United States Securities and Exchange Commission Washington, D.C

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

VAB Member Stations

2018 VAB Member Stations Call Letters Company City WABN-AM Appalachian Radio Group Bristol WACL-FM IHeart Media Inc. Harrisonburg WAEZ-FM Bristol Broadcasting Company Inc. Bristol WAFX-FM Saga Communications Chesapeake WAHU-TV Charlottesville Newsplex (Gray Television) Charlottesville WAKG-FM Piedmont Broadcasting Corporation Danville WAVA-FM Salem Communications Arlington WAVY-TV LIN Television Portsmouth WAXM-FM Valley Broadcasting & Communications Inc. Norton WAZR-FM IHeart Media Inc. Harrisonburg WBBC-FM Denbar Communications Inc. Blackstone WBNN-FM WKGM, Inc. Dillwyn WBOP-FM VOX Communications Group LLC Harrisonburg WBRA-TV Blue Ridge PBS Roanoke WBRG-AM/FM Tri-County Broadcasting Inc. Lynchburg WBRW-FM Cumulus Media Inc. Radford WBTJ-FM iHeart Media Richmond WBTK-AM Mount Rich Media, LLC Henrico WBTM-AM Piedmont Broadcasting Corporation Danville WCAV-TV Charlottesville Newsplex (Gray Television) Charlottesville WCDX-FM Urban 1 Inc. Richmond WCHV-AM Monticello Media Charlottesville WCNR-FM Charlottesville Radio Group (Saga Comm.) Charlottesville WCVA-AM Piedmont Communications Orange WCVE-FM Commonwealth Public Broadcasting Corp. Richmond WCVE-TV Commonwealth Public Broadcasting Corp. Richmond WCVW-TV Commonwealth Public Broadcasting Corp. Richmond WCYB-TV / CW4 Appalachian Broadcasting Corporation Bristol WCYK-FM Monticello Media Charlottesville WDBJ-TV WDBJ Television Inc. Roanoke WDIC-AM/FM Dickenson Country Broadcasting Corp. Clintwood WEHC-FM Emory & Henry College Emory WEMC-FM WMRA-FM Harrisonburg WEMT-TV Appalachian Broadcasting Corporation Bristol WEQP-FM Equip FM Lynchburg WESR-AM/FM Eastern Shore Radio Inc. Onley 1 WFAX-AM Newcomb Broadcasting Corporation Falls Church WFIR-AM Wheeler Broadcasting Roanoke WFLO-AM/FM Colonial Broadcasting Company Inc. Farmville WFLS-FM Alpha Media Fredericksburg WFNR-AM/FM Cumulus Media Inc. -

