COVID-19: Summary of Cases and Monitoring Data Through May 14, 2021 Verified As of May 15, 2021 at 09:25 AM Data in This Report Are Provisional and Subject to Change

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Featured Cocktails Glass $10 Electric Feel Dark Chocolate Liquor, Strawberry Puree and Vanilla Soda

LeMoNAdE glass: $9, pitcher: $32 Royal Tenenbaum Cucumber Purus Vodka, rosemary Gin, cucumber infused syrup, fresh cranberries, liqueur, fresh mint, ginger beer lemonade Rosemary Peach El Diablo Purus Organic Vodka, Milagro Tequila, creme rosemary syrup, peach de cassis, ginger beer, lemonade lemonade Cherry Limeade Strawberry Purus Organic Vodka, Basil cherry, lemonade, lime, Purus Organic Vodka, fresh lemon-lime soda basil, strawberry, lemonade Hawaiian Breeze Bourbon Basil Coconut rum, peach nectar, Old Forester, basil, iced tea, lemonade, cranberry juice lemonade Limoncello Ginger Peach Purus Organic Vodka, fresh Purus Organic Vodka, mint, famous house-made peach nectar, ginger beer, Limoncello lemonade Featured cocktails glass $10 Electric Feel Dark chocolate liquor, strawberry puree and vanilla soda. Delicious with a shocking mouthfeel. Spice Girl Spiced Rum, a bit of honey and ginger infused apple cider . Served Hot. FloAts & ShAkEs Lemon Squeezy $9 Banana Foster $9 Purus Organic Vodka, Dark rum, caramel, banana, Limoncello, lemon raspberry vanilla & salted caramel ice ice cream shake cream shake Horchata $9 Irish Coffee $9 Purus Organic Vodka, Irish whiskey, Irish cream, cinnamon ice cream shake espresso ice cream shake Dreamsicle $9 PB Vibes $9 Purus Organic Vodka, Peanut Butter whiskey, creme Fanta Orange, vanilla ice de cassis and chocolate ice cream float cream shake WINe Glass: $8, Bottle: $28 White Red Trapiche Chardonnay H3 Red Blend Mendoza, Argentina Columbia Valley, Washington Paparuda Pinot Grigio Terra Romana Pinot Noir Recas, Romania Prahova, Romania Beer 9 oz 16oz 2ND SHIFT Albino Pygmy Puma $4 $6 Smooth, citrus, New England-style Pale Ale with a few different hops. 2ND SHIFT Little Big Hop $4 $6 Hazy Session, Low ABV, Double IPA. -

Cloudwater and Vault City Beers in Your Shopping Trolley

FRESH BEER Catch up on the latest UK Craft Beer releases. SUPERMARKET WARS Cloudwater and Vault City beers in your shopping trolley. TWICB BEER TOURS Check out our curated & hosted Craft Beer Tours. TWICB PODCAST Rob is joined by Ben from Rivington Brewing Co. 60 ISSUE SIXTY APRIL 19th 2021 ISSUE 60 - 19 APRIL 2021 Thankfully the sun shone for most of us last week which enabled thirsty punters to enjoy beers again in pub gardens and outside taproom areas. Long may it continue. Plenty of great new Craft Beer releases last week as breweries re- veal their newest wares to coincide with the loosening of lockdown. If you really fancy saying good riddance to lockdown, then join us on one of our new Grand Beer Tours commencing in the second half of 2021, (Covid permitting). TWICB Grand Tours are carefully curated, hosted, long-weekend tours for small groups of Craft Beer fans. Tours are jointly hosted by TWICB and a leading UK Brewery and the Brewery Owner/Head Brewer will join the tour and be company throughout. Tours includes either 3 or 4 B&B nights hotel accommodation, in-destination ground transportation, tutored tasting events and beer launch events. Tours to Copenhagen, Denmark and New England in the US are now available to book. Check out the promotional pages in this Newsletter for more details. CONTENTS Beer Releases Beer Tours Brewer’s Corner Festivals Page 3 Page 19 Page 22 Page 25 TWICB Podcast Online Beer Taproom Directory Podcast Directory Page 28 Page 29 Page 38 Page 46 A big thank you to our current patreon supporters: John Stevens Jamie Ramsey Peter Corrigan Sue Johnson Angela Peterson Alex Postles Nick Flynn Jazz Hundal Charlie Smith Phantom Brewing Co. -

