2010-JBW-Form-990.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Eyes Wide Open the SPRINGMONT NEWSLETTER - ALUMNI EDITION Summer 2020

eyes wide open THE SPRINGMONT NEWSLETTER - ALUMNI EDITION Summer 2020 IN THIS ISSUE Dear Springmont Alumni and Alumni Families: What a trying year 2020 has been so far! In my 19 2 Letter from the years as a Head of School, this has easily been the Head of School, most challenging to navigate, and I’m sure many continued of you have had similar experiences at work and at home. I owe a great amount of gratitude to the Covid-19 Springmont community for the many ways we Emergency have pulled together to handle this unprecedented Tuition situation and the obstacles it presented. Assistance Fund Springmont’s last day of on-campus lessons was Thursday, March 12th. On March 13th Parent/ 3 Congratulations Teacher Conferences took place as scheduled, and Class of 2020 we dismissed for the weekend with plans for Faculty and Staff to return to campus the following Monday to organize and strategize for what we thought 4 Maria’s 150th would be two weeks of remote learning. By Sunday, Birthday I alerted Faculty and Staff not to report to campus the following day as the risk of infection was increasing by the moment. Alumni Association It’s said that “necessity is the mother of invention” and that certainly was accurate. Changes Many in the modern workplace are equipped to work from home as needed, but that was not the case for educators, especially those dedicated to the hands-on/experiential pedagogy of the Montessori experience. Our teachers, assistants, specialists and 5 As Seen on administration worked tirelessly to launch a Learning From Home program that was Instagram student-centered and honored Springmont’s mission and core values. -

(Gisa) Schools

GEORGIA INDEPENDENT SCHOOL ASSOCIATION (GISA) SCHOOLS Academy of Innovation Furtah Preparatory School Providence Christian Academy The Academy of Scholars Providence School of Tifton Al-Falah Academy The Galloway School Annunciation Day School Gatewood Schools Rivers Academy Arlington Christian School George Walton Academy Robert Toombs Christian Academy Athens Academy Georgia Christian School The Atlanta Academy GRACEPOINT School Savannah Christian Preparatory Atlanta Girls’ School Greater Atlanta Christian School Savannah Country Day School Atlanta International School The Schenck School Atlanta Jewish Academy Hancock Day School Screven Christian Academy Atlanta Speech School Hebron Christian Academy Smoke Rise Prep Atlanta Youth Academy Heirway Christian Academy Solid Rock Academy Augusta Preparatory Day School Heritage Christian Academy Southland Academy Heritage Preparatory School Southwest Georgia Academy The Bedford School The Heritage School Springmont School Berry Elementary & Middle School Highland Christian Academy St. Andrew’s School Bethlehem Christian Academy High Meadows School St. Benedict’s Episcopal School Brandon Hall School Holy Innocents’ Episcopal School St. Francis School Brentwood School Holy Spirit Preparatory School St. George’s Episcopal School Briarwood Academy The Howard School St. John the Evangelist Catholic Brookstone School St. Martin’s Episcopal School Brookwood School Imhotep Academy Stratford Academy Bulloch Academy Strong Rock Christian School John Hancock Academy The Swift School Calvary Day School, -

Breakthrough Atlanta Annual Report 2018 Page 1 WELCOME

ANNUAL REPORT 2 018 ATLANTA Breakthrough Atlanta Annual Report 2018 page 1 WELCOME Dear Friends, 2018 has been a year of remarkable growth for Breakthrough Atlanta. We expanded our programs to serve a total of 686 students from 75 zip codes across metro Atlanta, equipping them with the skills and resources to succeed on the path to college. Middle school and ninth grade students in our High School Readiness Program experienced academic growth throughout the summer and school year, building critical skills in math, science, social studies and English language arts, as well as personal skills and habits to support their academic success. Breakthrough Atlanta’s College Prep Program achieved new milestones: our students graduating in the class of 2018 earned more than $3.5 million in scholarships and were accepted into 98 colleges and universities across the country. Through our six-year program, Breakthrough Atlanta supports our students every step of the way as they grow from sixth graders into high school graduates prepared to succeed in college and beyond. “… the class of 2018 earned more than $3.5 million CONTENTS in scholarships and were accepted into 98 colleges Welcome Letter ....................................................2 and universities across the country.” Leadership ............................................................3 In the summer of 2018, talented college students from across the country participated in Breakthrough Atlanta’s Students ................................................................4 Teaching Fellowship Program. These aspiring teachers gained hands-on teaching experience and mentoring from experienced, professional educators. In this report, we’re excited to share reflections from Breakthrough Atlanta Impact: Student Class of 2018 ..................... 5-6 student and teaching fellow alumni on how Breakthrough empowered them to grow as learners, teachers and leaders. -

