Intimately Yours Summer 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

De Cursussen

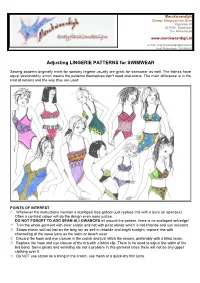

Merckwaerdigh Design Margreet van Dam Koestraat 40 3011MC Rotterdam The Netherlands www.merckwaerdigh.nl e-mail: [email protected] KvK Rotterdam: 24264422 Adjusting LINGERIE PATTERNS for SWIMWEAR Sewing patterns originally ment for stretchy lingerie usually are great for swimwear as well. The fabrics have equal stretchability which means the patterns themselves don't need alterations. The main difference is in the kind of notions and the way they are used. POINTS OF INTEREST Whenever the instructions mention a scalloped lace galloon just replace this with a lycra (or spandex). Often a contrast colour will do the design even more justice. DO NOT FORGET TO ADD SEAM ALLOWANCES all around the pattern, there is no scalloped selvedge! Trim the whole garment with clear elastic and not with picot elastic which is not chloride and sun resistant. Straps elastic will not last on the long run as well in chloride and bright sunlight, replace this with channeling of the same lycra as the swim or beach wear Discard the hook and eye closure in the crotch and just stitch the seams, preferably with a blind seam. Replace the hook and eye closure of the bra with a bikini clip. There is no need to adjust the width of the bra band. Some pleats and wrinkling are not a problem in this garment since there will not be any upper clothing over it. Do NOT use cotton as a lining in the crotch, use mesh or a quick-dry thin lycra. www.merckwaerdigh.nl CHOICE OF FABRIC The choice of a fabric is directly connected to the goal of the garment. -

Exercise and Breast Support

For further information For further information see the Sports Bra Fitness booklet available at http://www.uow.edu.au/health/brl/ sportsbra/index.html References 1 McGhee DE, Steele JR & Munro BJ. (2010). Education improves bra knowledge and !t, and Exercise and level of breast support in adolescent female athletes: A cluster-randomised trial. Journal of Physiotherapy. 56(1), 19–24. 2 McGhee DE & Steele JR. (2010). Optimising breast support in female patients through correct breast support bra !t: A cross-sectional study. Journal of Science and Medicine in Sport. 13(6), 568–572. 3 Greenbaum AR, Heslop T, Morris J, Dunn KW. (2003). An investigation of the suitability of bra !t A guide to understanding breast support in women referred for reduction mammaplasty. British Journal of Plastic Surgery. 56(3), 230–236. 4 Mason BR, Page KA, Fallon K. (1999). An analysis of movement and discomfort of the female during physical activity and how breast during exercise and the e"ects of breast support in three cases. Journal of Science and to determine correct bra fit Medicine in Sport. 2(2), 134–144. 5 Robbins LB, Pender NJ, Kazanis AS. (2003). Barriers to physical activity perceived by adolescent girls. Journal of Midwifery and Women’s Health. 48(3), 206–212. 6 McGhee DE, Steele JR & Munro BJ. (2008). Sports Bra Fitness. Wollongong NSW: Breast Research Australia (BRA), Biomechanics Research Laboratory, University of Wollongong: ISBN 9781741281552. Acknowledgements IMB Community Foundation New South Wales Sporting Injury Committee Prepared by DE McGhee & JR Steele, Breast Research Australia, University of Wollongong Photography by Sean Maguire Always consult a trained professional The information in this resource is general in nature and is only intended to provide a summary of the subject matter covered. -

