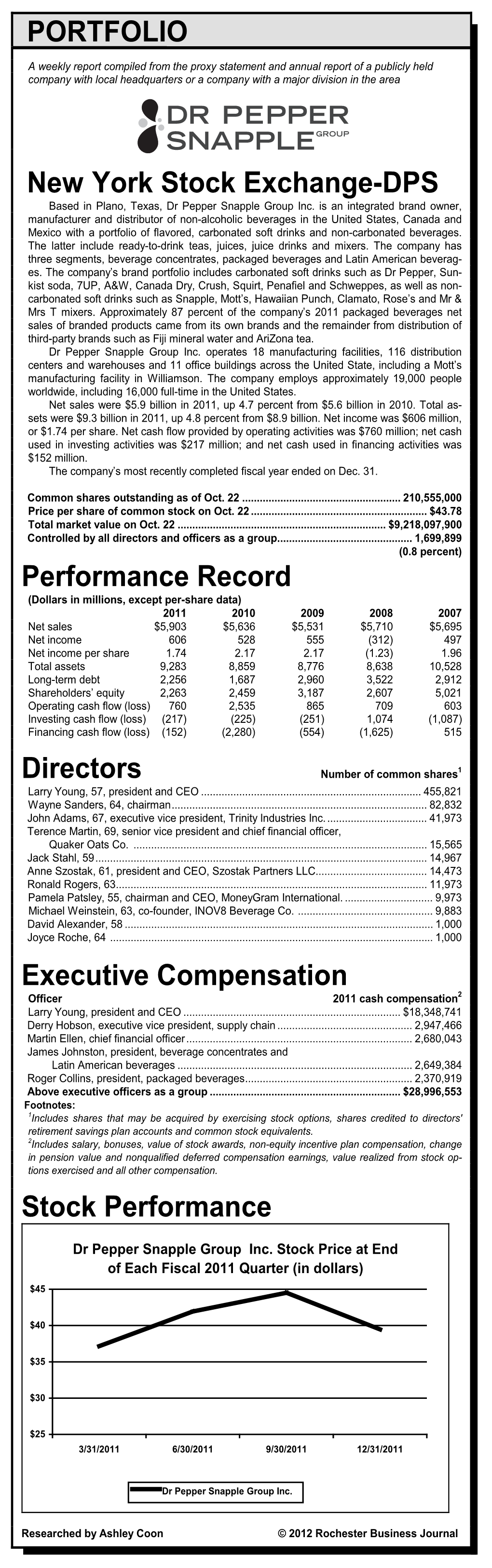

PORTFOLIO New York Stock Exchange-DPS Performance Record

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sunrise Beverage 2021 Craft Soda Price Guide Office 800.875.0205

