Points in Reply to Submissions by Optus, Internode, PIPE and AAPT on Telstra’S DCTS Exemption Applications for CBD/Metro IEN and Tail Transmission—PUBLIC VERSION

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TPG Telecom Limited and Its Controlled Entities ABN 46 093 058 069

TPG Telecom Limited and its controlled entities ABN 46 093 058 069 Annual Report Year ended 31 July 2016 2 TPG Telecom Limited and its controlled entities Annual report For the year ended 31 July 2016 Contents Page Chairman’s letter 3 Directors’ report 5 Lead auditor’s independence declaration 34 Consolidated income statement 35 Consolidated statement of comprehensive income 36 Consolidated statement of financial position 37 Consolidated statement of changes in equity 38 Consolidated statement of cash flows 39 Notes to the consolidated financial statements 40 Directors’ declaration 91 Independent auditor’s report 92 ASX additional information 94 3 TPG Telecom Limited and its controlled entities Chairman’s letter For the year ended 31 July 2016 Dear Shareholders On behalf of the Board of Directors, I am pleased to present to you the TPG Telecom Limited Annual Report for the financial year ended 31 July 2016 (“FY16”). Financial Performance FY16 was another successful year for the Group. Continued organic growth and the integration of iiNet into the business have resulted in further increases in revenue, profits and dividends for shareholders. FY16 represents the eighth consecutive year that this has been the case. A detailed review of the Group’s operating and financial performance for the year is provided in the Operating and Financial Review section of the Directors’ Report starting on page 7 of this Annual Report, and set out below are some of the key financial highlights and earnings attributable to shareholders from the year. FY16 FY15 Movement Revenue ($m) 2,387.8 1,270.6 +88% EBITDA ($m) 849.4 484.5 +75% NPAT ($m) 379.6 224.1 +69% EPS (cents/share) 45.3 28.2 +61% Dividends (cents/share) 14.5 11.5 +26% iiNet Acquisition At the beginning of FY16 we completed the acquisition of iiNet and consequently there has been significant focus during the year on integrating the businesses to improve the efficiency of the combined organisation. -

Amaga 2020 Individual.Pdf

Tax invoice Membership category Payment details ABN 83 048 139 955 Membership Form Regular (Loyalty) Concession* (Loyalty) Membership Fee $ (inc of GST) (inc of GST) + Networks $ Individual □ $180 ($162) □ $90 ($81) + Donation* $ Your information Individual (existing Total Payable $ New member ICOM members only) □ $171 ($153) □ $86 ($76.50) □ Australian Museums and Galleries Association AMaGA Membership Card * Donations over $2.00 are tax deductible. □ Renewing member Individual employed by a member - Australian Museums and Galleries Association □ $144 ($144**) Member number (if known) AMaGA □ Membership Card institution Individual employed Payment method AMaGA by a member Please email or post your completed form for payment □ Please send me a new membership card □ $144 ($144**) - Member Number institution (existing New members will automatically get sent a card. Expiry processing. Your receipt and membership card or sticker will be Member Name AMaGA is a partner to ICOM members only) Renewing members will receive a sticker with your Australian AMaGA Museums ICOM Australia. and Galleries If found, please return to Association PO Box 24, Deakin West receipt/invoice to attach to your current card. Member ACT 2600 issued when payment has been processed. * Concession rates available to retired, full-time students, pensioners, unemployed Member Number Expiry Member Name and volunteers Australian AMaGA is a partner to Museums ICOM Australia. and Galleries If found, please return to Association PO Box 24, Deakin West Member ACT 2600 made payable to Australian Museums and Galleries Association ** Discounts are capped at 20% □ Cheque Title □ Mr □ Miss □ Ms □ Mrs □ Dr □ Name Loyalty Discount Members of more than five consecutive years can claim a 10% loyalty Credit Card (Visa or Mastercard only) discount on their membership. -