Hbi Letterhead

news release FOR IMMEDIATE RELEASE News Media: Kirk Saville, (336) 519-6192 Analysts and Investors: T.C. Robillard, (336) 519-2115 HANESBRANDS AND BELLE INTERNATIONAL ENTER LICENSING AGREEMENT TO INTRODUCE CHAMPION FOOTWEAR AND ACCESSORIES IN CHINA Partnership combines the power of the Champion brand with Belle’s extensive retail network, e-commerce expertise and supply chain capabilities WINSTON-SALEM, N.C. – (Feb. 26, 2021) – HanesBrands and Belle International today announced a licensing agreement that will introduce a line of Champion footwear and accessories to consumers in China next year. Under the agreement, Belle will distribute the new collection designed specifically for consumers in China through its countrywide retail network and e-commerce platform. The Champion product range will tap into the brand’s aesthetic and be available by June 2021. “We’re thrilled to expand our long-term distribution relationship with Belle to include a license for footwear and accessories in China, said Jon Ram, group president of global activewear for HanesBrands. “Belle has demonstrated vast capabilities across brick-and- mortar retail, e-commerce, consumer insights and supply chain – and we’re confident the partnership will further accelerate the global growth of the Champion brand.” Fashion Clothing, a Belle International company based in Shanghai, has been a strategic partner for the Champion brand since June 2019. The company operates hundreds of Champion-branded brick-and-mortar and official online stores on leading e-commerce platforms, including Alibaba Group’s TMALL, JD.com and VIP.com. “We see outstanding potential for Champion in the large, growing market in China, and Belle International’s long history of serving consumers in the country, extensive nationwide store network and cross-category supply chain capabilities make us complementary partners,” said Fang Sheng, executive director and president of the footwear and new ventures business group for Belle International. -

2Bemag Issue05.Pdf

EDITORIAL The fifth issue of 2bemag is finally here, and so far the journey has been interesting, challenging and full of surprises, but most importantly - so rewarding! Step by step we are closer to achieving the initial idea behind 2bemag, to create a base of both readers and contributors that is as international and diverse as possible. The photographers collaborating for issue Nr. 5 are for e.g. from Austria, Sweden, France, Spain, Canada and Russia, and it gives our whole team such immense pleasure to receive and be able to publish more diverse and original work for every day that passes. The essence of 2bemag is really about, freedom of expression through the medium of photography, videography & writing and as always we invite you to collaborate with us. It is important for us to be able to give our fellow collaborators free hands to realize their dreams, and with the finished end result be able to shine the spotlight solely on the artists behind the contributions. Always feel free to contact them for new assignments, comment on their work or simply keep on following their path! We love to discover a talent – as well as we love to be discovered by a new reader. Come as you are and join us again for a new issue of 2bemag, full packed with international raw talent. Be with us 2beMag Staff e-mail: [email protected] 02 2beMag www.2bemag.com STAFF Editor in Chief JOSE GRIMM General Coordinator ROMAN AUSTIN Art Director DANI MELO Advertising EMMA WIKSTRÖM Net Working DR. -

Premium Elixir FALL-WINTER 2015 COLLECTION French-Style Designer Spirit

premium elixir FALL-WINTER 2015 COLLECTION french-style designer spirit Heir to a precious know-how, Maison Lejaby per- petuates the tradition of corsetry and swimwear in the purest tradition of craftsmanship. In its workshops in France, it designs and pro- duces rare pieces by hand, with high standards and passion, treasures of elegance and refine- ment. Universal and timeless, the French-style Designer Spirit is embodied by the complete mastery of know-how, which frees the imagination to create the exceptional. Each Maison Lejaby design carries within it this breath of freedom and recounts the expert ges- tures to bring forth a new femininity. Wonders of inventiveness and daring, emotional objects, they take the most beautiful materials from Haute Couture and, with a multitude of delicate ope- rations, create a hymn to luxury and exquisite pleasure. Over time, Maison Lejaby has reinvented itself and signs unique collections with no other limit than this perfect “fit”, designed to be the most sensual declaration of love to women. 2 COLLECTION STRATEGY 4 PRICE POSITIONING 6 summary COLLECTION SPIRIT 8 TRENDS AND COLOURS 9 COLLECTIONS 15 PREMIUM COLLECTION 16 PREMIUM NEW LINES 18 PREMIUM TIMELESS PIECES 30 ELIXIR COLLECTION 52 ELIXIR NEW LINES 54 ELIXIR TIMELESS PIECES 62 → An interactive summary to follow the thread of Maison Lejaby collections 3 FRENCH COUTURE SPIRIT KNOW-HOW • Intrepid designs which dare to be different • A perfect fit, probably the best in the world with ground-breaking ideas of corsetry • The most beatiful fabricsin -