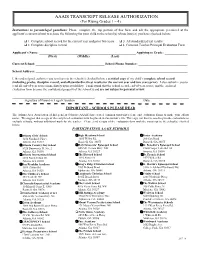

AAAIS TRANSCRIPT RELEASE AUTHORIZATION (For Rising Grades 1 – 4)

AAAIS TRANSCRIPT RELEASE AUTHORIZATION (For Rising Grades 1 – 4) Instructions to parents/legal guardians: Please complete the top portion of this form and ask the appropriate personnel at the applicant’s current school to release the following for your child to the school(s) whose box(es) you have checked below: 1. Complete school record for the current year and prior two years 3. All standardized test results 2. Complete discipline record 4. Common Teacher/Principal Evaluation Form Applicant’s Name: ___________________________________________________________ Applying to Grade: ______________ (First) (Middle) (Last) Current School: __________________________________________ School Phone Number: ______________________________ School Address: _____________________________________________________________________________________________ I, the undersigned, authorize you to release to the school(s) checked below a certified copy of my child’s complete school record (including grades, discipline record, and all standardized test results for the current year and two years prior). I also authorize you to send all end-of-year scores immediately upon availability. I understand that the school record, end-of-year scores, and the enclosed evaluation form become the confidential property of the school(s) and are not subject to parental review. Signature of Parent or Legal Guardian Date IMPORTANT – SCHOOLS PLEASE READ The Atlanta Area Association of Independent Schools (AAAIS) has created common transcript release and evaluation forms to make your efforts easier. We suggest that a copy of the completed evaluation form be placed in the student’s file. This copy can then be used to provide evaluations to multiple schools, without additional work for the teacher. Please send a copy of the evaluation form with the transcript to the school(s) checked below. -

2017 Middle School Spelling Bee

2017 Middle School Spelling Bee NOTES: You can download for FREE the 2016-2017 State Spelling Bee Procedures, Rules, & Regulations via the GAE Website at www.gae.org/spellingbee. You also download the Order form for Spelling Bee Pins, or GAE Spelling Bee Certificates, etc. The Bee's Official study guide from Merriam-Webster, 2017 Spell-It is available ONLINE at www.myspellit.com GISA Middle School Spelling Bee Timetable August 22, 2016 - Enrollment Period for Scripps’ National Spelling Bee October 14, 2016 Deadline to enroll your school to participate in the State Level Spelling Bee via online registration at www.spellingbee.com December 2, 2016 Confirmation Letter from principals due in GISA Office. Confirmation letter should indicate that the school will send two (2) contestants and should include the name of the faculty member willing to assist in the competitions and in what capacity. January 20, 2017 Due date for the names of two contestants and two alternates from your school who will be participating in the GISA Unit Bee. February 9, 2017 Round 1 of GISA Middle School Spelling Bees at the five area sites. Two contestants from each GISA school will compete at the designated areas. February 28, 2017 Rounds 2 & 3 (GISA Unit Finals) of GISA Middle School Spelling Bee Competition at The Atlanta Academy, Roswell March 17, 2017 GAE State Final in Georgia State University, Atlanta May/June, 2017 Scripps National Competition, Washington, D.C. Please note: No student may compete in Round 2 unless he/she participates and is a top scorer in Round 1. -

