Bankruptcy Forms

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK

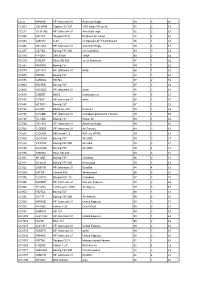

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK-HFM Tupolev Tu-134 CSA -large OK on fin 91 2 £3 CC211 G-31-962 HP Jetstream 31 American eagle 92 2 £1 CC368 N4213X Douglas DC-6 Northern Air Cargo 88 4 £2 CC373 G-BFPV C-47 ex Spanish AF T3-45/744-45 78 1 £4 CC446 G31-862 HP Jetstream 31 American Eagle 89 3 £1 CC487 CS-TKC Boeing 737-300 Air Columbus 93 3 £2 CC489 PT-OKF DHC8/300 TABA 93 2 £2 CC510 G-BLRT Short SD-360 ex Air Business 87 1 £2 CC567 N400RG Boeing 727 89 1 £2 CC573 G31-813 HP Jetstream 31 white 88 1 £1 CC574 N5073L Boeing 727 84 1 £2 CC595 G-BEKG HS 748 87 2 £2 CC603 N727KS Boeing 727 87 1 £2 CC608 N331QQ HP Jetstream 31 white 88 2 £1 CC610 D-BERT DHC8 Contactair c/s 88 5 £1 CC636 C-FBIP HP Jetstream 31 white 88 3 £1 CC650 HZ-DG1 Boeing 727 87 1 £2 CC732 D-CDIC SAAB SF-340 Delta Air 89 1 £2 CC735 C-FAMK HP Jetstream 31 Canadian partner/Air Toronto 89 1 £2 CC738 TC-VAB Boeing 737 Sultan Air 93 1 £2 CC760 G31-841 HP Jetstream 31 American Eagle 89 3 £1 CC762 C-GDBR HP Jetstream 31 Air Toronto 89 3 £1 CC821 G-DVON DH Devon C.2 RAF c/s VP955 89 1 £1 CC824 G-OOOH Boeing 757 Air 2000 89 3 £1 CC826 VT-EPW Boeing 747-300 Air India 89 3 £1 CC834 G-OOOA Boeing 757 Air 2000 89 4 £1 CC876 G-BHHU Short SD-330 89 3 £1 CC901 9H-ABE Boeing 737 Air Malta 88 2 £1 CC911 EC-ECR Boeing 737-300 Air Europa 89 3 £1 CC922 G-BKTN HP Jetstream 31 Euroflite 84 4 £1 CC924 I-ATSA Cessna 650 Aerotaxisud 89 3 £1 CC936 C-GCPG Douglas DC-10 Canadian 87 3 £1 CC940 G-BSMY HP Jetstream 31 Pan Am Express 90 2 £2 CC945 7T-VHG Lockheed C-130H Air Algerie -

Airline Schedules

Airline Schedules This finding aid was produced using ArchivesSpace on January 08, 2019. English (eng) Describing Archives: A Content Standard Special Collections and Archives Division, History of Aviation Archives. 3020 Waterview Pkwy SP2 Suite 11.206 Richardson, Texas 75080 [email protected]. URL: https://www.utdallas.edu/library/special-collections-and-archives/ Airline Schedules Table of Contents Summary Information .................................................................................................................................... 3 Scope and Content ......................................................................................................................................... 3 Series Description .......................................................................................................................................... 4 Administrative Information ............................................................................................................................ 4 Related Materials ........................................................................................................................................... 5 Controlled Access Headings .......................................................................................................................... 5 Collection Inventory ....................................................................................................................................... 6 - Page 2 - Airline Schedules Summary Information Repository: -