Jan 2020 (Wave

Telecommunications Customer Satisfaction Results of polling undertaken by Roy Morgan Research for Communications Alliance Ltd Wave 25 – January 2020 Research Objective • Roy Morgan Research is tracking customer satisfaction among Australian telecommunications customers. • Quarterly polling monitors: • overall customer satisfaction; and • customer experience viz. four transactional touch points relating to Telecommunications Consumer Protections (TCP) Code provisions; and • fulfils in part the agreed co-regulatory requirement to create trackable performance metrics re customer service and complaint handling. Touch Points • Customer Information – satisfaction with information provided at point of sale or post purchase, • Billing – ease of understanding the Telco bill • Spend Management – experience with, and awareness of, tools to monitor and manage spend with the Telco Service Provider and how this aligns with “Bill Shock” experiences, and • Complaint Handling – satisfaction levels amongst those who have raised a complaint with their Telco Service Provider, particularly in regard to how the process was handled and the outcome of the complaint. Methodology • The first wave of the research was conducted in March 2013 and the survey has been conducted on a quarterly basis since then, with the exception of 3 quarters (December 2015, March 2016 and June 2016). This report summarises the key findings of the Wave 25 survey held in January 2020. • Around 500 online interviews are conducted per wave, amongst a representative sample of Australian population in terms of gender, age (18+) and location (State, metro and non-metro). Results are weighted to current ABS population estimates. Target Audience The target respondent for the research has been defined as: • Males and females aged 18+ • Having at least one of these three items for personal usage - home phone, internet connection and mobile phone • Had some form of contact with at least one telephone or internet service provider in the six months prior to their interview. -

Extreme Weather Events Impact Service in the South West District of Western Australia Iinet Group Reference ID: 2529877

CUSTOMER SERVICE NOTICE FROM IINET GROUP (IINET LTD, WESTNET PTY LTD, NETSPACE PTY LTD, AAPT CONSUMER DIVISION, INTERNODE PTY LTD, TRANSACT CAPITAL COMMUNICATIONS PTY LTD) Extreme Weather events impact service in the South West district of Western Australia iiNet Group reference ID: 2529877 The iiNet Group (iiNet Ltd, Westnet Pty Ltd, Netspace Pty Ltd, Internode Pty Ltd, AAPT Consumer Division and TransACT Capital Communications Pty Ltd) is currently working to manage the impact to its network that has occurred as a result of a series of lightning strikes and some heavy rain in the South West district of Western Australia on or about Wednesday 17 April. Lightning strikes and heavy rain have caused notable damage to the network, rendering some services faulty, as referred to in Telstra Wholesales Mass Service Disruption Notification which can be found at http://telstra.com. au/abouttelstra/commitments/mass-service-disruption/. A copy of this notice will also be published in the West Australian on 26 April 2013. The iiNet Group is working closely with suppliers and wholesalers to assess and repair the damage to affected services in a timely manner. Customers in these regions may experience service disruptions and delays to normal connection times and fault restoration. Because these events are outside the iiNet Group’s control, iiNet is claiming an exemption under Section 21 of the Telecommunications (Customer Service Guarantee) Standard 2011 from the normal performance standards. The exemption shall apply from 18 April 2013 to 3 May 2013 inclusive. This date is indicative only; customers should anticipate that some further delays may occur. -

National Broadband Network Goes Live in Melbourne

National Broadband Network Goes Live in Melbourne Prime Minister switches on network in Brunswick area 4 August 2011 The National Broadband Network came to Melbourne this morning with the inner city suburb of Brunswick becoming the first metropolitan area in Australia to receive superfast* fibre-based broadband. Prime Minister the Hon Julia Gillard MP switched on the network at a ceremony at the Brunswick Town Hall. The suburb is the third and latest mainland test site to receive the fibre optic-enabled NBN. The fibre network in Brunswick covers approximately 2,689 premises; residents in more than half of these premises consented to having a connection to make their premises “NBN ready”. The trial phase is due to run until late September, after which residents in the Brunswick fibre coverage area are expected to be able to order broadband services over the NBN from retail service providers. To date fourteen customers have been connected as part of the trial in Brunswick, with more service activations in the queue. More than 700 homes and businesses across Australia are now connected to the NBN as part of the trials, including 114 on the mainland. The network trial is up and running in Kiama on the NSW South Coast, in Armidale in the Central West of NSW and in the Tasmanian communities of Smithton, Scottsdale and Midway Point. Construction is underway in seven additional sites in Tasmania and the proposed timetable for the rollout of fibre in nine new sites in NSW, Queensland and the ACT was announced this week. NBN Co Chairman, Harrison Young, said: “The launch today of the NBN in Brunswick and new construction activity we’ve announced are the latest steps towards delivery of a crucial piece of nation-building infrastructure. -