SUNRISE BEVERAGE 2021 CRAFT SODA PRICE GUIDE OFFICE 800.875.0205 Donnie Shinn Sales Mgr 704.310.1510 Ed Saul Mgr 336.596.5846 BUY 20 CASES GET $1 OFF PER CASE Email to:[email protected] SODA PRICE QUANTITY Boylan Root Beer 24.95 Boylan Diet Root Beer 24.95 Boylan Black Cherry 24.95 Boylan Diet Black Cherry 24.95 Boylan Ginger Ale 24.95 Boylan Diet Ginger Ale 24.95 Boylan Creme 24.95 Boylan Diet Creme 24.95 Boylan Birch 24.95 Boylan Creamy Red Birch 24.95 Boylan Cola 24.95 Boylan Diet Cola 24.95 Boylan Orange 24.95 Boylan Grape 24.95 Boylan Sparkling Lemonade 24.95 Boylan Shirley Temple 24.95 Boylan Original Seltzer 24.95 Boylan Raspberry Seltzer 24.95 Boylan Lime Seltzer 24.95 Boylan Lemon Seltzer 24.95 Boylan Heritage Tonic 10oz 29.95 Uncle Scott’s Root Beer 28.95 Virgil’s Root Beer 26.95 Virgil’s Black Cherry 26.95 Virgil’s Vanilla Cream 26.95 Virgil’s Orange 26.95 Flying Cauldron Butterscotch Beer 26.95 Bavarian Nutmeg Root Beer 16.9oz 39.95 Reed’s Original Ginger Brew 26.95 Reed’s Extra Ginger Brew 26.95 Reed’s Zero Extra Ginger Brew 26.95 Reed’s Strongest Ginger Brew 26.95 Virgil’s Zero Root Beer Cans 17.25 Virgil’s Zero Black Cherry Cans 17.25 Virgil’s Zero Vanilla Cream Cans 17.25 Virgil’s Zero Cola Cans 17.25 Reed’s Extra Cans 26.95 Reed’s Zero Extra Cans 26.95 Reed’s Real Ginger Ale Cans 16.95 Reed’s Zero Ginger Ale Cans 16.95 Maine Root Mexican Cola 28.95 Maine Root Lemon Lime 28.95 Maine Root Root Beer 28.95 Maine Root Sarsaparilla 28.95 Maine Root Mandarin Orange 28.95 Maine Root Spicy Ginger Beer 28.95 Maine Root Blueberry 28.95 Maine Root Lemonade 12ct 19.95 Blenheim Regular Ginger Ale 28.95 Blenheim Hot Ginger Ale 28.95 Blenheim Diet Ginger Ale 28.95 Cock & Bull Ginger Beer 24.95 Cock & Bull Apple Ginger Beer 24.95 Double Cola 24.95 Sunkist Orange 24.95 Vernor’s Ginger Ale 24.95 Red Rock Ginger Ale 24.95 Cheerwine 24.95 Diet Cheerwine 24.95 Sundrop 24.95 RC Cola 24.95 Nehi Grape 24.95 Nehi Orange 24.95 Nehi Peach 24.95 A&W Root Beer 24.95 Dr. -

Keurig to Acquire Dr Pepper Snapple for $18.7Bn in Cash

Find our latest analyses and trade ideas on bsic.it Coffee and Soda: Keurig to acquire Dr Pepper Snapple for $18.7bn in cash Dr Pepper Snapple Group (NYSE:DPS) – market cap as of 17/02/2018: $28.78bn Introduction On January 29, 2018, Keurig Green Mountain, the coffee group owned by JAB Holding, announced the acquisition of soda maker Dr Pepper Snapple Group. Under the terms of the reverse takeover, Keurig will pay $103.75 per share in a special cash dividend to Dr Pepper shareholders, who will also retain 13 percent of the combined company. The deal will pay $18.7bn in cash to shareholders in total and create a massive beverage distribution network in the U.S. About Dr Pepper Snapple Group Incorporated in 2007 and headquartered in Plano (Texas), Dr Pepper Snapple Group, Inc. manufactures and distributes non-alcoholic beverages in the United States, Mexico and the Caribbean, and Canada. The company operates through three segments: Beverage Concentrates, Packaged Beverages, and Latin America Beverages. It offers flavored carbonated soft drinks (CSDs) and non-carbonated beverages (NCBs), including ready-to-drink teas, juices, juice drinks, mineral and coconut water, and mixers, as well as manufactures and sells Mott's apple sauces. The company sells its flavored CSD products primarily under the Dr Pepper, Canada Dry, Peñafiel, Squirt, 7UP, Crush, A&W, Sunkist soda, Schweppes, RC Cola, Big Red, Vernors, Venom, IBC, Diet Rite, and Sun Drop; and NCB products primarily under the Snapple, Hawaiian Punch, Mott's, FIJI, Clamato, Bai, Yoo- Hoo, Deja Blue, ReaLemon, AriZona tea, Vita Coco, BODYARMOR, Mr & Mrs T mixers, Nantucket Nectars, Garden Cocktail, Mistic, and Rose's brand names. -