CASE 1 3Coke and Pepsi Learn to Compete in India

CASE 13 Coke and Pepsi Learn to Compete in India THE BEVERAGE BATTLEFIELD had to resort to using a costly imported substitute, estergum, or they had to fi nance their own R&D in order to fi nd a substitute In 2007, the President and CEO of Coca-Cola asserted that Coke ingredient. Many failed and quickly withdrew from the industry. has had a rather rough run in India; but now it seems to be getting Competing with the segment of carbonated soft drinks is an- its positioning right. Similarly, PepsiCo’s Asia chief asserted that other beverage segment composed of noncarbonated fruit drinks. India is the beverage battlefi eld for this decade and beyond. These are a growth industry because Indian consumers perceive Even though the government had opened its doors wide to for- fruit drinks to be natural, healthy, and tasty. The leading brand has eign companies, the experience of the world’s two giant soft drinks traditionally been Parle’s Frooti, a mango-fl avored drink, which companies in India during the 1990s and the beginning of the new was also exported to franchisees in the United States, Britain, Por- millennium was not a happy one. Both companies experienced a tugal, Spain, and Mauritius. range of unexpected problems and diffi cult situations that led them to recognize that competing in India requires special knowledge, skills, and local expertise. In many ways, Coke and Pepsi manag- OPENING INDIAN MARKET ers had to learn the hard way that “what works here” does not In 1991, India experienced an economic crisis of exceptional se- always “work there.” “The environment in India is challenging, but verity, triggered by the rise in imported oil prices following the we’re learning how to crack it,” says an industry leader. -

A Guide to the Soft Drink Industry Acknowledgments

BREAKING DOWN THE CHAIN: A GUIDE TO THE SOFT DRINK INDUSTRY ACKNOWLEDGMENTS This report was developed to provide a detailed understanding of how the soft drink industry works, outlining the steps involved in producing, distributing, and marketing soft drinks and exploring how the industry has responded to recent efforts to impose taxes on sugar-sweetened beverages in particular. The report was prepared by Sierra Services, Inc., in collaboration with the Supply Chain Management Center (SCMC) at Rutgers University – Newark and New Brunswick. The authors wish to thank Kristen Condrat for her outstanding support in all phases of preparing this report, including literature review and identifying source documents, writing, data analysis, editing, and final review. Special thanks also goes to Susanne Viscarra, who provided copyediting services. Christine Fry, Carrie Spector, Kim Arroyo Williamson, and Ayela Mujeeb of ChangeLab Solutions prepared the report for publication. ChangeLab Solutions would like to thank Roberta Friedman of the Yale Rudd Center for Food Policy and Obesity for expert review. For questions or comments regarding this report, please contact the supervising professors: Jerome D. Williams, PhD Prudential Chair in Business and Research Director – The Center for Urban Entrepreneurship & Economic Development (CUEED), Rutgers Business School – Newark and New Brunswick, Management and Global Business Department 1 Washington Park – Room 1040 Newark, NJ 07102 Phone: 973-353-3682 Fax: 973-353-5427 [email protected] www.business.rutgers.edu/CUEED Paul Goldsworthy Senior Industry Project Manager Department of Supply Chain Management & Marketing Sciences Rutgers Business School Phone: 908-798-0908 [email protected] Design: Karen Parry | Black Graphics The National Policy & Legal Analysis Network to Prevent Childhood Obesity (NPLAN) is a project of ChangeLab Solutions. -

