Statkraft As C6,000,000,000 Euro Medium Term Note

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ARAMARK HOLDINGS CORPORATION (Exact Name of Registrant As Specified in Its Charter) ______

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ___________________________________________ FORM 10-Q ___________________________________________ x QUARTERLY REPORT PURSUANT TO SECTION 13 or 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Quarterly Period Ended March 28, 2014 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 001-36223 ___________________________________________ ARAMARK HOLDINGS CORPORATION (Exact name of registrant as specified in its charter) ___________________________________________ Delaware 20-8236097 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification Number) ARAMARK Tower 1101 Market Street Philadelphia, Pennsylvania 19107 (Address of principal executive offices) (Zip Code) (215) 238-3000 (Registrant’s telephone number, including area code) ___________________________________________ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that registrant was required to submit and post such files). Yes x No ¨ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. -

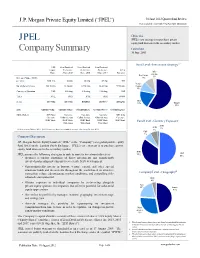

JPEL Company Summary

J.P. Morgan Private Equity Limited (“JPEL”) 30 June 2012 Quarter End Review Professional Investors Only – Not For Public Distribution Objective JPEL JPEL’s core strategy is to purchase private equity fund interests in the secondary market. Company Summary Launched 30 June 2005 Fund Level - Investment Strategy1,2 US$ Zero Dividend Zero Dividend Zero Dividend Eqqyuity Preference Preference Preference JPEL IfInfra- Share Share 2013 Share 2015 Share 2017 Warrants structure Real Estate 3% Net Asset Value (“NAV”) 9% per share US$ 1.14 68.05p 65.31p 69.25p N/A Venture No. of shares in issue 380.35 mm 63.16 mm 67.08 mm 30.41 mm 57.90 mm Capital 10% Currency of Quotation US$ £ Sterling £ Sterling £ Sterling US$ Ticker JPEL JPEZ JPZZ JPSZ JPWW Sedol B07V0H2 B07V0R2 B00DDT8 B5N4JV7 B60XDY5 DbtDebt 19% Buyout 59% ISIN GB00B07V0H27 GB00B07V0R25 GG00B00DDT81 GG00B5N4JV75 GG00B60XDY53 Market Makers ABN Amro Cazenove Cazenove Cazenove ABN Amro Cazenove Collins Stewart Collins Stewart Collins Stewart Cazenove HSBC Bank HSBC Bank HSBC Bank HSBC Bank HSBC Bank Fund Level - Currency Exposure1 Winterflood Winterflood Winterflood AED AUD 1% All figures as at 30 June 2012. NAV Figures are based based on unaudited net asset values as at 30 June 2012 . 7% GBP 7% Company Description J.P. Morgan Private Equity Limited (“JPEL” or the “Company”) is a global private equity fund listed on the London Stock Exchange. JPEL’s core strategy is to purchase private equity fund interests in the secondary market. EUR 35% USD JPEL pursues the following strategies to seek to meet its investment objectives 50% •Acquires secondary portfolios of direct investments and siggynificantly invested partnership investments to accelerate NAV development. -

