Introduction to Options

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Margin Requirements Across Equity-Related Instruments: How Level Is the Playing Field?

Fortune pgs 31-50 1/6/04 8:21 PM Page 31 Margin Requirements Across Equity-Related Instruments: How Level Is the Playing Field? hen interest rates rose sharply in 1994, a number of derivatives- related failures occurred, prominent among them the bankrupt- cy of Orange County, California, which had invested heavily in W 1 structured notes called “inverse floaters.” These events led to vigorous public discussion about the links between derivative securities and finan- cial stability, as well as about the potential role of new regulation. In an effort to clarify the issues, the Federal Reserve Bank of Boston sponsored an educational forum in which the risks and risk management of deriva- tive securities were discussed by a range of interested parties: academics; lawmakers and regulators; experts from nonfinancial corporations, investment and commercial banks, and pension funds; and issuers of securities. The Bank published a summary of the presentations in Minehan and Simons (1995). In the keynote address, Harvard Business School Professor Jay Light noted that there are at least 11 ways that investors can participate in the returns on the Standard and Poor’s 500 composite index (see Box 1). Professor Light pointed out that these alternatives exist because they dif- Peter Fortune fer in a variety of important respects: Some carry higher transaction costs; others might have higher margin requirements; still others might differ in tax treatment or in regulatory restraints. The author is Senior Economist and The purpose of the present study is to assess one dimension of those Advisor to the Director of Research at differences—margin requirements. -

307439 Ferdig Master Thesis

Master's Thesis Using Derivatives And Structured Products To Enhance Investment Performance In A Low-Yielding Environment - COPENHAGEN BUSINESS SCHOOL - MSc Finance And Investments Maria Gjelsvik Berg P˚al-AndreasIversen Supervisor: Søren Plesner Date Of Submission: 28.04.2017 Characters (Ink. Space): 189.349 Pages: 114 ABSTRACT This paper provides an investigation of retail investors' possibility to enhance their investment performance in a low-yielding environment by using derivatives. The current low-yielding financial market makes safe investments in traditional vehicles, such as money market funds and safe bonds, close to zero- or even negative-yielding. Some retail investors are therefore in need of alternative investment vehicles that can enhance their performance. By conducting Monte Carlo simulations and difference in mean testing, we test for enhancement in performance for investors using option strategies, relative to investors investing in the S&P 500 index. This paper contributes to previous papers by emphasizing the downside risk and asymmetry in return distributions to a larger extent. We find several option strategies to outperform the benchmark, implying that performance enhancement is achievable by trading derivatives. The result is however strongly dependent on the investors' ability to choose the right option strategy, both in terms of correctly anticipated market movements and the net premium received or paid to enter the strategy. 1 Contents Chapter 1 - Introduction4 Problem Statement................................6 Methodology...................................7 Limitations....................................7 Literature Review.................................8 Structure..................................... 12 Chapter 2 - Theory 14 Low-Yielding Environment............................ 14 How Are People Affected By A Low-Yield Environment?........ 16 Low-Yield Environment's Impact On The Stock Market........ -

The Behaviour of Small Investors in the Hong Kong Derivatives Markets

Tai-Yuen Hon / Journal of Risk and Financial Management 5(2012) 59-77 The Behaviour of Small Investors in the Hong Kong Derivatives Markets: A factor analysis Tai-Yuen Hona a Department of Economics and Finance, Hong Kong Shue Yan University ABSTRACT This paper investigates the behaviour of small investors in Hong Kong’s derivatives markets. The study period covers the global economic crisis of 2011- 2012, and we focus on small investors’ behaviour during and after the crisis. We attempt to identify and analyse the key factors that capture their behaviour in derivatives markets in Hong Kong. The data were collected from 524 respondents via a questionnaire survey. Exploratory factor analysis was employed to analyse the data, and some interesting findings were obtained. Our study enhances our understanding of behavioural finance in the setting of an Asian financial centre, namely Hong Kong. KEYWORDS: Behavioural finance, factor analysis, small investors, derivatives markets. 1. INTRODUCTION The global economic crisis has generated tremendous impacts on financial markets and affected many small investors throughout the world. In particular, these investors feared that some European countries, including the PIIGS countries (i.e., Portugal, Ireland, Italy, Greece, and Spain), would encounter great difficulty in meeting their financial obligations and repaying their sovereign debts, and some even believed that these countries would default on their debts either partially or completely. In response to the crisis, they are likely to change their investment behaviour. Corresponding author: Tai-Yuen Hon, Department of Economics and Finance, Hong Kong Shue Yan University, Braemar Hill, North Point, Hong Kong. Tel: (852) 25707110; Fax: (852) 2806 8044 59 Tai-Yuen Hon / Journal of Risk and Financial Management 5(2012) 59-77 Hong Kong is a small open economy. -

