Semi-Annual Report 2004

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CHINA CORP. 2015 AUTO INDUSTRY on the Wan Li Road

CHINA CORP. 2015 AUTO INDUSTRY On the Wan Li Road Cars – Commercial Vehicles – Electric Vehicles Market Evolution - Regional Overview - Main Chinese Firms DCA Chine-Analyse China’s half-way auto industry CHINA CORP. 2015 Wan Li (ten thousand Li) is the Chinese traditional phrase for is a publication by DCA Chine-Analyse evoking a long way. When considering China’s automotive Tél. : (33) 663 527 781 sector in 2015, one may think that the main part of its Wan Li Email : [email protected] road has been covered. Web : www.chine-analyse.com From a marginal and closed market in 2000, the country has Editor : Jean-François Dufour become the World’s first auto market since 2009, absorbing Contributors : Jeffrey De Lairg, over one quarter of today’s global vehicles output. It is not Du Shangfu only much bigger, but also much more complex and No part of this publication may be sophisticated, with its high-end segment rising fast. reproduced without prior written permission Nevertheless, a closer look reveals China’s auto industry to be of the publisher. © DCA Chine-Analyse only half-way of its long road. Its success today, is mainly that of foreign brands behind joint- ventures. And at the same time, it remains much too fragmented between too many builders. China’s ultimate goal, of having an independant auto industry able to compete on the global market, still has to be reached, through own brands development and restructuring. China’s auto industry is only half-way also because a main technological evolution that may play a decisive role in its future still has to take off. -

State of Automotive Technology in PR China - 2014

Lanza, G. (Editor) Hauns, D.; Hochdörffer, J.; Peters, S.; Ruhrmann, S.: State of Automotive Technology in PR China - 2014 Shanghai Lanza, G. (Editor); Hauns, D.; Hochdörffer, J.; Peters, S.; Ruhrmann, S.: State of Automotive Technology in PR China - 2014 Institute of Production Science (wbk) Karlsruhe Institute of Technology (KIT) Global Advanced Manufacturing Institute (GAMI) Leading Edge Cluster Electric Mobility South-West Contents Foreword 4 Core Findings and Implications 5 1. Initial Situation and Ambition 6 Map of China 2. Current State of the Chinese Automotive Industry 8 2.1 Current State of the Chinese Automotive Market 8 2.2 Differences between Global and Local Players 14 2.3 An Overview of the Current Status of Joint Ventures 24 2.4 Production Methods 32 3. Research Capacities in China 40 4. Development Focus Areas of the Automotive Sector 50 4.1 Comfort and Safety 50 4.1.1 Advanced Driver Assistance Systems 53 4.1.2 Connectivity and Intermodality 57 4.2 Sustainability 60 4.2.1 Development of Alternative Drives 61 4.2.2 Development of New Lightweight Materials 64 5. Geographical Structure 68 5.1 Industrial Cluster 68 5.2 Geographical Development 73 6. Summary 76 List of References 78 List of Figures 93 List of Abbreviations 94 Edition Notice 96 2 3 Foreword Core Findings and Implications . China’s market plays a decisive role in the . A Chinese lean culture is still in the initial future of the automotive industry. China rose to stage; therefore further extensive training and become the largest automobile manufacturer education opportunities are indispensable. -