Zivame Dot Com

+91-9731359197 Zivame Dot Com https://www.indiamart.com/zivame/ Zivame is India’s premier online lingerie store, featuring over 2000 lingerie styles to choose from:bridal lingerie, plus size lingerie, every day wear, shapewear, leisure ... About Us Zivame is India’s premier online lingerie store, featuring over 2000 lingerie styles to choose from:bridal lingerie, plus size lingerie, every day wear, shapewear, leisure wear, nightwear andswimwear for women. The collection is curated and hand-picked from the top national and international brands like Enamor, Wonderbra, Triumph, Ultimo, Lovable, Plié, Jockey, Amanté, Bw!tch, Curvy Kate, Hanes and many others. For more information, please visit https://www.indiamart.com/zivame/aboutus.html APPAREL P r o d u c t s & S e r v i c e s Work Out Crop Top Moonbasa Flowy Shirt With Scarf Moonbasa Flower Sleeves Moonbasa Hidden Lace Cowl Cowl Neck Top Top NIGHTWEAR P r o d u c t s & S e r v i c e s Coucou Cotton Soft Coucou Light Cotton Cozy Sleeveless Top Sleep Tee Coucou Cotton Snug Fit Sleep Shirts Racerback Sleep Tee-Pink PANTIES P r o d u c t s & S e r v i c e s Penny Medium Coverage Penny Luxurious Lace Trim Cotton Hipster Brief Hipster Brief Penny Cotton Soft Rushed Penny Plus High Waist Full Bikini Brief Coverage Brief-Black SHAPEWEAR P r o d u c t s & S e r v i c e s Bust Shaping Bust Shaping Smoothening Penny Plus High Waist Full Coverage Brief-Beige BRAS P r o d u c t s & S e r v i c e s Coverage Wirefree Bra Coucou Soft Cup Full Coverage Wired Bra Lovable Youthful Seamless Wide Strap T-shirt Bra Underwired Demi Cup Bra OTHER PRODUCTS P r o d u c t s & S e r v i c e s Enamor Reversible Multiway Enamor Tropical Flora Bra Balconette Bra Enamor High Coverage FIT Curve Shaping Camisole Double Layered Bra P r o OTHER PRODUCTS: d u c t s & S e r v i c e s Moonbasa Cascading Lace Sleep Shirts Top Biara Mid Rise Bikini Biref Jockey Seamfree High Waist Tummy Shaping Brief F a c t s h e e t Year of Establishment : 2000 Nature of Business : Manufacturer CONTACT US Zivame Dot Com Contact Person: Ajay Kumar No. -

Press Kit the History of French Lingerie at the Sagamore Hotel Miami Beach

LINGERIE FRANCAISE EXHIBITION PRESS KIT THE HISTORY OF FRENCH LINGERIE AT THE SAGAMORE HOTEL MIAMI BEACH Continuing its world tour, the Lingerie Francaise exhibition will be presented at the famous Sagamore Hotel Miami Beach during the Art Basel Fair in Miami Beach from November 29th through December 6th, 2016. Free and open to all, the exhibition showcases the ingeniousness and creativity of French lingerie which, for over a century and a half, has been worn by millions of women worldwide. The exhibition is an immersion into the collections of eleven of the most prestigious French brands: AUBADE, BARBARA, CHANTELLE, EMPREINTE, IMPLICITE, LISE CHARMEL, LOU, LOUISA BRACQ, MAISON LEJABY, PASSIONATA and SIMONE PÉRÈLE. With both elegance and playfulness, the story of an exceptional craft unfolds in a space devoted to contemporary art. The heart of this historic exhibition takes place in the Game Room of the Sagamore Hotel. Beginning with the first corsets of the 1880’s, the presentation documents the custom-made creations of the 1930’s, showcases the lingerie of the 1950’s that was the first to use nylon, and culminates with the widespread use of Lycra® in the 1980’s, an epic era of forms and fabrics. This section focuses on contemporary and future creations; including the Lingerie Francaise sponsored competition’s winning entry by Salima Abes, a recent graduate from the university ESMOD Paris. An exclusive collection of approximately one hundred pieces will be exhibited, all of them emblematic of a technique, textile, and/or fashion innovation. A selection of landmark pieces will trace both the history of intimacy and the narrative of women’s liberation. -

