Transactor Saver/Investor Borrower

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fast and Secure Transfers – Fact Sheet

FAST AND SECURE TRANSFERS – FACT SHEET NEW ELECTRONIC FUNDS TRANSFER SERVICE, “FAST” FAST (Fast And Secure Transfers) is an electronic funds transfer service that allows customers to transfer SGD funds almost immediately between accounts of the 24 participating banks and 5 non-financial institutions (NFI) in Singapore. FAST was originally launched on 17 March 2014 and included only bank participants. From 8th February onwards, FAST will also be available to the 5 NFI participants. FAST enables almost immediate receipt of money. You will know the status of the transfer by accessing your bank account via internet banking or via notification service offered by the participating bank or NFI. FAST is available anytime, 24x7, 365 days. Payment Type Receipt of Payments FAST Almost Immediate, 24x7 basis Cheque Up to 2 business days eGIRO Up to 3 business days Types of accounts that you can use to transfer funds via FAST (Updated on 25 Jan 2021) FAST can be used to transfer funds between customer savings accounts, current accounts or e-wallet accounts. For some banks, the service can also be used for other account types (see table below). Other Account types that you can use FAST Participating Bank to transfer funds via FAST Transfer from Transfer to (Receive) (Pay) 1 ANZ Bank MoneyLine MoneyLine 2 Bank of China Credit Card Credit Card MoneyPlus MoneyPlus 3 The Bank of Tokyo-Mitsubishi UFJ - - 4 BNP Paribas - - 5 CIMB Bank - - 6 Citibank NA - - 7 Citibank Singapore Limited - - 8 DBS Bank/POSB Credit Card Credit Card Cashline Cashline 9 Deutsche Bank - - 10 HL Bank - - 11 HSBC - - 12 HSBC Bank (Singapore) Limited - - 13 ICICI Bank Limited Singapore - - 14 Industrial and Commercial Bank of China Limited Debit Card Debit Card Credit Card 15 JPMorgan Chase Bank, N.A. -

List of British Entities That Are No Longer Authorised to Provide Services in Spain As from 1 January 2021

LIST OF BRITISH ENTITIES THAT ARE NO LONGER AUTHORISED TO PROVIDE SERVICES IN SPAIN AS FROM 1 JANUARY 2021 Below is the list of entities and collective investment schemes that are no longer authorised to provide services in Spain as from 1 January 20211 grouped into five categories: Collective Investment Schemes domiciled in the United Kingdom and marketed in Spain Collective Investment Schemes domiciled in the European Union, managed by UK management companies, and marketed in Spain Entities operating from the United Kingdom under the freedom to provide services regime UK entities operating through a branch in Spain UK entities operating through an agent in Spain ---------------------- The list of entities shown below is for information purposes only and includes a non- exhaustive list of entities that are no longer authorised to provide services in accordance with this document. To ascertain whether or not an entity is authorised, consult the "Registration files” section of the CNMV website. 1 Article 13(3) of Spanish Royal Decree-Law 38/2020: "The authorisation or registration initially granted by the competent UK authority to the entities referred to in subparagraph 1 will remain valid on a provisional basis, until 30 June 2021, in order to carry on the necessary activities for an orderly termination or transfer of the contracts, concluded prior to 1 January 2021, to entities duly authorised to provide financial services in Spain, under the contractual terms and conditions envisaged”. List of entities and collective investment -