Integrated Report 2020 Index

INTEGRATED REPORT 2020 INDEX 4 28 70 92 320 PRESENTATION CORPORATE GOVERNANCE SECURITY METHODOLOGY SWORN STATEMENT 29 Policies and practices 71 Everyone’s commitment 93 Construction of the report 31 Governance structure 96 GRI content index 35 Ownership structure 102 Global Compact 5 38 Policies 103 External assurance 321 HIGHLIGHTS 74 104 Glossary CORPORATE STRUCTURE LATAM GROUP EMPLOYEES 42 75 Joint challenge OUR BUSINESS 78 Who makes up LATAM group 105 12 81 Team safety APPENDICES 322 LETTER FROM THE CEO 43 Industry context CREDITS 44 Financial results 47 Stock information 48 Risk management 83 50 Investment plan LATAM GROUP CUSTOMERS 179 14 FINANCIAL INFORMATION INT020 PROFILE 84 Connecting people This is a 86 More digital travel experience 180 Financial statements 2020 navigable PDF. 15 Who we are 51 270 Affiliates and subsidiaries Click on the 17 Value generation model SUSTAINABILITY 312 Rationale buttons. 18 Timeline 21 Fleet 52 Strategy and commitments 88 23 Passenger operation 57 Solidary Plane program LATAM GROUP SUPPLIERS 25 LATAM Cargo 62 Climate change 89 Partner network 27 Awards and recognition 67 Environmental management and eco-efficiency Presentation Highlights Letter from the CEO Profile Corporate governance Our business Sustainability Integrated Report 2020 3 Security Employees Customers Suppliers Methodology Appendices Financial information Credits translated at the exchange rate of each transaction date, • Unless the context otherwise requires, references to “TAM” although a monthly rate may also be used if exchange rates are to TAM S.A., and its consolidated affiliates, including do not vary widely. TAM Linhas Aereas S.A. (“TLA”), which operates under the name “LATAM Airlines Brazil”, Fidelidade Viagens e Turismo Conventions adopted Limited (“TAM Viagens”), and Transportes Aéreos Del * Unless the context otherwise requires, references to Mercosur S.A. -

Bankruptcy Tilts Playing Field Frank Boroch, CFA 212 272-6335 [email protected]

Equity Research Airlines / Rated: Market Underweight September 15, 2005 Research Analyst(s): David Strine 212 272-7869 [email protected] Bankruptcy tilts playing field Frank Boroch, CFA 212 272-6335 [email protected] Key Points *** TWIN BANKRUPTCY FILINGS TILT PLAYING FIELD. NWAC and DAL filed for Chapter 11 protection yesterday, becoming the 20 and 21st airlines to do so since 2000. Now with 47% of industry capacity in bankruptcy, the playing field looks set to become even more lopsided pressuring non-bankrupt legacies to lower costs further and low cost carriers to reassess their shrinking CASM advantage. *** CAPACITY PULLBACK. Over the past 20 years, bankrupt carriers decreased capacity by 5-10% on avg in the year following their filing. If we assume DAL and NWAC shrink by 7.5% (the midpoint) in '06, our domestic industry ASM forecast goes from +2% y/y to flat, which could potentially be favorable for airline pricing (yields). *** NWAC AND DAL INTIMATE CAPACITY RESTRAINT. After their filing yesterday, NWAC's CEO indicated 4Q:05 capacity could decline 5-6% y/y, while Delta announced plans to accelerate its fleet simplification plan, removing four aircraft types by the end of 2006. *** BIGGEST BENEFICIARIES LIKELY TO BE LOW COST CARRIERS. NWAC and DAL account for roughly 26% of domestic capacity, which, if trimmed by 7.5% equates to a 2% pt reduction in industry capacity. We believe LCC-heavy routes are likely to see a disproportionate benefit from potential reductions at DAL and NWAC, with AAI, AWA, and JBLU in particular having an easier path for growth. -