SEVP-Certified Schools in AL, AR, FL, GA, KY, MS, NC, TN, TX, SC, and VA

Student and Exchange Visitor Program U.S. Immigration and Customs Enforcement FOIA 13-15094 Submitted to SEVP FOIA March 7, 2013 Summary The information presented in the tables below contains the names of SEVP-certified schools located in Alabama, Arkansas, Florida, Georgia, Kentucky, Mississippi, North Carolina, Tennessee, Texas, South Carolina and Virginia that have received certification or are currently in the SEVP approval process, between January 1, 2012 -February 28, 2013, to include the date that each school received certification. The summary counts for the schools are as follows: Count of schools School certifications Certification type approved in duration * currently in process * Initial 127 87 Recertification 773 403 (*) In the requested states Initials Approved School Code School Name State Approval Date ATL214F52444000 Glenwood School ALABAMA 1/17/2013 ATL214F52306000 Restoration Academy ALABAMA 11/28/2012 ATL214F51683000 Eastwood Christian School ALABAMA 9/12/2012 ATL214F51988000 Tuscaloosa Christian School ALABAMA 9/11/2012 ATL214F51588000 Bayside Academy ALABAMA 7/27/2012 NOL214F51719000 Bigelow High School ARKANSAS 11/1/2012 NOL214F52150000 Booneville Public Schools ARKANSAS 9/27/2012 NOL214F52461000 Westside High School ARKANSAS 1/22/2013 NOL214F52156000 Charleston High School ARKANSAS 10/22/2012 NOL214F52133000 Atkins Public Schools ARKANSAS 9/19/2012 MIA214F52212000 Barnabas Christian Academy FLORIDA 1/2/2013 MIA214F51178000 The Potter's House Christian Academy FLORIDA 1/10/2012 MIA214F52155000 Conchita Espinosa Academy FLORIDA 11/6/2012 MIA214F52012000 St. Michael Lutheran School FLORIDA 11/14/2012 MIA214F52128000 Calvary Christian Academy FLORIDA 11/16/2012 MIA214F51412000 Hillsborough Baptist School FLORIDA 9/19/2012 MIA214F52018000 Saint Paul's School FLORIDA 10/18/2012 MIA214F52232000 Citrus Park Christian School FLORIDA 12/14/2012 MIA214F52437000 AEF Schools FLORIDA 1/9/2013 MIA214F51721000 Electrolysis Institute of Tampa, Inc. -

Mt. Bethel Christian Academy Brings Tradition of Academic, Spiritual and Athletic Excellence to East Cobb Families Founded in 1998, East Cobb’S Mt

Mt. Bethel Christian Academy Brings Tradition of Academic, Spiritual and Athletic Excellence to East Cobb Families Founded in 1998, East Cobb’s Mt. Bethel Christian Academy has maintained a reputation for excellence for more than a decade. With the addition of Jim R. Callis as head of school in July 2011, Mt. Bethel Christian Academy is poised to realize its potential as a world-class institution. An educator for more than 20 years, Callis came to MBCA from St. Paul Christian Academy in Nashville. s Students working on the computers are: Clifton Shepherd, “I do this because it’s Laney Brooks, Ellen Williams, Bailey Yeager, Kaitlin Miniutti, what God called me to do, and Stephen Tonge. In the row behind, Nick Couch. and there’s not a day that s Jim Callis, Headmaster I’m not reminded of that,” potential. Partly because of our investment in technology, said Callis. “I couldn’t be but more importantly because of our investment in people.” happy doing anything else.” As a non-denomintional faith-based school, MBCA But Callis emphasizes that continuing the success of offers a Christ-centered approach that is evident in many MBCA is not a one-man show. He credits the members of the areas such as the servant leadership requirement for stu- Board and the exemplary staff for maintaining the highest dents. A championship sports program is an important part standards of academic, athletic and spiritual excellence to of the middle school experience and MBCA fields teams in prepare students for success in the area’s most competitive baseball, basketball, cheerleading, cross country, golf, soc- public, private and applicant-only programs. -

TC Code Institution City State 001370 UNIV of ALASKA ANCHORAGE ANCHORAGE AK 223160 KENNY LAKE SCHOOL COPPER CENTER AK 161760

