Habib Annul 2016.Fh10

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annualrep2008.Pdf

ABOUT THE COVER A comprehensive Sustainability Strategy is Nurturing Growth at National Foods Limited today, driving all operations towards Vision 20/20. Featured on the cover is the red chilli plant (Capsicum annuum). As part of its sustainability strategy, National Foods Limited is undertaking a planned effort, starting at the grassroots level, to support quality improvement and enhanced production of red chilli in Pakistan. NATIONAL FOODS LIMITED National Foods Limited (NFL), founded in 1970, is today Pakistans leading multi-category Food Company with over 250 different products in 12 categories. It is the only food Company in Pakistan to have ISO 9001 and HACCP certifications along with SAP business technology to drive the Companys strong commitment to quality and management excellence. NFL is an international brand sold in over 35 countries and it aims to be a Rs. 50 billion company under its Vision 20/20. NFL is dedicated to improving the well-being of society through continuous development of innovative food products and through a wide-ranging corporate social responsibility program. FOUNDERS PHILOSOPHY National Foods Limited must focus on customers needs and serve them with quality products at affordable prices at their doorstep. Our products must be pure; conforming to international standards. Our research must produce continuously new adventurous products scientifically tested, hygienically produced in safe and attractive packages We must create an environment in our offices and factories where talents are groomed and have opportunity to advance in their careers. We must prove to be recognized as good corporate citizens, support good causes and charity and bear fair share of taxes. -

Star Textile Mills LTD. A-41 SITE, Karachi

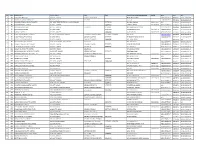

S# M # Company Name Mailing Address Tel # Fax # Name of Authorized Representative Designation Mobile-1 Email-1 NIC # NTN ST # 1 0026 Star Textile Mills LTD. A-41 SITE, Karachi. 32561127-29, 3251149 32580836 Mian MUHAMMAD ZAHID Law Consultant 0300-9243820 [email protected] 42201-6422669-5 069845-9 02-02-5111-019-19 2 0028 A. B. (Al-Hashmi Brothers) (PVT) LTD. H-6 SITE, Karachi. 32572963 Syed Shakir Hashmi Director 0333-2283020 [email protected] 42000-7647196-1 0704163-2 02-02-2811-003-55 3 0041 KOHINOOR CHEMICAL CO. (PVT) LIMITED 9TH FLOOR, TIBBET CENTRE, M. A. JINNAH ROAD, KHI 32564553, 32563425, 32563730, 32570144-6, 32571127 Mr. Aslam Allawala 0300-2150567 [email protected] 0710919-9 02-06-3302-001-91 4 0043 AHMED FOODS (PVT) LTD. D-112, AHMED HOUSE, SITE, KARACHI 111-987-789, 32563520-4 32578196 SYED HASIB AHMED Executive Director 0300-8269430 [email protected] 42101-0715400-3 0704016-4 02-06-2100-002-37 5 0046 HELIX PHARMA (PVT) LIMITED A-56, SITE, KARACHI 32562507, 32563856, 32563882, 32570182-3 32564393 TANWEER AHMED GM-HR & Admin 0333-0202206 [email protected] 42201-0793883-7 0710606-8 11-01-7010-002-46 6 0049 INDUS PENCIL INDUSTRIES (PVT) LIMITED B-54, SITE, KARACHI 32573214-7 32564931 MR. NAEEM AKHTAR YOUSUF 0300-8221852 [email protected] 42201-0468514-1 0710696-3 02-02-3208-016-64 7 0052 EXIDE PAKISTAN LIMITED A-44, SITE, Karachi 32578061-4, 32574610 32591679 SYED ZULQARNAIN SHAH GM 0333-2244702 [email protected] 42000-0479156-9 0676659-5 02-01-8507-001-64 8 0061 PAKISTAN CABLES LIMITED B-21, SITE, KARACHI 32561170-5 32564614 Aslam Sadruddin 0300-9227015 [email protected] 42301-4759734-3 0711509-1 02-02-7605-001-82 9 0067 Pakistan Paper Products Limited D-58 SITE, Karachi. -