"Industrial Groups and Division of Labor in China's Automobile

The Developing Economies, XXXIII-3 (September 1995) INDUSTRIAL GROUPS AND DIVISION OF LABOR IN CHINA’S AUTOMOBILE INDUSTRY TOMOO MARUKAWA I. INTRODUCTION A. Changes in the Division of Labor in China Until the 1970s, China’s industries had followed a system which can be called a vertically divided division of labor. Under this system each enterprise within an industry generally specialized in producing a particular end product within a spe- cific narrow field, and each enterprise subsumed within itself all of the stages in the production process. In the machinery industry, for example, a firm manufacturing a particular machine would carry out the final assembly process as well as the upstream machining, casting, forging, and heat-treating processes. Figure 1 illus- trates the concept of the vertically divided division of labor as was found in the automobile manufacturing industry. An enterprise subsumed within itself all of those upstream-production stages encompassed by the solid line, but very often the firm produced only one particular end product. This division-of-labor system derives partly from the preconditions in China at the time the country began industrialization. The country’s preexisting industrial base was extremely weak, and there was little hope of procuring parts and compo- nents externally. In addition, the vertically divided division of labor reduced the uncertainties inherent in transactions among enterprises because only a small num- ber of enterprises became involved in the production process from the raw-materi- als stage to the final-assembly stage. As a result the system was seen as more suit- able for a planned economy. -

Le Trattative Per La Cessione Di Iveco a FAW (Cina): Implicazioni E Possibili Strumenti a Tutela Dell’Interesse Nazionale

Le trattative per la cessione di Iveco a FAW (Cina): implicazioni e possibili strumenti a tutela dell’interesse nazionale. Santagada Francesco – Livadiotti Luca Analytica for intelligence and security studies Paper Intelligence ISSN 2724-3796 Le trattative per la cessione di Iveco a FAW (Cina). Implicazioni e possibili strumenti a tutela dell’interesse nazionale. Livadiotti Luca – Santagada Francesco Correzioni e revisioni a cura del Dottor PANEBIANCO Andrea Torino, marzo 2020 Le trattative per la cessione di Iveco a FAW (Cina): implicazioni e possibili strumenti a tutela dell’interesse nazionale Executive Summary Secondo le dichiarazioni di un portavoce del Gruppo, CNH Industrial è in trattativa per la cessione di Iveco alla FAW Group Corporation (FAW), primario produttore automobilistico cinese, la cui proprietà è riferibile alla Commissione per la Supervisione e l’Amministrazione dei Beni dello Stato cinese. L’eventuale cessione di Iveco, che si configura come alternativa allo spin-off aziendale annunciato da CNH nel 2019, non include i veicoli militari di IVECO Defence Vehicles, storico fornitore dell’Esercito Italiano, ma riguarda potenzialmente tutti gli altri marchi di Iveco S.p.A., oltre a una quota di minoranza della società FPT (divisione motori del Gruppo CNH). Gli impatti dell’operazione sugli interessi italiani possono essere sia occupazionali, per oltre 8.000 dipendenti di Iveco e FPT sul territorio italiano, sia tecnologici, soprattutto in materia di biomobilità e progetti sull’utilizzo dell’idrogeno. A fronte delle numerose -

The Case of FAW Volkswagen

2018 International Conference on Economic Management Science and Financial Innovation (ICEMSFI 2018) ISBN: 978-1-60595-576-6 The Supplier System in Chinese Automobile Industry: The Case of FAW Volkswagen Meihui Zhao ABSTRACT Recently, the Chinese automobile industry has achieved remarkable progress. Both production and sales volumes in China have been rapidly increasing. Based on the overall auto sale volume in China, over 50 percent of production volume belongs to joint-venture manufacturers. In order to investigate competitive strategies of the Chinese automobile industry, the study of automobile companies and their supplier systems (SS) are necessary. In the current research, the joint venture manufacturer FAW VW Automobile Co. Ltd., (FAW VW), which is a leading automobile company with high performance in the Chinese market, is taken as an example. Through applying the comparative study methodology, as well as the investigation and analysis methods based on FAW-VW and its supplier system, the drawback of the current supplier system has been identified. The major implication of the proposed study is that inter-organizational relationships of FAW-VW and its suppliers are becoming stronger during the progress of solving problems while the development and production systems are still relying much on suppliers1. INTRODUCTION In the automobile assembly maker, approximately 20000 parts are assembled, and the ratio of material cost to manufacturing cost exceeds 70%. As automobile assembly manufacturers procure most of them from external parts suppliers, their competitiveness depends largely not on only their own development and production process management but also the purchasing control abilities. Therefore, when analyzing the competitiveness of automobile manufacturers, it is important for 1Meihui Zhao, Graduate School of Utsunomiya University, 350 Mine-Machi Utsunomiya, Tochigi, Japan 141 automobile manufacturers to focus on the supplier system, which is the comprehensive interdependence relationship with suppliers (Asanuma, 1997; Fujimoto, 1998). -