Bottles on the Border: the History and Bottles of the Soft Drink Industry In

Bottles on the Border: The History and Bottles of the Soft Drink Industry in El Paso, Texas, 1881-2000 © Bill Lockhart 2010 [Revised Edition – Originally Published Online in 2000] Chapter 5d Chapter 5d Later Empire Companies, Part II, and Duffy’s Draft Beverages Grapette Bottling Company (1941-1969) History Grapette was a relative latecomer to the El Paso bottling industry, although the company began shortly after franchises were first offered by the Grapette Company of Camden, Arkansas, in 1940. The founder of Grapette, Benjamin T. Fooks, originally opened a service station in Camden, Arkansas, but had left the business to begin a bottling plant by 1926. He expanded over the next few years and experimented with flavors including a grape drink. He purchased the registered trademarks, Grapette, Lemonette, and Orangette from Rube Goldstein in 1940 and officially began marketing Grapette in the Spring of that year as the B.T. Fooks Mfg. Co. In 1946, he renamed the business the Grapette Co. He sold the company in 1972 to the Rheingold Corp., a group that became the victim of a hostile takeover by PepsiCo in 1975. Pepsi sold the Grapette line to Monarch in 1977, and the brand was discontinued in the U.S. The drink is still available overseas in 1998 (Magnum 1998). The Grapette Bottling Co. opened its doors in El Paso in 1941, during the World War II sugar rationing period and survived until 1969. In its earliest days, Grapette actually bottled Seven-Up for A.L. Randle who then distributed the product from the Seven-Up Bottling Company next door. -

NUTRITIONAL GUIDE January 2020

NUTRITIONAL GUIDE January 2020 Nutritional and Calorie Guide Hot Food Items Bakery Items Fountain and Frozen Beverages Coffee Drinks The nutritional information is derived from a computer analysis of recipes with the assistance of an ESHA Research Nutrition Labeling and Formulation Software (Genesis R&D 9.11.0 Version), and standard supplier product formulations. The rounding of figures is based on the US Food and Drug Administration NLEA Guidelines. Variations within the nutritional values may occur due to the use of regional suppliers, manufacturing tolerances, minor differences in preparation techniques at the store level, recipe revisions, periodic product formulation changes and other factors. 3 11/01/2019 Table of Contents Hot Food Items 5 Bakery Items 14 Fountain & Frozen Beverages 22 Coffee Drinks 83 The nutritional information is derived from a computer analysis of recipes with the assistance of an ESHA Research Nutrition Labeling and Formulation Software (Genesis R&D 9.11.0 Version), and standard supplier product formulations. The rounding of figures is based on the US Food and Drug Administration NLEA Guidelines. Variations within the nutritional values may occur due to the use of regional suppliers, manufacturing tolerances, minor differences in preparation techniques at the store level, recipe revisions, periodic product formulation changes and other factors. 4 11/01/2019 NachoTaco Cheese Sauce Queso Blanco Cheese Sauce Ghels Chili Sauce 09/24/2019 09/24/2019 09/24/2019 Taco Cheese Sauce Queso Blanco Cheese Sauce Gehls Chili -

Box O' Sandwiches

Name ___________________________________________________________ 300 Ren Center , Ste 1304 Page of (Renaissance Center) Company _________________________________________________________ Address __________________________________________________________ (313) 566-0028 (313) 567-6527 City ___________________________ Phone ____________________________ Fax your order, then call to confirm your order. Fax your order ahead for pick-up. No need to wait in line — go right to the register. Desired date __________ Desired time ________ am / pm PICK-UP or DELIVERY Order online at * Payment: Cash Credit (please have credit card info ready when calling to confirm) *Delivery varies by location, call your local shop for more info. Potbelly.com ORIGINALS SKINNYS Drinks Shakes /Malts /Smoothies Turkey Breast CANNED SODA LOW_FAT A Wreck® How many of FLAVOR ShAKE MALT Circle your choice Less meat & cheese Coke Diet SmoothIE 1 Italian on“Thin-Cut” bread 2 each sandwich? Box O’ Sandwiches Chocolate Roast Beef with 25% less fat REGULAR OR Wheat BOTTLED DRINKS of Box below Meatball than Originals 20oz Coke Diet Chicken Salad Strawberry T-K-Y TURKEY BREAST ______R _____ W Smoked Ham 20oz Coke Zero Mushroom Melt ® Tuna Salad A WRECK ______R _____ W Vanilla Hammie 20oz Sprite Vegetarian italian ______R _____ W 500ml Crystal Geyser Water Pizza Sandwich Banana Grilled Chicken ROAST BEEF ______R _____ W 750ml Crystal Geyser Water MeatbaLL ______R _____ W Boylan Black Cherry Oreo® FULL BELLY CHICKEN SALAD ______R _____ W If you ordered IBC Cream Soda Sandwich, Deli -