Customer Service Notice from Iinet Group (Iinet Ltd, Westnet Pty Ltd, Netspace Pty Ltd, Aapt Consumer Division)

CUSTOMER SERVICE NOTICE FROM IINET GROUP (IINET LTD, WESTNET PTY LTD, NETSPACE PTY LTD, AAPT CONSUMER DIVISION) Extreme weather events impact services in Sydney Metropolitan, Greater Sydney, Hunter, Illawarra, South Coast, Central Tablelands, South West Slopes, Central West Slopes and Plains districts – Extension iiNet Group reference ID: 1909592 As previously notified by the iiNet Group (iiNet Ltd, Westnet Pty Ltd, Netspace Pty Ltd, Internode Pty Ltd and the AAPT Consumer Division) on Tuesday 28th February 2012, normal operations in the Sydney Metropolitan, Greater Sydney, Hunter, Illawarra, South Coast, Central Tablelands, South West Slopes, Central West Slopes and Plains districts have been affected by ongoing extreme weather events and again on or about Wednesday 7 March 2012 through Thursday 8 March 2012. Severe thunderstorms, heavy rain and flash flooding previously caused notable damage to the network, rendering some services faulty, as referred to in Telstra Wholesales Mass Service Disruption Notification which can be found at http://telstra.com.au/abouttelstra/commitments/mass-service-disruption/ a copy of this notice will also be published in the Daily Telegraph on Wednesday 28th March 2012. The iiNet Group is working closely with suppliers and wholesalers to assess and repair the damage to affected services in a timely manner. Customers in these regions may experience service disruptions and delays to normal connection times and fault restoration. Because these events are outside the iiNet Group’s control, iiNet is claiming an exemption under Section 21 of the Telecommunications (Customer Service Guarantee) Standard 2011 from the normal performance standards. The exemption shall apply from 29th February 2012 to 27th April 2012 inclusive. -

Chapter 3 (PDF 544KB)

3 Competition and Regulatory Issues Introduction 3.1 During the course of its first review period, the committee was presented with competition and regulatory issues arising from the implementation of the Government’s National Broadband Network (NBN) policy. A number of these matters were raised in the committee’s First Report and have been updated to take into account additional information received, and recent developments reported in the Government’s 23 September 2011 NBN rollout Performance Report. 3.2 This chapter includes discussion on the competition and regulatory issues pertaining to: the Binding Definitive Agreements between the NBN Co Limited (NBN Co) and Telstra and the NBN Co and Optus, Telstra’s Structural Separation Undertaking (SSU) and draft Migration Plan, the NBN Co’s Special Access Undertaking (SAU) and Wholesale Broadband Agreement (WBA). 3.3 In addition, issues such as competition and pricing concerns raised by Retail Service Providers (RSPs) and the engagement of private sector equity to fund the NBN are also discussed. 34 REVIEW OF THE ROLLOUT OF THE NATIONAL BROADBAND NETWORK: SECOND REPORT Binding Definitive Agreements with Telstra and Optus Background 3.4 On 7 April 2009, the Government announced the establishment of NBN Co to: design, build (over an eight year period)1 and operate a ‘wholesale- only national high-speed broadband network for all Australians’ which would be capable of delivering speeds of up to 100 Megabits per second (Mbps) at a cost of up to $43 billion.2 The purpose of the NBN would be to connect all premises across Australia, to improve service delivery in areas such as education and health, and more broadly drive productivity growth, thereby enhancing Australia’s international competitiveness.’3 3.5 The Government’s 2009 NBN policy (including the establishment of NBN Co) was intended as a micro economic reform measure designed to improve the competitive dynamics of the Australian telecommunications sector. -