Case 20-32299-KLP Doc 208 Filed 06/01/20 Entered 06/01/20 16

Case 20-32299-KLP Doc 208 Filed 06/01/20 Entered 06/01/20 16:57:32 Desc Main Document Page 1 of 137 Case 20-32299-KLP Doc 208 Filed 06/01/20 Entered 06/01/20 16:57:32 Desc Main Document Page 2 of 137 Exhibit A Case 20-32299-KLP Doc 208 Filed 06/01/20 Entered 06/01/20 16:57:32 Desc Main Document Page 3 of 137 Exhibit A1 Served via Overnight Mail Name Attention Address 1 Address 2 City State Zip Country Aastha Broadcasting Network Limited Attn: Legal Unit213 MezzanineFl Morya LandMark1 Off Link Road, Andheri (West) Mumbai 400053 IN Abs Global LTD Attn: Legal O'Hara House 3 Bermudiana Road Hamilton HM08 BM Abs-Cbn Global Limited Attn: Legal Mother Ignacia Quezon City Manila PH Aditya Jain S/O Sudhir Kumar Jain Attn: Legal 12, Printing Press Area behind Punjab Kesari Wazirpur Delhi 110035 IN AdminNacinl TelecomunicacionUruguay Complejo Torre De Telecomuniciones Guatemala 1075. Nivel 22 HojaDeEntrada 1000007292 5000009660 Montevideo CP 11800 UY Advert Bereau Company Limited Attn: Legal East Legon Ars Obojo Road Asafoatse Accra GH Africa Digital Network Limited c/o Nation Media Group Nation Centre 7th Floor Kimathi St PO Box 28753-00100 Nairobi KE Africa Media Group Limited Attn: Legal Jamhuri/Zaramo Streets Dar Es Salaam TZ Africa Mobile Network Communication Attn: Legal 2 Jide Close, Idimu Council Alimosho Lagos NG Africa Mobile Networks Cameroon Attn: Legal 131Rue1221 Entree Des Hydrocarbures Derriere Star Land Hotel Bonapriso-Douala Douala CM Africa Mobile Networks Cameroon Attn: Legal BP12153 Bonapriso Douala CM Africa Mobile Networks Gb, -

Programme for the Issuance of Debt Instruments

INFORMATION MEMORANDUM AEGON N.V. (incorporated with limited liability in The Netherlands and having its corporate seat in The Hague) Programme for the Issuance of Debt Instruments Application has been made to the Financial Services Authority (in its capacity as competent authority for the purposes of Part VI of the Financial Services and Markets Act 2000 (the ‘‘FSMA’’), the ‘‘UKLA’’) for debt instruments (the ‘‘Instruments’’) issued under the programme (the ‘‘Programme’’) described in the Information Memorandum (as defined below) during the period of twelve months from the Publication Date (the date of this Information Memorandum) to be admitted to the Official List of the UKLA and to trading on the London Stock Exchange plc (the ‘‘London Stock Exchange’’). This Information Memorandum supersedes the Information Memorandum dated 18th December, 2002 in relation to the Programme and comprises listing particulars (‘‘Listing Particulars’’) issued in compliance with the listing rules made under Section 74 of the FSMA (the ‘‘Listing Rules’’) for the purpose of giving information with regard to the issue during the period of twelve months from the Publication Date of Instruments under the Programme. Copies of the Listing Particulars, have been delivered for registration to the registrar of Companies in England and Wales in accordance with Section 83 of the FSMA. Arranger for the Programme MORGAN STANLEY Dealers ABN AMROBARCLAYS CAPITAL CITIGROUPCREDIT SUISSE FIRST BOSTON DEUTSCHE BANKDRESDNER KLEINWORT WASSERSTEIN GOLDMAN SACHS INTERNATIONALJPMORGAN LEHMAN BROTHERSMERRILL LYNCH INTERNATIONAL MORGAN STANLEYUBS INVESTMENT BANK 18th December, 2003 AEGON N.V. (the ‘‘Issuer’’) accepts responsibility for the information contained in these listing particulars. To the best of the knowledge and belief of the Issuer (who has taken all reasonable care to ensure that such is the case), the information contained in the listing particulars is in accordance with the facts and does not omit anything likely to affect the import of such information. -