(Winner)MCB Bank Limited Best Bank of the Year 2017 – Mid Size Banks

Banking: Best Bank of the year 2017 – Large Size Banks (Winner)MCB Bank Limited Best Bank of the year 2017 – Mid Size Banks (Winner) Bank Al Habib Limited Best Bank of the year 2017 – Small Size Banks Industrial and Commercial Bank of China (Winner) Limited Best Islamic Window of the year 2017 (Winner) Habib Bank Limited Best Islamic Bank of the year 2017 (Winner) Meezan Bank Limited Corporate Finance: Transaction of the year 2017 (Winner) Habib Bank Limited for Dasu Hydropower Project Best Corporate Finance House of the year (Fixed Income) 2017 United Bank Limited (Winner) Best Corporate Finance House of the year (Fixed Income) 2017Habib Bank Limited (Runner-up) Best Corporate Finance House of the year (Equity & Advisory) - Banks Bank Alfalah Limited 2017 (Winner) Best Corporate Finance House of the year (Equity & Advisory) - Banks United Bank Limited 2017 (Runner-up) Best Corporate Finance House of the year (Equity & Advisory) – Arif Habib Limited Security Firms 2017 (Winner) Best Corporate Finance House of the year (Equity & Advisory) – AKD Securities Limited Security Firms 2017 (Runner-up) Investor Relations: Best Investor Relations – Listed Companies 2017 (Winner) Bank Alfalah Limited Best Investor Relations – Listed Companies 2017 (Runner-up) Engro Fertilizers Limited Women in Finance Initiative: Gender Diversity at Workplace Award 2017 (Winner) Unilever Pakistan Limited Recognizing Gender Diversity Award – Special Recognition: Local National Foods Limited Industry 2017 (Winner) Recognizing Gender Diversity Award – Special Recognition: -

Final List of Voters 28-Aug-2021.Xlsx

SN MN Company Name Factory Address Tel # Fax # Name of Authorized Representative Mobile NIC # NTN ST # 1 26 STAR TEXTILE MILLS LTD A-41 SITE, KARACHI 32561127-29, 3251149 MUHAMMAD ZAHID 42101-1632401-5 0698459-2 02-02-5111-019-19 2 28 A.B.(Al-Hashmi Brothers) (PVT) LTD. H-6 SITE, Karachi. 32572963 mr aslam 42000-7647196-1 0704163-2 02-02-2811-003-55 3 41 KOHINOOR CHEMICAL CO. (PVT.) LIMITED 9TH FLOOR, TIBBET CENTRE, M. A. JINNAH ROAD, KHI 32578196 Mr. Aslam Allawala 0300-2150567 N/A 0710919-9 02-06-3302-001-91 4 46 HELIX PHARMA (PVT.) LIMITED A-56, SITE, KARACHI 32564393 TANWEER AHMED 0333-0202206 42201-0793883-7 0710606-8 11-01-7010-002-46 5 49 INDUS PENCIL INDUSTRIES B-54, SITE, KARACHI 32573216-7 32564931 MR. NAEEM AKHTAR YOUSUF 42201-0468514-1 0710696-3 02-02-3208-016-64 6 52 EXIDE PAKISTAN LIMITED A-44, SITE, Karachi 32591679 SYED ZULQARNAIN SHAH 0333-2244702 42000-0479156-9 0676659-5 02-01-8507-001-64 7 61 PAKISTAN CABLES LTD B-21, SITE, KARACHI 32564614 Aslam Sadruddin 0345-8907009 42301-4759734-3 0711509-1 02-02-7605-001-82 8 67 PAKISTAN PAPER PRODUCTS LIMITED D-58,ESTATE AVENUE,SITE, KARACHI 32579698/32579302/32569303 32579301, 32560880 ABID SYEED 42201-0241628-7 0999468-8 02-06-4816-005-73 9 69 S J & G FAZUL ELLAHIE (PVT) LTD. E-46 SITE, Karachi. 32573049 - 32574648 32565075 Mr Saeed Ahmed Danishmandi 42101-2233276-9 0635798-9 11-00-3004-008-82 10 78 M. -

