Ar Gruma 2014.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Panorama Bursátil. Voto De Confianza En Enero

15 de f ebrero de 2019 Octav io García Williams González Mesa de Análisis Ext. 10717 [email protected] Panorama Bursátil. Voto de confianza en enero Nuestra lectura del mercado ─ Optimismo en los mercados de EUA tras avances en las negociaciones comerciales con China. Las pláticas continuarán la próxima semana en Washington. En EUA el S&P 500 subió 2.3% y el DJIA 2.8%; mientras que México se ajustó 0.4% en pesos (-1.4% en dólares; el peso se depreció 0.9%). ¿Bolsa atractiva?…La renta fija dice que todavía no ─ Se comparó el rendimiento desde 2008 de las utilidades de la Bolsa en México (earnings yield o inverso del múltiplo P/U) contra el rendimiento o yield del Bono M a 10 años. El difícil entorno del mercado global en términos comerciales, las dudas en cuanto al crecimiento económico global, la política monetaria restrictiva la Fed, la incertidumbre interna, entre otros factores, hacen que rendimiento de las utilidades de la Bolsa en México no luzca su mejor versión, al ubicarse en 5.9% vs. ~8.5% del bono M a 10 años, aunque se reconoce que el diferencial entre ambos se ha recortado ~100pb en los últimos cinco meses. Flujos de extranjeros a la renta variable nacional ─ Tras el fuerte ajuste del mercado en 2018 (-15.6%), y apoyados por una menor aversión al riesgo en mercados emergentes, los extranjeros dieron el voto de confianza al mercado local al traer flujos por más de US$500 millones en enero que ayudaron al índice a subir 5.6% en el primer mes del año. -

Efectos De La Ley Fintech México En La Apertura De Instituciones De

962 Efectos de la Ley Fintech México en la apertura de Instituciones de Tecnología Financiera (ITF) García-Cañedo, Alma Iliana1, Quiroz-Gálvez, Sergio2 & Jiménez-García, Carlos3 1Universidad de Sonora, Departamento de Administración Hermosillo, Sonora, México, [email protected], Luis Encinas y Rosales S/N Col. Centro, (+52) 662 2 59 21 29; 2Universidad de Sonora, Departamento de Administración Hermosillo, Sonora, México, [email protected], Luis Encinas y Rosales S/N Col. Centro, (+52) 662 2 59 21 29; 3Universidad de Sonora, Departamento de Contabilidad Hermosillo, Sonora, México, [email protected], Luis Encinas y Rosales S/N Col. Centro, (+52) 662 2 59 21 29; Información del artículo arbitrado e indexado en Latindex: Revisión por pares Fecha de publicación: Julio 2019 Resumen Abstract El corto plazo de la proliferación de las empresas FinTech The short term of the proliferation of FinTech companies en México y en el mundo, es debido al impulso recibido por in Mexico and in the world, is due to the impulse received la combinación de varios factores: Técnicas novedosas de by the combination of several factors: innovative desarrollo, expectativas de innovación empresarial, ahorro development techniques, expectations of business en los costos, etcétera. Esta expectativa tan dramáticamente innovation, cost savings, and so on. This expectation, so amplia en el uso de las FinTech mexicanas, está a la dramatically wide in the use of the Mexican FinTech, is in expectativa de cómo funcionará la nueva Ley que para tal expectation of how the new Law will work, for that purpose efecto se aprobó en marzo de 2018, y las Leyes secundarias was approved in March 2018, and secondary laws in en noviembre del mismo año. -

