Bskyb Finance UK

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Etfsat-H10D Assessthis Well Thought-Out and Unobtrusive'5qish' Dish

fAdAf'o,.n Deepintotechn y Flat-platerotation is provided by the well-engineeredmount, in addition to the usualelevation and azimuth etfsat-H10D assessthis well thought-out and unobtrusive'5qish' dish. Squarialfor the 21st century? Doyou remember the'Squarial'fl at-plate satellite Shopis working on newhardware that will enable the aerialthat helped to sellthe ill-fatedSky Sqishto be mountedcloser to thewall competitor,BSB, nearly 20 years ago? TheSqish is no moredifficult to erectthan a standard wasincredibly hi+ech for itsday Backthen, as now, all dishThe wall bracket could be better;it's pressed outwards domesticsatellite systems used lhe typicaldish to forma lipthat makes tightening nuts (Rawlbolts and so theplastic frontage of a Squarial,the LNBwas driven on)tricky because there's little clearance between the complexarray of tinyaerials and waveguides The mountingholes and the metalwork workedwell, but it wasn'tready on timeand it was Alignrnentis also easy In addition to the usualazimuth to produce andelevation adjustments - which are precise, with no flat-platesatellite antennas are smaller, less unwantedplay - isthe ability to rotatethe panelThis ls the andmore attractive than a dish theydon't rust , equivalentofthe skewadjustment found on the LNB Butthey're still far moreexpensive to make,which bracketofconventional dishes which ensures that the heldback their take-up LNB'svertical and horizontal probes are accurately aligned Product:Selfsat-H 10D/Sqish flat-plateaerial we're examining here is rectangular withthe appropriately -

ARAMARK HOLDINGS CORPORATION (Exact Name of Registrant As Specified in Its Charter) ______

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ___________________________________________ FORM 10-Q ___________________________________________ x QUARTERLY REPORT PURSUANT TO SECTION 13 or 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Quarterly Period Ended March 28, 2014 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 001-36223 ___________________________________________ ARAMARK HOLDINGS CORPORATION (Exact name of registrant as specified in its charter) ___________________________________________ Delaware 20-8236097 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification Number) ARAMARK Tower 1101 Market Street Philadelphia, Pennsylvania 19107 (Address of principal executive offices) (Zip Code) (215) 238-3000 (Registrant’s telephone number, including area code) ___________________________________________ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that registrant was required to submit and post such files). Yes x No ¨ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. -

Sky Corporate Responsibility Review 2005–06

13671_COVER.qxd 15/8/06 1:54 pm Page 1 British Sky Broadcasting Group plc GRANT WAY, ISLEWORTH, Sky Corporate Responsibility Review 2005–06 MIDDLESEX TW7 5QD, ENGLAND TELEPHONE 0870 240 3000 British Sky Broadcasting Group plc FACSIMILE 0870 240 3060 WWW.SKY.COM REGISTERED IN ENGLAND NO. 2247735 British Sky Broadcasting Group plc Group Broadcasting Sky British Corporate ResponsibilityCorporate 2005–06 Review 13671_COVER.qxd 21/8/06 1:26 pm Page 49 WHAT DO YOU WANT TO KNOW? GRI INDICATORS THE GLOBAL REPORTING INITIATIVE (GRI) GUIDELINES IS A FRAMEWORK FOR VOLUNTARY REPORTING ON AN ORGANISATION’S CORPORATE RESPONSIBILITY PERFORMANCE. THE FOLLOWING TABLE SHOWS WHERE WE HAVE REPORTED AGAINST THESE GUIDELINES. We’re inviting you to find out more about Sky. This table shows you where to find the information you’re interested in. SECTION SEE PAGE GRI INDICATORS WELCOME TO SKY A broader view.......................................4 A major commitment.............................5 INSIDE FRONT COVER/CONTENTS 2.10, 2.11, 2.12, 2.22, S04 Business overview..................................6 Talking to our stakeholders....................8 LETTER FROM THE CEO 1 1.2 WELCOME TO SKY 3 1.1, 2.2, 2.4, 2.5, 2.7, 2.8, 2.9, 2.13, 2.14, 3.9, 3.10, 3.11, 3.12, 3.15, EC1, LA4, S01 Choice and control................................12 BUILDING ON OUR BUILDING ON OUR FOUNDATIONS 11 2.19, 3.15, 3.16, EN3, EN17, EN4, EN19, EN5, EN8, EN11, PR8 FOUNDATIONS In touch with the odds.........................14 Customer service..................................15 Our environment..................................16 -