Dai Ly Quotati

D A I LY Q U O TAT I O N S No. 161/2021 Wednesday, Sep 1, 2021 LISTED COMPANIES - 531 MARKET REPORT UPTO 04:15 LISTED CAPITAL 1,458,220.972 M TRADING VOLUME TRADING VALUE MARKET CAPITALIZATION COS. TOTAL Pre. 378,832,096 Pre. 14,023,728,426 Pre: Rs.8,290,427,669,434 P LUS. 307 Cur. 536,640,545 Cur. 14,368,773,492 Cur: Rs. 8,307,132,366,059 MINUS. 207 N.Change: 16,704,696,625 E QUA L. 20 TOTA L. 534 TRADING VOLUME (B&B) TRADING VALUE (B&B) REMARKS Pre. 0 Pre. 0 For further details, please see debt instrument segments hereunder Cur. 0 Cur. 0 PSX INDICES Index Code Previous Current High Low Change %age Change K S E-100 47,419.74 47,413.46 47,629.20 47,352.54 -6.28 -0.01 K S E-A LL-Shares 32,394.47 32,460.77 32,590.08 32,394.47 66.30 0.20 K S E-30 19,027.87 19,029.27 19,129.16 19,011.66 1.40 0.01 K MI-30 77,641.73 77,663.99 78,115.66 77,574.99 22.26 0.03 B K Ti 12,936.20 12,886.42 13,009.69 12,866.71 -49.78 -0.38 OGTi 12,244.10 12,239.90 12,345.54 12,223.88 -4.20 -0.03 P S X-K MI-All-Shares 23,461.71 23,525.33 23,613.54 23,461.71 63.62 0.27 UP P9 13,056.93 13,065.87 13,129.56 13,048.09 8.94 0.07 NITP GI 9,744.65 9,746.77 9,793.90 9,738.20 2.12 0.02 NB P P GI 11,757.52 11,770.22 11,830.08 11,757.52 12.70 0.11 MZNP I 10,854.55 10,861.58 10,918.47 10,850.82 7.03 0.06 APPLIED FOR LISTING PROSPECTUS/OFFER FOR SALE APPROVED BY THE EXCHANGE COMPANY Sr. -

Disciplinary Register – Issuers

Disciplinary Register - Issuers Under Regulation 14.6.1 of the CDC Regulations S. No. Name of the Issuer Security Type Date of Action Action taken Reason for action Consequent to restoration of trading by the PSX vide notice notice no. PSX/N-936 dated 1 Ordinary Shares 30-Jul-21 Removal of Suspension Husein Industries Limited July 30, 2021. Consequent to restoration of trading by the PSX vide notice notice no. PSX/N-935 dated 2 Ordinary Shares 30-Jul-21 Removal of Suspension Huffaz Seamless Pipe Industries Limited July 30, 2021. Consequent to the suspension trading by the PSX vide notice no. PSX/N-763 dated June 23, 1 Ordinary Shares 25-Jun-21 Suspended Islan d Textile Mills Limited 2021. Consequent to the suspension trading by the PSX vide notice no. PSX/N-764 dated June 23, 2 Ordinary Shares 25-Jun-21 Suspended Salfi Textile Mills Limited 2021. Consequent to restoration of trading by the PSX vide notice notice no. PSX/N-731 dated 3 Ordinary Shares 17-Jun-21 Revised Suspension SG Allied Businesses Limited (Formerly S.G. Fiber Limited) June 17, 2021. Consequent to restoration of trading by the PSX vide notice notice no. PSX/N-732 dated 4 Ordinary Shares 17-Jun-21 Revised Suspension S.G. Power Limited June 17, 2021. 5 Jubilee Spinning & Weaving Mills Limited Ordinary Shares 5-May-21 Censure Letter Non-Compliance of CDC Regulations 6 TRG Pakistan Limited - CLASS ‘A’ Ordinary Shares Class 'A' 3-May-21 Censure Non-Compliance of CDC Regulations consequent to restoration of trading by the PSX vide notice notice no. -

Tackling Childcare Pakistan: Creating Family-Friendly Workplaces / Insights from IFC-PBC Peer Learning Collaboration

Tackling Childcare Pakistan: Creating Family-Friendly Workplaces Insights from an IFC-PBC Peer-Learning Collaboration IN PARTNERSHIP WITH About IFC IFC – a member of the World Bank Group—is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2020, we invested $22 billion in private companies and financial institutions in developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity. For more information, visit www.ifc.org. About PBC The Pakistan Business Council is the country’s premier research-based business advocacy body that promotes policies to sustainably foster growth of jobs, exports and import substitution. Its Centre of Excellence in Responsible business works towards lifting the capacity of business to act responsibly. For more information, visit www.pbc.org.pk. Disclaimer © International Finance Corporation 2021. All rights reserved. 2121 Pennsylvania Avenue, N.W. Washington, D.C. 20433 Internet: www.ifc.org The material in this work is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. IFC encourages dissemination of its work and will normally grant permission to reproduce portions of the work promptly, and when the reproduction is for educational and non-commercial purposes, without a fee, subject to such attributions and notices as we may reasonably require. IFC does not guarantee the accuracy, reliability, or completeness of the content included in this work, or for the conclusions or judgments described herein, and accepts no responsibility or liability for any omissions or errors (including, without limitation, typographical errors and technical errors) in the content whatsoever or for reliance thereon. -