Annual Report 2010

2010 t R AnnuAl l Repo A RepoRt 2010 Annu About this report In order to make known its performance, The financial data for 2009 and 2010 were perspectives and management model, Embraer S.A. has calculated according to the criteria set forth by adopted, for the third consecutive year, the international Brazilian accounting standards (International Financial Global Reporting Initiative (GRI) guidelines in the G3 Accounting Standards – IFRS), and they were audited version, and we declare that we have achieved application by PricewaterhouseCoopers. In the case of significant level “B.” This publication makes reference to the results of changes that affect the comparability of the information, 2010 as published in 2011. GRI 3.2 | 3.3 they will be duly indicated during the report. Information Our objective is to present economic, social and regarding the location of the GRI indicators can be environmental results clearly, transparently and broadly to found at the end of this report and, also, at the end of stakeholders (employees, customers, community, financial the paragraphs, graphs or tables in which they were institutions, suppliers, government, NGOs, shareholders and described. GRI 3.7 | 3.8 | 3.9 | 3.10 | 3.11 | 3.12 | 3.13 investors, representative associations and organizations, As Embraer sees it, the geographical definition of and media). GRI 4.14 “place” refers to the suppliers located in the same country We also plan to show the initiatives and the as its headquarters – that is, Brazil. GRI 2.1 commitment to development, with a focus on management and results, and to show how Embraer mitigates the impacts caused by its activities on the environment. -

Rslt Airport Activitydatetime Aircraftnummodeltypeactivity

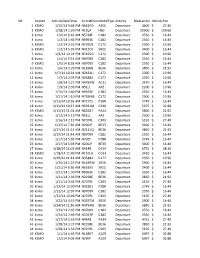

rslt Airport ActivityDateTime AircraftNumModelTypeActivity MaxLandin ActivityFee 1 KSMO 1/10/14 9:43 PM N661PD AS50 Departure 4600 $ 27.40 2 KSMO 1/18/14 1:20 PM N15LA H60 Departure 20000 $ 109.60 3 ksmo 1/2/14 9:16 AM N5738F C182 Departure 2550 $ 16.44 4 ksmo 1/2/14 1:43 PM N9955E C182 Departure 2550 $ 16.44 5 KSMO 1/2/14 3:52 PM N739DZ C172 Departure 2300 $ 10.96 6 KSMO 1/2/14 5:03 PM N412DJ SR22 Departure 3400 $ 16.44 7 ksmo 1/3/14 12:24 PM N7425G C172 Departure 2300 $ 10.96 8 ksmo 1/4/14 9:51 AM N97099 C182 Departure 2550 $ 16.44 9 KSMO 1/5/14 8:28 AM N97099 C182 Departure 2550 $ 16.44 10 ksmo 1/6/14 2:29 PM N18308 BE36 Departure 3850 $ 21.92 11 ksmo 1/7/14 10:24 AM N2434U C172 Departure 2300 $ 10.96 12 ksmo 1/7/14 2:33 PM N35884 C177 Departure 2350 $ 10.96 13 ksmo 1/8/14 1:21 PM N4792W AC11 Departure 3140 $ 16.44 14 ksmo 1/9/14 2:33 PM N51LL AA5 Departure 2200 $ 10.96 15 ksmo 1/10/14 2:40 PM N9955E C182 Departure 2550 $ 16.44 16 ksmo 1/11/14 1:10 PM N739MB C172 Departure 2300 $ 10.96 17 ksmo 1/13/14 10:26 AM N727CS P28R Departure 2749 $ 16.44 18 ksmo 1/13/14 10:27 AM N5931M C340 Departure 5975 $ 32.88 19 KSMO 1/13/14 11:01 AM N8328T PA44 Departure 3800 $ 21.92 20 ksmo 1/13/14 5:13 PM N51LL AA5 Departure 2200 $ 10.96 21 ksmo 1/16/14 2:12 PM N707RL C303 Departure 5150 $ 27.40 22 ksmo 1/17/14 7:36 AM N200JF BE33 Departure 3400 $ 16.44 23 ksmo 1/17/14 11:13 AM N2111Q BE36 Departure 3850 $ 21.92 24 ksmo 1/17/14 11:44 AM N97099 C182 Departure 2550 $ 16.44 25 ksmo 1/17/14 5:02 PM N70EF P28R Departure 2749 $ 16.44 26 ksmo 1/17/14 5:03 PM -