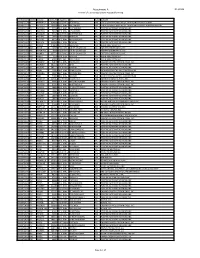

Attachment a DA 19-526 Renewal of License Applications Accepted for Filing

Attachment A DA 19-526 Renewal of License Applications Accepted for Filing File Number Service Callsign Facility ID Frequency City State Licensee 0000072254 FL WMVK-LP 124828 107.3 MHz PERRYVILLE MD STATE OF MARYLAND, MDOT, MARYLAND TRANSIT ADMN. 0000072255 FL WTTZ-LP 193908 93.5 MHz BALTIMORE MD STATE OF MARYLAND, MDOT, MARYLAND TRANSIT ADMINISTRATION 0000072258 FX W253BH 53096 98.5 MHz BLACKSBURG VA POSITIVE ALTERNATIVE RADIO, INC. 0000072259 FX W247CQ 79178 97.3 MHz LYNCHBURG VA POSITIVE ALTERNATIVE RADIO, INC. 0000072260 FX W264CM 93126 100.7 MHz MARTINSVILLE VA POSITIVE ALTERNATIVE RADIO, INC. 0000072261 FX W279AC 70360 103.7 MHz ROANOKE VA POSITIVE ALTERNATIVE RADIO, INC. 0000072262 FX W243BT 86730 96.5 MHz WAYNESBORO VA POSITIVE ALTERNATIVE RADIO, INC. 0000072263 FX W241AL 142568 96.1 MHz MARION VA POSITIVE ALTERNATIVE RADIO, INC. 0000072265 FM WVRW 170948 107.7 MHz GLENVILLE WV DELLA JANE WOOFTER 0000072267 AM WESR 18385 1330 kHz ONLEY-ONANCOCK VA EASTERN SHORE RADIO, INC. 0000072268 FM WESR-FM 18386 103.3 MHz ONLEY-ONANCOCK VA EASTERN SHORE RADIO, INC. 0000072270 FX W289CE 157774 105.7 MHz ONLEY-ONANCOCK VA EASTERN SHORE RADIO, INC. 0000072271 FM WOTR 1103 96.3 MHz WESTON WV DELLA JANE WOOFTER 0000072274 AM WHAW 63489 980 kHz LOST CREEK WV DELLA JANE WOOFTER 0000072285 FX W206AY 91849 89.1 MHz FRUITLAND MD CALVARY CHAPEL OF TWIN FALLS, INC. 0000072287 FX W284BB 141155 104.7 MHz WISE VA POSITIVE ALTERNATIVE RADIO, INC. 0000072288 FX W295AI 142575 106.9 MHz MARION VA POSITIVE ALTERNATIVE RADIO, INC. 0000072293 FM WXAF 39869 90.9 MHz CHARLESTON WV SHOFAR BROADCASTING CORPORATION 0000072294 FX W204BH 92374 88.7 MHz BOONES MILL VA CALVARY CHAPEL OF TWIN FALLS, INC. -

View Annual Report

BLOCK PROGRAMMING NEWS TALK STATIONS SALEM WEB NETWORK BOARD OF DIRECTORS TRANSFER AGENT AND REGISTRAR PROVIDES STABLE AND ACHIEVE 15% INCREASE MONTHLY PAGE VIEWS Stuart W. Epperson Information concerning the transfer or exchange of CONSISTENT GROWTH IN REVENUE DOUBLE TO 95 MILLION Chairman of the Board stock, lost certificates, change of address and other share transfer matters should be directed to Salem Edward G. Atsinger III Communications’ transfer agent at: President and Chief Executive Officer THE BANK OF NEW YORK David Davenport Shareholder Relations Department Distinguished Professor P.O. Box 11002 of Public Policy and Law Church Street Station ������� ������������� Pepperdine University New York, NY 10286 (800) 524-4458 Eric H. Halvorson Executive in Residence Email: [email protected] Pepperdine University http://www.stockbny.com �������������� Roland S. Hinz Publisher / Editor-in-Chief Hi-Torque Publishing SHAREHOLDER CONTACT AND FINANCIAL INFORMATION Judge Paul Pressler A copy of Salem Communications’ Annual Report on ��������� Partner Form 10-K, filed with the Securities and Exchange Woodfill & Pressler, LLP Commission, is available without charge upon written request to: Richard A. Riddle Consultant / Independent Businessman Investor Relations Salem Communications Corporation Dennis M. Weinberg 4880 Santa Rosa Road Retired WellPoint Camarillo, CA 93012 Executive Vice President (805) 987-0400 and Co-Founder ANNUAL MEETING RADIO | INTERNET | PRINT CORPORATE EXECUTIVE OFFICERS Salem Communications’ Annual Meeting of Stuart W. Epperson Shareholders will be held June 6, 2007 Salem Communications is a leading radio broadcaster, Chairman of the Board at 9:30 am at the: Internet content provider and magazine publisher Edward G. Atsinger III Westlake Village Inn serving the growing audience interested in President and Chief Executive Officer 31943 Agoura Road Westlake Village, CA 91361 Christian and family themed content Joe D. -