Teaming up for Success

. Real business . Real people . Real experience Teaming Up for Success Reward Advisory Services AFGHANISTAN: Remuneration Benchmarking Survey 2007 February 2007 A. F. Ferguson & Co. , A member firm of Chartered Accountants 2 AFGHANISTAN Remuneration Benchmarking Survey 2007 PwC would like to invite your organization to participate in the Remuneration Benchmarking Survey 2007 which will be conducted once every year. This survey will cover all multinational organizations and local companies in AFGHANISTAN, regardless of any particular industry/ sector. This effort is being formulated so as to bring organizations at par with other players in market-resulting by bringing sanity to management and HRM practice in Afghanistan especially during reconstruction era. The survey will comprise of two parts: • Part A – remuneration to personnel in managerial and executive cadres (excluding CEOs/ Country Heads) • Part B – remuneration to CEOs/ Country Heads (international and local nationals separately) • Part C – remuneration to non-management cadre Each report is prepared separately, and participants may choose to take part in either one or all three sections of the survey. Job benchmarking and data collection from the participating organizations will be done through personal visits by our consultants. A structured questionnaire will be used to record detailed information on salaries, allowances, all cash and non-cash benefits and other compensation policies. The collected information will be treated in strict confidence and the findings of the survey will be documented in the form of a report, which will be coded. Each participating organization will be provided a code number with which they can identify their own data and the report will only be available to the participant pool. -

List of Importing Companies in Pakistan for the Following Product Product Category: Food Preparations 090921 Coriander Seeds, Neither Crushed Nor Ground

List of importing companies in Pakistan for the following product Product category: Food preparations 090921 Coriander seeds, neither crushed nor ground Number of product Company name or service categories Number of employees Country City traded A. Rahim Foods Private Limited - A. Rahim Foods 5 140 Pakistan Lahore ABDOOLALLY MOOSABHOY & SONS 4 40 Pakistan Karachi Abdullah Sugar Mills Limited - Asml 6 300 Pakistan Lahore ADAM TEA LTD 5 350 Pakistan Karachi AL-ABBAS SUGAR MILLS LTD. 5 549 Pakistan Karachi Al-Noor Sugar Mills Limited - Alnrs 4 815 Pakistan Karachi Alliance Sugar Mills Private Limited - Alliance Sugar Mills 2 371 Pakistan Lahore Almoiz Industries Limited - Ail 6 3000 Pakistan Lahore BROOKE BOND PAKISTAN LTD 5 2000 Pakistan Karachi 75750 Brother Sugar Mills Limited - Brother Sugar Mills 2 900 Pakistan Lahore Chanar Sugar Mills Ltd - Csml 2 1000 Pakistan Lahore CHAUDHRY SUGAR MILLS LIMITED 3 1200 Pakistan Lahore CHAWLA INTERNATIONAL 3 20 Pakistan Karachi CLOVER PAKISTAN LIMITED 1 150 Pakistan Karachi Colony Sugar Mills Limited - Colony Sugar Mills 6 1895 Pakistan Lahore CRESCENT SUGAR MILLS & DISTILLERY LIMITED 2 1615 Pakistan Lahore CSK LIMITED 2 450 Pakistan Lahore EDEN'S MILK PRODUCTS 5 0 Pakistan Sahiwal Number of product Company name or service categories Number of employees Country City traded Engro Foods Limited - Efoods 6 800 Pakistan Karachi Etihad Sugar Mills Limited - Etihad 1 400 Pakistan Lahore Far Eastern Impex (Private) Limited. - Fei 6 75 Pakistan Karachi Farhan Food Industries (Pvt) Ltd. - Farhan Food Industries 5 200 Pakistan Karachi FAUJI FRESH N FREEZE LIMITED 5 43 Pakistan Rawalpindi Garibsons (Private) Limited - Garibsons 6 0 Pakistan Karachi GOJRA SAMUNDRI SUGAR MILLS LIMITED 1 0 Pakistan Lahore H. -