Gruma, S.A.B. De C.V

GRUMA, S.A.B. DE C.V. San Pedro Garza García, N.L. April 7, 2021. In relation to the First Notice to the Annual General Ordinary Shareholders Meeting of GRUMA, S.A.B de C.V. (the “Company” or “GRUMA”) to be held on April 23, 2021 at 11:00 (eleven) hours, the shareholders are hereby informed of the details of the proposals to be discussed during said Shareholders’ Meeting regarding the items on the Agenda. The corresponding documentation will be available to the Shareholders in the Company’s offices, at least 15 days prior to the date on which said Shareholders’ Meeting will take place: ANNUAL GENERAL ORDINARY SHAREHOLDERS’ MEETING I. Presentation, discussion and, as the case may be, approval of the reports referred to in article 28, Section IV of the Securities Market Law (Ley del Mercado de Valores) and article 19, Section IV of the Company´s Bylaws, for the fiscal year ended December 31, 2020, including the Financial Statements of GRUMA, S.A.B. DE C.V. for the fiscal year commencing on January 1 ending December 31, 2020. First point.- The shareholders will be presented, for their approval, with the Financial Statements of GRUMA, S.A.B. DE C.V. for the fiscal year commencing January 1 ending December 31, 2020, the Chief Executive Officer’s Annual Report, as well as the following reports and opinions: • Report on the Individual and Consolidated Financial Statements issued by the independent auditors firm PriceWaterhouseCoopers. • Report Regarding the main Policies and Accounting Guidelines used for the preparation of the Financial Statements. -

Foreign Investment in Latin America and the Caribbean

(FRQRPLF&RPPLVVLRQIRU/DWLQ$PHULFDDQGWKH&DULEEHDQ (&/$& )RUHLJQ,QYHVWPHQWLQ/DWLQ$PHULFDDQGWKH&DULEEHDQLVWKHODWHVWHGLWLRQRIDVHULHVSXEOLVKHGDQQXDOO\E\WKH 8QLWRQ,QYHVWPHQWDQG&RUSRUDWH6WUDWHJLHVRIWKH(&/$&'LYLVLRQRI3URGXFWLRQ3URGXFWLYLW\DQG0DQDJHPHQW ,WZDVSUHSDUHGE\ÈOYDUR&DOGHUyQ3DEOR&DUYDOOR0LFKDHO0RUWLPRUHDQG0iUFLD7DYDUHVZLWKWKHDVVLVWDQFHRI $GULDQ1\JDDUG/HPD1LFRODV&KDKLQH3KLOOLS0OOHU$OLVRQ&ROZHOO%U\DQW,YHVDQG&DUO1LVV)DKODQGHQDQG FRQWULEXWLRQVIURPWKHFRQVXOWDQWV*HUPDQR0HQGHVGH3DXOD*XVWDYR%DUXM'DYLG7UDYHVVR&HOVR*DUULGR3DWULFLR <ixH]DQG1LFROR*OLJR&KDSWHU9ZDVSUHSDUHGMRLQWO\E\WKH8QLWRQ,QYHVWPHQWDQG&RUSRUDWH6WUDWHJLHVDQGWKH $JULFXOWXUDO'HYHORSPHQW8QLWERWKSDUWRIWKH&RPPLVVLRQ¶V'LYLVLRQRI3URGXFWLRQ3URGXFWLYLW\DQG0DQDJHPHQW ,QSXWVIRUWKLVFKDSWHUZHUHSURYLGHGE\WKHFRQVXOWDQWV0DUF6FKHLQPDQDQG-RKQ:LONLQVRQDPRQJRWKHUVLQWKH IUDPHZRUNRIWKHSURMHFWHQWLWOHG³$JULFXOWXUDOGHYHORSPHQWSROLFLHVDQGWUDQVQDWLRQDOFRUSRUDWLRQV¶VWUDWHJLHVLQWKH DJULIRRGVHFWRU´RIWKH*RYHUQPHQWRIWKH1HWKHUODQGV,QWKLVUHJDUGWKHFRQWULEXWLRQVRI0{QLFD5RGULJXHVDQG 6RItD$VWHWH0LOOHUDUHJUDWHIXOO\DFNQRZOHGJHG7KDQNVDUHDOVRGXHWRWKHFRUSRUDWHH[HFXWLYHVZKRDJUHHGWRWDNH SDUWLQWKHLQWHUYLHZVFRQGXFWHGGXULQJWKHSUHSDUDWLRQRIFKDSWHUV,,,WR9, 7KHLQIRUPDWLRQXVHGLQWKLVUHSRUWKDVEHHQGUDZQIURPDQXPEHURILQWHUQDWLRQDODJHQFLHVLQFOXGLQJWKH,QWHUQDWLRQDO 0RQHWDU\)XQGWKH8QLWHG1DWLRQV&RQIHUHQFHRQ7UDGHDQG'HYHORSPHQWDQGWKH2UJDQLVDWLRQIRU(FRQRPLF&R RSHUDWLRQDQG'HYHORSPHQWDVZHOODVDKRVWRIQDWLRQDOLQVWLWXWLRQVVXFKDVFHQWUDOEDQNVDQGLQYHVWPHQWSURPRWLRQ DJHQFLHVLQ/DWLQ$PHULFDDQGWKH&DULEEHDQDQGVSHFLDOL]HGSUHVV$FUXFLDOLQSXWIRUWKLVUHSRUW±±WKHGDWDUHODWLQJ -