Daily from 7AM to 11PM EXT 8206 Would You Like to Order in Advance? Please Contact Us at [email protected]

Daily from 7AM to 11PM EXT 8206 Would you like to order in advance? Please contact us at [email protected] ICED TEA AND JUICES WATER Electrolit Flavors 625 mL Bonafont 1 L Gatorade Flavors 500 mL Bonafont 1.5 L Jumex orange, pineapple, mango, peach, apple Fiji 1 L And cranberry 1 L Fiji 500 mL Sonrisa Juice grapefruit 1 L Perrier 499 mL Cold/hot tea Starbucks Product Perrier 330 mL Green Lipton tea 600 mL San Pellegrino 500 mL Twinings pure chamomile tea, box 25 pieces Schweppes Tonic V8 Splash 413 mL San Pellegrino Limonata 11.5 oz Canada Dry club soda 355 mL DAIRY Brand Dressing (Ranch and Caesar) SODAS Greek yogurt Pepsi 2 L Ice cream: 1 scoop, 2 scoops, 3 scoops, in the following flavors: Pepsi 600 mL vanilla, chocolate, rocky road, vanilla caramel, pistachio, strawberry, Pepsi 355 mL raspberry, lime, hazelnut, berry, cheese cake and mango Diet Pepsi 600 mL Lala whole milk 1L Diet Pepsi 2 L Lala light milk 1 L Diet Pepsi 355 mL Lala Non-Lactose Milk 1L 7 Up 600 mL Coconut Milk 7up 2 L Butter without salt 90 g 7up 355 mL Mayonnaise Mirinda 2 L Philadelphia cream cheese Mirinda 600 mL Manchego cheese Mirinda 355 mL Cheese with pepers Manzanita 2 L Cheese with chili Manzanita 600 mL Silk milk Almond Pacific Manzanita 355 mL Ades Soy Milk Monster energy 473 mL Yoplait Yogurt Cereal, Natural, Strawberry, Mango 125 g Dr Pepper 12 oz Yoplait Yogurt pineapple coconut, Peach, Strawberry, Natural 220 g Red Bull 250 mL Red Bull Sugar free 250 mL BEER Boos Energy Drink Bud Light 355 mL Squirt 600 mL Budweiser 355 mL Squirt 2 L Corona -

Inside Matters the Pepsi Bottling Group, Inc

2004 ANNUAL REPORT Inside Matters The Pepsi Bottling Group, Inc. is the world’s largest manufacturer, seller and distributor of carbonated and non-carbonated Pepsi-Cola beverages. Outside 2004 Facts about PBG U.S. the U.S. Total Number of Plants: 46 50 96 Number of Distribution Centers: 254 267 521 Number of Employees: 31,700 33,000 64,700 Percentage of Volume: 61% 39% 100% U.S. / Canada Brand Mix Trademark Pepsi Trademark Mountain Dew Aquafina Other PepsiCo brands Dr Pepper Sierra Mist Other Non-PepsiCo brands Lipton SoBe Tropicana Frappuccino Europe Brand Mix Trademark Pepsi Other PepsiCo brands KAS Aqua Minerale Other Non-PepsiCo brands 7 UP IVI Fruko Mexico Brand Mix Electropura Trademark Pepsi Manzanita Sol Mirinda Squirt 7 UP Other PepsiCo brands Garci Crespo Other Non-PepsiCo brands Financial Highlights $ in millions, except per share data 2004 2003 2002 Chairman’s Letter Net Revenues $10,906 $10,265 $9,216 Page 2 Pro Forma Net Revenues1 $10,906 $10,265 $8,926 PBG / U.S. and Canada Operating Income $976 $ 956 $ 898 $ in millions Page 4 Diluted$800 EPS $ 1.73 $ 1.50 $ 1.46 Pro Forma Diluted EPS2 $ 1.73 $ 1.56 $ 1.46 PBG / Mexico $700 Net Cash Provided by Operations $ 1,251 $ 1,084 $1,014 Page 8 Capital$600 Expenditures $ (717) $ (644) $ (623) PBG / Europe Net$500 Cash Provided by Operations, $534 Page 10 less Capital Expenditures $ 534 $ 440 $ 391 $400 $440 Board of Directors 1 Fiscal year 2002 has been adjusted to reflect$391 the adoption of Emerging Issues Task Force (EITF) Issue Page 12 No.$300 02-16. -