U.S. Department of Transportation Federal Motor Carrier Safety Administration REGISTER

U.S. Department of Transportation Federal Motor Carrier Safety Administration REGISTER A Daily Summary of Motor Carrier Applications and of Decisions and Notices Issued by the Federal Motor Carrier Safety Administration DECISIONS AND NOTICES RELEASED January 22, 2013 -- 10:30 AM NOTICE Please note the timeframe required to revoke a motor carrier's operating authority for failing to have sufficient levels of insurance on file is a 33 day process. The process will only allow a carrier to hold operating authority without insurance reflected on our Licensing and Insurance database for up to three (3) days. Revocation decisions will be tied to our enforcement program which will focus on the operations of uninsured carriers. This process will further ensure that the public is adequately protected in case of a motor carrier crash. Accordingly, we are adopting the following procedure for revocation of authority; 1) The first notice will go out three (3) days after FMCSA receives notification from the insurance company that the carrier's policy will be cancelled in 30 days. This notification informs the carrier that it must provide evidence that it is in full compliance with FMCSA's insurance regulations within 30 days. 2) If the carrier has not complied with FMCSA's insurance requirements after 30 days, a final decision revoking the operating authority will be issued. NAME CHANGES NUMBER TITLE DECIDED MC-192175 BITUMINOUS TRANSPORT LLC - DODGE CITY, KS 01/16/2013 MC-256495 WESTERN INTERLOCK, INC. - RICKREALL, OR 01/16/2013 MC-288734 BEE-LINE TRANSPORTATION, INC. - HOUSTON, TX 01/16/2013 MC-357748 BRIAN HOWARD - SPEEDWELL, TN 01/16/2013 MC-454098 DENNIS H HAUGEN - MCFARLAND, WI 01/16/2013 MC-471779 OUTLANDER INC - EDMONDS, WA 01/16/2013 MC-503359 JOHN K ACKAH - MORENO VALLEY, CA 01/16/2013 MC-508985 MICHAEL PRALLE - MANTENO, IL 01/16/2013 MC-508985 MICHAEL PRALLE - MANTENO, IL 01/16/2013 MC-551868 1ST COAST CARGO INC. -

CHANGE FEDERAL AVIATION ADMINISTRATION CHG 2 Air Traffic Organization Policy Effective Date: November 8, 2018

U.S. DEPARTMENT OF TRANSPORTATION JO 7340.2H CHANGE FEDERAL AVIATION ADMINISTRATION CHG 2 Air Traffic Organization Policy Effective Date: November 8, 2018 SUBJ: Contractions 1. Purpose of This Change. This change transmits revised pages to Federal Aviation Administration Order JO 7340.2H, Contractions. 2. Audience. This change applies to all Air Traffic Organization (ATO) personnel and anyone using ATO directives. 3. Where Can I Find This Change? This change is available on the FAA website at http://faa.gov/air_traffic/publications and https://employees.faa.gov/tools_resources/orders_notices. 4. Distribution. This change is available online and will be distributed electronically to all offices that subscribe to receive email notification/access to it through the FAA website at http://faa.gov/air_traffic/publications. 5. Disposition of Transmittal. Retain this transmittal until superseded by a new basic order. 6. Page Control Chart. See the page control chart attachment. Original Signed By: Sharon Kurywchak Sharon Kurywchak Acting Director, Air Traffic Procedures Mission Support Services Air Traffic Organization Date: October 19, 2018 Distribution: Electronic Initiated By: AJV-0 Vice President, Mission Support Services 11/8/18 JO 7340.2H CHG 2 PAGE CONTROL CHART Change 2 REMOVE PAGES DATED INSERT PAGES DATED CAM 1−1 through CAM 1−38............ 7/19/18 CAM 1−1 through CAM 1−18........... 11/8/18 3−1−1 through 3−4−1................... 7/19/18 3−1−1 through 3−4−1.................. 11/8/18 Page Control Chart i 11/8/18 JO 7340.2H CHG 2 CHANGES, ADDITIONS, AND MODIFICATIONS Chapter 3. ICAO AIRCRAFT COMPANY/TELEPHONY/THREE-LETTER DESIGNATOR AND U.S. -