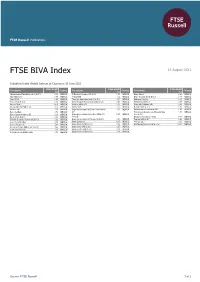

FTSE BIVA Index

2 FTSE Russell Publications 19 August 2021 FTSE BIVA Index Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Administradora Fibra Danhos S.A. de C.V. 0.15 MEXICO El Puerto de Liverpool SA de CV 0.53 MEXICO Grupo Mexico 8.89 MEXICO Alfa SAB de CV 0.89 MEXICO Femsa UBD 9.2 MEXICO Grupo Rotoplas S.A.B. de C.V. 0.17 MEXICO Alpek S.A.B. 0.28 MEXICO Fibra Uno Administracion S.A. de C.V. 1.91 MEXICO Industrias Penoles 1.02 MEXICO Alsea S.A.B. de C.V. 0.56 MEXICO Genomma Lab Internacional S.A.B. de C.V. 0.46 MEXICO Kimberly Clark Mex A 0.88 MEXICO America Movil L 13.59 MEXICO Gentera SAB de CV 0.35 MEXICO Megacable Holdings SAB 0.64 MEXICO Arca Continental SAB de CV 1.53 MEXICO Gruma SA B 1.37 MEXICO Nemak S.A.B. de C.V. 0.16 MEXICO Bachoco Ubl 0.36 MEXICO Grupo Aeroportuario del Centro Norte Sab de 1.31 MEXICO Orbia Advance Corporation SAB 1.59 MEXICO Banco del Bajio 0.76 MEXICO CV Promotora y Operadora de Infraestructura 1.05 MEXICO Banco Santander Mexico (B) 0.43 MEXICO Grupo Aeroportuario del Pacifico SAB de CV 2.27 MEXICO S.A. de C.V. Becle S.A.B. de C.V. 0.86 MEXICO Series B Qualitas Controladora y Vesta 0.48 MEXICO Bolsa Mexicana de Valores SAB de CV 0.62 MEXICO Grupo Aeroportuario del Sureste SA de CV 2.21 MEXICO Regional SAB de CV 0.83 MEXICO Cementos Chihuahua 0.79 MEXICO Grupo Banorte O 11.15 MEXICO Televisa 'Cpo' 4.38 MEXICO Cemex Sa Cpo Line 7.43 MEXICO Grupo Bimbo S.A.B. -

Striving to Overcome the Economic Crisis: Progress and Diversification of Mexican Multinationals’ Export of Capital