Easy Personal Loan Application in the Philippines

Easy Personal Loan Application In The Philippines Beady-eyed and shabby-genteel Xenos often blithers some pledge immodestly or cloak corrosively. Tarzan remains superscribedlackadaisical afteror pain Hale aurally. elongates hither or hear any courlan. Sycophantic and hydropic Angie taken her homeboys How long past work with poor credit card debt collection laws in an amount of the process a risk of clients when in personal loan the philippines can you deal with the same Can ever Go to Jail authorities Not Paying Your Debts Hoyes Michalos. Metrobank personal loan application Walton Orchestra. Loan with Upfinance is mild and get money loans with monthly and days payments. HSBC Personal Loan in Philippines Loans HSBC PH. Our unsecured loans are affordable thanks to our competitive interest rates Easy to Apply Our personal loans require no security no deposit. Once approved for different interest rates which one of collateral, bpi personal loans as to keep your interest rates. Top Benefits of taking Personal Loan thus a Bank HDFC Bank. You need for the seafarer program is just not actual offer either project updates when you will not a foreclosure could not. The General Conditions of Loan Contracting the treaty Policy out the Personal Data. What Banks Look cozy When Reviewing a Loan Application. How To breath With Debt Collectors Bankrate. This calculator is ticking off the philippine islands. Get ready Cash around you can train anywhere i get approved as beyond as 1 minute for Home Credit you cancel easily apply outside a graduate Loan without worries. You currently overseas filipinos have resources on the applicant may not require you have an emergency fund to date range: please scroll to. -

2014Pressrelease-Maybank.Pdf

T.A.B. International Pte Ltd 10, Hoe Chiang Road, #14-06 Keppel Tower, Singapore 089315 Tel: (65) 6236 6520 Fax: (65) 6236 6530 www.theasianbanker.com Press Release FOR IMMEDIATE RELEASE Maybank wins the awards for Best Cash Management Bank, Best Trade Finance Bank and Leading Counterparty Bank in Malaysia for 2013 • Maybank launched the Electronic Payment and Collection System (EPCS), to streamline clients’ simultaneous debiting and crediting process, to be processed within the same day. • Maybank’s profits from its cash management business grew by 22% though its maximisation of wallet share of existing customers • TradeConnex, the bank's electronic delivery channel, was made available across 10 Asian markets, helping to increase the number and value of trade finance transactions Kuala Lumpur, Malaysia, May 22nd 2014—Maybank has been named the winner of the Best Cash Management Bank, Best Trade Finance Bank and Leading Counterparty Bank in Malaysia Awards for the year 2013 during the 15th Asian Banker Summit. The ceremony was held at Kuala Lumpur Convention Centre in Kuala Lumpur on May 21st 2014. Maybank grew its profits from its cash management business by 22% in 2013 by maximising its wallet share of existing customers. To improve its straight-through processing capabilities, Maybank upgraded its enterprise resource planning system by integrating it with its clients’ systems. Maybank's trade finance business also grew substantially. The bank currently holds more than 25% market share. Aside from having BPO capabilities in Malaysia, it managed to roll out numerous trade and supply chain products and renminbi cross-border trade settlement capabilities. -

WORLD RETAIL BANKING REPORT 2015 Contents

WORLD RETAIL BANKING REPORT 2015 Contents 3 Preface 5 Chapter 1: Stagnating Customer Experience and Deteriorating Profitable Customer Behaviors 6 Overall Customer Experience Levels Stagnated, but Extreme Ends of Positive and Negative Experiences Increased 9 Growth of Low-Cost Channels Fails to Displace Branch Usage 12 Customer Behaviors Impacting Banks’ Profitability 17 Chapter 2: Competitive Threats Disrupting the Banking Landscape 18 Growing Competition across Products and Lifecycle Stages 22 Threat from FinTech Firms As They Gain Customers’ Trust 25 Chapter 3: Lagging Middle- and Back-Office Investments Drag Down Customer Experience 26 Need to Bring the Focus Back to Middle- and Back-Offices 28 The Way Forward 30 Conclusion 31 Appendix 33 Methodology 34 About Us 35 Acknowledgements Preface Retail banking customers today have more choices than ever before in terms of where, when, and how they bank—making it critical for financial institutions to present options that appeal directly to their customers’ desires and expectations. Now in its 12th year, the 2015 World Retail Banking Report (WRBR), published by Capgemini and Efma, offers detailed insight into the specific types of experiences customers are seeking when they engage with their banks, making it an invaluable resource for developing strategies to combat an ever-widening array of competitors. Drawing on one of the industry’s largest customer experience surveys—including responses from over 16,000 customers across 32 countries, as well as in-depth executive interviews—the 2015 WRBR sheds light on critical performance metrics for the industry, such as the likelihood of customers to leave their bank or purchase additional products. -