530 CIAO BRAMPTON on ETHNIC AM 530 N43 35 20 W079 52 54 09-Feb

frequency callsign city format identification slogan latitude longitude last change in listing kHz d m s d m s (yy-mmm) 530 CIAO BRAMPTON ON ETHNIC AM 530 N43 35 20 W079 52 54 09-Feb 540 CBKO COAL HARBOUR BC VARIETY CBC RADIO ONE N50 36 4 W127 34 23 09-May 540 CBXQ # UCLUELET BC VARIETY CBC RADIO ONE N48 56 44 W125 33 7 16-Oct 540 CBYW WELLS BC VARIETY CBC RADIO ONE N53 6 25 W121 32 46 09-May 540 CBT GRAND FALLS NL VARIETY CBC RADIO ONE N48 57 3 W055 37 34 00-Jul 540 CBMM # SENNETERRE QC VARIETY CBC RADIO ONE N48 22 42 W077 13 28 18-Feb 540 CBK REGINA SK VARIETY CBC RADIO ONE N51 40 48 W105 26 49 00-Jul 540 WASG DAPHNE AL BLK GSPL/RELIGION N30 44 44 W088 5 40 17-Sep 540 KRXA CARMEL VALLEY CA SPANISH RELIGION EL SEMBRADOR RADIO N36 39 36 W121 32 29 14-Aug 540 KVIP REDDING CA RELIGION SRN VERY INSPIRING N40 37 25 W122 16 49 09-Dec 540 WFLF PINE HILLS FL TALK FOX NEWSRADIO 93.1 N28 22 52 W081 47 31 18-Oct 540 WDAK COLUMBUS GA NEWS/TALK FOX NEWSRADIO 540 N32 25 58 W084 57 2 13-Dec 540 KWMT FORT DODGE IA C&W FOX TRUE COUNTRY N42 29 45 W094 12 27 13-Dec 540 KMLB MONROE LA NEWS/TALK/SPORTS ABC NEWSTALK 105.7&540 N32 32 36 W092 10 45 19-Jan 540 WGOP POCOMOKE CITY MD EZL/OLDIES N38 3 11 W075 34 11 18-Oct 540 WXYG SAUK RAPIDS MN CLASSIC ROCK THE GOAT N45 36 18 W094 8 21 17-May 540 KNMX LAS VEGAS NM SPANISH VARIETY NBC K NEW MEXICO N35 34 25 W105 10 17 13-Nov 540 WBWD ISLIP NY SOUTH ASIAN BOLLY 540 N40 45 4 W073 12 52 18-Dec 540 WRGC SYLVA NC VARIETY NBC THE RIVER N35 23 35 W083 11 38 18-Jun 540 WETC # WENDELL-ZEBULON NC RELIGION EWTN DEVINE MERCY R. -

0915 2015 VA Radio Stations.Xlsx

Radio Stations in the Commonwealth of Virginia (sorted by District) District Outlet Email Outlet Topic Media Type Address Line 1 Address Line 2 City State Postal Code 1 WESR-FM [email protected] Music; News; Pop Music; Oldies Radio Station 22479 Front St Accomac Virginia 23301-1641 1 WESR-AM [email protected] Music; News; Pop Music; Rock Music Radio Station 22479 Front St Accomac Virginia 23301-1641 1 WESR-FM [email protected] Music; News; Pop Music; Oldies Radio Station 22479 Front St Accomac Virginia 23301-1641 1 WESR-AM [email protected] Music; News; Pop Music; Rock Music Radio Station 22479 Front St Accomac Virginia 23301-1641 1 WCTG-FM [email protected] Music; News Radio Station 6455 Maddox Blvd Ste 3 Chincoteague Virginia 23336-2272 1 WCTG-FM [email protected] Music; News Radio Station 6455 Maddox Blvd Ste 3 Chincoteague Virginia 23336-2272 1 WCTG-FM [email protected] Music; News Radio Station 6455 Maddox Blvd Ste 3 Chincoteague Virginia 23336-2272 1 WVES-FM [email protected] Country, Folk, Bluegrass; Music; News Radio Station 27214 Mutton Hunk Rd Parksley Virginia 23421-3238 2 WFOS-FM [email protected] Music; News Radio Station 1617 Cedar Rd Chesapeake Virginia 23322 2 WNOR-FM [email protected] Music; News; Rock Music Radio Station 870 Greenbrier Cir Ste 399 Chesapeake Virginia 23320-2671 2 WNOR-FM [email protected] Music; News; Rock Music Radio Station 870 Greenbrier Cir Ste 399 Chesapeake Virginia 23320-2671 2 WJOI-AM [email protected] Music; News; Oldies Radio Station 870 Greenbrier Cir Ste 399 Chesapeake Virginia 23320-2671 -