Black-Scholes Equations

Chapter 8 Black-Scholes Equations 1 The Black-Scholes Model Up to now, we only consider hedgings that are done upfront. For example, if we write a naked call (see Example 5.2), we are exposed to unlimited risk if the stock price rises steeply. We can hedge it by buying a share of the underlying asset. This is done at the initial time when the call is sold. We are then protected against any steep rise in the asset price. However, if we hold the asset until expiry, we are not protected against any steep dive in the asset price. So is there a hedging that is really riskless? The answer was given by Black and Scholes, and also by Merton in their seminal papers on the theory of option pricing published in 1973. The idea is that a writer of a naked call can protect his short position of the option by buying a certain amount of the stock so that the loss in the short call can be exactly offset by the long position in the stock. This is standard in hedging. The question is how many stocks should he buy to minimize the risk? By adjusting the proportion of the stock and option continuously in the portfolio during the life of the option, Black and Scholes demonstrated that investors can create a riskless hedging portfolio where all market risks are eliminated. In an efficient market with no riskless arbitrage opportunity, any portfolio with a zero market risk must have an expected rate of return equal to the riskless interest rate. -

Volatility Uncertainty and the Cross-Section of Option Returns*

Volatility Uncertainty and * the Cross-Section of Option Returns [December 24, 2019] Jie Cao The Chinese University of Hong Kong E-mail: [email protected] Aurelio Vasquez ITAM E-mail: [email protected] Xiao Xiao Erasmus University Rotterdam E-mail: [email protected] Xintong Zhan The Chinese University of Hong Kong E-mail: [email protected] Abstract This paper studies the relation between the uncertainty of volatility, measured as the volatility of volatility, and future delta-hedged equity option returns. We find that delta-hedged option returns consistently decrease in uncertainty of volatility. Our results hold for different measures of volatility such as implied volatility, EGARCH volatility from daily returns, and realized volatility from high-frequency data. The results are robust to firm characteristics, stock and option liquidity, volatility characteristics, and jump risks, and are not explained by common risk factors. Our findings suggest that option dealers charge a higher premium for single-name options with high uncertainty of volatility, because these stock options are more difficult to hedge. * We thank Peter Christoffersen, Christian Dorion, Bjorn Eraker, Stephen Figlewski, Amit Goyal, Bing Han, Jianfeng Hu, Kris Jacobs, Inmoo Lee, Lei Jiang, Neil Pearson, and seminar participants at The Chinese University of Hong Kong, Erasmus University Rotterdam, Korea Advanced Institute of Science and Technology, HEC Montréal, Wilfrid Laurier University, and University of Hong Kong. We have benefited from the comments of participants at the 2018 Canadian Derivatives Institute (CDI) Annual Conference, the 2018 China International Conference in Finance, the 2018 Northern Finance Association Annual Conference, and the 2018 SFS Cavalcade Asia-Pacific. -

Basic Financial Derivatives

An Introduction to Lecture 3 Mathematical Finance UiO-STK-MAT3700 Autumn 2018 Professor: S. Ortiz-Latorre Basic Financial Derivatives The valuation of financial derivatives will be based on the principle of no arbitrage. Definition 1. Arbitrage means making of a guaranteed risk free profit with a trade or a series of trades in the market. Definition 2. An arbitrage free market is a market which has no opportunities for risk free profit. Definition 3. An arbitrage free price for a security is a price that ensure that no arbitrage opportunity can be designed with that security. The principle of no arbitrage states that the markets must be arbitrage free. Some financial jargon will be used in what follows. One says that has/takes a long position on an asset if one owns/is going to own a positive amount of that asset. One says that has/takes a short position on an asset if one has/is going to have a negative amount of that asset. Being short on money means borrowing. You can take a short position on many financial assets by short selling. Example 4 (Short selling). To implement some trading strategy you need to sell some amount of shares (to get money and invest in other assets). The problem is that you do not have any shares right now. Then, you can borrow the shares from another investor for a time period (paying interest) and sell the borrowed shares in the market to get the money you need for your strategy. To close this position, at the end of the borrowing period you must buy again the shares in the market and give them back to the lender. -