Bskyb Finance UK

PROSPECTUS BSkyB Finance UK plc (incorporated with limited liability in England and Wales) (Registered Number 05576975) and British Sky Broadcasting Group plc (incorporated with limited liability in England and Wales) (Registered Number 02247735) £1,000,000,000 Euro Medium Term Note Programme unconditionally and irrevocably guaranteed by BSkyB Finance UK plc BSkyB Publications Limited British Sky Broadcasting Group plc British Sky Broadcasting Limited Sky Subscribers Services Limited Sky In-Home Service Limited and BSkyB Investments Limited Under the Euro Medium Term Note Programme described in this Prospectus (the “Programme”), BSkyB Finance UK plc (“BSkyB Finance”) and British Sky Broadcasting Group plc (“BSkyB”) (each an “Issuer” and together, the “Issuers”), subject to compliance with all relevant laws, regulations and directives, may from time to time issue Euro Medium Term Notes (the “Notes”). Notes issued by BSkyB Finance will be guaranteed by BSkyB, British Sky Broadcasting Limited (“BSkyB Limited”), BSkyB Publications Limited (“BSkyB Publications”), Sky Subscribers Services Limited (“Sky Subscribers”), Sky In-Home Service Limited (“Sky In-Home”) and BSkyB Investments Limited (“BSkyB Investments”). Notes issued by BSkyB will be guaranteed by BSkyB Finance, BSkyB Limited, BSkyB Publications, Sky Subscribers, Sky In-Home and BSkyB Investments (when acting in its capacity as guarantor of the relevant Notes, each such entity (subject to change in accordance with Condition 3(c)) and any acceding guarantor is referred to as a “Guarantor” and the Guarantors of the Notes issued by BSkyB Finance are together, referred to herein as the “Guarantors”). The aggregate nominal amount of Notes outstanding will not at any time exceed £1,000,000,000 (or the equivalent in other currencies). -

Global ABS/CDO Weekly Market Snapshot

Global Structured Finance Research J.P. Morgan Securities Inc. New York June 10, 2004 Global ABS/CDO Weekly Market Snapshot Contents Investment Themes: We continue to recommend longer-dated ABS in the context of position for yield curve flattening as the Fed starts to US Relative Value 2 tighten. In addition, we like subordinates ABS based on solid fundamentals and attractive spread pickup in lower rated credits. The single- Spreads Volatility 3 A segment of the credit curve remains cheap across ABS sectors. CDS Spreads 5 Issuance 18 This Week: US ABS. ABS issuance totaled roughly $5.4bn over the last four days, including $2.5bn in HEL ABS and a large $1.4bn Europe Spreads 42 Credit Card deal. Within the Home Equity sector this year, deals backed entirely by second lien mortgages tallies up to just over $2bn across Issuance 43 six transactions. Investors’ desire to diversify and the scarcity value of paper are creating favorable technicals in that segment. Year-to-date Asia Spreads 52 Issuance 53 supply currently stands at $241bn. AAA spreads were unchanged on the week. BBB Credit Card ABS spreads tightened 5bp on the long CDO Spreads 58 maturities (7-year and beyond). BBB HEL spreads narrowed as well with better bids from CDOs, while mezzanines tranches are still Issuance 60 experiencing light demand and weak pricing. Pipeline 75 Rating Changes 89 European ABS. The pace of the new issue market remains brisk ahead of next week's ABS conference, with many issuers hoping to price Ratings Watch 92 their transactions ahead of a growing post-conference pipeline. -

Caspar Agnew

Financial Services Authority FINAL NOTICE To: Caspar Jonathan William Agnew Address: J.P. Morgan Securities Limited JPMorgan Chase Bank, N.A. 125 London Wall London EC2Y 5AJ Individual Reference No: CJA01049 Date: 3 October 2011 TAKE NOTICE: The Financial Services Authority of 25 The North Colonnade, Canary Wharf, London E14 5HS ("the FSA") gives Caspar Jonathan William Agnew final notice about a requirement to pay a financial penalty of £65,000: 1. ACTION 1.1. The FSA gave Mr Agnew a Decision Notice on 19 August 2011, which notified him that for the reasons given below and pursuant to section 66(1) of the Financial Services and Markets Act 2000, the FSA had decided to impose on Mr Agnew a financial penalty of £65,000 on the grounds that Mr Agnew has failed to exercise due skill, care and diligence in breach of Principle 2 of the FSA’s Statement of Principle and Code of Practice for Approved Persons. 1.2. Mr Agnew has notified the FSA that he will not refer the matter to the Upper Tribunal (Tax and Chancery Division). Accordingly, the FSA hereby imposes on Mr Agnew a financial penalty of £65,000. 2. SUMMARY OF REASONS FOR THE ACTION 2.1. This notice is issued to Mr Agnew as a result of his conduct on 15 June 2009 and immediately thereafter. At that time he was approved to perform the Customer Function (CF 30), a controlled function, at an investment bank, JP Morgan Cazenove Limited (“the Bank”). This role permitted him to execute orders on behalf of customers in relation to the sale and purchase of investments. -

XCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) |X| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended November 30, 2005 or |_| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ______________ to ________________ Commission file number: 1-9610 Commission file number: 1-15136 Carnival Corporation Carnival plc ---------------------------- ---------------------------- (Exact name of registrant as (Exact name of registrant as specified in its charter) specified in its charter) Republic of Panama England and Wales ------------------------------- ------------------------------- (State or other jurisdiction of (State or other jurisdiction of incorporation or organization) incorporation or organization) 59-1562976 98-0357772 ------------------- ------------------- (I.R.S. Employer (I.R.S. Employer Identification No.) Identification No.) 3655 N.W. 87th Avenue Carnival House, 5 Gainsford Street, Miami, Florida 33178-2428 London SE1 2NE, United Kingdom ------------------------- ------------------------------ (Address of principal (Address of principal executive offices) executive offices) (Zip code) (Zip code) (305) 599-2600 011 44 20 7940 5381 ------------------------------ ------------------------------ (Registrant's telephone number, (Registrant's telephone number, including area code) including area code) Securities registered pursuant Securities registered pursuant to -

8-K Filed December 8, 2015

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of report (Date of earliest event reported): December 2, 2015 IDEXX LABORATORIES, INC. (Exact name of registrant as specified in its charter) Delaware 000-19271 01-0393723 (State or other jurisdiction (Commission File Number) (IRS Employer Identification No.) of incorporation) One IDEXX Drive, Westbrook, Maine 04092 (Address of principal executive offices) (ZIP Code) 207.556.0300 (Registrant’s telephone number, including area code) Not Applicable (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Item 1.01. Entry into a Material Definitive Agreement. On December 4, 2015, IDEXX Laboratories, Inc. (the “Company”), with IDEXX Distribution, Inc., IDEXX Operations, Inc., OPTI Medical Systems, Inc., IDEXX Laboratories Canada Corporation, and IDEXX Europe B.V., each a wholly-owned subsidiary (whether directly or indirectly held) of the Company (collectively, the “Borrowers”), entered into a second amended and restated credit agreement relating to a five-year unsecured revolving credit facility (the “Credit Agreement”) in the principal amount of $850 million, among the Borrowers, the lenders party thereto, JPMorgan Chase Bank, N.A., as administrative agent, JPMorgan Chase Bank, N.A., Toronto Branch, as Toronto agent, and J.P. -