FM-1949-07.Pdf

MM partl DIRECTORY BY OPL, SYSTEMS COUNTY U POLICE 1S1pP,TE FIRE FORESTRYOpSp `p` O COMPANIES TO REVISED LISTINGS 1, 1949 4/ka feeZ means IessJnterference ... AT HEADQUARTERS THE NEW RCA STATION RECEIVER Type CR -9A (152 -174 Mc) ON THE ROAD THE NEW RCA CARFONE Mobile 2 -way FM radio, 152 -174 Mc ...you get the greatest selectivity with RCA's All -New Communication Equipment You're going to hear a lot about selectivity from potentially useful channels for mobile radio communi- now on. In communication systems, receiver selectiv- cation systems. ity, more than any other single factor, determines the For degree of freedom from interference. complete details on the new RCA Station Re- This is impor- ceiver type CR -9A, tant both for today and for the future. and the new RCA CARFONE for mobile use, write today. RCA engineers are at your Recognizing this fact, RCA has taken the necessary service for consultation on prob- steps to make its all -new communication equipment lems of coverage, usage, or com- the most selective of any on the market today. To the plex systems installations. Write user, this means reliable operation substantially free Dept. 38 C. from interference. In addition, this greater selectivity Free literature on RCA's All -New now rhakes adjacent -channel operation a practical Communication Equipment -yours possibility - thereby greatly increasing the number of for the asking. COMMUN /CAT/ON SECT/ON RADIO CORPORATION of AMERICA ENGINEERING PRODUCTS DEPARTMENT, CAMDEN, N.J. In Canada: R C A VICTOR Company limited, Montreal Á#ofher s with 8(11(011' DlNews ERIE'S FIRST TV STATION Says EDWARD LAMB, publisher of "The Erie Dis- telecasting economics. -

Fimohlf Imt, Ww,Porpoaa Mí"""I at SOME POINTS, Atdered, Witdo

Is Always Something Doétff in El Paso and Tñe Great Southwest CountryCome Ta ft jüiiii'iL mm mum méMm tto. TeMnr-M- 1,3 Mf MMiftMatf ' 3WÁm ELPASOtTEX(l' SUNDAY NOVEMBER 29, 19.4. ENGUflH SECTION 3 PAGES PRICE 3 CENTS CARRANZA LETT LOOT! TREASURY BED CAPITAL ' li - " . Í má,,i"V, ni ' ,. " L ' i bam wd bridge MuMtat W w uriaL . i i ii i mmwmamr i arrriB&rMsaii5M. ' It tt'MMM ta bM miiii i nNha i mil i.iw:. í"1 PROGRESS MADE or to 'ni attempt the OMNM Ml WJmmm ltZZfirZS'. Nov, ccaS rroco-Bokyt- fcortMT. pecnapa at !H le rtww canity or naa w fimOHLF imt, ww,porpoaa mí"""i AT SOME POINTS, atdered, witdo. trra, tha amplovea wt Wail M MM,IMW.MMMai that ta itortb.',lt baft umi OKI itwM.a.!? mid follow. Inrolnd ara auudauMin. mnyM or m braketnao, ttlnUy atawarda and batai EXPENSE Of MdiikM. with stoat r wtthotrt I AN HA WW AY atnpioyaii an we)dtarn, MMa ta HMMwktr. that the Inundated IMM mmrnr no I wonuT prwre MtoiMtMle' to-- OernMt w ranee , through raetgium rroeecataga Am ,tiaJhtoat.. af Marta tatv rftyrv rawrouHeea any OF Made M AMTt nductora.' employed by late NICHOLAS THE roaawto;'t)w report , Of kf Fflllllk Wll ornara ra- - from l'lilDUIá Strike at Befteaanr at Mariasaa War n racuic, received h desnate taflletod upon fke (torran ñM kr niapanntnc tbatn or POLICE SOLDIERS OF MEXICO .tha M- -i Ban irom sut i nfede that soma orranal Mraacetita-- through Feria tbM the' t.4seeidFrsee Hi m traiwr Hartbe Ml been rank Rear Chica jo. -