Iinet Group Acceptable Use Policy

Our Customer Relationship Agreement ACCEPTABLE USE POLICY iiNet Limited ACN 068 628 937 Phone: 13 22 58 Internode Pty Ltd ABN 82 052 008 581 Phone: 13 66 33 TransACT Capital Communications Pty Limited ACN 093 966 888 Phone: 13 30 61 TransACT Victoria Communications Pty Limited ACN 063 024 475 Phone: 13 30 61 Westnet Pty Ltd ACN 086 416 908 Phone: 1300 786 068 Adam Internet Pty Ltd ACN 055 495 853 Phone: (08) 8434 4000 1/502 Hay Street, Subiaco WA 6008 17 March 2014 Rules of interpretation and capitalised terms used in this Acceptable Use Policy are defined in the General Terms of our CRA, or our MSA (if an MSA has been provided to you). 1. ABOUT OUR ACCEPTABLE USE POLICY 1.1 To ensure the availability of our Services to eligible customers, we have an Acceptable Use Policy to make sure everyone gets a fair go. We have designed our products to be generous, but we do not want those generous terms abused. 1.2 We may immediately suspend, cancel or restrict the supply of the Service to you under clause 12.3 of the General Terms if you use the Service, or if any person who accesses your Service uses the Service, in any way which breaches this Acceptable Use Policy. 2. PROHIBITED USE 2.1 You, and any person who accesses your Service, must not use, or attempt to use, the Service: (a) for illegal purposes or practices; (b) for any purpose if we advised you that such purpose was prohibited in your Application or the relevant Service Description; (c) in any way which damages or interferes (or threatens to damage or interfere) with the operation of -

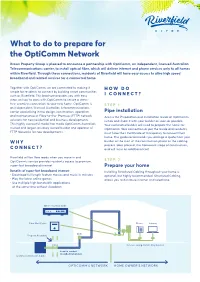

Opticomm Network

What to do to prepare for the OptiComm Network Brown Property Group is pleased to announce a partnership with OptiComm, an independent, licensed Australian Telecommunications carrier, to install optical fibre, which will deliver internet and phone services only to all homes within Riverfield. Through these connections, residents of Riverfield will have easy access to ultra high speed broadband and related services for a connected home. Together with OptiComm, we are committed to making it HOW DO simple for residents to connect by building smart communities such as Riverfield. This brochure provides you with easy I CONNECT? steps on how to work with OptiComm to secure a stress- free, seamless connection to your new home. OptiComm is STEP 1: an independent, licensed Australian Telecommunications carrier specialising in the design, construction, operation Pipe installation and maintenance of Fibre-to-the- Premises (FTTP) network Access the Preparation and Installation Guide at OptiComm. solutions for new residential and business developments. net.au and share it with your builder as soon as possible. This highly successful model has made OptiComm Australia’s Your nominated builder will need to prepare the home for trusted and largest privately owned builder and operator of OptiComm fibre connection as per the Guide and residents FTTP Networks for new developments. must have their Certificate of Occupancy to connect their home. The guide recommends you arrange a quote from your WHY builder at the start of the construction phase as the cabling process takes place at the framework stage of construction, CONNECT? and will incur an additional cost. Riverfield will be fibre ready when you move in and OptiComm’s service provides residents access to premium, STEP 2: super-fast broadband internet. -

ASX Release Iinet Generates Record Half Year Earnings with Growth Across Key Financial and Operating Metrics