Airline Bankruptcy: the Post-Deregulation Epidemic

Airline Bankruptcy: The Post-Deregulation Epidemic By Paul Stephen Dempsey McGill University Institute of Air & Space Law Copyright © 2012 by the author • “Airline deregulation is a bankrupt policy.” Hobart Rowen Washington Post columnist Every major US interstate airline at the time of deregulation in 1978 has since visited bankruptcy court, several more than once. 15 US AIRLINE INDUSTRY NET PROFIT MARGINS 1950-2009 10 5 0 -5 -10 net profit margins net -15 -20 year • 2000 – U.S. profit $2.5 billion • 2001 - U.S. loses $8.3 billion • 2002 - U.S. loses $11.4 billion • 2003 - U.S. loses $1.7 billion • 2004 - U.S. loses $9.1billion • 2005 - U.S. loses $27.2 billion • 2006 - U.S. profit $18.2 billion • 2007 - U.S. profit $7.7 billion • 2008 - U.S. loses $23.8 billion • 2009 - U.S. loses $2.5 billion • 2010 – U.S. profit $3.6 billion US Carriers cumulatively lost $52 billion in this decade. U.S. General Accountability Office • “Structurally, the airline industry is characterized by high fixed costs, cyclical demand for its services, intense competition, and vulnerability to external shocks. As a result, airlines have been more prone to failure than many other businesses, and the sector’s financial performance has continually been very weak . • “Since the 1978 economic deregulation of the U.S. airline industry, airline bankruptcy filings have become prevalent in the United States, and airlines fail at a higher rate than companies in most other industries.” • U.S. Government Accountability Office, Commercial Aviation: Bankruptcy and Pension Problems are Symptoms of Underlying Structural Issues (Sep. -

CASO PRÁCTICO Iberia

CASO PRÁCTICO Iberia: Cómo adaptarse a un entorno cambiante Diego Abellán Martínez Junio 2006 ©: Quedan reservados todos los derechos. (Ley de Propiedad Intelectual del 17 de noviembre de 1987 y Reales Decretos) Documentación elaborada por el profesor para EOI. Prohibida la reproducción total o parcial sin autorización escrita de la EOI Iberia: Cómo adaptarse a un entorno cambiante ÍNDICE: 1. INTRODUCCIÓN. 3 1.1. Historia de Iberia. 3 1.2. Plan de viabilidad 1994-1996. 7 1.3. Plan Director I 1997-1999. 8 1.4. Plan Director II: 2000-2002. 12 2. SECTOR DE TRANSPORTE AÉREO DE PASAJEROS. 18 2.1. Nuevos entrantes en el mercado, las compañías de bajo coste (low 19 cost carriers). 2.2. Evolución de la demanda y capacidad en la industria de transporte 30 de aviación comercial. 2.3. Impacto del precio del petróleo. 33 2.4. Situación financiera de las líneas aéreas. 36 2.5. Fabricación de aviones comerciales: un mercado de dos. 42 2.6. El nuevo modelo aeroportuario europeo. 46 2.7. Transporte ferroviario en la Unión Europea. 50 2.8. Mercado español de aviación comercial. 52 3. PLAN DIRECTOR 2003-2005. 57 4. CONCLUSIONES. 65 5. PREGUNTAS 67 ANEXOS 70 Iberia: Cómo adaptarse a un entorno cambiante 1. INTRODUCCIÓN. El equipo gestor de Iberia tendrá una reunión la próxima semana para establecer las líneas estratégicas para el período 2006-2008. Como miembro del equipo de trabajo estas preparando el informe estratégico que será presentado al Consejo de Administración de Iberia. Deberás determinar cuáles son los principales factores de éxito en la industria de aviación comercial y qué estrategias y actuaciones tendrá que realizar la aerolínea española para mantener su posición de liderazgo en el sector del transporte aéreo de viajeros. -