Symbols & Indies Planogram 1/1.25M England & Wales

SYMBOLS & INDIES PLANOGRAM 1/1.25M ENGLAND & WALES DRINK NOW SYMBOLS & INDIES PLANOGRAM 1/1.25M ENGLAND & WALES DRINK NOW SYMBOLS & INDIES PLANOGRAM 1/1.25M ENGLAND & WALES DRINK NOW SHELF SHELF 11 SHELF SHELF 22 SHELF SHELF 33 SHELF SHELF 44 SHELF SHELF 55 Shelf 1 Shelf 2 Shelf 3 Shelf 4 Shelf 5 FantaShelf 1Orange Pm 65p 330ml DrShelf Pepper 2 Drink Pm 1.09 / 2 For 2.00 500ml FantaShelf 3Orange Pm 1.09 / 2 For 2.00 500ml FantaShelf 4Lemon 500ml SpriteShelf 5Std 500ml IrnFanta Bru OrangeDrink Pm Pm 59p 65p 330ml 330ml MountainDr Pepper Dew Drink Drink Pm Pm1.09 1.19 / 2 For500ml 2.00 500ml FantaFanta FruitOrange Twist Pm Pm 1.09 1.09/2 / 2 For For 2.00 2.00 500ml 500ml FantaFanta ZeroLemon Grape 500ml 500ml IrnSprite Bru StdDrink 500ml Pm 99p 500ml DrIrn PepperBru Drink Std Pm Pm 59p 65p 330ml 330ml CocaMountain Cola Dew Std PmDrink 1.25 Pm 500ml 1.19 500ml DietFanta Coke Fruit Std Twist Pm Pm 1.09 1.09/2 / 2 For For 2.00 2.00 500ml 500ml PepsiFanta MaxZero Std Grape Nas 500mlPm 1.00 / 2 For 1.70 500ml PepsiIrn Bru Max Drink Cherry Pm 99p Nas 500ml Pm 1.00 / 2 F 1.70 500ml CocaDr Pepper Cola StdStd CanPm 65pPm 79p330ml 330ml CocaCoca ColaCola CherryStd Pm Pm 1.25 1.25 500ml 500ml CocaDiet Coke Cola StdZero Pm Std 1.09 Nas / Pm2 For 1.09 2.00 / 2 500ml For 2.00 500ml PepsiPepsi StdMax Pm Std 1.19 Nas 500ml Pm 1.00 / 2 For 1.70 500ml DietPepsi Pepsi Max Std Cherry Pm 1.00Nas Pm/ 2 For1.00 1.70 / 2 F 500ml 1.70 500ml DietCoca Coke Cola Std Std Can Can Pm Pm 69p 79p 330ml 330ml MonsterCoca Cola Energy Cherry Original Pm 1.25 Pm 500ml 1.35 -