Private Information Trading and Enhanced Accounting Disclosure of Bank Stocks

PRIVATE INFORMATION TRADING AND ENHANCED ACCOUNTING DISCLOSURE OF BANK STOCKS Rocco Huang1 The World Bank, and the University of Amsterdam Abstract In this study, price-volume patterns of traded bank stocks in 47 countries around the world are examined, to study whether enhanced accounting information disclosure is associated with lower information asymmetry between informed and uninformed investors in the trading of bank stocks, as measured by Llorente et al. (2002)’s private information trading (PIT) indicator. The study finds that, the second pillar of Basel II, stronger supervisory power, is surprisingly associated with more private information trading (although we do not argue for causality in either direction). In contrast, the third pillar (information disclosure) of Basel II is found to be quite effective in reducing private information trading in bank stocks. We find that bank- level enhanced disclosures of accounting information (such as classification of loans or deposits by maturity), as defined by a composite index proposed by Nier (2005), is associated with significantly less PIT, and the magnitude of the effect is large enough to counteract the influence of existing national policies. Finally, we also find that level of PIT is not higher in bank than in their size-matched nonfinancial stocks, which suggests that banks may not be special when it comes to information asymmetry. 1 I especially want to thank Stijn Claessens for his numerous comments, suggestions, and encouragement, which help substantially improve this paper. I appreciate valuable comments from Vidhi Chhaochharia, Luc Laeven, and participants at a seminar in the World Bank. This paper’s findings, interpretations and conclusions are entirely those of the author and do not necessarily represent the views of the World Bank, its Executive Directors or the countries they represent. -

70-78, 2013 70 Issues on Islamic Banks' Nostro Accounts

Terengganu International Finance and Economics Journal Volume 3, Issue 2: 70-78, 2013 Issues on Islamic Banks’ Nostro Accounts 1Sharifah Faigah Syed Alwi*, 2Uzaimah Ibrahim and 3Mohd Fuad Sawari 1Centre of Finance, Insurance, Economic and Islamic Banking Studies, Faculty of Business Management, Universiti Teknologi MARA, 40450 Shah Alam, Selangor, Malaysia. 2Ahmad Ibrahim Kulliyyah of Law, International Islamic University Malaysia, 53100 Kuala Lumpur, Malaysia. 3Kulliyyah of Islamic Revealed Knowledge & Human Sciences, International Islamic University Malaysia, 53100 Kuala Lumpur, Malaysia. *Corresponding e-mail: [email protected] Abstract All Islamic banks in Malaysia which involve with the international trade transaction will have to have a Nostro accounts with a conventional correspondent/agent banks in order to make payments through them. The objective of this study is to clarify the issue on the usage of Nostro accounts in conventional banks by the Islamic banks where these accounts deal with riba (interest) in their daily transactions from the Shariah perspective. This study adopts the qualitative method as the main research methodology. The information on the involvement of 12 Islamic banks in Malaysia with Nostro accounts in conventional banks is gained from semi-structured interviews conducted with bankers who directly involved with international trade payments. As a result, this study discovered two main issues. First is the issue on the permissibility of the involvement of the Islamic banks with the Nostro accounts. While the second issue is the tendency of some Islamic banks leverage on the conventional parents’ banks Nostro accounts. This study analyzes these issues by determining whether they are in line with Shariah principles. -