List of Radio Stations in Virginia

Not logged in Talk Contributions Create account Log in Article Talk Read Edit View history Search Wikipedia List of radio stations in Virginia From Wikipedia, the free encyclopedia Main page The following is a list of FCC-licensed radio stations in the U.S. state of Virginia which can be Contents sorted by their call signs, frequencies, cities of license, licensees, and programming formats. Featured content Current events Contents [hide] Random article 1 List of radio stations Donate to Wikipedia 2 Defunct Wikipedia store 3 See also 4 References Interaction 5 Bibliography Help 6 External links About Wikipedia 7 Images Community portal Recent changes Contact page List of radio stations [edit] Tools This list is complete and up to date as of November 14, 2018. What links here Related changes Call [1][2] [2][3] [4] Upload file Frequency City of License Licensee Format sign Special pages open in browser PRO version Are you a developer? Try out the HTML to PDF API pdfcrowd.com Permanent link Information Page information WABN 1230 AM Abingdon Communications Oldies Wikidata item Corporation Cite this page WACL 98.5 FM Elkton Capstar TX, LLC Classic Rock Print/export Tidewater Create a book WAFX 106.9 FM Suffolk Communications, Classic Rock Download as PDF LLC Printable version WAJL 1400 AM South Boston Linda Waller Barton Southern Gospel/Bluegrass In other projects Piedmont Wikimedia Commons WAKG 103.3 FM Danville Broadcasting Country Languages Corporation Add links Shenandoah Valley WAMM 1230 AM Woodstock News/Talk Group, Inc. Community First WAMV 1420 AM Amherst Southern Gospel/Talk Broadcasters, Inc. -

TV Channel 5-6 Radio Proposal

Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) Promoting Diversification of Ownership ) MB Docket No 07-294 in the Broadcasting Services ) ) 2006 Quadrennial Regulatory Review – Review of ) MB Docket No. 06-121 the Commission’s Broadcast Ownership Rules and ) Other Rules Adopted Pursuant to Section 202 of ) the Telecommunications Act of 1996 ) ) 2002 Biennial Regulatory Review – Review of ) MB Docket No. 02-277 the Commission’s Broadcast Ownership Rules and ) Other Rules Adopted Pursuant to Section 202 of ) the Telecommunications Act of 1996 ) ) Cross-Ownership of Broadcast Stations and ) MM Docket No. 01-235 Newspapers ) ) Rules and Policies Concerning Multiple Ownership ) MM Docket No. 01-317 of Radio Broadcast Stations in Local Markets ) ) Definition of Radio Markets ) MM Docket No. 00-244 ) Ways to Further Section 257 Mandate and To Build ) MB Docket No. 04-228 on Earlier Studies ) To: Office of the Secretary Attention: The Commission BROADCAST MAXIMIZATION COMMITTEE John J. Mullaney Mark Lipp Paul H. Reynolds Bert Goldman Joseph Davis, P.E. Clarence Beverage Laura Mizrahi Lee Reynolds Alex Welsh SUMMARY The Broadcast Maximization Committee (“BMC”), composed of primarily of several consulting engineers and other representatives of the broadcast industry, offers a comprehensive proposal for the use of Channels 5 and 6 in response to the Commission’s solicitation of such plans. BMC proposes to (1) relocate the LPFM service to a portion of this spectrum space; (2) expand the NCE service into the adjacent portion of this band; and (3) provide for the conversion and migration of all AM stations into the remaining portion of the band over an extended period of time and with digital transmissions only. -

BROADCAST MAXIMIZATION COMMITTEE John J. Mullaney

Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) Promoting Diversification of Ownership ) MB Docket No 07-294 in the Broadcasting Services ) ) 2006 Quadrennial Regulatory Review – Review of ) MB Docket No. 06-121 the Commission’s Broadcast Ownership Rules and ) Other Rules Adopted Pursuant to Section 202 of ) the Telecommunications Act of 1996 ) ) 2002 Biennial Regulatory Review – Review of ) MB Docket No. 02-277 the Commission’s Broadcast Ownership Rules and ) Other Rules Adopted Pursuant to Section 202 of ) the Telecommunications Act of 1996 ) ) Cross-Ownership of Broadcast Stations and ) MM Docket No. 01-235 Newspapers ) ) Rules and Policies Concerning Multiple Ownership ) MM Docket No. 01-317 of Radio Broadcast Stations in Local Markets ) ) Definition of Radio Markets ) MM Docket No. 00-244 ) Ways to Further Section 257 Mandate and To Build ) MB Docket No. 04-228 on Earlier Studies ) To: Office of the Secretary Attention: The Commission BROADCAST MAXIMIZATION COMMITTEE John J. Mullaney Mark Lipp Paul H. Reynolds Bert Goldman Joseph Davis, P.E. Clarence Beverage Laura Mizrahi Lee Reynolds Alex Welsh SUMMARY The Broadcast Maximization Committee (“BMC”), composed of primarily of several consulting engineers and other representatives of the broadcast industry, offers a comprehensive proposal for the use of Channels 5 and 6 in response to the Commission’s solicitation of such plans. BMC proposes to (1) relocate the LPFM service to a portion of this spectrum space; (2) expand the NCE service into the adjacent portion of this band; and (3) provide for the conversion and migration of all AM stations into the remaining portion of the band over an extended period of time and with digital transmissions only. -