DR PEPPER SNAPPLE GROUP ANNUAL REPORT DPS at a Glance

DR PEPPER SNAPPLE GROUP ANNUAL REPORT DPS at a Glance NORTH AMERICA’S LEADING FLAVORED BEVERAGE COMPANY More than 50 brands of juices, teas and carbonated soft drinks with a heritage of more than 200 years NINE OF OUR 12 LEADING BRANDS ARE NO. 1 IN THEIR FLAVOR CATEGORIES Named Company of the Year in 2010 by Beverage World magazine CEO LARRY D. YOUNG NAMED 2010 BEVERAGE EXECUTIVE OF THE YEAR BY BEVERAGE INDUSTRY MAGAZINE OUR VISION: Be the Best Beverage Business in the Americas STOCK PRICE PERFORMANCE PRIMARY SOURCES & USES OF CASH VS. S&P 500 TWO-YEAR CUMULATIVE TOTAL ’09–’10 JAN ’10 MAR JUN SEP DEC ’10 $3.4B $3.3B 40% DPS Pepsi/Coke 30% Share Repurchases S&P Licensing Agreements 20% Dividends Net Repayment 10% of Credit Facility Operations & Notes 0% Capital Spending -10% SOURCES USES 2010 FINANCIAL SNAPSHOT (MILLIONS, EXCEPT EARNINGS PER SHARE) CONTENTS 2010 $5,636 NET SALES +2% 2009 $5,531 $ 1, 3 21 SEGMENT +1% Letter to Stockholders 1 OPERATING PROFIT $ 1, 310 Build Our Brands 4 $2.40 DILUTED EARNINGS +22% PER SHARE* $1.97 Grow Per Caps 7 Rapid Continuous Improvement 10 *2010 diluted earnings per share (EPS) excludes a loss on early extinguishment of debt and certain tax-related items, which totaled Innovation Spotlight 23 cents per share. 2009 diluted EPS excludes a net gain on certain 12 distribution agreement changes and tax-related items, which totaled 20 cents per share. See page 13 for a detailed reconciliation of the Stockholder Information 12 7 excluded items and the rationale for the exclusion. -

Island Oasis Drink Guide

Frozen Drink Guide “The World’s Finest Frozen DrinkTM” Island Oasis, the leader in the frozen beverage industry, provides outstanding customer service, 24 hour response to all technical service issues and the most innovative and reliable equipment for frozen and “rocks” drinks. Generic and Customized POS such as banners, posters, table tents and menus are available to all customers. Storage & Handling: Store our products frozen for up to two years. Keep refrigerated after thawing. Refrigerated Shelf Life: Unopened: 60 days Opened: 21 days Dairy: 1 yr frozen, 15 days refrigerated Contact Us: We care about your business. Call us today at 1-800-999-5674 or visit our web site at www.islandoasis.com. Classic Cocktails Alcoholic Strawberry Toasted Blue Margarita Daiquiri Almond 4oz Margarita or Sour 4oz Strawberry 3.5oz Ice Cream 1oz Tequila 1.25oz Rum .75oz Amaretto .5oz Blue Curacao .75oz Coffee Liqueur Piña Colada Tropicolada 4oz Piña Colada Strawberry 2oz Piña Colada 1.25oz Dark Rum Shortcake 1oz Banana 4oz Strawberry 1oz Mango Margarita 1.25oz Amaretto 1.25oz Coconut Rum 4oz Margarita or Sour Mix Bushwacker Banana 1.25oz Tequila 3oz Piña Colada Daiquiri 1oz Ice Cream 4oz Banana Mudslide .75oz Coffee Liqueur 1.25oz Rum 3.5oz Ice Cream .75oz Rum .5oz Vodka .5oz Irish Cream .5oz Coffee Liqueur Smoothies Non-Alcoholic Strawberry Mango Colada Tropicolada Smoothie 3oz Piña Colada 1oz Mango 5oz Strawberry 2oz Mango 3oz Piña Colada 1oz Banana Strawberries Kookie Monster n’ Cream 5oz Ice Cream Blended Mocha 3oz Strawberry 2 Crushed Cookies 3oz Ice -