2020 International Forum (TEDA) on Chinese Automotive Industry

2020 International Forum (TEDA) on Chinese Automotive Industry Development Annual Theme: Double Upgrading of Industry and Consumption Restructuring the New Ecological Layout September 4, 2020 (Offline Meeting) Opening and Cooperation to achieve Win-win in Future: Development Environment for High-level Autonomous Driving and International Coordination Background: At present, the mass production of low-level autonomous driving vehicles has started. The development of high-level self-driving vehicles is still in the initial stage due to the impacts of various factors such as laws, regulations, usage environment, and technology maturity etc.. Europe, the United States, and other countries and regions have been relatively active in programming and investing in the field of autonomous driving. The R & D and tests on autonomous vehicles had been carried out earlier; the Framework Documents for Autonomous Driving Vehicles, which was jointly established by China, the European Union, Japan and the United States, had passed the examination of the United Nations in June 2019. It is a solid step in the development of high-level self-driving vehicles. However, G9 Forum (VIP the future development is still highly dependent on the supports of the policy Closed-door Meeting, environment, technology R&D, and the building of infrastructure. Therefore, to for VIP only) carry out international exchanges and cooperation to actively promote the development of autonomous driving and intelligent connection has become an 13:00~15:30 important direction for the sustainable development of the automotive industries in various countries. Form of Meeting: Build a multilateral communication platform for the automotive industry. The host will lead each speaker to gave a speech (about 5 minutes) in turn. -

How Successfully Manage Joint Ventures China.Indd

How to Successfully Manage Joint Ventures in China The Boston Consulting Group (BCG) is a global management consulting firm and the world’s leading advisor on business strategy. We partner with clients from the private, public, and not-for- profit sectors in all regions to identify their highest-value opportunities, address their most critical challenges, and transform their enterprises. Our customized approach combines deep insight into the dynamics of companies and markets with close collaboration at all levels of the client organization. This ensures that our clients achieve sustainable competitive advantage, build more capable organizations, and secure lasting results. Founded in 1963, BCG is a private company with 85 offices in 48 countries. For more information, please visit bcg.com. How to Successfully Manage Joint Ventures in China Nikolaus Lang, Marco Gerrits, Dinesh Khanna, Alexander Roos, Frauke Uekermann, Ying Luo, and Gang Xu March 2016 AT A GLANCE With over 1 billion consumers eager to buy everything from beauty products to luxury cars, China is an irresistible target for multinational corporations (MNCs) seeking growth. But in some industries, regulatory restrictions on foreign ownership make joint ventures the only viable option for producing goods locally. JV Activity Is Booming—but Outcomes Are Often Disappointing While generally bullish on JVs, most MNCs believe that they give more value than they get. Typical problems include organizational and governance models that don’t work well, cultural differences, and difficulties -