Values of Coca Cola

CONTENTS CHAPTER-1 ……………………………………………2- 07 • Objective of study • Scope of study • Executive Summery CHAPTER- 2……………………………………………8- 42 • Introduction • Industry Scenario & Company Profile • Product Profile CHAPTER-3…………………………………………...43- 78 • Research methodology & Sample design • Factor analysis • Data Analysis CHAPTER- 4…………………………………………..72- 82 • Findings • Suggestions & Recommendations CHAPTE R- 5…………………………………………..83 -84 • Limitation of the study CHAPTER- 6…………………………………………..85- 92 • Conclusion • Annexure • Bibliography [1] CHAPTER-1 OBJECTIVE OF THE STUDY [2] OBJECTIVES OF THE STUDY The survey was conducted at Mula Ali region in Hyderabad keeping following objectives in view: ➢ The survey was done to know the current status of activation element of coca cola in the outlets. ➢ To know the effect of the activation elements of coca cola in market. ➢ To increase incidence through effective utilization of activation elements of coca cola in the outlets. ➢ To ensure the visibility of coca cola products in the outlets. ➢ To find out the present status of Coca-Cola brands in the retail outlets. [3] SCOPE OF THE STUDY [4] SCOPE OF THE STUDY This study has been done at Maula-Ali region in Hyderabad only. During the study I went through different aspects. The study would be only a drop in the ocean that can help to understand the current status of activation elements of Coca-Cola in retail outlet. The study can be conduct on the national basis also with large sample size & sufficient time by taking feedback of many retailers which sell Coke products. There are some important aspects of this study which are as follow— ➢ This study will help to the company to know about their new concepts position in the market. -

May 19,1887.—20 A

The Republican Journal VOLUME 59. BELFAST, MAINE, THURSDAY, MAY 19, 1887. NUMBER 20. Street Scenes in a Mexican City. either on foot, on horse or in :i carriage, Maine Matters. Generalities. The Professor to His Critics. The French Spoliation Claims. The Capture of East port. Wintrrport Corn Factor). JOURNAL. would he ivm nted a< a deadly insult and ^i\e KKITBLICAX 1 TIIK The s sufficient cause fora duel, siiiee to the NEWS A X I> GOSSII* FKOM Al.I. OVKK Till. STATE, To tin: Editor of the Journal: I To Kldiuu of IHF J<d unai. All article, requisite number of acres of corn rs« i.iai.ti ij wnu li a-h »nisii \ s11: vm.i 1:. accept Vandals have marred the Washington monu- say, The Court of Claims resumed the considera- paving invitation would her from I»een the the I'nion Packing seriously compromise ment. Mr. T won copied your paper, which lias recently ap- ! pledged hy farmers, r.i.ism !• rm isi'.w moumm; i«v tiik < orrt spomlonee of the Journal. Rust, have the bet. It was a new tion of the French spoliation eases on 3. yrood name. A GOO]* STATE TO I.IVE IX. May ! Co. anti hat that I could peared in the Uoston Dailj Record as t<* the capture have closet! the lease of Central wharf (ir\I»AI A.lAliA. Will. Tile utilities of on all afternoons Pa., has a six feet again prod you into print in The delay has been due to the request of the 1 Apr. -

Appendix Unilever Brands

The Diffusion and Distribution of New Consumer Packaged Foods in Emerging Markets and what it Means for Globalized versus Regional Customized Products - http://globalfoodforums.com/new-food-products-emerging- markets/ - Composed May 2005 APPENDIX I: SELECTED FOOD BRANDS (and Sub-brands) Sample of Unilever Food Brands Source: http://www.unilever.com/brands/food/ Retrieved 2/7/05 Global Food Brand Families Becel, Flora Hellmann's, Amora, Calvé, Wish-Bone Lipton Bertolli Iglo, Birds Eye, Findus Slim-Fast Blue Band, Rama, Country Crock, Doriana Knorr Unilever Foodsolutions Heart Sample of Nestles Food Brands http://www.nestle.com/Our_Brands/Our+Brands.htm and http://www.nestle.co.uk/about/brands/ - Retrieved 2/7/05 Baby Foods: Alete, Beba, Nestle Dairy Products: Nido, Nespray, La Lechera and Carnation, Gloria, Coffee-Mate, Carnation Evaporated Milk, Tip Top, Simply Double, Fussells Breakfast Cereals: Nesquik Cereal, Clusters, Fruitful, Golden Nuggets, Shreddies, Golden Grahams, Cinnamon Grahams, Frosted Shreddies, Fitnesse and Fruit, Shredded Wheat, Cheerios, Force Flake, Cookie Crisp, Fitnesse Notes: Some brands in a joint venture – Cereal Worldwide Partnership, with General Mills Ice Cream: Maxibon, Extreme Chocolate & Confectionery: Crunch, Smarties, KitKat, Caramac, Yorkie, Golden Cup, Rolo, Aero, Walnut Whip, Drifter, Smarties, Milkybar, Toffee Crisp, Willy Wonka's Xploder, Crunch, Maverick, Lion Bar, Munchies Prepared Foods, Soups: Maggi, Buitoni, Stouffer's, Build Up Nutrition Beverages: Nesquik, Milo, Nescau, Nestea, Nescafé, Nestlé's -