Jpmorgan Chase Bank, N.A

SUPPLEMENT No. 10 DATED 7 APRIL 2011 TO THE BASE PROSPECTUS DATED 14 MAY 2010 J.P. Morgan Structured Products B.V. (incorporated with limited liability in The Netherlands) as Issuer J.P. Morgan Bank Dublin plc (incorporated with limited liability in Ireland) as Issuer J.P. Morgan Indies SRL (incorporated as a society with restricted liability in Barbados) as Issuer JPMorgan Chase Bank, N.A. (a national banking association organised under the laws of the United States of America) as Issuer and as Guarantor in respect of Securities issued by J.P. Morgan Structured Products B.V. JPMorgan Chase & Co. (incorporated in the State of Delaware, United States of America) as Issuer and as Guarantor in respect of Securities issued by J.P. Morgan Bank Dublin plc and J.P. Morgan Indies SRL Structured Products Programme for the issuance of Notes, Warrants and Certificates Arranger and Dealer for the Programme J.P. Morgan Supplement to the Base Prospectus This supplement (the "Supplement") constitutes a supplement to the base prospectus dated 14 May 2010 (the "Original Base Prospectus") as supplemented by Supplement No. 1 dated 4 June 2010, Supplement No. 2 dated 4 August 2010, Supplement No. 3 dated 24 August 2010, Supplement No. 4 dated 8 September 2010, Supplement No. 5 dated 12 October 2010, Supplement No. 6 dated 26 October 2010, Supplement No. 7 dated 30 November 2010, Supplement No. 8 dated 25 January 2011 and Supplement No. 9 dated 9 March 2011 to the Original Base Prospectus (the Original Base Prospectus, as so supplemented, the "Base Prospectus") prepared in connection with the issue of non- equity securities under the Structured Products Programme for the issuance of Notes, Warrants and Certificates (the "Programme") by J.P. -

127286 Fujian

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. When considering what action you LR 13.3.1(4) should take, you are recommended to seek your own personal financial advice from your stockbroker, bank manager, solicitor, accountant, fund manager or other appropriately qualified independent financial adviser authorised under the Financial Services and Markets Act 2000 immediately. This document comprises a prospectus relating to Fidelity Asian Values PLC prepared in accordance with the Prospectus Rules made under LR 2.2.10(2)(a) section 84 of the Financial Services and Markets Act 2000 in order to make an offer of transferable securities to the public and to admit the transferable securities to trading on the London Stock Exchange. This document has been approved by and filed with the Financial Services Authority in accordance with the Prospectus Rules. This document and the information herein relates expressly to the Subscription Shares. Application will be made to the Financial Services Authority for the Subscription Shares to be admitted to the Official List. Application will III 6.1 also be made to the London Stock Exchange for all such Subscription Shares to be admitted to trading on the London Stock Exchange’s market LR 2.2.9(1) for listed securities. If you sell or have sold or otherwise transferred all of your Ordinary Shares, please send this document, Form of Proxy LR 13.3.1(6) and/or Voting Instruction Form at once to the purchaser or transferee or to the bank, stockbroker or other agent through whom or by whom the sale or transfer was made, for delivery to the purchaser or transferee. -

Application Form

Morgan Stanley Investment Management (Ireland) Limited Application Form Morgan Stanley Investment Funds Société d’Investissement à Capital Variable Luxembourg (“SICAV”) This form is for investment in the Morgan Stanley Investment Funds. Before completion, please ensure that you read the notes and instructions contained overleaf. Job No: 45486 Proof Event: 1 Park Communications Ltd Alpine Way London E6 6LA Customer: Morgan Stanley Project Title: English Application Form T: 0207 055 6500 F: 020 7055 6600 Morgan Stanley Investment Funds Application Form August 2021 Important notes 1. Account Holder details sub-indicators: X, M, R and RM. Please indicate if you would prefer to reinvest dividend All applicants should complete this section in full. Please indicate if you are an existing Morgan distributions in the relevant fund (each a “Fund”) or receive a cash payment. If no indication Stanley Investment Funds (the “Company”) client, and where applicable, provide your account is made, the money will be automatically reinvested in the same Fund. number. 4. Fund selection 2. Tax Status of Applicant For each Fund you wish to invest in, please indicate the following information: In order to comply with obligations under Luxembourg law and tax regulations that enable a) Please print the name of the Fund you wish to invest in. the automatic exchange of information, including OECD Common Reporting Standard (“CRS”) and U.S. Foreign Account Tax Compliance Act (“FATCA”), we are required to collect certain b) Please print the corresponding ISIN code as shown on www.morganstanleyinvestmentfunds.com. information about the investor’s tax residency and citizenship. In certain circumstances we may c) Enter the class of share that you wish to invest in.