TC Code Institution City State 001370 UNIV OF ALASKA ANCHORAGE ANCHORAGE AK 223160 KENNY LAKE SCHOOL COPPER CENTER AK 161760 GLENNALLEN HIGH SCHOOL GLENNALLEN AK 217150 HAINES HIGH SCHOOL HAINES AK 170350 KETCHIKAN HIGH SCHOOL KETCHIKAN AK 000690 KENAI PENINSULA COLLEGE SOLDOTNA AK 000010 CENTRAL ALABAMA COMMUNITY COLLEGE ALEXANDER CITY AL 000810 LURLEEN B WALLACE COMM COLLEGE ANDALUSIA AL 232220 ANNISTON HIGH SCHOOL ANNISTON AL 195380 ATHENS HIGH SCHOOL ATHENS AL 200490 AUBURN HIGH SCHOOL AUBURN AL 000350 COASTAL ALABAMA COMMUNITY COLLEGE BAY MINETTE AL 000470 JEFFERSON STATE C C - CARSON RD BIRMINGHAM AL 000560 UNIV OF ALABAMA AT BIRMINGHAM BIRMINGHAM AL 158980 CARVER HIGH SCHOOL BIRMINGHAM AL 159110 WOODLAWN HIGH SCHOOL BIRMINGHAM AL 162830 HUFFMAN HIGH SCHOOL BIRMINGHAM AL 224680 SHADES VALLEY HIGH SCHOOL BIRMINGHAM AL 241320 RAMSAY HIGH SCHOOL BIRMINGHAM AL 000390 COASTAL ALABAMA COMMUNITY COLLEGE BREWTON AL 170150 WILCOX CENTRAL HIGH SCHOOL CAMDEN AL 227610 MACON EAST MONTGOMERY ACADEMY CECIL AL 207960 BARBOUR COUNTY HIGH SCHOOL CLAYTON AL 230850 CLEVELAND HIGH SCHOOL CLEVELAND AL 165770 DADEVILLE HIGH SCHOOL DADEVILLE AL 163730 DAPHNE HIGH SCHOOL DAPHNE AL 170020 DECATUR HIGH SCHOOL DECATUR AL 163590 NORTHVIEW HIGH SCHOOL DOTHAN AL 170030 DOTHAN PREPARATORY ACADEMY DOTHAN AL 203600 ELMORE COUNTY HIGH SCHOOL ECLECTIC AL 213060 ELBA HIGH SCHOOL ELBA AL 000450 ENTERPRISE STATE COMM COLLEGE ENTERPRISE AL 170100 EUFAULA HIGH SCHOOL EUFAULA AL 166720 FAIRHOPE HIGH SCHOOL FAIRHOPE AL 000800 BEVILL STATE C C - BREWER CAMPUS FAYETTE AL 000140 -

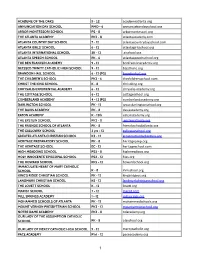

Member School List for Website

ACADEME OF THE OAKS 9 - 12 academeatlanta.org ANNUNCIATION DAY SCHOOL PMO - 6 annuncia/ondayschool.org ARBOR MONTESSORI SCHOOL PS - 8 arbormontessori.org THE ATLANTA ACADEMY PK2 - 8 atlantaacademy.com ATLANTA COUNTRY DAY SCHOOL 7 - 12 atlantacountrydayschool.com ATLANTA GIRLS’ SCHOOL 6 - 12 atlantagirlsschool.org ATLANTA INTERNATIONAL SCHOOL 3K - 12 aischool.org ATLANTA SPEECH SCHOOL PK - 6 atlantaspeechschool.org THE BEN FRANKLIN ACADEMY 9 - 12 benfranklinacademy.org BLESSED TRINITY CATHOLIC HIGH SCHOOL 9 - 12 btcatholic.org BRANDON HALL SCHOOL 6 - 12 (PG) brandonhall.org THE CHILDREN’S SCHOOL PK3 - 6 thechildrensschool.com CHRIST THE KING SCHOOL K - 8 christking.org CHRYSALIS EXPERIENTIAL ACADEMY 6 - 12 chrysalis-academy.org THE COTTAGE SCHOOL 6 - 12 co9ageschool.org CUMBERLAND ACADEMY 4 - 12 (PG) cumberlandacademy.org DARLINGTON SCHOOL PK - 12 www.darlingtonschool.org THE DAVIS ACADEMY PK - 8 davisacademy.org EATON ACADEMY K - 12th eatonacademy.org THE EPSTEIN SCHOOL PK2 - 8 epsteinatlanta.org THE FRIENDS SCHOOL OF ATLANTA PK - 8 friendsschoolatlanta.org THE GALLOWAY SCHOOL 3 yrs - 12 gallowayschool.org GREATER ATLANTA CHRISTIAN SCHOOL K3 - 12 greateratlantachris/an.org HERITAGE PREPARATORY SCHOOL PK - 8 heritageprep.org THE HERITAGE SCHOOL EC - 12 heritageschool.com HIGH MEADOWS SCHOOL PS3 - 8 highmeadows.org HOLY INNOCENTS’ EPISCOPAL SCHOOL PS3 - 12 hies.org THE HOWARD SCHOOL PK5 - 12 howardschool.org IMMACULATE HEART OF MARY CATHOLIC SCHOOL K - 8 ihmschool.org KING’S RIDGE CHRISTIAN SCHOOL PK - 12 kingsridgecs.org LANDMARK CHRISTIAN -