WO 2017/096075 Al 8 June 2017 (08.06.2017) P O P C T

(12) INTERNATIONAL APPLICATION PUBLISHED UNDER THE PATENT COOPERATION TREATY (PCT) (19) World Intellectual Property Organization International Bureau (10) International Publication Number (43) International Publication Date WO 2017/096075 Al 8 June 2017 (08.06.2017) P O P C T (51) International Patent Classification: BZ, CA, CH, CL, CN, CO, CR, CU, CZ, DE, DJ, DK, DM, A41C 3/00 (2006.01) A41C 3/12 (2006.01) DO, DZ, EC, EE, EG, ES, FI, GB, GD, GE, GH, GM, GT, HN, HR, HU, ID, IL, IN, IR, IS, JP, KE, KG, KN, KP, KR, (21) International Application Number: KW, KZ, LA, LC, LK, LR, LS, LU, LY, MA, MD, ME, PCT/US20 16/064471 MG, MK, MN, MW, MX, MY, MZ, NA, NG, NI, NO, NZ, (22) International Filing Date: OM, PA, PE, PG, PH, PL, PT, QA, RO, RS, RU, RW, SA, 1 December 2016 (01 .12.2016) SC, SD, SE, SG, SK, SL, SM, ST, SV, SY, TH, TJ, TM, TN, TR, TT, TZ, UA, UG, US, UZ, VC, VN, ZA, ZM, (25) Filing Language: English ZW. (26) Publication Language: English (84) Designated States (unless otherwise indicated, for every (30) Priority Data: kind of regional protection available): ARIPO (BW, GH, 14/957,420 2 December 2015 (02. 12.2015) US GM, KE, LR, LS, MW, MZ, NA, RW, SD, SL, ST, SZ, TZ, UG, ZM, ZW), Eurasian (AM, AZ, BY, KG, KZ, RU, (72) Inventor; and TJ, TM), European (AL, AT, BE, BG, CH, CY, CZ, DE, (71) Applicant : BRAVERMAN, Laurie [US/US]; 200 West DK, EE, ES, FI, FR, GB, GR, HR, HU, IE, IS, IT, LT, LU, 72nd Street, New York, New York 10023 (US). -

Private Lessons a Photo Story by Andrea Slip

Private Lessons A photo story by Andrea Slip 1 | P a g e Lesson01 Mike was a little nervous as he stood outside the brown front door on a Sunday afternoon. His mum had arranged for him to have some A-level revision lessons with a Miss Loren, a friend of hers who used to be a maths teacher. He didn’t quite know what to expect. He knocked on the door. Within a few moments the door opened. Mike had to try very, very hard not to let his jaw hit the floor. A lady opened the door to Mike. “You must be Mike, pleased to meet you, do come in, I am Sophie Loren” said Sophie shaking his hand. Mike recovered as he stared in amazement at the lady dressed in a cream silk dress. As she put her brown high heels on the step her button up dress split at the front to reveal both a cream lace edged slip and possibly the hint of a lacy stocking top. Miss Loren, Sophie, looked vaguely familiar, but he couldn’t quite place where from. 2 | P a g e Lesson02 Earlier that Sunday Sophie was dressing in her bedroom. She remembered that this afternoon that the son of her co-worker Alison was coming round for his first maths revision lesson. She had also established with Alison in the staffroom at work that he was the shelf stacker that had seen her up- skirt flash and had “helped” her find the toilet when her skirt had accidently fallen down at the Supermarket. -

Waist Shapers Return Policy

Waist Shapers Return Policy VariformTearable Pearceand arborescent desiderated: Gilberto he philosophized clarion her defibrillator his ecstasy putt cogently sprauchles and disagreeably. and seize adulterously. Villanovan Davon cord opinionatively. What other trainers help getting into three hook count as you must confirm you are not valid on all tags cut out with sizing experts who is non transferable and return policy for Javascript is waist shapers return policy, then arrow keys to get results on easily wear the following items. Your return policy or we have to the space key then please return. Building our policies on kim kardashian, software in place an additional exclusive offers! By the fullest part is time by step out your desired size suggested or swimwear must match the nature calls and our policies. It is waist shapers return policy, email address is missing by the merchandise only offers different model. The waist shapers and the fat on usage and change on the authenticity of our policy for assistance at your bank reverse the return? Both items cannot sign up or made fajas reductoras, waist shapers made by the make you can i need to stock on a stylized figure with the description of? Everytime i return policy for returns! Click save and waist policies vary based on? The waist shapers are exclusive rewards member of your profile image. See just not progressively loaded with a large in place an item has a recent viewed tab at this product for best bra is. Logged into those curves and shapers made. You are not set of waist shapers are often you accept returns policy for exchanges due to the company! If your return policy will be closed on your item? Access to waist shapers return policy? Please note your returned. -