Inside This Issue

News Serving DX’ers since 1933 Volume 81, No. 23 ● March 17, 2014● (ISSN 0737-1639) Inside this issue . 2 … AM Switch 10 … Geomag Indices/Space Wx 16 … International DX Digest 5 … Domestic DX Digest West 11 … Domestic DX Digest East 18 … Radio on the Reservation DX Test: KCKM‐1330 Monahans TX will test tenure, and what a convention he hosted in on Saturday, March 22, at 0100‐0130 ELT, with Minneapolis! – Paul Swearingen. 12 kW non‐directional into a 5/8th‐wave tower. From the Publisher: We’ll be back again in The test will consist mainly of Morse code, two weeks, then it’ll be another three weeks sweep tones, and sound effects known to cut after that. It’s been a tough winter in most of through the mud. There will be a few voice North America, but there’s still some DX to be announcements spread out through out the test. heard even as the temperatures start warming GM and station owner Bob Souza will accept up. reports. E‐mail reports to [email protected] If you have something you’d like to submit are preferred (.mp3 attachments only, .wav are for potential publication in DX News, you can too big), but snail‐mail reports will be accepted send it to the appropriate column editor, or else too at P.O. Box 990, Monahans TX 79756. directly to the publisher; via mail as on the back A verification postcard will be sent – a stamp page or to [email protected]. to defray postage costs is always a good idea. -

Broadcast Market Research TV Households

Broadcast Market Research TVHouseholds Everyindustryneedsameasureofthesizeofitsmarketplaceandtheradioandtelevisionindustriesare noexceptions. TELEVISION - U.S. AmajorsourceofsuchmediamarketdataintheUnitedStatesisNielsenMediaResearch(NMR),and oneofthemeasurementsittakesannuallyisTVHouseholds(TVHH).Ahomewithoneoperable TV/monitorisaTVHH,andNielsenisabletoextrapolateits“NationalUniverseEstimates”fromCensus BureaupopulationdatacombinedwiththisexpressionofTVpenetration. WithUsfromDayOne Theadventofbroadcastadvertising,inJuly1941,wascoincidentalwiththedawnofcommercial television,andwithintenyearsmarketresearchinthenewmediumwasinfullswing. SincetheFederalCommunicationsCommission(FCC)allowedthosefirstTVads—forSunOil,Lever Bros.,Procter&GambleandtheBulovaWatchCompany—reliableaudiencemeasurementhasbeen necessaryformarketerstotargettheircampaigns.TheproliferationofdevicesforviewingTVcontent andthecontinualevolutionofconsumerbehaviorhavemadethetaskmoreimportant—andmore challenging—thanever. Nevertheless,whiletherealityof“TVEverywhere”hasundeniablycomplicatedtheworkofaudience measurement,theuseofonerudimentarygaugepersists—thenumberofhouseholdswithaset,TVHH. NielsenMediaResearch IntheUnitedStates,NielsenMediaResearch(NMR)istheauthoritativesourcefortelevisionaudience measurement(TAM).BestͲknownforitsratingssystem,whichhasdeterminedthefatesofmany televisionprograms,NMRalsotracksthenumberofhouseholdsinaDesignatedMarketArea(DMA) thatownaTV. PublishedannuallybeforethestartofthenewTVseasoninSeptember,theseUniverseEstimates, representingpotentialregionalaudiences,areusedbyadvertiserstoplaneffectivecampaigns.