Challenges Facing Civil Aviation in the 21St Century

Challenges Facing Civil Aviation in the 21st Century By Prof. Dr. Paul Stephen Dempsey McGill University Institute of Air & Space Law Copyright © 2015 by the author The world based on commercial aircraft departures. 1. Environmental Challenges 2. Safety Challenges 3. Security Challenges 4. Financial Challenges Aircraft Engine Emissions Noise Source: ICAO Key Environmental Issues Aviation Environmental Issues Global climate The potential impact of aviation on global climate Community Noise Impacts Dealing with significant aircraft noise impacts around airports Water Quality Limiting or reducing impact of aviation on Air Quality water quality Limiting or reducing impact of aviation on local air quality Source: US FAA The Kyoto Protocol • Adopted in 1997, the Kyoto Protocol to the United Nations Framework Convention on Climate Change promises to move the international community closer to achieving the Convention’s ultimate objective of preventing "dangerous anthropogenic [man-made] interference with the climate system". • The developed countries commit themselves to reducing their collective emissions of six key greenhouse gases by at least 5% compared to 1990 levels, of which CO2 is most relevant to aviation. Each country’s emissions target must be achieved by the period 2008-2012. • Countries will have a certain degree of flexibility in how they make and measure their emissions reductions. In particular, an international "emissions trading" regime will be established allowing industrialized countries to buy and sell emissions credits amongst themselves. Source: EU Commission Kyoto and ICAO “The Parties included in Annex I shall pursue limitation or reduction of emissions of greenhouse gases not controlled by the Montreal Protocol from aviation … working through the International Civil Aviation Organization….” Kyoto Protocol to the United Nations Framework Convention on Climate Change Art. -

Statement of Marshall S. Huebner, Partner, Davis

STATEMENT OF MARSHALL S. HUEBNER, PARTNER, DAVIS POLK & WARDWELL LLP BEFORE THE COMMERCIAL AND ADMINISTRATIVE LAW SUBCOMMITTEE OF THE COMMITTEE ON THE JUDICIARY U.S. HOUSE OF REPRESENTATIVES WASHINGTON, D.C. DECEMBER 16, 2009 PROTECTING EMPLOYEES IN AIRLINE BANKRUPTCIES Good afternoon, Mr. Chairman, Ranking Member, and honorable members of the Subcommittee. Thank you for inviting me to testify today. I am Marshall Huebner, co-chair of the insolvency and restructuring department at Davis Polk & Wardwell LLP. I have authored many articles on bankruptcy law as well as the forthcoming Oxford University Press treatise on Chapter 11 reorganization. Among other things, I was lead counsel to Delta Air Lines in its out-of-court restructuring and Chapter 11 proceedings, and advised Frontier Airlines and the Star Tribune in their Chapter 11 proceedings. I have also represented the lenders in several of the largest loans ever extended to Chapter 11 debtors, experience whose relevance I will address in a few moments. I would like to note that I am here today to provide the Subcommittee with what is hopefully useful information in my individual capacity, and I represent neither the views of Davis Polk & Wardwell as a firm, nor the views of any of its clients. As the Subcommittee and my fellow witnesses know all too well, the topic of Chapter 11 in general, and sections 1113 and 1114 in particular, presents a very difficult set of issues and balances. On the one hand, debtors, especially those with substantial legacy liabilities, are frequently fighting for their very lives at a severe disadvantage to newer entrants in the industry and foreign competition, both of whom often have substantially lower costs.