CPY Document

THE COCA-COLA COMPANY 795 795 Complaint IN THE MA TIER OF THE COCA-COLA COMPANY FINAL ORDER, OPINION, ETC., IN REGARD TO ALLEGED VIOLATION OF SEC. 7 OF THE CLAYTON ACT AND SEC. 5 OF THE FEDERAL TRADE COMMISSION ACT Docket 9207. Complaint, July 15, 1986--Final Order, June 13, 1994 This final order requires Coca-Cola, for ten years, to obtain Commission approval before acquiring any part of the stock or interest in any company that manufactures or sells branded concentrate, syrup, or carbonated soft drinks in the United States. Appearances For the Commission: Joseph S. Brownman, Ronald Rowe, Mary Lou Steptoe and Steven J. Rurka. For the respondent: Gordon Spivack and Wendy Addiss, Coudert Brothers, New York, N.Y. 798 FEDERAL TRADE COMMISSION DECISIONS Initial Decision 117F.T.C. INITIAL DECISION BY LEWIS F. PARKER, ADMINISTRATIVE LAW JUDGE NOVEMBER 30, 1990 I. INTRODUCTION The Commission's complaint in this case issued on July 15, 1986 and it charged that The Coca-Cola Company ("Coca-Cola") had entered into an agreement to purchase 100 percent of the issued and outstanding shares of the capital stock of DP Holdings, Inc. ("DP Holdings") which, in tum, owned all of the shares of capital stock of Dr Pepper Company ("Dr Pepper"). The complaint alleged that Coca-Cola and Dr Pepper were direct competitors in the carbonated soft drink industry and that the effect of the acquisition, if consummated, may be substantially to lessen competition in relevant product markets in relevant sections of the country in violation of Section 7 of the Clayton Act, as amended, 15 U.S.C. -

Pepsi Diet Pepsi Dr Pepper Sierra Mist Mountain Dew Orange Crush Fruit Punch Lemonade

Beefed Up! Cheese Fries 9.59 Buffalo Fries 5.95 4 Cheese Toasted Ravioli 5.95 10 pc Homestyle Onion Rings 5.95 Loaded Cheese Fries 9.59 Mozzarella Sticks 5.95 6 pc 7.95 10 pc BEEFED UP! CHEESE FRIES BUFFALO BLEU FRIES Factory Fries 2.95 Add Cheddar Cheese 1.95 Mac & Cheese Wedges 5.95 8 pc Factory Sampler Platter 12.95 Chicago Dog Fries 9.95 Buffalo Bleu Fries 9.59 Southern Comfort Fries 9.59 Fried Pickles 5.95 SOUTHERN COMFORT FRIES Factory Salad 9.59 Hearts of romaine, sweet red onion, roasted red peppers, grilled chicken breast, smoked bacon bits, chopped avocado, topped with crumbled bleu cheese Chicago Chopped Salad 9.59 Finely chopped hearts of romaine, tomato, cucumber, sweet onion, garlic roasted croutons, mozzarella and smoked bacon bits. Add chicken 3.00 Very Berry Almond Salad 7.95 Spring mixed leaves salad with cranberries, sliced almonds and topped with crumbled bleu cheese and balsamic vinaigrette California Cobb Salad 9.59 Romaine lettuce, Grape tomato, Grilled chicken breast, chopped avocado, crumbled bleu cheese, smoked bacon bits and boiled egg Mediterranean Greek Salad 7.95 Romaine lettuce, grape tomato, sweet red onion, cucumbers, black olives, Greekdolmades served with Greek vinaigrette dressing Garden Salad 6.95 Hearts of romaine, tomato, sweet red onion, cucumber, boiled egg and pepperoncini Add chicken 3.00 Caesar Salad 6.95 Hearts of romaine, shaved parmigiano reggiano, garlic roasted croutons, and parmesan cheese Add chicken 3.00 Fresca 6.95 Local Spring mix, Grape tomatoes, sweet red onions, imported shaved parmigiano reggiano with balsamic dressing Meatball Salad 9.59 3 house made meatballs, along side fresh shredded Parmigiano Regiano with an hearty Italian spring mix garden salad Perfect Spinach Salad 6.95 Dressing Choices: House Italian Caesar Balsamic Vinaigrette Raspberry Vinaigrette Ranch Asian Sesame Ginger Creamy Garlic Lemon Vinaigrette Bleu Cheese Greek Vinaigrette No substitutions or modification on slice-thru orders.