Global Derivatives Market

GLOBAL DERIVATIVES MARKET Aleksandra Stankovska European University – Republic of Macedonia, Skopje, email: aleksandra. [email protected] DOI: 10.1515/seeur-2017-0006 Abstract Globalization of financial markets led to the enormous growth of volume and diversification of financial transactions. Financial derivatives were the basic elements of this growth. Derivatives play a useful and important role in hedging and risk management, but they also pose several dangers to the stability of financial markets and thereby the overall economy. Derivatives are used to hedge and speculate the risk associated with commerce and finance. When used to hedge risks, derivative instruments transfer the risks from the hedgers, who are unwilling to bear the risks, to parties better able or more willing to bear them. In this regard, derivatives help allocate risks efficiently between different individuals and groups in the economy. Investors can also use derivatives to speculate and to engage in arbitrage activity. Speculators are traders who want to take a position in the market; they are betting that the price of the underlying asset or commodity will move in a particular direction over the life of the contract. In addition to risk management, derivatives play a very useful economic role in price discovery and arbitrage. Financial derivatives trading are based on leverage techniques, earning enormous profits with small amount of money. Key words: financial derivatives, leverage, risk management, hedge, speculation, organized exchange, over- the counter market. 81 Introduction Derivatives are financial contracts that are designed to create market price exposure to changes in an underlying commodity, asset or event. In general they do not involve the exchange or transfer of principal or title (Randall, 2001). -

Derivatives Market Structure 2020

Q1Month 2020 2015 Cover Headline Here (Title Case)Derivatives Market CoverStructure subhead here (sentence 2020case) I In partnership with DATA | ANALYTICS | INSIGHTS CONTENTS 2 Executive Summary 3 Methodology Executive Summary 3 Introduction 4 Capital, Libor and UMR The global derivatives market has undergone tremendous change over the past decade and, by most measures, has come out more 6 Market Structure: Potential for robust and efficient than ever. Increased transparency, more central Change clearing and vastly improved technology for trading, clearing and risk- 9 Understanding Derivatives End Users managing everything from futures to swaps to options has created 11 The Client to Clearer Relationship an environment in which nearly 80% of the market participants in this study believe liquidity in 2020 will only continue to improve. 13 The Sell-Side Perspective 16 Looking Forward To understand more deeply where we’ve been and where the derivatives market is headed, Greenwich Associates conducted a study in partnership with FIA, an association that represents banks, brokers, exchanges, and other firms in the global derivatives markets. The study gathered insights from nearly 200 derivatives market participants—traders, brokers, investors, clearing firms, exchanges, and clearinghouses—examining derivatives product usage, how they manage their counterparty relationships, their expectations for regulatory change, and more. The results painted a picture of an industry with the appetite and Managing Director opportunity for growth, but also one with challenges many are eager Kevin McPartland is to see overcome. The approaching Libor transition, continued rollout the Head of Research of uncleared margin rules, ongoing concern about capital requirements, for Market Structure and Technology at and a renewed focus on clearinghouse “skin in the game” are on the the Firm. -

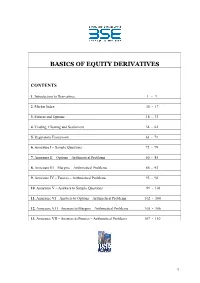

Basics of Equity Derivatives

BASICS OF EQUITY DERIVATIVES CONTENTS 1. Introduction to Derivatives 1 - 9 2. Market Index 10 - 17 3. Futures and Options 18 - 33 4. Trading, Clearing and Settlement 34 - 62 5. Regulatory Framework 63 - 71 6. Annexure I – Sample Questions 72 - 79 7. Annexure II – Options – Arithmetical Problems 80 - 85 8. Annexure III – Margins – Arithmetical Problems 86 - 92 9. Annexure IV – Futures – Arithmetical Problems 93 - 98 10. Annexure V – Answers to Sample Questions 99 - 101 11. Annexure VI – Answers to Options – Arithmetical Problems 102 - 104 12. Annexure VI I– Answers to Margins – Arithmetical Problems 105 - 106 13. Annexure VII – Answers to Futures – Arithmetical Problems 107 - 110 1 CHAPTER I - INTRODUCTION TO DERIVATIVES The emergence of the market for derivative products, most notably forwards, futures and options, can be traced back to the willingness of risk-averse economic agents to guard themselves against uncertainties arising out of fluctuations in asset prices. By their very nature, the financial markets are marked by a very high degree of volatility. Through the use of derivative products, it is possible to partially or fully transfer price risks by locking- in asset prices. As instruments of risk management, these generally do not influence the fluctuations in the underlying asset prices. However, by locking in asset prices, derivative products minimize the impact of fluctuations in asset prices on the profitability and cash flow situation of risk-averse investors. 1.1 DERIVATIVES DEFINED Derivative is a product whose value is derived from the value of one or more basic variables, called bases (underlying asset, index, or reference rate), in a contractual manner. -

Inflation Derivatives: Introduction One of the Latest Developments in Derivatives Markets Are Inflation- Linked Derivatives, Or, Simply, Inflation Derivatives