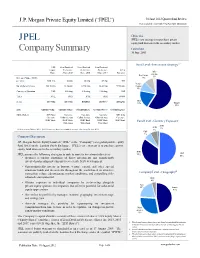

JPEL Company Summary

J.P. Morgan Private Equity Limited (“JPEL”) 30 June 2012 Quarter End Review Professional Investors Only – Not For Public Distribution Objective JPEL JPEL’s core strategy is to purchase private equity fund interests in the secondary market. Company Summary Launched 30 June 2005 Fund Level - Investment Strategy1,2 US$ Zero Dividend Zero Dividend Zero Dividend Eqqyuity Preference Preference Preference JPEL IfInfra- Share Share 2013 Share 2015 Share 2017 Warrants structure Real Estate 3% Net Asset Value (“NAV”) 9% per share US$ 1.14 68.05p 65.31p 69.25p N/A Venture No. of shares in issue 380.35 mm 63.16 mm 67.08 mm 30.41 mm 57.90 mm Capital 10% Currency of Quotation US$ £ Sterling £ Sterling £ Sterling US$ Ticker JPEL JPEZ JPZZ JPSZ JPWW Sedol B07V0H2 B07V0R2 B00DDT8 B5N4JV7 B60XDY5 DbtDebt 19% Buyout 59% ISIN GB00B07V0H27 GB00B07V0R25 GG00B00DDT81 GG00B5N4JV75 GG00B60XDY53 Market Makers ABN Amro Cazenove Cazenove Cazenove ABN Amro Cazenove Collins Stewart Collins Stewart Collins Stewart Cazenove HSBC Bank HSBC Bank HSBC Bank HSBC Bank HSBC Bank Fund Level - Currency Exposure1 Winterflood Winterflood Winterflood AED AUD 1% All figures as at 30 June 2012. NAV Figures are based based on unaudited net asset values as at 30 June 2012 . 7% GBP 7% Company Description J.P. Morgan Private Equity Limited (“JPEL” or the “Company”) is a global private equity fund listed on the London Stock Exchange. JPEL’s core strategy is to purchase private equity fund interests in the secondary market. EUR 35% USD JPEL pursues the following strategies to seek to meet its investment objectives 50% •Acquires secondary portfolios of direct investments and siggynificantly invested partnership investments to accelerate NAV development. -

(“JCRA”) Decision M622/10 Acquisition of Virgin Media

Jersey Competition Regulatory Authority (“JCRA”) Decision M622/10 Acquisition of Virgin Media Television Rights Limited and Virgin Media Television Limited by British Sky Broadcasting Group plc The Notified Transaction 1. On 13 August 2010, the JCRA received an application (the “ Application ”) for approval under Articles 20 and 21 of the Competition (Jersey) Law 2005 (the “Law ”) concerning the acquisition of Virgin Media Television Rights Limited and Virgin Media Television Limited, together with the rights to all assets used exclusively in the Virgin Media television business acquisition (together: “VMTV ”) by British Sky Broadcasting Group plc (“ Sky ”), through the intermediary Kestrel Broadcasting Limited. 2. The JCRA published a notice of its receipt of the Application in the Jersey Gazette and on its website on 17 August 2010, inviting comments on the Acquisition by 31 August 2010. During this period, the JCRA received one written submission concerning the Acquisition. This submission is discussed in more detail in paragraph 29 below. In addition to public consultation, the JCRA conducted its own market enquiries concerning the Acquisition. 3. In addition to Jersey, the parties stated that the acquisition had been notified with the relevant authorities in the UK and the Republic of Ireland. On 29 June 2010 the Irish Competition Authority approved the Acquisition. The JCRA has had contact with the Office of Fair Trading (“ OFT ”), the UK authority, regarding the acquisition. The Parties (a) Sky 4. Sky is incorporated in England and Wales and its shares are listed on the London Stock Exchange. The worldwide turnover in the year ending June 2009 was approximately £5.4 billion. -