The Coca-Cola/Sabmiller Value Chain Impacts in Zambia

Exploring the links between international business and poverty reduction The Coca-Cola/SABMiller value chain impacts in Zambia and El Salvador By Oxfam America, The Coca-Cola Company, and SABMiller 2 Exploring the Links Between International Business and Poverty Reduction Contents 1 About the organizations 4 2 Letters from our leadership 8 3 Executive summary 12 4 Introduction 20 5 Setting the scene 26 6 The Coca-Cola/SABMiller value chain 30 7 Value chain: Macroeconomic impacts 36 8 Value chain: Livelihoods 44 9 Value chain: Empowerment 54 10 Value chain: Security and stability 58 11 Value chain: Diversity and women’s participation 60 12 Local environmental impacts: Focus on water and recycling 64 13 Products and marketing 70 14 Enabling policies and institutions 74 15 Conclusion 78 Methodology 80 16 Acknowledgments 82 Endnotes 84 Exploring the Links Between International Business and Poverty Reduction 3 1 About the organizations The Coca-Cola Company is the world’s largest nonalcoholic ready-to-drink beverage company, with the world’s most recognized brand. Its products are available in more than 200 countries, and nearly 1.7 billion servings of its products are consumed each day. The Coca-Cola system is defined as the Company and its more than 300 bottling partners worldwide. The Coca-Cola Company sustainability platform Three years ago, The Coca-Cola Company launched Live Energy Efficiency and Climate Protection: Aim to be the Positively™/Live For A Difference, a systemwide sustainability beverage industry leader in energy efficiency and climate framework that is embedded in every aspect of the protection. -

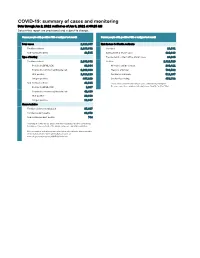

COVID-19: Summary of Cases and Monitoring Data Through Jun 2, 2021 Verified As of Jun 3, 2021 at 09:25 AM Data in This Report Are Provisional and Subject to Change

COVID-19: summary of cases and monitoring Data through Jun 2, 2021 verified as of Jun 3, 2021 at 09:25 AM Data in this report are provisional and subject to change. Cases: people with positive PCR or antigen test result Cases: people with positive PCR or antigen test result Total cases 2,329,867 Risk factors for Florida residents 2,286,332 Florida residents 2,286,332 Traveled 18,931 Non-Florida residents 43,535 Contact with a known case 920,896 Type of testing Traveled and contact with a known case 24,985 Florida residents 2,286,332 Neither 1,321,520 Positive by BPHL/CDC 83,364 No travel and no contact 280,411 Positive by commercial/hospital lab 2,202,968 Travel is unknown 733,532 PCR positive 1,819,119 Contact is unknown 511,267 Antigen positive 467,213 Contact is pending 459,732 Non-Florida residents 43,535 Travel can be unknown and contact can be unknown or pending for Positive by BPHL/CDC 1,037 the same case, these numbers will sum to more than the "neither" total. Positive by commercial/hospital lab 42,498 PCR positive 29,688 Antigen positive 13,847 Characteristics Florida residents hospitalized 95,607 Florida resident deaths 36,973 Non-Florida resident deaths 744 Hospitalized counts include anyone who was hospitalized at some point during their illness. It does not reflect the number of people currently hospitalized. More information on deaths identified through death certificate data is available on the National Center for Health Statistics website at www.cdc.gov/nchs/nvss/vsrr/COVID19/index.htm. -

