Return of 16.7% • Since Willis Towers Watson's (WTW) appointment as investment manager in April 2017, TSR has been 21.1%, NAV Total Return 20.5% and the Equity Portfolio Total Return 22.2%* compared to the MSCI ACWI’s 21.5% and 18.6% for the peer group median** over the same period • Interim dividend of 3.490p, an increase of 3% year on year and over 50 years of successive dividend growth • Discount to NAV averaged 5.1% over the period (H1 2018: 5.8%) • Investment portfolio now comprises 99.5% global equities following completion of the sale of Alliance Trust Savings *before fees ** Morningstar universe of 306 UK retail global equity funds (open-ended and closed-ended) Lord Smith of Kelvin, Chairman of Alliance Trust PLC, commented: “I am pleased to report an encouraging period of strong absolute returns to shareholders. Global equity markets rebounded strongly in the first half and we delivered a Total Shareholder Return of 16.8% against the 16.7% return of our benchmark index. -

Execu on Counterpar

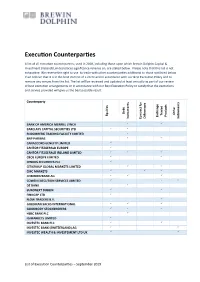

Execu�on Counterpar�es A list of all execu�on counterpar�es, used in 2018, including those upon which Brewin Dolphin Capital & Investment (Ireland) Limited places significance reliance on, are stated below. Please note that this list is not exhaus�ve. We reserve the right to use to trade with other counterpar�es addi�onal to those not listed below if we believe that it is in the best interest of a client and in accordance with our Best Execu�on Policy and to remove any venues from the list. The list will be reviewed and updated at least annually as part of our review of best execu�on arrangements or in accordance with our Best Execu�on Policy to sa�sfy that the execu�ons and service provided will give us the best possible result. r s Counterparty s s t t o e s e f n n s t c g d r e e e t c t n n e e c � b e a i d h a e r du t r h a e t o rum r rum D c qu O r t t n T x ff E s s i P E o n n D C I I BANK OF AMERICA MERRILL LYNCH BARCLAYS CAPITAL SECURITIES LTD BLOOMBERG TRADING FACILITY LIMITED BNP PARIBAS CANACCORD GENUITY LIMITED CANTOR FITZGERALD EUROPE CANTOR FITZGERALD IRELAND LIMITED CBOE EUROPE LIMITED CENKOS SECURITIES PLC CITIGROUP GLOBAL MARKETS LIMITED CMC MARKETS COMMERZBANK AG COWEN EXECUTION SERVICES LIMITED DZ BANK EURONEXT DUBLIN FINNCAP LTD FLOW TRADERS B.V.