China Annex VI

Annex I. Relations Between Foreign and Chinese Automobile Manufacturers Annex II. Brands Produced by the Main Chinese Manufacturers Annex III. SWOT Analysis of Each of the Ten Main Players Annex IV. Overview of the Location of the Production Centers/Offices of the Main Chinese Players Annex V. Overview of the Main Auto Export/Import Ports in China Annex VI. An Atlas of Pollution: The World in Carbon Dioxide Emissions Annex VII. Green Energy Vehicles Annex VIII. Further Analysis in the EV vehicles Annex IX. Shifts Towards E-mobility Annex I. Relations Between Foreign and Chinese Automobile Manufacturers. 100% FIAT 50% Mitsubishi Guangzhou IVECO 50% Beijing Motors 50% Hyundai 50% GAC Guangzhou FIAT GAC VOLVO 91.94% Mitsubishi 50% 50% 50% 50% 50% (AB Group) Guangzhou BBAC 50% Hino Hino Dongfeng DCD Yuan Beiqi 50% 50% NAVECO Invest Dongfeng NAC Yuejin 50% Cumins Wuyang 50% Guangzhou GAC Motor Honda 50% Yuejin Beiqi Foton Toyota 50% Cumins DET 50% 55.6% 10% 20% 50% Beiqi DYK 100% Guangzhou Group Motors 50% 70% Daimler Toyota 30% 25% 50% 65% Yanfeng SDS shanghai 4.25% 100% 49% Engine Honda sunwin bus 65% 25% visteon Holdings Auto 50% (China) UAES NAC Guangzhou 50% Beilu Beijing 34% Denway Automotive 50% Foton 51% 39% motorl Guangzhou 50% Shanghai Beiqi Foton Daimler 100% 30% 50% VW BAIC Honda Kolben 50% 90% Zhonglong 50% Transmission 50% DCVC schmitt Daimler Invest 100% 10% Guangzhou piston 49% DFM 53% Invest Guangzhou Isuzu Bus 100% Denway Beiqi 33.3% Bus GTE GTMC Manafacture xingfu motor 50% 20% SAIC SALES 100% 20% 100% 100% DFMC 100% Shanghai -

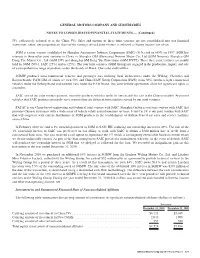

General Motors Company and Subsidiaries Notes To

GENERAL MOTORS COMPANY AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued) JV), collectively referred to as the China JVs. Sales and income of these joint ventures are not consolidated into our financial statements; rather, our proportionate share of the earnings of each joint venture is reflected as Equity income, net of tax. SGM is a joint venture established by Shanghai Automotive Industry Corporation (SAIC) (51%) and us (49%) in 1997. SGM has interests in three other joint ventures in China — Shanghai GM (Shenyang) Norsom Motor Co., Ltd (SGM Norsom), Shanghai GM Dong Yue Motors Co., Ltd (SGM DY) and Shanghai GM Dong Yue Powertrain (SGM DYPT). These three joint ventures are jointly held by SGM (50%), SAIC (25%) and us (25%). The four joint ventures (SGM Group) are engaged in the production, import, and sale of a comprehensive range of products under the brands of Buick, Chevrolet and Cadillac. SGMW produces mini-commercial vehicles and passenger cars utilizing local architectures under the Wuling, Chevrolet and Baojun brands. FAW-GM, of which we own 50% and China FAW Group Corporation (FAW) owns 50%, produces light commercial vehicles under the Jiefang brand and medium vans under the FAW brand. Our joint venture agreements allow for significant rights as a member. SAIC, one of our joint venture partners, currently produces vehicles under its own brands for sale in the Chinese market. At present vehicles that SAIC produces primarily serve markets that are different from markets served by our joint ventures. PATAC is our China-based engineering and technical joint venture with SAIC. Shanghai OnStar is our joint venture with SAIC that provides Chinese customers with a wide array of vehicle safety and information services. -