ASX release iiNet generates record half year earnings with growth across key financial and operating metrics 21 February 2012 – iiNet Limited (ASX: IIN) today announced its results for the six months ended 31 December 2011 (H1 FY12), delivering on its growth strategy and capturing further broadband market share. Commenting on the results, iiNet’s Chief Executive Officer, Michael Malone, said that the Company continued to grow across all key financial metrics, had a strong balance sheet, and growing dividends. “The last six months have been a period of considerable expansion, with iiNet continuing to grow scale and cementing its position as the clear number two in DSL broadband. As a leader in telecommunications consolidation, we now have 860,000 individual subscribers across a record 1.7 million services. “We have laid the foundations for an exciting future. iiNet’s excellent financial performance over the past six months and attractive growth outlook clearly shows we are successfully executing the right strategy in light of the changing industry dynamics,” Mr Malone said. Key highlights included: WINNER Partnerships for Growth (iiNet & fetchtv) and Revenue up 11% to $365 million Communications Ambassador, EBITDA up 36% to $56.4 million ACOMMS Communications NPAT up 17% to $14.4 million Alliance & CommsDay Awards 2011 EPS up 19% to 9.6 cents per share Strong balance sheet, with comfortable gearing at 73% net debt to equity as at 31 December 2011 Acquisitions of TransACT and Internode taking iiNet’s broadband DSL market share to around 16 per cent Substantial scale post acquisitions – 860,000 broadband customers with 1.7 million National Large Business - iiNet services WA Large Business - iiNet WA Service Excellence in a Market leading low levels of churn with customer service-driven strategy continuing to Contact Centre – Westnet Customer Service Institute of deliver Australia (CSIA) Interim dividend up 20% to 6 cents per share fully franked. -

BROADBAND Consumer Handbook

National Broadband Network: A Guide for Consumers A project prepared by the Internet Society of Australia (ISOC-AU) and the Australian Communications Consumer Action Network (ACCAN). April 2011 This work is licensed under the Creative Commons Attribution-NonCommercial 3.0 Australia License. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc/3.0/au/ PREFACE The internet has changed most people’s lives in the past decade. But the technology that enables us to get connected can seem hard to understand. This Guide will try to answer common questions about the internet, broadband connections and the National Broadband Network (NBN). The following guide has been prepared on the basis of early plans for the design and rollout of the NBN and contains information which will be subject to change and further refinement. It has been compiled using information publicly available at the time of writing through NBN Co, government agencies, industry forums and standards bodies. Check for current information with your service provider when making decisions about phone or broadband services. THE BASICS: THE INTERNET AND BROADBAND KEY POINTS TO KNOW: • Broadband means a high-speed, ‘always on’, communications link that carries information between one location and another. • Today, fixed broadband usually uses the copper-wire telephone network. • You can use a broadband connection to access the internet or a range of other services which are separate from the internet. • The National Broadband Network (NBN) is going to make available a very fast broadband link to just about everyone. It will mainly use fibre-optic cable. -

Oct 2019 (Wave

Telecommunications Customer Satisfaction Results of polling undertaken by Roy Morgan Research for Communications Alliance Ltd Wave 24 – October 2019 Research Objective • Roy Morgan Research is tracking customer satisfaction among Australian telecommunications customers. • Quarterly polling monitors: • overall customer satisfaction; and • customer experience viz. four transactional touch points relating to Telecommunications Consumer Protections (TCP) Code provisions; and • fulfils in part the agreed co-regulatory requirement to create trackable performance metrics re customer service and complaint handling. Touch Points • Customer Information – satisfaction with information provided at point of sale or post purchase, • Billing – ease of understanding the Telco bill • Spend Management – experience with, and awareness of, tools to monitor and manage spend with the Telco Service Provider and how this aligns with “Bill Shock” experiences, and • Complaint Handling – satisfaction levels amongst those who have raised a complaint with their Telco Service Provider, particularly in regard to how the process was handled and the outcome of the complaint. Methodology • The first wave of the research was conducted in March 2013 and the survey has been conducted on a quarterly basis since then, with the exception of 3 quarters (December 2015, March 2016 and June 2016). This report summarises the key findings of the Wave 24 survey held in October 2019. • Around 500 online interviews are conducted per wave, amongst a representative sample of Australian population in terms of gender, age (18+) and location (State, metro and non-metro). Results are weighted to current ABS population estimates. Target Audience The target respondent for the research has been defined as: • Males and females aged 18+ • Having at least one of these three items for personal usage - home phone, internet connection and mobile phone • Had some form of contact with at least one telephone or internet service provider in the six months prior to their interview.