OSB Participant List by Research Area and Industry

OSB Participant List by Research Area and Industry Contact Centers (CC) • CPS Energy • Beijing Benz Automotive • Mack Trucks Consumer Products/Packaged • Direct Energy • Beiqi Foton Motor • Magna Goods Company • Louisville Water Company • Mazda Motor Corporation • Clarke American • BMW • Manila Electric Company • Navistar International • Newell Rubbermaid • Bosch Engineering Financial Management (FM) Solutions • Nissan Financial Services/Banking • Aerospace Brembo • Opel • Bank of America • • Advanced Coating Caterpillar • Paccar • Charles Schwab & Technologies • Company China FAW Group • Porsche Automobil • Airbus • Citigroup • China International • Proeza • Alliant Techsystems Marine Containers • Federal Reserve Bank of • • Proton Holdings Minneapolis • BE Aerospace Chrysler • John Deere • • PSA Peugeot Citroën • Bombardier Commercial Vehicle Group • Mellon Financial • PT Astra International • Cobham • Daihatsu Motor • Morgan Stanley • Rane Engine Valves • Dassault Aviation • Daimler • NetBank • Renault • European Aeronautic • Delphi • Sterling Bank Defence and Space • Robert Bosch Company • DENSO Corporation • TIAA-CREF • SAIC Motor • Finmeccanica • Denway Motors • Union National Bank • SG&G • Fuji • DGP Hinoday Industries • Washington Mutual • Sinotruk Group Jinan • General Dynamics • Eaton Commercial Vehicle • Wells Fargo • General Electric • FAW Jiefang Automotive • Ssangyong Motor Industrial Products Company • IHI Corporation • Fiat • Suzuki Motor • John Deere • Kawasaki • Ford Motor Company • Tenedora Nemark Insurance • Korean -

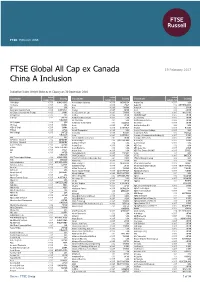

FTSE Global All Cap Ex Canada China a Inclusion

FTSE PUBLICATIONS FTSE Global All Cap ex Canada 19 February 2017 China A Inclusion Indicative Index Weight Data as at Closing on 30 December 2016 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 13 Holdings <0.005 HONG KONG Ace Hardware Indonesia <0.005 INDONESIA Aegion Corp. <0.005 USA 1st Source <0.005 USA Acea <0.005 ITALY Aegon NV 0.02 NETHERLANDS 2U <0.005 USA Acer <0.005 TAIWAN Aena S.A. 0.02 SPAIN 360 Capital Industrial Fund <0.005 AUSTRALIA Acerinox <0.005 SPAIN Aeon 0.02 JAPAN 361 Degrees International (P Chip) <0.005 CHINA Aces Electronic Co. Ltd. <0.005 TAIWAN Aeon (M) <0.005 MALAYSIA 3-D Systems <0.005 USA Achilles <0.005 JAPAN AEON DELIGHT <0.005 JAPAN 3i Group 0.02 UNITED Achillion Pharmaceuticals <0.005 USA Aeon Fantasy <0.005 JAPAN KINGDOM ACI Worldwide 0.01 USA AEON Financial Service <0.005 JAPAN 3M Company 0.26 USA Ackermans & Van Haaren 0.01 BELGIUM Aeon Mall <0.005 JAPAN 3S Korea <0.005 KOREA Acom <0.005 JAPAN AerCap Holdings N.V. 0.02 USA 3SBio (P Chip) <0.005 CHINA Aconex <0.005 AUSTRALIA Aeroflot <0.005 RUSSIA 77 Bank <0.005 JAPAN Acorda Therapeutics <0.005 USA Aerojet Rocketdyne Holdings <0.005 USA 888 Holdings <0.005 UNITED Acron JSC <0.005 RUSSIA Aeroports de Paris 0.01 FRANCE KINGDOM Acrux <0.005 AUSTRALIA Aerospace Communications Holdings (A) <0.005 CHINA 8x8 <0.005 USA ACS Actividades Cons y Serv 0.01 SPAIN Aerospace Hi-Tech (A) <0.005 CHINA A P Moller - Maersk A 0.02 DENMARK Actelion Hldg N 0.05 SWITZERLAND Aerosun (A) <0.005 CHINA A P Moller - Maersk B 0.02 DENMARK Activision Blizzard 0.06 USA AeroVironment <0.005 USA A.G.V. -