2 Way Signal Booster with IR Bypass 27822BMR User Guide Digilink

2 Way Signal Booster with IR Bypass 27822BMR User Guide DigiLink Introduction Congratulations on the purchase of your new If you have any queries please get in touch SLx Booster. SLx is renowned for producing with our technical department at high quality electrical accessories and www.slxtechnology.com/support signal distribution products. Slx Boosters have a number of features that assist quality Additional Features distribution of your TV and/or Radio signals SLx Bypass boosters have an IR bypass circuit around your home, including: and are DigiLink compatible, which means • More efficient Switch-Mode Power Supply - you have the option to control a digital these run cooler saving energy whilst also satellite receiver via a Link-eye in another making them safer in your home room using the original or a compatible remote control. • Improved gain flatness delivering a better balance across the performance range SLx Bypass boosters provide 9V DC on every outlet to power a Link-eye but also have short- • Lower noise figure for optimimum picture circuit protection to prevent overload. If the and sound quality booster detects a short-circuit it will only shut down the power on the outlet with the short, • Greater signal handling capacity to cope all other outlets will continue to function as with more channels normal. • Coaxial connectors – simple to plug in to Please Note: To view output from the standard aerial connections satellite RF2 output you will need a TV We are sure you will enjoy using your SLx with an analogue tuner. Booster, it’s easy to install and incorporates All SLx boosters comply with RED (The Radio the latest technology for energy efficient, Equipment Directive 2014/53/EU). -

British Sky Broadcasting Group Plc Annual Report 2009 U07039 1010 P1-2:BSKYB 7/8/09 22:08 Page 1 Bleed: 2.647 Mm Scale: 100%

British Sky Broadcasting Group plc Annual Report 2009 U07039 1010 p1-2:BSKYB 7/8/09 22:08 Page 1 Bleed: 2.647mm Scale: 100% Table of contents Chairman’s statement 3 Directors’ report – review of the business Chief Executive Officer’s statement 4 Our performance 6 The business, its objectives and its strategy 8 Corporate responsibility 23 People 25 Principal risks and uncertainties 27 Government regulation 30 Directors’ report – financial review Introduction 39 Financial and operating review 40 Property 49 Directors’ report – governance Board of Directors and senior management 50 Corporate governance report 52 Report on Directors’ remuneration 58 Other governance and statutory disclosures 67 Consolidated financial statements Statement of Directors’ responsibility 69 Auditors’ report 70 Consolidated financial statements 71 Group financial record 119 Shareholder information 121 Glossary of terms 130 Form 20-F cross reference guide 132 This constitutes the Annual Report of British Sky Broadcasting Group plc (the ‘‘Company’’) in accordance with International Financial Reporting Standards (‘‘IFRS’’) and with those parts of the Companies Act 2006 applicable to companies reporting under IFRS and is dated 29 July 2009. This document also contains information set out within the Company’s Annual Report to be filed on Form 20-F in accordance with the requirements of the United States (“US”) Securities and Exchange Commission (the “SEC”). However, this information may be updated or supplemented at the time of filing of that document with the SEC or later amended if necessary. This Annual Report makes references to various Company websites. The information on our websites shall not be deemed to be part of, or incorporated by reference into, this Annual Report. -