Quarter Century of Challenges Tackled

The trusted voice of the auto industry for more than 25 years Issue 09-2013 21 May 2013 In this issue Quarter century of p7 Fiat Chrysler new venture p10 Ad complaint thrown out p11 Delivering dealer savings challenges tackled p15 Marque under one roof p16 Examining ESC in depth any changes can take level and to agree to establish one place in an industry trade association,” recalls Kerr. p17 Selling systems essential during two-and-a-half “At that time, there were still Mdecades, but two of the biggest significant tariffs on CBU vehicles, challenges Perry Kerr has faced and a fair degree of animosity in the automotive sector came to between the importers and local pass within two years of each other. assemblers. Kerr is retiring next month “Having said that, there was after 26 years in the sector. a high degree of co-operation at Sixteen of those were as chief the technical level where I had executive officer of the Motor Perry Kerr co-ordinated numerous meetings Industry Association (MIA), between the importers and Trusted for which he helped to establish, time – getting the MIA up and assemblers. over 25 years and before that he worked for running and then overseeing the “For the importers, BMW’s John Freephone: 0800 435 7868 [email protected] • www.protecta.co.nz the Motor Vehicle Manufacturers’ closure of the assembly industry. Leggett was one of the primary Association (MVMA). The MIA, which was established movers in this co-operation.” He has relinquished his role as in October 1996, brought together As for the biggest challenge CEO of the MIA but is staying on the Association of Motor Importers since then, one that stands out is Maserati's new Ghibli until the end of June in an advisory and Distributors NZ and the MVMA. -

North Korea Sanctions & Enforcement Actions Advisory

DEPARTMENT OF THE TREASURY DEPARTMENT OF STATE DEPARTMENT OF HOMELAND SECURITY WASHINGTON, D.C. 20520 North Korea Sanctions & Enforcement Actions Advisory Issued: July 23, 2018 Title: Risks for Businesses with Supply Chain Links to North Korea The U.S. Department of State, with the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) and the U.S. Department of Homeland Security’s (DHS) Customs and Border Protection (CBP) and Immigration and Customs Enforcement (ICE), is issuing this advisory to highlight sanctions evasions tactics used by North Korea that could expose businesses – including manufacturers, buyers, and service providers – to sanctions compliance risks under U.S. and/or United Nations sanctions authorities. This advisory also assists businesses in complying with the requirements under Title III, the Korean Interdiction and Modernization of Sanctions Act of the Countering America’s Adversaries Through Sanctions Act (CAATSA). Businesses should be aware of deceptive practices employed by North Korea in order to implement effective due diligence policies, procedures, and internal controls to ensure compliance with applicable legal requirements across their entire supply chains. Multiple U.S. and UN sanctions impose restrictions on trade with North Korea and the use of North Korean labor.1 The two primary risks are: (1) inadvertent sourcing of goods, services, or technology from North Korea; and (2) the presence of North Korean citizens or nationals in companies’ supply chains, whose labor generates revenue for the North Korean government. This advisory also provides due diligence references for businesses. North Korea’s system of forced labor operates both domestically and internationally. -

Audi in China

Audi Communications China Site Communications Site Communications Johanna Barth Joachim Cordshagen Tel: +86 10 6531-3962 Tel: +49 841 89-36340 E -mail: [email protected] E-mail: [email protected] www.audi-mediacenter.com/en March 2017 B A S I C P R E S S INFORMATION Audi in China ► The China site 2 ► Highlights at the site 2 ► Important cornerstones 3 ► Engagement of Audi in China 6 ► The history of Audi in China 7 ► Facts and figures 9 ► Fuel consumption of the models named above 10 1/10 www.audi-mediacenter.com Audi Communications ► The China site Audi has been active in China since 1988 and has been the leader in the country’s premium segment ever since. AUDI AG is represented in China through its joint venture FAW-Volkswagen and its one-hundred-percent subsidiary Audi China in Beijing. The Audi joint venture FAW-Volkswagen produces the models Audi A4 L, Audi A6 L, Audi A6 L e-tron, Audi Q3 and Audi Q5 in Changchun, northern China. The Audi A6 L and the Audi A4 L were developed especially for China with a longer wheelbase. In 2017, the first locally produced Audi plug-in hybrid will be available in China: the Audi A6 L e-tron. In the plant in Foshan in the south of China, the joint venture produces the Audi A3 Sportback and the Audi A3 Sedan. In August 2016 the new Audi transmission plant at Volkswagen Automatic Transmission Tianjin (ATJ) was inaugurated. The plant supplies highly-efficient seven-speed S tronic transmissions for locally produced Audi models.