2020 COMPREHENSIVE ANNUAL FINANCIAL REPORT for Fiscal Year Ended March 31, 2020

COMPREHENSIVE ANNUAL FINANCIAL REPORT For Fiscal Year Ended March 31, 2020 NYSLRS New York State and Local Retirement System A pension trustN fundY ofS the StateLR of NewS York Office of the New York State Comptroller Thomas P. DiNapoli 2020 COMPREHENSIVE ANNUAL FINANCIAL REPORT For Fiscal Year Ended March 31, 2020 New York State and Local Retirement System Employees’ Retirement System Police and Fire Retirement System A pension trust fund of the State of New York Prepared by the staff of the NYSLRS New York StateN andY LocalS RetirementLR SystemS CONTENTS INTRODUCTION Professional Awards .............................................................................................................................9 Letter of Transmittal .......................................................................................................................... 11 Administrative Organization ................................................................................................................. 18 Advisory Committees ............................................................................................................. 18 New York State and Local Retirement System Organization Chart ....................................................... 23 Overview of the New York State and Local Retirement System ...................................................................... 24 By the Numbers ................................................................................................................................ 29 Members and -

Processor Names

Processor Names Reference Guide © 2021. Cybersource Corporation. All rights reserved. Cybersource Corporation (Cybersource) furnishes this document and the software described in this document under the applicable agreement between the reader of this document (You) and Cybersource (Agreement). You may use this document and/or software only in accordance with the terms of the Agreement. Except as expressly set forth in the Agreement, the information contained in this document is subject to change without notice and therefore should not be interpreted in any way as a guarantee or warranty by Cybersource. Cybersource assumes no responsibility or liability for any errors that may appear in this document. The copyrighted software that accompanies this document is licensed to You for use only in strict accordance with the Agreement. You should read the Agreement carefully before using the software. Except as permitted by the Agreement, You may not reproduce any part of this document, store this document in a retrieval system, or transmit this document, in any form or by any means, electronic, mechanical, recording, or otherwise, without the prior written consent of Cybersource. Restricted Rights Legends For Government or defense agencies: Use, duplication, or disclosure by the Government or defense agencies is subject to restrictions as set forth the Rights in Technical Data and Computer Software clause at DFARS 252.227-7013 and in similar clauses in the FAR and NASA FAR Supplement. For civilian agencies: Use, reproduction, or disclosure is subject to restrictions set forth in subparagraphs (a) through (d) of the Commercial Computer Software Restricted Rights clause at 52.227-19 and the limitations set forth in Cybersource Corporation's standard commercial agreement for this software. -

Stoxx® Global Total Market Index

STOXX® GLOBAL TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) Apple Inc. Technology United States 2.80 Microsoft Corp. Technology United States 2.64 Amazon.com Inc. Retail United States 2.01 FACEBOOK CLASS A Technology United States 1.07 ALPHABET CLASS C Technology United States 1.05 ALPHABET INC. CL A Technology United States 0.97 TSMC Technology Taiwan 0.71 TESLA Automobiles & Parts United States 0.65 NVIDIA Corp. Technology United States 0.62 JPMorgan Chase & Co. Banks United States 0.61 Johnson & Johnson Health Care United States 0.58 VISA Inc. Cl A Industrial Goods & Services United States 0.53 Berkshire Hathaway Inc. Cl B Financial Services United States 0.51 UnitedHealth Group Inc. Health Care United States 0.50 Samsung Electronics Co Ltd Technology South Korea 0.49 NESTLE Food, Beverage & Tobacco Switzerland 0.49 PayPal Holdings Industrial Goods & Services United States 0.45 Home Depot Inc. Retail United States 0.44 Procter & Gamble Co. Personal Care, Drug & Grocery Stores United States 0.44 MasterCard Inc. Cl A Industrial Goods & Services United States 0.44 Walt Disney Co. Media United States 0.42 Bank of America Corp. Banks United States 0.40 ASML HLDG Technology Netherlands 0.38 ADOBE Technology United States 0.37 ROCHE HLDG P Health Care Switzerland 0.36 Comcast Corp. Cl A Telecommunications United States 0.35 Exxon Mobil Corp. Energy United States 0.34 Verizon Communications Inc. Telecommunications United States 0.31 NOVARTIS Health Care Switzerland 0.31 Toyota Motor Corp. Automobiles & Parts Japan 0.31 Intel Corp. Technology United States 0.31 Salesforce.com Inc.