Welcome to Sky+

WELCOME TO SKY+ This is your guide to using Sky+, giving you the essentials as well as handy tips. Read on and get ready - Sky+ could change the way you watch TV, forever. WHAT DO YOU WANT TO DO? Get started page 9 Enjoy the freedom of Sky Anytime on TV page 38 See what’s on page 14 Order Box Offi ce programmes page 43 Use your Planner page 20 Have more control over kids’ viewing page 45 Record programmes page 23 Watch your favourite channels page 50 Pause and rewind live TV page 30 Go interactive page 52 Play recordings page 32 Troubleshooting page 65 RECORDING WITH SKY+ 23 FULL CONTENTS Recording without interrupting what you’re watching 23 Recording from TV Guide or Box Offi ce listings 23 FOR YOUR SAFETY 4 Recording from anywhere you go 23 Electrical information 5 Recording an entire series 23 Recording a promoted programme 24 BACK TO BASICS 6 When recordings clash 24 About your Sky+ box 6 Avoiding recordings from being deleted 25 Keeping you up-to-date 6 PIN-protecting kept recordings 25 Features available with your Sky+ subscription 7 Cancelling current and future recordings 26 Your viewing card 7 Deleting existing recordings 26 Your Sky+ remote control and your TV 8 Keeping an eye on available disk space 27 GETTING STARTED 9 Disk space warning 27 Turning your Sky+ box on and off 9 Recording radio channels 28 Changing the volume 9 Adding to the start and end of recordings 29 Changing channels 10 PAUSING AND REWINDING LIVE TV 30 Using the Search & Scan banner 11 Saving after pausing or rewinding 31 TAKING CONTROL 12 Changing how far -

Converged?" • Occasionally You May Run Into Situations Where Common Physical Infrastructure Serves Multiple Purposes

The Inescapable Inevitability of Convergence (Unless You "Help") Converging Campus Technologies: Evolution or Intelligent Re-Design? NWACC 2006 Annual Conference Portland, Oregon, June 9th, 2006 Joe St Sauver, Ph.D. ([email protected]) Director, User Services and Network Applications University of Oregon Computing Center http://www.uoregon.edu/~joe/convergence/ Introduction • Welcome to the last session for this year's NWACC conference. I'd like to thank Marty for the opportunity to present this session, and I hope you've all enjoyed the rest of this year's meeting as much as I have. • It's rare for me to have a talk theme mesh so well with the overall theme of an event, or so closely with the major news events of the day, but I think that may be fortunate since I'm all that's between you and lunch (or a few hours of exploring Portland before heading home). I'll try to make sure you get your money's worth for the time you're investing. 2 Format of This Session/Handout • This session will be a half hour introduction/ overview followed by up to an hour for discussion. • While I'll begin by presenting one perspective on convergence, mine,* I hope you'll feel free to share your perspective during the discussion period, particularly if you see things differently than I do. • A note about this handout: I tend to cover a lot of material, so to help me stay on track, to facilitate later review by folks not here with us today, and to accommodate attendees who may be hearing impaired, I've scripted these slides in some detail (think of them as "closed captioning"). -

Zen Torii MK IV Owners Manual

MODEL - ZEN TORII MK IV - OWNER’S MANUAL DATE 11/2013 Zen Torii Mk IV Dual Mono 12 Valve Class A Push Pull Amplifier zero negative feedback Manufactured by High Fidelity Engineering Co. WWW.DECWARE.COM MODEL - ZEN TORII MK IV - OWNER’S MANUAL DATE 11/2013 "GETTING STARTED The TORII MKIV is two completely separate mono amplifies built side by side into the same chassis. The only common thing they share is the power cord and front mounted gain "control. This amplifier was built in two halves. Each half is a mirror image of the other. This includes the jacks on the back and even all the parts on the inside. There are two power "switches, one for each side. Below the switches and jacks have been labeled in the picture. SPEAKER" IMPEDANCE " SWITCH RECONSTRUCTIVE FEEDBACK SWITCH 5 A FUSE TREBLE ADJ LEFT INPUT B RECONSTRUCTIVE FEEDBACK SWITCH LEFT ON/OFF INPUT A SPEAKER" RIGHT IMPEDANCE " INPUT SWITCH A RIGHT INPUT B TREBLE ADJ TORII MK IV–" Rear View "Binding Posts The only thing not labeled is the speaker binding posts. The outside post is marked at the base with a red washer indicating speaker (+). The post next to it marked at the base with a black washer is speaker (-) " "Speaker Impedance Switch The speaker impedance switch may be operated “on the fly” while you listen. Select the "setting that sounds best. The amp is wired standard for 4 and 8 ohm speakers. Manufactured by High Fidelity Engineering Co. WWW.DECWARE.COM MODEL - ZEN TORII MK IV - OWNER’S MANUAL DATE 11/2013 "Speaker Impedance Switch (cont.) The amplifier is sold with the option of being wired for 8 and 16 ohm speakers. -