Annual Report 2015

Heritage of Flavors Heritage of Flavors Annual Report 2015 Nationaltional Foods Limited Limi 12/CL-6 Claremont Road, Civil Lines, Karachi. UAN: 111-222-282 Email: [email protected] Website: www.nfoods.com About this Report Embracing the richness of Pakistani culture and cuisine, NFL celebrates its 45th anniversary of delivering excellence. This year's annual report pays homage to the traditions and values we cherish, establishing our legacy of providing nutritious, hygienic and premium quality products. The colors and design of this report have been carefully orchestrated to represent our irreplaceable warm heritage and vibrant essence of food. Illustrating the extensive pallets of Pakistan, it aims to provide a holistic outlook of National’s portfolio; from spicy condiments, hearty main dishes to delectable desserts. It is a journey of flavors depicting every aspect of food and culture brought to life by NFL. eport ’ R # 57 Financial Review rs 51 to 58 DuPont Analysis c e 59 Financial Ratios r i 60 Horizontal Analysis of D List 61 Vertical Analysis Content Flow sh s # 64 Statement of Value a 6 C 2 Added and its Distribution r a e 65 Pattern of Shareholding Y 67 Statement of Compliance with the x ry # 04 06 Business Profile i Code of Corporate Governance to S S r 08 Geographical Presence 69 Review Report to the Members on u 10 Founders’ Philosophy Compliance with the Code of O 12 Vision & Mission Corporate Governance 14 Core Values Financial ics ne Eth & lo nts # 70 f a e 143 Notice of Annual General Meeting o tices d m e c # 1 18 Company Information n te ra 6 a 148 Comparative Statement of Existing and a l d P t t 20 Calendar of Major Events a o s S Proposed (Alterations & Additions) in s S i C e 21 Organizational Chart c the Articles of Association n n 6 i a 22 Directors’ Profile 0 s 157 Glossary n 1 u i 26 CEO’s Message F # B 158 Jama Punji Information C d s on ate t Form of Proxy solid en Statem National Foods Limited (NFL), founded in 1970, is Pakistan’s leading multi category foods company with over 250 different products in 12 categories. -

Association of Dividend and Share Price in Longrun

Association of Dividend and Share Price in Longrun Malik Muhammad Shehryar Khan*, Zubair Ali Shahid†,Agha Amad Nabi‡, and Akhtiar Ali§ Abstract This research is to scrutinize the long-haul causal relationship between dividend and share price. It helpsinvestors to make right decisions and also organization to build dividend policy. Prior to this, FMOLS shows long-run associationto dividend that influence share price. Panel unit root tests, Panel Least Squares test and Granger Causality tests are used for statistic findings of unit root test thataffects the results of existing long-run causal link between the variables. 50 non- financial organizationsof different sectors are selected from the panel of KSE-100 index, 25 top listed firms are selected from KSE-100 and 25 are multinational organizations are selected. The criteria for the selected firms are that those organization that have paid the dividend from 2003-2013 for at least three consecutive years. The result of the causal relationship between variables explainsthe movement of the share prices into two opposite direction. Keywords:Share Price, Dividend, Unit Root Process Introduction News about the economy is vital and imperative for the financial specialist's to learn and analyze situations. Most agents decode or explain what is going on in the business sector by taking a glance at the business records. Thus, the significance of business stock concerning the industry is essential for the comprehension of the general pattern in the industry. In Pakistan there are 3 indexes that are running in which KSE-100 index seems to be better and also unpredictable because of the movement of the stocks. -

European Academic Research

EUROPEAN ACADEMIC RESEARCH Vol. IV, Issue 1/ April 2016 Impact Factor: 3.4546 (UIF) ISSN 2286-4822 DRJI Value: 5.9 (B+) www.euacademic.org Impact of Capital Structure on Firm Performance: Moderating role of Corporate Governance MUHAMMAD SHAUKAT MALIK Alfalah Institute of Banking and Finance Bahauddin Zakariya University, Multan Pakistan [email protected] LAILA NAZ M.Phil Scholar Alfalah Institute of Banking and Finance Bahauddin Zakariya University, Multan Pakistan [email protected] Abstract: Purpose – The aim of this study is to empirically test the impact of capital structure on firm performance and to investigate the moderating role of corporate governance. Design/methodology/approach – This study examines the capital structure impact on firm performance of non financial companies listed at Karachi Stock Exchange. 100 companies were taken as sample of the study. Panel data was analyzed by regression analysis, fixed-effects model is considered as most appropriate technique for extracting results. Findings – The study disclosed that capital structure has significant and positive impact on firm performance and corporate governance act as moderator and enhances the firm’s performance. Research limitations/implications – Due to limited access to data of the non financial companies, and non availability of their share prices and annual reports we were unable to increase our sample size and to get more reliable results. Deliberate application of corporate governance is necessary, for betterment of the management to mitigate 270 Muhammad Shaukat Malik, Laila Naz- Impact of Capital Structure on Firm Performance: Moderating role of Corporate Governance the opportunistic behavior and to increase the firm performance. So managers must focus on this aspect.