2016 Middle School Spelling Bee

2016 Middle School Spelling Bee NOTES: You can download for FREE the 2015-2016 State Spelling Bee Procedures, Rules, & Regulations via the GAE Website at www.gae.org/spellingbee. You also download the Order form for Spelling Bee Pins, or GAE Spelling Bee Certificates, etc. The Bee's Official study guide from Merriam-Webster, 2016 Spell-It is available ONLINE at www.myspellit.com GISA Middle School Spelling Bee Timetable August 14, 2015 - Enrollment Period for Scripps’ National Spelling Bee October 15, 2015 Deadline to enroll your school to participate in the State Level Spelling Bee via online registration at www.spellingbee.com December 4, 2015 Confirmation Letter from principals due in GISA Office. Confirmation letter should indicate that the school will send two (2) contestants and should include the name of the faculty member willing to assist in the competitions and in what capacity. January 22, 2016 Due date for the names of two contestants and two alternates from your school who will be participating in the GISA Unit Bee. February 11, 2016 Round 1 of GISA Middle School Spelling Bees at the five area sites. Two contestants from each GISA school will compete at the designated areas. February 23, 2016 Rounds 2 & 3 (GISA Unit Finals) of GISA Middle School Spelling Bee Competition at The Atlanta Academy, Roswell March 18, 2016 GAE State Final in Atlanta, GA May/June, 2016 Scripps National Competition, Washington, D.C. Please note: No student may compete in Round 2 unless he/she participates and is a top scorer in Round 1. No student may compete in Round 3 unless he/she participates and is a top scorer in Round 2. -

Storywinter 2020

WINTER 2020 STORY 60 YEARS JOSH CLARK, HEAD OF SCHOOL The Hula-Hoop was only a year old when David Schenck descended the steps of St. Anne’s Church and met his fate. Nervous and unsure, he might have been running later than expected after filling his gas tank on the way for $.25 a gallon. I imagine he drove in silence the last quarter mile as the radio reports about a Cuban revolutionary named Castro and legislators considering the new Hawaii Admissions Act were irritating distractions. Perhaps he calmed his nerves by thinking about the odd new television program, The Twilight Zone, he and Dee had watched the night before. As he parked the car and made his way inside, he probably thought little of the worn concrete steps framed by cobwebbed corners and filled with the echoes of his shoes. Fifteen orange crates for desks were filled by only seven students. His journey that morning must have felt much more like an uncertain start than the coronation time has rendered it. As David himself said, “It was an insane idea.” Beginnings can be hard. But beginnings are the business of The Schenck School. morning 60 years ago in the borrowed space of a church basement, David Schenck debunked that myth. He did not Every year approximately 100 students walk down the The have the luxury of a beautiful campus, an army of well- Schenck School’s steps for the first time feeling a lot like trained teachers, or a larger community that understood David on that day. For most students and families, it is an and respected his work. -

Vinings Vision Plan Final Report Table of Contents Page

Vinings Vision: A Master Plan for a Georgia Historic Community BOARD OF COMMISSIONERS Timothy D. Lee, Chairman Helen Goreham JoAnn Birrell Bob Ott Woody Thompson PLANNING COMMISSION Murray Homan, Chairman Bob Hovey Mike Terry Christi Trombetti Judy Williams COUNTY MANAGER David Hankerson COMMUNITY DEVELOPMENT AGENCY Rob Hosack, AICP, Director Dana Johnson, AICP, Manager Mandy Elliott, Historic Preservation Planner Xiaoang Qin, AICP, Urban Designer James Bikoff, Intern, Georgia Institute of Technology Carnell Brame, Intern, Georgia Institute of Technology DEPARTMENT OF TRANSPORTATION Faye DiMassimo, AICP, Director Bryan Ricks, District Engineer Laraine Vance, Manager Jason Gaines, Planner Chris Pruitt Adopted July 24, 2012 Vinings Vision Plan Final Report Table of Contents Page Chapter 1 - Vinings Context Community Character and Organizations 1 Vinings History 2 Regional and Local Context 4 Study Boundaries 6 Planning Process and Public Participation 7 Previous Planning for Vinings 9 Chapter 2 - Existing Conditions Demographics 12 Housing 14 Market Analysis 17 Business Survey 25 Land Use 26 Community Facilities 30 Historic Preservation 31 Environmental and Natural Resources 33 Transportation 35 Crime 43 Chapter 3 - Vision and Concept Plan Themes, Goals & Objectives 44 Character of Study Area 47 Natural and Cultural Resources 50 Master Plan 55 Transportation 59 Additional Concepts 64 Chapter 4 - Recommendations and Implementation Program 66 Appendix 74 Illustrations Maps Page Tables Page Map 1 – Regional Context 4 Table 1 – Population 12