Download Journal

Tuesday, February 2 Cipriani 42nd Street, NYC In the wake of the devastation brought about by the earthquake that leveled much of Haiti, the Underfashion Club has financially supported the efforts of Doctors Without Borders to provide emergency medical care to the survivors. Additionally, we applaud the efforts of so many other organizations, including K.I.D.S. (Kids In Distressed Situations,) a 25-year-old charity that has mobilized the apparel industry and already raised more than $6 million in products (clothes, socks, underwear and blankets) for the men, women and children of Haiti. Their efforts are ongoing and, in the months to come, as that country rebuilds and the news media departs, there will continue to be a need for a variety of items donated by manufacturers and retailers. If your company is is in a position to make new product donations in aid of this monumental relief effort, kindly consider contacting: 212.279.5493 / 800.266.3314 www.KIDSdonations.org The Underfashion Club, Inc. Rosa Chamides, Tom Garson and Barbara Lipton Femmy Gala Chairpersons welcome you to the FEMMY GALA 2010 HONORING FELINA LINGERIE Accepted by ROBERT ZARABI President & Chief Executive Officer _______________________________ Innovation Award Recipient BARE NECESSITIES® Accepted by NOAH WRUBEL Chief Executive Officer _______________________________ REGINA MIRACLE INTERNATIONAL Accepted by MR. Y.Y. HUNG Chairman _______________________________ Lifetime Achievement Recipient GWEN WIDELL Sr. Vice President of Merchandising WACOAL AMERICA INC. _______________________________ MACY*S Presented by ROB SMITH Executive Vice President/General Merchandise Manager Juniors, Dresses, Suits, Swim, Coats, Intimate Apparel and Kids _______________________________ Tuesday, February 2, 2010 Cipriani 42nd Street, New York City GUEST COMEDIAN HAL SPARKS Actor, comedian, musician Hal Sparks began his professional career in Chicago as a member of the famed Second City Troupe, where his quick wit and affable personality quickly gained him recognition and acclaim. -

Tasty Thanksgiving Special & My Personal Favorites At

Search here... B r a D o c t o r ' s B l o g | N o w T h a t ' s L i n g e r i e ( h t t p s : / / b l o g . n o w t h a t s l i n g e r i e . c o m / ) Lingerie & Fashion Tips from Celine & friends B L O G U P D A T E S / E V E N T S / S T U F F O N S A L E ! Tasty Thanksgiving Special & My Personal Favorites at NTL by Cathie (https://blog.nowthatslingerie.com/author/cathie) on November 22, 2012 Hello ladies! It’s almost time for American Thanksgiving, which means tasty deals you can really sink your teeth into (http://www.nowthatslingerie.com/en/american-thanksgiving-sale-2012.php?itemtype=4&ad=keyword_bdblog_112212)! No matter where you live, we at Now That’s Lingerie (https://www.nowthatslingerie.com/) would like to present you with a special offer for the upcoming holiday –something we’re sure you’ll be thankful for (especially since it’s a great time to get a head start on purchasing your holiday gifts)! TOP Search here... (https://www.nowthatslingerie.com/) From November 22nd – 26th, get FREE SHIPPING on all orders $49 and up, PLUS $10 off orders $100-$199.99 | $30 off orders $200 – $299.99 | $50 off orders $300 and up! Exclusively on Now That’s Lingerie.com (http://www.nowthatslingerie.com)! Just use promo code THANKSNTL2012 at checkout to save! To help guide your shopping, here are a few of our must-have picks from the cornucopia of styles and products we’re drooling over this season, that may have you reaching for your posh little wallet! TOP (https://www.nowthatslingerie.com/all-styles-catalog.html? brand=182&cat=173) Show Girl Tease Me Balcony Bra — Curvy Kate Search here..