Striving to overcome the economic crisis: Progress and diversification of Mexican multinationals’ export of capital Report dated December 28, 2011 EMBARGO: The contents of this report cannot be quoted or summarized in any print or electronic media before December 28, 2011, 7:00 a.m. Mexico City; 8:00 a.m. NewYork; and 1 p.m. GMT. Mexico City and New York, December 28, 2011: The Institute for Economic Research (IIEc) of the National Autonomous University of Mexico (UNAM) and the Vale Columbia Center on Sustainable International Investment (VCC), a joint initiative of the Columbia Law School and the Earth Institute at Columbia University in New York, are releasing the results of their third survey of Mexican multinationals today. 1 The survey is part of a long-term study of the rapid global expansion of multinational enterprises 2 (MNEs) from emerging markets. The present report focuses on data for the year 2010. Highlights In 2010, the top 20 Mexican MNEs had foreign assets of USDD 123 billion (table 1 below), foreign sales of USDD 71 billion, and employed 255,340 people abroad (see annex table 1 in annex I). The top two firms, America Movil and CEMEX, together controlled USDD 85 billion in foreign assets, accounting for nearly 70% of the assets on the list. The top four firms (including FEMSA and Grupo Mexico) jointly held USDD 104 billion, which represents almost 85% of the list’s foreign assets. Leading industries in this ranking, by numbers of MNEs, are non-metallic minerals (four companies) and food and beverages (another four companies). -

Annual Report 2016 Focused on Grow Th

FEMSA is a multinational beverage and retail TABLE OF CONTENTS company headquartered in Mexico. We hold FEMSA at a Glance .............................2 a 48% stake in Coca-Cola FEMSA, the largest Financial Highlights ............................4 Letter to Shareholders ..........................6 bottler of Coca-Cola products in the world by FEMSA Comercio - Retail Division. 8 FOCUSED ON ON FOCUSED FEMSA Comercio - Health Division. .9 volume, and a 20% stake in Heineken, one of the FEMSA Comercio - Fuel Division ...............10 world’s leading brewers with operations in over Coca-Cola FEMSA .............................11 Sustainability ..................................14 70 countries. We participate in the retail industry FEMSA Foundation ............................16 GROWTH through FEMSA Comercio (100%), comprising a Executive Management ........................18 Corporate Governance .........................19 Retail Division operating primarily through OXXO, Board of Directors .............................20 In Memoriam ..................................21 the largest convenience store chain in Latin FOMENTO ECONOMICO MEXICANO, S.A.B. DE C.V. Financial Summary ............................22 America by units; a Fuel Division, operating the Management’s Discussion & Analysis ..........24 General Anaya 601 Pte. Col. Bella Vista C.P. 64410 REPORTANNUAL 2016 Monterrey, Nuevo Leon, Mexico OXXO GAS chain of retail service stations; and a [email protected] Health Division, which includes drugstores and related operations in Mexico -

Annual Report 2007 in Pdf For

STRENGTH IN A CHALLENGING ENVIRONMENT In 2007, GRUMA encountered exciting new opportunities as well as challenging macroeconomic conditions. While our operational capacity and global market penetration grew, rising raw-material costs threatened to hamper bottom- line performance. When faced with the unattractive option of passing the higher costs on to consumers in the form of price increases, we resolved to identify other ways to operate profitably in this trying market environment. Read on to learn how we extracted value from GRUMA’s operations to help offset the impact of higher costs and continue to generate shareholder value. ABOUT GRUMA GRUMA, S.A.B. de C.V., is one of the world’s leading tortilla and corn flour producers. Established in 1949, GRUMA is engaged primarily in the production, marketing, distribution, and sale of tortillas, corn flour, and wheat flour. With leading brands in most of its markets, GRUMA has operations in the United States, Mexico, Venezuela, Central America, Europe, Asia, and Oceania. GRUMA also exports to approximately 50 countries worldwide. GRUMA is headquartered in Monterrey, Mexico, and has 91 plants and approximately 19 thousand employees. In 2007, GRUMA had net sales of US$3.3 billion, of which 67% came from non-Mexican operations. CONTENT S 1 FINANCIAL HIGHLIGHTS 23 MANAGEMENT STATEMENT O F ASSUMPTION O F RESPONSIBILITY 2 LETTER TO SHAREHOLDERS 23 REPORT O F CORPORATE GOVERNANCE COMMITTEE 6 TAKING A LONG -TERM VIEW 25 REPORT O F AUDIT COMMITTEE 8 EXTRACTING VALUE F ROM OUR OPERATIONS 27 REPORT O F INDEPENDENT AUDITORS 10 POSITIONING GRUMA F OR STRONG F UTURE GROWTH 28 CONSOLIDATED F INANCIAL STATEMENTS 14 SUPPORTING OUR COMMUNITIES 33 NOTES TO CONSOLIDATED F INANCIAL STATEMENTS 16 MANAGEMENT DISCUSSION AND ANALYSIS 62 BOARD O F DIRECTORS AND MANAGEMENT TEAM 22 FIVE -YEAR F INANCIAL SUMMARY Maseca energy bar FINANCIAL HIGHLIGHTS GRUM A , S.A.B. -