Jewels of India: Ramesh Chauhan

Jewels of India: Ramesh Chauhan Thums Up to Ramesh Chauhan Creator of a number of high profile brands like Thums up, Gold Spot, Limca, Citra and now Bislery, the 72-year Ramesh Chauhan’s success journey has had a spectacular-though not always smooth-success ride. After all, it takes some doing to ensure that happy days are here again and again. Passionate about whatever he did, Ramesh Chauhan went on to create ripples in the world of beverages by creating one successful brand after another one. By Ketan Mistry At Sindhia Boarding School, it is a tense night before the next day exams. Given to learning by rot, a 10-12 year boy is burning the midnight oil to commit to memory all information regarding the 1857 mutiny. After mugging overnight, he is shocked to see the question paper next day. The question asked therein was on bubonic Plague. Looking back at the past, Ramesh Chauhan reminisces, ‘Since that day I vowed never ever to do mugging. It was important to absorb the concept, that is all. And later when I was required to make a blueprint for a soft drink factory at the age of 22-23, this lesson came handy: absorb the concept Chairman and managing director of the 1800-crore Bisleri International Private Limited, Ramesh Jayantilal Chauhan or RJC is known as the brand guru of India, He is the same Ramesh Chauhan who monopolized the market for three decades with brands like Gold Spot, Thums up, Maaza, Citra. He is the same Ramesh Chauhan who created a flutter in the corporate world by selling off these iconic brands in the early 90s. -

Operations Management Introduction

B7801 Operations Management Introduction 18 August 2000 Nelson M. Fraiman p. 1 Outline • Course requirements and administration • What is this course about? • The role of operations and its impact on the firm’s performance • Begin operations strategy discussion p. 2 Course requirements • Readings – Casebook – The Goal • Class participation (20%) – Bring tent cards to every class • Case assignments (28%) – 4 assignments (see schedule) – groups of 3 max. – executive summary format (1 page + exhibits) • Midterm exam on 22 September 2000 (25%) • Project (27%) p. 3 Course administration • Web syllabus – http://www.gsb.columbia.edu/faculty/nfraiman – “One-stop shopping” for ... • schedule of assignments • case questions • data sets • announcements • useful links – Bookmark it and check it often! • Office hours: W 5-6:30 pm and by appointment • Chatroom hours: W 6:30 – 7:30 pm [email protected] 212 854 2076 405A Uris Hall • TA:Srinivas Krishnamoorthy • [email protected] p. 4 What exactly are a firm’s operations ? p. 5 The activities/processes involved in producing the firm’s outputs (products & services) retailers customers suppliers plants distribution center customer replenishment service orders orders/service requests How does (or could) the firm’s work get done? What is the business impact? p. 6 Ex: Can of Coke • Where did you buy it? How did it get there? • Where was it made? • What is it made of? Where did the materials come from? • When was it made? • Why did you buy it? • How did someone know you were going to buy it? • Is the quality okay? How do “they” know the quality is okay? • How many other units where made at the same time? • Does the plant produce other products? How many? • Do different plants produce different products? Why/why not? • Why is this can of Coke produced and distributed this way? • Are there alternatives? • What decisions had to be made to make all this possible? p. -

Coca-Cola Historie a Současnost

Coca-Cola historie a současnost Jiřina Borková Bakalářská práce 2010 ABSTRAKT Historie obchodní značky Coca-Cola, produkty Coca-Cola, specifika značky, Coca-Cola jako leader na trhu, šetření zkoumající nákupní preference spotřebitelů colových nápojů Klíčová slova: Coca-Cola, logo, nápoje ABSTRACT History of trademark Coca-Cola, products of Coca-Cola, specific brand, Coca-Cola as the market leader, research exploring consumer´s preferences Keywords: Coca-Cola, logo, drinks Děkuji prof. PhDr. Pavlu Horňákovi Ph.D. za pedagogické vedení bakalářské práce a také všem pedagogům Fakulty multimediálních komunikací za tříletý návrat do studentských starostí, ale i radostí. OBSAH ÚVOD .................................................................................................................................... 8 I TEORETICKÁ ČÁST ............................................................................................... 9 1 HISTORIE ................................................................................................................ 10 1.1 HISTORIE COCA-COLY V ČESKÉ REPUBLICE ........................................................ 10 1.2 LOGO .................................................................................................................... 11 1.2.1 Specifika budování obchodní značky Coca-Cola ........................................ 12 1.2.1.1 Barva .................................................................................................... 12 1.2.1.2 Grafologický výklad loga Coca-Cola .................................................