In Re Ford Motor Company Securities Litigation 00-CV-74233

UNITED STATES DISTRICT COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION Master C e No. 00-74233 In re FORD MOTOR CO. CLASS A TION SECURITIES LITIGATION The Honorable Avern Cohn DEMAND FOR JURY TRIAL CONSOLIDATED COMPLAINT FOR VIOLATIONS OF THE SECURITIES EXCHANGE ACT OF 1934 l r" CJ'^ zti ^ OVERVIEW 1. This is an action on behalf of all purchasers of the common stock of Ford Motor Company, Inc. ("Ford") between March 31, 1998 and August 31, 2000 (the "Class Period"). This action arises out of the conduct of Ford to conceal from the investment community defects in Ford's Explorer sport-utility vehicles equipped with steel-belted radial ATX tires manufactured by Bridgestone Corp.'s U.S. subsidiary, Bridgestone/Firestone, Inc. ("Bridgestone/Firestone"). The Explorer is Ford's most important product and its largest selling vehicle, which has accounted for 25% of Ford's profits during the 1990s. Due to the success of the Explorer, Ford became Bridgestone/ Firestone's largest customer and sales of ATX tires have been the largest source of revenues and profits for Bridgestone/Firestone during the 1990s. During the Class Period, Ford and Bridgestone had knowledge ofthousands ofclaims for and complaints concerning ATX tire failures, especially ATX tires manufactured at Bridgestone/Firestone's Decatur, Illinois plant during and after a bitter 1994-1996 strike, due to design and manufacturing defects in, and under-inflation of, the tires, which, when combined with the unreasonably dangerous and unstable nature of the Explorer, resulted in over 2,200 rollover accidents, 400 serious injuries and 174 fatalities by 2000. -

UVA-BC-0145 FORD's E-BUSINESS STRATEGY in the Fall of 1999, Jacques Nasser, Ford Motor Company President and Chief Executive O

Graduate School of Business Administration UVA-BC-0145 University of Virginia FORD’S E-BUSINESS STRATEGY In the fall of 1999, Jacques Nasser, Ford Motor Company president and chief executive officer, announced a grand new vision for the firm: to become the “world’s leading consumer company providing automotive products and services.” Key to that dream was the transformation of the business using Web technologies. The company that taught the world how to mass- produce cars for the consumer market was going to become the leading e-business firm. Brian P. Kelly, Ford’s e-business vice president, described Ford’s plan to rebuild itself as a move to “consumercentric” from “dealercentric,” and stated that Ford would transform itself from being a “manufacturer to dealers” into a “marketer to consumers.” Our consumer-connect business has a totally integrated strategy to reach the consumer in conjunction with our dealers at every touch point. Ford continues to be at the forefront, integrating our global e-commerce activity from the consumer back through the entire supply chain, including linking our Customer Assistance Centers and in-vehicle communications.1 New Web sites were launched for buyers and owners. In-car computer and communications services were announced that would bring travel, security, entertainment, and Web access to the motorist and an electronic connection between consumers and the Ford Motor Company. In February, the company announced it was purchasing Internet PCs for all employees, “to reach its vision of being on the leading edge of technology and connect more closely with its customers.” In March 2000, the company announced the creation of a business- to-business integrated supplier exchange through a single global portal, a joint venture with GM and DaimlerChrysler to create the world’s largest virtual marketplace.