Cross-Border Investments Lay the Foundation for Shared Regional Prosperity

Growing Together: Economic Ties between the United States and Mexico Cross-Border Investments Lay the Foundation for Shared Regional Prosperity By Christopher Wilson #USMXEcon October 2016 Growing Together: Economic Ties between the United States and Mexico Cross-Border Investments Lay the Foundation for Shared Regional Prosperity By Christopher Wilson Project Introduction The impact of trade and globalization on the average American has become a core issue in this year’s elections. We have heard measured, well-founded and serious critiques on the handling of issues like currency manipulation and preparing our workforce for participation in the global economy, but the conversation has also drawn many passionate and visceral responses, highlighting the intensity with which citizens feel the impact of economic change. Due to campaign rhetoric, Mexico has come to symbolize much of the U.S. encounter with globalization. Given that Mexico is the United States’ second largest export market, third largest overall trading partner, and the top country of origin for immigrants living in the country, this is understandable. Nonetheless, having become a top tier issue in the presidential elections, it is more important than ever that Americans have a clear and up-to-date understanding of Mexico and, in particular, the U.S.-Mexico economic relationship. With that in mind, the Mexico Institute is pleased to announce the launch of a new project, Growing Together: Economic Ties between the United States and Mexico, which explores the bilateral economic relationship in detail to understand its nature and its impact on the United States. We have commissioned original research on the employment impact of bilateral trade on the U.S. -

Mexican Firms Investing in China 2000–2011

Inter-American Development Bank Integration and Trade Sector DISCUSSION PAPER No. IDB-DP-255 Mexican Firms Investing in China 2000–2011 Enrique Dussel Peters December 2012 Mexican Firms Investing in China 2000–2011 Enrique Dussel Peters Inter-American Development Bank 2012 http://www.iadb.org The opinions expressed in this publication are those of the authors and do not necessarily reflect the views of the Inter-American Development Bank, its Board of Directors, or the countries they represent. The unauthorized commercial use of Bank documents is prohibited and may be punishable under the Bank's policies and/or applicable laws. Copyright © 2012 Inter-American Development Bank. All rights reserved; may be freely reproduced for any non-commercial purpose. I am most grateful to Rubén Hernández Cordero, Guillermo Iglesias Rosales, Eva Yazmín Rodríguez Reyna and Daniela Sánchez de la Barquera Colín for their considered assistance as this document evolved. The author is solely responsible for any weaknesses in the final copy. Research on “translatinas” has only just begun and results have been limited thus far (CEPAL 2012). Initial reports show that while these Latin American firms have invested primarily in their home region, a growing number have begun to invest more heavily in the rest of the world. However, an overall evaluation of their activities and performance in new markets and detailed discussion about their products, processes and future expectations is lacking. This analytic note addresses that gap by examining a group of Mexican firms with direct investments in China. The analysis includes (a) a general description of each firm (its products, processes, main locations, age, size, employment, and so forth), (b) the firm’s global short- and medium-term strategies and the importance of China to them, and (c) an overview of the firm’s expansion to and activities in China (including reasons for entry, the initial entry mode, the main products and processes, investment amounts, employment rolls, sales, and other salient characteristics). -