Inflation-indexed Derivatives Inflation derivatives: introduction One of the latest developments in derivatives markets are inflation- linked derivatives, or, simply, inflation derivatives. The first examples were introduced into the market in 2001. They arose out of the desire of investors for real, inflation-linked returns and hedging rather than nominal returns. Although index-linked bonds are available for those wishing to have such returns, as we’ve observed in other asset classes, inflation derivatives can be tailor- made to suit specific requirements. Volume growth has been rapid during 2003, as shown in Figure 9.4 for the European market. 4000 3000 2000 1000 0 Jul 01 Jul 02 Jul 03 Jan 02 Jan 03 Sep 01 Sep 02 Mar 02 Mar 03 Nov 01 Nov 02 May 01 May 02 May 03 Figure 9.4 Inflation derivatives volumes, 2001-2003 Source: ICAP The UK market, which features a well-developed index-linked cash market, has seen the largest volume of business in inflation derivatives. They have been used by market-makers to hedge inflation-indexed bonds, as well as by corporates who wish to match future liabilities. For instance, the retail company Boots plc added to its portfolio of inflation-linked bonds when it wished to better match its future liabilities in employees’ salaries, which were assumed to rise with inflation. Hence, it entered into a series of 1 Inflation-indexed Derivatives inflation derivatives with Barclays Capital, in which it received a floating-rate, inflation-linked interest rate and paid nominal fixed- rate interest rate. The swaps ranged in maturity from 18 to 28 years, with a total notional amount of £300 million. -

EQUITY DERIVATIVES Faqs

NATIONAL INSTITUTE OF SECURITIES MARKETS SCHOOL FOR SECURITIES EDUCATION EQUITY DERIVATIVES Frequently Asked Questions (FAQs) Authors: NISM PGDM 2019-21 Batch Students: Abhilash Rathod Akash Sherry Akhilesh Krishnan Devansh Sharma Jyotsna Gupta Malaya Mohapatra Prahlad Arora Rajesh Gouda Rujuta Tamhankar Shreya Iyer Shubham Gurtu Vansh Agarwal Faculty Guide: Ritesh Nandwani, Program Director, PGDM, NISM Table of Contents Sr. Question Topic Page No No. Numbers 1 Introduction to Derivatives 1-16 2 2 Understanding Futures & Forwards 17-42 9 3 Understanding Options 43-66 20 4 Option Properties 66-90 29 5 Options Pricing & Valuation 91-95 39 6 Derivatives Applications 96-125 44 7 Options Trading Strategies 126-271 53 8 Risks involved in Derivatives trading 272-282 86 Trading, Margin requirements & 9 283-329 90 Position Limits in India 10 Clearing & Settlement in India 330-345 105 Annexures : Key Statistics & Trends - 113 1 | P a g e I. INTRODUCTION TO DERIVATIVES 1. What are Derivatives? Ans. A Derivative is a financial instrument whose value is derived from the value of an underlying asset. The underlying asset can be equity shares or index, precious metals, commodities, currencies, interest rates etc. A derivative instrument does not have any independent value. Its value is always dependent on the underlying assets. Derivatives can be used either to minimize risk (hedging) or assume risk with the expectation of some positive pay-off or reward (speculation). 2. What are some common types of Derivatives? Ans. The following are some common types of derivatives: a) Forwards b) Futures c) Options d) Swaps 3. What is Forward? A forward is a contractual agreement between two parties to buy/sell an underlying asset at a future date for a particular price that is pre‐decided on the date of contract. -

Stalemate in Spain

INVESTMENT SOLUTIONS & PRODUCTS Investment Alert International Wealth Management, 21/12/2015 Spain Stalemate in Spain No obvious alliance for an absolute majority in the 350 seat Parliament. Near-term prospects for growth are still solid, but some growing uncertainty about the medium term and the sustainability of the public debt. Michael O'Sullivan European periphery. The strong showing of Podemos will re- CIO – UK & EEMEA michael.o'[email protected], +41 44 332 81 73 mind many investors of the similar rise of Syriza in Greece. Second, there is the possibility that political uncertainty proves Anne-Charlotte Perot Investment Strategy Europe & CH disruptive economically. Here we would emphasize that, in [email protected], +41 44 333 17 23 terms of consumer confidence, job creation and most lead in- dicators, Spain has considerable economic momentum and this may at least prove resilient in the short run. Sunday’s general election in Spain has failed to deliver a decis- ive result, and has produced a number of surprises. With no ob- vious government in sight, Spanish equities and bonds have Possible scenario of alliance sold off. The incumbent PP party (People’s Party) has ob- In terms of what materializes next, a new parliament will be tained 123 seats, the socialist PSOE came second with 90 formed on 13 January and will be able to vote for the first seats, and Podemos and Ciudadanos obtained 69 and 40 time. After this, the government approval process should not seats, respectively. While prime minister Mariano Rajoy’s PP exceed two months; otherwise new elections would have to be party has re-emerged in the pole position, its ability to form a called.