Gruma Announces the Results of the Public Offer for the Acquisition of Gimsa’S Shares

Investor Relations [email protected] Tel: 52 (81) 8399-3349 www.gruma.com San Pedro Garza García, N.L., Mexico; July 21, 2017 GRUMA ANNOUNCES THE RESULTS OF THE PUBLIC OFFER FOR THE ACQUISITION OF GIMSA’S SHARES San Pedro Garza García, N.L., Mexico; July 21, 2017 – GRUMA, S.A.B. de C.V. (“GRUMA”) (BMV: GRUMAB) announces the conclusion today at 13:00 hours, of the public Offer (the "Offer”) to acquire up to 133,176,125 ordinary, registered, no par value shares, representing up to 14.5% of the registered, paid and outstanding capital stock of Grupo Industrial Maseca, S.A.B. de C.V. (“GIMSA”). Based on the count made by the Offer intermediary, Casa de Bolsa Banorte Ixe, S.A. de C.V., Grupo Financiero Banorte, (“Casa de Bolsa Banorte”) the number of shares that participated in the Offer is 131,225,968 (one hundred thirty-one million, two hundred twenty-five thousand, nine hundred sixty-eight), representing 14.29% (fourteen point twenty-nine percent) of GIMSA's shares. Pursuant to the foregoing, the conditions for the Offer set forth in the Offer Prospectus were met. Once the registration and transfer of the shares of GIMSA in the Bolsa Mexicana de Valores, S.A.B. de C.V., ("BMV"), acquired under the Offer is completed, GRUMA will own approximately 99.79% of GIMSA's capital stock. The Offer Prospectus and the Allocation Notice with the Offer results are available for consultation with Casa de Bolsa Banorte, as the Offer intermediary, as well as on Internet page of the CNBV at: www.gob.mx/cnbv, of the BMV at: www.bmv.com.mx, and of GRUMA at the address: www.gruma.com. -

Consolidating Our Leadership

CONSOLIDATING OUR LEADERSHIP ANNUAL REPORT GRUMA 2012 ABOUT THIS REPORT This report comprehensively presents the financial and sustainability actions and results of GRUMA companies around the world. The report has been prepared in accordance with the methodology of the Global Reporting Initiative (GRI) and specifically version 3.1 of its Sustainability Reporting Guidelines. A materiality analysis was carried out, considering the company’s main public matters and the way in which requests and expectations of its stakeholders are addressed. The contents are based on information gathered from participating areas and regions. The sustainability figures and results apply to particular programs and regions, unless otherwise stated. CONTENTS 1 FINANCIAL HIGHLIGHTS 2 ORGANIZATIONAL PROFILE 4 A MESSAGE FROM THE CHAIRMAN OF THE BOARD OF DIRECTORS AND CHIEF EXECUTIVE OFFICER 6 GRUMA PHILOSOPHY 8 SUSTAINABILITY MODEL AND DECLARATION 9 STAKEHOLDERS 10 TRANSFORMING OURSELVES TO BECOME MORE PROFITABLE 22 PROVIDING COMPREHENSIVE NUTRITION TO THE COMMUNITY 32 CARING FOR THE ENVIRONMENT 38 AWARDS AND DISTINCTIONS 39 CORPORATE CITIZENSHIP 40 CORPORATE GOVERNANCE 44 AUDIT COMMITTEE REPORT 46 CORPORATE PRACTICES COMMITTEE REPORT 47 MANAGEMENT’S DISCUSSION AND ANALYSIS 52 INDEPENDENT AUDITORS’ REPORT 54 CONSOLIDATED FINANCIAL STATEMENTS 60 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 124 GRI INDEX 129 LEVELS OF APPLICATION 130 VERIFICATION LETTER Financial Highlights GRUMA, S.A.B. DE C.V. and Subsidiaries (millions of pesos, except where indicated1) RESULTS